Claws and Horns / Profile

Claws and Horns

News of the day. 24.02.2017

RBA Deputy Governor Lowe Speech. Australia, 00:30 (GMT+2)

RBA Deputy Governor Lowe Speech is due at 00:30 (GMT+2). His comments on the current economic situation in Australia may lead to growing volatility of AUD.

Consumer Price Index. Canada, 15:30 (GMT+2)

Consumer Price Index is due at 15:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 0.3% in January from -0.2% a month earlier. The indicator shows the changes in price of the basic basket of goods. High values of the indicator can lead to the rise of CAD rate. Growth of this indicator strengthens the CAD, decrease weakens the CAD.

New Home Sales. USA, 17:00 (GMT+2)

The data on new home sales is due on 17:00 (GMT+2). It is forecasted that the indicator will rise to 6.3% in January compared to -10.4% a month earlier. This is a very important indicator in terms of US real estate market. Its growth shows that the overall state of economy is improving. Higher values of the indicator influences the US dollar positively. Lower values have negative impact on the USD.

RBA Deputy Governor Lowe Speech. Australia, 00:30 (GMT+2)

RBA Deputy Governor Lowe Speech is due at 00:30 (GMT+2). His comments on the current economic situation in Australia may lead to growing volatility of AUD.

Consumer Price Index. Canada, 15:30 (GMT+2)

Consumer Price Index is due at 15:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 0.3% in January from -0.2% a month earlier. The indicator shows the changes in price of the basic basket of goods. High values of the indicator can lead to the rise of CAD rate. Growth of this indicator strengthens the CAD, decrease weakens the CAD.

New Home Sales. USA, 17:00 (GMT+2)

The data on new home sales is due on 17:00 (GMT+2). It is forecasted that the indicator will rise to 6.3% in January compared to -10.4% a month earlier. This is a very important indicator in terms of US real estate market. Its growth shows that the overall state of economy is improving. Higher values of the indicator influences the US dollar positively. Lower values have negative impact on the USD.

Claws and Horns

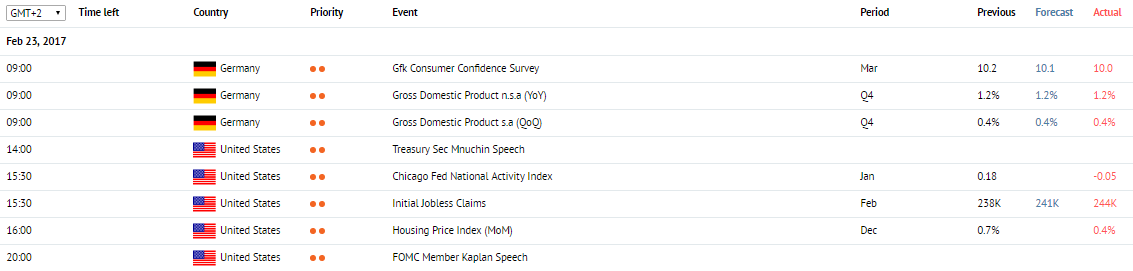

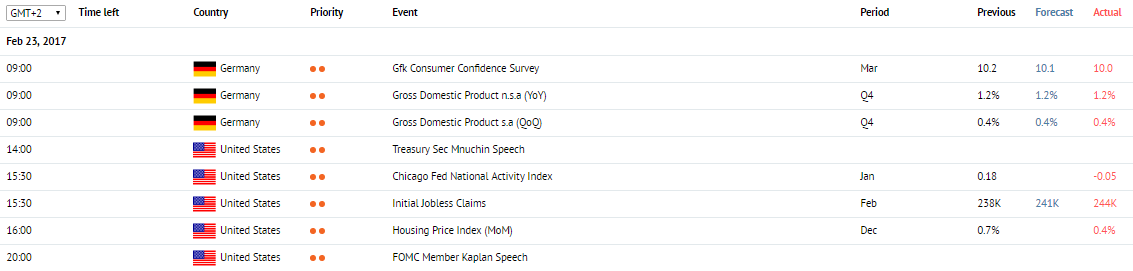

News of the day. 23.02.2017

Gross Domestic Product. Germany, 09:00 (GMT+2)

The data on Gross Domestic Product in Germany is due at 09:00 (GMT+2). It is expected that in Q4, the indicator will remain unchanged at the level of 0.4%. The indicator shows market value of all final goods and services produced in Germany in a year. Higher results induce euro rate increase. Lower results, on the contrary, call for decreasing euro rate.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The weekly data on Initial Jobless Claims in the USA is due at 15:30 (GMT+2). It is forecasted that the previous week indicator will grow from 239K to 241K. This indicator shows the amount of new initial jobless claims, is published weekly on Thursdays, and gives a perspective of the NonFarm Payrolls indicator. The decrease of the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Gross Domestic Product. Germany, 09:00 (GMT+2)

The data on Gross Domestic Product in Germany is due at 09:00 (GMT+2). It is expected that in Q4, the indicator will remain unchanged at the level of 0.4%. The indicator shows market value of all final goods and services produced in Germany in a year. Higher results induce euro rate increase. Lower results, on the contrary, call for decreasing euro rate.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The weekly data on Initial Jobless Claims in the USA is due at 15:30 (GMT+2). It is forecasted that the previous week indicator will grow from 239K to 241K. This indicator shows the amount of new initial jobless claims, is published weekly on Thursdays, and gives a perspective of the NonFarm Payrolls indicator. The decrease of the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Claws and Horns

