Luiz Felipe De Oliveira Caldas / 个人资料

- 信息

|

4 年

经验

|

8

产品

|

330

演示版

|

|

1

工作

|

0

信号

|

0

订阅者

|

Alien Wolf Scalper 是一款全自动剥头皮机器人,它使用非常有效的突破策略、先进的资金管理和概率分析。在占据大部分市场时间的价格整合阶段最为有效。在真实账户上以出色的风险回报率证明了自己。不需要强制优化,这是其可靠性的主要因素,也是未来稳定盈利的保证。适合初学者和经验丰富的交易者。 要求 交易对 ALL PAIRS (EURUSD, USDJPY, [..]) 时间表 H1 最低存款 $100(0.1) $20(0.01) 杠杆作用 1:500 经纪人 对冲 ECN 账户。低点差和零止损水平 设置 1.外星狼黄牛 1.1 幻数 1.2 固定体积 1.3 获利 1.4 止损 1.5 止损(高或低)最后一根蜡烛 2.保护停止 2.1 开启盈亏平衡和尾随 Sto 2.2 收支平衡触发 2.3 尾随止损触发器(0 不工作 TS) 2.4 追踪止损步骤 三、交易时间 3.1 会话 1 开始 3.2 会话 1 结束 3.3 会话 2 开始 3.4 第二节课结束 4.新闻过滤器 4.1 打开新闻过滤器 新闻前 4.2 分钟 4.3 分钟后新 4.4 影响程度最小 4.5 货币 1

RSI Divergence Signal The RSI Divergence Signal is a technical analysis tool used in financial markets to identify potential trend reversals. It compares the Relative Strength Index (RSI) with price action to detect divergences. When the RSI moves in the opposite direction of the price, it signals a potential change in momentum, suggesting that the current trend may be weakening. This divergence can indicate a buying opportunity in a downtrend or a selling opportunity in an uptrend

Infinity Indicator MT5 1.0 Panel Asset Rate % EURUSD 96.0% GBPUSD 94.1% AUDCAD 90.5% USDCHF 87.8% BTCUSD 78.4% Panel Win Rate based on CandleMT4 Exit Button Calculates the StdDev standard deviation indicator on the RSI data, stored in the matrix similar to the keltner. input int HourCalculate = 12; RsiLength = 5; RsiPrice = PRICE_CLOSE; HalfLength = 4; DevPeriod = 100; Deviations = 0.9; UseAlert =

| 规格质量 | 5.0 | |

| 结果检查质量 | 5.0 | |

| 可用性和沟通技巧 | 5.0 |

An expert advisor (EA) is an automated trading system designed to execute trades on behalf of traders in the financial markets. In the context of a buy and sell grid system of levels breakout, the EA is programmed to identify key price levels and initiate buy or sell trades when those levels are broken. Here's a step-by-step description of how such an EA might work: Level Identification: The EA identifies significant price levels on the chart, such as support and resistance levels or trendlines

Grid trading is when orders are placed above and below a set price, creating an order grid with increasing and decreasing prices. Grid trading is most commonly associated with the foreign exchange market. In general, the technique seeks to capitalize on the normal volatility of an asset's price by placing buy and sell orders at certain regular intervals above and below a predefined base price. For example, a forex trader can place buy orders every 15 pips above a set price, while also placing

VWAP 波段视觉样式 1.0 金融市场指标是交易者和投资者用来分析金融市场和做出决策的重要工具。 VWAP 和布林带是交易者用来衡量市场趋势和价格波动的两种流行技术分析工具。在此产品中,我们建议结合这两个指标来创建一个独特的产品,提供对市场趋势和波动性的全面分析。该产品非常适合希望根据数据驱动分析做出明智决策的交易者和投资者。 背离策略是一种流行的技术分析技术,交易者使用它来识别市场中潜在的趋势逆转。该策略依赖于识别价格走势和技术指标之间的差异。在本节中,我们将使用视觉风格和布林带描述背离策略。 例如,使用 Visual Style 和 Bollinger Bands 的背离策略是一种流行的技术分析技术,交易者使用它来识别市场中潜在的趋势逆转。该策略依赖于识别 RSI 和证券价格行为之间的差异。通过使用此策略,交易者可以根据数据驱动的分析做出明智的决策,从而实现更有利可图的交易和投资。

Grid trading is executed when orders are placed above or below a set price, creating a grid of orders with rising and falling prices. Our patented trader makes it possible to open new grids at the average price, thereby increasing the chances of recovering a negative floating balance. Unlike other trading strategies, our focus is on decreasing Bollinger bands. This means that if the market has abruptly moved into a region and is weakening, it is more vulnerable to a reversal. This innovative

Infinity Indicator MT4 3.3 Panel Win Rate based on CandleMT4 Exit Button Calculates the StdDev standard deviation indicator on the RSI data, stored in the matrix similar to the keltner. input int HourCalculate = 12; RsiLength = 5; RsiPrice = PRICE_CLOSE; HalfLength = 4; DevPeriod = 100; Deviations = 0.9; UseAlert = true; DrawArrows = true; TimerWork=300; LevelUp = 80; LevelDown = 20; MoreSignals = true;

What I've learned?

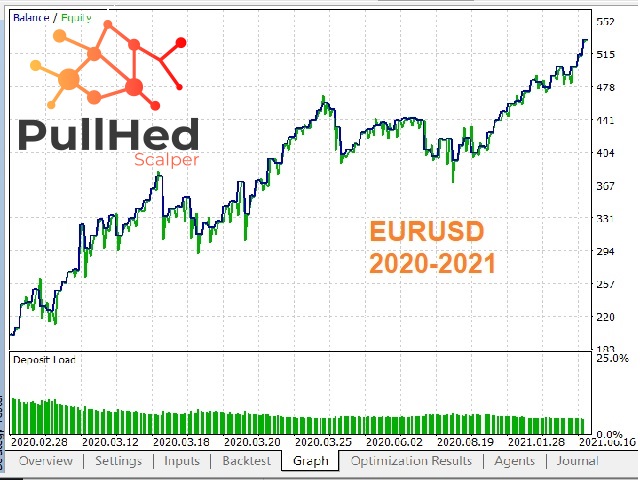

Law #1 Pullback Retraction: Whenever the market tends to "burst" up or down, those who are defending opposite positions (HFTs or humans) will want to settle on the pullback retraction, to finally reverse the position.

Law #2 Linear Regression: Linear regression analysis generates an equation that describes the statistical relationship between one or more predictor variables and the response variable.

Law #3 Heads or Tails: 'Heads' refers to the side of the coin that features a portrait, or head, while 'Tails' refers to the opposite side. This is not because it features any form of tail, but because it is the opposite of heads. In other words, you have a 50% chance of winning or losing, just like in trade (buy, sell).

Summary #1: The futures price follows an average, and how do you profit from it? The answer is to lose less than you gain.

And how did I implement this in Pulled?

Simple!! I set a target (head) with input of 100 points less than the moving average based on average price, with a target of 50% (50 points).

Logic #1: If the target is 50 (head) and he dropped 100(2x tails) below the average price, it has a statistically 66.66% hit, because 3x "plays" are 150 points in play (50/150= 0.33*100%), or if it is 33.33% for loss. Of course the financial market is not a bet haha

Logic #2: If the loss is -50 zero to zero for the market, but if the price tends to return to the average price, why accept this loss? Let's take more statistical advantage! Let's close when crossing the line!

Logic #2: 1st scenario-> I close the trade 20 points above my defined stop at -50, that is, I lost -30, "I gained +20", or even if I gained 50 without any foundation, I would be missing 20 like a breakeven based on the average.

2nd scenario->I close the trade -20 points below my defined stop -50, that is, I lost -70, "I lost -20", or even if I lost 50 without any fundamentals, I would be missing 20. And what does this prove? You have a statistical credit of 20 points

Question: Logic #2-> ok! If I have "statistical credit" of 20 points profitable for the 2nd scenario, I also have "statistical credit" of 20 negative points also for the 1st scenario!! Ok cool, but you are basing yourself on the average price (future) that the entire volume of trades is also targeted over there, but who has never used a robot with a stop on the moon? "50 of take profit and 1000 of stop loss" I see several fools falling in this type of miracle robot, What is the advantage of the robot having 98% success if in the single trade of losing, it breaks the balance? https://www.mql5.com/en/market/product/59849?source=Site+Market+Product+Page

https://t.me/felipeDevMQL