Yen Surges on Trump Remarks! Market Shaken by Dollar Intervention! Total +52,810 USD/Week FX Weekly Forecast July 22, 20

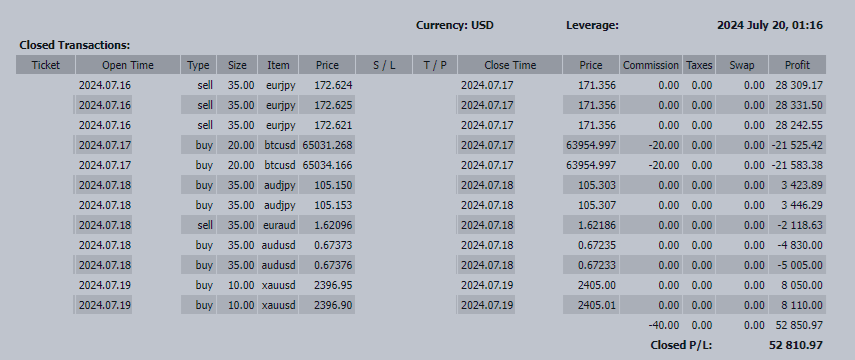

The trades from July 15 to July 19 resulted in a total of +52,810 USD.

It was another week of significant movement for the Japanese yen.

On the 16th, former U.S. President Trump strongly intervened against the strong dollar, saying, "The U.S. has a big problem with the strong dollar. The depreciation of the yen and the Chinese yuan against the dollar is significant." On the 17th, Digital Minister Taro Kono stated, "I requested the Bank of Japan to raise interest rates."

This led to a significant shift towards yen buying, so we responded with short positions on EURJPY as planned. This worked out well and extended nicely.

However, following that, Finance Minister Shunichi Suzuki commented on Kono's statements, saying, "I hope he will be cautious with his remarks," leading to a sell-off of the Japanese yen. If Kono's remarks alone, without intervention, can stop the pressure to sell the yen, it would be very welcome for Japan. I couldn't help but think that Finance Minister Suzuki should have just stayed out of it and kept quiet.

While the pressure to buy the yen has slowed down a bit due to Suzuki's remarks, the medium-term trend is still expected to be yen buying.

Future Focus

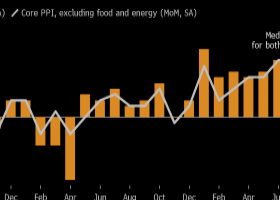

1. PCE Deflator Expected to Satisfy the Fed

Following last week's inflation indicators, the market has increased its expectations for a Fed rate cut, and the short-term financial market has fully priced in a September rate cut. The focus now is on the June PCE deflator, scheduled for the end of this month, which is a preferred reference for the Fed.

Economists expect the PCE core deflator to show a slight increase of 0.2% month-over-month, based on last week's inflation data. This essentially aligns with the Fed's 2% target. Although the Producer Price Index (PPI) was a surprise on the upside, it was mainly due to service inflation, while the specifics used in calculating the PCE deflator were relatively soft.

On the other hand, due to the base effect from the previous year, the year-over-year figure is expected to remain at 2.6%.

If the PCE deflator on the 26th falls below expectations, the USD could see further selling. We want to follow the flow of the USD after the results are out.

2. Digital Minister Kono's Yen Depreciation Remarks "Be Cautious" - Finance Minister Suzuki

In a press conference after the Cabinet meeting on the 19th, Finance Minister Shunichi Suzuki commented on remarks made by Digital Minister Taro Kono that were reported to curb yen depreciation. "Considering the unforeseen impacts on the market, I hope he will be cautious with his remarks," Suzuki said.

Bloomberg News reported on the 17th that Kono had stated, "The yen is too weak. We need to restore its value," and that he had asked the BOJ to raise the policy interest rate. In the foreign exchange market that day, the yen rose against the dollar, and long-term interest rates in the domestic bond market also increased.

Regarding the level and movement of the exchange rate and the corresponding response, Suzuki explained, "We always refrain from making careless remarks that could affect the market." He pointed out that Kono's remarks were made without such awareness.

Suzuki also mentioned, "Although I won't go into the details, we have talked," emphasizing that the independence of the BOJ's monetary policy should be fully respected.

If Suzuki had stuck to his usual no-comment stance, the yen appreciation would have accelerated. However, his remarks led to a renewed sell-off of the yen. Considering the BOJ's intention to stop the yen depreciation, Suzuki's comments seem more appropriate to the words "be cautious with remarks" than those of Kono.

However, the medium-term trend is still expected to be yen buying.

Key Points for Each Currency

USD (US Dollar): Neutral to Sell The USD/JPY has been volatile due to former President Trump's remarks against the strong dollar and early BOJ rate hike expectations. Trump's comments shook the market, making the dollar's upside heavy. Particularly, Trump's statement that "the U.S. has a big problem with the strong dollar" led to further dollar depreciation and yen appreciation. Trump also indicated that rate cuts should not occur before the November presidential election and expressed his intention to let Powell complete his term as Fed Chair.

Trump's remarks, being the most likely next president, have made it difficult to aggressively buy the dollar, although he suggested the earliest rate cut would be in December, making the dollar's outlook very uncertain. After Trump's remarks on the 16th, USD/JPY plummeted, temporarily reaching 155.38 yen before recovering to the mid-157 yen range.

JPY (Japanese Yen): Neutral to Buy The yen has been unstable due to Trump's remarks and Digital Minister Kono's comments on BOJ rate hikes. Kono's statement that he "requested the BOJ to raise interest rates" has raised expectations for a rate hike at the BOJ's Monetary Policy Meeting on July 30-31. Kono is considered a candidate for the next Prime Minister, increasing speculation about early rate hikes, but many in Japan believe it is premature to incorporate further tightening at this stage.

EUR (Euro): Neutral EUR/USD is expected to be influenced by the dollar's movements. The ECB left the policy rate unchanged at its meeting on the 18th, and President Lagarde stated, "We have not yet decided what to do in September." As a result, the euro lacks trading material and is likely to continue being swayed by dollar movements.

AUD (Australian Dollar): Neutral to Buy The Australian dollar continues to show volatile movements, particularly against the yen. The yen buying intensified due to remarks from former President Trump and Digital Minister Kono, leading to significant adjustments for the AUD against the yen. The Australian dollar is sensitive to US interest rate movements and stock prices. As long as inflation in Australia continues, the RBA might move towards another rate hike. If the June employment statistics released on the 18th are favorable, the AUD could rise further.

NZD (New Zealand Dollar): Sell The NZ dollar is expected to show weak movements. The Reserve Bank of New Zealand (RBNZ) left the policy rate unchanged but increased rate cut expectations based on predictions that inflation will return within the target range by the end of the year. The market also expects a rate cut within the year, making the NZD's upside heavy.

ZAR (South African Rand): Neutral to Buy The South African rand is expected to move steadily. The formation of a Government of National Unity (GNU) with the pro-business Democratic Alliance (DA) is expected to improve economic policies. The South African Reserve Bank (SARB) left the policy rate unchanged on the 18th, but inflation expectations remain high, raising hopes for an early rate cut. The release of June CPI and PPI next week will be closely watched.

GBP (British Pound): Neutral The pound is expected to be swayed by risk sentiment. The Labour Party is expected to win the general election, with Starmer taking office as Prime Minister. The June Consumer Price Index (CPI) released on the 17th remained flat at 2.0% year-over-year, but the services CPI remains high. The pound's movements will be influenced by the results of the UK employment statistics to be released on the 18th.

CAD (Canadian Dollar): Neutral Attention is focused on the results of the Bank of Canada's (BOC) monetary policy meeting on the 24th. The June CPI released on the 16th rose 2.7% year-over-year, falling short of expectations, reigniting speculation of additional rate cuts. The short-term financial market is dominated by expectations for a rate cut, with attention on the BOC's statement on the degree of expected inflation deceleration.

P.S.

This week, I am staying at a temple lodging in Kyoto to refresh my mind and body. I wake up at 5 AM to listen to sutras for about an hour and a half and meditate. I eat vegetarian meals without meat or fish and increase the time I spend reflecting on myself.

As a child, I was often taken to temples to listen to sutras, but honestly, I didn't understand their meaning.

However, while listening to the sutras, various thoughts would come and go in my mind, perhaps because I had nothing else to do. In retrospect, for a child, sitting still for long periods in meditation might have been a form of self-control training.

Temple lodging is an attractive stay for those seeking to reset their mind and body and discover new things, so I encourage you to try it.

Have a great weekend.