Arturo Lopez Perez / 个人资料

- 信息

|

11+ 年

经验

|

194

产品

|

1037

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

It's not just a coincidence. The markets are incredibly tough to navigate and fiercely competitive. When you step into the market, you're going head-to-head with some of the sharpest minds on the planet, ready to take your money without a second thought, devour you like a chicken in a stew, and leave your bones bare on the plate.

We've all lost money in the markets. Every single one of us. Anyone who says they've never lost money in the markets is lying. Even me. I've lost astronomical amounts of money trading. I've lost more money than I'm willing to admit.

You're not alone.

I've lost money I could afford to part with, but also money I desperately needed. I've lost money to the point where I couldn't buy Christmas gifts for my family. I've lost money to the point of eating rice and canned meat until the end of the month. I've lost money to the point of selling stuff just to make ends meet. I've lost money to the point of biking to save on gas.

The markets have made me experience frustration, anxiety, sadness, anger, and shame. In that order. I've seen my dreams shatter overnight. The markets have beaten my ego like a piñata, reducing it to pulp repeatedly. The market has shaped my personality like a psychopath ex-wife.

The emotional rollercoaster of trading can either make you or break you; the choice is yours. Traders, by necessity, must develop impeccable emotional control. If you develop it, you can recover from setbacks. If not, you'll leave the markets with your tail between your legs, never to return.

The world is full of novice and undisciplined traders who venture into the markets without proper knowledge, abuse leverage, lose everything, and proceed to cry, complain to regulators, or jump out the window.

I've been trading successfully for over fifteen years, and I can confidently say that the difference between a successful trader and a loser lies in their ability to control themselves. In their ability to keep a cool head and maintain ironclad discipline when others opt for madness or despair. A successful trader must treat profits and losses as the impostors they are.

The irony of trading is that to succeed and amass wealth, you must first conquer yourself, control your ego, and learn to put the value of money in perspective. A good trader must keep their head on their shoulders while simultaneously being able to doubt themselves. They must trust their knowledge but keep learning. They must act decisively but not irresponsibly. They must respect money but not obsess over it.

Choosing trading setups, entries, exits, and managing risk is easy.

What's truly difficult is controlling yourself.

To make things worse, the financial industry is designed for you to lose money.

Numerous studies show that the emotional impact of losing 10% of your money is equivalent to the joy of winning 25%, and the financial industry capitalizes on that. Financial institutions make money when you open a new position or close an existing one. Your broker makes money when you change your mind. If you have no positions, your broker will send you optimistic news to buy. If you have positions, your broker will send you pessimistic news to sell. The broker's interface is filled with flashing colors like stuttering traffic lights, intending to cause you anxiety and encourage repetitive transactions.

I'll be brutally honest with you, in case you just fell off the turnip truck.

Financial entities are not your friends. No matter how many years you've been working with them, whether they're regulated and have prestigious awards. The broker's success lies in making you lose discipline to take money out of your pocket and put it in theirs.

Your success, on the other hand, lies in keeping a cool head.

Now, I'm going to say something that might surprise you.

After many years of profitable trading, I've come to the conclusion that to be a successful trader, you only need three things. Just three. The right mindset, understanding the markets, and having the right technical tools. That's it. Nothing more. Everything else is bells and whistles. The first two will allow you to control yourself, choose instruments, and structure your operations, and the third will give you an edge to exploit systematically against other participants.

The mindset is the most important thing for successful trading.

It's impossible to make money in the markets with the mindset of an employee, civil servant, or retiree. Thriving in the markets doesn't require great intelligence, but it does require the right mindset. In trading, like in life, you're your own worst enemy. You come to the markets pre-cursed, and if you're seeking income stability, the markets aren't for you.

Discipline will be your best friend in the markets, and the lack of it will be a terrible curse. Without discipline, the markets will turn your money into carrion for vultures. It's imperative that you develop your discipline before trading, and the best way to do that is outside of the markets, where the price for faltering is modest. The markets, on the other hand, will make you pay the highest price for your weaknesses. If you can't live a disciplined and systematic life before trading in the markets, you’ll send your money to money heaven.

You can start developing your discipline by waking up early and exercising in the morning. Join a crossfit gym, go for a bike ride, or swim fifteen hundred meters. It doesn't matter what, just do it. Whether it's cold or hot, snowing or raining, whether you feel like it or not. Implement a healthy diet and follow it with the systematic approach of a soldier. Throw the TV in the trash and acquire the habit of reading regularly on any topic that interests you: investments, trading, gardening, or philosophy, whatever floats your boat.

Let me repeat that so it sinks in. Don't try trading until you've developed discipline.

Next, you need to understand what markets are and how they work.

You must understand that the markets are an efficient information-discounting machine with a three-year time horizon, and the shorter the time horizon, the more efficient the market is at assigning prices.

This means that any publicly available information has already been discounted by the market before you can do anything about it: I don't care where it comes from. It doesn't matter what specialized media you read, what news sources you follow, or how many newsletters you're subscribed to: you won't be able to consistently extract money from the market using public domain information.

The markets are the great humiliator. The market's mission is to drive you crazy, make you make mistakes, snatch your money, and destroy your self-esteem. The markets enjoy doing what others don't expect and emptying the pockets of all those foolish enough to try to take theirs. The markets are a wealth transmission vehicle from the patient to the impatient and from the educated to the ignorant.

To make money in the short term in the markets, you must know things that others don't, have tools that others don't, and be more disciplined than your adversaries. If you want to make money in the short term, you must turn volatility into your best friend because it's the worst enemy of long-term holders.

The directionality of prices matters, but for a trader, volatility matters more.

Volatility is the nemesis of ignorant investors because it robs them of sleep and drives them to make all sorts of counterproductive decisions. You must understand that in the markets, other participants are your enemies, and volatility increases the probability that they will make mistakes due to anxiety or fear.

Volatility is your adversary's enemy and therefore, your best friend. The more long-term holders there are in a particular asset, the more lucrative it will be for a trader to operate it. You need victims from whom to mercilessly take money when negative emotions invade them. When long-term holders panic and sell valuable assets out of fear of price fluctuations, you must be there to take their money with a smile on your face.

The world is full of investors who are unable to accept market volatility and consequently make colossal mistakes time and time again. When volatility comes into play, investors stampede like frightened buffalo and throw their money off a cliff.

The best traders in the world are dedicated to picking up the money that long-term investors lose due to fear of volatility. In this sense, what instruments to trade matters much more than how you decide to trade them. Most traders don't understand this and fail miserably. You need to trade assets with many fearful long-term holders whom you can empty when they make mistakes and throw their money off the cliff, prey to panic.

The number of long-term holders in a particular asset indicates how attractive it is to trade, and volatility indicates when it's most profitable to do so. The more volatility there is, the more ignorant investors there will be making mistakes and generously donating their money to you.

Most investors lose money in the market for fear of losing money, which is the height of stupidity. They're undisciplined people or gamblers who haven't done their homework and therefore deserve to be stripped of their money mercilessly. He who is about to fall deserves to be pushed, as Nietzsche said.

If you understand the markets and choose what to trade wisely, you'll make fortunes.

Fortunes that others lose.

And finally, you need the right tools.

This is where I come into play. The tools of a good trader are technical indicators and robots. A good technical indicator will allow you to see things that others don't and take full advantage of situations that cause panic and despair to everyone else, as well as improve the timing of your trades.

On the other hand, trading robots will lighten your workload and allow you to focus on the discretionary aspects of trading, delegating order management, exit strategy, and countless other things.

If you trade the right markets, at the right time, and with the right tools, you'll crush it. You'll clean up. You'll be able to take a dump on top of your boss's desk. You'll be able wipe your butt with hundred-dollar bills. You'll feel like you've broken the bank at the Monte Carlo casino every year. You won't distinguish between Tuesdays and Saturdays. You'll have an irresistible conversation for the opposite sex. You'll go to the grocery store in a Ferrari. You'll be able to rent a yacht in the summer and fill it with naked chicks. You'll triple your dating game. You'll extend your sex life beyond fifty…

You get the idea.

If you have discipline and understand the markets, my indicators and robots can make you a fortune because they offer you a statistical edge that you can exploit systematically against your adversaries.

Let me repeat that so it sinks in. My trading tools can make you a boatload of money.

The good news is that most of my trading tools are completely free.

That means you'll get them free of charge. In exchange for nothing. For zero dollars. Zip. Nil. On the house. All you have to do to get them is enter your email, and I'll send them to your inbox faster than you can say "bull market".

Plain and simple. No nonsense. No bullshit. No strings attached.

People tend to dismiss everything free, assuming it has no value, but when it comes to my indicators and robots, you'd be mistaken to do so. On my website, you'll find high-quality free tools, better than the vast majority of paid alternatives you'll find online.

Now, I could brag about my experience as a programmer, the quality and uniqueness of my tools, how robust they are, the flexibility they offer, and the honesty with which I present them, but I'm not going to do that because that's what everyone else does. Instead of that, I prefer you download them and see for yourself.

But I can't give away all my work.

I'd love to offer all my indicators and robots completely free of charge, but it turns out that keeping them updated and answering your burning questions requires some effort and dedication.

Therefore, you should know that I also offer premium tools and I'm going to try to sell them to you because it's my duty. That's how it is. If I didn't, I'd be irresponsible and throwing my only talent down the drain.

I'm not going to beat around the bush.

The market wants your money, the broker wants your money, and I want your money.

But at least I'm being upfront with you and willing to play fair. I won't subject you to sophisticated conversion tunnels, unfulfillable promises, recurring charges, upsells, downsells, or relentless phone calls. There are no rags-to-riches tales here, no reels, shorts, or tweets designed to awaken your greed and urge you to buy something you don't need. What you see is what you get.

If you like my free tools or you've enjoyed my rant, consider the possibility of buying some of my indicators or robots. I'll be eternally grateful, and it will allow me to keep the show running, instead of just lounging around in my penthouse overlooking the ski slopes or chilling in the spa.

I'm aware that if I didn't give away most of my tools, but instead wrapped them in colorful paper and promoted them tirelessly on social media without rocking the boat, I would make much more money than I do now. But to be honest, all of that feels like too much effort to me.

I wish you the best of luck in your trading.

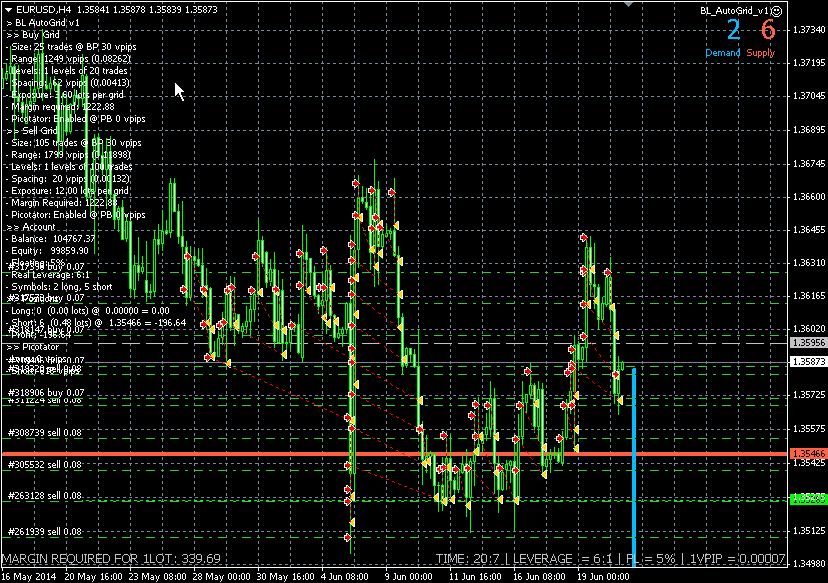

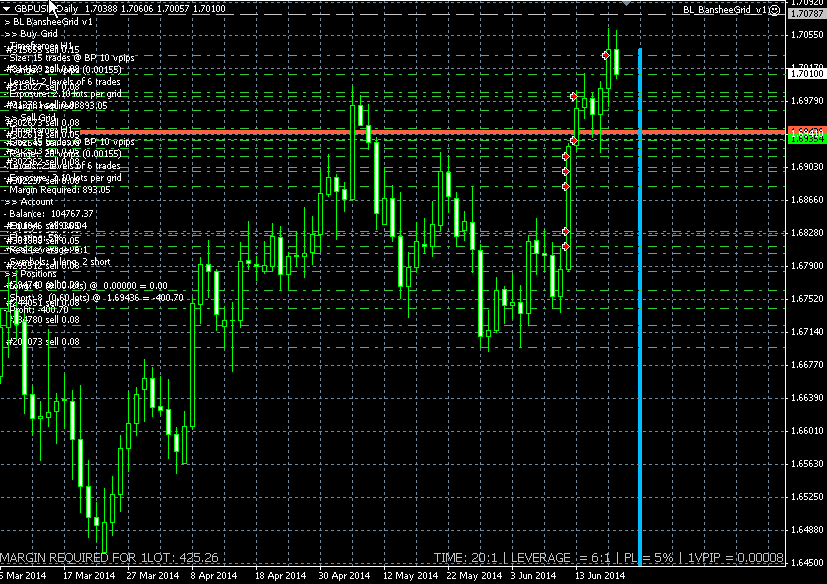

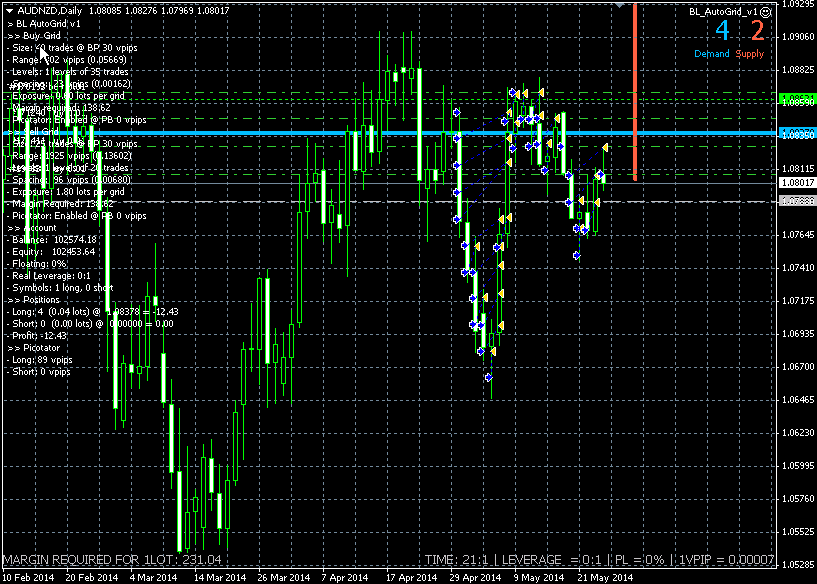

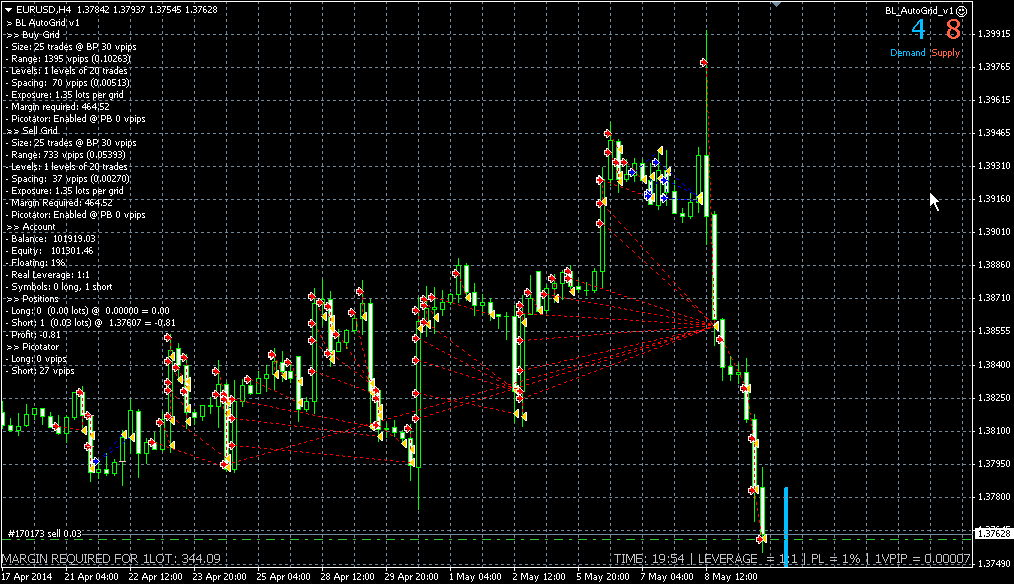

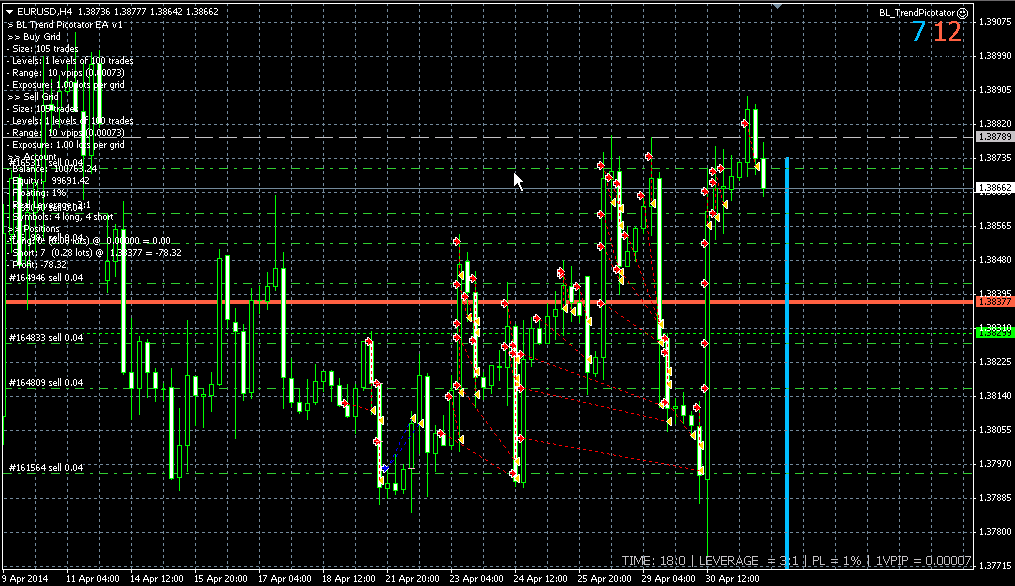

该指标分析过去的价格走势以预测市场的买入和卖出压力:它可以通过回顾过去并分析当前价格附近的价格高峰和低谷来做到这一点。这是最先进的确认指示器。 [ 安装指南 | 更新指南 | 故障排除 | 常见问题 | 所有产品 ] 预测市场的买卖压力 避免陷入购买狂潮的陷阱 无需设置也无需优化 该指标在所有时间范围内均有效 极易使用 潜在的供求价格是指许多市场参与者可能持有其亏损头寸,希望在收支平衡时清算的价格。因此,在这些价格水平上有大量活动。 供需双方都量化为数字 如果供应高于需求,则可以预期卖压 如果供应低于需求,则可以预期购买压力 当供应高于需求时寻找空头 当供应低于需求时寻找多头 输入参数 范围:当前价格附近的波动率乘数,用于搜索过去的高峰和低谷。 作者 ArturoLópezPérez,私人投资者和投机者,软件工程师,零零点交易解决方案的创始人。

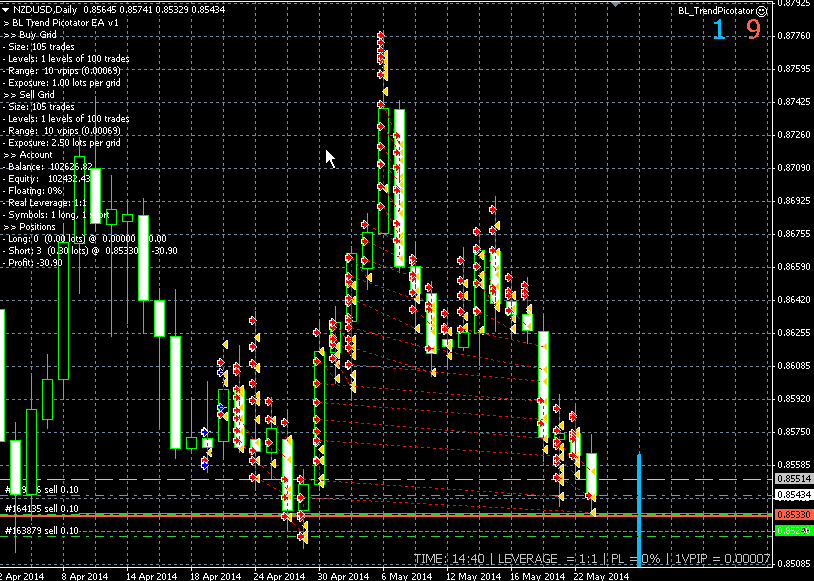

该指标仅使用价格行为分析和donchian渠道以锯齿形检测价格反转。它是专门为短期交易而设计的,根本不需要重新粉刷或补漆。对于精明的交易者来说,这是一个绝佳的工具,旨在增加他们的运作时间。 [ 安装指南 | 更新指南 | 故障排除 | 常见问题 | 所有产品 ] 极易交易 它在每个时间段都提供价值 实施自我分析统计 它实现了电子邮件/声音/视觉警报 基于可变长度的突破和拥挤区域,该指标仅使用价格行为来选择交易并对市场快速做出反应。 显示过去信号的潜在利润 该指标分析其自身的质量和性能 突围的损失突出显示并解决 该指标是不可重涂和不可重涂的 该指标将帮助盘中交易者不要错过单个价格反转。但是,并非所有价格反转都是一样的,也不是具有相同的可行质量。决定要突破哪些突破而忽略哪些取决于交易者的良好判断。 如何解释统计数据 该指标研究其自身信号的质量,并在图表上绘制相关信息。将分析每笔交易,并在图表的左上角显示总体历史结果,这使您可以针对任何给定的工具和时间范围自行优化指标参数。每个乐器和时间表都有其自己的最佳设置,您可以自己找到它们。 最大优惠交易:对于任何给定的交易,MFE都是最好的结果。

该指标仅使用价格行为分析和donchian渠道以锯齿形检测价格反转。它是专门为短期交易而设计的,根本不需要重新粉刷或补漆。对于精明的交易者来说,这是一个绝佳的工具,旨在增加他们的运作时间。 [ 安装指南 | 更新指南 | 故障排除 | 常见问题 | 所有产品 ] 极易交易 它在每个时间段都提供价值 实施自我分析统计 它实现了电子邮件/声音/视觉警报 基于可变长度的突破和拥挤区域,该指标仅使用价格行为来选择交易并对市场快速做出反应。 显示过去信号的潜在利润 该指标分析其自身的质量和性能 突围的损失突出显示并解决 该指标是不可重涂和不可重涂的 该指标将帮助盘中交易者不要错过单个价格反转。但是,并非所有价格反转都是一样的,也不是具有相同的可行质量。决定要突破哪些突破而忽略哪些取决于交易者的良好判断。 如何解释统计数据 该指标研究其自身信号的质量,并在图表上绘制相关信息。将分析每笔交易,并在图表的左上角显示总体历史结果,这使您可以针对任何给定的工具和时间范围自行优化指标参数。每个乐器和时间表都有其自己的最佳设置,您可以自己找到它们。 最大优惠交易:对于任何给定的交易,MFE都是最好的结果。

该指标分析过去的价格走势以预测市场的买入和卖出压力:它可以通过回顾过去并分析当前价格附近的价格高峰和低谷来做到这一点。这是最先进的确认指示器。 [ 安装指南 | 更新指南 | 故障排除 | 常见问题 | 所有产品 ] 预测市场的买卖压力 避免陷入购买狂潮的陷阱 无需设置也无需优化 该指标在所有时间范围内均有效 极易使用 潜在的供求价格是指许多市场参与者可能持有其亏损头寸,希望在收支平衡时清算的价格。因此,在这些价格水平上有大量活动。 供需双方都量化为数字 如果供应高于需求,则可以预期卖压 如果供应低于需求,则可以预期购买压力 当供应高于需求时寻找空头 当供应低于需求时寻找多头 输入参数 范围:当前价格附近的波动率乘数,用于搜索过去的高峰和低谷。 作者 ArturoLópezPérez,私人投资者和投机者,软件工程师,零零点交易解决方案的创始人。

This indicator calculates how much has an instrument won or lost in percentage terms on each bar displayed in the chart. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ] Identify market patterns Find decisive price movements Be suspicious about overbought/oversold situations It is an extremely easy to use indicator... The blue histogram represents winning bars The red histogram represents losing bars The gray line represents the average win/loss per bar Labels are

该指标找到AB = CD回撤形态。 AB = CD回调模式是一种4点价格结构,其中初始价格区间被部分回调,然后与回调完成后等距移动,这是所有谐波模式的基本基础。 [ 安装指南 | 更新指南 | 故障排除 | 常见问题 | 所有产品 ] 可定制的图案尺寸 可定制的AC和BD比率 可定制的突破时间 可定制的线条,颜色和大小 它根据CD纤维水平显示SL和TP水平 视觉/声音/推送/邮件警报,用于模式和突破 AB = CD Retracements可以扩展和重新绘制很多内容。为了使事情变得更容易,该指标实施了一个转折:它在向交易发出信号之前等待正确方向的Donchian突破。最终结果是带有非常可靠的交易信号的重新粉刷指示器。输入donchian突破时段作为输入。 看涨回撤是蓝色的 空头回撤是红色的 请注意,价格模式(例如AB = CD)可以扩展,指标必须重新绘制以跟随该模式的扩展。如果图案重涂超出了参数中输入的AC / BD / AB = CD比率,则该图案将消失,因为它将不再有效。要交易这些模式,请求助于donchian突破信号。 输入参数 幅度:AB = CD模式的大小

http://www.pointzero-trading.com/ManagedAccounts

This indicator evaluates the market sentiment using raw price action measurements, and it is an amazing trading confirmation. It can be used to take a trend-trade approach or a contrarian approach using reversal patterns. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ] Find early reversals Confirm short-term trades Detect indecision on the market Take contrarian trades near support and resistance levels Trade inside bars confirmed by overall direction of the market

This indicator evaluates the market sentiment using raw price action measurements, and it is an amazing trading confirmation. It can be used to take a trend-trade approach or a contrarian approach using reversal patterns. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ] Find early reversals Confirm short-term trades Detect indecision on the market Take contrarian trades near support and resistance levels Trade inside bars confirmed by overall direction of the market

http://www.pointzero-trading.com/

该指标同时评估波动率和价格方向性,从而发现以下事件。 [ 安装指南 | 更新指南 | 故障排除 | 常见问题 | 所有产品 ] 决定性和突然的价格变动 大锤子/流星图案 大多数市场参与者都支持强劲的突破 犹豫不决但动荡的市场形势 这是一个非常易于使用的指标... 蓝色直方图代表看涨的冲动 红色直方图代表看跌冲动 灰色直方图表示当前的波动率 移动平均线是平均波动率 该指标实施各种警报 指示器不重涂或重涂 ...具有直接的交易含义。 当看涨冲动超过平均波动率时,您可以购买 当看跌冲动超过平均波动率时,您可以卖出 该指标跟踪市场波动以及每个单个柱的看涨和看跌冲动。如果看涨的冲动超过平均波动率,那可能是做多空头的好机会。这些强劲的价格走势是可靠的,因为其他市场参与者可能会补仓。如果使用得当,此指示器功能非常强大。 作者 ArturoLópezPérez,私人投资者和投机者,软件工程师和Point Zero Trading Solutions的创始人。