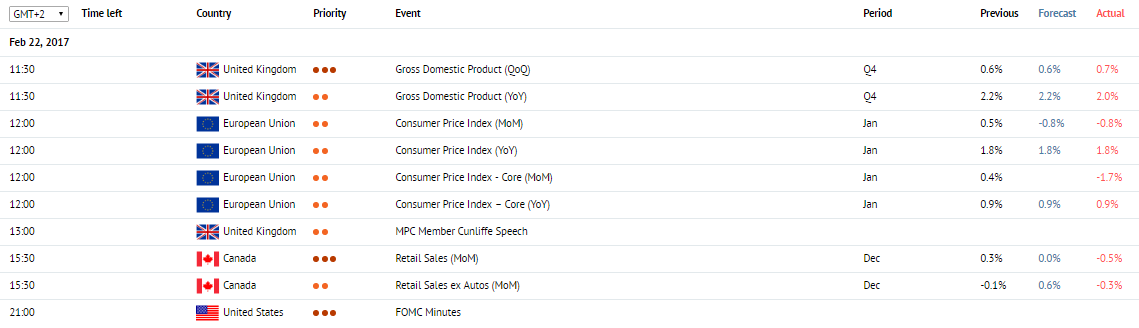

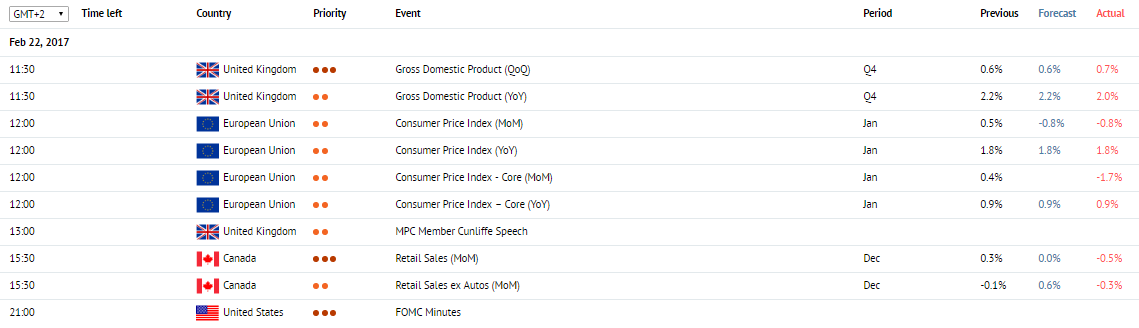

News of the day. 22.02.2017

Gross Domestic Product. UK, 11:30 am (GMT+2)

Data on the Gross Domestic Product for the 4 quarter of 2016 is due at 11:30 am (GMT+2). On a year-to-year basis, the index is expected to remain unchanged at 2.2%. On a quarter-to-quarter basis, the index will remain at 0.6%.

Consumer Price Index. EU, 12:00 pm (GMT+2)

Data on the Consumer Price Index for January is due at 12:00 pm (GMT+2). On a year-to-year basis, the index is expected to remain unchanged at 1.8%. Over the month, it is expected to fall from 0.5% to -0.8%. The index is the key indicator of inflation in the eurozone. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Retail Sales. Canada, 3:30 pm (GMT+2)

Data on Retail Sales for December 2016 is due at 3:30 pm (GMT+2). On a month-to-month basis, the index will fall from 0.2% to 0.1%. Represents the change in the volume of retail sales. A growth in the index is positive for the national economy and strengthens the CAD. A fall in the index weakens the CAD.

FOMC Minutes. US, 9:00 pm (GMT+2)

The FOMC Minutes are due at 9:00 pm (GMT+2). The committee gives their opinion on current economic conditions in the US and decides on the direction of monetary policy.

Gross Domestic Product. UK, 11:30 am (GMT+2)

Data on the Gross Domestic Product for the 4 quarter of 2016 is due at 11:30 am (GMT+2). On a year-to-year basis, the index is expected to remain unchanged at 2.2%. On a quarter-to-quarter basis, the index will remain at 0.6%.

Consumer Price Index. EU, 12:00 pm (GMT+2)

Data on the Consumer Price Index for January is due at 12:00 pm (GMT+2). On a year-to-year basis, the index is expected to remain unchanged at 1.8%. Over the month, it is expected to fall from 0.5% to -0.8%. The index is the key indicator of inflation in the eurozone. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Retail Sales. Canada, 3:30 pm (GMT+2)

Data on Retail Sales for December 2016 is due at 3:30 pm (GMT+2). On a month-to-month basis, the index will fall from 0.2% to 0.1%. Represents the change in the volume of retail sales. A growth in the index is positive for the national economy and strengthens the CAD. A fall in the index weakens the CAD.

FOMC Minutes. US, 9:00 pm (GMT+2)

The FOMC Minutes are due at 9:00 pm (GMT+2). The committee gives their opinion on current economic conditions in the US and decides on the direction of monetary policy.

Claws and Horns

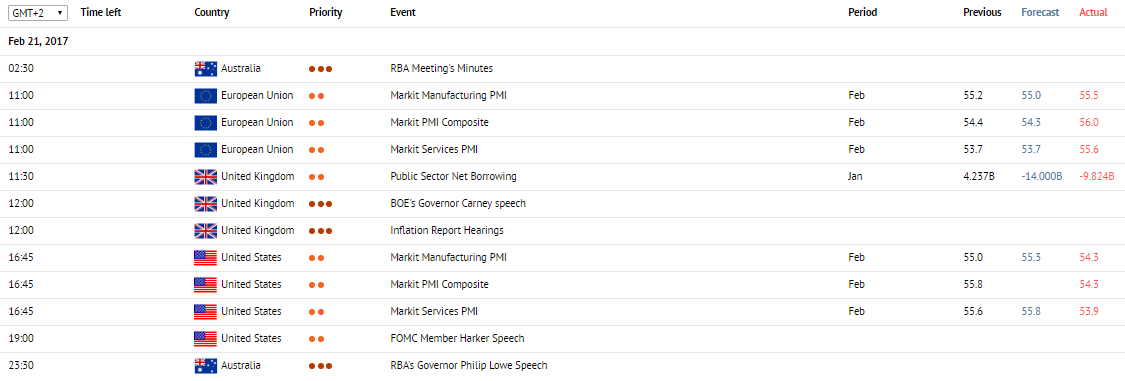

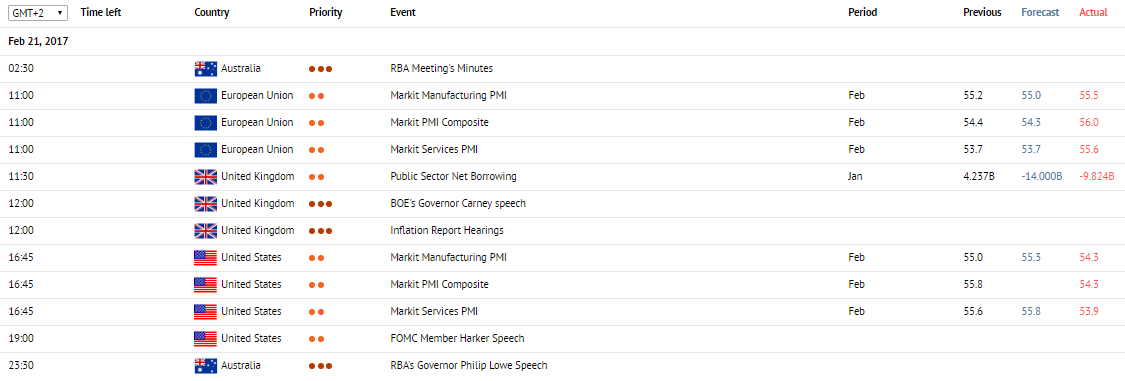

News of the day. 21.02.2017

RBA Meeting's Minutes. Australia, 02:30 (GMT+2)

The RBA Meeting's Minutes is due to 02:30 (GMT+2) in Australia. Minutes of the RBA monetary policy meetings are released two weeks after each meeting. The publication contains commentaries regarding the most recent decisions as well as information about the votes of each individual member of the Board.

Markit Services PMI. EU, 11:00 (GMT+2)

The Markit Services PMI is due at 11:00 (GMT+2) in the European Union. The index is expected to grow to 53.8 points in February from 53.7 in the previous month. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the EUR. A reading below 50, on the contrary, is perceived negative and weakens the EUR.

Public Sector Net Borrowing. United Kingdom, 11:30 (GMT+2)

The Public Sector Net Borrowing data are sue at 11:30 (GMT+2) in the UK. The index represents the government debt. Positive values indicate a budget deficit and weaken the GBP. Negative values denote a budget surplus and strengthen the GBP.

Markit Services PMI. USA, 16:45 (GMT+2)

The Markit Services PMI is due at 16:45 (GMT+2) in the USA. The index is expected to grow to 55.7 points in February from 55.6 in the previous month. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

RBA Meeting's Minutes. Australia, 02:30 (GMT+2)

The RBA Meeting's Minutes is due to 02:30 (GMT+2) in Australia. Minutes of the RBA monetary policy meetings are released two weeks after each meeting. The publication contains commentaries regarding the most recent decisions as well as information about the votes of each individual member of the Board.

Markit Services PMI. EU, 11:00 (GMT+2)

The Markit Services PMI is due at 11:00 (GMT+2) in the European Union. The index is expected to grow to 53.8 points in February from 53.7 in the previous month. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the EUR. A reading below 50, on the contrary, is perceived negative and weakens the EUR.

Public Sector Net Borrowing. United Kingdom, 11:30 (GMT+2)

The Public Sector Net Borrowing data are sue at 11:30 (GMT+2) in the UK. The index represents the government debt. Positive values indicate a budget deficit and weaken the GBP. Negative values denote a budget surplus and strengthen the GBP.

Markit Services PMI. USA, 16:45 (GMT+2)

The Markit Services PMI is due at 16:45 (GMT+2) in the USA. The index is expected to grow to 55.7 points in February from 55.6 in the previous month. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Claws and Horns

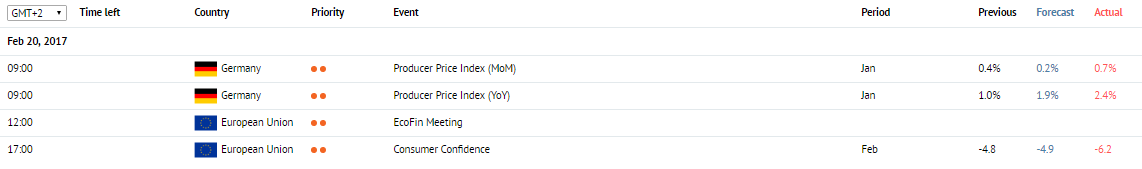

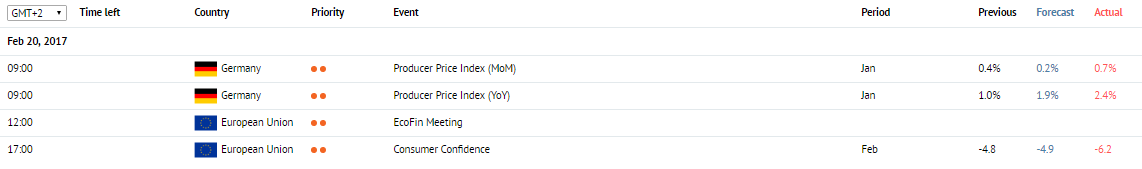

News of the day. 20.02.2017

Producer Price Index. Germany, 09:00 (GMT+2)

At 09:00 (GMT+2) producer price index will be published in Germany. It is predicted that the rate will fall to 0.2% in January from 0.4% a month earlier. The index tracks the performance of commodity prices in wholesale scale. The growth of index, in general, strengthen EUR, the decrease weakens it.

Consumer Confidence. EU, 17:00 (GMT+2)

At 17:00 (GMT+2), data on the level of consumer confidence in the Eurozone. It is expected that the rate will remain unchanged at -4.9 points. This indicator reflects the confidence of consumers in the current economic situation. Higher values are considered to be a positive signal and support the exchange rate of EUR. Values lower than expected weaken EUR.

Producer Price Index. Germany, 09:00 (GMT+2)

At 09:00 (GMT+2) producer price index will be published in Germany. It is predicted that the rate will fall to 0.2% in January from 0.4% a month earlier. The index tracks the performance of commodity prices in wholesale scale. The growth of index, in general, strengthen EUR, the decrease weakens it.

Consumer Confidence. EU, 17:00 (GMT+2)

At 17:00 (GMT+2), data on the level of consumer confidence in the Eurozone. It is expected that the rate will remain unchanged at -4.9 points. This indicator reflects the confidence of consumers in the current economic situation. Higher values are considered to be a positive signal and support the exchange rate of EUR. Values lower than expected weaken EUR.

Claws and Horns

News of the day. 17.02.2017

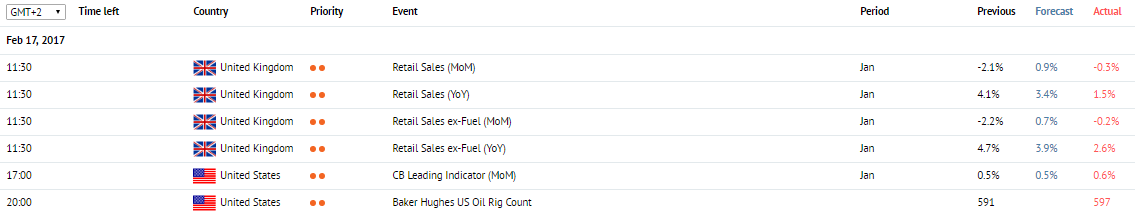

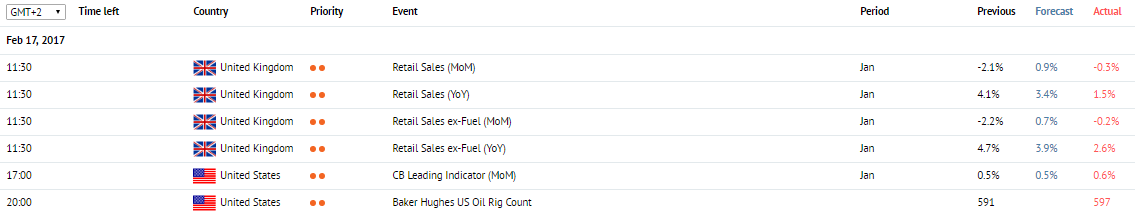

Retail Sales. United Kingdom, 11:30 (GMT+2)

The Retail Sales data are due at 11:30 (GMT+2) in the UK. The MoM index is expected to grow to 1.0% in January from - 1.9% in the previous months. The YoY index is expected to lower to 3.5% in January from 4.3% in the previous month. The index represents the total value of all receipts from retail shops in the country. It characterizes the level of consumer expenditure and demand. Growth in retail sales is an important factor for the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

Baker Hughes US Oil Rig Count. USA, 20:00 (GMT+2)

The Baker Hughes US Oil Rig Count is due at 20:00 (GMT+2) in the USA. The growth of the number can press the oil prices, and the lowering of the number can support it.

Retail Sales. United Kingdom, 11:30 (GMT+2)

The Retail Sales data are due at 11:30 (GMT+2) in the UK. The MoM index is expected to grow to 1.0% in January from - 1.9% in the previous months. The YoY index is expected to lower to 3.5% in January from 4.3% in the previous month. The index represents the total value of all receipts from retail shops in the country. It characterizes the level of consumer expenditure and demand. Growth in retail sales is an important factor for the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

Baker Hughes US Oil Rig Count. USA, 20:00 (GMT+2)

The Baker Hughes US Oil Rig Count is due at 20:00 (GMT+2) in the USA. The growth of the number can press the oil prices, and the lowering of the number can support it.

Claws and Horns

News of the day. 16.02.2017

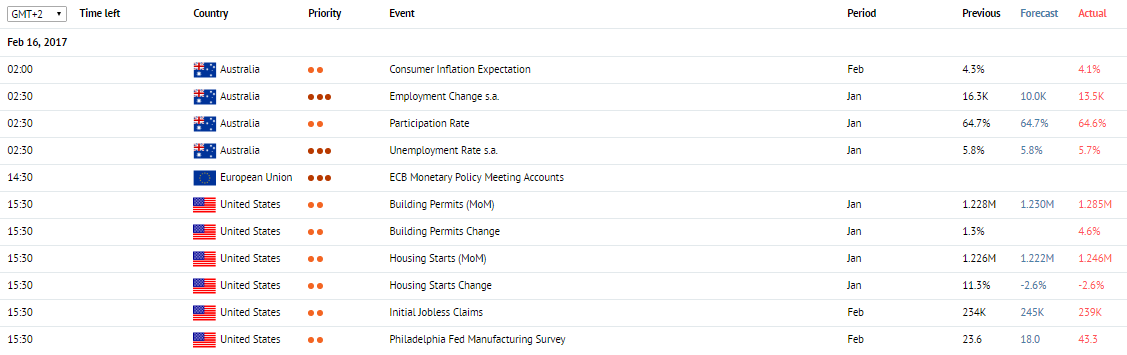

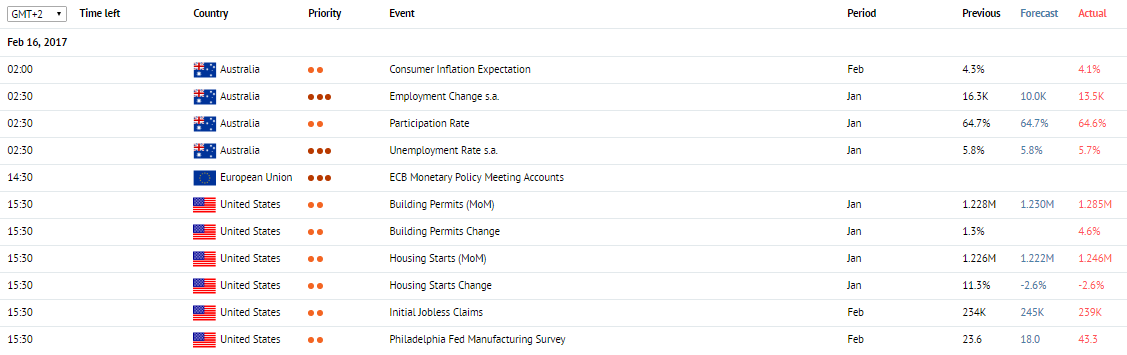

Unemployment Rate s.a. Australia, 02:30 (GMT+2)

The January Unemployment Rate s.a. is due at 02:30 (GMT+2) in Australia. The index is expected to stay on the same level of 5.8%. The data on unemployment rate represents a percentage of the total labor force that is currently unemployed. A growth in the indicator is considered a negative factor for the country’s economy and weakens the AUD. A fall in the indicator suggests economic growth and strengthens the AUD.

ECB Monetary Policy Meeting Accounts. EU, 14:30 (GMT+2)

The ECB Monetary Policy Meeting Accounts is due at 14:30 (GMT+2). Account of the monetary policy meeting contains an overview of the current economic situation, commentaries on the recent monetary policy decisions and macroeconomic forecasts.

Continuing Jobless Claims. USA, 15:30 (GMT+2)

The Continuing Jobless Claims index is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 245K WoW from 234K in the previous week. The index refers to the number of unemployed receiving unemployment benefits and is published weekly on Tuesdays. It predicts the nonfarm payrolls value. A growth in the index weakens the USD. A fall in the index strengthens the USD.

Unemployment Rate s.a. Australia, 02:30 (GMT+2)

The January Unemployment Rate s.a. is due at 02:30 (GMT+2) in Australia. The index is expected to stay on the same level of 5.8%. The data on unemployment rate represents a percentage of the total labor force that is currently unemployed. A growth in the indicator is considered a negative factor for the country’s economy and weakens the AUD. A fall in the indicator suggests economic growth and strengthens the AUD.

ECB Monetary Policy Meeting Accounts. EU, 14:30 (GMT+2)

The ECB Monetary Policy Meeting Accounts is due at 14:30 (GMT+2). Account of the monetary policy meeting contains an overview of the current economic situation, commentaries on the recent monetary policy decisions and macroeconomic forecasts.

Continuing Jobless Claims. USA, 15:30 (GMT+2)

The Continuing Jobless Claims index is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 245K WoW from 234K in the previous week. The index refers to the number of unemployed receiving unemployment benefits and is published weekly on Tuesdays. It predicts the nonfarm payrolls value. A growth in the index weakens the USD. A fall in the index strengthens the USD.

Claws and Horns

News of the day. 15.02.2017

Non-monetary policy's ECB meeting. EU, 10:00 (GMT+2)

The Non-monetary policy's ECB meeting is due at 10:00 (GMT+2).

Trade Balance. EU, 12:00 (GMT+2)

The December Trade Balance data are due at 12:00 (GMT+2) in the EU. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Consumer Price Index. USA, 15:30 (GMT+2)

The January Consumer Price Index is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 2.4% YoY in January from 2.1% in the previous month. The MoM value is expected to stay on the same level of 0.3%. The index is the key indicator of inflation in the country. It represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

Retail Sales. USA, 15:30 (GMT+2)

The Retail Sales data are due at 15:30 (GMT+2) in the USA. The index is expected to lower to 0.1% in January from 0.6% in the previous month. The value indicates consumer spending. It represents the change in the volume of retail sales. A growth in the index is the positive factor for the economy and strengthens the USD. A fall in the index weakens the USD.

Industrial Production. USA, 16:15 (GMT+2)

The Industrial Production data are sue at 16:15 (GMT+2) in the USA. The index is expected to lower to 0.1% MoM in January from 0.8% in the previous month.

Fed's Yellen Speech. USA, 17:00 (GMT+2)

The Fed's Yellen Speech is due at 17:00 (GMT+2) in the USA. Janet Yellen is the Chair of the Fed since 2014. The commentaries can lead to the growth of the volatility in the market.

Non-monetary policy's ECB meeting. EU, 10:00 (GMT+2)

The Non-monetary policy's ECB meeting is due at 10:00 (GMT+2).

Trade Balance. EU, 12:00 (GMT+2)

The December Trade Balance data are due at 12:00 (GMT+2) in the EU. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Consumer Price Index. USA, 15:30 (GMT+2)

The January Consumer Price Index is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 2.4% YoY in January from 2.1% in the previous month. The MoM value is expected to stay on the same level of 0.3%. The index is the key indicator of inflation in the country. It represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

Retail Sales. USA, 15:30 (GMT+2)

The Retail Sales data are due at 15:30 (GMT+2) in the USA. The index is expected to lower to 0.1% in January from 0.6% in the previous month. The value indicates consumer spending. It represents the change in the volume of retail sales. A growth in the index is the positive factor for the economy and strengthens the USD. A fall in the index weakens the USD.

Industrial Production. USA, 16:15 (GMT+2)

The Industrial Production data are sue at 16:15 (GMT+2) in the USA. The index is expected to lower to 0.1% MoM in January from 0.8% in the previous month.

Fed's Yellen Speech. USA, 17:00 (GMT+2)

The Fed's Yellen Speech is due at 17:00 (GMT+2) in the USA. Janet Yellen is the Chair of the Fed since 2014. The commentaries can lead to the growth of the volatility in the market.

Claws and Horns

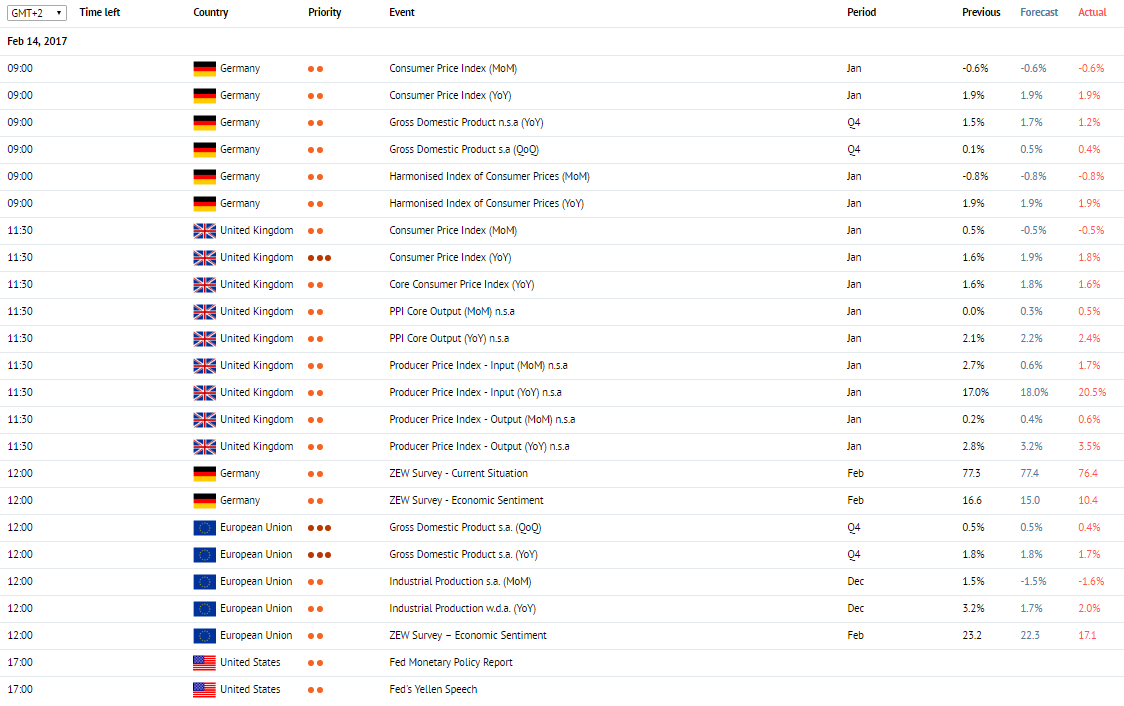

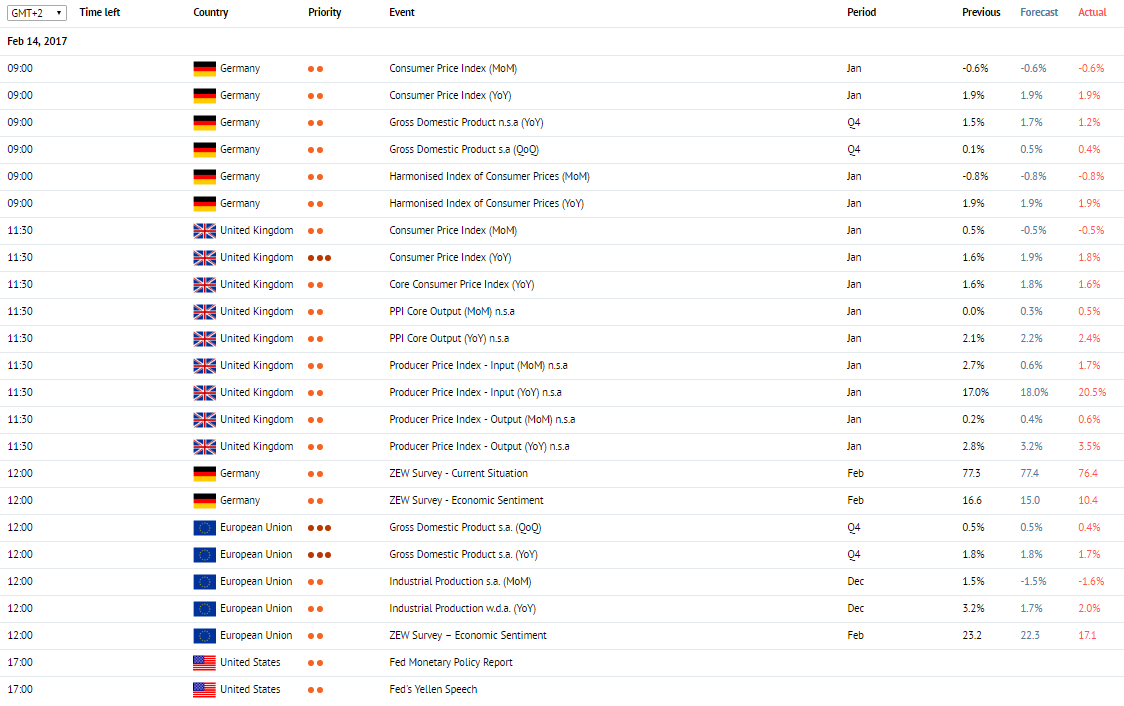

News of the day. 14.02.2017

Gross Domestic Product. Germany, 09:00 (GMT+2)

The Gross Domestic Product data are due at 09:00 (GMT+2) in Germany. Te QoQ index is expected to grow to 0.5% in the fourth quarter from 0.2% in the previous month. The YoY index is expected to grow to 1.7% in the fourth quarter from 1.5% in the previous period. The Gross Domestic Product released by the Statistisches Bundesamt Deutschland is a measure of the total value of all goods and services produced by Germany. The GDP is considered as a broad measure of the German economic activity and health. A high reading or a better than expected number has a positive effect on the EUR, while a falling trend is seen as negative.

Consumer Price Index. United Kingdom, 11:30 (GMT+2)

The Consumer Price Index is due at 11:30 (GMT+2) in the UK. The index is expected to be - 0.5% MoM in January against 0.5% MoM in the previous month. The YoY value is expected to grow to 1.9% in January from 1.6% in the previous month. The index is one of the key indicators of inflation in the country. It represents the change in prices for goods and services. A high reading strengthens the GBP. A low reading weakens the GBP.

Gross Domestic Product. EU, 12:00 (GMT+2)

The 4 quarter Gross Domestic Product data are due at 12:00 (GMT+2) in the European Union. The index is expected to stay on the same level of 0.5%. The indicator represents the value of all goods and services produced by the Eurozone in a time period. A high reading strengthens the EUR. A low reading weakens the EUR.

ZEW Survey - Economic Sentiment. Germany, 12:00 (GMT+2)

ZEW Survey Economic Sentiment is due at 12:00 (GMT+2) in Germany. The index is expected to lower to 15.0 points in February from 16.6 points in the previous month. The Economic Sentiment measures the institutional investor sentiment, reflecting the difference between the share of investors that are optimistic and the share of analysts that are pessimistic. Generally speaking, an optimistic view is considered as positive (or bullish) for the EUR, whereas a pessimistic view is considered as negative (or bearish).

Industrial Production. EU, 12:00 (GMT+2)

The Industrial Production data are due at 12:00 (GMT+2). The MoM index is expected to be - 1.5% in December against 1.5% in the previous month. The YoY value is expected to lower to 1.7% in December from 3.2% in the previous month. Data on industrial production represents changes in industrial output and is considered as one of the major indicators of the state of the economy. A high reading strengthens the EUR. A low reading weakens the EUR.

Fed's Yellen Speech. USA, 17:00 (GMT+2)

The Chair of the USA FRS Janet Yellen Speech is due at 17:00 (GMT+2). Yellen will comment the current economical state and answer the Congressmen questions. The Speech can cause a high volatility in the market.

Gross Domestic Product. Germany, 09:00 (GMT+2)

The Gross Domestic Product data are due at 09:00 (GMT+2) in Germany. Te QoQ index is expected to grow to 0.5% in the fourth quarter from 0.2% in the previous month. The YoY index is expected to grow to 1.7% in the fourth quarter from 1.5% in the previous period. The Gross Domestic Product released by the Statistisches Bundesamt Deutschland is a measure of the total value of all goods and services produced by Germany. The GDP is considered as a broad measure of the German economic activity and health. A high reading or a better than expected number has a positive effect on the EUR, while a falling trend is seen as negative.

Consumer Price Index. United Kingdom, 11:30 (GMT+2)

The Consumer Price Index is due at 11:30 (GMT+2) in the UK. The index is expected to be - 0.5% MoM in January against 0.5% MoM in the previous month. The YoY value is expected to grow to 1.9% in January from 1.6% in the previous month. The index is one of the key indicators of inflation in the country. It represents the change in prices for goods and services. A high reading strengthens the GBP. A low reading weakens the GBP.

Gross Domestic Product. EU, 12:00 (GMT+2)

The 4 quarter Gross Domestic Product data are due at 12:00 (GMT+2) in the European Union. The index is expected to stay on the same level of 0.5%. The indicator represents the value of all goods and services produced by the Eurozone in a time period. A high reading strengthens the EUR. A low reading weakens the EUR.

ZEW Survey - Economic Sentiment. Germany, 12:00 (GMT+2)

ZEW Survey Economic Sentiment is due at 12:00 (GMT+2) in Germany. The index is expected to lower to 15.0 points in February from 16.6 points in the previous month. The Economic Sentiment measures the institutional investor sentiment, reflecting the difference between the share of investors that are optimistic and the share of analysts that are pessimistic. Generally speaking, an optimistic view is considered as positive (or bullish) for the EUR, whereas a pessimistic view is considered as negative (or bearish).

Industrial Production. EU, 12:00 (GMT+2)

The Industrial Production data are due at 12:00 (GMT+2). The MoM index is expected to be - 1.5% in December against 1.5% in the previous month. The YoY value is expected to lower to 1.7% in December from 3.2% in the previous month. Data on industrial production represents changes in industrial output and is considered as one of the major indicators of the state of the economy. A high reading strengthens the EUR. A low reading weakens the EUR.

Fed's Yellen Speech. USA, 17:00 (GMT+2)

The Chair of the USA FRS Janet Yellen Speech is due at 17:00 (GMT+2). Yellen will comment the current economical state and answer the Congressmen questions. The Speech can cause a high volatility in the market.

