Piyush Lalsingh Ratnu / Profilo

Piyush Lalsingh Ratnu

- Trader & Analyst al Piyush Ratnu XAUUSD Spot Gold Research

- Emirati Arabi Uniti

- 156

- Informazioni

|

no

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

3

segnali

|

1

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

Why XAUUSD / Spot Gold Price is rising since last 24 hours?

Analysis by Piyush Ratnu Gold Market Research

(Range witnessed: $2407-2424-2442)

Projected by us in advance since last Thursday

Verify at: https://www.reddit.com/r/prgoldanalysis/comments/1e19xbw/why_xauusd_price_breached_2424_after_reversing/

Gold price is looking to extend previous gains early Tuesday, having clinched a new two-month high at $2,440 a day ago. Growing expectations that a US Federal Reserve (Fed) interest-rate cut in September is a done deal continue to underpin the non-interest-bearing Gold price.

🟢 Powell's Comments

Fed Chairman Jerome Powell’s comments affirmed bets for a rate reduction in September after he said Monday that the central bank will not wait until inflation hits 2% to lower interest rates. The Fed is looking for “greater confidence” that inflation will return to the 2% level, Powell added.

Those remarks by the Fed Chief fueled a fresh leg down in the US Dollar (USD) alongside the US Treasury bond yields, driving Gold price back toward an all-time high of $2,450 zone.

🟢 Trump Assassination Attempt

Earlier, yesterday, Gold price witnessed some corrective moves, as the Greenback took advantage of risk-aversion induced by the weekend’s assassination attempt on ex-US President Donald Trump during his Pennsylvania rally. Investors digested the fateful Trump attack and ramped up the odds of his win in the US Presidential race.

🟢 China Second Quarter GDP

Further, investors flocked to safety in the USD following China’s second-quarter GDP miss in Asian hours on Monday. Data released by the National Bureau of Statistics (NBS) showed Monday that the world's second-largest economy grew 4.7% year-on-year in April-June, slowing from 5.3% in the previous three months while recording the weakest growth since the third quarter of 2023.

🟢 China Stimulus

Speculations that China could roll out stimulus measures to boost economic performance could also render Gold positive in the near term.

🟢 Weak US Treasury Bonds

In Tuesday’s trading so far, Gold price is gathering strength for the next push higher even as the US Dollar stages a modest comeback. The rebound in the USD/JPY pair could be attributed to the USD uptick. However, weak US Treasury bond yields continue to support the non-yielding Gold price.

🟢 Core Retail Sales Data today

Later in the day, the US Retail Sales report and Fedspeak will grab the eyeballs, as traders look to seal in a September Fed rate cut. Weaker-than-expected US Retail Sales data could reinforce the USD selling, lifting the Gold price northward.

🟢 Key Economic Data today:

16:30 USD Core Retail Sales (MoM) (Jun) 0.1% -0.1%

16:30 USD Export Price Index (MoM) (Jun) -0.6%

16:30 USD Import Price Index (MoM) (Jun) 0.2% -0.4%

16:30 USD Retail Control (MoM) (Jun) 0.4%

16:30 USD Retail Sales (MoM) (Jun) -0.3% 0.1%

18:00 USD Business Inventories (MoM) (May) 0.4% 0.3%

18:00 USD Retail Inventories Ex Auto (May) 0.0% 0.3%

20:00 USD Atlanta Fed GDPNow (Q2) 2.0% 2.0%

🟢 Crucial Price Zones today:

🔻BZ $2407/2385

🔺SZ $2450/2469

Analysis by Piyush Ratnu Gold Market Research

(Range witnessed: $2407-2424-2442)

Projected by us in advance since last Thursday

Verify at: https://www.reddit.com/r/prgoldanalysis/comments/1e19xbw/why_xauusd_price_breached_2424_after_reversing/

Gold price is looking to extend previous gains early Tuesday, having clinched a new two-month high at $2,440 a day ago. Growing expectations that a US Federal Reserve (Fed) interest-rate cut in September is a done deal continue to underpin the non-interest-bearing Gold price.

🟢 Powell's Comments

Fed Chairman Jerome Powell’s comments affirmed bets for a rate reduction in September after he said Monday that the central bank will not wait until inflation hits 2% to lower interest rates. The Fed is looking for “greater confidence” that inflation will return to the 2% level, Powell added.

Those remarks by the Fed Chief fueled a fresh leg down in the US Dollar (USD) alongside the US Treasury bond yields, driving Gold price back toward an all-time high of $2,450 zone.

🟢 Trump Assassination Attempt

Earlier, yesterday, Gold price witnessed some corrective moves, as the Greenback took advantage of risk-aversion induced by the weekend’s assassination attempt on ex-US President Donald Trump during his Pennsylvania rally. Investors digested the fateful Trump attack and ramped up the odds of his win in the US Presidential race.

🟢 China Second Quarter GDP

Further, investors flocked to safety in the USD following China’s second-quarter GDP miss in Asian hours on Monday. Data released by the National Bureau of Statistics (NBS) showed Monday that the world's second-largest economy grew 4.7% year-on-year in April-June, slowing from 5.3% in the previous three months while recording the weakest growth since the third quarter of 2023.

🟢 China Stimulus

Speculations that China could roll out stimulus measures to boost economic performance could also render Gold positive in the near term.

🟢 Weak US Treasury Bonds

In Tuesday’s trading so far, Gold price is gathering strength for the next push higher even as the US Dollar stages a modest comeback. The rebound in the USD/JPY pair could be attributed to the USD uptick. However, weak US Treasury bond yields continue to support the non-yielding Gold price.

🟢 Core Retail Sales Data today

Later in the day, the US Retail Sales report and Fedspeak will grab the eyeballs, as traders look to seal in a September Fed rate cut. Weaker-than-expected US Retail Sales data could reinforce the USD selling, lifting the Gold price northward.

🟢 Key Economic Data today:

16:30 USD Core Retail Sales (MoM) (Jun) 0.1% -0.1%

16:30 USD Export Price Index (MoM) (Jun) -0.6%

16:30 USD Import Price Index (MoM) (Jun) 0.2% -0.4%

16:30 USD Retail Control (MoM) (Jun) 0.4%

16:30 USD Retail Sales (MoM) (Jun) -0.3% 0.1%

18:00 USD Business Inventories (MoM) (May) 0.4% 0.3%

18:00 USD Retail Inventories Ex Auto (May) 0.0% 0.3%

20:00 USD Atlanta Fed GDPNow (Q2) 2.0% 2.0%

🟢 Crucial Price Zones today:

🔻BZ $2407/2385

🔺SZ $2450/2469

Piyush Lalsingh Ratnu

The Gold price (XAU/USD) trades with mild gains on Wednesday during the early European session. The growing speculation that the US Federal Reserve (Fed) is likely to start cutting rates as early as September continues to support the non-yielding metal. Furthermore, political uncertainties within Europe and globally might boost Gold price, a traditional safe-haven asset.

On the other hand, the pause of China's central bank Gold purchases for a second consecutive month might prompt traders to reduce bullish bets in the yellow metal as China is the world's largest gold consumer. Investors will keep an eye on the second semi-annual testimony by Federal Reserve (Fed) Chair Jerome Powell on Wednesday, along with speeches by the Fed's Michelle Bowman and Austan Goolsbee. On Thursday, the US Consumer Price Index (CPI) inflation data will be closely monitored. This data might offer more clarity on the US interest rate path.

Powell Testimony: Key Takeaways

Federal Reserve (Fed) Chair Jerome Powell said in testimony Tuesday to Congress that the most recent inflation data showed some modest further progress and "more good data" could open the door to interest rate cuts.

Powell emphasized that the central bank will continue to make decisions on monetary policy meeting by meeting, adding that holding interest rates too high for too long could jeopardize economic growth.

Fed Chair Powell stated that “elevated inflation is not the only risk we face,” warning that lowering interest rates too little or too soon could put the economy at risk. He added that while it’s possible to hike rates if the data supports it, the most likely direction would be to “begin to loosen policy at the right moment."

Powell further stated that inflation readings over the first three months of this year did not boost Fed officials’ confidence that inflation was coming under control.

World Gold Council (WGC) revealed that Gold exchange-traded funds (ETFs) experienced a second month of inflows in June. The WGC stated that total fund holdings rose by around 18 tonnes to 3,106 tonnes.

This contrasts with the People’s Bank of China’s (PBoC) decision not to buy Gold in June as it did in May. China held 72.80 million troy ounces of the precious metal at the end of June.

Key Economic Data ahead:

15:00 USD OPEC Monthly Report

17:30 GBP BoE MPC Member Pill Speaks

18:00 USD Fed Chair Powell Testifies

18:30 USD Crude Oil Inventories 0.700M -12.157M

18:30 USD Cushing Crude Oil Inventories 0.345M

19:30 GBP BoE MPC Member Mann Speaks

20:00 USD Atlanta Fed GDPNow (Q2) 1.5% 1.5%

21:00 USD 10-Year Note Auction 4.438%

22:30 USD FOMC Member Bowman Speaks

Key Economic Data Tomorrow:

16:30 USD Continuing Jobless Claims 1,858K

16:30 USD Core CPI (MoM) (Jun) 0.2% 0.2%

16:30 USD Core CPI (YoY) (Jun) 3.4% 3.4%

16:30 USD CPI (MoM) (Jun) 0.1% 0.0%

16:30 USD CPI (YoY) (Jun) 3.1% 3.3%

16:30 USD Initial Jobless Claims 236K 238K

19:30 USD FOMC Member Bostic Speaks

21:00 USD 30-Year Bond Auction 4.403%

22:00 USD Federal Budget Balance (Jun) -347.0B

XAUUSD: Crucial Price Stops:

🔺SZ $2400/2424/2442

🔻BZ $2332/2323/2300

On the other hand, the pause of China's central bank Gold purchases for a second consecutive month might prompt traders to reduce bullish bets in the yellow metal as China is the world's largest gold consumer. Investors will keep an eye on the second semi-annual testimony by Federal Reserve (Fed) Chair Jerome Powell on Wednesday, along with speeches by the Fed's Michelle Bowman and Austan Goolsbee. On Thursday, the US Consumer Price Index (CPI) inflation data will be closely monitored. This data might offer more clarity on the US interest rate path.

Powell Testimony: Key Takeaways

Federal Reserve (Fed) Chair Jerome Powell said in testimony Tuesday to Congress that the most recent inflation data showed some modest further progress and "more good data" could open the door to interest rate cuts.

Powell emphasized that the central bank will continue to make decisions on monetary policy meeting by meeting, adding that holding interest rates too high for too long could jeopardize economic growth.

Fed Chair Powell stated that “elevated inflation is not the only risk we face,” warning that lowering interest rates too little or too soon could put the economy at risk. He added that while it’s possible to hike rates if the data supports it, the most likely direction would be to “begin to loosen policy at the right moment."

Powell further stated that inflation readings over the first three months of this year did not boost Fed officials’ confidence that inflation was coming under control.

World Gold Council (WGC) revealed that Gold exchange-traded funds (ETFs) experienced a second month of inflows in June. The WGC stated that total fund holdings rose by around 18 tonnes to 3,106 tonnes.

This contrasts with the People’s Bank of China’s (PBoC) decision not to buy Gold in June as it did in May. China held 72.80 million troy ounces of the precious metal at the end of June.

Key Economic Data ahead:

15:00 USD OPEC Monthly Report

17:30 GBP BoE MPC Member Pill Speaks

18:00 USD Fed Chair Powell Testifies

18:30 USD Crude Oil Inventories 0.700M -12.157M

18:30 USD Cushing Crude Oil Inventories 0.345M

19:30 GBP BoE MPC Member Mann Speaks

20:00 USD Atlanta Fed GDPNow (Q2) 1.5% 1.5%

21:00 USD 10-Year Note Auction 4.438%

22:30 USD FOMC Member Bowman Speaks

Key Economic Data Tomorrow:

16:30 USD Continuing Jobless Claims 1,858K

16:30 USD Core CPI (MoM) (Jun) 0.2% 0.2%

16:30 USD Core CPI (YoY) (Jun) 3.4% 3.4%

16:30 USD CPI (MoM) (Jun) 0.1% 0.0%

16:30 USD CPI (YoY) (Jun) 3.1% 3.3%

16:30 USD Initial Jobless Claims 236K 238K

19:30 USD FOMC Member Bostic Speaks

21:00 USD 30-Year Bond Auction 4.403%

22:00 USD Federal Budget Balance (Jun) -347.0B

XAUUSD: Crucial Price Stops:

🔺SZ $2400/2424/2442

🔻BZ $2332/2323/2300

Piyush Lalsingh Ratnu

Ample gold market liquidity

Global gold trading volumes across various markets averaged US$195bn/day in June, 9.5% down m/m. Over-the-counter (OTC) trading activities rose by 8.6% compared to May – LBMA trades were the main driver, signalling robust demand globally. In contrast, exchange-traded derivatives saw a -32% m/m plunge: volumes at COMEX fell by -35% m/m and Shanghai futures trading continued to cool (-24%). Gold ETF trading volumes saw a contraction of 15%m/m, mainly due to North American funds.

Despite the decline in June, global gold market liquidity averaged US$210bn/day, remaining well above Q1(US$182bn/day) and 2023 (US$163bn/day). Rising OTC trading activities, mainly at the LBMA, together with surges in Shanghai Futures Exchange and the North American gold ETF market were main H1 contributors.

COMEX total net longs remained stable at 767t by the end of June, a 1t m/m decline. Meanwhile money manager net longs rose further, reaching 575t at the end of June, a 3% increase m/m and the highest month-end value since February 2020.

Total net longs and money manager net longs have risen in H1 by 13% and 36% respectively – the strong gold price performance and various uncertainties on multiple fronts may have attracted investors.

Global gold trading volumes across various markets averaged US$195bn/day in June, 9.5% down m/m. Over-the-counter (OTC) trading activities rose by 8.6% compared to May – LBMA trades were the main driver, signalling robust demand globally. In contrast, exchange-traded derivatives saw a -32% m/m plunge: volumes at COMEX fell by -35% m/m and Shanghai futures trading continued to cool (-24%). Gold ETF trading volumes saw a contraction of 15%m/m, mainly due to North American funds.

Despite the decline in June, global gold market liquidity averaged US$210bn/day, remaining well above Q1(US$182bn/day) and 2023 (US$163bn/day). Rising OTC trading activities, mainly at the LBMA, together with surges in Shanghai Futures Exchange and the North American gold ETF market were main H1 contributors.

COMEX total net longs remained stable at 767t by the end of June, a 1t m/m decline. Meanwhile money manager net longs rose further, reaching 575t at the end of June, a 3% increase m/m and the highest month-end value since February 2020.

Total net longs and money manager net longs have risen in H1 by 13% and 36% respectively – the strong gold price performance and various uncertainties on multiple fronts may have attracted investors.

Piyush Lalsingh Ratnu

WGC: GOLD ETF FLOWS: June 2024

Highlights

Following the strongest month since May 2023, global gold ETFs have now seen inflows two months in a row; in June, notable European and Asian buying offset outflows from North America

Although June and May inflows helped limit global gold ETFs’ y-t-d losses to US$6.7bn (-120t), this remains the worst H1 since 2013 – both Europe and North America saw hefty outflows while Asia was the only region with inflows

A stronger gold price and recent inflows pushed the total AUM to US$233bn, but collective holdings remain near their lowest since 2020

Trading volumes across different gold markets witnessed a mild decline in June; however, the H1 average remains well above its 2023 level as OTC and futures trading were exceptionally active.

Regional overview

North America continued to see mild outflows, shedding US$573mn in June. The dollar strength and continued equity rally may have drawn investor attention away from gold despite falling Treasury yields.3 Nonetheless, flare-ups in geopolitical risk prompted sporadic inflows, partially offsetting larger outflows during the month.

North America saw outflows of US$4.9bn during H1, the largest in three years. However, a 13% rise in the gold price during H1 also resulted in a 7.7% increase in North America’s total AUM. Meanwhile, the region’s collective holdings reduced by 78t.

European funds added US$1.4bn in June, the second consecutive month of inflows. This helped further narrow Europe’s H1 outflows to US$4.9bn. The region’s central banks adopted a different path to that of the US Fed. For instance, in June, the European Central Bank delivered its first rate cut for almost five years whilst the Swiss National Bank lowered rates for the second time this year.4 In the UK, the Bank of England hinted that a potential cut was on the cards but left rates unchanged following a surprise general election announcement. As such, lowering yields were a key contributor to the region’s inflows. Additionally, falling equities and political uncertainties related to elections in the UK and France, which sparked notable inflows there, also pushed up investor interest in gold.5

Nonetheless, 2024 saw the worst first half for European funds since 2013 (-US$8bn). Despite a 6% fall in holdings, total AUM of European funds experienced a 6.3% rise during the first half, thanks to the higher gold price.

Asia extended its inflow streak to 16 months, attracting US$560mn in June. Similar to previous months, Asian inflows were mainly driven by China, which added US$429mn in the month. Among factors that kept Chinese investor interest in gold elevated, we believe persistent weaknesses in stocks and the property sector, as well as continued depreciation in the RMB were highly relevant. Japan also witnessed its 16th consecutive monthly inflow in June, primarily supported by a weakening yen.

Asia registered inflows of US$3.1bn in H1, significantly outpacing all other markets and the only region witnessing positive flows. This represents the strongest ever H1 for Asian funds, mainly driven by record-level inflows into China and Japan. Supported by record-breaking inflows and a higher gold price, the total AUM of Asian funds reached US$14bn, the highest ever, while collective holdings increased by 41t.

Following two consecutive monthly outflows, funds in other regions captured a small inflow of US$37mn in June, led by Australia and South Africa. In H1, funds listed in other regions saw mild outflows, mainly from Turkey.

Highlights

Following the strongest month since May 2023, global gold ETFs have now seen inflows two months in a row; in June, notable European and Asian buying offset outflows from North America

Although June and May inflows helped limit global gold ETFs’ y-t-d losses to US$6.7bn (-120t), this remains the worst H1 since 2013 – both Europe and North America saw hefty outflows while Asia was the only region with inflows

A stronger gold price and recent inflows pushed the total AUM to US$233bn, but collective holdings remain near their lowest since 2020

Trading volumes across different gold markets witnessed a mild decline in June; however, the H1 average remains well above its 2023 level as OTC and futures trading were exceptionally active.

Regional overview

North America continued to see mild outflows, shedding US$573mn in June. The dollar strength and continued equity rally may have drawn investor attention away from gold despite falling Treasury yields.3 Nonetheless, flare-ups in geopolitical risk prompted sporadic inflows, partially offsetting larger outflows during the month.

North America saw outflows of US$4.9bn during H1, the largest in three years. However, a 13% rise in the gold price during H1 also resulted in a 7.7% increase in North America’s total AUM. Meanwhile, the region’s collective holdings reduced by 78t.

European funds added US$1.4bn in June, the second consecutive month of inflows. This helped further narrow Europe’s H1 outflows to US$4.9bn. The region’s central banks adopted a different path to that of the US Fed. For instance, in June, the European Central Bank delivered its first rate cut for almost five years whilst the Swiss National Bank lowered rates for the second time this year.4 In the UK, the Bank of England hinted that a potential cut was on the cards but left rates unchanged following a surprise general election announcement. As such, lowering yields were a key contributor to the region’s inflows. Additionally, falling equities and political uncertainties related to elections in the UK and France, which sparked notable inflows there, also pushed up investor interest in gold.5

Nonetheless, 2024 saw the worst first half for European funds since 2013 (-US$8bn). Despite a 6% fall in holdings, total AUM of European funds experienced a 6.3% rise during the first half, thanks to the higher gold price.

Asia extended its inflow streak to 16 months, attracting US$560mn in June. Similar to previous months, Asian inflows were mainly driven by China, which added US$429mn in the month. Among factors that kept Chinese investor interest in gold elevated, we believe persistent weaknesses in stocks and the property sector, as well as continued depreciation in the RMB were highly relevant. Japan also witnessed its 16th consecutive monthly inflow in June, primarily supported by a weakening yen.

Asia registered inflows of US$3.1bn in H1, significantly outpacing all other markets and the only region witnessing positive flows. This represents the strongest ever H1 for Asian funds, mainly driven by record-level inflows into China and Japan. Supported by record-breaking inflows and a higher gold price, the total AUM of Asian funds reached US$14bn, the highest ever, while collective holdings increased by 41t.

Following two consecutive monthly outflows, funds in other regions captured a small inflow of US$37mn in June, led by Australia and South Africa. In H1, funds listed in other regions saw mild outflows, mainly from Turkey.

Piyush Lalsingh Ratnu

What is T+1 settlement?

As of 2024, the U.S. stock market has transitioned to a T+1 settlement cycle, meaning that most stock transactions now settle one business day after the trade date. This change aims to reduce settlement risk and align with modern technology and practices.

Example of T+1 Settlement

Say that on Monday, June 3, an investor named Sarah decides to sell 100 shares of XYZ Corporation stock at $50 per share. She places the order through her broker and the trade is executed the same day.

Under a "T+1" settlement cycle, the settlement date for this transaction would be Tuesday, June 4, (assuming no holidays). This means that:

Sarah's broker-dealer will deliver the 100 shares of XYZ Corporation stock to the buyer's account on Tuesday, June 4.

The buyer's payment of $5,000 (100 shares × $50 per share) will be delivered to Sarah's account on Tuesday, June 4.

If the trade was executed under a "T+2" settlement cycle, the settlement date would have been Wednesday, June 5 instead, meaning the transfer of securities and cash would have occurred two business days after the trade date, and not one.

#Forex #Trading #XAUUSD #Gold #Shares #markets

As of 2024, the U.S. stock market has transitioned to a T+1 settlement cycle, meaning that most stock transactions now settle one business day after the trade date. This change aims to reduce settlement risk and align with modern technology and practices.

Example of T+1 Settlement

Say that on Monday, June 3, an investor named Sarah decides to sell 100 shares of XYZ Corporation stock at $50 per share. She places the order through her broker and the trade is executed the same day.

Under a "T+1" settlement cycle, the settlement date for this transaction would be Tuesday, June 4, (assuming no holidays). This means that:

Sarah's broker-dealer will deliver the 100 shares of XYZ Corporation stock to the buyer's account on Tuesday, June 4.

The buyer's payment of $5,000 (100 shares × $50 per share) will be delivered to Sarah's account on Tuesday, June 4.

If the trade was executed under a "T+2" settlement cycle, the settlement date would have been Wednesday, June 5 instead, meaning the transfer of securities and cash would have occurred two business days after the trade date, and not one.

#Forex #Trading #XAUUSD #Gold #Shares #markets

Piyush Lalsingh Ratnu

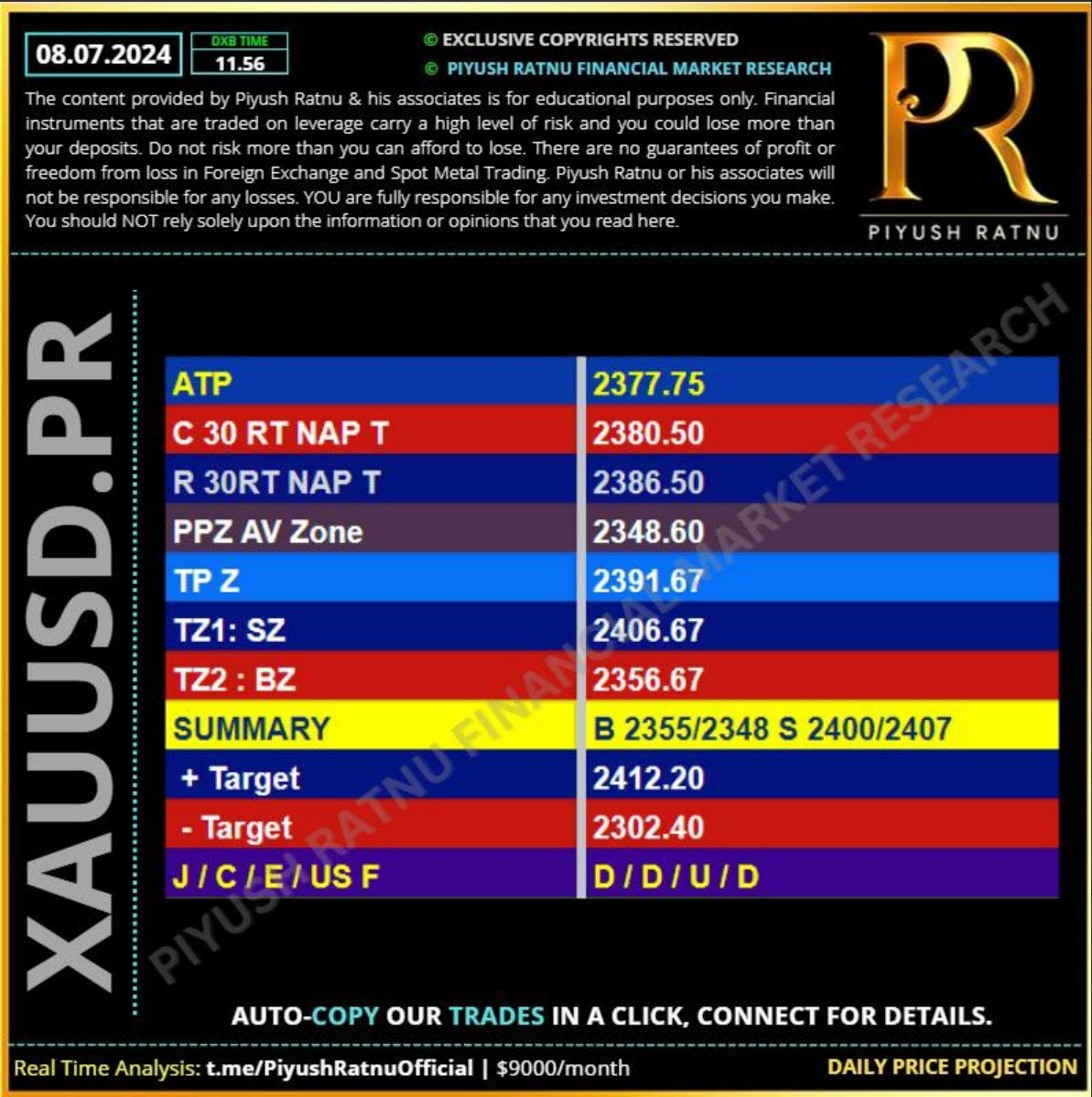

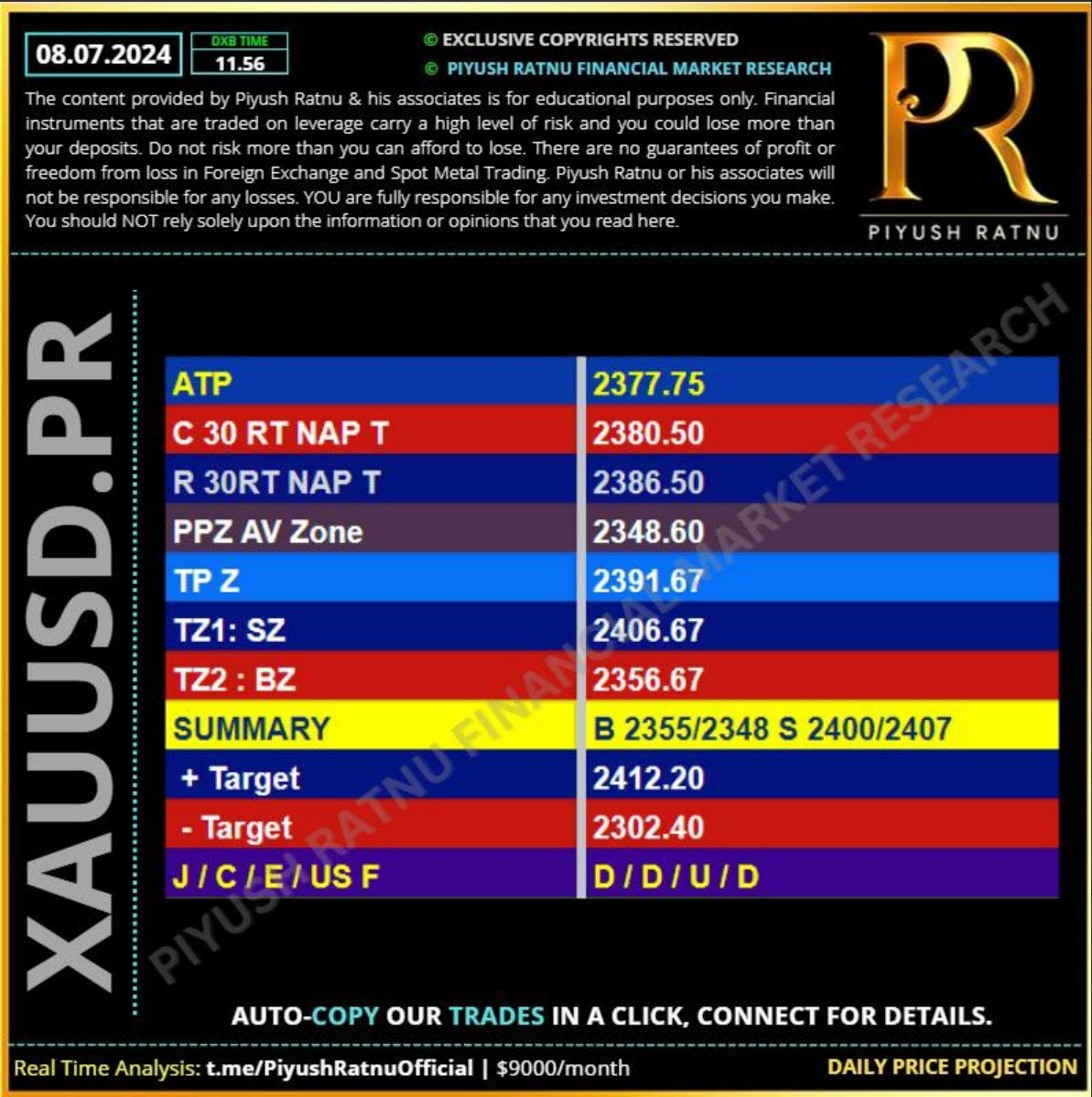

08 July 2024:

XAUUSD crashed from $2381-2351, I had projected price target of $2355/2348, buying at and below $2355 gave us neat exit: CMP $2369 zone (2368)

#XAUUSD #PiyushRatnu #Forex #PRDXB #Gold

Verify at:

https://t.me/c/1654158888/10036

XAUUSD crashed from $2381-2351, I had projected price target of $2355/2348, buying at and below $2355 gave us neat exit: CMP $2369 zone (2368)

#XAUUSD #PiyushRatnu #Forex #PRDXB #Gold

Verify at:

https://t.me/c/1654158888/10036

Piyush Lalsingh Ratnu

🆘 WHY XAUUSD crashed today?

XAUUSD crashed from Friday high $2392 ($2385 zone - 2351.00 - today's low)

A fear of increased inflation under a Trump presidency with the consequent higher interest rates is negatively impacting Gold. Gold weakened as fears Trump could win the next presidency weigh on bond markets.

Gold (XAU/USD) falls on Monday in line with most commodities, which are declining due to global growth fears after under-par US employment data last week.

Rising US Treasury bond yields, as a result of increased probabilities that former President Donald Trump could win the next presidential election in November, may also be weakening Gold. Trump is expected to cut taxes but maintain spending which will lead to higher inflation and interest rates – a negative for the non-interest-bearing asset Gold.

Given the question marks over President Joe Biden’s capacity to hold office and with no popular replacement on the radar, Trump is increasingly being viewed as the most likely candidate to win the presidential election. Known for cutting taxes and borrowing to cover the short-fall, his fiscal policies are likely to keep inflation high, leading to higher interest rates. This is having a negative impact on US Treasury bonds and pushing up yields, which are inversely correlated to Gold. The US Dollar is also benefiting from the outlook and further weighing on Gold price, which is primarily bought and sold in USD, according to Reuters.

China's Central Bank has stopped buying for the second month in June.

The precious metal loses traction as the People’s Bank of China (PBoC), the Chinese central bank kept Gold buying on hold for the second month in June, according to official data released on Sunday. It’s worth noting that China is the world’s biggest bullion consumer, and the pause in gold buying could weigh on the Gold price.

Technical Correction/Profit Booking sliced down long volumes.

Additionally, short-term traders taking profit after the 1.45% gain witnessed on Friday, could also be weighing.

Crucial Zones ahead:

🔻2342/2323/2303

🔺$2369/2385/2407

🆘 ALERT:

Gold could target all-time-highs due to geo-political tension, avoid BIG SHORT POSITIONS.

XAUUSD crashed from Friday high $2392 ($2385 zone - 2351.00 - today's low)

A fear of increased inflation under a Trump presidency with the consequent higher interest rates is negatively impacting Gold. Gold weakened as fears Trump could win the next presidency weigh on bond markets.

Gold (XAU/USD) falls on Monday in line with most commodities, which are declining due to global growth fears after under-par US employment data last week.

Rising US Treasury bond yields, as a result of increased probabilities that former President Donald Trump could win the next presidential election in November, may also be weakening Gold. Trump is expected to cut taxes but maintain spending which will lead to higher inflation and interest rates – a negative for the non-interest-bearing asset Gold.

Given the question marks over President Joe Biden’s capacity to hold office and with no popular replacement on the radar, Trump is increasingly being viewed as the most likely candidate to win the presidential election. Known for cutting taxes and borrowing to cover the short-fall, his fiscal policies are likely to keep inflation high, leading to higher interest rates. This is having a negative impact on US Treasury bonds and pushing up yields, which are inversely correlated to Gold. The US Dollar is also benefiting from the outlook and further weighing on Gold price, which is primarily bought and sold in USD, according to Reuters.

China's Central Bank has stopped buying for the second month in June.

The precious metal loses traction as the People’s Bank of China (PBoC), the Chinese central bank kept Gold buying on hold for the second month in June, according to official data released on Sunday. It’s worth noting that China is the world’s biggest bullion consumer, and the pause in gold buying could weigh on the Gold price.

Technical Correction/Profit Booking sliced down long volumes.

Additionally, short-term traders taking profit after the 1.45% gain witnessed on Friday, could also be weighing.

Crucial Zones ahead:

🔻2342/2323/2303

🔺$2369/2385/2407

🆘 ALERT:

Gold could target all-time-highs due to geo-political tension, avoid BIG SHORT POSITIONS.

Piyush Lalsingh Ratnu

DXY 104.5590

USDJPY 160.900 +

M15: M15V0.0

US10YT 4.295

XAUXAG 76.67

XAUUSD $2380

H1AS5 H1AS1 H1AS2 ideal entries.

USDJPY 160.900 +

M15: M15V0.0

US10YT 4.295

XAUXAG 76.67

XAUUSD $2380

H1AS5 H1AS1 H1AS2 ideal entries.

Piyush Lalsingh Ratnu

WHY XAUUSD shot up to $2380 (current high) after NFP Data?

Gold (XAU/USD) rises on Friday, continuing its run of positive days as investors become increasingly optimistic the Federal Reserve (Fed) will lower interest rates sooner than previously thought, and the US Dollar (USD) softens, adding a lift to Gold which is predominantly bought and sold in Dollars.

I had indicated the same, in advance that retail traders might focus on NFP data and might ignore UE, however UE plays a major role in policy making/FED cut related statements/decisions.

-UE resulted in + XAUUSD after NFP Data.

Gold (XAU/USD) rises on Friday, continuing its run of positive days as investors become increasingly optimistic the Federal Reserve (Fed) will lower interest rates sooner than previously thought, and the US Dollar (USD) softens, adding a lift to Gold which is predominantly bought and sold in Dollars.

I had indicated the same, in advance that retail traders might focus on NFP data and might ignore UE, however UE plays a major role in policy making/FED cut related statements/decisions.

-UE resulted in + XAUUSD after NFP Data.

Piyush Lalsingh Ratnu

NFP (+) than forecast

(-) than last time data

Unemployment Rate (-) = USD - XAUUSD +

After crash till $2350 psychological zone, XAUUSD reversed to $2375 R3

Buying below S1, PPZ gave us amazing results in 5-10 seconds. NET PIPS observed: 2000

EXIT LONG POSITIONS. #XAUUSD #NFP #Trading #Forex #PiyushRatnu #PRDXB #GOld

(-) than last time data

Unemployment Rate (-) = USD - XAUUSD +

After crash till $2350 psychological zone, XAUUSD reversed to $2375 R3

Buying below S1, PPZ gave us amazing results in 5-10 seconds. NET PIPS observed: 2000

EXIT LONG POSITIONS. #XAUUSD #NFP #Trading #Forex #PiyushRatnu #PRDXB #GOld

Piyush Lalsingh Ratnu

Gold price is consolidating near two-week highs of $2,365 reached on Wednesday, as the US Dollar (USD) continues to lick its wounds, shrugging off a minor bounce in the US Treasury bond yields. Gold price braces for the return of US traders from the July 4 holiday and the all-important Nonfarm Payrolls data for fresh impulse.

🟢 Thin volumes: driving price range in one direction 🔺, as alerted by us in advance

With an Independence Day holiday in the US on Thursday, Gold price held higher ground near two-week highs while within a confined range due to thin liquidity conditions. Markets also stayed unnerved, as UK voters headed to polls, limiting the trading activity around the traditional safe-haven Gold price.

Traders are pricing in a 73% chance of a cut in September, according to the CME FedWatch tool. Markets are also pricing in potentially two rate cuts this year.

🟢 The NFP Saga

All eyes now turn to the high-impact US labor market report due later on Friday at 12:30 GMT, which could have a strong bearing on the market’s pricing of the Fed rate cuts, affecting the value of the US Dollar and that of the Gold price.

US Nonfarm Payrolls are set to rise by 190K in June after recording a 272K gain in May while Average Hourly Earnings are expected to show a 3.9% growth annually, following a 4.1% advance previously. If these key data sets come in below the market consensus, it would reinforce bets for two Fed rate cuts this year and a September rate cut would be a done deal. In such a scenario, the US Dollar is likely to meet fresh supply, offering a fresh leg to the Gold price upside.

However, the Greenback could rebound firmly if the headline NFP and the wage inflation data surprise to the upside, prompting investors to dial down their dovish Fed expectations. This would render negative for the non-interest-bearing Gold price.

🆘 Crucial Price Zones:

🔺 SZ $2385/2407/2424/2442

🔻 BZ $2332/2323/2303/2288

🟢 Refer Algo: PRSRSDBS TF H1 Set W1

🟢 Thin volumes: driving price range in one direction 🔺, as alerted by us in advance

With an Independence Day holiday in the US on Thursday, Gold price held higher ground near two-week highs while within a confined range due to thin liquidity conditions. Markets also stayed unnerved, as UK voters headed to polls, limiting the trading activity around the traditional safe-haven Gold price.

Traders are pricing in a 73% chance of a cut in September, according to the CME FedWatch tool. Markets are also pricing in potentially two rate cuts this year.

🟢 The NFP Saga

All eyes now turn to the high-impact US labor market report due later on Friday at 12:30 GMT, which could have a strong bearing on the market’s pricing of the Fed rate cuts, affecting the value of the US Dollar and that of the Gold price.

US Nonfarm Payrolls are set to rise by 190K in June after recording a 272K gain in May while Average Hourly Earnings are expected to show a 3.9% growth annually, following a 4.1% advance previously. If these key data sets come in below the market consensus, it would reinforce bets for two Fed rate cuts this year and a September rate cut would be a done deal. In such a scenario, the US Dollar is likely to meet fresh supply, offering a fresh leg to the Gold price upside.

However, the Greenback could rebound firmly if the headline NFP and the wage inflation data surprise to the upside, prompting investors to dial down their dovish Fed expectations. This would render negative for the non-interest-bearing Gold price.

🆘 Crucial Price Zones:

🔺 SZ $2385/2407/2424/2442

🔻 BZ $2332/2323/2303/2288

🟢 Refer Algo: PRSRSDBS TF H1 Set W1

Piyush Lalsingh Ratnu

Gold price is looking to extend the previous upsurge early Thursday, sitting at the highest level in over a week near $2,360. Sustained US Dollar (USD) weakness alongside sluggish US Treasury bond yields underpin Gold price amid the July 4 US holiday-thinned market conditions.

Following US Federal Reserve (Fed) Chairman Jerome Powell’s remarks at the European Central Bank (ECB) Forum On Central Banking in Sintra on Tuesday, the USD sellers refuse to give up as Fed doves returned to the table with strong conviction after US economic data on Wednesday failed to impress, despite not-so-dovish Minutes of the June policy meeting.

Discouraging US data ramped up September Fed rate cut bets, with markets now pricing a 73% chance, against a 67% probability seen before the data release. This smashed the US Treasury bond yields across the curve, heavily weighing on the US Dollar. Gold price tends to benefit in times of low interest-rates era.

🟢 Gold price continues to capitalize on the dovish Fed expectations heading into the US Independence Day holiday, with moves likely to be exaggerated likely to be exaggerated by low liquidity and repositioning ahead of the all-important US Nonfarm Payrolls data due on Friday.

Election based safe haven demand:

In the meantime, investors would prefer to seek safety in the Gold price, as the UK general elections get underway on Thursday, heightening market anxiety even though the Labour Party is set for a sweeping victory for the first time in 14 years.

Following US Federal Reserve (Fed) Chairman Jerome Powell’s remarks at the European Central Bank (ECB) Forum On Central Banking in Sintra on Tuesday, the USD sellers refuse to give up as Fed doves returned to the table with strong conviction after US economic data on Wednesday failed to impress, despite not-so-dovish Minutes of the June policy meeting.

Discouraging US data ramped up September Fed rate cut bets, with markets now pricing a 73% chance, against a 67% probability seen before the data release. This smashed the US Treasury bond yields across the curve, heavily weighing on the US Dollar. Gold price tends to benefit in times of low interest-rates era.

🟢 Gold price continues to capitalize on the dovish Fed expectations heading into the US Independence Day holiday, with moves likely to be exaggerated likely to be exaggerated by low liquidity and repositioning ahead of the all-important US Nonfarm Payrolls data due on Friday.

Election based safe haven demand:

In the meantime, investors would prefer to seek safety in the Gold price, as the UK general elections get underway on Thursday, heightening market anxiety even though the Labour Party is set for a sweeping victory for the first time in 14 years.

Piyush Lalsingh Ratnu

#XAUUSD

XAUUSD CMP $2358

Current Status:

M15A236

M15AS5

Price Target on radar:

M30AS5

H1AS5

US10YT - RT + 4.369

USDJPY - RT + 161.530

XAUXAG 77.62

XAUXPD 2.3117

Key Economic Data today:

12:30 GBP BOE Credit Conditions Survey

12:30 GBP S&P Global / CIPS UK Construction PMI (Jun) 54.0 54.7

13:00 EUR ECB's Lane Speaks

13:35 EUR ECB McCaul Speaks

14:00 GBP U.K. General Election

15:30 EUR ECB Publishes Account of Monetary Policy Meeting

🆘 All Day Holiday United States - Independence Day

Humble reminder:

🟢 Due to US HOLIDAY and thin trading volumes a sudden spike/crash of $50 cannot be ruled out hence avoid taking big lots, implement risk management.

#Gold #PiyushRatnu #Forex #Trading

XAUUSD CMP $2358

Current Status:

M15A236

M15AS5

Price Target on radar:

M30AS5

H1AS5

US10YT - RT + 4.369

USDJPY - RT + 161.530

XAUXAG 77.62

XAUXPD 2.3117

Key Economic Data today:

12:30 GBP BOE Credit Conditions Survey

12:30 GBP S&P Global / CIPS UK Construction PMI (Jun) 54.0 54.7

13:00 EUR ECB's Lane Speaks

13:35 EUR ECB McCaul Speaks

14:00 GBP U.K. General Election

15:30 EUR ECB Publishes Account of Monetary Policy Meeting

🆘 All Day Holiday United States - Independence Day

Humble reminder:

🟢 Due to US HOLIDAY and thin trading volumes a sudden spike/crash of $50 cannot be ruled out hence avoid taking big lots, implement risk management.

#Gold #PiyushRatnu #Forex #Trading

Piyush Lalsingh Ratnu

⚡️⚡️⚡️⚡️⚡️⚡️

Shrinking gap between M5 M15 M30 SMA is a clear sign of high volatility price action ahead.

Kindly avoid BIG LOTS. Implement Risk Management.

Gold (XAU/USD) continues trading in a familiar range within our projected price range: the $2,323-$2,332, just below the 50-day Simple Moving Average (SMA) on Tuesday, amid Futures’ traders “short-covering”, as well as “bargain hunting” by longer-term investors

Unresolved geopolitical conflicts in the Middle East and Ukraine, a lurch right politically in Europe, Trump, and growing fracture lines along ideological, political, and economic grounds between the East and West – exemplified by the expansion of the BRICS trading confederation – are increasingly posing a threat to the smooth running of global free trade.

As a safe-haven in times of crisis and probably the only viable alternative to the dominance of the US Dollar, Gold steps forward as a leading actor on the new world order’s stage.

Are traders FED up with THE FED's DRAMA?

Gold is trapped in a range as the US Federal Reserve (Fed) remains reluctant to commit to a date for when it will begin cutting interest rates. Gold is a non-interest-paying asset, so there is an opportunity cost to holding it. This opportunity cost continues to remain high as long as the Fed waits. When the Fed does finally start cutting interest rates, however, it will provide a positive back wind for Gold.

Although the Fed’s preferred gauge of inflation, the US Personal Consumption Expenditures (PCE) Price Index, continued to fall in line with expectations in May, reaching 2.6% year-over-year (YoY) – another step closer to the Fed’s 2.0% target – Fed officials speaking after the event still remained coy about committing to cuts.

Richmond Fed President Thomas Barkin talked of “lags” in monetary tightening playing out and cautioned that "services and shelter price-setters still have room to push prices higher." Prior to him, San Francisco Fed President Mary Daly told CNBC that cooling inflation showed that the monetary policy was working as it should, but that it was still too early to tell when it would be appropriate to cut interest rates.

Now traders are awaiting more commentary from Chairman of the Fed Jerome Powell on Tuesday, whilst US jobs data including JOLTS Job Openings and then the Nonfarm Payrolls release on Friday could all color the outlook for interest rates and impact Gold.

SUMMARY:

Investors now look forward to Fed Chair Jerome Powell's speech later this Tuesday for some meaningful impetus ahead of the FOMC minutes on Wednesday and the US Nonfarm Payrolls report on Friday.

Crucial price Zones B/S Stops this week:

🔺SZ $2369/2385/2407/2424

🔻BZ $2303/2288/2266/2244

Net movement of $90 🔻🔺 from CMP $2323 is expected.

USDJPY: CMP $161.636

Key Economic Data this week:

Today:

17:30 USD Fed Chair Powell Speaks

17:30 EUR ECB President Lagarde Speaks

18:00 USD JOLTs Job Openings (May) 7.960M 8.059M

Wednesday, July 3, 2024 (Low volume alert)🆘

Holiday United States - Independence Day - Early close at 13:00

16:15 USD ADP Nonfarm Employment Change (Jun) 159K 152K

16:30 USD Continuing Jobless Claims 1,840K 1,839K

16:30 USD Initial Jobless Claims 235K 233K

16:30 USD Trade Balance (May) -76.00B -74.60B

17:45 USD S&P Global Composite PMI (Jun) 54.6 54.5

17:45 USD S&P Global Services PMI (Jun) 55.1 54.8

18:00 USD Factory Orders (MoM) (May) 0.2% 0.7%

18:00 USD ISM Non-Manufacturing Employment (Jun) 47.1

18:00 USD ISM Non-Manufacturing PMI (Jun) 52.7 53.8

18:00 USD ISM Non-Manufacturing Prices (Jun)

Thursday, July 4, 2024 (Low Volume Alert)🆘

All Day Holiday United States - Independence Day

⚠️Friday, July 5, 2024 ($24/42/69) price movement expected)

🆘 HIGH VOLAILITY PRICE ACTION DAY, may continue for next three trading days.

00:30 USD Fed's Balance Sheet

16:30 USD Average Hourly Earnings (YoY) (YoY) (Jun) 4.1%

16:30 USD Average Hourly Earnings (MoM) (Jun) 0.3% 0.4%

🟢16:30 USD Nonfarm Payrolls (Jun) 189K 272K

16:30 USD Participation Rate (Jun) 62.5%

16:30 USD Private Nonfarm Payrolls (Jun) 160K 229K

16:30 USD U6 Unemployment Rate (Jun) 7.4%

16:30 USD Unemployment Rate (Jun) 4.0% 4.0%

🟢19:00 USD Fed Monetary Policy Report

#PiyushRatnu #PRDXB #XAUUSD #Gold #Forex #Trading #Education

Shrinking gap between M5 M15 M30 SMA is a clear sign of high volatility price action ahead.

Kindly avoid BIG LOTS. Implement Risk Management.

Gold (XAU/USD) continues trading in a familiar range within our projected price range: the $2,323-$2,332, just below the 50-day Simple Moving Average (SMA) on Tuesday, amid Futures’ traders “short-covering”, as well as “bargain hunting” by longer-term investors

Unresolved geopolitical conflicts in the Middle East and Ukraine, a lurch right politically in Europe, Trump, and growing fracture lines along ideological, political, and economic grounds between the East and West – exemplified by the expansion of the BRICS trading confederation – are increasingly posing a threat to the smooth running of global free trade.

As a safe-haven in times of crisis and probably the only viable alternative to the dominance of the US Dollar, Gold steps forward as a leading actor on the new world order’s stage.

Are traders FED up with THE FED's DRAMA?

Gold is trapped in a range as the US Federal Reserve (Fed) remains reluctant to commit to a date for when it will begin cutting interest rates. Gold is a non-interest-paying asset, so there is an opportunity cost to holding it. This opportunity cost continues to remain high as long as the Fed waits. When the Fed does finally start cutting interest rates, however, it will provide a positive back wind for Gold.

Although the Fed’s preferred gauge of inflation, the US Personal Consumption Expenditures (PCE) Price Index, continued to fall in line with expectations in May, reaching 2.6% year-over-year (YoY) – another step closer to the Fed’s 2.0% target – Fed officials speaking after the event still remained coy about committing to cuts.

Richmond Fed President Thomas Barkin talked of “lags” in monetary tightening playing out and cautioned that "services and shelter price-setters still have room to push prices higher." Prior to him, San Francisco Fed President Mary Daly told CNBC that cooling inflation showed that the monetary policy was working as it should, but that it was still too early to tell when it would be appropriate to cut interest rates.

Now traders are awaiting more commentary from Chairman of the Fed Jerome Powell on Tuesday, whilst US jobs data including JOLTS Job Openings and then the Nonfarm Payrolls release on Friday could all color the outlook for interest rates and impact Gold.

SUMMARY:

Investors now look forward to Fed Chair Jerome Powell's speech later this Tuesday for some meaningful impetus ahead of the FOMC minutes on Wednesday and the US Nonfarm Payrolls report on Friday.

Crucial price Zones B/S Stops this week:

🔺SZ $2369/2385/2407/2424

🔻BZ $2303/2288/2266/2244

Net movement of $90 🔻🔺 from CMP $2323 is expected.

USDJPY: CMP $161.636

Key Economic Data this week:

Today:

17:30 USD Fed Chair Powell Speaks

17:30 EUR ECB President Lagarde Speaks

18:00 USD JOLTs Job Openings (May) 7.960M 8.059M

Wednesday, July 3, 2024 (Low volume alert)🆘

Holiday United States - Independence Day - Early close at 13:00

16:15 USD ADP Nonfarm Employment Change (Jun) 159K 152K

16:30 USD Continuing Jobless Claims 1,840K 1,839K

16:30 USD Initial Jobless Claims 235K 233K

16:30 USD Trade Balance (May) -76.00B -74.60B

17:45 USD S&P Global Composite PMI (Jun) 54.6 54.5

17:45 USD S&P Global Services PMI (Jun) 55.1 54.8

18:00 USD Factory Orders (MoM) (May) 0.2% 0.7%

18:00 USD ISM Non-Manufacturing Employment (Jun) 47.1

18:00 USD ISM Non-Manufacturing PMI (Jun) 52.7 53.8

18:00 USD ISM Non-Manufacturing Prices (Jun)

Thursday, July 4, 2024 (Low Volume Alert)🆘

All Day Holiday United States - Independence Day

⚠️Friday, July 5, 2024 ($24/42/69) price movement expected)

🆘 HIGH VOLAILITY PRICE ACTION DAY, may continue for next three trading days.

00:30 USD Fed's Balance Sheet

16:30 USD Average Hourly Earnings (YoY) (YoY) (Jun) 4.1%

16:30 USD Average Hourly Earnings (MoM) (Jun) 0.3% 0.4%

🟢16:30 USD Nonfarm Payrolls (Jun) 189K 272K

16:30 USD Participation Rate (Jun) 62.5%

16:30 USD Private Nonfarm Payrolls (Jun) 160K 229K

16:30 USD U6 Unemployment Rate (Jun) 7.4%

16:30 USD Unemployment Rate (Jun) 4.0% 4.0%

🟢19:00 USD Fed Monetary Policy Report

#PiyushRatnu #PRDXB #XAUUSD #Gold #Forex #Trading #Education

Piyush Lalsingh Ratnu

CMP: $2333 XAUUSD at R1 PPZ

R2: $2355 / S2: $2300 crucial

#XAUUSD #PiyushRatnu #Gold #Forex

R2: $2355 / S2: $2300 crucial

#XAUUSD #PiyushRatnu #Gold #Forex

Piyush Lalsingh Ratnu

🟢 Economic Data ahead:

16:30 USD Core PCE Price Index (MoM) (May) 0.1% 0.2%

16:30 USD Core PCE Price Index (YoY) (May) 2.6% 2.8%

16:30 USD PCE price index (MoM) (May) 0.0% 0.3%

16:30 USD PCE Price index (YoY) (May) 2.6% 2.7%

16:30 USD Personal Spending (MoM) (May) 0.3% 0.2%

17:45 USD Chicago PMI (Jun) 39.7 35.4

16:30 USD Core PCE Price Index (MoM) (May) 0.1% 0.2%

16:30 USD Core PCE Price Index (YoY) (May) 2.6% 2.8%

16:30 USD PCE price index (MoM) (May) 0.0% 0.3%

16:30 USD PCE Price index (YoY) (May) 2.6% 2.7%

16:30 USD Personal Spending (MoM) (May) 0.3% 0.2%

17:45 USD Chicago PMI (Jun) 39.7 35.4

Piyush Lalsingh Ratnu

Key Economic Data today and tomorrow:

🍎 Today:

00:30 USD Fed Bank Stress Test Results

00:30 USD Fed's Balance Sheet

🍎 Tomorrow:

7,253B

03:30 JPY Tokyo Core CPI (YoY) (Jun) 2.0% 1.9%

03:50 JPY Industrial Production (MoM) (May) 2.0% -0.9%

05:00 USD U.S. President Biden Speaks

10:00 GBP Business Investment (QoQ) (Q1) 0.9% 1.4%

10:00 GBP Current Account (Q1) -17.7B -21.2B

10:00 GBP GDP (QoQ) (Q1) 0.6% -0.3%

10:00 GBP GDP (YoY) (Q1) 0.2% -0.2%

14:00 EUR EU Leaders Summit

14:00 EUR Eurogroup Meetings

🟢 High Volatility News

16:30 USD Core PCE Price Index (MoM) (May) 0.1% 0.2%

16:30 USD Core PCE Price Index (YoY) (May) 2.6% 2.8%

16:30 USD PCE price index (MoM) (May) 0.0% 0.3%

16:30 USD PCE Price index (YoY) (May) 2.6% 2.7%

16:30 USD Personal Spending (MoM) (May) 0.3% 0.2%

17:45 USD Chicago PMI (Jun) 39.7 35.4

🍎 Today:

00:30 USD Fed Bank Stress Test Results

00:30 USD Fed's Balance Sheet

🍎 Tomorrow:

7,253B

03:30 JPY Tokyo Core CPI (YoY) (Jun) 2.0% 1.9%

03:50 JPY Industrial Production (MoM) (May) 2.0% -0.9%

05:00 USD U.S. President Biden Speaks

10:00 GBP Business Investment (QoQ) (Q1) 0.9% 1.4%

10:00 GBP Current Account (Q1) -17.7B -21.2B

10:00 GBP GDP (QoQ) (Q1) 0.6% -0.3%

10:00 GBP GDP (YoY) (Q1) 0.2% -0.2%

14:00 EUR EU Leaders Summit

14:00 EUR Eurogroup Meetings

🟢 High Volatility News

16:30 USD Core PCE Price Index (MoM) (May) 0.1% 0.2%

16:30 USD Core PCE Price Index (YoY) (May) 2.6% 2.8%

16:30 USD PCE price index (MoM) (May) 0.0% 0.3%

16:30 USD PCE Price index (YoY) (May) 2.6% 2.7%

16:30 USD Personal Spending (MoM) (May) 0.3% 0.2%

17:45 USD Chicago PMI (Jun) 39.7 35.4

Piyush Lalsingh Ratnu

⚡️⚡️⚡️⚡️⚡️⚡️

Will this FRIDAY prove a FRY DAY for GOLD TRADERS?

🔘 Current status:

XAUUSD price slipped to $2313 zone, RT $2323 zone

Gold price tumbled after reaching a weekly high of $2,334 and fell as the Greenback staged a recovery underpinned by a minimal rise in US Treasury bond yields, spurred by Federal Reserve (Fed) Governor Michelle Bowman's hawkish comments. The XAU/USD trades at $2,319, down 0.59% after recovering from $2310 mark projected by us yesterday as a buying zone.

The Federal Reserve's recent indication of only one interest rate cut this year has increased market uncertainty. The gold market is currently in a holding pattern as traders await key inflation figures due later this week, which could provide significant clues about the future direction of monetary policy. Earlier this month, the Federal Reserve surprised markets by indicating only one interest rate cut this year, maintaining a hawkish stance on inflation by keeping borrowing costs at a 23-year high. This marked a significant shift from the Federal Open Market Committee's previous projection of three cuts in 2024. The upcoming Personal Consumption Expenditures (PCE) Price Index, the Fed's preferred inflation measure, is expected to show a slight slowdown in May, potentially adding to the evidence from the Consumer and Producer Price Index reports that inflation is easing in the U.S. Traders are also monitoring other economic indicators such as initial jobless claims, pending home sales, and first-quarter GDP figures, which will help gauge the strength of the U.S. economy. These data points will be crucial in determining when the Fed might initiate its first rate cut, with current market pricing suggesting a September timeline. As a result, the gold market remains sensitive to these developments, with any deviation from expectations likely to create significant trading opportunities.

🔘Will Bears Roar?

Gold prices form a head and shoulders pattern and show bearish price action, as shown in the chart below. This head and shoulders formation is followed by the emergence of a bear flag, with prices now attempting to break through this pattern. The typical price behaviour in June, characterized by choppy and overlapping movements, has created a bearish tone in the gold market. However, the long-term price structure remains strongly bullish. If prices continue to decline from here and break below $2285, it will likely initiate a quick drop. However, this quick drop is expected to reverse higher, marking a strong bottom for the next significant upward move.

🔘Facts

• Federal Reserve policymakers continue to argue in favor of keeping rates higher for longer, which pushes the US Treasury bond yields higher and caps the upside for the non-yielding Gold price.

• A survey from the Conference Board showed on Tuesday that the US Consumer Confidence Index ticked lower to 100.4 in June from 101.3 in the previous month amid worries about the economic outlook.

• Russia’s Foreign Ministry summoned US Ambassador Lynne Tracy earlier this week and blamed the US for a barbaric attack in Crimea, and said that retaliatory measures would “definitely follow”.

• Concerns about an all-out war between Israel and Lebanon remain alive in the wake of soaring tensions on provocations by Hezbollah, helping limit the downside for the safe-haven precious metal.

• Traders also seem reluctant to place aggressive directional bets and now look forward to the release of the Personal Consumption Expenditures (PCE) Price Index on Friday for some meaningful impetus.

• Gold serves particularly well as an inflation hedge. Since 1971 it has outpaced both U.S. and and global CPI. The yellow metal also tends to do well in high inflation periods. This has proved true during the recent inflationary cycle. The price of gold has increased by about 29 percent since June 2021 (as inflation started heating up). In that same period, CPI increased by 12.30 percent based on official Bureau of Labor Statistics data. Ultimately, gold is money. And it is sound money. Every major currency has depreciated significantly compared to gold. Despite its strong performance over time, most investors don't hold any gold in their portfolios. Is it perhaps time to change that?

🔘Crucial Price Zones:

🔻 BZ $2288/2266/2244 | ultimate RT target $2222/2200/2185 trap

🔺SZ $2342/2369/2385 |2400+ 2407/2424/2442

🔘Refer Algorithm: PRSDBS PRSR Set W1 and MN

#PiyushRatnu #Forex #XAUUSDAnalysis #Gold #PRDXB

Will this FRIDAY prove a FRY DAY for GOLD TRADERS?

🔘 Current status:

XAUUSD price slipped to $2313 zone, RT $2323 zone

Gold price tumbled after reaching a weekly high of $2,334 and fell as the Greenback staged a recovery underpinned by a minimal rise in US Treasury bond yields, spurred by Federal Reserve (Fed) Governor Michelle Bowman's hawkish comments. The XAU/USD trades at $2,319, down 0.59% after recovering from $2310 mark projected by us yesterday as a buying zone.

The Federal Reserve's recent indication of only one interest rate cut this year has increased market uncertainty. The gold market is currently in a holding pattern as traders await key inflation figures due later this week, which could provide significant clues about the future direction of monetary policy. Earlier this month, the Federal Reserve surprised markets by indicating only one interest rate cut this year, maintaining a hawkish stance on inflation by keeping borrowing costs at a 23-year high. This marked a significant shift from the Federal Open Market Committee's previous projection of three cuts in 2024. The upcoming Personal Consumption Expenditures (PCE) Price Index, the Fed's preferred inflation measure, is expected to show a slight slowdown in May, potentially adding to the evidence from the Consumer and Producer Price Index reports that inflation is easing in the U.S. Traders are also monitoring other economic indicators such as initial jobless claims, pending home sales, and first-quarter GDP figures, which will help gauge the strength of the U.S. economy. These data points will be crucial in determining when the Fed might initiate its first rate cut, with current market pricing suggesting a September timeline. As a result, the gold market remains sensitive to these developments, with any deviation from expectations likely to create significant trading opportunities.

🔘Will Bears Roar?

Gold prices form a head and shoulders pattern and show bearish price action, as shown in the chart below. This head and shoulders formation is followed by the emergence of a bear flag, with prices now attempting to break through this pattern. The typical price behaviour in June, characterized by choppy and overlapping movements, has created a bearish tone in the gold market. However, the long-term price structure remains strongly bullish. If prices continue to decline from here and break below $2285, it will likely initiate a quick drop. However, this quick drop is expected to reverse higher, marking a strong bottom for the next significant upward move.

🔘Facts

• Federal Reserve policymakers continue to argue in favor of keeping rates higher for longer, which pushes the US Treasury bond yields higher and caps the upside for the non-yielding Gold price.

• A survey from the Conference Board showed on Tuesday that the US Consumer Confidence Index ticked lower to 100.4 in June from 101.3 in the previous month amid worries about the economic outlook.

• Russia’s Foreign Ministry summoned US Ambassador Lynne Tracy earlier this week and blamed the US for a barbaric attack in Crimea, and said that retaliatory measures would “definitely follow”.

• Concerns about an all-out war between Israel and Lebanon remain alive in the wake of soaring tensions on provocations by Hezbollah, helping limit the downside for the safe-haven precious metal.

• Traders also seem reluctant to place aggressive directional bets and now look forward to the release of the Personal Consumption Expenditures (PCE) Price Index on Friday for some meaningful impetus.

• Gold serves particularly well as an inflation hedge. Since 1971 it has outpaced both U.S. and and global CPI. The yellow metal also tends to do well in high inflation periods. This has proved true during the recent inflationary cycle. The price of gold has increased by about 29 percent since June 2021 (as inflation started heating up). In that same period, CPI increased by 12.30 percent based on official Bureau of Labor Statistics data. Ultimately, gold is money. And it is sound money. Every major currency has depreciated significantly compared to gold. Despite its strong performance over time, most investors don't hold any gold in their portfolios. Is it perhaps time to change that?

🔘Crucial Price Zones:

🔻 BZ $2288/2266/2244 | ultimate RT target $2222/2200/2185 trap

🔺SZ $2342/2369/2385 |2400+ 2407/2424/2442

🔘Refer Algorithm: PRSDBS PRSR Set W1 and MN

#PiyushRatnu #Forex #XAUUSDAnalysis #Gold #PRDXB

Piyush Lalsingh Ratnu

US10YT - 4.224

DXY + 105.280

XAUXAG 79.00

XAUXPD 2.4206

USDJPY 159.456 (ATH)

USD S 90

AUD S 22

JPY S 80

🆘 Data at 17.00 hours

Crucial Price Entries:

🔻BZ $2313/2303/2288

🔺SZ $2349/2359/2369

Refer Algo: PRSR D1 MTD

DXY + 105.280

XAUXAG 79.00

XAUXPD 2.4206

USDJPY 159.456 (ATH)

USD S 90

AUD S 22

JPY S 80

🆘 Data at 17.00 hours

Crucial Price Entries:

🔻BZ $2313/2303/2288

🔺SZ $2349/2359/2369

Refer Algo: PRSR D1 MTD

: