당사 팬 페이지에 가입하십시오

- 조회수:

- 8596

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

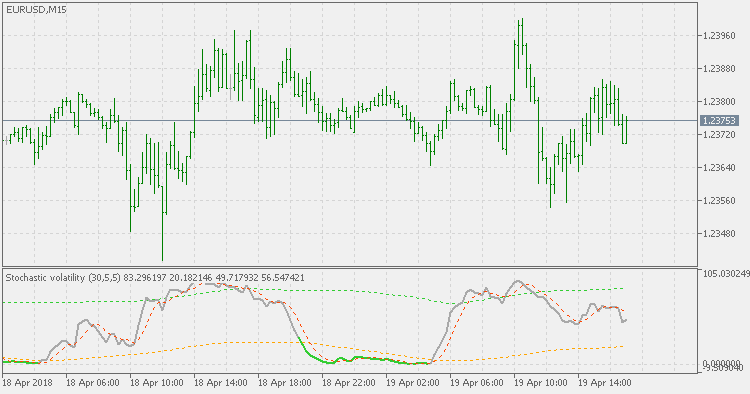

The indicator is made after the original work and idea of Francesco G. Cavasino (described in his published article "Stochastic volatility").

- Original stochastic (OriginalStoch input variable in the code or Calculate using original stochastic option in the inputs tab of the indicator) - do you want the indicator to calculate the smoothness of the stochastic the original George Lane way or do you want it to be calculated as an EM. By default it is set to true.

- Original volatility (OriginalVolatility input variable in the code or Calculate using original volatility option in the inputs tab of the indicator) - in the original indicator historical volatility was predicted to be calculated on daily data and the assumption was that there are 252 working days in a year. If you are using the indicator on a time frame that is not daily, it is probably smarter to turn the original volatility calculation off (setting this parameter to false).

Some explanation of usage:

This is not a directional indicator. This means that even it is stochastic it does not show the direction of the market, but shows the direction-amount-size of volatility. The assumption that seems sound enough and after which this indicator is made is that in the times of extremely low volatility it is a good time to enter the market, since the change in volatility is imminent. Those times are marked by dark gray dots on this indicator. For direction of entry, you should use some other trend showing indicator(s).

EMA Levels MTF

EMA Levels MTF

EMA Levels multi timeframe version.

Schaff trend RSX mtf

Schaff trend RSX mtf

Schaff Trend RSX multi timeframe version.

Heiken Ashi Oscillator

Heiken Ashi Oscillator

Instead of using "pure price" this indicator uses Heiken Ashi values to determine the trend as well as the "strength" of the trend.

Heiken Ashi Smoothed Oscillator

Heiken Ashi Smoothed Oscillator

Instead of using the "regular" Heiken Ashi for oscillator calculations, this version is using the smoothed Heiken Ashi. That makes the number of false signals fall dramatically, and, when pre-smoothing is applied to Heiken Ashi, the lag is in acceptable bounds.