Piyush Lalsingh Ratnu / Profilo

Piyush Lalsingh Ratnu

- Trader & Analyst al Piyush Ratnu XAUUSD Spot Gold Research

- Emirati Arabi Uniti

- 156

- Informazioni

|

no

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

3

segnali

|

1

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

⚠️ Buying at H1AS5 gave us neat results: CMP $2288

Net Profit: $3 | 300/lot in 15 minutes

Net Profit: $3 | 300/lot in 15 minutes

Piyush Lalsingh Ratnu

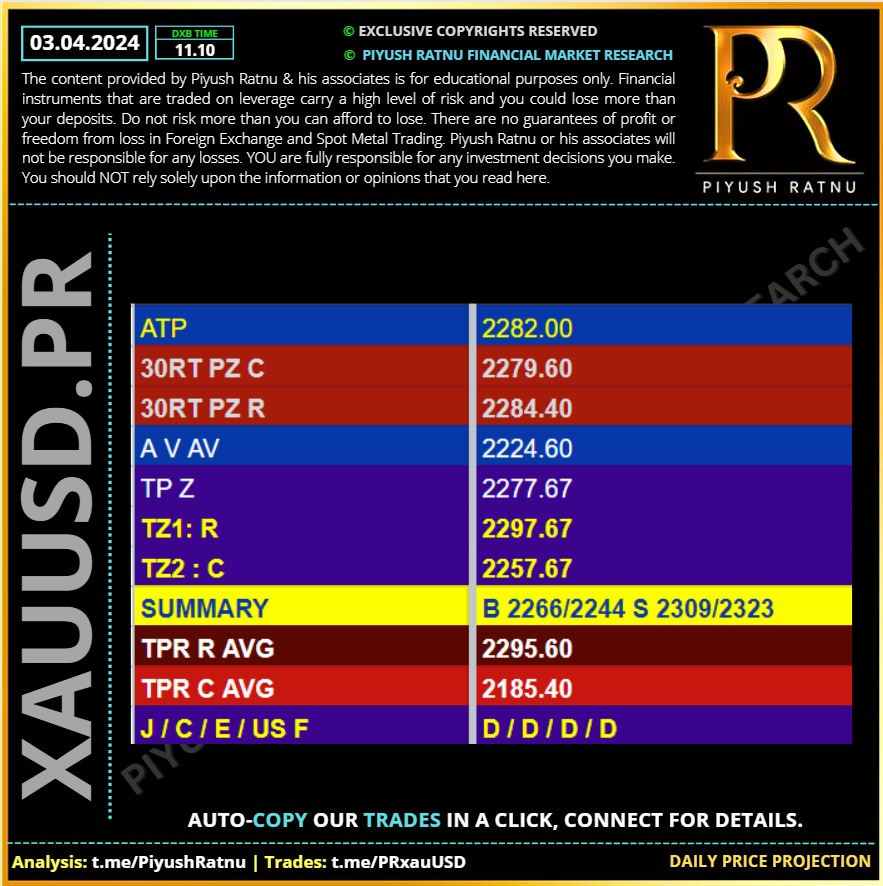

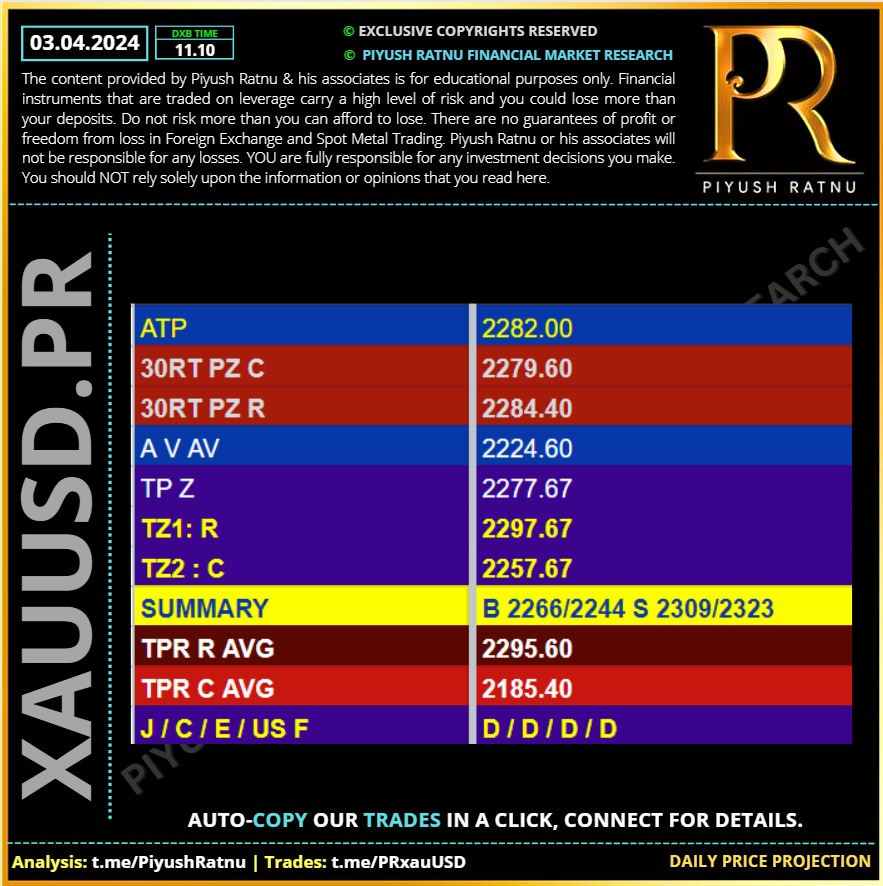

03.04.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

Federal Reserve chairman Jerome Powell said Wednesday most voting Fed participants support lowering interest rates at some point this year, but not until the central bank has greater confidence from incoming data that inflation is on a sustainable move lower.

"If the economy evolves broadly as we expect, most FOMC participants see it as likely to be appropriate to begin lowering the policy rate at some point this year," Powell said in opening remarks ahead of a question-and-answer session at Stanford University.

But a pivot to cuts isn't expected to arrive until "we have greater confidence that inflation is moving sustainably down toward 2 percent," the fed chief said, adding that the Fed has the luxury of waiting because of the strength in the economy and progress on inflation.

The recent data showing that the economy remains solid and inflation surprised to the upside since the turn of the year, muddying the outlook on rate cuts forcing investors to rein in expectations of rate cuts.

But Powell said that the recent data haven't materially changed the Fed's outlook, which continues "to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2 percent on a sometimes bumpy path."

Powell continued to flag the risk for the future monetary policy decision remain two-sided risks -- cutting rates too early, risks undoing the progress on inflation, but keeping rates higher for longer could unduly "weaken economic activity and employment."

Treasury yields dipped following the remarks, dragging the US Dollar Index Futures lower.

🔺 XAUUSD: Today's HIGH: $2298.00

"If the economy evolves broadly as we expect, most FOMC participants see it as likely to be appropriate to begin lowering the policy rate at some point this year," Powell said in opening remarks ahead of a question-and-answer session at Stanford University.

But a pivot to cuts isn't expected to arrive until "we have greater confidence that inflation is moving sustainably down toward 2 percent," the fed chief said, adding that the Fed has the luxury of waiting because of the strength in the economy and progress on inflation.

The recent data showing that the economy remains solid and inflation surprised to the upside since the turn of the year, muddying the outlook on rate cuts forcing investors to rein in expectations of rate cuts.

But Powell said that the recent data haven't materially changed the Fed's outlook, which continues "to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2 percent on a sometimes bumpy path."

Powell continued to flag the risk for the future monetary policy decision remain two-sided risks -- cutting rates too early, risks undoing the progress on inflation, but keeping rates higher for longer could unduly "weaken economic activity and employment."

Treasury yields dipped following the remarks, dragging the US Dollar Index Futures lower.

🔺 XAUUSD: Today's HIGH: $2298.00

Piyush Lalsingh Ratnu

⚡️⚡️⚡️⚡️⚡️⚡️

Bitcoin price on edge as US government seen mobilizing Silk Road funds:

⚠️ Proof:

1. https://www.bloomberg.com/news/articles/2024-04-02/silk-road-linked-us-digital-wallet-moves-bitcoin-analysts-say

2. https://www.nasdaq.com/articles/us-government-preparing-to-sell-30000-silk-road-bitcoin-on-chain-data-shows

3. https://www.coindesk.com/markets/2024/04/02/silk-road-bitcoin-worth-2b-moved-by-us-government-on-chain-data/

4. https://in.investing.com/news/us-government-reportedly-moves-bitcoin-seized-from-silk-road-sparking-sale-speculation-432SI-4104052

5. https://bitcoinmagazine.com/markets/us-government-preparing-to-sell-30000-silk-road-bitcoin-on-chain-data-shows

Bitcoin price remained range-bound on Wednesday, constrained mainly by pressure from a strong dollar as investors grew more uncertain over the path of U.S. interest rates in anticipation of key labor market data this week.

A broader decline in risk appetite- marked by a sharp fall in global stock markets- also pressured Bitcoin, as investors pivoted into safe havens such as the dollar and gold. The greenback 🔺 raced to a 4-½ month high this week, while gold 🔺 prices notched record highs.

Risk appetite- particularly in Asian markets- was also dented by a devastating earthquake in Taiwan, the impact of which remained unclear. But this kept Asian stocks trading negative, while the dollar stemmed a decline from recent peaks.

A potential mass sale event also kept Bitcoin investors on edge, especially as the U.S. government was seen mobilizing part of the 30.1K Bitcoins ($2.1 billion) recovered from the Silk Road marketplace.

🆘 Crypto influencer ZachXBT noted on social media platform X that an address associated with the U.S. government had moved $139 million of Bitcoin to a Coinbase (NASDAQ:COIN) deposit address.

A move onto an exchange could herald a potential sale of the tokens on the open market, presenting some sell-side pressure on Bitcoin. Past crypto seizures by the U.S. government have usually resulted in the government auctioning off the seized tokens.

Trading volumes in Bitcoin ETFs tripled to $110M in March

Bitcoin’s strong price run-up this year- where the token hit a new record high was driven chiefly by the U.S. approval of spot exchange-traded funds.

In March, these funds witnessed a significant surge in trading volume, reaching over $110 billion—tripling the trading volumes seen in January and February—as Bitcoin's value reached new heights.

BlackRock (NYSE:BLK)'s IBIT led the charge, accounting for nearly half of the month's total trading volume, according to Bloomberg Intelligence analyst Eric Balchunas. Close behind, Grayscale's GBTC captured 20% of the market share, with Fidelity's FBTC contributing to 17%.

Bitcoin price on edge as US government seen mobilizing Silk Road funds:

⚠️ Proof:

1. https://www.bloomberg.com/news/articles/2024-04-02/silk-road-linked-us-digital-wallet-moves-bitcoin-analysts-say

2. https://www.nasdaq.com/articles/us-government-preparing-to-sell-30000-silk-road-bitcoin-on-chain-data-shows

3. https://www.coindesk.com/markets/2024/04/02/silk-road-bitcoin-worth-2b-moved-by-us-government-on-chain-data/

4. https://in.investing.com/news/us-government-reportedly-moves-bitcoin-seized-from-silk-road-sparking-sale-speculation-432SI-4104052

5. https://bitcoinmagazine.com/markets/us-government-preparing-to-sell-30000-silk-road-bitcoin-on-chain-data-shows

Bitcoin price remained range-bound on Wednesday, constrained mainly by pressure from a strong dollar as investors grew more uncertain over the path of U.S. interest rates in anticipation of key labor market data this week.

A broader decline in risk appetite- marked by a sharp fall in global stock markets- also pressured Bitcoin, as investors pivoted into safe havens such as the dollar and gold. The greenback 🔺 raced to a 4-½ month high this week, while gold 🔺 prices notched record highs.

Risk appetite- particularly in Asian markets- was also dented by a devastating earthquake in Taiwan, the impact of which remained unclear. But this kept Asian stocks trading negative, while the dollar stemmed a decline from recent peaks.

A potential mass sale event also kept Bitcoin investors on edge, especially as the U.S. government was seen mobilizing part of the 30.1K Bitcoins ($2.1 billion) recovered from the Silk Road marketplace.

🆘 Crypto influencer ZachXBT noted on social media platform X that an address associated with the U.S. government had moved $139 million of Bitcoin to a Coinbase (NASDAQ:COIN) deposit address.

A move onto an exchange could herald a potential sale of the tokens on the open market, presenting some sell-side pressure on Bitcoin. Past crypto seizures by the U.S. government have usually resulted in the government auctioning off the seized tokens.

Trading volumes in Bitcoin ETFs tripled to $110M in March

Bitcoin’s strong price run-up this year- where the token hit a new record high was driven chiefly by the U.S. approval of spot exchange-traded funds.

In March, these funds witnessed a significant surge in trading volume, reaching over $110 billion—tripling the trading volumes seen in January and February—as Bitcoin's value reached new heights.

BlackRock (NYSE:BLK)'s IBIT led the charge, accounting for nearly half of the month's total trading volume, according to Bloomberg Intelligence analyst Eric Balchunas. Close behind, Grayscale's GBTC captured 20% of the market share, with Fidelity's FBTC contributing to 17%.

Piyush Lalsingh Ratnu

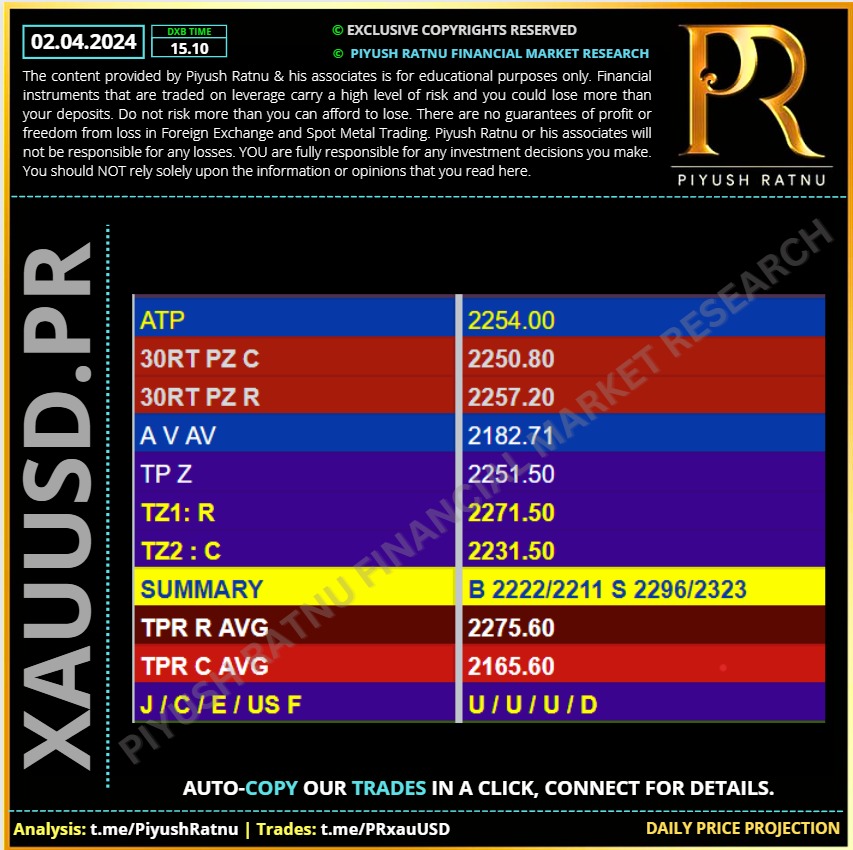

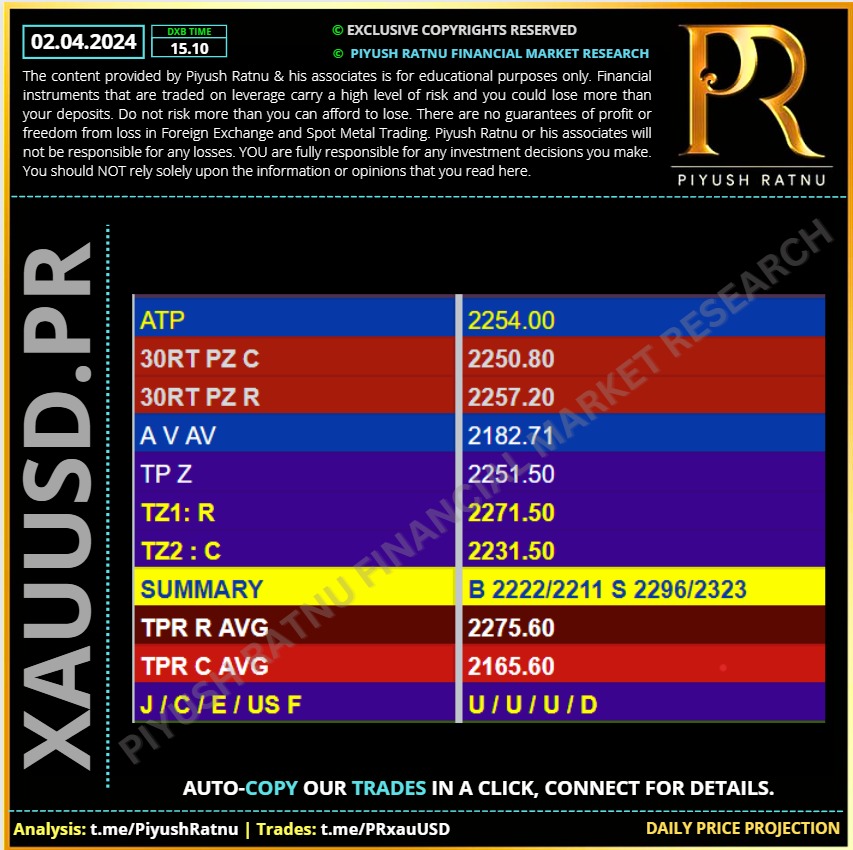

02.04.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

♾ Short positions at $2288 gave us neat exit.

CMP $2277 | Exit SHORT POSITIONS.

CMP $2277 | Exit SHORT POSITIONS.

Piyush Lalsingh Ratnu

XAUUSD: $2244-2266-2288 targets achieved.

RT $2222 or EXT $2323 next?

Piyush Ratnu Financial Market Research: Watch Accuracy Review:

https://youtu.be/QeMovc3n3xs

RT $2222 or EXT $2323 next?

Piyush Ratnu Financial Market Research: Watch Accuracy Review:

https://youtu.be/QeMovc3n3xs

Piyush Lalsingh Ratnu

#XAUUSD #Gold price prints a fresh all-time high above $2,274

Gold price (XAU/USD) refreshes all-time highs above $2,274 in Tuesday’s early New York session as the United States Bureau of Labor Statistics (BLS) has reported steady JOLTS Job Openings for February.

US employers posted fresh 8.756 million job openings, similar to expectations of 8.74 million and the prior reading of 8.748 million in January, revised lower from 8.748 million. The US Dollar Index (DXY) fell slightly after refreshing four-month highs of 105.00 to 104.70.

Gold seems not ready to surrender gains on expectations that February’s core Personal Consumption Expenditure Price Index (PCE) figure, the lowest in two years, will keep the Fed on track to cut interest rates three times this year.

Going forward, the Gold price could face pressure to maintain higher levels as US #bond yields have extended their upside, with 10-year US Treasury yields up to 4.34%. The rise in yields came as investors scaled back their expectations that the Federal Reserve (Fed) will pivot to rate cuts in #June. Higher yields on interest-bearing assets increase the opportunity cost of holding investments in non-yielding assets, such as Gold.

This week, investors will focus on the US Nonfarm Payrolls (#NFP) for #March, which will be published on Friday. The labor market data could give clues about when the #Fed could start reducing interest rates.

🟢Crucial Zones ahead:

C: $2244/2222

R: $2300/2323

🔺CMP XAUUSD $2274 USDJPY $151.525

#PiyushRatnu #PRDXB #Forex

Gold price (XAU/USD) refreshes all-time highs above $2,274 in Tuesday’s early New York session as the United States Bureau of Labor Statistics (BLS) has reported steady JOLTS Job Openings for February.

US employers posted fresh 8.756 million job openings, similar to expectations of 8.74 million and the prior reading of 8.748 million in January, revised lower from 8.748 million. The US Dollar Index (DXY) fell slightly after refreshing four-month highs of 105.00 to 104.70.

Gold seems not ready to surrender gains on expectations that February’s core Personal Consumption Expenditure Price Index (PCE) figure, the lowest in two years, will keep the Fed on track to cut interest rates three times this year.

Going forward, the Gold price could face pressure to maintain higher levels as US #bond yields have extended their upside, with 10-year US Treasury yields up to 4.34%. The rise in yields came as investors scaled back their expectations that the Federal Reserve (Fed) will pivot to rate cuts in #June. Higher yields on interest-bearing assets increase the opportunity cost of holding investments in non-yielding assets, such as Gold.

This week, investors will focus on the US Nonfarm Payrolls (#NFP) for #March, which will be published on Friday. The labor market data could give clues about when the #Fed could start reducing interest rates.

🟢Crucial Zones ahead:

C: $2244/2222

R: $2300/2323

🔺CMP XAUUSD $2274 USDJPY $151.525

#PiyushRatnu #PRDXB #Forex

Piyush Lalsingh Ratnu

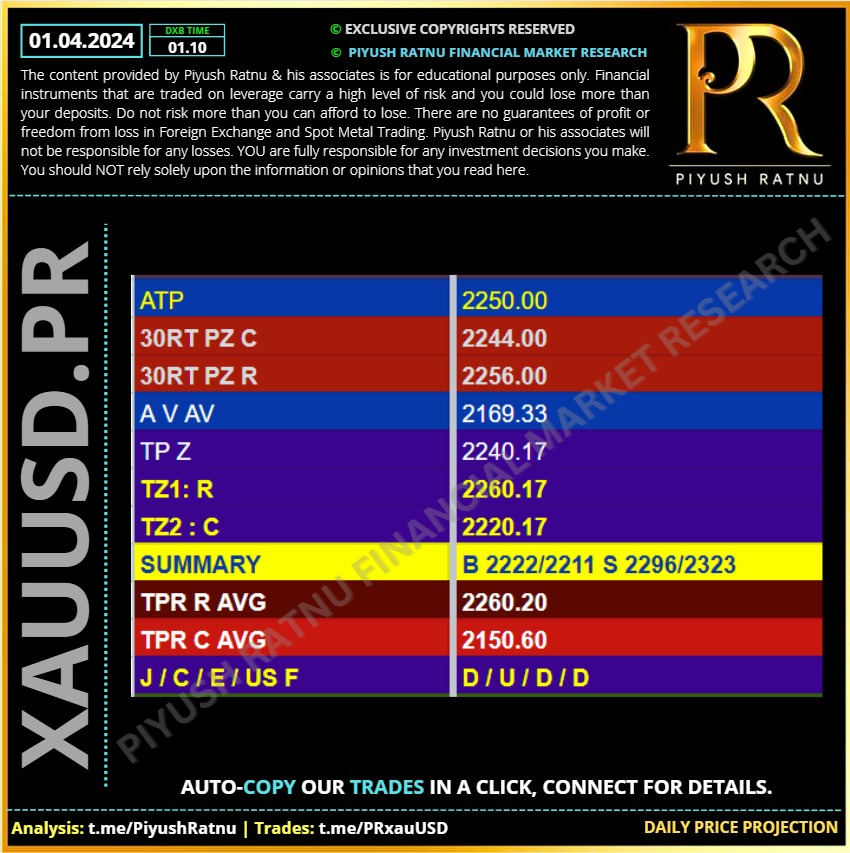

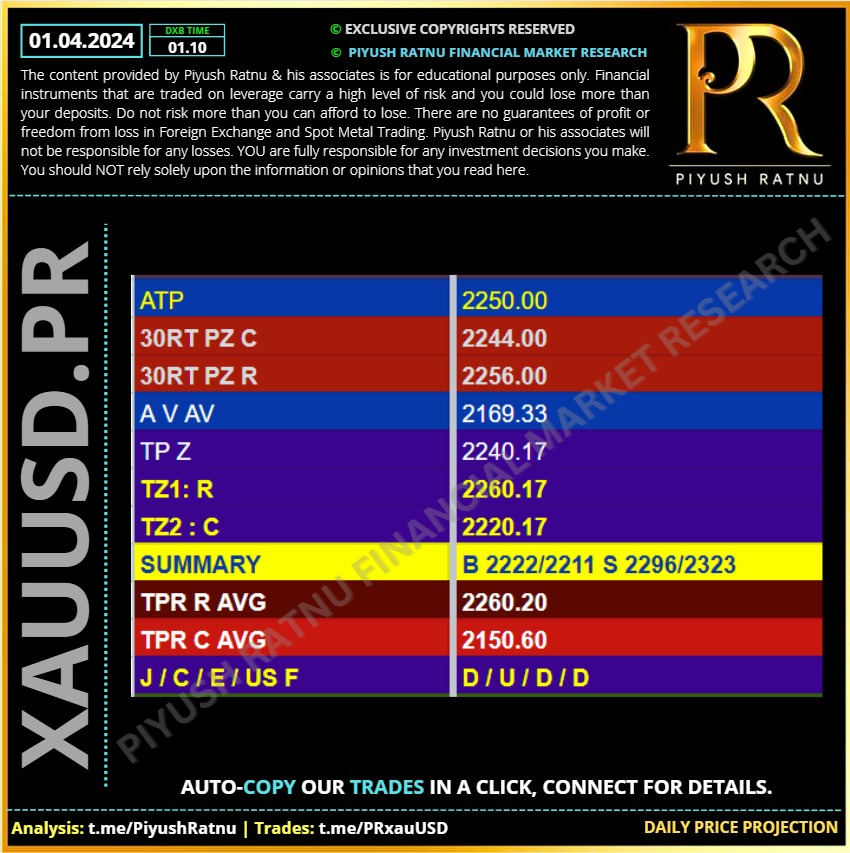

01.04.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

XAUUSD: H1A236 achieved | CMP $2240

Selling at and above $2244 gave us neat results.

Selling at and above $2244 gave us neat results.

Piyush Lalsingh Ratnu

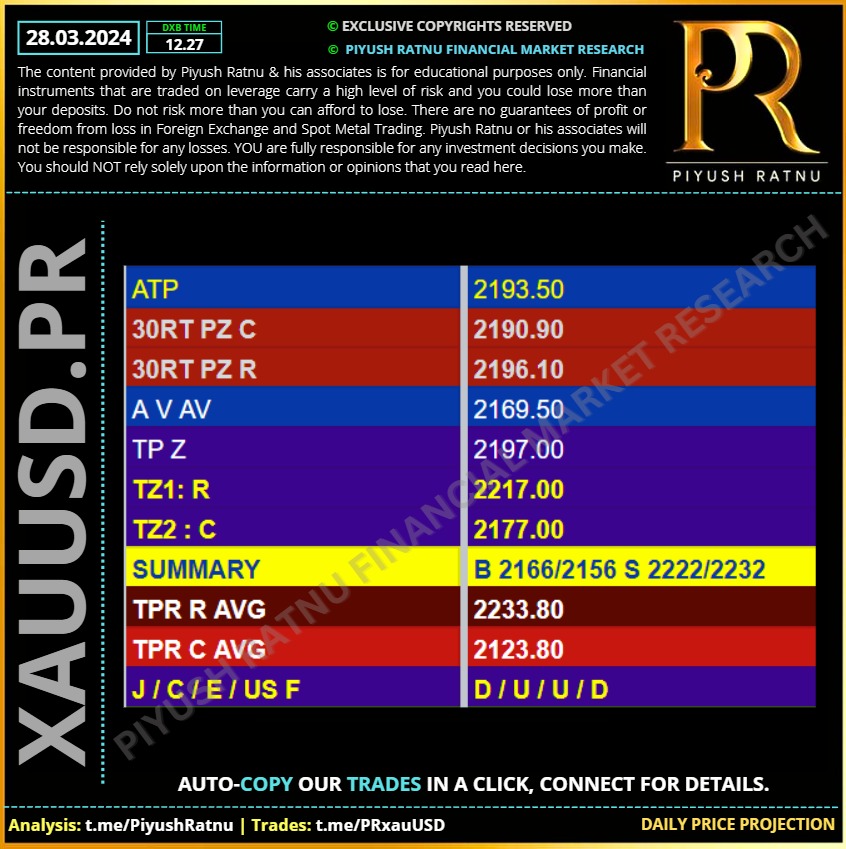

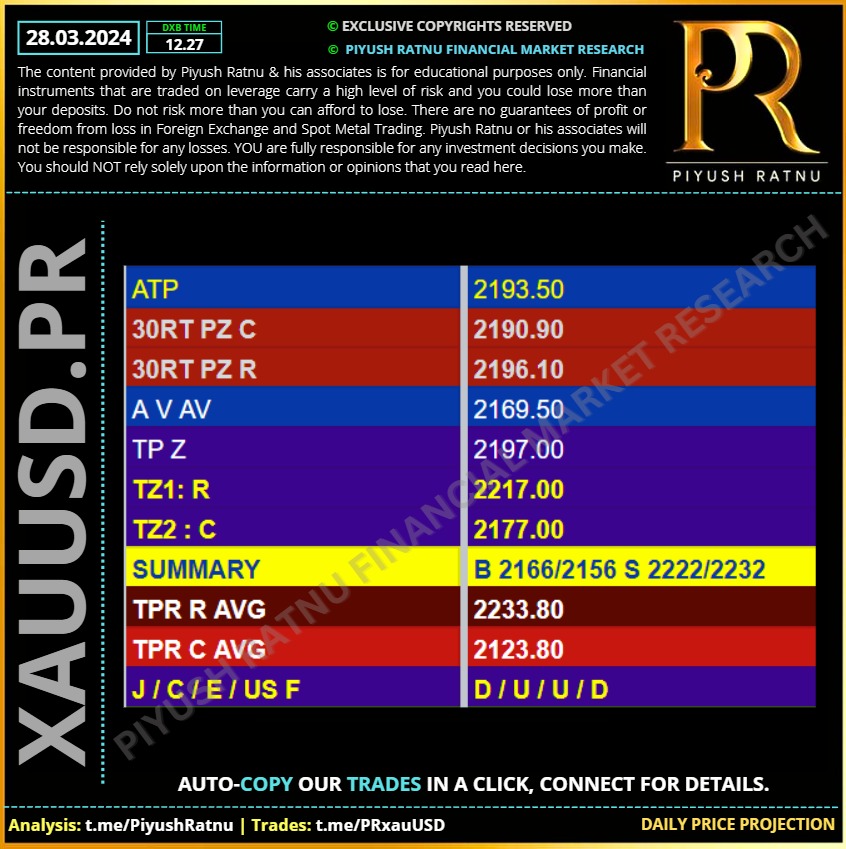

28.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

XAUUSD: $2244-2266 targets achieved, $2222 or $2323 next?

Gold price is consolidating the latest uptick to a new all-time high of $2,260, kicking off Easter Monday and the second quarter of 2024 on a positive note. Extended Easter holiday-induced thin liquidity conditions aid the Gold price uptrend amid a broadly subdued US Dollar.

A June Fed policy pivot bets underpin Gold price

The US Dollar remains defensive, as markets set off the new quarter with optimism, especially after China’s Manufacturing and Services PMI data surpassed expectations in March. On Sunday, China’s official Manufacturing Purchasing Managers' Index (PMI) jumped to 50.8 in March, compared with the 49.1 contraction reported in February and above the estimates of a 49.9 figure. The Non-Manufacturing PMI rose to 53.3 in the same period vs. February’s 51.4. Meanwhile, China's Caixin Manufacturing Purchasing Managers' Index (PMI) edged higher to 51.1 in March on Monday, beating estimates of 51.0.

Additionally, increased bets that the US Federal Reserve (Fed) will begin lowering interest rates in June, following Friday’s US Personal Consumption Expenditures (PCE) Price Index, exert downside pressure on the US Dollar, keeping Gold price underpinned.

Inflation in the US, as measured by the change in Personal Consumption Expenditures (PCE) Price Index, increased slightly to 2.5% on a yearly basis in February, data released by the US Bureau of Economic Analysis (BEA) showed Friday. The reading met the consensus forecast and followed January’s 2.4% increase. The Core PCE Price Index, which excludes volatile food and energy prices, rose at an annual pace of 2.8%, in line with the market expectations but slowing from a 2.9% increase reported previously.

Markets are currently pricing a 68% probability of a June Fed rate cut, up from 63% seen before the PCE data release. Heightened expectations of a June Fed rate cut come even after Fed Chair Jerome Powell said Friday that “the economy is strong” and there is “no hurry to cut rates.” Powell participated in a discussion at the Macroeconomics and Monetary Policy Conference, in San Francisco, on Friday.

Looking ahead, the US Nonfarm Payrolls data, due on Friday, will be critical to sealing in a June Fed rate cut, having a significant impact on the value of the US Dollar and on the Gold price direction. In the meantime, the return of full markets in the US after the long Easter weekend break could trigger a bout of profit-taking in Gold price, as markets resort to position readjustment, in anticipation of the US employment data, trickling in from Tuesday.

Later on Monday, the US ISM Manufacturing PMI data will be also closely scrutinized for fresh hints on the strength of the US economy, influencing the market’s pricing of the Fed rate cut expectations and, in turn, the non-interest-beating Gold price.

Gold price is consolidating the latest uptick to a new all-time high of $2,260, kicking off Easter Monday and the second quarter of 2024 on a positive note. Extended Easter holiday-induced thin liquidity conditions aid the Gold price uptrend amid a broadly subdued US Dollar.

A June Fed policy pivot bets underpin Gold price

The US Dollar remains defensive, as markets set off the new quarter with optimism, especially after China’s Manufacturing and Services PMI data surpassed expectations in March. On Sunday, China’s official Manufacturing Purchasing Managers' Index (PMI) jumped to 50.8 in March, compared with the 49.1 contraction reported in February and above the estimates of a 49.9 figure. The Non-Manufacturing PMI rose to 53.3 in the same period vs. February’s 51.4. Meanwhile, China's Caixin Manufacturing Purchasing Managers' Index (PMI) edged higher to 51.1 in March on Monday, beating estimates of 51.0.

Additionally, increased bets that the US Federal Reserve (Fed) will begin lowering interest rates in June, following Friday’s US Personal Consumption Expenditures (PCE) Price Index, exert downside pressure on the US Dollar, keeping Gold price underpinned.

Inflation in the US, as measured by the change in Personal Consumption Expenditures (PCE) Price Index, increased slightly to 2.5% on a yearly basis in February, data released by the US Bureau of Economic Analysis (BEA) showed Friday. The reading met the consensus forecast and followed January’s 2.4% increase. The Core PCE Price Index, which excludes volatile food and energy prices, rose at an annual pace of 2.8%, in line with the market expectations but slowing from a 2.9% increase reported previously.

Markets are currently pricing a 68% probability of a June Fed rate cut, up from 63% seen before the PCE data release. Heightened expectations of a June Fed rate cut come even after Fed Chair Jerome Powell said Friday that “the economy is strong” and there is “no hurry to cut rates.” Powell participated in a discussion at the Macroeconomics and Monetary Policy Conference, in San Francisco, on Friday.

Looking ahead, the US Nonfarm Payrolls data, due on Friday, will be critical to sealing in a June Fed rate cut, having a significant impact on the value of the US Dollar and on the Gold price direction. In the meantime, the return of full markets in the US after the long Easter weekend break could trigger a bout of profit-taking in Gold price, as markets resort to position readjustment, in anticipation of the US employment data, trickling in from Tuesday.

Later on Monday, the US ISM Manufacturing PMI data will be also closely scrutinized for fresh hints on the strength of the US economy, influencing the market’s pricing of the Fed rate cut expectations and, in turn, the non-interest-beating Gold price.

Piyush Lalsingh Ratnu

⚡️⚡️⚡️⚡️⚡️⚡️

Gold price soars to all-time high of $2,225, defying rising Treasury yields and a robust US Dollar.

Gold price rallied during the North American session on Thursday and hit a new all-time high of $2,225 in the mid-North American session. Precious metal prices are trending higher even though US Treasury yields are advancing, underpinning the Greenback. Hawkish comments by a Federal Reserve (Fed) policymaker and solid economic data from the United States (US) keep the US Dollar and Gold prices bid. XAU/USD trades at $2,221 and gains more than 1.20%.

Christopher Waller, a Fed Governor, noted the US central bank is in no rush to cut rates, even though he expects the beginning of the easing cycle. However, he needs to see a couple of months’ evidence that inflation is curbing toward the Fed’s 2% goal.

Data-wise, the US economy grew faster than expected. Meanwhile, according to the Initial Jobless Claims (IJC) report, the jobs market remains tight. Further data showed that consumer sentiment improved, according to a poll from the University of Michigan, while Pending Home Sales in February ticked higher than in January.

Ahead in the week, Gold traders are eyeing the release of the Fed’s preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) price index for the month of February.

Money market traders predict a 63% chance that the Fed will slash rates by a quarter of a percentage point in June, lower than Wednesday's 70% odds.

The US GDP rose by 3.4%, exceeding the preliminary reading of 3.2%, an indication of a strong economy. The Core Personal Consumption Expenditure (PCE) for Q4 2023 hit the Fed’s target of 2% QoQ.

Why is GOLD price rising?

Gold prices seem to be rallying based on speculation of a lower February inflation report in the US. The Core PCE is expected to slow from 0.4% to 0.3% MoM, while the headline PCE is expected to edge higher from 0.3% to 0.4% MoM.

Gold price soars to all-time high of $2,225, defying rising Treasury yields and a robust US Dollar.

Gold price rallied during the North American session on Thursday and hit a new all-time high of $2,225 in the mid-North American session. Precious metal prices are trending higher even though US Treasury yields are advancing, underpinning the Greenback. Hawkish comments by a Federal Reserve (Fed) policymaker and solid economic data from the United States (US) keep the US Dollar and Gold prices bid. XAU/USD trades at $2,221 and gains more than 1.20%.

Christopher Waller, a Fed Governor, noted the US central bank is in no rush to cut rates, even though he expects the beginning of the easing cycle. However, he needs to see a couple of months’ evidence that inflation is curbing toward the Fed’s 2% goal.

Data-wise, the US economy grew faster than expected. Meanwhile, according to the Initial Jobless Claims (IJC) report, the jobs market remains tight. Further data showed that consumer sentiment improved, according to a poll from the University of Michigan, while Pending Home Sales in February ticked higher than in January.

Ahead in the week, Gold traders are eyeing the release of the Fed’s preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) price index for the month of February.

Money market traders predict a 63% chance that the Fed will slash rates by a quarter of a percentage point in June, lower than Wednesday's 70% odds.

The US GDP rose by 3.4%, exceeding the preliminary reading of 3.2%, an indication of a strong economy. The Core Personal Consumption Expenditure (PCE) for Q4 2023 hit the Fed’s target of 2% QoQ.

Why is GOLD price rising?

Gold prices seem to be rallying based on speculation of a lower February inflation report in the US. The Core PCE is expected to slow from 0.4% to 0.3% MoM, while the headline PCE is expected to edge higher from 0.3% to 0.4% MoM.

Piyush Lalsingh Ratnu

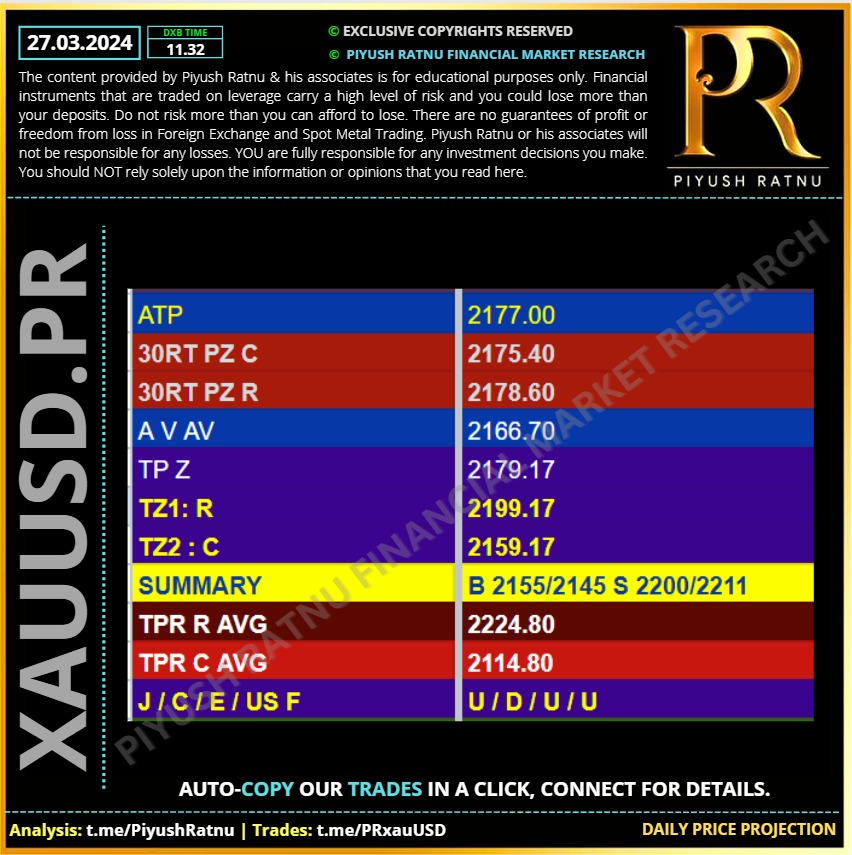

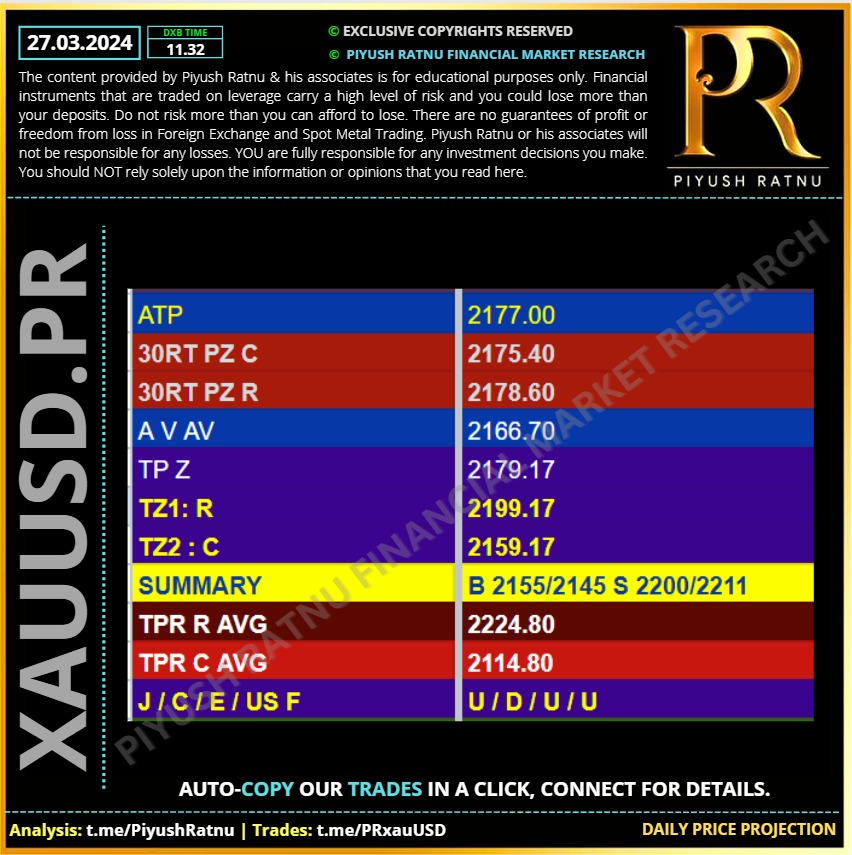

27.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

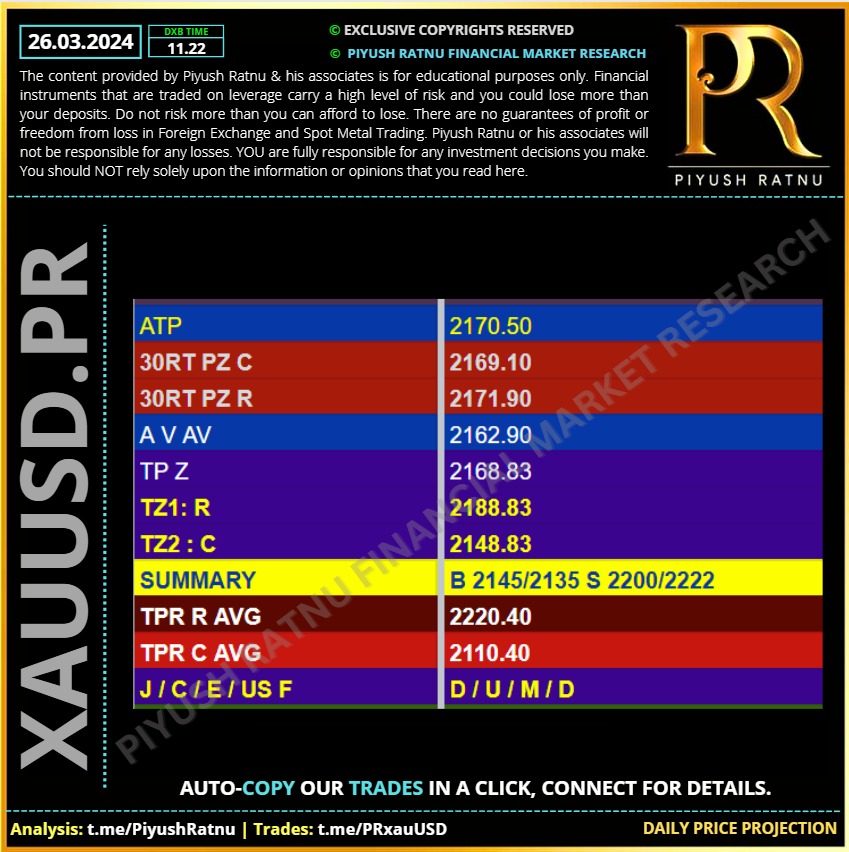

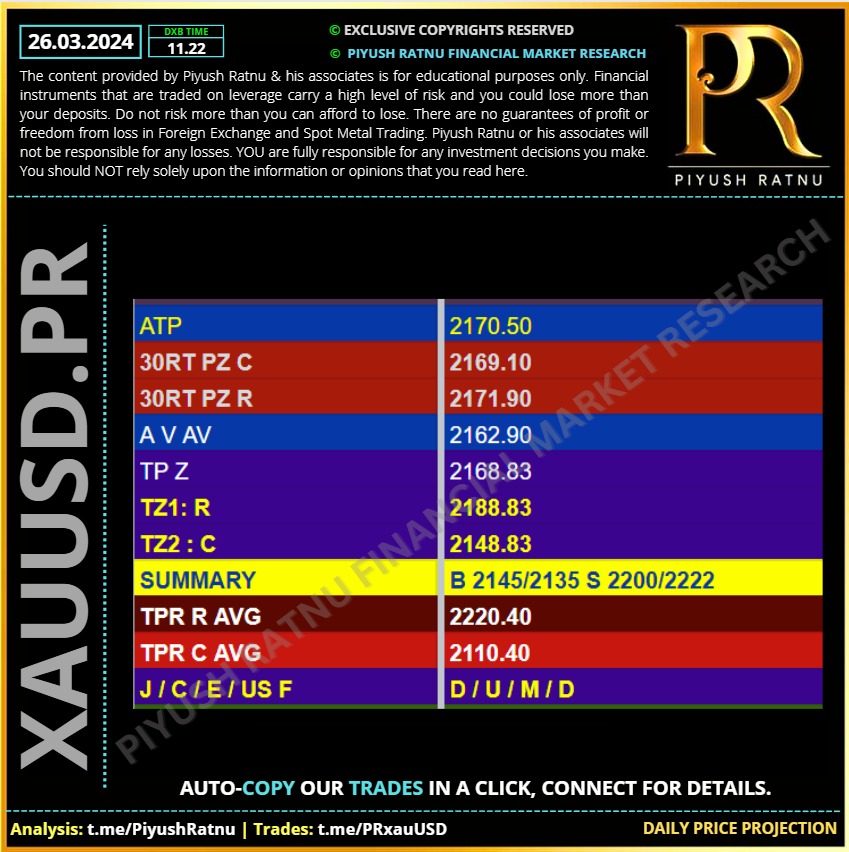

26.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

‘We must enter Rafah now’: Israeli minister

Israeli National Security Minister Itamar Ben-Gvir has said that the army should enter Rafah in southern Gaza even without the US support.

“We must enter Rafah now,” he said, in remarks quoted by the Israeli Army Radio.

When he was reportedly asked if the action should be taken even if Washington does not back it, he said: “Clearly, I remind you that we went into several wars without the support of the Americans and the whole world.”

Defying international calls to halt its military operation, Israel has pledged to push into Rafah on the southern tip of Gaza, where more than half of the enclave’s 2.3 million residents have been sheltering after fleeing the Israeli assault farther north.

⚠️ This might push up GOLD to $2323 territory.

Israeli National Security Minister Itamar Ben-Gvir has said that the army should enter Rafah in southern Gaza even without the US support.

“We must enter Rafah now,” he said, in remarks quoted by the Israeli Army Radio.

When he was reportedly asked if the action should be taken even if Washington does not back it, he said: “Clearly, I remind you that we went into several wars without the support of the Americans and the whole world.”

Defying international calls to halt its military operation, Israel has pledged to push into Rafah on the southern tip of Gaza, where more than half of the enclave’s 2.3 million residents have been sheltering after fleeing the Israeli assault farther north.

⚠️ This might push up GOLD to $2323 territory.

Piyush Lalsingh Ratnu

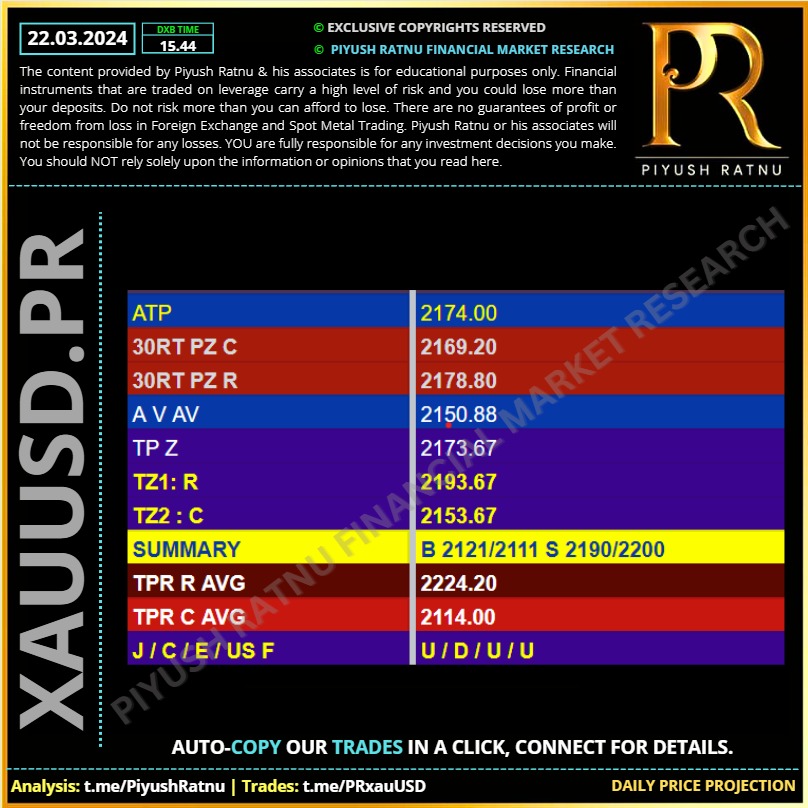

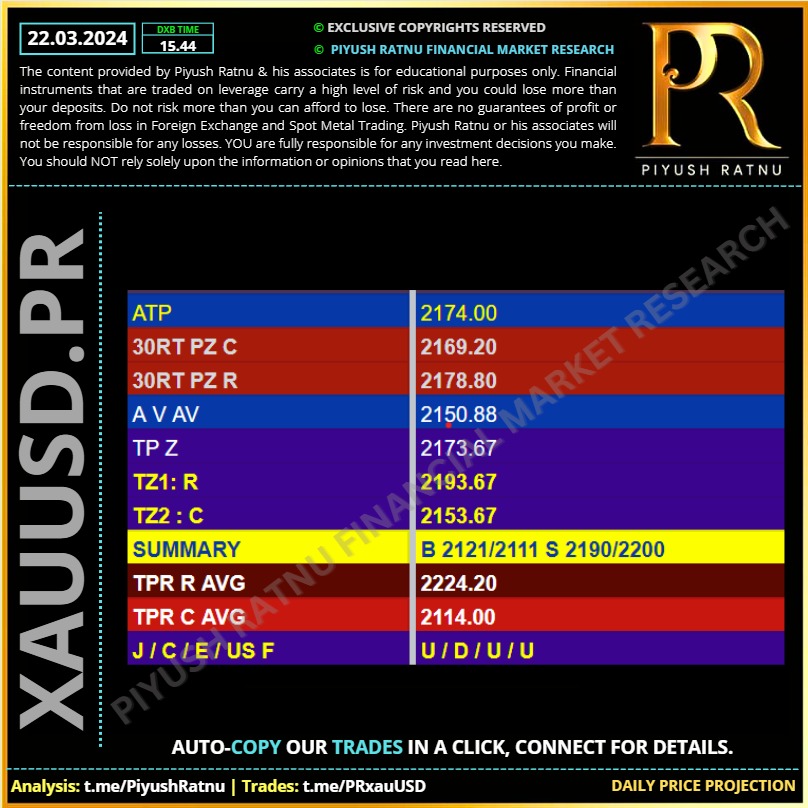

22.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

Piyush Ratnu Financial Market Research: Accuracy Check and Analysis Review

$2222 target price achieved, as projected before FOMC, achieved post FOMC.

#xauusd #piyushratnu #prgoldanalysis #gold #analysis #forex

Watch detailed summary at: https://youtu.be/HTRlSl1TW88

$2222 target price achieved, as projected before FOMC, achieved post FOMC.

#xauusd #piyushratnu #prgoldanalysis #gold #analysis #forex

Watch detailed summary at: https://youtu.be/HTRlSl1TW88

Piyush Lalsingh Ratnu

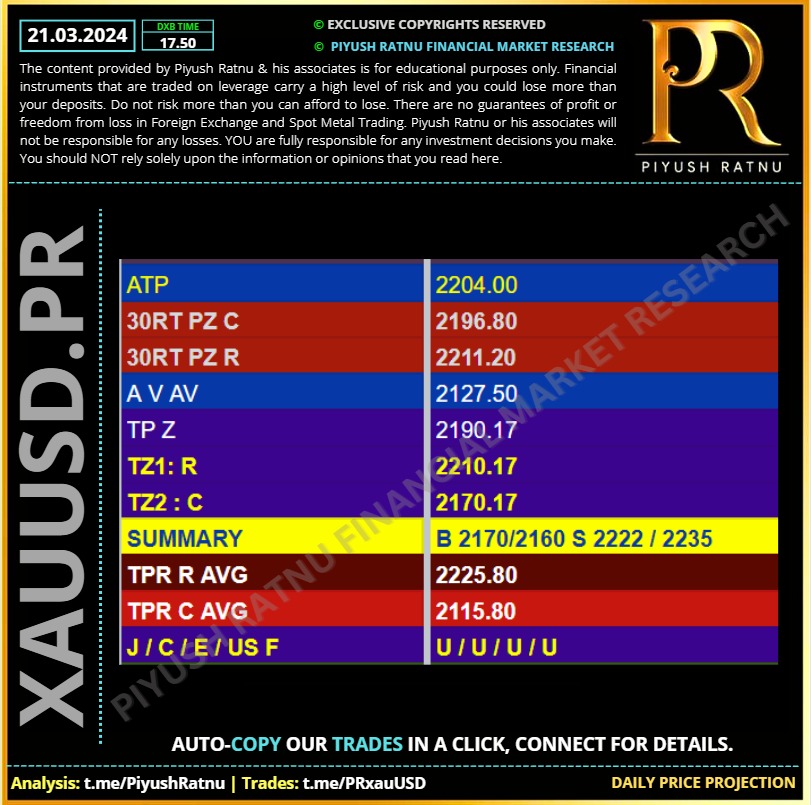

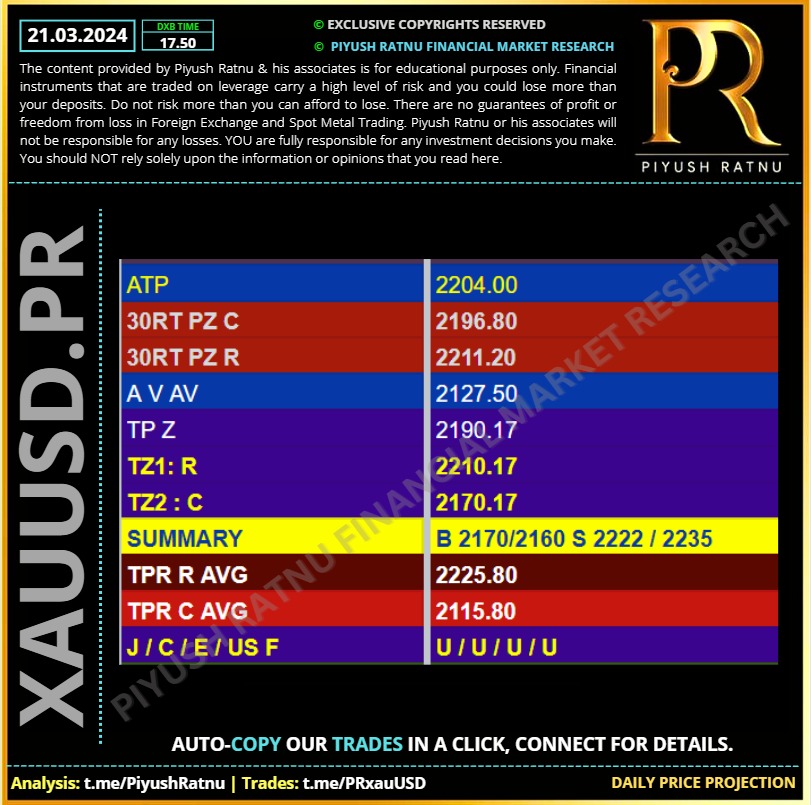

21.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

#forextrading #XAUUSD #SpotGold #PiyushRatnu #analysis #ForexTraining #forexcourse

Subscribe to our Telegram channel to receive live analysis without delay

#forextrading #XAUUSD #SpotGold #PiyushRatnu #analysis #ForexTraining #forexcourse

: