EmmeMe / Profil

EmmeMe

Three factors determine the importance of a trendline: the lenght of time it has been intact, the number of time it has been tested and the steepness or slope of the trendline...

Partager sur les réseaux sociaux · 1

716

2

EmmeMe

Trading Manual: How to Trade Trendlines - Trend is a Friend Until It Bends

3 septembre 2014, 21:11

One of the basic foundation of technical analysis is that prices move in trends. The corollary to this premise states a trend in motion is more likely to continue until it reverses. So as long as the trend is intact, trendlines could be used as a buying and selling areas...

EmmeMe

NZDUSD may have reached a turning point with a Hammer formation offering a sign of hope for the bulls. An ensuing up-day and close above the 0.8400 hurdle would be required to signal the potential for a more sustained recovery for the pair...

EmmeMe

The latest tally of analyst opinions from the major brokerage houses shows that among the components of the S&P 500 index, Navient Corp (NAVI) is now the #139 analyst pick, moving up by 2 spots...

EmmeMe

NZDUSD is struggling to reclaim lost ground with an absence of bullish candlesticks casting doubt on a recovery. A Dragonfly Doji is emerging on the daily, which may offer a sign of hope to the bulls...

EmmeMe

San Francisco Open Exchange Aims to Provide Better Trading Opportunities for Bitcoiners San Francisco Open Exchange or SFOX is an online trading platform that helps people find the best Bitcoin prices at various exchanges...

Partager sur les réseaux sociaux · 1

267

EmmeMe

A recent line of research has established that global factors significantly correlate with national inflation rate movements, so much in fact that they can help forecast national inflation rates.1 A forthcoming Federal Reserve Bank of St...

EmmeMe

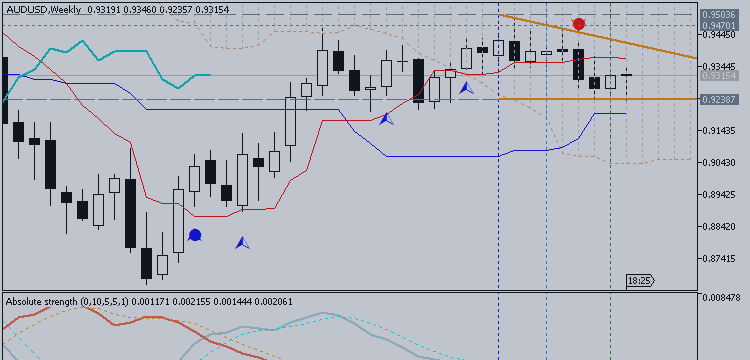

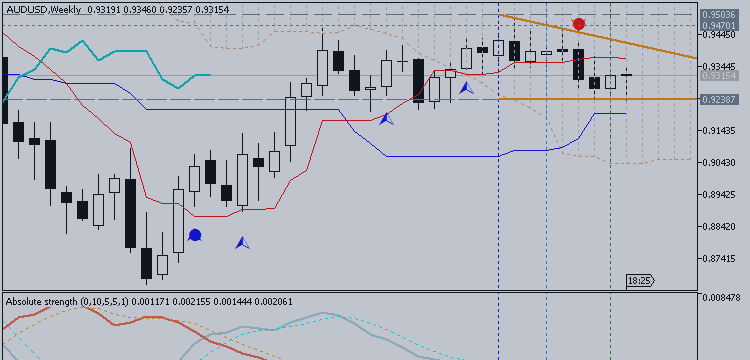

“The combination of the .9400 figure and weekly RSI failing near 60 indicates a lot of overhead to punch through. Since the 2011 top, each RSI failure near 60 has led to a top or topping process (range for several weeks then a breakdown...that may be the case now...

EmmeMe

The dollar dominated once again, with multi-month gains against major currencies. Is it time for a correction or will this trend continue? German Ifo Business Climate, US housing data, Durable Goods Orders and GDP are amongthe highlights of this week...

EmmeMe

manijeh alizadi ghahveh

PRECIOUS-Gold up slightly after Yellen comment, but outlook dim

NEW YORK/LONDON, Aug 22 (Reuters) - Gold prices edged up on Friday as U.S. equities slipped, but gains were limited by fears over deflation after Federal Reserve Chair Janet Yellen said U.S. labor markets remain hampered by the effects of the Great Recession.

In a speech at a central banking conference in Jackson Hole, Wyoming, Yellen said the U.S. central bank should move cautiously in determining when interest rates should rise, as economic disruption of the last five years has left millions of workers sidelined, discouraged, or stuck in part-time jobs.

Gold prices continued to hover just above a two-month low reached on Thursday. Bullion has dropped about 3 percent in the past five sessions, underperforming U.S. Treasury bonds, which are considered the preferred safe-haven investment, traders said.

"I see no reasons to own gold, which is likely to trend lower with rallies being sold. The Treasury yields at under 3 percent and crude oil prices showing signs of a recession are significant headwinds for precious metals," said Jonathan Jossen, COMEX gold options floor trader in New York.

Spot gold was up 0.3 percent at $1,280.49 an ounce by 11:29 a.m. (1529 GMT), not far from a two-month low of $1,273.06 hit on Thursday. The metal is down almost 2 percent for the week, the biggest drop since the week ended July 18.

U.S. COMEX gold futures for December delivery gained $6.10 to $1,281.50 an ounce.

Brent crude oil futures drifted further below $103 a barrel on Friday as a strong dollar and plentiful supplies continued to pressure prices. Oil prices have dropped more than 4 percent in the last ten sessions.

Among other precious metals, silver was up 0.1 percent at $19.43 an ounce. Platinum rose 0.6 percent to $1,420.50 an ounce, on track to snap a nine-day losing streak, its longest since July 2008. Spot palladium climbed 1.2 percent to $884.50 an ounce.

NEW YORK/LONDON, Aug 22 (Reuters) - Gold prices edged up on Friday as U.S. equities slipped, but gains were limited by fears over deflation after Federal Reserve Chair Janet Yellen said U.S. labor markets remain hampered by the effects of the Great Recession.

In a speech at a central banking conference in Jackson Hole, Wyoming, Yellen said the U.S. central bank should move cautiously in determining when interest rates should rise, as economic disruption of the last five years has left millions of workers sidelined, discouraged, or stuck in part-time jobs.

Gold prices continued to hover just above a two-month low reached on Thursday. Bullion has dropped about 3 percent in the past five sessions, underperforming U.S. Treasury bonds, which are considered the preferred safe-haven investment, traders said.

"I see no reasons to own gold, which is likely to trend lower with rallies being sold. The Treasury yields at under 3 percent and crude oil prices showing signs of a recession are significant headwinds for precious metals," said Jonathan Jossen, COMEX gold options floor trader in New York.

Spot gold was up 0.3 percent at $1,280.49 an ounce by 11:29 a.m. (1529 GMT), not far from a two-month low of $1,273.06 hit on Thursday. The metal is down almost 2 percent for the week, the biggest drop since the week ended July 18.

U.S. COMEX gold futures for December delivery gained $6.10 to $1,281.50 an ounce.

Brent crude oil futures drifted further below $103 a barrel on Friday as a strong dollar and plentiful supplies continued to pressure prices. Oil prices have dropped more than 4 percent in the last ten sessions.

Among other precious metals, silver was up 0.1 percent at $19.43 an ounce. Platinum rose 0.6 percent to $1,420.50 an ounce, on track to snap a nine-day losing streak, its longest since July 2008. Spot palladium climbed 1.2 percent to $884.50 an ounce.

EmmeMe

If you get stuck paying out huge amounts to anyone, you want to ease the burden by writing it off. Bank of America may be smarting over the historic $17 billion legal settlement it reached over soured mortgage securities...

EmmeMe

Here are top 8 current list of candidates: Baxter International (NYSE:BAX) Berkshire Hathaway (NYSE:BRK.B) BlackRock Incorporated (NYSE:BLK) Coca-Cola (NYSE:KO...

Partager sur les réseaux sociaux · 1

531

EmmeMe

The Futures Mag portal asked few experts what indicators they look to in today's markets to stay successful. Here's what they said. Moving Averages still useful The entire psychology of ‘trend’ analysis (vs. short-term trading or long-term valuations) rests on timeless precepts...

EmmeMe

Over time, we have hearing about major online retails and businesses’ plans to accept cryptocurrencies as payments. While some of them have already started to accept them as one, few are still planning the revolutionary integrations...

Partager sur les réseaux sociaux · 2

297

EmmeMe

1. Indicators for Metatrader 5 AwesomeModPips - indicator for MetaTrader 5 - this indicator is a modification of classical Awesome Oscillator indicator. It computes the smoothed difference of two exponential moving averages...

Partager sur les réseaux sociaux · 1

396

EmmeMe

There are some systems by manual trading and EAs which can be used on every day basis: to evaluate the market condition on any timeframe to trade manually for profit to trade by EAs. Go to the links to download...

Partager sur les réseaux sociaux · 2

584

EmmeMe

The stronger U.S. economy and the possibility of higher interest rates helped drive the EUR/USD lower in July. At the same time, Euro investors are starting to believe the European Central Bank may have to impose more aggressive economic stimulus on the Euro Zone in order to avoid deflation...

Partager sur les réseaux sociaux · 1

387

EmmeMe

Fundamental Forecast for Yen: Bullish Bank of Japan disappoints, Japanese Yen relatively unchanged USDJPY posts largest move in four weeks The Japanese Yen rallied sharply a complete lack of market news. Why is this significant, and what does it tell us about the next moves for the USDJPY...

Partager sur les réseaux sociaux · 1

287

EmmeMe

Warren Buffett, Chairman of the Board and CEO of Berkshire Hathaway, says parents should start teaching children about importance of money at an early age, even in preschool. Do you think most parents do a good job teaching their kids about money...

Partager sur les réseaux sociaux · 7

449

EmmeMe

Stock market investing provides a great vehicle to potentially earn a lot of money. However, you can only be successful if you have the right knowledge and information. The following tips can provide some advice on how to maximize your stoick investment opportunities...

Partager sur les réseaux sociaux · 7

264

: