A Quantitative Analysis - Like most people on this site, I'm having a harder and harder time trying to find destinations for new money.

Here are top 8 current list of candidates:

- Baxter International (NYSE:BAX)

- Berkshire Hathaway (NYSE:BRK.B)

- BlackRock Incorporated (NYSE:BLK)

- Coca-Cola (NYSE:KO)

- Deere & Company (NYSE:DE)

- McDonald's (NYSE:MCD)

- Monsanto (NYSE:MON)

- Procter & Gamble (NYSE:PG)

Baxter International manufactures therapies for a variety of diseases, medical products for dialysis systems, intravenous therapies and other injectables, and anesthetic agents. The company recently announced a spin-off of its biopharmaceutical segment to take place in 2015, and in the most recent earnings call, raised its guidance for 2014 EPS to $5.10-5.20 after a 16% y/y increase in consolidated revenues. Though the company's ROIC does not consistently outpace its cost of capital, Morningstar awards the company with a company-wide moat based upon its economies of scale, wide pipeline, pricing power, and intangible assets. The company is a slow but steady grower, and growth looks to accelerate with the upcoming spinoff. Though the anticipated total return for the company remains attractive, it does not currently trade at a large enough margin of safety-- though it's close.

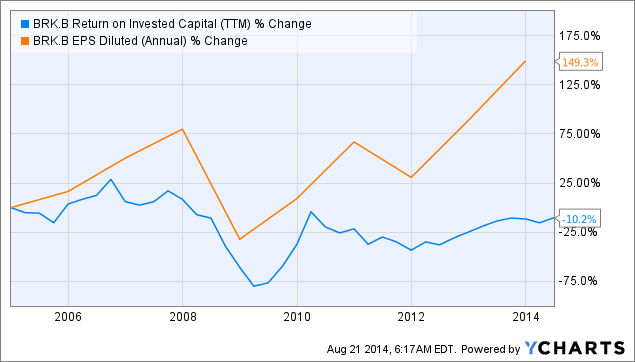

2. Berkshire Hathaway:

BlackRock, the world's largest asset manager, is now trading near

52-week highs. Inflows to its funds came roaring in last quarter, with

AUM growing almost 20%. Though growth like that isn't likely to continue

for long, the firm benefits from the secular trend towards passively

managed ETFs and similarly packaged products, and should see returns

that at least mimic the returns of the broader market, plus a percentage

point or two. Double-digit total returns, aided by share repurchases

and dividends (both of which should come from the firm's generous free

cash flow generation) seem likely. Though this remains my largest

holding, shares are now trading reasonably close to my fair value

estimate, and I'd wait for a dip before adding more funds to this name.

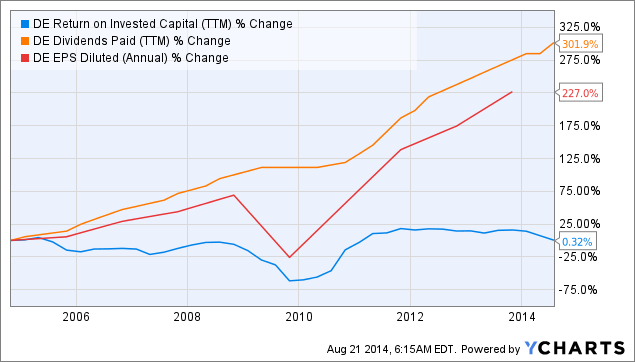

5. Deere & Co.:

6. McDonald's:

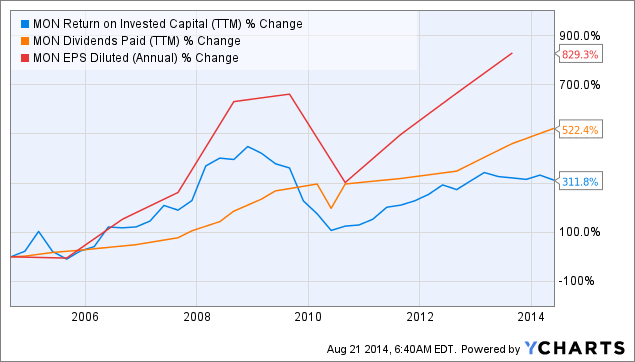

7. Monsanto: