Price Pattern Amalysis for Gold, US Dollar, S&P 500 and Grude Oil - Gold in Consolidation Mode, Crude Oil Drops to Five-Year Low

US DOLLAR TECHNICAL ANALYSIS

Prices paused to consolidate after

producing the largest daily rally in five weeks. Near-term resistance

is at 11511, the 50% Fibonacci expansion, with a break above that on a

daily closing basis exposing the 61.8% level at 11565.

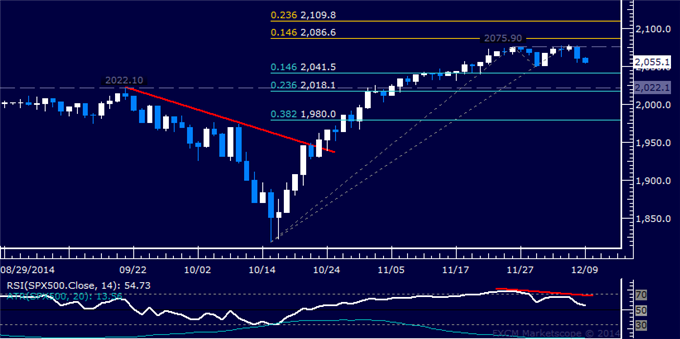

S&P 500 TECHNICAL ANALYSIS

Prices began to turn lower as

expected. A drop below the 2041.50-49.10 area marked by the 14.6%

Fibonacci retracement and the December 1 low exposes the 2018.10-22.10

zone (23.6% level, September 19 high).

GOLD TECHNICAL ANALYSIS

Prices met resistance at a falling

trend line set from early July. A break below the 14.6% Fibonacci

expansion at 1189.74 exposes the 23.6% level at 1170.39.

CRUDE OIL TECHNICAL ANALYSIS

Prices are testing below support

at 65.96, the 50% Fibonacci expansion. A daily close below this barrier

exposes the 61.8% level at 64.30.