LiteFinance / Profil

The online ECN broker LiteFinance (ex. LiteForex) has been providing its clients access to Tier 1 liquidity in the currency, commodity, and stock market since 2005. All major currency pairs and cross rates, oil, precious metals, stock indexes, blue chips, and the largest set of cryptocurrency pairs can be traded at LiteFinance (ex. LiteForex).

LiteFinance

Dollar wants to smile again. Forecast as of 05.02.2021

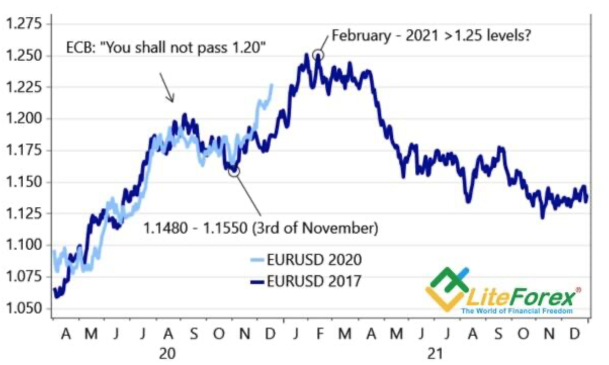

The leading vaccination rate in the USA compared to the euro area contributes to the expansion of divergence in economic growth and presses down the EURUSD. How long can this last? Let us discuss the Forex outlook and make up a trading plan.

Fundamental US dollar forecast for six months

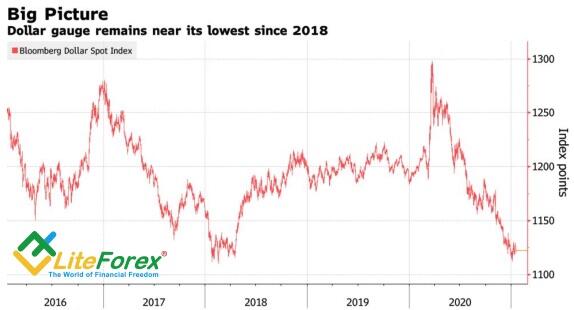

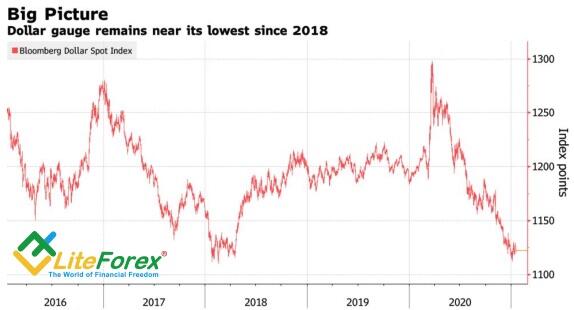

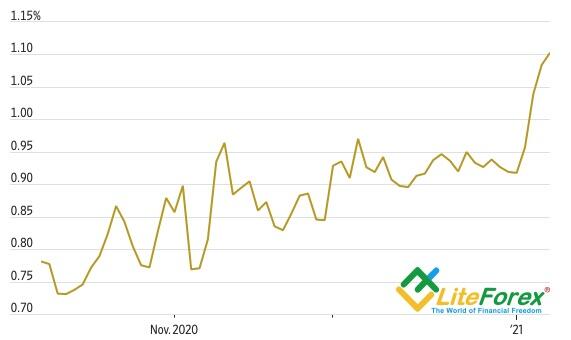

The greenback seems to be smiling… The USD index has been growing for four weeks out of five this year, featuring the best trading performance since October in the first week of February. It reminds me of the dollar smile theory. According to the theory, the USD, first, strengthens amid the concerns about the recession risks; next, the dollar weakens amid the Fed's aggressive monetary stimulus. Then, it strengthens again amid the USD GDP rate outpacing the global growth.

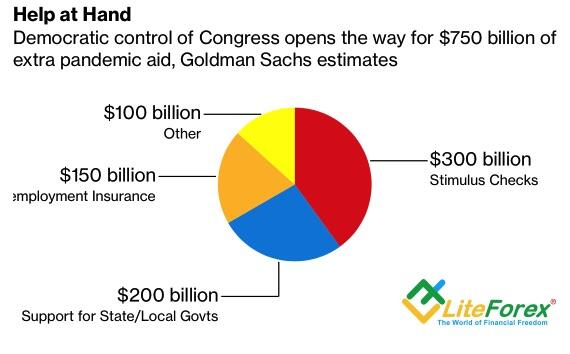

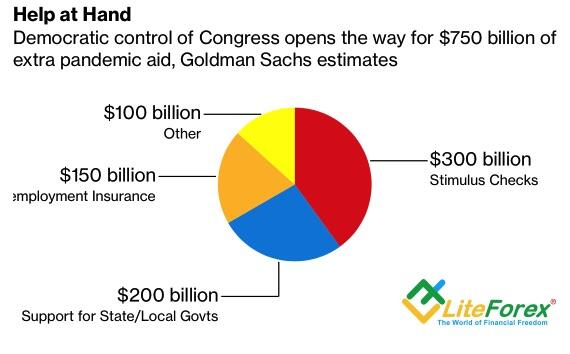

The dollar smile theory fits well with the concepts of the greenback transformation from a safe-haven asset into a risky currency and uneven economic growth. The USD is strengthening even amid the growth of the US stock indexes, which break through all-time highs. Joe Biden is ready to compromise with the Republicans and reduce the previously announced fiscal stimulus amount of $1.9 trillion, but hardly by much. Investors expect $1 trillion, and if the actual aid package is larger, the S&P 500 will continue to rally. At the same time, the inverse correlation of stock indices with the US dollar is weakening, which, amid Treasury yields growth, suggests a change in the US dollar status. Why not use yesterday's safe-haven asset as a risky currency in carry trades today?

Remarkably, Reuters experts still believe that the current USD rally is just a temporary surge. According to 63 out of 73 economists, the greenback in 3 months will remain at current levels or decrease. The consensus forecast assumes EURUSD will rise to 1.23 and 1.25 in 6 and 12 months. Many experts believe that the outperformance of the US economy will ultimately crash the dollar. The US and China will become the drivers of the global GDP growth, which will negatively affect safe-haven assets. In addition to the progress in the euro-area vaccination campaign, this will result in the EURUSD uptrend recovery. I share the same point of view.

The main risks for this scenario are in the uneven recovery of the world economy, which will allow the dollar smile theory to work out, and suggest an earlier than currently assumed Fed’s monetary normalization. If the dollar bulls use both of the greenback’s advantages, we can consider the EURUSD uptrend to be broken down.

The uneven distribution of vaccines suggests that the GDP will grow in some countries and contract in other ones. But still, I hope that the EU's efforts to accelerate the vaccination process will be successful, and the euro area, together with China and the US, will become a driver of global economic growth. The Fed should consider the US economic situation and the global growth as well before deciding to wind down the QE.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-wants-to-smile-again-forecast-as-of-05022021/?uid=285861726&cid=79634

The leading vaccination rate in the USA compared to the euro area contributes to the expansion of divergence in economic growth and presses down the EURUSD. How long can this last? Let us discuss the Forex outlook and make up a trading plan.

Fundamental US dollar forecast for six months

The greenback seems to be smiling… The USD index has been growing for four weeks out of five this year, featuring the best trading performance since October in the first week of February. It reminds me of the dollar smile theory. According to the theory, the USD, first, strengthens amid the concerns about the recession risks; next, the dollar weakens amid the Fed's aggressive monetary stimulus. Then, it strengthens again amid the USD GDP rate outpacing the global growth.

The dollar smile theory fits well with the concepts of the greenback transformation from a safe-haven asset into a risky currency and uneven economic growth. The USD is strengthening even amid the growth of the US stock indexes, which break through all-time highs. Joe Biden is ready to compromise with the Republicans and reduce the previously announced fiscal stimulus amount of $1.9 trillion, but hardly by much. Investors expect $1 trillion, and if the actual aid package is larger, the S&P 500 will continue to rally. At the same time, the inverse correlation of stock indices with the US dollar is weakening, which, amid Treasury yields growth, suggests a change in the US dollar status. Why not use yesterday's safe-haven asset as a risky currency in carry trades today?

Remarkably, Reuters experts still believe that the current USD rally is just a temporary surge. According to 63 out of 73 economists, the greenback in 3 months will remain at current levels or decrease. The consensus forecast assumes EURUSD will rise to 1.23 and 1.25 in 6 and 12 months. Many experts believe that the outperformance of the US economy will ultimately crash the dollar. The US and China will become the drivers of the global GDP growth, which will negatively affect safe-haven assets. In addition to the progress in the euro-area vaccination campaign, this will result in the EURUSD uptrend recovery. I share the same point of view.

The main risks for this scenario are in the uneven recovery of the world economy, which will allow the dollar smile theory to work out, and suggest an earlier than currently assumed Fed’s monetary normalization. If the dollar bulls use both of the greenback’s advantages, we can consider the EURUSD uptrend to be broken down.

The uneven distribution of vaccines suggests that the GDP will grow in some countries and contract in other ones. But still, I hope that the EU's efforts to accelerate the vaccination process will be successful, and the euro area, together with China and the US, will become a driver of global economic growth. The Fed should consider the US economic situation and the global growth as well before deciding to wind down the QE.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-wants-to-smile-again-forecast-as-of-05022021/?uid=285861726&cid=79634

LiteFinance

Euro suffers losses. Forecast as of 04.02.2021

The slower the vaccination campaign progresses, the more likely are the lockdowns to continue and the recession to start in the euro-area. Besides, the Eurosceptics use the authorities’ failures for their purposes, which presses down the EURUSD. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Donald Trump lost the presidential election due to the pandemic. At first, the White House did not recognize the threat and then very slowly closed the economy for a lockdown. In the first wave of COVID-19, the EU acted much more efficiently, laying the foundation for the EURUSD uptrend. However, the slow vaccination in the euro area presses down the euro bulls and the EU governments. Eurosceptics go ahead, and the rise in political risks contributes to the euro fall.

Marine Le Pen appears to be almost the only serious opponent of Emmanuel Macron in France's 2022 presidential elections. Their confrontation, which ended in the victory of the current head of state, triggered the euro rally in 2017. Nobody knows what will happen this time. Nor is there any certainty that Mario Draghi will save Italy. Yes, the ex-president of the ECB is most likely the best person for the worst job. Yes, financial markets were optimistic about his willingness to manage Italy's political crisis, which is evident from a narrower yield spread between Italian and German bonds. Still, it will be complicated for anyone to bring order to the chaos in which Rome lives today.

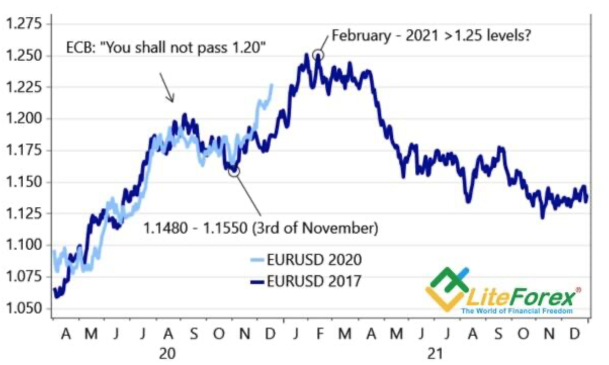

According to Bloomberg research, the euro-area economy is currently operating at 95% of its pre-pandemic capacity due to lockdowns. This is the equivalent of losing €12 billion a week. The euro area is several weeks behind the US in vaccination. The US will soon return to full-fledged work while the eurozone will maintain existing restrictions, which will cost it € 500-1000 billion within one or two months. Thus, the vaccination campaign directly impacts the economy and allows Eurosceptics to go ahead, which puts pressure on the euro. There is a clear divergence in economic growth, which is reflected in the different rates of the US and euro-area PMIs.

I don’t think that the surge of the euro-area inflation from -0.3% to 0.9% in January will be the reason for the ECB to pull back on the pandemic emergency purchase program. The rise in consumer prices resulted from temporary factors, and the Governing Council is likely to ignore it.

The US dollar is supported by the Treasury yield growth ahead of the auctions. In the week ending Feb 14, the Treasury plans to place 3-year bills, 10-year and 30-year bonds totaling $ 126 billion. The interest rates on the securities are rising, and investors remember that the growth of Treasury yields in January resulted in the greenback strengthening.

Weekly EURUSD trading plan

The current Forex sentiment makes banks abandon bullish forecasts for the euro. Nomura exits EURUSD longs, and Deutsche Bank says the pair can go down to 1.18. It is still relevant to hold down shorts entered at level 1.208 and enter short-term sell trades at least until the EURUSD goes up above the indicated level.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-suffers-losses-forecast-as-of-04022021/?uid=285861726&cid=79634

Dynamics of Italy-Germany 10 Year Bond Spread

The slower the vaccination campaign progresses, the more likely are the lockdowns to continue and the recession to start in the euro-area. Besides, the Eurosceptics use the authorities’ failures for their purposes, which presses down the EURUSD. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Donald Trump lost the presidential election due to the pandemic. At first, the White House did not recognize the threat and then very slowly closed the economy for a lockdown. In the first wave of COVID-19, the EU acted much more efficiently, laying the foundation for the EURUSD uptrend. However, the slow vaccination in the euro area presses down the euro bulls and the EU governments. Eurosceptics go ahead, and the rise in political risks contributes to the euro fall.

Marine Le Pen appears to be almost the only serious opponent of Emmanuel Macron in France's 2022 presidential elections. Their confrontation, which ended in the victory of the current head of state, triggered the euro rally in 2017. Nobody knows what will happen this time. Nor is there any certainty that Mario Draghi will save Italy. Yes, the ex-president of the ECB is most likely the best person for the worst job. Yes, financial markets were optimistic about his willingness to manage Italy's political crisis, which is evident from a narrower yield spread between Italian and German bonds. Still, it will be complicated for anyone to bring order to the chaos in which Rome lives today.

According to Bloomberg research, the euro-area economy is currently operating at 95% of its pre-pandemic capacity due to lockdowns. This is the equivalent of losing €12 billion a week. The euro area is several weeks behind the US in vaccination. The US will soon return to full-fledged work while the eurozone will maintain existing restrictions, which will cost it € 500-1000 billion within one or two months. Thus, the vaccination campaign directly impacts the economy and allows Eurosceptics to go ahead, which puts pressure on the euro. There is a clear divergence in economic growth, which is reflected in the different rates of the US and euro-area PMIs.

I don’t think that the surge of the euro-area inflation from -0.3% to 0.9% in January will be the reason for the ECB to pull back on the pandemic emergency purchase program. The rise in consumer prices resulted from temporary factors, and the Governing Council is likely to ignore it.

The US dollar is supported by the Treasury yield growth ahead of the auctions. In the week ending Feb 14, the Treasury plans to place 3-year bills, 10-year and 30-year bonds totaling $ 126 billion. The interest rates on the securities are rising, and investors remember that the growth of Treasury yields in January resulted in the greenback strengthening.

Weekly EURUSD trading plan

The current Forex sentiment makes banks abandon bullish forecasts for the euro. Nomura exits EURUSD longs, and Deutsche Bank says the pair can go down to 1.18. It is still relevant to hold down shorts entered at level 1.208 and enter short-term sell trades at least until the EURUSD goes up above the indicated level.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-suffers-losses-forecast-as-of-04022021/?uid=285861726&cid=79634

Dynamics of Italy-Germany 10 Year Bond Spread

LiteFinance

Silver will feed the wolves of Wall Street. Forecast as of 01.02.2021

The attack on silver market tests the strength of such a phenomenon as Reddit traders. If the crowd of small traders succeeds, all the professionals will have to reckon with them. What if it doesn't? Let's discuss the market outlook and make up a trading plan.

Weekly silver fundamental forecast

January from time to time brings real shocks to financial markets, which makes people forget about politics, the economy, and even about a pandemic. At the beginning of 2015, the Swiss National Bank decided to stop spending its gold and foreign exchange reserves to hold the EURCHF bears at level 1.2. After that, the pair collapsed sharply, and the franc became the Forex best performer of the year before its end. At the start of 2020, due to the flash crash, the yen strengthened sharply, rising within a few minutes against the Australian dollar by 8%. In January 2021, it's time for Reddit newbie traders.

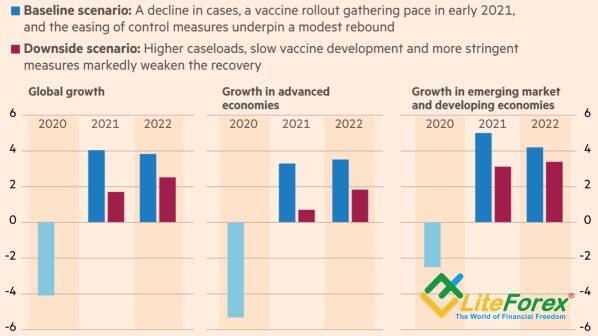

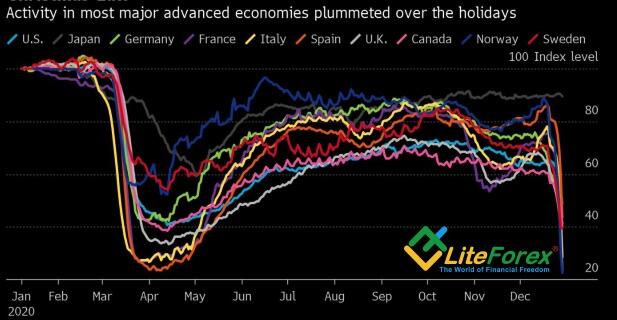

United in a crowd resembling a flock of animals, newbies brought hedge funds to their knees, pumping up GameStop prices by 1500%. After that, they began to be taken seriously. If earlier small traders had to look for large players' traces to earn money, now it is enough to enter the forum. Following the shares of the video game maker, silver came into the focus of the Reddit flock. As a result, the XAGUSD prices soared to 5-month highs, and the stocks of the largest ETF iShares Silver Trust grew by a record $944 million overnight.

The flock has far more options than any particular wolf on Wall Street. Professionals cannot agree to collude; otherwise, they will face a prison sentence. They incur more serious brokerage costs than small traders. The flock has other problems. A split may occur in its ranks at any time. Opinion leader Ken Griffin's calls to buy silver were initially met with enthusiasm, but then skeptics emerged. They noted that unlike GameStop, hedge funds had been net buyers of precious metals since mid-2019. Who are they going to fight against? Perhaps the flock leader, who has a lot of iShares Silver Trust shares in his portfolio, is merely pursuing his own goals of enrichment and will abandon the people following him at any moment?

In the case of GameStop, ordinary traders outplayed Wall Street professionals. However, the large traders can benefit from the attack on the silver market. Can a crowd of individual traders influence the precious metal market? The capitalization of the precious metal market ($48 billion) significantly exceeds the value of the shares of the manufacturer of video games when the securities began to soar in mid-January ($1.4 billion). The flock runs the risk of breaking teeth.

Weekly silver trading plan

In any case, the silver scam is a test of the durability of such a phenomenon as Reddit traders. If newbies manage to boost XAGUSD prices, regulators will have to get down to business. The market is already ceasing to fulfill some of its functions. The last thing we need is to turn the market into a distorting mirror. Failure can discourage newbies from becoming professional traders. However, a precedent has been set, and other forums or social networks may follow Reddit. In the meantime, the inability of silver to break out the resistance at $ 30.15-30.3 per ounce serves as a signal of the flock's mission's failure and the basis for sales.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/silver-will-feed-the-wolves-of-wall-street-forecast-as-of-01022021/?uid=285861726&cid=79634

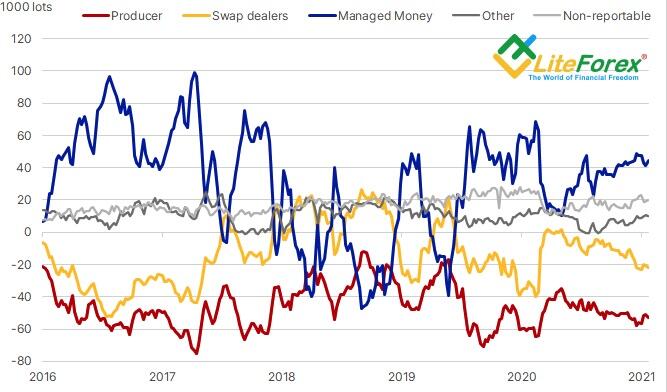

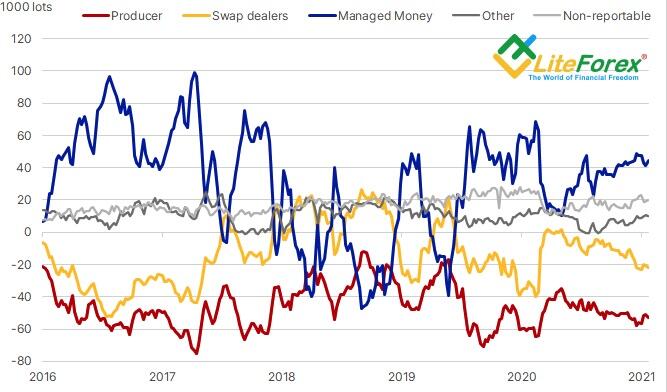

Dynamics of hedge funds positions and other silver market participants

The attack on silver market tests the strength of such a phenomenon as Reddit traders. If the crowd of small traders succeeds, all the professionals will have to reckon with them. What if it doesn't? Let's discuss the market outlook and make up a trading plan.

Weekly silver fundamental forecast

January from time to time brings real shocks to financial markets, which makes people forget about politics, the economy, and even about a pandemic. At the beginning of 2015, the Swiss National Bank decided to stop spending its gold and foreign exchange reserves to hold the EURCHF bears at level 1.2. After that, the pair collapsed sharply, and the franc became the Forex best performer of the year before its end. At the start of 2020, due to the flash crash, the yen strengthened sharply, rising within a few minutes against the Australian dollar by 8%. In January 2021, it's time for Reddit newbie traders.

United in a crowd resembling a flock of animals, newbies brought hedge funds to their knees, pumping up GameStop prices by 1500%. After that, they began to be taken seriously. If earlier small traders had to look for large players' traces to earn money, now it is enough to enter the forum. Following the shares of the video game maker, silver came into the focus of the Reddit flock. As a result, the XAGUSD prices soared to 5-month highs, and the stocks of the largest ETF iShares Silver Trust grew by a record $944 million overnight.

The flock has far more options than any particular wolf on Wall Street. Professionals cannot agree to collude; otherwise, they will face a prison sentence. They incur more serious brokerage costs than small traders. The flock has other problems. A split may occur in its ranks at any time. Opinion leader Ken Griffin's calls to buy silver were initially met with enthusiasm, but then skeptics emerged. They noted that unlike GameStop, hedge funds had been net buyers of precious metals since mid-2019. Who are they going to fight against? Perhaps the flock leader, who has a lot of iShares Silver Trust shares in his portfolio, is merely pursuing his own goals of enrichment and will abandon the people following him at any moment?

In the case of GameStop, ordinary traders outplayed Wall Street professionals. However, the large traders can benefit from the attack on the silver market. Can a crowd of individual traders influence the precious metal market? The capitalization of the precious metal market ($48 billion) significantly exceeds the value of the shares of the manufacturer of video games when the securities began to soar in mid-January ($1.4 billion). The flock runs the risk of breaking teeth.

Weekly silver trading plan

In any case, the silver scam is a test of the durability of such a phenomenon as Reddit traders. If newbies manage to boost XAGUSD prices, regulators will have to get down to business. The market is already ceasing to fulfill some of its functions. The last thing we need is to turn the market into a distorting mirror. Failure can discourage newbies from becoming professional traders. However, a precedent has been set, and other forums or social networks may follow Reddit. In the meantime, the inability of silver to break out the resistance at $ 30.15-30.3 per ounce serves as a signal of the flock's mission's failure and the basis for sales.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/silver-will-feed-the-wolves-of-wall-street-forecast-as-of-01022021/?uid=285861726&cid=79634

Dynamics of hedge funds positions and other silver market participants

LiteFinance

Euro declares war. Forecast as of 29.01.2021

The verbal interventions of the European Central Bank could enrage Washington. And the ECB needn’t have interfered with the currency rates under the current conditions. The divergences in the economic expansion and vaccination rates press down the EURUSD. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

If the ECB is willing to discourage investors by suggesting a potential interest rate cut, it should not mention the rise of Germany’s consumer prices. In January, the German inflation has surged from 0.7% to +1.6% and is likely to push the euro-area inflation up. This fact could mean that the European Central Bank will end the pandemic emergency purchase program earlier than expected, which could have supported the EURUSD bulls. However, the euro bulls haven’t enjoyed the success for a long time.

Following the president of the central bank of the Netherlands, Klaas Knot, the Governor of the Bank of Finland, Olli Rehn says the ECB will spare no effort to stimulate the inflation growth and is monitoring the euro exchange rate. According to Commerzbank, the choice of the European regulator's information campaign means that it has declared a currency war. The Governing Council’s officials' emphasis on cutting the interest rates and ordering research, whether the weakening of the US dollar is connected with a large-scale fiscal stimulus, suggests that the ECB is worried about the current euro exchange rate rather than the speed of its strengthening.

If the Commerzbank is correct, the ECB's verbal interventions should disappoint Janet Yellen, who promised to stop other countries' attempts to artificially depreciate their currencies. Besides, the inflation rebound could mess the ECB plans. The rise of Germany’s consumer prices could have resulted from temporary factors. However, according to the ING, ECB obviously underestimates the potential inflation growth following a period of persistently low inflation. The CPI increase will worsen the dispute among the Governing Council’s members, encouraging the ECB to start monetary normalization. If so, the EURUSD trend should turn up. However, the euro bulls are now concerned about defending their positions and preventing the euro from a deeper fall.

Slow vaccination progress in Europe and the fact that the USA, unlike the euro area, won’t slide into a double-dip recession press the euro exchange rate down. In fact, the ECB is going too far: verbal interventions are not needed in the current situation, they risk provoking the White House's anger.

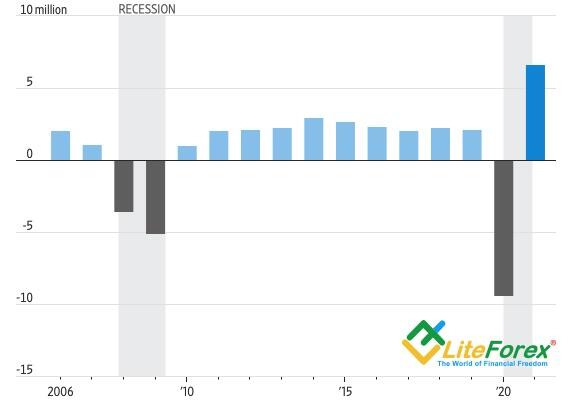

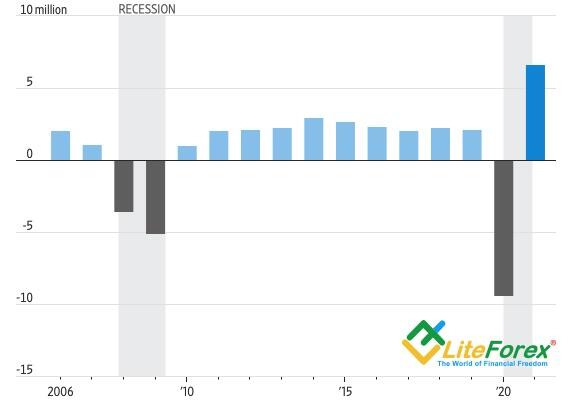

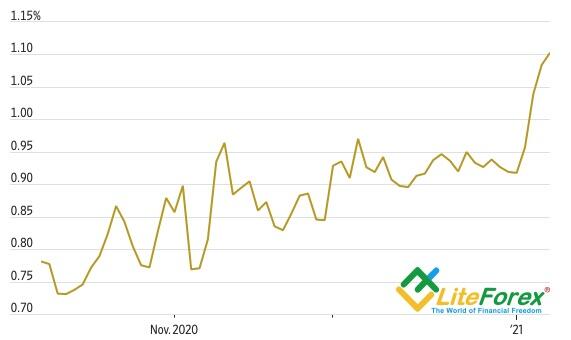

In 2020, the US economy contracted 3.5%, the worst since the end of World War II and the first recession since 2009. However, thanks to fiscal stimulus of $900 billion from Donald Trump and $1,900 billion from Joe Biden, the US GDP, following a weak start in 2021, should rapidly rebound in the next quarters. The IMF notes that the US economy has enormous growth potential, and the World Bank calls for winning the war on COVID-19 first and paying off debts later.

In contrast to the Americans, generously spending money, the € 750 billion European Recovery Fund, according to the ECB, will lead to a more than modest 1.5% expansion of the euro-area GDP.

Weekly EURUSD trading plan

Therefore, the economic growth gap and different paces of vaccinations in Europe and the USA will continue pressing down the EURUSD in the short run. If the price breaks out the support at 1.208, it could slide down towards 1.204, 1.199, and 1.195.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-declares-war-forecast-as-of-29012021/?uid=285861726&cid=79634

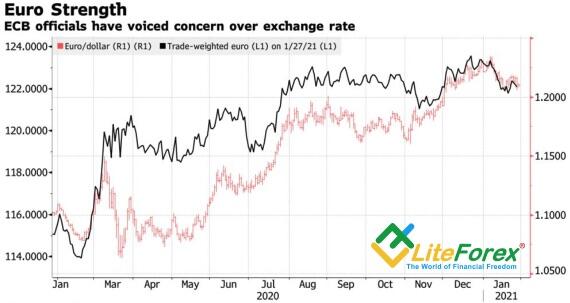

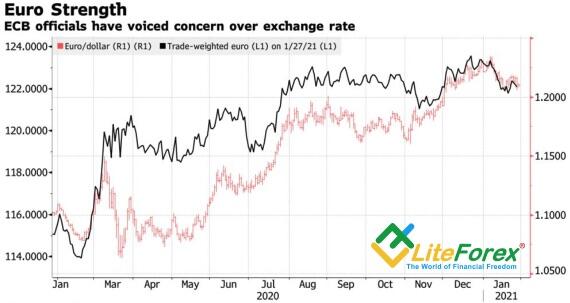

Dynamics of EURUSD and trade-weighted euro

The verbal interventions of the European Central Bank could enrage Washington. And the ECB needn’t have interfered with the currency rates under the current conditions. The divergences in the economic expansion and vaccination rates press down the EURUSD. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

If the ECB is willing to discourage investors by suggesting a potential interest rate cut, it should not mention the rise of Germany’s consumer prices. In January, the German inflation has surged from 0.7% to +1.6% and is likely to push the euro-area inflation up. This fact could mean that the European Central Bank will end the pandemic emergency purchase program earlier than expected, which could have supported the EURUSD bulls. However, the euro bulls haven’t enjoyed the success for a long time.

Following the president of the central bank of the Netherlands, Klaas Knot, the Governor of the Bank of Finland, Olli Rehn says the ECB will spare no effort to stimulate the inflation growth and is monitoring the euro exchange rate. According to Commerzbank, the choice of the European regulator's information campaign means that it has declared a currency war. The Governing Council’s officials' emphasis on cutting the interest rates and ordering research, whether the weakening of the US dollar is connected with a large-scale fiscal stimulus, suggests that the ECB is worried about the current euro exchange rate rather than the speed of its strengthening.

If the Commerzbank is correct, the ECB's verbal interventions should disappoint Janet Yellen, who promised to stop other countries' attempts to artificially depreciate their currencies. Besides, the inflation rebound could mess the ECB plans. The rise of Germany’s consumer prices could have resulted from temporary factors. However, according to the ING, ECB obviously underestimates the potential inflation growth following a period of persistently low inflation. The CPI increase will worsen the dispute among the Governing Council’s members, encouraging the ECB to start monetary normalization. If so, the EURUSD trend should turn up. However, the euro bulls are now concerned about defending their positions and preventing the euro from a deeper fall.

Slow vaccination progress in Europe and the fact that the USA, unlike the euro area, won’t slide into a double-dip recession press the euro exchange rate down. In fact, the ECB is going too far: verbal interventions are not needed in the current situation, they risk provoking the White House's anger.

In 2020, the US economy contracted 3.5%, the worst since the end of World War II and the first recession since 2009. However, thanks to fiscal stimulus of $900 billion from Donald Trump and $1,900 billion from Joe Biden, the US GDP, following a weak start in 2021, should rapidly rebound in the next quarters. The IMF notes that the US economy has enormous growth potential, and the World Bank calls for winning the war on COVID-19 first and paying off debts later.

In contrast to the Americans, generously spending money, the € 750 billion European Recovery Fund, according to the ECB, will lead to a more than modest 1.5% expansion of the euro-area GDP.

Weekly EURUSD trading plan

Therefore, the economic growth gap and different paces of vaccinations in Europe and the USA will continue pressing down the EURUSD in the short run. If the price breaks out the support at 1.208, it could slide down towards 1.204, 1.199, and 1.195.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-declares-war-forecast-as-of-29012021/?uid=285861726&cid=79634

Dynamics of EURUSD and trade-weighted euro

LiteFinance

The Fed failed mission. EURUSD forecast as of 28.01.2021

To convince investors in the continuous QE, the Fed chair should have surprised them. Let us discuss the markets’ reaction to Powell’s speech and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

The economy, like viruses, mutates. Through innovation, the global economy adjusts to new conditions. The problem is that viruses mutate faster. The emergence of new COVID-19 variants in Britain, Brazil, and South Africa has seriously scared the financial markets. Can existing vaccines handle the coronavirus variants? Will humanity need another vaccination campaign? How long will it take to develop new vaccines? In addition to the vaccine supply problems, such ideas, gloomy comments by Jerome Powell, and the ECB dovish tone dropped EURUSD below the bottom of figure 21.

The euro dropped because of the ECB officials’ speeches. The European Central Bank, which, according to Bloomberg source familiar with the matter, at the meeting on January 21, decided it was necessary to shake the markets. Investors stopped pricing the possible rate cut in the financial instruments, which supported the EURUSD bulls. Christine Lagarde and her colleagues decided to resort to verbal interventions. Klaas Knot's statement that the ECB has the opportunity to lower the deposit rate from the current -0.5% made the markets remember this scenario and triggered a wave of euro sales. The president of the central bank of the Netherlands noted the Governing Council has investigated the effective lower bound for interest rates but has not yet found it. According to a recent ECB analysis, the interest rate of -1% will do the economy more harm than good

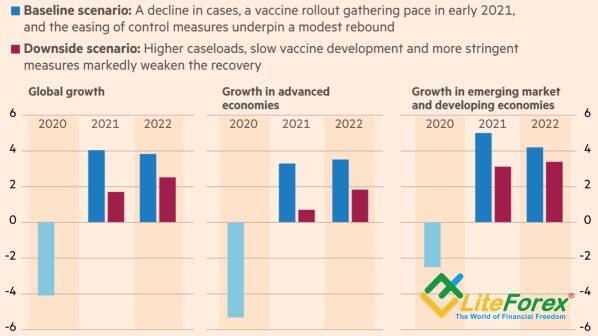

The ECB’s intention to shake financial markets is understandable. The euro-area economy has had a bad start in 2021. According to the IMF forecasts, the Eurozone's growth will recover up to the pre-crisis levels by late 2022. For comparison, the size of China's economy is already larger than in 2019, and the US growth will return to the trend in late 2021.

Unlike the European Central Bank, the Fed aimed at calming down the financial markets. After comments from individual FOMC officials, investors began to worry about a possible repeat of the 2013 taper tantrum. Has Jerome Powell reassured investors? Looking at the worst daily S&P 500 crash since October, he has failed. The Fed Chairman noted that it is too early to suggest pulling back on the QE, and the central bank will make sure to warn about slow and gradual scaling down of the asset purchases in advance. The problem is that Powell had to add a gloomy tint to the description of the US economic performance to convince investors that the central bank will not change the monetary policy for a long time. Therefore, the Fed’s post-meeting statement scared investors.

Weekly EURUSD trading plan

By and large, three divergences are supporting the EURUSD bears. They are the divergence in monetary policies (the Fed remains passive, the ECB talks about cutting rates), economic growth rates, and vaccination speed. Therefore, I expect the pair to continue correction down towards 1.204, 1.199 and 1.195. A reason to enter short-term sell trades will be a successful test of the support at 1.208.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/the-fed-failed-mission-eurusd-forecast-as-of-28012021/?uid=285861726&cid=79634

Dynamics of the market expectations for the ECB rate changes

To convince investors in the continuous QE, the Fed chair should have surprised them. Let us discuss the markets’ reaction to Powell’s speech and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

The economy, like viruses, mutates. Through innovation, the global economy adjusts to new conditions. The problem is that viruses mutate faster. The emergence of new COVID-19 variants in Britain, Brazil, and South Africa has seriously scared the financial markets. Can existing vaccines handle the coronavirus variants? Will humanity need another vaccination campaign? How long will it take to develop new vaccines? In addition to the vaccine supply problems, such ideas, gloomy comments by Jerome Powell, and the ECB dovish tone dropped EURUSD below the bottom of figure 21.

The euro dropped because of the ECB officials’ speeches. The European Central Bank, which, according to Bloomberg source familiar with the matter, at the meeting on January 21, decided it was necessary to shake the markets. Investors stopped pricing the possible rate cut in the financial instruments, which supported the EURUSD bulls. Christine Lagarde and her colleagues decided to resort to verbal interventions. Klaas Knot's statement that the ECB has the opportunity to lower the deposit rate from the current -0.5% made the markets remember this scenario and triggered a wave of euro sales. The president of the central bank of the Netherlands noted the Governing Council has investigated the effective lower bound for interest rates but has not yet found it. According to a recent ECB analysis, the interest rate of -1% will do the economy more harm than good

The ECB’s intention to shake financial markets is understandable. The euro-area economy has had a bad start in 2021. According to the IMF forecasts, the Eurozone's growth will recover up to the pre-crisis levels by late 2022. For comparison, the size of China's economy is already larger than in 2019, and the US growth will return to the trend in late 2021.

Unlike the European Central Bank, the Fed aimed at calming down the financial markets. After comments from individual FOMC officials, investors began to worry about a possible repeat of the 2013 taper tantrum. Has Jerome Powell reassured investors? Looking at the worst daily S&P 500 crash since October, he has failed. The Fed Chairman noted that it is too early to suggest pulling back on the QE, and the central bank will make sure to warn about slow and gradual scaling down of the asset purchases in advance. The problem is that Powell had to add a gloomy tint to the description of the US economic performance to convince investors that the central bank will not change the monetary policy for a long time. Therefore, the Fed’s post-meeting statement scared investors.

Weekly EURUSD trading plan

By and large, three divergences are supporting the EURUSD bears. They are the divergence in monetary policies (the Fed remains passive, the ECB talks about cutting rates), economic growth rates, and vaccination speed. Therefore, I expect the pair to continue correction down towards 1.204, 1.199 and 1.195. A reason to enter short-term sell trades will be a successful test of the support at 1.208.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/the-fed-failed-mission-eurusd-forecast-as-of-28012021/?uid=285861726&cid=79634

Dynamics of the market expectations for the ECB rate changes

LiteFinance

Dollar will spoil the party. Forecast for 27.01.2021

The FOMC's first meeting in 2021 is an important event for financial markets. However, the Fed’s meeting will hardly change investors’ sentiment. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Fundamental US dollar forecast for today

Jerome Powell is trying to convince the financial markets that the Fed will not take away the punch bowl just when the party gets going. However, different vaccination paces and the growth-gap between the US and euro-area economies suggest that the EURUSD bulls should not expect the euro rally to be as fast as it was in November-December. The IMF expects the US and China’s economies to exceed the forecasts made for 2022 before the pandemic by 1.5% by the end of next year. Some European economies will only be able to recover to pre-crisis levels in 2023.

In 1955, William McChesney Martin, then chairman of the US Federal Reserve, noted that the central bank’s attempt to raise interest rates too early to slow down inflation looks like taking away the punch bowl just when the party gets going. Jerome Powell does not want to repeat the mistakes of the former Fed’s chairs. For example, Ben Bernanke crashed financial markets in 2013, saying that it was the right time to start tapering the bond purchases. In early January, several FOMC officials talked about pulling back on the asset purchase program, which supported the US dollar. Powell aims now to dissuade investors from this idea.

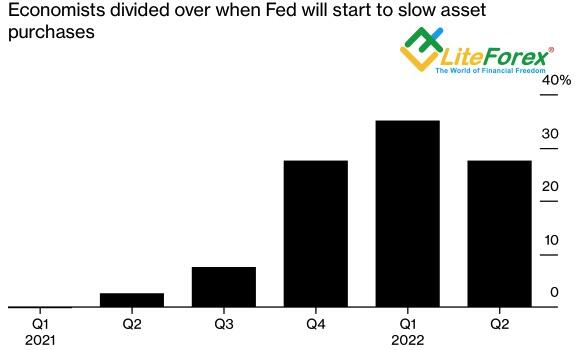

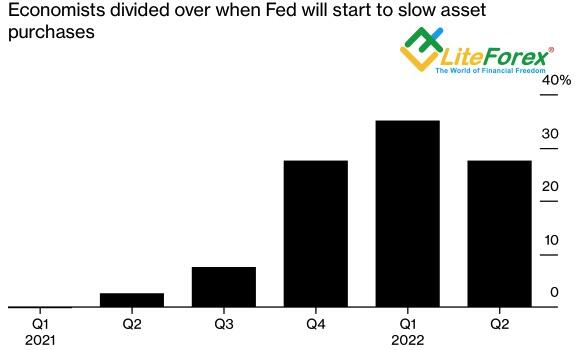

However, 37% of Bloomberg experts believe that the Fed should start winding down the QE as early as 2021. Such expectations are one of the key drivers of the greenback strengthening.

Furthermore, the US dollar has more benefits. They are a potential escalation of the US-China trade battle, divergence in the paces of vaccination and economic recovery in the US and the euro area. Although the upward revising of the forecasts for the global GDP in 2020 from -4.4% to -3.5% and in 2021 from +5.2% to 5.5% by the IMF is good news for the EURUSD bulls, it is necessary to understand what will drive the global economy. The leaders should be the USA and China, while the euro-area economies should be lagging behind.

I do not believe the above factors are the ultimate benefits for the greenback. The US dollar should benefit from the US-China battle escalation, but the greenback could weaken if the global GDP rebounds because of its safe-haven status. Such a scenario is more likely to work out in the medium term. In the short run, the EURUSD trend depends on the vaccination speed.

With this regard, the situation suggests the euro should be corrected down. Pfizer said it is ready to ship 200 million doses to the US by the end of May, two months earlier than initially estimated. On the contrary, the vaccine's provision to the European Union is being delayed due to problems with the manufacturer's plant in Belgium. AstraZeneca said it would ship substantially fewer doses to Europe than it had promised.

EURUSD trading plan for today

I believe Jerome Powell’s dovish stance could push the EURUSD up above the bottom of figure 22. However, investors should soon realize that there won’t be such a rally as it was in November-December and start selling the euro. It will be relevant to enter short-term sell trades if the price fails to test the resistances at 1.221 and 1.2245.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-will-spoil-the-party-forecast-for-27012021/?uid=285861726&cid=79634

Forecasts for the time of US QE slowing

The FOMC's first meeting in 2021 is an important event for financial markets. However, the Fed’s meeting will hardly change investors’ sentiment. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Fundamental US dollar forecast for today

Jerome Powell is trying to convince the financial markets that the Fed will not take away the punch bowl just when the party gets going. However, different vaccination paces and the growth-gap between the US and euro-area economies suggest that the EURUSD bulls should not expect the euro rally to be as fast as it was in November-December. The IMF expects the US and China’s economies to exceed the forecasts made for 2022 before the pandemic by 1.5% by the end of next year. Some European economies will only be able to recover to pre-crisis levels in 2023.

In 1955, William McChesney Martin, then chairman of the US Federal Reserve, noted that the central bank’s attempt to raise interest rates too early to slow down inflation looks like taking away the punch bowl just when the party gets going. Jerome Powell does not want to repeat the mistakes of the former Fed’s chairs. For example, Ben Bernanke crashed financial markets in 2013, saying that it was the right time to start tapering the bond purchases. In early January, several FOMC officials talked about pulling back on the asset purchase program, which supported the US dollar. Powell aims now to dissuade investors from this idea.

However, 37% of Bloomberg experts believe that the Fed should start winding down the QE as early as 2021. Such expectations are one of the key drivers of the greenback strengthening.

Furthermore, the US dollar has more benefits. They are a potential escalation of the US-China trade battle, divergence in the paces of vaccination and economic recovery in the US and the euro area. Although the upward revising of the forecasts for the global GDP in 2020 from -4.4% to -3.5% and in 2021 from +5.2% to 5.5% by the IMF is good news for the EURUSD bulls, it is necessary to understand what will drive the global economy. The leaders should be the USA and China, while the euro-area economies should be lagging behind.

I do not believe the above factors are the ultimate benefits for the greenback. The US dollar should benefit from the US-China battle escalation, but the greenback could weaken if the global GDP rebounds because of its safe-haven status. Such a scenario is more likely to work out in the medium term. In the short run, the EURUSD trend depends on the vaccination speed.

With this regard, the situation suggests the euro should be corrected down. Pfizer said it is ready to ship 200 million doses to the US by the end of May, two months earlier than initially estimated. On the contrary, the vaccine's provision to the European Union is being delayed due to problems with the manufacturer's plant in Belgium. AstraZeneca said it would ship substantially fewer doses to Europe than it had promised.

EURUSD trading plan for today

I believe Jerome Powell’s dovish stance could push the EURUSD up above the bottom of figure 22. However, investors should soon realize that there won’t be such a rally as it was in November-December and start selling the euro. It will be relevant to enter short-term sell trades if the price fails to test the resistances at 1.221 and 1.2245.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-will-spoil-the-party-forecast-for-27012021/?uid=285861726&cid=79634

Forecasts for the time of US QE slowing

LiteFinance

Pound: The vaccine changes rules of game. Forecast as of 26.01.2021

Investors prefer to buy those countries' currencies that are actively fighting COVID-19, including with the help of vaccines. Let's discuss how the vaccination campaign's speed will affect the EURGBP and GBPUSD prices and make up a trading plan.

Monthly pound fundamental forecast

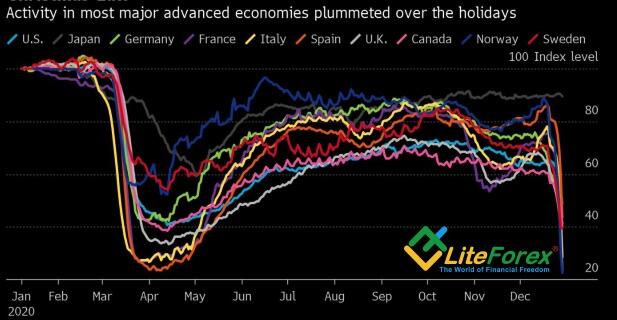

Traders love divergences. In technical analysis, the price chart's divergence with the MACD indicator is used in the well-known Elder Triple Screen Trading System. In fundamental research, divergences in central banks’ monetary policies and economic growth rates have served their fans for decades. Due to the pandemic, new strategies are emerging in the Forex market, and trading divergence in vaccination rates is gaining popularity.

Britain is considered to be one of the most COVID-19 affected countries. Due to the impressive share of the service sector as a whole (over 80%) and such spheres as recreation, culture, restaurants, and hotels (13%), in particular, in the UK's GDP, the UK economy faced the most destructive recession in the last three centuries. As a result, the country slipped into the last place among the G7 countries. It is all the more surprising to see the GBPUSD prices near the highs since April 2018 and the EURGBP prices near the 10-month bottom.

The vaccine changes the rules of the game. The currencies of the most COVID-19 affected countries that have a clear plan for overcoming the crisis are beginning to enjoy increased demand, and sterling has something to offer investors in this regard. At the end of January, 10% of Britain's population was inoculated which is five times more than in the European Union. Divergence in vaccination rates supports the EURGBP bears.

The EU is facing difficulties such as a delay in the supply of the AstraZeneca vaccine and Pfizer/BioNTech's intention to reduce its product offer outside the US. As a result, the vaccination campaign slows down, and the euro suffers. The surges of EURGBP are associated with weak statistics on retail sales, purchasing managers' index, and UK employment. The British economy is depressed, but this is a well-known fact. To predict exchange rates, you need to be able to predict the future. The belief that most of the UK population will receive the vaccine by summer allows Aberdeen Standard Investments to expect that the pound will rise by 20% against the euro.

I also believe that the primary beneficiaries of the victory over the pandemic will be the currencies of those countries that will eradicate COVID-19 first. Sterling will benefit from the booming economy following its release from the lockdown. Due to fiscal stimulus, the UK personal savings rate is near historic highs, and once people start spending that money, GDP will show strong growth.

As for the GBPUSD, despite the potential development of the correction in the short term, the growth of inflationary expectations in the US, measured by the break-even level, will push the USD index down.

EURGBP and GBPUSD trading plan for a month

In my opinion, after the release of disappointing data on the British economy, EURGBP price growth should be used for selling in the direction of 0.88, and rebounds from supports at 1.3565, 1.352, 1.349 for buying GBPUSD.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/pound-the-vaccine-changes-rules-of-game-forecast-as-of-26012021/?uid=285861726&cid=79634

Dynamics of EURGBP and vaccination rate

Investors prefer to buy those countries' currencies that are actively fighting COVID-19, including with the help of vaccines. Let's discuss how the vaccination campaign's speed will affect the EURGBP and GBPUSD prices and make up a trading plan.

Monthly pound fundamental forecast

Traders love divergences. In technical analysis, the price chart's divergence with the MACD indicator is used in the well-known Elder Triple Screen Trading System. In fundamental research, divergences in central banks’ monetary policies and economic growth rates have served their fans for decades. Due to the pandemic, new strategies are emerging in the Forex market, and trading divergence in vaccination rates is gaining popularity.

Britain is considered to be one of the most COVID-19 affected countries. Due to the impressive share of the service sector as a whole (over 80%) and such spheres as recreation, culture, restaurants, and hotels (13%), in particular, in the UK's GDP, the UK economy faced the most destructive recession in the last three centuries. As a result, the country slipped into the last place among the G7 countries. It is all the more surprising to see the GBPUSD prices near the highs since April 2018 and the EURGBP prices near the 10-month bottom.

The vaccine changes the rules of the game. The currencies of the most COVID-19 affected countries that have a clear plan for overcoming the crisis are beginning to enjoy increased demand, and sterling has something to offer investors in this regard. At the end of January, 10% of Britain's population was inoculated which is five times more than in the European Union. Divergence in vaccination rates supports the EURGBP bears.

The EU is facing difficulties such as a delay in the supply of the AstraZeneca vaccine and Pfizer/BioNTech's intention to reduce its product offer outside the US. As a result, the vaccination campaign slows down, and the euro suffers. The surges of EURGBP are associated with weak statistics on retail sales, purchasing managers' index, and UK employment. The British economy is depressed, but this is a well-known fact. To predict exchange rates, you need to be able to predict the future. The belief that most of the UK population will receive the vaccine by summer allows Aberdeen Standard Investments to expect that the pound will rise by 20% against the euro.

I also believe that the primary beneficiaries of the victory over the pandemic will be the currencies of those countries that will eradicate COVID-19 first. Sterling will benefit from the booming economy following its release from the lockdown. Due to fiscal stimulus, the UK personal savings rate is near historic highs, and once people start spending that money, GDP will show strong growth.

As for the GBPUSD, despite the potential development of the correction in the short term, the growth of inflationary expectations in the US, measured by the break-even level, will push the USD index down.

EURGBP and GBPUSD trading plan for a month

In my opinion, after the release of disappointing data on the British economy, EURGBP price growth should be used for selling in the direction of 0.88, and rebounds from supports at 1.3565, 1.352, 1.349 for buying GBPUSD.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/pound-the-vaccine-changes-rules-of-game-forecast-as-of-26012021/?uid=285861726&cid=79634

Dynamics of EURGBP and vaccination rate

LiteFinance

Euro has a compass. Forecast as of 22.01.2021

If you do not want to lose being in a losing position, you should create confusion. It is difficult to discourage investors who are willing to buy the EURUSD. The best way to press down the euro is to address uncertainty. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Christine Lagarde failed to drop the euro, but she didn’t let the single European currency grow, which could be recognized as the ECB success under the current conditions. Although the Governing Council admitted that concerns about the rapid strengthening of the euro have eased, and the euro-area bond yields increased, the EURUSD bulls failed to draw the price above figure 22 bottom. The reason is the confusion created by Lagarde.

What is good, what is bad. At a press conference shortly after the policy announcement, Lagarde spoke about both positive and negative aspects of the development of the world and European economies. As positive sides, Lagarde enumerated the beginning of vaccination, the Brexit deal, the European Rescue Fund, a decrease in political uncertainty in the United States, and the success of the euro-area manufacturing. The negative points are the pandemic and lockdowns in the euro-area countries, the likely double-dip recession, and stubbornly low inflation.

The Governing Council stands ready to adjust the pandemic asset purchase program but doesn’t say how exactly. Most of the uncertainty must result from Christine Lagarde's announcement that PEPP will be scaled up or down based on market data, including terms and conditions of bank lending and sovereign and corporate bond rates. It would seem that the ECB suggests yield targeting following the example of the central banks of Japan and Australia. Still, unlike them, the ECB uses not one but several criteria. The central bank doesn’t explain how exactly it should adjust its asset purchases. The market is confused, which is traditionally supports safe-haven assets. That is why the EURUSD could not rise high.

Christine Lagarde noted that financial conditions are the compass, and inflation is the anchor. At the same time, the fact that the ECB asset purchases under the PEPP are scaling down supports the euro.

ECB has given way to the Fed, whose meeting will highlight the last week of January. The Federal Reserve must be satisfied with the increase of inflation expectations suggested by different market indicators, including bond breakeven inflation rates, interest rate swaps, and hedging costs. But isn’t it an illusion? According to the Baupost Group, the US central bank and government have convinced investors that the risk has simply disappeared. As a result, the market cannot fulfill its function of determining prices.

In fact, the growth of the US stock indexes during the COVID-19 pandemic and GDP downturn is not natural. The higher the S&P 500 grow, the more likely the correction is to start. If the US equities go down, the euro will be pressed down.

Weekly EURUSD trading plan

If the euro-area PMI data are strong in January, it will signal that the euro-area economy has adopted to the pandemic. In this case, the EURUSD could rise above 1.22. Hold up the longs entered at 1.208 and 1.2125, but prepare for the violent price swings. As I noted earlier, the euro rally won’t be easy.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-has-a-compass-forecast-as-of-22012021/?uid=285861726&cid=79634

Dynamics of ECB asset purchases

If you do not want to lose being in a losing position, you should create confusion. It is difficult to discourage investors who are willing to buy the EURUSD. The best way to press down the euro is to address uncertainty. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Christine Lagarde failed to drop the euro, but she didn’t let the single European currency grow, which could be recognized as the ECB success under the current conditions. Although the Governing Council admitted that concerns about the rapid strengthening of the euro have eased, and the euro-area bond yields increased, the EURUSD bulls failed to draw the price above figure 22 bottom. The reason is the confusion created by Lagarde.

What is good, what is bad. At a press conference shortly after the policy announcement, Lagarde spoke about both positive and negative aspects of the development of the world and European economies. As positive sides, Lagarde enumerated the beginning of vaccination, the Brexit deal, the European Rescue Fund, a decrease in political uncertainty in the United States, and the success of the euro-area manufacturing. The negative points are the pandemic and lockdowns in the euro-area countries, the likely double-dip recession, and stubbornly low inflation.

The Governing Council stands ready to adjust the pandemic asset purchase program but doesn’t say how exactly. Most of the uncertainty must result from Christine Lagarde's announcement that PEPP will be scaled up or down based on market data, including terms and conditions of bank lending and sovereign and corporate bond rates. It would seem that the ECB suggests yield targeting following the example of the central banks of Japan and Australia. Still, unlike them, the ECB uses not one but several criteria. The central bank doesn’t explain how exactly it should adjust its asset purchases. The market is confused, which is traditionally supports safe-haven assets. That is why the EURUSD could not rise high.

Christine Lagarde noted that financial conditions are the compass, and inflation is the anchor. At the same time, the fact that the ECB asset purchases under the PEPP are scaling down supports the euro.

ECB has given way to the Fed, whose meeting will highlight the last week of January. The Federal Reserve must be satisfied with the increase of inflation expectations suggested by different market indicators, including bond breakeven inflation rates, interest rate swaps, and hedging costs. But isn’t it an illusion? According to the Baupost Group, the US central bank and government have convinced investors that the risk has simply disappeared. As a result, the market cannot fulfill its function of determining prices.

In fact, the growth of the US stock indexes during the COVID-19 pandemic and GDP downturn is not natural. The higher the S&P 500 grow, the more likely the correction is to start. If the US equities go down, the euro will be pressed down.

Weekly EURUSD trading plan

If the euro-area PMI data are strong in January, it will signal that the euro-area economy has adopted to the pandemic. In this case, the EURUSD could rise above 1.22. Hold up the longs entered at 1.208 and 1.2125, but prepare for the violent price swings. As I noted earlier, the euro rally won’t be easy.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-has-a-compass-forecast-as-of-22012021/?uid=285861726&cid=79634

Dynamics of ECB asset purchases

LiteFinance

Euro reads between the lines. Forecast for 21.01.2021

Investors do not expect anything new from the European Central Bank. This fact, as well as the return of the dollar bears and pleasant surprises from the euro-area economy, could encourage the EURUSD bulls to go ahead. Let us discuss the Forex outlook and make up a trading plan.

Fundamental Euro forecast today

People, who can earn money, can read between the lines. The US new administration and Joe Biden may suggest an unwillingness to weaken the dollar. However, the very fact of Janet Yellen's appointment to theTreasury Secretary gives the green light to the greenback sellers. At the press conference following the ECB's January meeting, Christine Lagarde may repeat the mantra that the central bank is closely monitoring the euro exchange rate. However, the repetition of the previous wording will most likely contribute to the EURUSD growth. It is simply because the ECB, after the pair’s correction, has fewer reasons to worry about the euro’s appreciation than in December.

The S&P 500 bulls correctly interpreted Joe Biden’s call for national unity. The new US president is preparing Congress to adopt the new $1.9 trillion fiscal stimulus package. In addition to the positive corporative reporting, this fact allowed the US stock index to hit a new all-time high. According to FactSet, as of January 20, actual earnings data were better than expected by 88% of companies reporting. Besides, investors believe in the rebound of the US economy in the second quarter, so the US stock market's bullish sentiment is natural.

History knows only a few examples of the S&P 500 fall during economic booms. In 1946, after a short downturn, investors feared that the economy would repeat the recession of the 1930s and sold stocks. In 1980, during a short-term recovery in the double-dip recession, the stock index fell as the Fed tried to mitigate excessive inflation growth. A drop in the S&P 500 during a time of GDP growth is rare. So, investors naturally stick to a strategy of buying the stocks on the corrections and selling the dollar on the price rise. The EURUSD current correction seems to be just the rebalancing of the large investors’ positions.

The ECB passive attitude will support the recovery of the euro uptrend. Investors don’t expect anything new from the central bank, so they should focus on Christine Lagarde’s press conference. Not long ago, the ECB president supported the central bank’s forecast for a 3.9% growth of the euro-area GDP in 2021 following a decline by 7.3%. She said that it is too early to discuss the ECB monetary policy tightening, and the ECB is monitoring the euro’s exchange rate. She is likely to repeat the same on January 21. The Central Bank has nothing to surprise investors, and the fact that the EURUSD correction reduces the need for verbal intervention, on the contrary, may strengthen the euro.

EURUSD trading plan for today

I do not think the ECB will expand the QE. The euro-area economy adjusts to the pandemic and improves its performance. The US dollar bears go ahead, and the EURUSD bulls could be only discouraged by slow vaccination. The EU, where 1.4% of the population have been inoculated, is behind the UK (7.1%) and USA (5%). However, the progress in the vaccination campaign supports the euro. If the euro breaks out the resistance at $1.215, it can be the reason to buy.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-reads-between-the-lines-forecast-for-21012021/?uid=285861726&cid=79634

Dynamics of USD index

Investors do not expect anything new from the European Central Bank. This fact, as well as the return of the dollar bears and pleasant surprises from the euro-area economy, could encourage the EURUSD bulls to go ahead. Let us discuss the Forex outlook and make up a trading plan.

Fundamental Euro forecast today

People, who can earn money, can read between the lines. The US new administration and Joe Biden may suggest an unwillingness to weaken the dollar. However, the very fact of Janet Yellen's appointment to theTreasury Secretary gives the green light to the greenback sellers. At the press conference following the ECB's January meeting, Christine Lagarde may repeat the mantra that the central bank is closely monitoring the euro exchange rate. However, the repetition of the previous wording will most likely contribute to the EURUSD growth. It is simply because the ECB, after the pair’s correction, has fewer reasons to worry about the euro’s appreciation than in December.

The S&P 500 bulls correctly interpreted Joe Biden’s call for national unity. The new US president is preparing Congress to adopt the new $1.9 trillion fiscal stimulus package. In addition to the positive corporative reporting, this fact allowed the US stock index to hit a new all-time high. According to FactSet, as of January 20, actual earnings data were better than expected by 88% of companies reporting. Besides, investors believe in the rebound of the US economy in the second quarter, so the US stock market's bullish sentiment is natural.

History knows only a few examples of the S&P 500 fall during economic booms. In 1946, after a short downturn, investors feared that the economy would repeat the recession of the 1930s and sold stocks. In 1980, during a short-term recovery in the double-dip recession, the stock index fell as the Fed tried to mitigate excessive inflation growth. A drop in the S&P 500 during a time of GDP growth is rare. So, investors naturally stick to a strategy of buying the stocks on the corrections and selling the dollar on the price rise. The EURUSD current correction seems to be just the rebalancing of the large investors’ positions.

The ECB passive attitude will support the recovery of the euro uptrend. Investors don’t expect anything new from the central bank, so they should focus on Christine Lagarde’s press conference. Not long ago, the ECB president supported the central bank’s forecast for a 3.9% growth of the euro-area GDP in 2021 following a decline by 7.3%. She said that it is too early to discuss the ECB monetary policy tightening, and the ECB is monitoring the euro’s exchange rate. She is likely to repeat the same on January 21. The Central Bank has nothing to surprise investors, and the fact that the EURUSD correction reduces the need for verbal intervention, on the contrary, may strengthen the euro.

EURUSD trading plan for today

I do not think the ECB will expand the QE. The euro-area economy adjusts to the pandemic and improves its performance. The US dollar bears go ahead, and the EURUSD bulls could be only discouraged by slow vaccination. The EU, where 1.4% of the population have been inoculated, is behind the UK (7.1%) and USA (5%). However, the progress in the vaccination campaign supports the euro. If the euro breaks out the resistance at $1.215, it can be the reason to buy.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-reads-between-the-lines-forecast-for-21012021/?uid=285861726&cid=79634

Dynamics of USD index

LiteFinance

Dollar listens to a teacher. Forecast as of 20.01.2021

Yellen’s speech in the US Congress met investors' expectations. Stock bulls hope for an additional fiscal stimulus, and dollar bears believe the Treasury will not interfere. Where will the EURUSD go? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Monthly US dollar fundamental forecast

When the verdict is not as strict as expected, you feel relief. Markets expected Janet Yellen to voice her adherence to a strong dollar policy. However, Yellen says the US doesn’t seek a weaker dollar to gain a competitive advantage. The EURUSD bears are discouraged as the Treasury secretary nominee says the Treasury should oppose attempts by other countries to manipulate currency values artificially. Will the ECB resort to verbal interventions after that?

Markets must have missed the rural teacher. This is how investors once called Janet Yellen for her ability to sort things out. Yellen satisfied the market with her speech in Congress. US stocks bulls hope for an additional fiscal stimulus of $1.9 trillion; US dollar bears believe that the Treasury won’t oppose the dollar weakening, suggesting the value of the US dollar should be determined by markets. At the same time, Yellen expressed her opposition to the euro weakening.

If the European Central Bank wants to press the EURUSD down, it should outplay the Fed. Yes, Christine Lagarde and her fellow central bankers were aggressive during the recession, but they were hardly more aggressive than the Fed. The Governing Council can’t affect foreign exchange rates now. The QE expansion won’t accelerate inflation and will face serious opposition from the hawks. The transition to a yield targeting policy will strengthen the euro by reducing the volume of asset purchases. By the way, according to the Bloomberg source familiar with the matter, the ECB is already doing something similar, narrowing the yield spreads between the euro-area government bonds. Christine Lagarde will not dare to speak about it aloud. There are the Japanese and Australian experiences with the subsequent growth of the yen and "Aussie" rates.

As long as most investors expect the dollar to weaken, the ECB's failure to cut European bond yields suggests the euro should be growing in value. There is another problem. The EURUSD bulls bet on entirely different conditions.

Remember, the bullish euro projections for 2021 were based on the expected victory over the pandemic, exit from the lockdowns, and a rapid rebound of the euro-area economy. However, the vaccination progresses extremely slowly in Europe. About 4% of people received the vaccination in the US, while about 1% of people were inoculated in Germany.

Monthly EURUSD trading plan

The lockdown in the euro area could last longer than expected. If so, the euro-area GDP recovery won’t be that fast, and the EURUSD won’t reach level 1.25 soon. Of course, the rally might continue amid the euphoria about the pair consolidation above 1.208, followed by a successful test of the resistance at 1.215. However, I believe the euro-dollar should enter a short-term consolidation range of 1.208-1.238. If the bulls fail to break out the resistance at 1.215, the consolidation range will move lower.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-listens-to-a-teacher-forecast-as-of-20012021/?uid=285861726&cid=79634

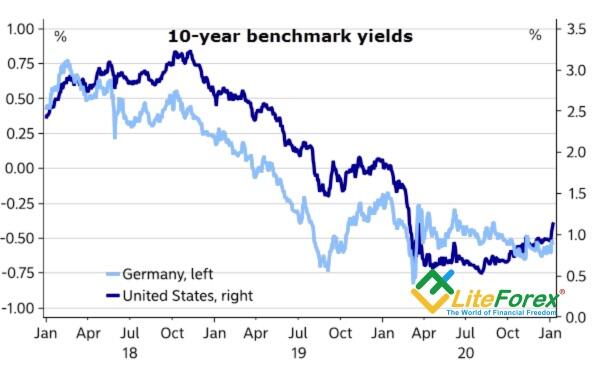

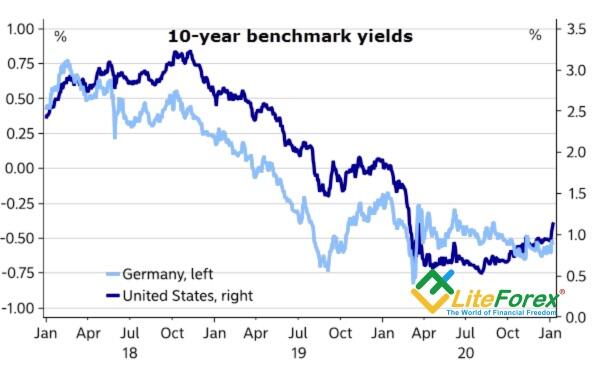

Dynamics of bond yields and spread between euro-area bond yields

Yellen’s speech in the US Congress met investors' expectations. Stock bulls hope for an additional fiscal stimulus, and dollar bears believe the Treasury will not interfere. Where will the EURUSD go? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Monthly US dollar fundamental forecast

When the verdict is not as strict as expected, you feel relief. Markets expected Janet Yellen to voice her adherence to a strong dollar policy. However, Yellen says the US doesn’t seek a weaker dollar to gain a competitive advantage. The EURUSD bears are discouraged as the Treasury secretary nominee says the Treasury should oppose attempts by other countries to manipulate currency values artificially. Will the ECB resort to verbal interventions after that?

Markets must have missed the rural teacher. This is how investors once called Janet Yellen for her ability to sort things out. Yellen satisfied the market with her speech in Congress. US stocks bulls hope for an additional fiscal stimulus of $1.9 trillion; US dollar bears believe that the Treasury won’t oppose the dollar weakening, suggesting the value of the US dollar should be determined by markets. At the same time, Yellen expressed her opposition to the euro weakening.

If the European Central Bank wants to press the EURUSD down, it should outplay the Fed. Yes, Christine Lagarde and her fellow central bankers were aggressive during the recession, but they were hardly more aggressive than the Fed. The Governing Council can’t affect foreign exchange rates now. The QE expansion won’t accelerate inflation and will face serious opposition from the hawks. The transition to a yield targeting policy will strengthen the euro by reducing the volume of asset purchases. By the way, according to the Bloomberg source familiar with the matter, the ECB is already doing something similar, narrowing the yield spreads between the euro-area government bonds. Christine Lagarde will not dare to speak about it aloud. There are the Japanese and Australian experiences with the subsequent growth of the yen and "Aussie" rates.

As long as most investors expect the dollar to weaken, the ECB's failure to cut European bond yields suggests the euro should be growing in value. There is another problem. The EURUSD bulls bet on entirely different conditions.

Remember, the bullish euro projections for 2021 were based on the expected victory over the pandemic, exit from the lockdowns, and a rapid rebound of the euro-area economy. However, the vaccination progresses extremely slowly in Europe. About 4% of people received the vaccination in the US, while about 1% of people were inoculated in Germany.

Monthly EURUSD trading plan

The lockdown in the euro area could last longer than expected. If so, the euro-area GDP recovery won’t be that fast, and the EURUSD won’t reach level 1.25 soon. Of course, the rally might continue amid the euphoria about the pair consolidation above 1.208, followed by a successful test of the resistance at 1.215. However, I believe the euro-dollar should enter a short-term consolidation range of 1.208-1.238. If the bulls fail to break out the resistance at 1.215, the consolidation range will move lower.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-listens-to-a-teacher-forecast-as-of-20012021/?uid=285861726&cid=79634

Dynamics of bond yields and spread between euro-area bond yields

LiteFinance

Cunning Aussie. Forecast as of 19.01.2021

By 2028, the American economy will be bypassed by China. This fact and the PRC's insatiable demand for iron ore will favor the AUUSD bulls for many years to come. Let us discuss the Forex outlook and make up a trading plan.

Fundamental Australian Dollar forecast for six months

Vaccine, incentives, and China are the recipe for a nearly 42% rally in AUDUSD from March lows to January highs. Looking at the astonishing rise of the Australian dollar, one may begin to doubt its continuation. But what if none of the investors will no longer buy, global risk appetite will stop growing so fast? Will Joe Biden's inauguration be a signal for profit-taking on US stock indices? Will China's GDP accelerate in 2021? Finally, can vaccine continue to push the S&P 500 up?

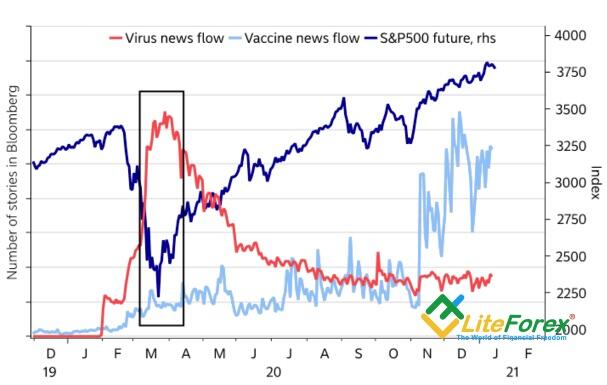

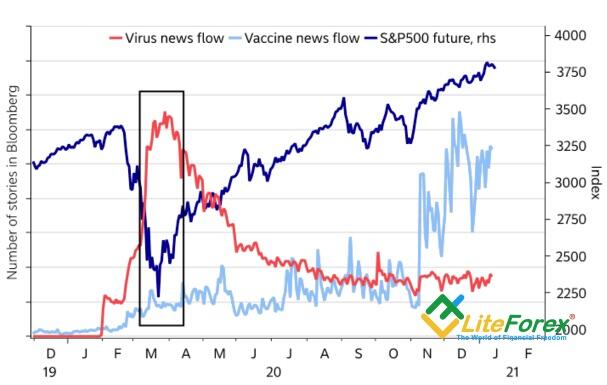

Investors cannot expect the same scale of monetary and fiscal stimulus as in 2020. At best, the Fed will continue to buy assets for $120 billion a month until the end of the year, and the factor of Joe Biden's $1.9 trillion aid package is already included in the prices of US stock indices. According to Nordea Markets, the number of positive news about vaccines has approached its extreme value and will no longer provide the previous support for the S&P 500. At least for a while. This is fraught with increased turbulence in the stock market and the strengthening of the greenback.

Will China's GDP Accelerate in 2021? The World Bank thinks so. According to its forecasts, China's economy will expand by 8% this year and exceed the 2019 level by 10%. Beijing's voracious demand for steel is fueling the rise in iron ore futures, which is a crucial component of Australian exports even as the US dollar strengthens. At the same time, in 2020, China fulfilled only 52% of its obligations to purchase US goods. If Joe Biden touches on this topic during the inauguration, the yuan's fall will create problems for the AUDUSD bulls.

Let's not forget about the potential expansion of the US Treasury bond issue due to the need to finance $1.9 trillion in fiscal stimulus. This action could provoke further growth in treasury yields and a correction of dollar pairs on Forex.

Thus, in the short term, the Australian dollar has a lot of risks. Nevertheless, in the medium and long term investment, it will probably be able to recoup. History shows that crises worked in China's favor. In 2001, when Beijing joined the WTO, its economy was only 13% of America's size. In 2009 this figure increased to 35%, in 2020 to 71%. By 2028, the American economy will be bypassed by China. Growth in its GDP and Aussie neutral positioning serves as bullish factors for AUDUSD.

AUDUSD trading plan for six months

In my opinion, the acceleration of the vaccination process and the more vigorous growth of the global economy than currently expected will help restore the uptrend in emerging markets' currencies and the Australian dollar. However, the AUDUSD correction may continue shortly. So much, the better. The fall of the AUDUSD pair to the supports at 0.763 and 0.759 will make it possible to buy the Australian dollar at a lower price. It is still relevant to open AUDUSD long positions on the price rise with the targets at 0.79 and 0.82.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/cunning-aussie-forecast-as-of-19012021/?uid=285861726&cid=79634

S&P 500 and virus/vaccines news dynamics

By 2028, the American economy will be bypassed by China. This fact and the PRC's insatiable demand for iron ore will favor the AUUSD bulls for many years to come. Let us discuss the Forex outlook and make up a trading plan.

Fundamental Australian Dollar forecast for six months

Vaccine, incentives, and China are the recipe for a nearly 42% rally in AUDUSD from March lows to January highs. Looking at the astonishing rise of the Australian dollar, one may begin to doubt its continuation. But what if none of the investors will no longer buy, global risk appetite will stop growing so fast? Will Joe Biden's inauguration be a signal for profit-taking on US stock indices? Will China's GDP accelerate in 2021? Finally, can vaccine continue to push the S&P 500 up?

Investors cannot expect the same scale of monetary and fiscal stimulus as in 2020. At best, the Fed will continue to buy assets for $120 billion a month until the end of the year, and the factor of Joe Biden's $1.9 trillion aid package is already included in the prices of US stock indices. According to Nordea Markets, the number of positive news about vaccines has approached its extreme value and will no longer provide the previous support for the S&P 500. At least for a while. This is fraught with increased turbulence in the stock market and the strengthening of the greenback.

Will China's GDP Accelerate in 2021? The World Bank thinks so. According to its forecasts, China's economy will expand by 8% this year and exceed the 2019 level by 10%. Beijing's voracious demand for steel is fueling the rise in iron ore futures, which is a crucial component of Australian exports even as the US dollar strengthens. At the same time, in 2020, China fulfilled only 52% of its obligations to purchase US goods. If Joe Biden touches on this topic during the inauguration, the yuan's fall will create problems for the AUDUSD bulls.

Let's not forget about the potential expansion of the US Treasury bond issue due to the need to finance $1.9 trillion in fiscal stimulus. This action could provoke further growth in treasury yields and a correction of dollar pairs on Forex.

Thus, in the short term, the Australian dollar has a lot of risks. Nevertheless, in the medium and long term investment, it will probably be able to recoup. History shows that crises worked in China's favor. In 2001, when Beijing joined the WTO, its economy was only 13% of America's size. In 2009 this figure increased to 35%, in 2020 to 71%. By 2028, the American economy will be bypassed by China. Growth in its GDP and Aussie neutral positioning serves as bullish factors for AUDUSD.

AUDUSD trading plan for six months

In my opinion, the acceleration of the vaccination process and the more vigorous growth of the global economy than currently expected will help restore the uptrend in emerging markets' currencies and the Australian dollar. However, the AUDUSD correction may continue shortly. So much, the better. The fall of the AUDUSD pair to the supports at 0.763 and 0.759 will make it possible to buy the Australian dollar at a lower price. It is still relevant to open AUDUSD long positions on the price rise with the targets at 0.79 and 0.82.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/cunning-aussie-forecast-as-of-19012021/?uid=285861726&cid=79634

S&P 500 and virus/vaccines news dynamics

LiteFinance

How long will the EURUSD be falling? Forecast as of 18.01.2021

What will signal the end of the EURUSD correction? The ECB meeting? Joe Biden’s inauguration? The Fed meeting? Each of these events could discourage euro bears. Let us discuss the Forex outlook and make up a trading plan.

Weekly Euro fundamental forecast