Piyush Lalsingh Ratnu / Profil

Piyush Lalsingh Ratnu

- Trader & Analyst in Piyush Ratnu XAUUSD Spot Gold Research

- Vereinigte Arabische Emirate

- 156

- Information

|

nein

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

3

Signale

|

1

Abonnenten

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Freunde

15

Anfragen

Ausgehend

Piyush Lalsingh Ratnu

XAUUSD @$1930: The factors in play 🆘

Gold price faces immense pressure as US labor market data turns out extremely tight than expected.

The US Dollar Index rebounds as US ADP reports fresh additions of 324K payrolls vs. estimates of 189K.

The impact of a decline in Gold demand, reported by the World Gold Council, starts fading.

Strong US JOTLS job openings and ADP Employment Change data indicate that the country’s labor market conditions remain tight, backing the case for further rate hikes by the Federal Reserve.

Gold trading faced headwinds on Wednesday as the U.S. dollar strengthened despite Fitch's downgrade of the U.S. credit rating to AA+ from AAA. Investors seemed unfazed and focused on positive data from the ADP National Employment report that might possibly indicate a larger-than-expected Non-Farm Payrolls report this Friday.

Fitch's decision to downgrade the U.S. credit rating was attributed to concerns about potential fiscal deterioration over the next three years and the debt ceiling crisis that was averted at the last minute a couple months ago.

The impact of these developments on gold prices was evident, as it retreated for the second consecutive session, currently testing at $1,935 and might be approaching a significant technical support level at $1,930. On the flip side, if gold resumes its rebound, it may encounter initial resistance around $1,942, followed by the psychologically important $1,950 mark.

The US credit rating downgrade should not have been a surprise for investors that have been following Fitch’s comments, but the timing surely caught everyone off guard. The Japanese yen initially benefited the most, but eventually the dollar steadied as safe-haven flows broadened.

Gold prices are falling as the dollar steals all the safe-haven flows that stemmed from the US sovereign downgrade and as Treasury yields surge on rising debt sale expectations. The gold market is going to struggle as long as re-steepening of the US curve continues. The VIX is rising and it seems Wall Street is getting nervous here.

🍎Gold will eventually act like a safe-haven as stocks remain vulnerable given rising downbeat outlooks and as the UAW labor strike risks grow following the ambitious demands provided by the UAW president.

Gold price faces immense pressure as US labor market data turns out extremely tight than expected.

The US Dollar Index rebounds as US ADP reports fresh additions of 324K payrolls vs. estimates of 189K.

The impact of a decline in Gold demand, reported by the World Gold Council, starts fading.

Strong US JOTLS job openings and ADP Employment Change data indicate that the country’s labor market conditions remain tight, backing the case for further rate hikes by the Federal Reserve.

Gold trading faced headwinds on Wednesday as the U.S. dollar strengthened despite Fitch's downgrade of the U.S. credit rating to AA+ from AAA. Investors seemed unfazed and focused on positive data from the ADP National Employment report that might possibly indicate a larger-than-expected Non-Farm Payrolls report this Friday.

Fitch's decision to downgrade the U.S. credit rating was attributed to concerns about potential fiscal deterioration over the next three years and the debt ceiling crisis that was averted at the last minute a couple months ago.

The impact of these developments on gold prices was evident, as it retreated for the second consecutive session, currently testing at $1,935 and might be approaching a significant technical support level at $1,930. On the flip side, if gold resumes its rebound, it may encounter initial resistance around $1,942, followed by the psychologically important $1,950 mark.

The US credit rating downgrade should not have been a surprise for investors that have been following Fitch’s comments, but the timing surely caught everyone off guard. The Japanese yen initially benefited the most, but eventually the dollar steadied as safe-haven flows broadened.

Gold prices are falling as the dollar steals all the safe-haven flows that stemmed from the US sovereign downgrade and as Treasury yields surge on rising debt sale expectations. The gold market is going to struggle as long as re-steepening of the US curve continues. The VIX is rising and it seems Wall Street is getting nervous here.

🍎Gold will eventually act like a safe-haven as stocks remain vulnerable given rising downbeat outlooks and as the UAW labor strike risks grow following the ambitious demands provided by the UAW president.

Piyush Lalsingh Ratnu

Gold price drops as US ADP labor report remains resilient

• Gold price remains sideways around $1,950.00 as investors await United States labor market data for further guidance.

• The precious metal witnessed heavy selling on Tuesday after the World Gold Council reported a decline in Gold demand by global central banks. Gold purchased by central banks in the first half of 2023 dropped by 2% YoY amid higher interest rates and costly bullion.

• In addition to that, a significant recovery in United States factory orders kept the Gold price on a bearish trajectory.

• US new factory orders surprisingly rose to 47.3 in July from downwardly revised expectations of 44.0 against June’s reading of 45.6.

• The Institute of Supply Management (ISM) reported that Manufacturing PMI contracted for the ninth month in a row. July’s figure edged up to 46.4 from a previous figure of 46.0 but failed to match expectations of 46.8. All figures under 50.0 are contractionary.

• A straight three-quarter contraction in the Manufacturing PMI is sufficient enough to display the consequences of an aggressive rate-tightening cycle by the Federal Reserve.

• US JOLTS Job Openings dropped in July to 9.582M from its expectations and former reading. The July data recorded its lowest reading in more than two years as job changes waned due to easing wage growth.

• For more guidance about the labor market, investors will focus on the US Nonfarm Payrolls (NFP) and the Unemployment Rate, which will be published on Friday at 12:30 GMT.

• But before that, the entire focus will be on Automatic Data Processing Employment Change, which will be released at 12:15 GMT. Per estimates, US ADP will report the addition of fresh private payroll data in July by 189K vs. the strong addition of 497K recorded in June.

• Tight labor market conditions could force the Fed to raise interest rates further in September monetary policy meeting.

• Chicago Federal Reserve Bank President Austan Goolsbee said on Tuesday that inflation is on track to return to 2% without elevating the jobless rate significantly.

• The US Dollar Index (DXY) demonstrated a stellar recovery on Tuesday despite Fitch downgrading the United States government’s credit rating, citing concerns over forward fiscal spending.

• Gold price remains sideways around $1,950.00 as investors await United States labor market data for further guidance.

• The precious metal witnessed heavy selling on Tuesday after the World Gold Council reported a decline in Gold demand by global central banks. Gold purchased by central banks in the first half of 2023 dropped by 2% YoY amid higher interest rates and costly bullion.

• In addition to that, a significant recovery in United States factory orders kept the Gold price on a bearish trajectory.

• US new factory orders surprisingly rose to 47.3 in July from downwardly revised expectations of 44.0 against June’s reading of 45.6.

• The Institute of Supply Management (ISM) reported that Manufacturing PMI contracted for the ninth month in a row. July’s figure edged up to 46.4 from a previous figure of 46.0 but failed to match expectations of 46.8. All figures under 50.0 are contractionary.

• A straight three-quarter contraction in the Manufacturing PMI is sufficient enough to display the consequences of an aggressive rate-tightening cycle by the Federal Reserve.

• US JOLTS Job Openings dropped in July to 9.582M from its expectations and former reading. The July data recorded its lowest reading in more than two years as job changes waned due to easing wage growth.

• For more guidance about the labor market, investors will focus on the US Nonfarm Payrolls (NFP) and the Unemployment Rate, which will be published on Friday at 12:30 GMT.

• But before that, the entire focus will be on Automatic Data Processing Employment Change, which will be released at 12:15 GMT. Per estimates, US ADP will report the addition of fresh private payroll data in July by 189K vs. the strong addition of 497K recorded in June.

• Tight labor market conditions could force the Fed to raise interest rates further in September monetary policy meeting.

• Chicago Federal Reserve Bank President Austan Goolsbee said on Tuesday that inflation is on track to return to 2% without elevating the jobless rate significantly.

• The US Dollar Index (DXY) demonstrated a stellar recovery on Tuesday despite Fitch downgrading the United States government’s credit rating, citing concerns over forward fiscal spending.

Piyush Lalsingh Ratnu

XAUUSD Price Projection: Way forward:

A rise in gold above $1985 in the next few days would reduce doubts about the bullish scenario involving a renewal of historical highs.

A quick pullback below $1947 and the 50-day moving average would confirm the dominance of a short-term downtrend.

#XAUUSD #GOLD #forex #forextrading

A rise in gold above $1985 in the next few days would reduce doubts about the bullish scenario involving a renewal of historical highs.

A quick pullback below $1947 and the 50-day moving average would confirm the dominance of a short-term downtrend.

#XAUUSD #GOLD #forex #forextrading

Piyush Lalsingh Ratnu

Technical Update and Co-relations traced:

🆘XAUUSD and USDJPY both under PPZ

XAUUSD @ D1S5

USDJPY already breached D1S5

🟢Price zones:

USDJPY is at 138.500 zone (02.06.2023 price zone)

XAUUSD is at $1960 zone (02.06.2023 price zone)

🟢Fib Zones achieved:

XAUUSD: D1V382

USDJPY: D1A382

XAUUSD crucial zones:

C: $1947/1926

R: $1966/1985

USDJPY crucial zones:

C: 136.690/136.000

R: 139.690/140.360

🆘XAUUSD and USDJPY both under PPZ

XAUUSD @ D1S5

USDJPY already breached D1S5

🟢Price zones:

USDJPY is at 138.500 zone (02.06.2023 price zone)

XAUUSD is at $1960 zone (02.06.2023 price zone)

🟢Fib Zones achieved:

XAUUSD: D1V382

USDJPY: D1A382

XAUUSD crucial zones:

C: $1947/1926

R: $1966/1985

USDJPY crucial zones:

C: 136.690/136.000

R: 139.690/140.360

Piyush Lalsingh Ratnu

Core Focus:

Core CPI YoY MoM

18.00 BOC Interest Rate Decision

Humble reminder: last time: XAUUSD moved $25 post BOC IR, considering there are news is gaps followed by BOC G speech, 10 year note auction and Beige book data schedule at 21.00 and 22.00 hours.

A net movement of $15/24/30 is expected.

Suggested strategy:

Avoid Pivot Zone

Enter in Sell direction only at R2/R3 zone with NAP exit

Enter in Buy direction from S2 onwards PG 3 target NAP exit

CMP $1935

🆘Crucial PR XAUUSD Price Zones:

R: $1947/1966

C: $1926/1907

Core CPI YoY MoM

18.00 BOC Interest Rate Decision

Humble reminder: last time: XAUUSD moved $25 post BOC IR, considering there are news is gaps followed by BOC G speech, 10 year note auction and Beige book data schedule at 21.00 and 22.00 hours.

A net movement of $15/24/30 is expected.

Suggested strategy:

Avoid Pivot Zone

Enter in Sell direction only at R2/R3 zone with NAP exit

Enter in Buy direction from S2 onwards PG 3 target NAP exit

CMP $1935

🆘Crucial PR XAUUSD Price Zones:

R: $1947/1966

C: $1926/1907

Piyush Lalsingh Ratnu

Bets for a 25 bps Fed rate hike in July cap gains for XAU/USD

Gold price edges higher during the Asian session on Tuesday, albeit lacks bullish conviction and remains well below a key hurdle near the $1,935 area tested last week. The XAU/USD currently trades just above the $1,925 level, up less than 0.10% for the day, as traders keenly await the release of the latest consumer inflation figures from the United States (USD), due on Wednesday, before placing fresh directional bets.

The crucial US Consumer Price Index (CPI) will play a key role in influencing the Federal Reserve's (Fed) near-term policy outlook, which, in turn, will drive the US Dollar (USD) demand and provide some meaningful impetus to the Gold price. In the meantime, speculations that the US central bank is nearing the end of its policy tightening drag the USD lower for the fourth straight day, to its lowest level since May 11 and act as a tailwind for the US Dollar-denominated metal. The US monthly employment details released on Friday showed that the economy added the fewest jobs in 2-1/2 years, signalling that the labor market is cooling. Furthermore, the New York Fes's monthly survey revealed on Monday that the one-year consumer inflation expectation dropped to the lowest level since April 2021, to 3.8% in June from 4.1% in the previous month.

Impact:

This could allow the Fed to soften its hawkish stance and continues to weigh on the Greenback.

Gold price technical outlook

From a technical perspective, any subsequent move up might continue to confront stiff resistance near the $1,933-$1,935 supply zone. This is followed by the 100-day Simple Moving Average (SMA), currently around the $1,948-$1,949 region. A sustained strength beyond the latter might trigger a short-covering rally and lift the Gold price to the $1,962-$1,964 area en route to the $1,970-$1,972 supply zone. The momentum could get extended further, allowing bulls to reclaim the $2,000 psychological mark and testing the $2,010-$2,012 resistance.

On the flip side, the $1,912-$1,910 area seems to have emerged as an immediate support and should protect the downside ahead of the $1,900 mark and the multi-month low, around the $1,893-$1,892 region touched in June. Some follow-through selling will be seen as a fresh trigger for bearish traders and make the Gold price vulnerable to accelerate the downward trajectory towards the very important 200-day Simple Moving Average (SMA), currently around the $1,866-$1,865 zone. The latter should act as a pivotal point, which if broken decisively should pave the way for an extension of the recent sharp retracement slide from the all-time high, around the $2,080 region touched in May.

Gold price edges higher during the Asian session on Tuesday, albeit lacks bullish conviction and remains well below a key hurdle near the $1,935 area tested last week. The XAU/USD currently trades just above the $1,925 level, up less than 0.10% for the day, as traders keenly await the release of the latest consumer inflation figures from the United States (USD), due on Wednesday, before placing fresh directional bets.

The crucial US Consumer Price Index (CPI) will play a key role in influencing the Federal Reserve's (Fed) near-term policy outlook, which, in turn, will drive the US Dollar (USD) demand and provide some meaningful impetus to the Gold price. In the meantime, speculations that the US central bank is nearing the end of its policy tightening drag the USD lower for the fourth straight day, to its lowest level since May 11 and act as a tailwind for the US Dollar-denominated metal. The US monthly employment details released on Friday showed that the economy added the fewest jobs in 2-1/2 years, signalling that the labor market is cooling. Furthermore, the New York Fes's monthly survey revealed on Monday that the one-year consumer inflation expectation dropped to the lowest level since April 2021, to 3.8% in June from 4.1% in the previous month.

Impact:

This could allow the Fed to soften its hawkish stance and continues to weigh on the Greenback.

Gold price technical outlook

From a technical perspective, any subsequent move up might continue to confront stiff resistance near the $1,933-$1,935 supply zone. This is followed by the 100-day Simple Moving Average (SMA), currently around the $1,948-$1,949 region. A sustained strength beyond the latter might trigger a short-covering rally and lift the Gold price to the $1,962-$1,964 area en route to the $1,970-$1,972 supply zone. The momentum could get extended further, allowing bulls to reclaim the $2,000 psychological mark and testing the $2,010-$2,012 resistance.

On the flip side, the $1,912-$1,910 area seems to have emerged as an immediate support and should protect the downside ahead of the $1,900 mark and the multi-month low, around the $1,893-$1,892 region touched in June. Some follow-through selling will be seen as a fresh trigger for bearish traders and make the Gold price vulnerable to accelerate the downward trajectory towards the very important 200-day Simple Moving Average (SMA), currently around the $1,866-$1,865 zone. The latter should act as a pivotal point, which if broken decisively should pave the way for an extension of the recent sharp retracement slide from the all-time high, around the $2,080 region touched in May.

Piyush Lalsingh Ratnu

10.07.2023 | World Economics | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

#forex #XAUUSD #gold #PiyushRatnu #education #analysis #forexeducation

#forex #XAUUSD #gold #PiyushRatnu #education #analysis #forexeducation

Piyush Lalsingh Ratnu

10.07.2023 | XAUUSD NFP: Analysis Review | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

#forex #XAUUSD #gold #PiyushRatnu #education #analysis #forexeducation

#forex #XAUUSD #gold #PiyushRatnu #education #analysis #forexeducation

Piyush Lalsingh Ratnu

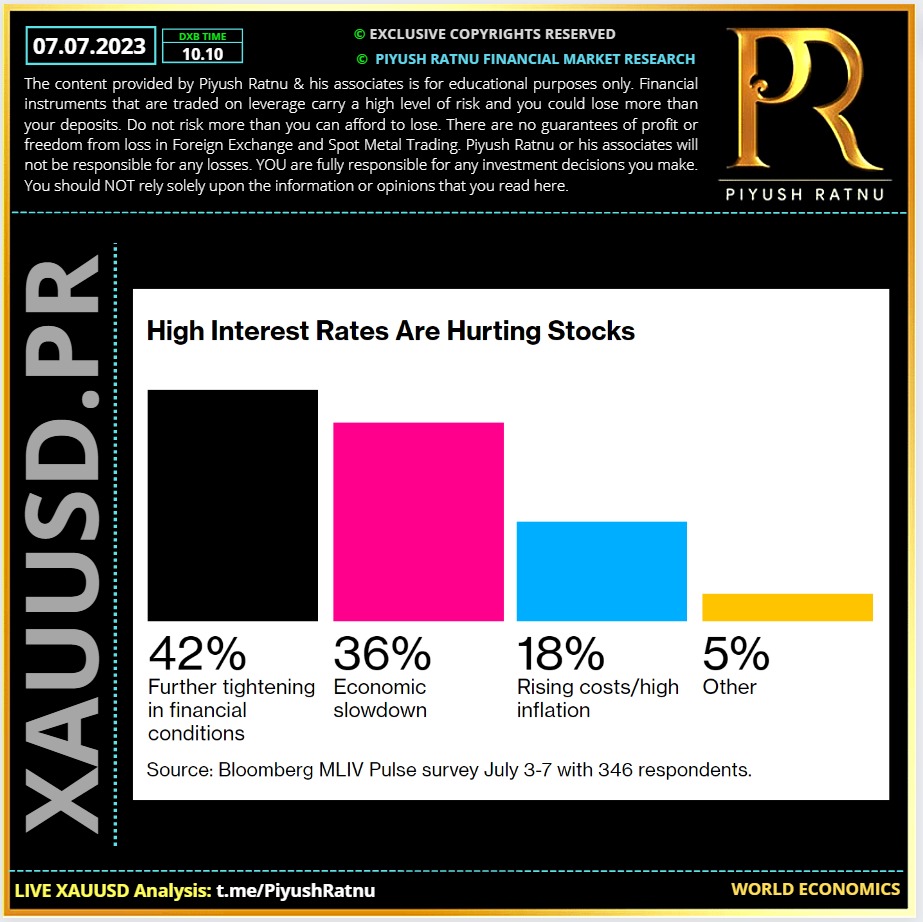

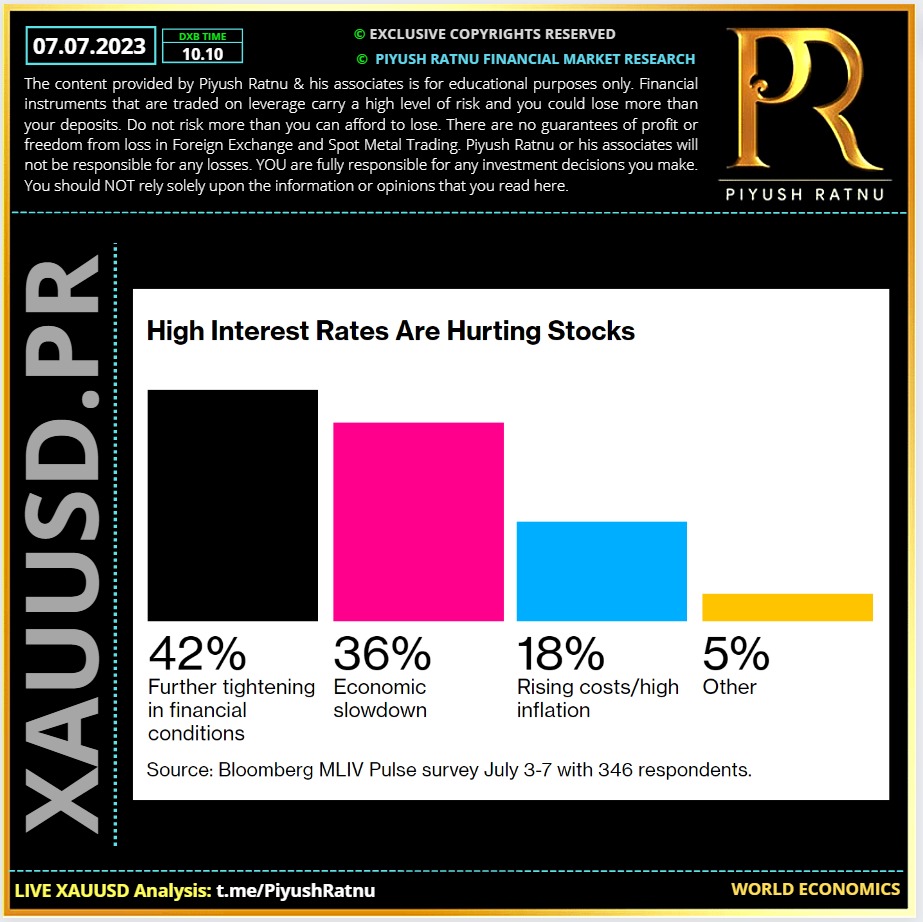

Does gold rise when stocks fall?

Gold has historically had a low or even negative correlation to stocks and bonds, helping minimize losses during periods of weakness in the market. In 2022, for example, gold prices ticked slightly higher by 0.4% while the S&P 500 dropped 19.4%.

Does gold go down with stocks?

When and Why Do Gold Prices Plummet?

A strong dollar and rising interest rates can also hurt the price of gold, as can low inflation. When the economy is healthy and growing, stocks and other investments may become more appealing to investors, who may sell their gold holdings, which can lead to a fall in gold prices.

What happens to gold when stocks crash?

The Effect of a Stock Market Collapse on Silver & Gold:

In other words, when one goes up, the other tends to go down. This makes sense when you think about it. Stocks benefit from economic growth and stability while gold benefits from economic distress and crisis. If the stock market falls, fear is usually high, and investors typically seek out the safe haven of gold.

Gold has historically had a low or even negative correlation to stocks and bonds, helping minimize losses during periods of weakness in the market. In 2022, for example, gold prices ticked slightly higher by 0.4% while the S&P 500 dropped 19.4%.

Does gold go down with stocks?

When and Why Do Gold Prices Plummet?

A strong dollar and rising interest rates can also hurt the price of gold, as can low inflation. When the economy is healthy and growing, stocks and other investments may become more appealing to investors, who may sell their gold holdings, which can lead to a fall in gold prices.

What happens to gold when stocks crash?

The Effect of a Stock Market Collapse on Silver & Gold:

In other words, when one goes up, the other tends to go down. This makes sense when you think about it. Stocks benefit from economic growth and stability while gold benefits from economic distress and crisis. If the stock market falls, fear is usually high, and investors typically seek out the safe haven of gold.

Piyush Lalsingh Ratnu

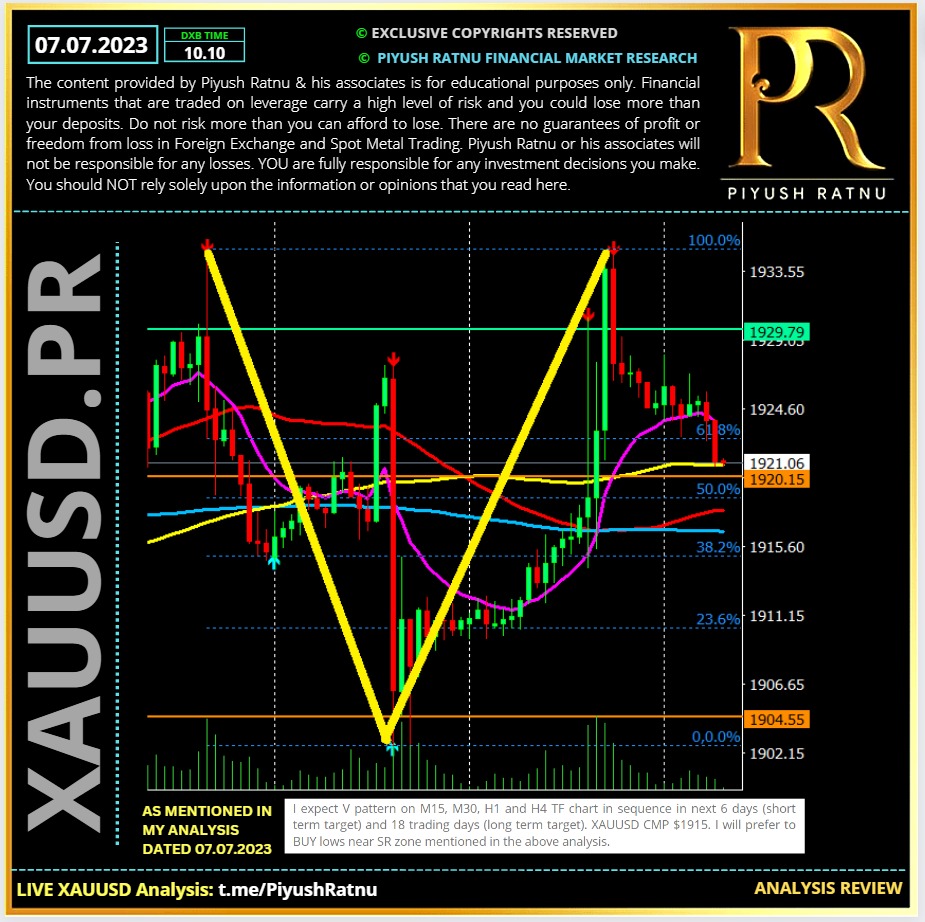

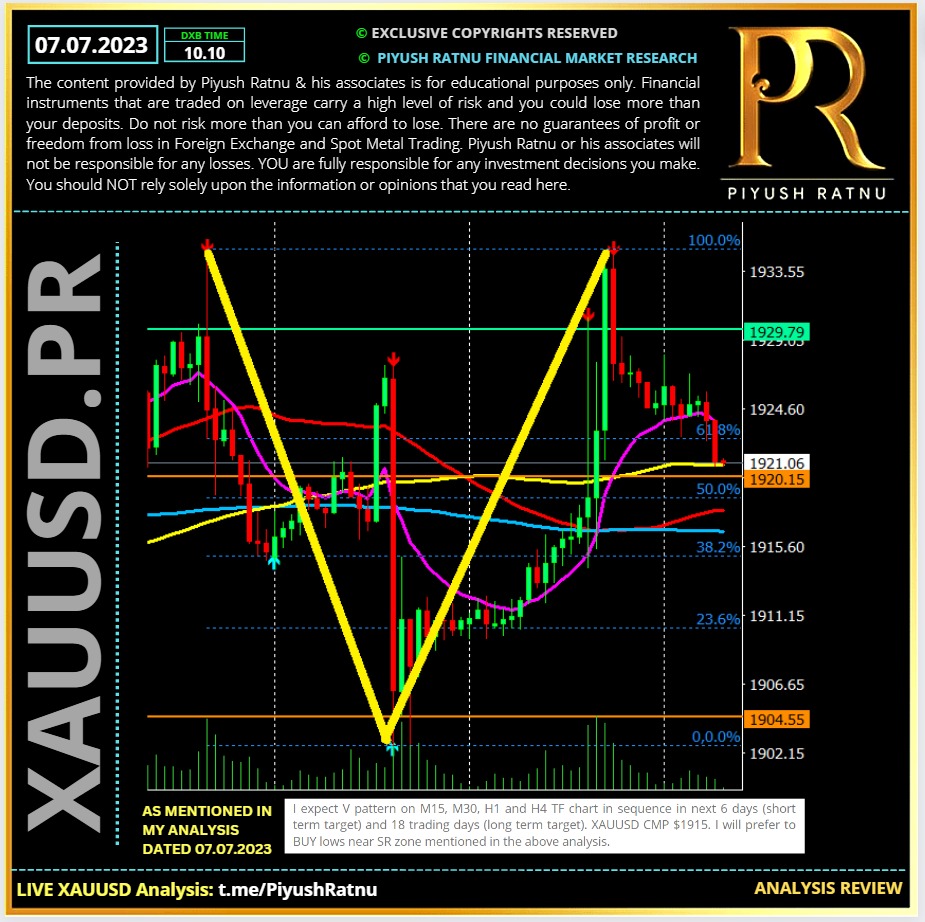

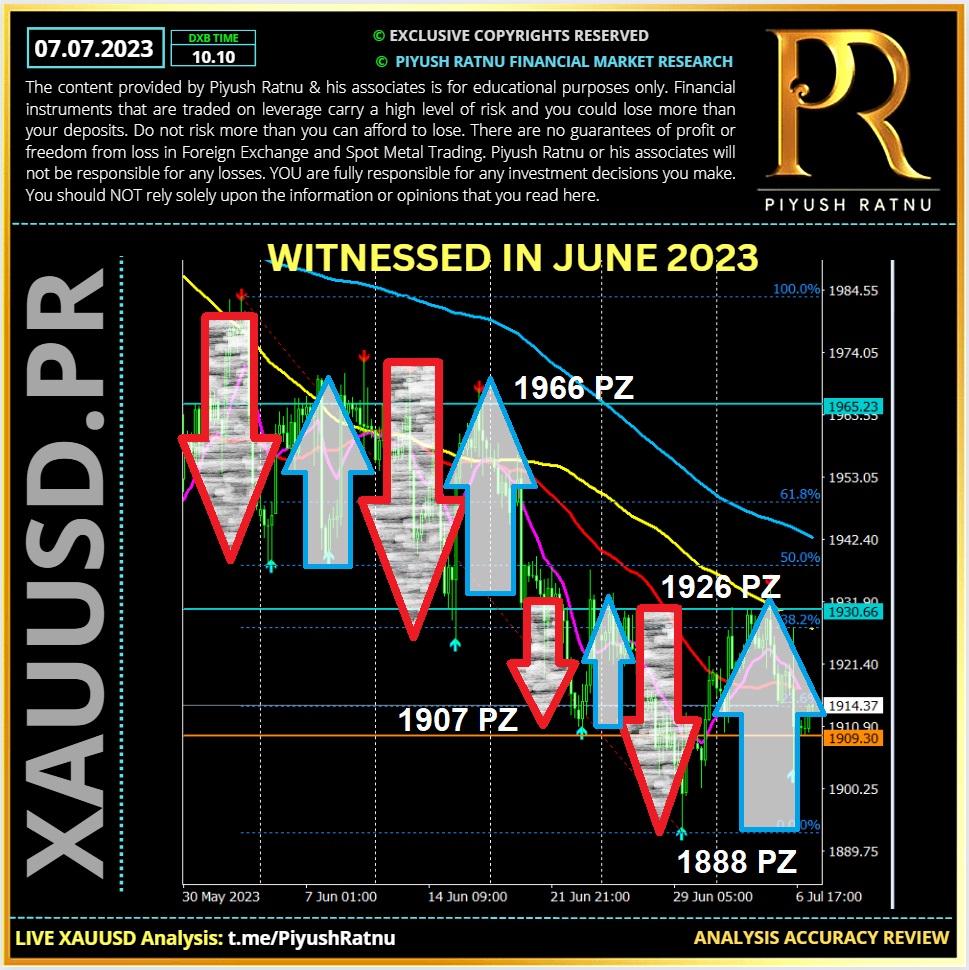

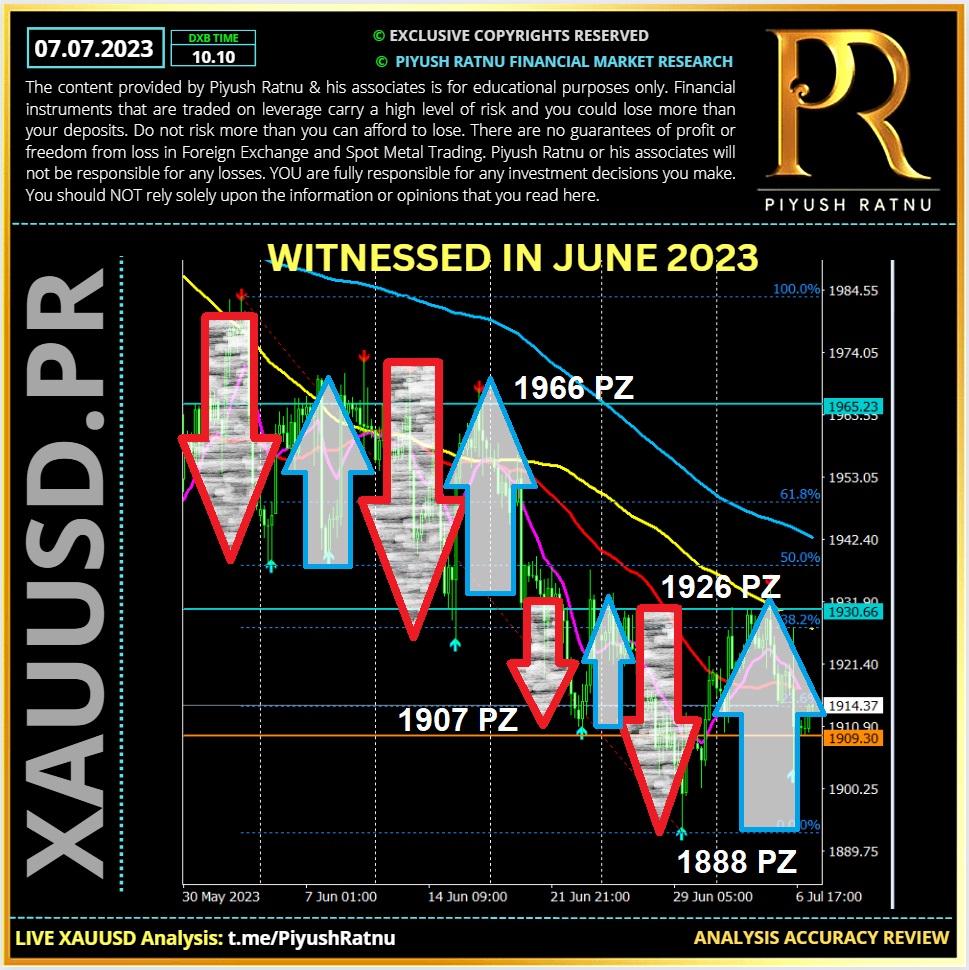

As projected in analysis 02.06.2023:

XAUUSD Bearish Scenario: $1926/1907/1888/1866?

If the bearish momentum continues, Spot Gold price may fall further from MP 02.06.2023 $1975 zone towards $1926/1907 price trap zone with 1947, 1926 and 1907 as next stops, if Gold crash halts at $1947/1926 or $1907/1888 zones a reversal can be expected towards RT 23.6 on M5 and M15 30% RT TF M30/H1 before/in next 9 trading days.

Buying zones projected in June 2023 analysis: 1926/1907/1888/1866/1836.

Accuracy Review Summary: For June 2023 Spot Gold Analysis

XAUUSD crashed post NFP DATA from $1975 till $1924 post NFP on 02 June, 2023, and reversed back to $1966 on 16.06.2023 hence buying at $1926: gave us good results with exit at $25/30 at $1966 zones projected as NAP/ Net exit for BUY entries implemented. In June 2023, XAUUSD struggled at price zones $1926 and $1907 marking it’s low in June at $1892, 29 June 20223 low (1888 zone), buying at $1926, 1907 and 1900 Psychological levels-based price zones gave us neat exits since XAUUSD attempted the high at $1935 on 05.07.2023.

Summary: buying lows: gave us less drawdown and neat exits, if implemented at the price zones mentioned in my analysis dated 02.06.2023. I had projected A pattern in next 10 trading days from 02.06.2023 which was well achieved multiple times on 07.06.2023 as $1938-1969-1938, 07.06.2023-13.06.2023: $1938-1974-1938, 15.06.2023-20.06.2023: $1930-1966-1930, 29.06.2023-06.07.2023: $1907-1935-1907. Current market Price: $1915.

Watch the projected vs witnessed price movement:

https://www.youtube.com/watch?v=TQHtw7gHAHg

XAUUSD Bearish Scenario: $1926/1907/1888/1866?

If the bearish momentum continues, Spot Gold price may fall further from MP 02.06.2023 $1975 zone towards $1926/1907 price trap zone with 1947, 1926 and 1907 as next stops, if Gold crash halts at $1947/1926 or $1907/1888 zones a reversal can be expected towards RT 23.6 on M5 and M15 30% RT TF M30/H1 before/in next 9 trading days.

Buying zones projected in June 2023 analysis: 1926/1907/1888/1866/1836.

Accuracy Review Summary: For June 2023 Spot Gold Analysis

XAUUSD crashed post NFP DATA from $1975 till $1924 post NFP on 02 June, 2023, and reversed back to $1966 on 16.06.2023 hence buying at $1926: gave us good results with exit at $25/30 at $1966 zones projected as NAP/ Net exit for BUY entries implemented. In June 2023, XAUUSD struggled at price zones $1926 and $1907 marking it’s low in June at $1892, 29 June 20223 low (1888 zone), buying at $1926, 1907 and 1900 Psychological levels-based price zones gave us neat exits since XAUUSD attempted the high at $1935 on 05.07.2023.

Summary: buying lows: gave us less drawdown and neat exits, if implemented at the price zones mentioned in my analysis dated 02.06.2023. I had projected A pattern in next 10 trading days from 02.06.2023 which was well achieved multiple times on 07.06.2023 as $1938-1969-1938, 07.06.2023-13.06.2023: $1938-1974-1938, 15.06.2023-20.06.2023: $1930-1966-1930, 29.06.2023-06.07.2023: $1907-1935-1907. Current market Price: $1915.

Watch the projected vs witnessed price movement:

https://www.youtube.com/watch?v=TQHtw7gHAHg

Piyush Lalsingh Ratnu

15.06.2023 | XAUUSD: H4A100 Achieved | XAUUSD was at same zone on 26 May | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

#forex #XAUUSD #gold #PiyushRatnu #education #analysis #forexeducation

#forex #XAUUSD #gold #PiyushRatnu #education #analysis #forexeducation

Piyush Lalsingh Ratnu

05.06.2023 | Alert: Debt Ceiling Deal | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

#forex #XAUUSD #gold #PiyushRatnu #education #analysis

#forex #XAUUSD #gold #PiyushRatnu #education #analysis

Piyush Lalsingh Ratnu

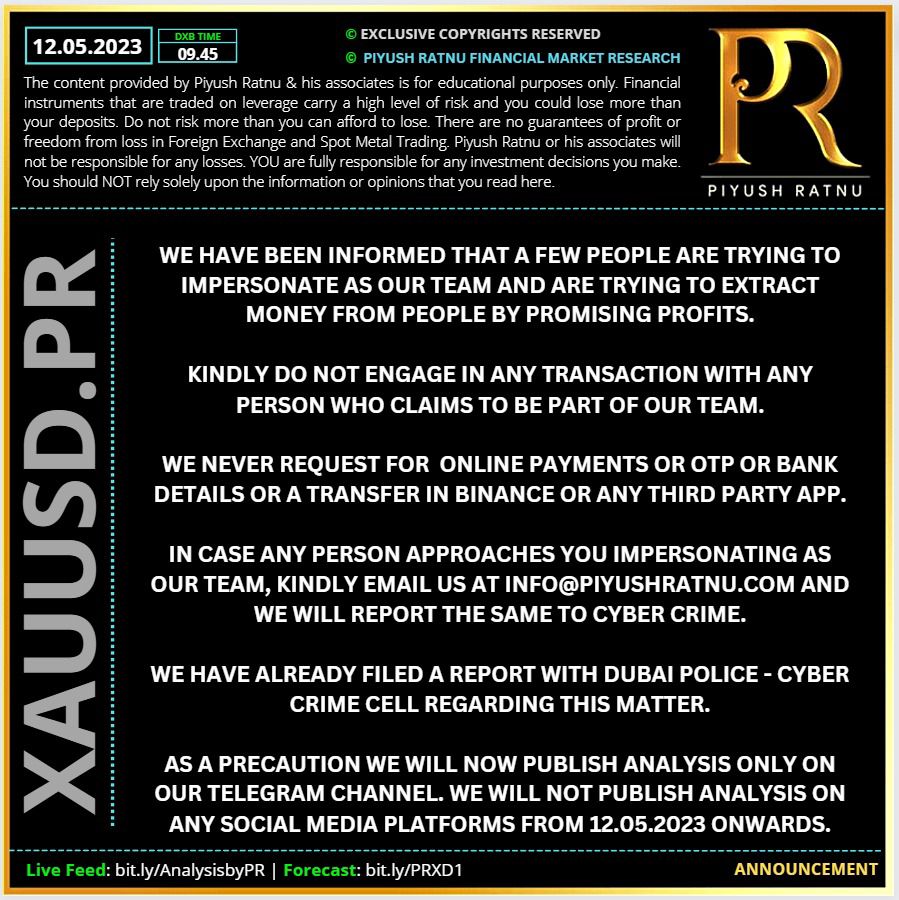

Do not LOSE your MONEY to SCAMMERS. WE ARE NOT RESPONSIBLE IF YOU DO ANY TRANSACTION WITH ANY PERSON IMPERSONATING AS OUR TEAM MEMBER. WE NEVER ASK FOR BITCOINS, CRYPTO PAYMENTS, WALLET TRANSFER, BANK CARD OTP, BANK ACCOUNT OR TRADING ACCOUNT PASSWORD TO TRADE ON YOUR BEHALF. WE ARE MARKET ANALYSTS, AND WE SOLELY PUBLISH ANALYSIS FOR EDUCATIONAL PURPOSE ONLY. IN CASE SOMEONE APPROACHES YOU IMPERSONATING AS OUR TEAM MEMBER KINDLY TAKE ALL HIS/HER DETAILS, AND SHARE THE SAME AT INFO@PIYUSHRATNU.COM

Piyush Lalsingh Ratnu

Important Announcement. WE ARE NOT RESPONSIBLE IF YOU DO ANY TRANSACTION WITH ANY PERSON IMPERSONATING AS OUR TEAM MEMBER. WE NEVER ASK FOR BITCOINS, CRYPTO PAYMENTS, WALLET TRANSFER, BANK CARD OTP, BANK ACCOUNT OR TRADING ACCOUNT PASSWORD TO TRADE ON YOUR BEHALF. WE ARE MARKET ANALYSTS, AND WE SOLELY PUBLISH ANALYSIS FOR EDUCATIONAL PURPOSE ONLY. IN CASE SOMEONE APPROACHES YOU IMPERSONATING AS OUR TEAM MEMBER KINDLY TAKE ALL HIS/HER DETAILS, AND SHARE THE SAME AT INFO@PIYUSHRATNU.COM

Piyush Lalsingh Ratnu

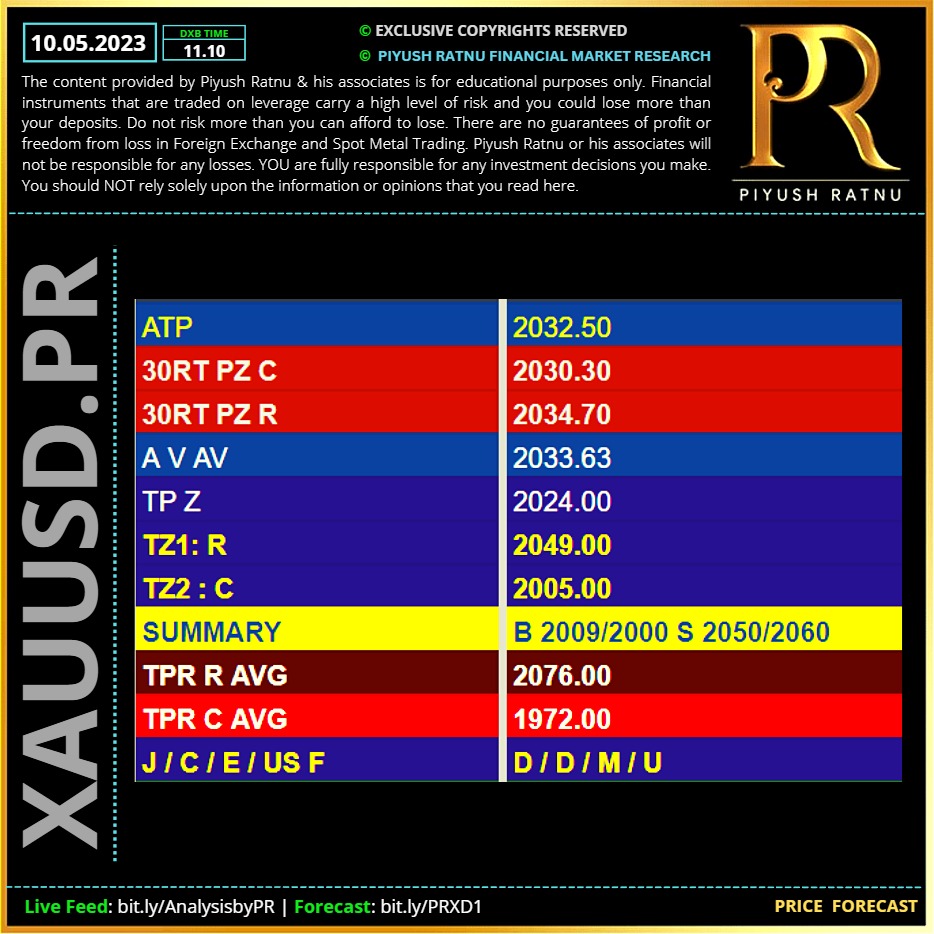

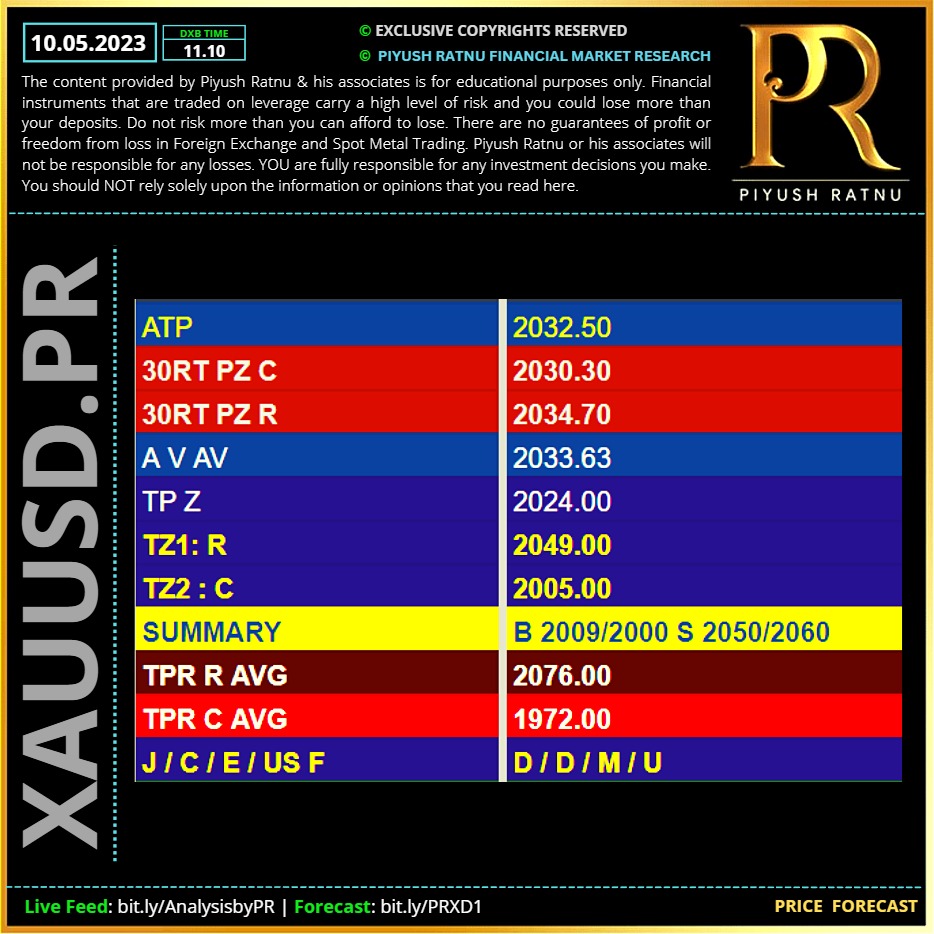

10.05.2023 | Price Forecast | Spot gold Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

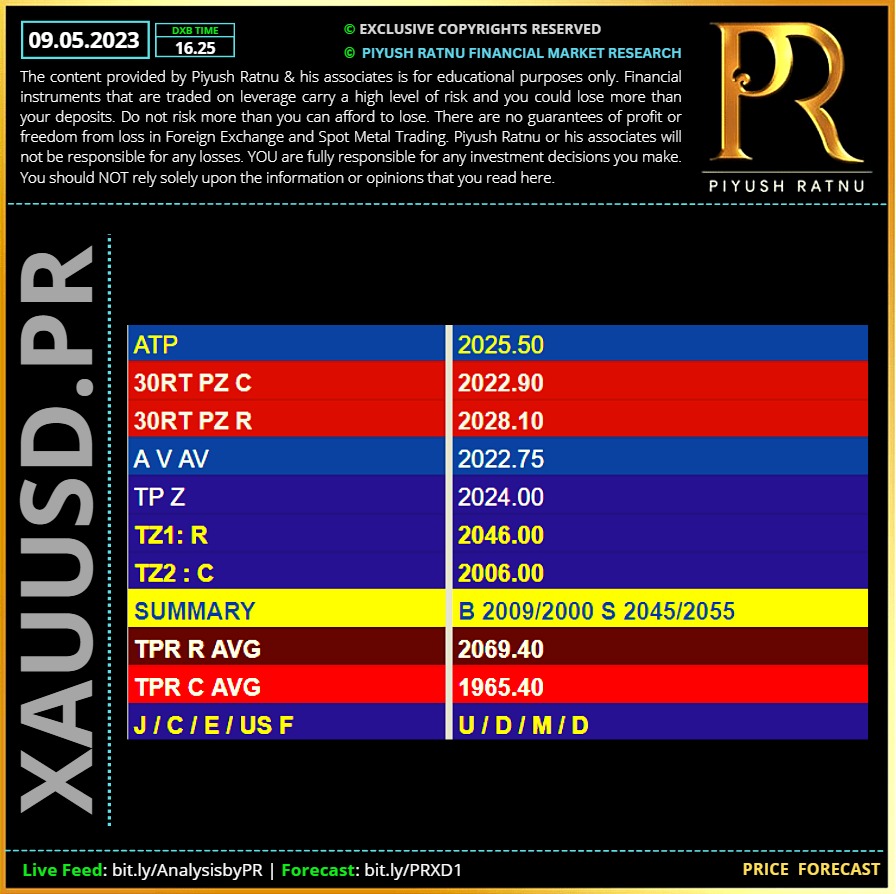

09.05.2023 | Price Forecast | Spot gold Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

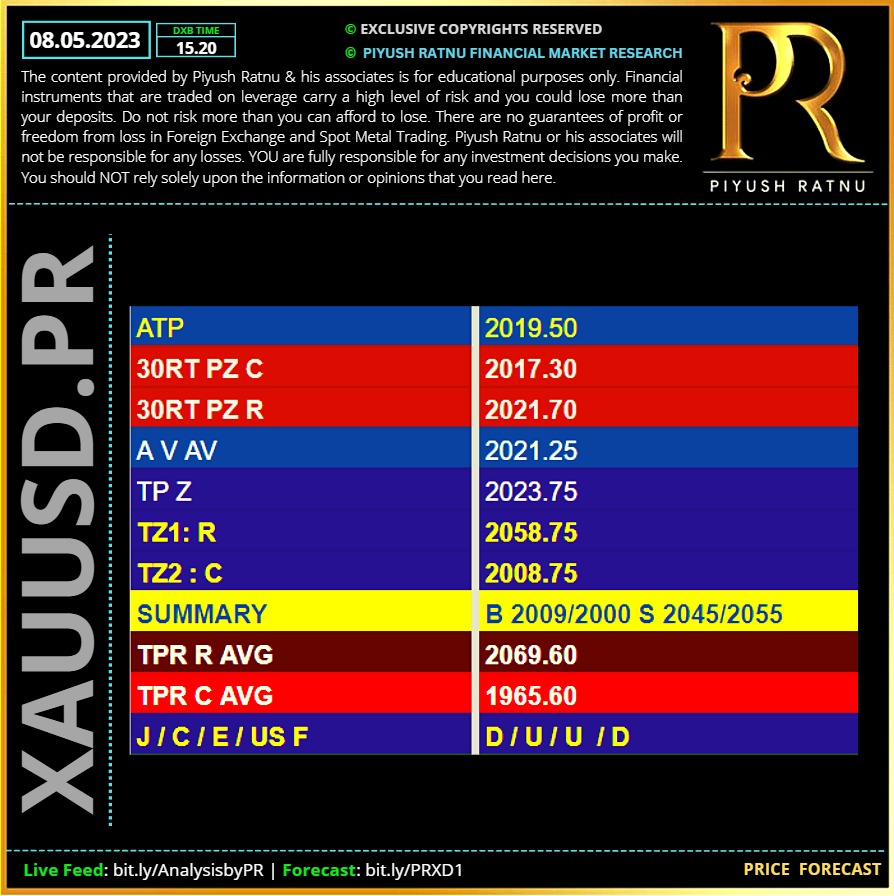

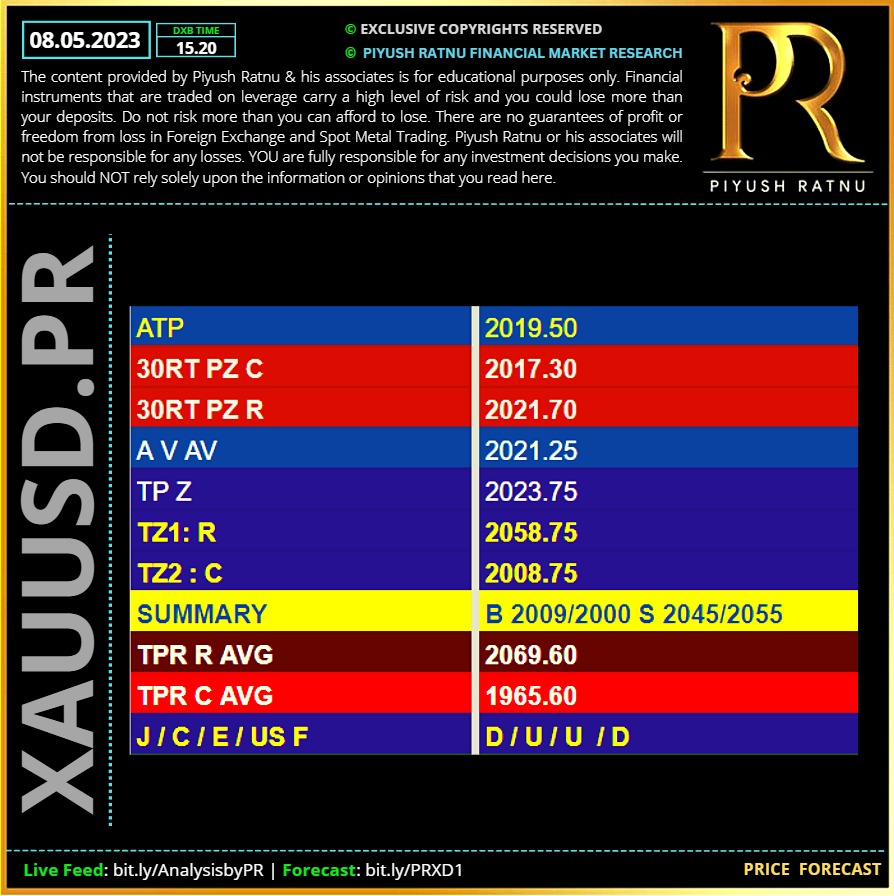

08.05.2023 | Price Forecast | Spot gold Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

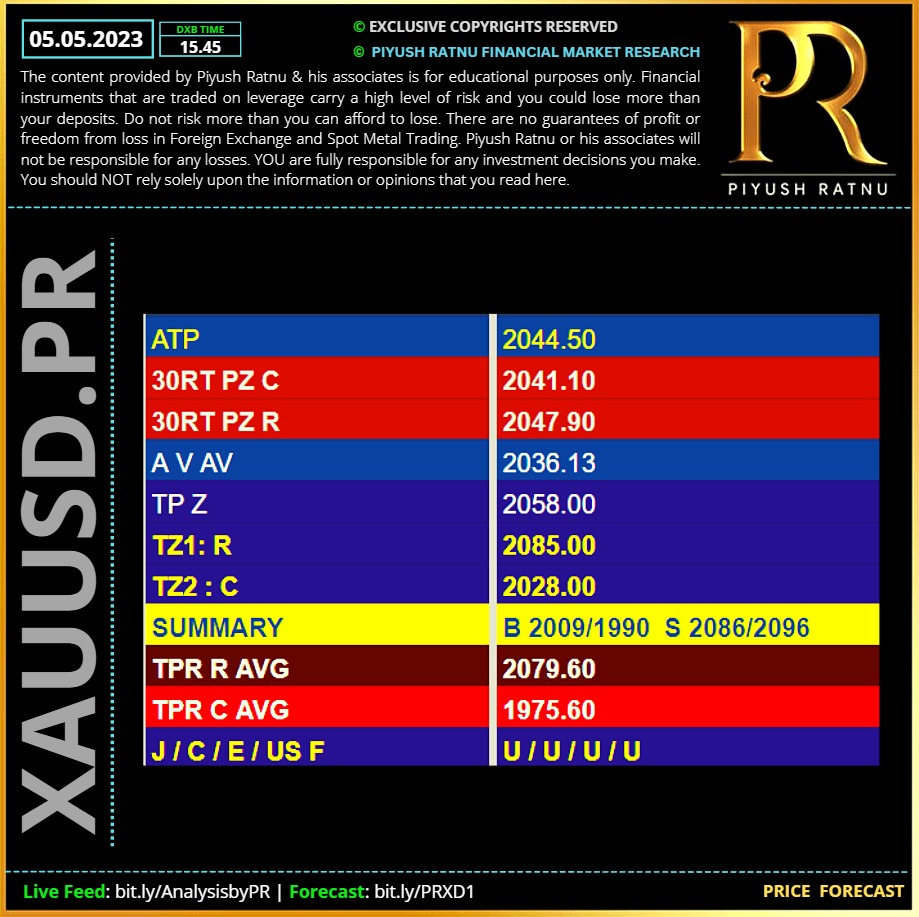

05.05.2023 | Price Forecast | Spot gold Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

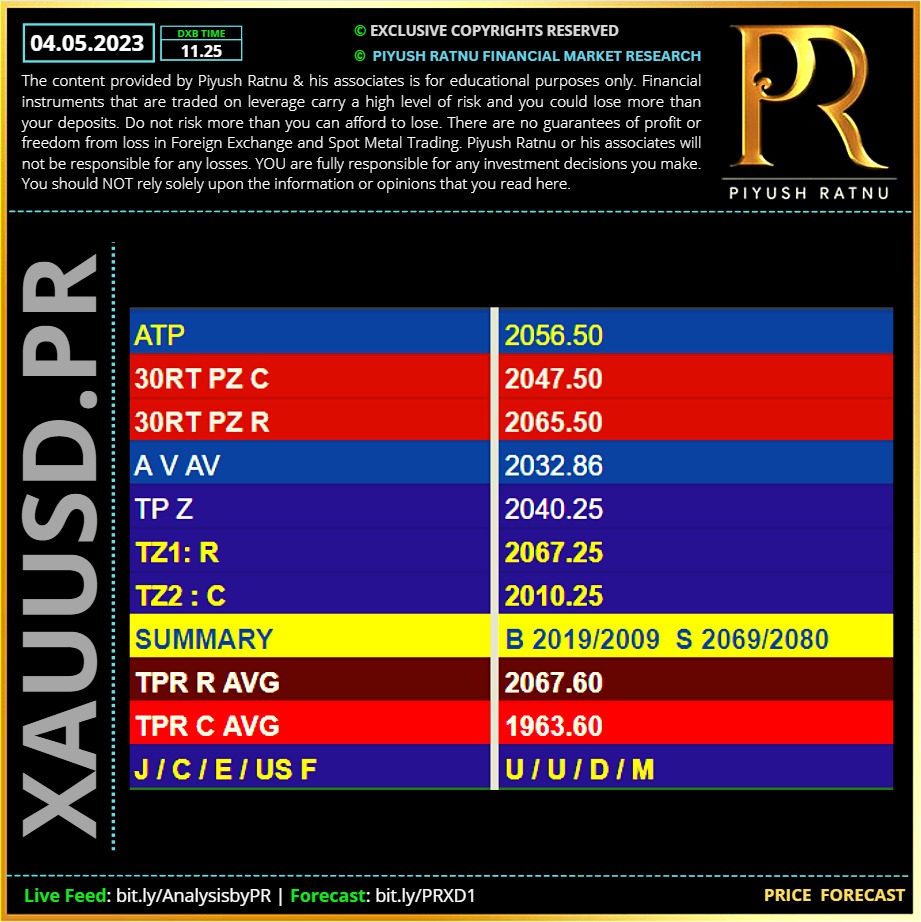

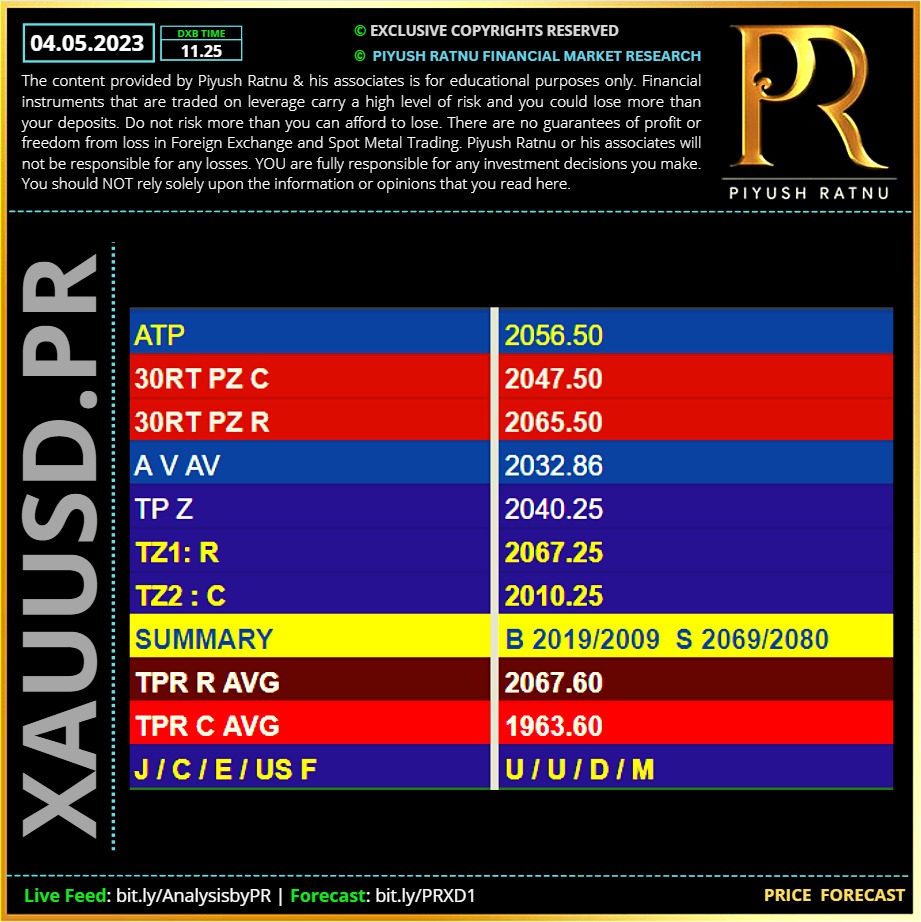

04.05.2023 | Price Forecast and Price Projection as alerted yesterday | Spot gold Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

: