Piyush Lalsingh Ratnu / Perfil

Piyush Lalsingh Ratnu

- Trader & Analyst en Piyush Ratnu Gold Market Research

- Emiratos Árabes Unidos

- 156

- Información

|

no

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Amigos

15

Solicitudes

Enviadas

Piyush Lalsingh Ratnu

Another Victory in #BullionTrading & Forex Trading

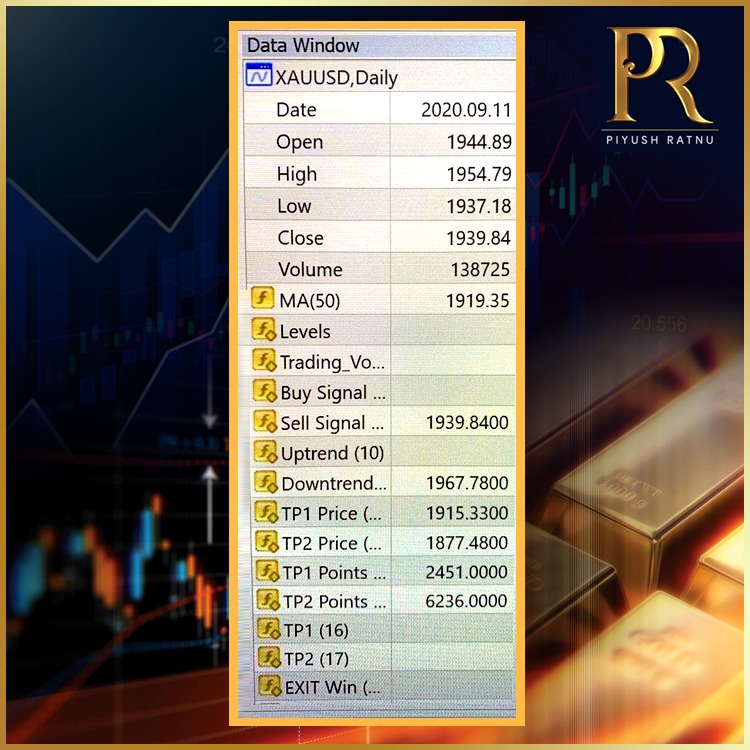

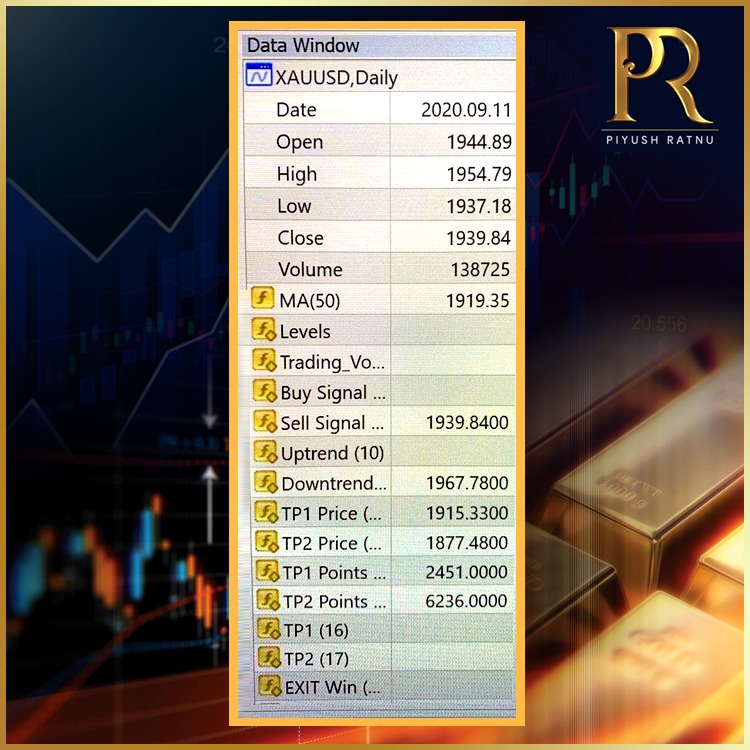

As per analysis dated 12.08.2020 #Gold crashed from 1966.00 - 1866.00 level today. Trading signal generated by my algorithm on 11.09.2020 for a sell at 1967.00 with TP1 at 1915.00 and TP2 at 1867.00 respectively, both TP achieved on 23.09.2020.

Net Profitable Pips: 10,000 pips in 12 days | 288 hours

To subscribe my analysis & signals: Email: piyushratnu@gmail.com

#PiyushRatnu #BullionTrading #Forex #Analysis #FinancialMarkets

As per analysis dated 12.08.2020 #Gold crashed from 1966.00 - 1866.00 level today. Trading signal generated by my algorithm on 11.09.2020 for a sell at 1967.00 with TP1 at 1915.00 and TP2 at 1867.00 respectively, both TP achieved on 23.09.2020.

Net Profitable Pips: 10,000 pips in 12 days | 288 hours

To subscribe my analysis & signals: Email: piyushratnu@gmail.com

#PiyushRatnu #BullionTrading #Forex #Analysis #FinancialMarkets

Piyush Lalsingh Ratnu

As per the analysis posted on 12.08.2020 and 18.08.2020:

BUY at 1926 price zone with target price 1947.00 | Sell limit: 1947/1954/1961 TP: 1926.00 | both directions, targets achieved | Trading Performance: 04.09.2020, economic event: NFP Unemployment Rate.

#gold #forex #forextrader #profit #money #tradeforex #bullion #FundManagers #forextrading #PiyushRatnu

BUY at 1926 price zone with target price 1947.00 | Sell limit: 1947/1954/1961 TP: 1926.00 | both directions, targets achieved | Trading Performance: 04.09.2020, economic event: NFP Unemployment Rate.

#gold #forex #forextrader #profit #money #tradeforex #bullion #FundManagers #forextrading #PiyushRatnu

Piyush Lalsingh Ratnu

Another amazing victory!

As per my analysis posted on 12.08.2020: Buy at 1866/88.

As per my analysis posted on 18.08.2020: Buy zone was at 1926.

Today Gold is back in 1990 zone. Total pips: 130/70*100= 13000/7000.

If you had taken:

1 lot: profit= 13000/7000$

10 lot: profit = 130,000/ 70,000$

100 lot profit = 13,00,000/ 7,00,000$

Those who followed the analysis: am sure made handsome profits! I am sure you would like to see our floating profits on the basis of our own analysis, the same are attached for your reference!

Those who didn’t follow the analysis, better luck next time!

#PiyushRatnu #Gold #Bullion #Forex

Email: piyushratnu@gmail.com for analysis.

As per my analysis posted on 12.08.2020: Buy at 1866/88.

As per my analysis posted on 18.08.2020: Buy zone was at 1926.

Today Gold is back in 1990 zone. Total pips: 130/70*100= 13000/7000.

If you had taken:

1 lot: profit= 13000/7000$

10 lot: profit = 130,000/ 70,000$

100 lot profit = 13,00,000/ 7,00,000$

Those who followed the analysis: am sure made handsome profits! I am sure you would like to see our floating profits on the basis of our own analysis, the same are attached for your reference!

Those who didn’t follow the analysis, better luck next time!

#PiyushRatnu #Gold #Bullion #Forex

Email: piyushratnu@gmail.com for analysis.

Piyush Lalsingh Ratnu

Another amazing victory!

As per my analysis posted on 12.08.2020: Buy at 1866/88.

As per my analysis posted on 18.08.2020: Buy zone was at 1926.

Today Gold is back in 1990 zone. Total pips: 130/70*100= 13000/7000.

If you had taken:

1 lot: profit= 13000/7000$

10 lot: profit = 130,000/ 70,000$

100 lot profit = 13,00,000/ 7,00,000$

Those who followed the analysis: am sure made handsome profits! I am sure you would like to see our floating profits on the basis of our own analysis, the same are attached for your reference!

Those who didn’t follow the analysis, better luck next time!

#PiyushRatnu #Gold #Bullion #Forex

Email: piyushratnu@gmail.com for analysis.

As per my analysis posted on 12.08.2020: Buy at 1866/88.

As per my analysis posted on 18.08.2020: Buy zone was at 1926.

Today Gold is back in 1990 zone. Total pips: 130/70*100= 13000/7000.

If you had taken:

1 lot: profit= 13000/7000$

10 lot: profit = 130,000/ 70,000$

100 lot profit = 13,00,000/ 7,00,000$

Those who followed the analysis: am sure made handsome profits! I am sure you would like to see our floating profits on the basis of our own analysis, the same are attached for your reference!

Those who didn’t follow the analysis, better luck next time!

#PiyushRatnu #Gold #Bullion #Forex

Email: piyushratnu@gmail.com for analysis.

Piyush Lalsingh Ratnu

Gold had its best day since April on 17 August 2020, but market history says it may be time to bet against the precious metal. (Crash after 15 Aug, 2020, as indicated by our algorithms too)

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Piyush Lalsingh Ratnu

A Dow buy signal says Warren Buffett’s gold stake came too late for the precious metal: CNBC

Important levels to notice:

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Important levels to notice:

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Piyush Lalsingh Ratnu

Precious Metals began a long anticipated correction a few weeks ago but it was somewhat interrupted by news of Warren Buffett buying a stake in Barrick Gold (NYSE:GOLD).

The Buffett bounce has passed and the correction could reassert itself as the path of least resistance remains to the downside.

Important levels to notice:

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

The Buffett bounce has passed and the correction could reassert itself as the path of least resistance remains to the downside.

Important levels to notice:

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Piyush Lalsingh Ratnu

Market Sentiment:

The investors - rightly or not - worry that mammoth injections of liquidity will translate into higher inflation one day. This is something that creates additional demand for gold as an inflation hedge, supporting its prices.

Important levels to notice:

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

The investors - rightly or not - worry that mammoth injections of liquidity will translate into higher inflation one day. This is something that creates additional demand for gold as an inflation hedge, supporting its prices.

Important levels to notice:

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Piyush Lalsingh Ratnu

GOLD: Downside Risks As Real As $2,000 Target

If it presses on to $1,990, buyers may look for a high of $2,008 next. But failure to hold at this level can push the price back to $1,924-$1,900.

If it tests $1,860 and bounces back to cross $2,000 and enters the bullish channel, a double-bottom can be established.

This potential formation will have the height of about $150, which if added to this week’s reach of $2000-2020, gives us the much anticipated $2,150 and beyond.

Above $1,795, (the) price is indeed heading higher with a topside breach above $2,033 needed to mark resumption. Subsequent topside resistance objective at 2105 and 2179.

Important levels to notice:

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

If it presses on to $1,990, buyers may look for a high of $2,008 next. But failure to hold at this level can push the price back to $1,924-$1,900.

If it tests $1,860 and bounces back to cross $2,000 and enters the bullish channel, a double-bottom can be established.

This potential formation will have the height of about $150, which if added to this week’s reach of $2000-2020, gives us the much anticipated $2,150 and beyond.

Above $1,795, (the) price is indeed heading higher with a topside breach above $2,033 needed to mark resumption. Subsequent topside resistance objective at 2105 and 2179.

Important levels to notice:

2070-2020-2000-1981-1966/1947-1921-1910-1888/1866-1836-1818-1777-1747-1711-1696-1666

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Piyush Lalsingh Ratnu

What would the yield-curve target imply for the monetary policy, economy and the gold market?

Well, it’s not rocket science – capping bond yields means that bond yields will remain very low for longer than they would be without the caps. The Fed would cap Treasury yields, which would allow the government to continue its spending spree and to not worry about the fiscal deficits and soaring public debt.

The yield-curve control flattens the yield curve, which hurts the commercial banks, which usually borrow short-term funds and lend long-term. So, a flat yield curve narrows their margins, impairing their lending ability, which is key to revive the economy.

Last but not least, the yield-curve control can become very easily (if it’s not already) a blunt tool to help government issue debt smoothly and cheaply. As the FOMC admitted itself in minutes of its recent meeting, “monetary policy goals might come in conflict with public debt management goals, which could pose risks to the independence of the central bank.”

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Well, it’s not rocket science – capping bond yields means that bond yields will remain very low for longer than they would be without the caps. The Fed would cap Treasury yields, which would allow the government to continue its spending spree and to not worry about the fiscal deficits and soaring public debt.

The yield-curve control flattens the yield curve, which hurts the commercial banks, which usually borrow short-term funds and lend long-term. So, a flat yield curve narrows their margins, impairing their lending ability, which is key to revive the economy.

Last but not least, the yield-curve control can become very easily (if it’s not already) a blunt tool to help government issue debt smoothly and cheaply. As the FOMC admitted itself in minutes of its recent meeting, “monetary policy goals might come in conflict with public debt management goals, which could pose risks to the independence of the central bank.”

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Piyush Lalsingh Ratnu

In a response to the coronavirus crisis, the Fed has already cut interest rates to zero and implemented quantitative easing. But that’s not enough and the U.S. central bankers are now talking about “yield curve control.” What is it and how it could affect the market?

Normally, the central banks lower the short-term interest rate to stimulate the economy. But the federal funds rate is already at zero, so the Fed now thinks about the yield curve control. It works basically like normal open-market operations – the only difference is that under the yield curve control, the Fed would target some longer-term interest rate. As the central bank would set the short-term rates at zero and it would target also longer-term rates, it would practically control the yield curve, which explains the name. Moreover, the Fed would also promise to buy enough bonds to keep the rate from moving above the target – this is why the yield curve control is also called “interest rate caps” or “interest rate pegs.”

It might be useful to compare the yield curve control with the quantitative easing. While the latter deals with quantities or amounts of bonds (e.g., the Fed commits to buying bonds worth $1 trillion, but the market still influences the price), the former deals with bond prices. In other words, under the yield curve control, the central banks pledge to buy whatever amount of bonds the market wants to supply at the target price (instead of a particular amount of bonds at whatever the price).

Although central banks normally target short-term interest rates, the yield-curve control would not be a new policy. It was already used by the Fed during and after the World War II, when it agreed to help Treasury in financing military expenditures and cap the Treasury yields by buying any Treasury bond that yielded above the target. In a more recent history, the Bank of Japan introduced its yield-curve control in September 2016, pegging yields on 10-year Japanese Treasuries around zero percent. Interestingly, under the yield-curve target, the BoJ has been buying government bonds at a slower pace than under the QE, as the chart below shows. This is because investors accepted that the BoJ would buy whatever quantity of bonds to keep yields from rising, so it has not had to buy too many of them to set the price.

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Normally, the central banks lower the short-term interest rate to stimulate the economy. But the federal funds rate is already at zero, so the Fed now thinks about the yield curve control. It works basically like normal open-market operations – the only difference is that under the yield curve control, the Fed would target some longer-term interest rate. As the central bank would set the short-term rates at zero and it would target also longer-term rates, it would practically control the yield curve, which explains the name. Moreover, the Fed would also promise to buy enough bonds to keep the rate from moving above the target – this is why the yield curve control is also called “interest rate caps” or “interest rate pegs.”

It might be useful to compare the yield curve control with the quantitative easing. While the latter deals with quantities or amounts of bonds (e.g., the Fed commits to buying bonds worth $1 trillion, but the market still influences the price), the former deals with bond prices. In other words, under the yield curve control, the central banks pledge to buy whatever amount of bonds the market wants to supply at the target price (instead of a particular amount of bonds at whatever the price).

Although central banks normally target short-term interest rates, the yield-curve control would not be a new policy. It was already used by the Fed during and after the World War II, when it agreed to help Treasury in financing military expenditures and cap the Treasury yields by buying any Treasury bond that yielded above the target. In a more recent history, the Bank of Japan introduced its yield-curve control in September 2016, pegging yields on 10-year Japanese Treasuries around zero percent. Interestingly, under the yield-curve target, the BoJ has been buying government bonds at a slower pace than under the QE, as the chart below shows. This is because investors accepted that the BoJ would buy whatever quantity of bonds to keep yields from rising, so it has not had to buy too many of them to set the price.

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Piyush Lalsingh Ratnu

The yield-curve control can become very easily (if it’s not already) a blunt tool to help government issue debt smoothly and cheaply. As the FOMC admitted itself in minutes of its recent meeting, “monetary policy goals might come in conflict with public debt management goals, which could pose risks to the independence of the central bank.”

It should be clear now that the yield-curve control should be positive for the gold prices, even if it would reduce the pace of the Fed’s balance sheet expansion (as in the case of the BoJ’s experience). After all, the caps on the Treasury yields imply low interest rates. Importantly, if inflation rises the cap on nominal interest rates this would lead to the decline in the real interest rates, as it happened in the aftermath of the World War II. The yield-curve control also caps the government’s borrowing costs, which encourage the increase in public debt, which raises the risk of the sovereign-debt crisis. Moreover, the yield curve control could spur some worries about the central bank’s independence, which could weaken the U.S. dollar. In such a macroeconomic environment, gold should shine. So, the Fed could cap the Treasury yields, while pushing gold upwards.

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

It should be clear now that the yield-curve control should be positive for the gold prices, even if it would reduce the pace of the Fed’s balance sheet expansion (as in the case of the BoJ’s experience). After all, the caps on the Treasury yields imply low interest rates. Importantly, if inflation rises the cap on nominal interest rates this would lead to the decline in the real interest rates, as it happened in the aftermath of the World War II. The yield-curve control also caps the government’s borrowing costs, which encourage the increase in public debt, which raises the risk of the sovereign-debt crisis. Moreover, the yield curve control could spur some worries about the central bank’s independence, which could weaken the U.S. dollar. In such a macroeconomic environment, gold should shine. So, the Fed could cap the Treasury yields, while pushing gold upwards.

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms | #Gold | #Dollar

Piyush Lalsingh Ratnu

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Subscribe for analysis & trading calls generated by trading algorithms powered by neural network.

Trading accuracy: 89%

Back dated data testing: 8 years

Gold, Silver, USD pairs and Euro pairs.

Analyse 28 currencies in 1 minute

Manage upto 100 accounts through trading robots and multi currency terminal

Execution in 3-5 ms | Reverse and Multiply Trades in seconds.

For more details: email at piyushratnu@gmail.com

Subscribe for analysis & trading calls generated by trading algorithms powered by neural network.

Trading accuracy: 89%

Back dated data testing: 8 years

Gold, Silver, USD pairs and Euro pairs.

Analyse 28 currencies in 1 minute

Manage upto 100 accounts through trading robots and multi currency terminal

Execution in 3-5 ms | Reverse and Multiply Trades in seconds.

For more details: email at piyushratnu@gmail.com

Piyush Lalsingh Ratnu

As per analysis posted on 13.08.2020:

#Gold crashed from 1965-1932.00 and reversed back to 1947 Level. Total pips: 3200

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

#Gold crashed from 1965-1932.00 and reversed back to 1947 Level. Total pips: 3200

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Piyush Lalsingh Ratnu

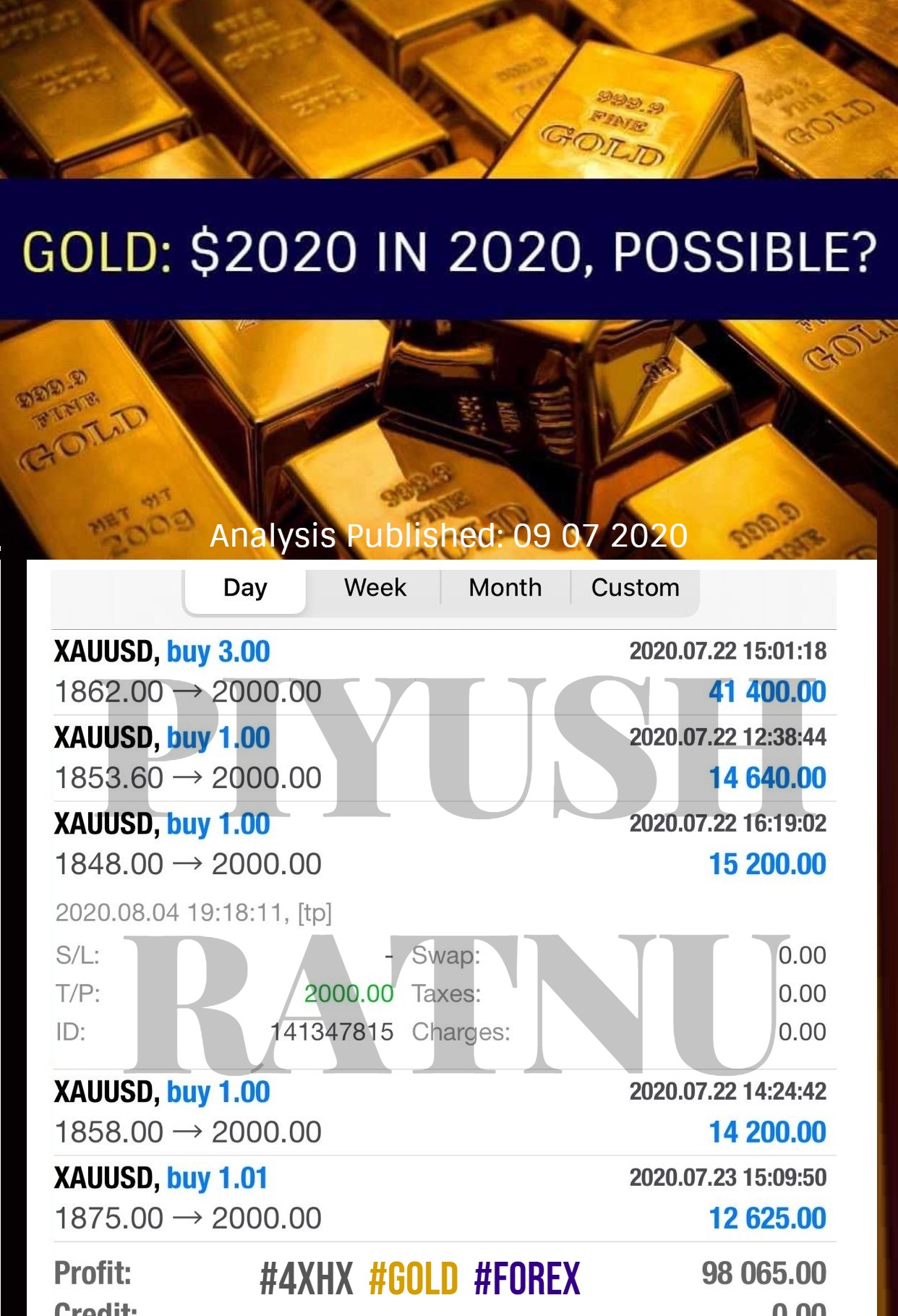

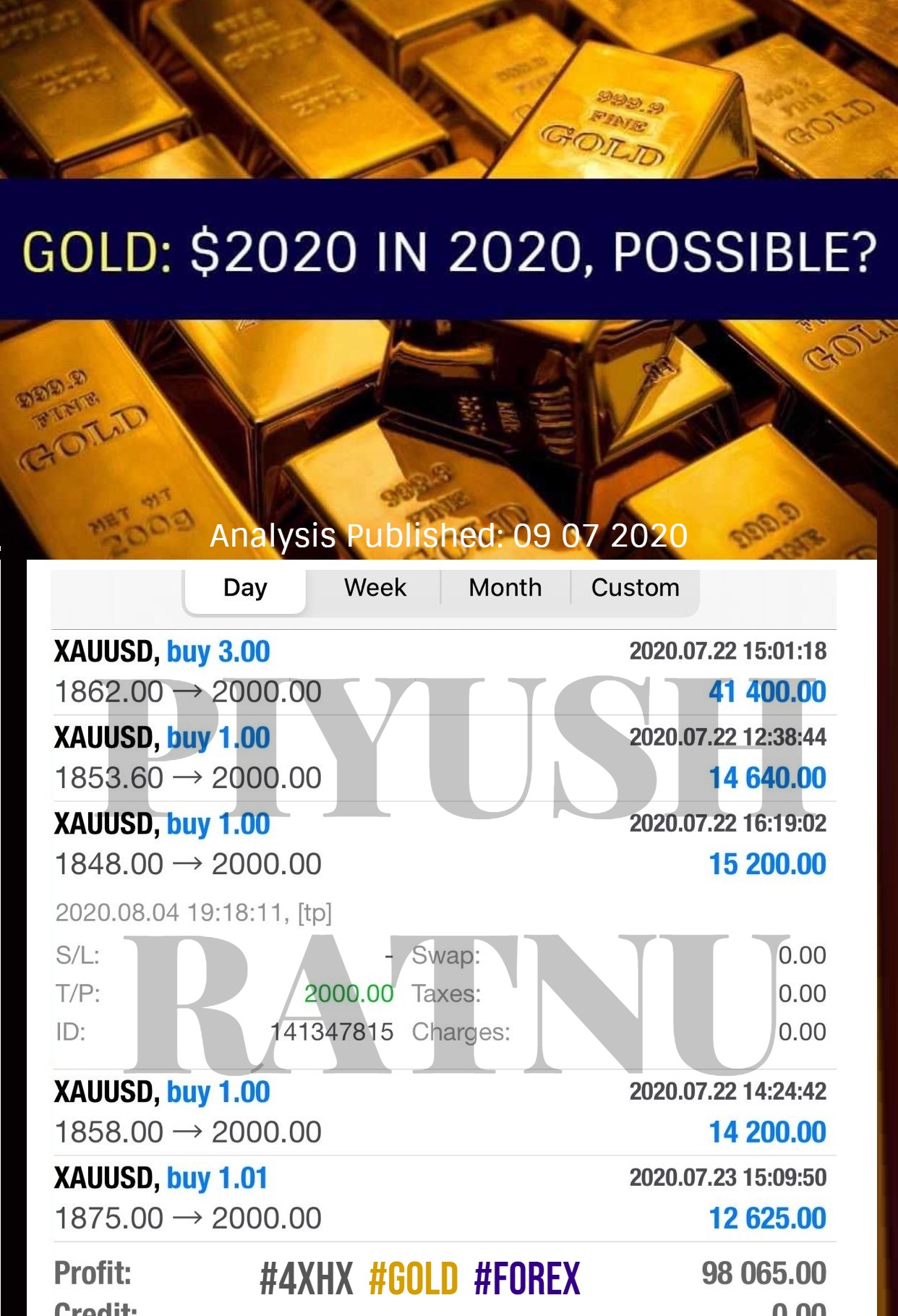

Trading Performance: 04 August, 2020 | XAUUSD | Spot Gold

Exit price: 2000.00$

Entry price: 1848.00

Holding time: 13 days

Profit booked: 98,000$

#GOLD | Why XAUUSD Gold is rising since 04 August 2020?

US stocks turned positive while at the same time US yields printed fresh lows helping XAU/USD.

The US 10-year yield fell to 0.515%, the lowest since mid-March.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Exit price: 2000.00$

Entry price: 1848.00

Holding time: 13 days

Profit booked: 98,000$

#GOLD | Why XAUUSD Gold is rising since 04 August 2020?

US stocks turned positive while at the same time US yields printed fresh lows helping XAU/USD.

The US 10-year yield fell to 0.515%, the lowest since mid-March.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Piyush Lalsingh Ratnu

Trading Performance: 04 August, 2020 | XAUUSD | Spot Gold

Exit price: 2000.00$

Entry price: 1848.00

Holding time: 13 days

Profit booked: 98,000$

#GOLD | Why XAUUSD Gold is rising since 04 August 2020?

US stocks turned positive while at the same time US yields printed fresh lows helping XAU/USD.

The US 10-year yield fell to 0.515%, the lowest since mid-March.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Exit price: 2000.00$

Entry price: 1848.00

Holding time: 13 days

Profit booked: 98,000$

#GOLD | Why XAUUSD Gold is rising since 04 August 2020?

US stocks turned positive while at the same time US yields printed fresh lows helping XAU/USD.

The US 10-year yield fell to 0.515%, the lowest since mid-March.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Piyush Lalsingh Ratnu

Trading Performance: 04 August, 2020 | XAUUSD | Spot Gold

#GOLD | Why XAUUSD Gold is rising today?

US stocks turned positive while at the same time US yields printed fresh lows helping XAU/USD.

The US 10-year yield fell to 0.515%, the lowest since mid-March.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

#GOLD | Why XAUUSD Gold is rising today?

US stocks turned positive while at the same time US yields printed fresh lows helping XAU/USD.

The US 10-year yield fell to 0.515%, the lowest since mid-March.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Piyush Lalsingh Ratnu

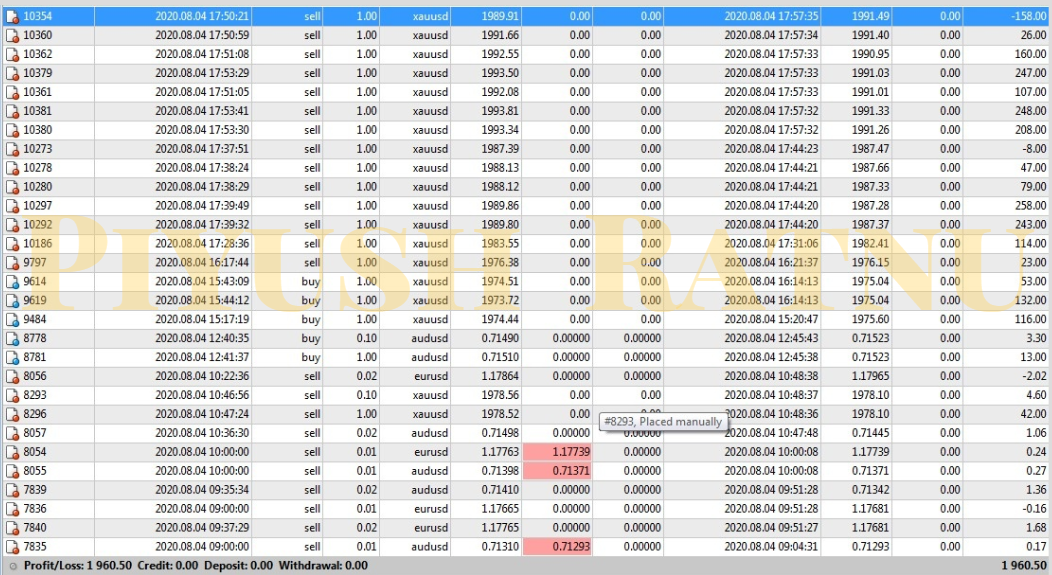

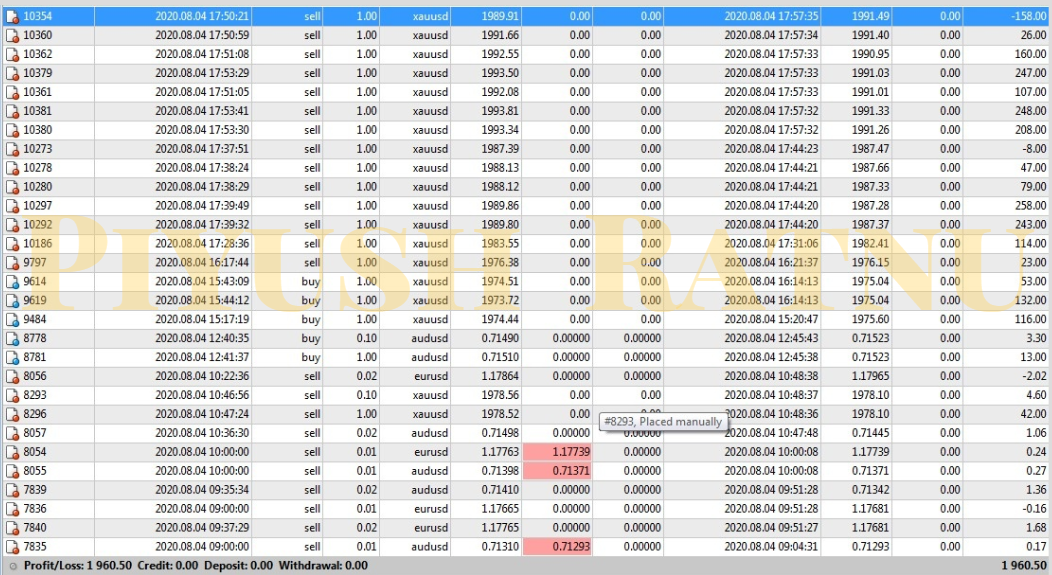

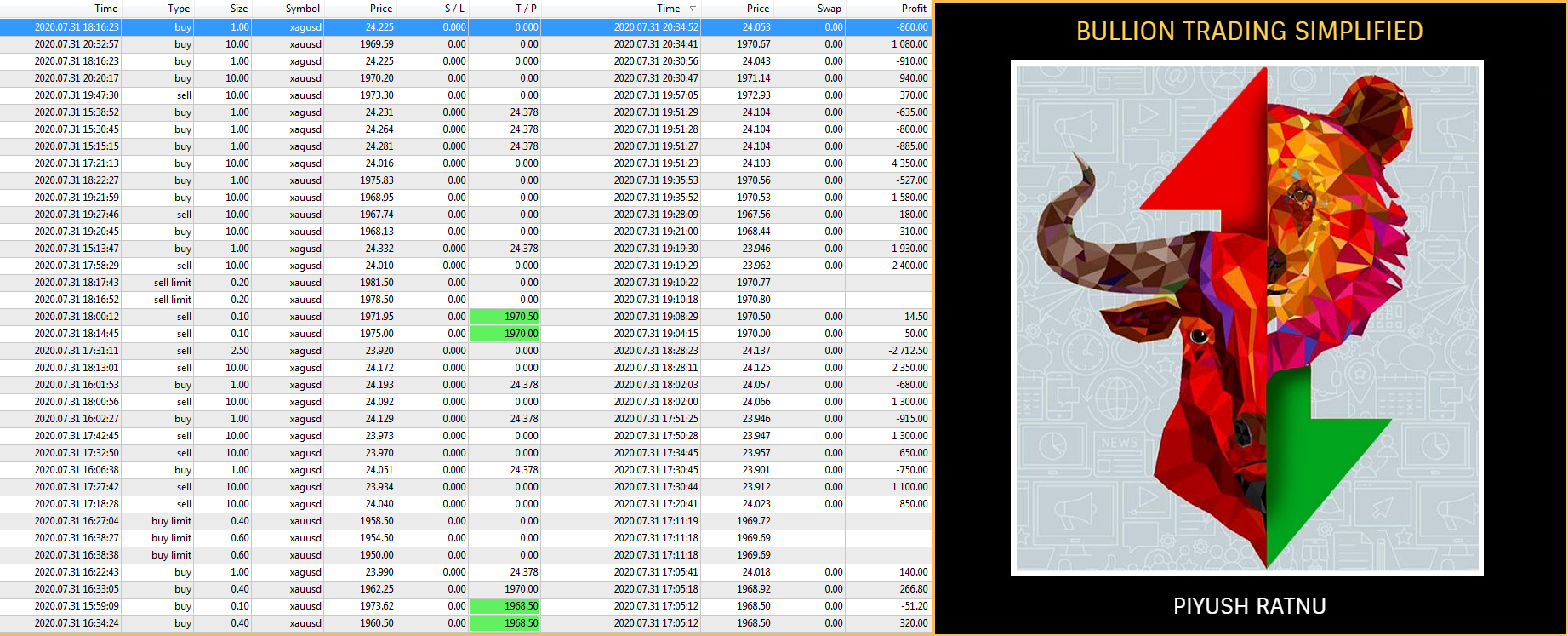

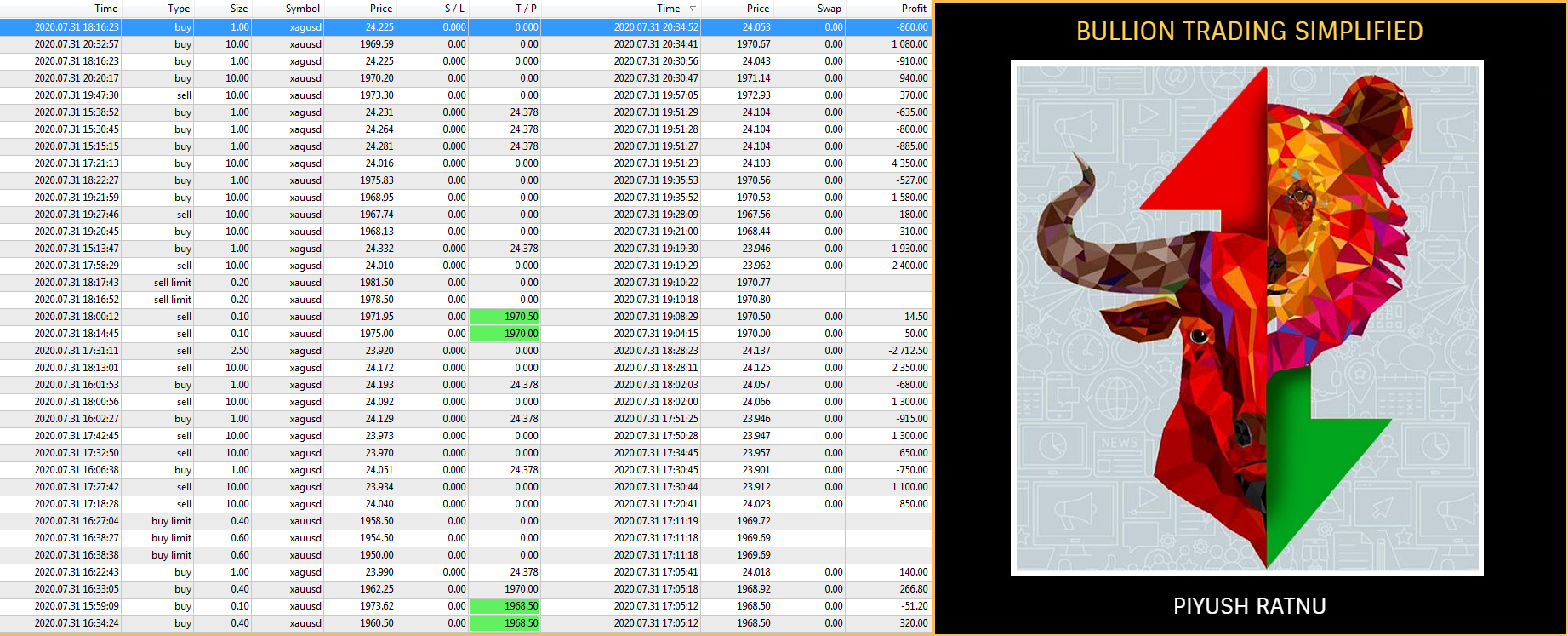

Trading Performance: 31 July 2020 | XAUUSD XAGUSD AUDUSD EURUSD | #Forex #Bullion

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Piyush Lalsingh Ratnu

Top Forex Trading Tips For Beginners

We have covered a lot of information in this article so, we’d like to conclude with an overview of our top Forex trading tips for beginners. If you take anything from this article, it should be these following tips:

Do Your Research

Generally speaking, the less you know, the more at risk you are, and there is no limit to how much you can know or risk. An endless amount of information is available on the internet free of charge, like:

Educational videos on Forex exchange trading for beginners

Educational articles and tutorials

Forex trading seminars for beginners and professionals

Forex trading webinars

If you want to know how to learn Forex trading as a beginner, simply read as much as you possibly can, and always analyse what you read – don’t just take information in good faith.

Test on a Demo Account or With Simulation Software

Every broker offers a demo account – whether you are a beginner or not, test every new strategy there first. Keep going until the results are conclusive and you are confident in what you are testing. Only then should you open a live account and use your strategy in the smallest volume trades available. Be sure to treat your demo account trades as if they were real trades.

Don’t Overcomplicate Things

Don’t overload your charts with indicators, or your strategy with handles or switches. The more complicated your trading strategy is, the harder it will be to follow, and the less likely it is to be effective. To find out how well a strategy performs on average in different markets, you need to carry out the necessary back testing and research.

Keeping it simple can be a real challenge, especially considering the multitude of supporting tools you can apply to your charts. Just remember – it’s not about the amount of tools at your disposal, but it is about being able to use a few tools in an effective way.

Be Careful in Volatile Markets

Volatility is what keeps your trading activity moving. However, if you’re not careful it can also destroy it. When volatile, the market moves sideways, which makes spreads grow and your orders slip. As a beginner Forex trader, you need to accept that once you are in the market, anything can potentially happen, and it can completely negate your strategy.

For example, the crisis with the Swiss Franc in January 2015 ended business for many traders and brokers within hours of its occurrence.

The Trend Is Your Friend

Whether you are a beginner trader or a pro, it is best to trade with what you see and not what you think. For example, you might think that the US dollar is overvalued and has been overvalued for too long. Naturally, you will want to short and you might be right eventually. But if the price is moving up, it does not matter what you think. In fact, it doesn’t matter what anybody thinks – the price is moving up and you should be trading with the trend.

The Trade Is Open Until It’s Closed

A regular Forex trading beginner concentrates on opening a trade, but the exit point is equally important. If your trading strategy does not consider the mechanism of closing a deal, it’s not going to end well, and you’re much more likely to suffer heavy losses.

Write Everything Down

A novice Forex trader must develop the mindset of a business owner. Every business requires a business plan, constant monitoring, and regular auditing. Jumping ahead without plans and processes is a sure-fire way to fail. Starting a trading journal is an absolute must.

Everyday, be sure to write the following:

Points for further research

Reasons to open or close a trade

Your achievements and mistakes.

Keep your journal handy as a point of reference when analysing your activity. A journal ensures none of your actions are in vain. Analysis of good trades will boost your trading confidence and motivate you to push harder and go further. On the other hand, analysis of bad trades will help you to extract value and improve.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

We have covered a lot of information in this article so, we’d like to conclude with an overview of our top Forex trading tips for beginners. If you take anything from this article, it should be these following tips:

Do Your Research

Generally speaking, the less you know, the more at risk you are, and there is no limit to how much you can know or risk. An endless amount of information is available on the internet free of charge, like:

Educational videos on Forex exchange trading for beginners

Educational articles and tutorials

Forex trading seminars for beginners and professionals

Forex trading webinars

If you want to know how to learn Forex trading as a beginner, simply read as much as you possibly can, and always analyse what you read – don’t just take information in good faith.

Test on a Demo Account or With Simulation Software

Every broker offers a demo account – whether you are a beginner or not, test every new strategy there first. Keep going until the results are conclusive and you are confident in what you are testing. Only then should you open a live account and use your strategy in the smallest volume trades available. Be sure to treat your demo account trades as if they were real trades.

Don’t Overcomplicate Things

Don’t overload your charts with indicators, or your strategy with handles or switches. The more complicated your trading strategy is, the harder it will be to follow, and the less likely it is to be effective. To find out how well a strategy performs on average in different markets, you need to carry out the necessary back testing and research.

Keeping it simple can be a real challenge, especially considering the multitude of supporting tools you can apply to your charts. Just remember – it’s not about the amount of tools at your disposal, but it is about being able to use a few tools in an effective way.

Be Careful in Volatile Markets

Volatility is what keeps your trading activity moving. However, if you’re not careful it can also destroy it. When volatile, the market moves sideways, which makes spreads grow and your orders slip. As a beginner Forex trader, you need to accept that once you are in the market, anything can potentially happen, and it can completely negate your strategy.

For example, the crisis with the Swiss Franc in January 2015 ended business for many traders and brokers within hours of its occurrence.

The Trend Is Your Friend

Whether you are a beginner trader or a pro, it is best to trade with what you see and not what you think. For example, you might think that the US dollar is overvalued and has been overvalued for too long. Naturally, you will want to short and you might be right eventually. But if the price is moving up, it does not matter what you think. In fact, it doesn’t matter what anybody thinks – the price is moving up and you should be trading with the trend.

The Trade Is Open Until It’s Closed

A regular Forex trading beginner concentrates on opening a trade, but the exit point is equally important. If your trading strategy does not consider the mechanism of closing a deal, it’s not going to end well, and you’re much more likely to suffer heavy losses.

Write Everything Down

A novice Forex trader must develop the mindset of a business owner. Every business requires a business plan, constant monitoring, and regular auditing. Jumping ahead without plans and processes is a sure-fire way to fail. Starting a trading journal is an absolute must.

Everyday, be sure to write the following:

Points for further research

Reasons to open or close a trade

Your achievements and mistakes.

Keep your journal handy as a point of reference when analysing your activity. A journal ensures none of your actions are in vain. Analysis of good trades will boost your trading confidence and motivate you to push harder and go further. On the other hand, analysis of bad trades will help you to extract value and improve.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Piyush Lalsingh Ratnu

6 Popular Forex Strategies

Now you know the what, the why, and the how of Forex trading. The next step to to create a trading strategy. For beginner traders, the ideal scenario is to follow a simple and effective strategy, which will allow you to confirm what works and what doesn’t work, without too many variables confusing things.

Fortunately, banks, corporations, investors, and speculators have all been trading the markets for decades, which means there is already a wide range of Forex trading strategies to choose from. These include:

Forex scalping: Scalping is a trading strategy that involves buying and selling currency pairs in very short increments – usually anywhere between a few seconds and a few hours. This is a very hands-on strategy that involves making a large number of small profits until those profits add up.

Intraday trading:Forex intraday trading is a more conservative approach than scalping, with trades focusing on daily price trends. Trades may be open anywhere between one to four days, but usually focus on the major sessions for each Forex market.

Swing trading: Swing trading is a medium-term trading approach that focuses on larger price movements than scalping or intraday trading. This means that traders can set up a trade and check in on it within a few hours, or a few days, rather than having to constantly sit in front of their trading platform, making it a good option for people trading alongside a day job.

Forex hedging:Hedging is a risk management technique where a trader can offset potential losses by taking opposite positions in the market. In Forex, this can be done by taking two opposite positions on the same currency pair (e.g. by opening a long trade and a short trade on the GBP/USD currency pair), or by taking opposite positions on two correlated currencies.

The Forex martingale strategy:The martingale strategy is a trading strategy whereby, for every losing trade, you double the investment made in future trades in order to recover your losses, as soon as you make a successful trade. For instance, if you invest 1 EUR on your first trade and lose, on the next trade you would invest 2 EUR, then 4 EUR , then 8 EUR and so on. Please note that this strategy is extremely risky by nature and not suitable for beginners!

The Forex grid strategy: The grid strategy is one that uses buy stop orders and sell stop orders to profit on natural market movements. These orders are usually placed at 10 pip intervals and, by having these stop orders put in place, a trader can then automate this trading strategy.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

Now you know the what, the why, and the how of Forex trading. The next step to to create a trading strategy. For beginner traders, the ideal scenario is to follow a simple and effective strategy, which will allow you to confirm what works and what doesn’t work, without too many variables confusing things.

Fortunately, banks, corporations, investors, and speculators have all been trading the markets for decades, which means there is already a wide range of Forex trading strategies to choose from. These include:

Forex scalping: Scalping is a trading strategy that involves buying and selling currency pairs in very short increments – usually anywhere between a few seconds and a few hours. This is a very hands-on strategy that involves making a large number of small profits until those profits add up.

Intraday trading:Forex intraday trading is a more conservative approach than scalping, with trades focusing on daily price trends. Trades may be open anywhere between one to four days, but usually focus on the major sessions for each Forex market.

Swing trading: Swing trading is a medium-term trading approach that focuses on larger price movements than scalping or intraday trading. This means that traders can set up a trade and check in on it within a few hours, or a few days, rather than having to constantly sit in front of their trading platform, making it a good option for people trading alongside a day job.

Forex hedging:Hedging is a risk management technique where a trader can offset potential losses by taking opposite positions in the market. In Forex, this can be done by taking two opposite positions on the same currency pair (e.g. by opening a long trade and a short trade on the GBP/USD currency pair), or by taking opposite positions on two correlated currencies.

The Forex martingale strategy:The martingale strategy is a trading strategy whereby, for every losing trade, you double the investment made in future trades in order to recover your losses, as soon as you make a successful trade. For instance, if you invest 1 EUR on your first trade and lose, on the next trade you would invest 2 EUR, then 4 EUR , then 8 EUR and so on. Please note that this strategy is extremely risky by nature and not suitable for beginners!

The Forex grid strategy: The grid strategy is one that uses buy stop orders and sell stop orders to profit on natural market movements. These orders are usually placed at 10 pip intervals and, by having these stop orders put in place, a trader can then automate this trading strategy.

For more details/queries, email at piyushratnu@gmail.com

#PiyushRatnu | #Forex | #Bullion | #Trading | #Algorithms

: