Luiz Felipe De Oliveira Caldas / 프로필

- 정보

|

3 년도

경험

|

8

제품

|

324

데몬 버전

|

|

1

작업

|

0

거래 신호

|

0

구독자

|

Alien Wolf Scalper는 매우 효율적인 탈출 전략, 고급 자금 관리 및 확률 분석을 사용하는 완전 자동화된 스캘핑 로봇입니다. 시장 시간의 대부분을 차지하는 가격 통합 단계에서 가장 효과적입니다. 탁월한 위험 대비 보상 비율로 실제 계정에서 입증되었습니다. 강제 최적화가 필요하지 않으며, 이는 안정성과 향후 안정적인 수익 보장의 주요 요소입니다. 초보자와 숙련된 트레이더 모두에게 적합합니다. 요구 사항 거래 쌍 모든 쌍 ( EURUSD, USDJPY, [..]) 기간 H1 최소 보증금 $100(0.1) $20(0.01) 영향력 1:500 브로커 ECN 계정을 헤징합니다. 낮은 스프레드 및 제로 스톱 수준 설정 1. 에일리언 울프 스캘퍼 1.1 매직넘버 1.2 고정 볼륨 1.3 이익을 취하다 1.4 손절매 1.5 (높음 또는 낮음) 마지막 촛불에서 중지 2. 보호 정지 2.1 손익분기점 및 후행 Sto 켜기 2.2 손익분기점 트리거 2.3 후행 정지 트리거(0이 작동하지

RSI Divergence Signal The RSI Divergence Signal is a technical analysis tool used in financial markets to identify potential trend reversals. It compares the Relative Strength Index (RSI) with price action to detect divergences. When the RSI moves in the opposite direction of the price, it signals a potential change in momentum, suggesting that the current trend may be weakening. This divergence can indicate a buying opportunity in a downtrend or a selling opportunity in an uptrend

Infinity Indicator MT5 1.0 Panel Asset Rate % EURUSD 96.0% GBPUSD 94.1% AUDCAD 90.5% USDCHF 87.8% BTCUSD 78.4% Panel Win Rate based on CandleMT4 Exit Button Calculates the StdDev standard deviation indicator on the RSI data, stored in the matrix similar to the keltner. input int HourCalculate = 12; RsiLength = 5; RsiPrice = PRICE_CLOSE; HalfLength = 4; DevPeriod = 100; Deviations = 0.9; UseAlert =

| 상세내용의 질 | 5.0 | |

| 결과 확인의 질 | 5.0 | |

| 능력과 커뮤니케이션 스킬 | 5.0 |

An expert advisor (EA) is an automated trading system designed to execute trades on behalf of traders in the financial markets. In the context of a buy and sell grid system of levels breakout, the EA is programmed to identify key price levels and initiate buy or sell trades when those levels are broken. Here's a step-by-step description of how such an EA might work: Level Identification: The EA identifies significant price levels on the chart, such as support and resistance levels or trendlines

Grid trading is when orders are placed above and below a set price, creating an order grid with increasing and decreasing prices. Grid trading is most commonly associated with the foreign exchange market. In general, the technique seeks to capitalize on the normal volatility of an asset's price by placing buy and sell orders at certain regular intervals above and below a predefined base price. For example, a forex trader can place buy orders every 15 pips above a set price, while also placing

VWAP 밴드 비주얼 스타일 1.0 금융 시장 지표는 트레이더와 투자자가 금융 시장을 분석하고 의사 결정을 내리는 데 사용하는 필수 도구입니다. VWAP 및 Bollinger Bands는 트레이더가 시장 추세 및 가격 변동성을 측정하는 데 사용하는 두 가지 인기 있는 기술 분석 도구입니다. 이 제품에서는 두 지표를 결합하여 시장 동향과 변동성에 대한 종합적인 분석을 제공하는 고유한 제품을 만들 것을 제안합니다. 이 제품은 데이터 기반 분석을 기반으로 정보에 입각한 결정을 내리려는 거래자와 투자자에게 이상적입니다. 다이버전스 전략은 트레이더가 시장에서 잠재적인 추세 반전을 식별하는 데 사용하는 인기 있는 기술 분석 기법입니다. 이 전략은 가격 변동과 기술 지표 간의 차이를 식별하는 데 의존합니다. 이 섹션에서는 비주얼 스타일과 볼린저 밴드를 사용한 다이버전스 전략에 대해 설명합니다. 예를 들어 비주얼 스타일과 볼린저 밴드를 사용하는 다이버전스 전략은 트레이더가 시장에서 잠재적인 추세

Grid trading is executed when orders are placed above or below a set price, creating a grid of orders with rising and falling prices. Our patented trader makes it possible to open new grids at the average price, thereby increasing the chances of recovering a negative floating balance. Unlike other trading strategies, our focus is on decreasing Bollinger bands. This means that if the market has abruptly moved into a region and is weakening, it is more vulnerable to a reversal. This innovative

Infinity Indicator MT4 3.3 Panel Win Rate based on CandleMT4 Exit Button Calculates the StdDev standard deviation indicator on the RSI data, stored in the matrix similar to the keltner. input int HourCalculate = 12; RsiLength = 5; RsiPrice = PRICE_CLOSE; HalfLength = 4; DevPeriod = 100; Deviations = 0.9; UseAlert = true; DrawArrows = true; TimerWork=300; LevelUp = 80; LevelDown = 20; MoreSignals = true;

What I've learned?

Law #1 Pullback Retraction: Whenever the market tends to "burst" up or down, those who are defending opposite positions (HFTs or humans) will want to settle on the pullback retraction, to finally reverse the position.

Law #2 Linear Regression: Linear regression analysis generates an equation that describes the statistical relationship between one or more predictor variables and the response variable.

Law #3 Heads or Tails: 'Heads' refers to the side of the coin that features a portrait, or head, while 'Tails' refers to the opposite side. This is not because it features any form of tail, but because it is the opposite of heads. In other words, you have a 50% chance of winning or losing, just like in trade (buy, sell).

Summary #1: The futures price follows an average, and how do you profit from it? The answer is to lose less than you gain.

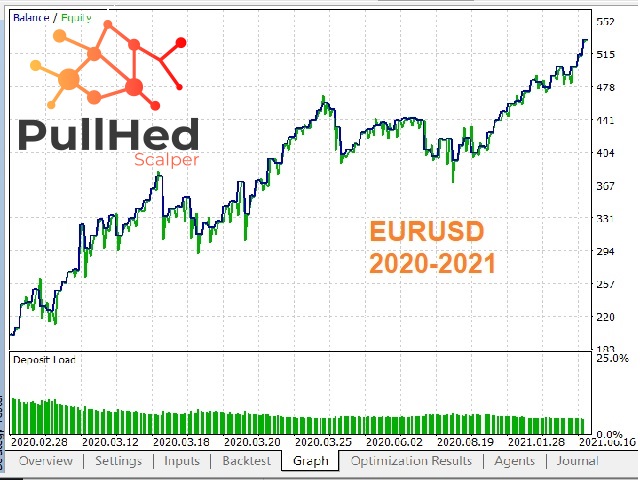

And how did I implement this in Pulled?

Simple!! I set a target (head) with input of 100 points less than the moving average based on average price, with a target of 50% (50 points).

Logic #1: If the target is 50 (head) and he dropped 100(2x tails) below the average price, it has a statistically 66.66% hit, because 3x "plays" are 150 points in play (50/150= 0.33*100%), or if it is 33.33% for loss. Of course the financial market is not a bet haha

Logic #2: If the loss is -50 zero to zero for the market, but if the price tends to return to the average price, why accept this loss? Let's take more statistical advantage! Let's close when crossing the line!

Logic #2: 1st scenario-> I close the trade 20 points above my defined stop at -50, that is, I lost -30, "I gained +20", or even if I gained 50 without any foundation, I would be missing 20 like a breakeven based on the average.

2nd scenario->I close the trade -20 points below my defined stop -50, that is, I lost -70, "I lost -20", or even if I lost 50 without any fundamentals, I would be missing 20. And what does this prove? You have a statistical credit of 20 points

Question: Logic #2-> ok! If I have "statistical credit" of 20 points profitable for the 2nd scenario, I also have "statistical credit" of 20 negative points also for the 1st scenario!! Ok cool, but you are basing yourself on the average price (future) that the entire volume of trades is also targeted over there, but who has never used a robot with a stop on the moon? "50 of take profit and 1000 of stop loss" I see several fools falling in this type of miracle robot, What is the advantage of the robot having 98% success if in the single trade of losing, it breaks the balance? https://www.mql5.com/en/market/product/59849?source=Site+Market+Product+Page

https://t.me/felipeDevMQL