Claws and Horns

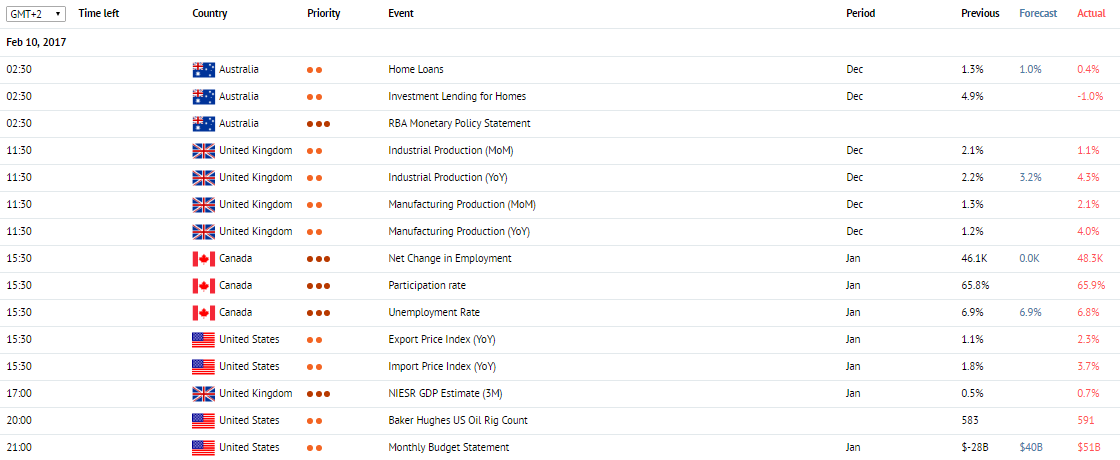

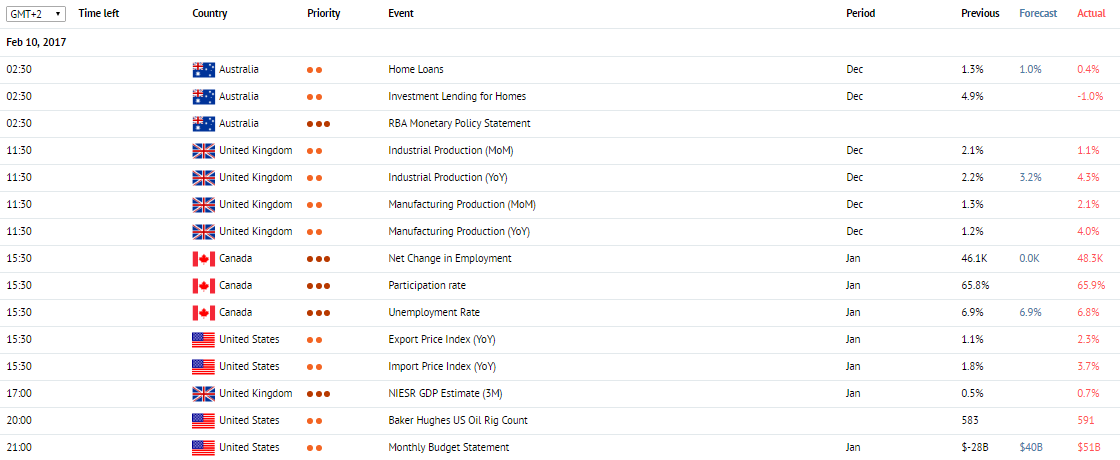

News of the day. 10.02.2017

RBA Monetary Policy Statement. Australia, 02:30 (GMT+2)

The Reserve Bank of Australia Monetary Policy Statement is due at 02:30 (GMT+2). A statement on monetary policy, released by the Reserve Bank of Australia, contains an overview of current economic conditions as well as factors which have lead to certain monetary policy stance adopted by the central bank. Commentaries have an impact on future interest rate decision

Industrial Production. United Kingdom, 11:30 (GMT+2)

The Industrial Production data are due at 11:30 (GMT+2) in the UK. The MoM index is expected to lower to 0.2% in December from 2.1% in the previous month. The YoY index is expected to grow to 3.2% in December from 2.0% in the previous month. The index represents industrial output in the UK. It is one of the major indicators of the state of the national economy. The index includes manufacturing, mining and utilities. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Net Change in Employment. Canada, 15:30 (GMT+2)

The Net Change in Employment data are due at 15:30 (GMT+2) in Canada. The value is expected to lower to -5K in January from 53.7K in the previous month. Represents the change in the number of employed. A growth in the index indicates economic growth and strengthens the CAD. A fall in the index weakens the CAD.

NIESR GDP Estimate. United Kingdom, 17:00 (GMT+2)

The NIESR GDP Estimate is due at 17:00 (GMT+2) in the UK. The report is published by the National Institute for Economic and Social Research. It tracks the UK economy growth for the last three months. The report has the potential to influence monetary policy in the country. A high reading strengthens the GBP. A low reading weakens the GBP.

Monthly Budget Statement. USA, 21:00 (GMT+2)

The Monthly Budget Statement is due at 21:00 (GMT+2) in the USA. It represents the difference between the government revenue and expenditures. The budget deficit appears when expenditures exceed revenues. When the opposite happens, the budget is said to be in surplus. Positive values strengthen the USD, and negative values weaken the USD.

RBA Monetary Policy Statement. Australia, 02:30 (GMT+2)

The Reserve Bank of Australia Monetary Policy Statement is due at 02:30 (GMT+2). A statement on monetary policy, released by the Reserve Bank of Australia, contains an overview of current economic conditions as well as factors which have lead to certain monetary policy stance adopted by the central bank. Commentaries have an impact on future interest rate decision

Industrial Production. United Kingdom, 11:30 (GMT+2)

The Industrial Production data are due at 11:30 (GMT+2) in the UK. The MoM index is expected to lower to 0.2% in December from 2.1% in the previous month. The YoY index is expected to grow to 3.2% in December from 2.0% in the previous month. The index represents industrial output in the UK. It is one of the major indicators of the state of the national economy. The index includes manufacturing, mining and utilities. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Net Change in Employment. Canada, 15:30 (GMT+2)

The Net Change in Employment data are due at 15:30 (GMT+2) in Canada. The value is expected to lower to -5K in January from 53.7K in the previous month. Represents the change in the number of employed. A growth in the index indicates economic growth and strengthens the CAD. A fall in the index weakens the CAD.

NIESR GDP Estimate. United Kingdom, 17:00 (GMT+2)

The NIESR GDP Estimate is due at 17:00 (GMT+2) in the UK. The report is published by the National Institute for Economic and Social Research. It tracks the UK economy growth for the last three months. The report has the potential to influence monetary policy in the country. A high reading strengthens the GBP. A low reading weakens the GBP.

Monthly Budget Statement. USA, 21:00 (GMT+2)

The Monthly Budget Statement is due at 21:00 (GMT+2) in the USA. It represents the difference between the government revenue and expenditures. The budget deficit appears when expenditures exceed revenues. When the opposite happens, the budget is said to be in surplus. Positive values strengthen the USD, and negative values weaken the USD.

Claws and Horns

News of the day. 9.02.2017

RBNZ Governor Wheeler Speech. New Zealand, 02:10 (GMT+2)

The Head of the Reserve Bank of the New Zealand Graeme Wheeler Speech is due at 02:10 Wheeler has been the Governor of the Reserve Bank of New Zealand since September 2012. In his speech, he gives commentaries regarding current economic conditions and monetary policy in the country.

Unemployment Rate s.a. Switzerland, 08:45 (GMT+2)

The Unemployment Rate s.a (MoM) is due at 08:45 (GMT+2) in Switzerland. The index is expected to stay on the same level of 3.3% in January. The indicator represents the percentage of the total labor force of Switzerland that is currently unemployed. A growth in unemployment suggests a slowdown of the economy. A high reading weakens the CHF, while a low reading strengthens the CHF.

Trade Balance s.a. Germany, 09:00 (GMT+2)

The Trade Balance s.a. is due at 09:00 (GMT+2) is Germany. The budget surplus is expected to lower to 21.4 billion EUR in December from 21.7 billion in the previous month. The index represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values represent the balance deficit and weaken the EUR.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The Initial Jobless Claims data are due at 15:30 (GMT+2) in the USA. The value is expected to grow to 250K WoW from 246K in the previous period. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

RBNZ Governor Wheeler Speech. New Zealand, 02:10 (GMT+2)

The Head of the Reserve Bank of the New Zealand Graeme Wheeler Speech is due at 02:10 Wheeler has been the Governor of the Reserve Bank of New Zealand since September 2012. In his speech, he gives commentaries regarding current economic conditions and monetary policy in the country.

Unemployment Rate s.a. Switzerland, 08:45 (GMT+2)

The Unemployment Rate s.a (MoM) is due at 08:45 (GMT+2) in Switzerland. The index is expected to stay on the same level of 3.3% in January. The indicator represents the percentage of the total labor force of Switzerland that is currently unemployed. A growth in unemployment suggests a slowdown of the economy. A high reading weakens the CHF, while a low reading strengthens the CHF.

Trade Balance s.a. Germany, 09:00 (GMT+2)

The Trade Balance s.a. is due at 09:00 (GMT+2) is Germany. The budget surplus is expected to lower to 21.4 billion EUR in December from 21.7 billion in the previous month. The index represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values represent the balance deficit and weaken the EUR.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The Initial Jobless Claims data are due at 15:30 (GMT+2) in the USA. The value is expected to grow to 250K WoW from 246K in the previous period. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Claws and Horns

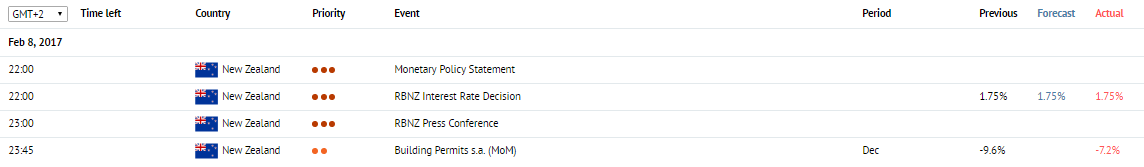

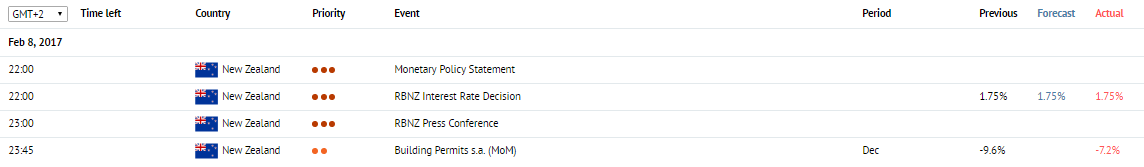

News of the day. 8.02.2017

RBNZ Interest Rate Decision. New Zealand, 22:00 (GMT+2)

The Reserve Bank of New Zealand Interest Rate Decision is due at 22:00 (GMT+2). The rate I expected to stay on the same level of 1.75%. The Reserve Bank of New Zealand announces its decision on interest rates based on current economical state and the level of inflation. A rate increase strengthens the NZD. If the rate stays on the same level or lower, the NZD is lowering.

Monetary Policy Statement. New Zealand, 22:00 (GMT+2)

The Monetary Policy Statement is due at 22:00 (GMT+2) in the New Zealand. The Monetary Policy Statement provides information on how the Reserve Bank proposes to achieve its targets, how it proposes to formulate and implement monetary policy during the next five years and how monetary policy has been implemented since the previous Monetary Policy Statement was released.

RBNZ Press Conference. New Zealand, 23:00 (GMT+2)

The Reserve Bank of New Zealand Press Conference is due at 23:00 (GMT+2). After the interest rate decision is announced, the Governor of RBNZ comments on monetary policy in the country. His commentaries can lead to an increase in volatility.

RBNZ Interest Rate Decision. New Zealand, 22:00 (GMT+2)

The Reserve Bank of New Zealand Interest Rate Decision is due at 22:00 (GMT+2). The rate I expected to stay on the same level of 1.75%. The Reserve Bank of New Zealand announces its decision on interest rates based on current economical state and the level of inflation. A rate increase strengthens the NZD. If the rate stays on the same level or lower, the NZD is lowering.

Monetary Policy Statement. New Zealand, 22:00 (GMT+2)

The Monetary Policy Statement is due at 22:00 (GMT+2) in the New Zealand. The Monetary Policy Statement provides information on how the Reserve Bank proposes to achieve its targets, how it proposes to formulate and implement monetary policy during the next five years and how monetary policy has been implemented since the previous Monetary Policy Statement was released.

RBNZ Press Conference. New Zealand, 23:00 (GMT+2)

The Reserve Bank of New Zealand Press Conference is due at 23:00 (GMT+2). After the interest rate decision is announced, the Governor of RBNZ comments on monetary policy in the country. His commentaries can lead to an increase in volatility.

Claws and Horns

News of the day. 7.02.2017

RBA Interest Rate Decision. Australia, 05:30 (GMT+2)

The Reserve Bank of Australia Interest Rate Decision is due at В 05:30 (GMT+2). The rate is expected to stay on the same level of 1.5%. The RBA makes a decision upon the interest rate based on the current economical state and the rate of the inflation. An increase in interest rates strengthens the AUD. If interest rates remain unchanged or get cut, the AUD weakens.

Trade Balance. USA, 15:30 (GMT+2)

The Trade Balance data are due at 15:30 (GMT+2) in the USA. The value is expected to decrease to -45.0 billion USD in December from -45.2 billion USD in the previous month. The value represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the USD. Negative values represent the balance deficit and weaken the USD.

Consumer Credit Change. USA, 22:00 (GMT+2)

The Consumer Credit Change data are due at 22:00 (GMT+2) in the USA. The value is expected to decrease to 20.60 billion USD in December from 24.53 billion USD in the previous month. The value represents the change in the volume of outstanding consumer credit in the US. A high reading strengthens the USD. A low reading weakens the USD. Sometimes, a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

RBA Interest Rate Decision. Australia, 05:30 (GMT+2)

The Reserve Bank of Australia Interest Rate Decision is due at В 05:30 (GMT+2). The rate is expected to stay on the same level of 1.5%. The RBA makes a decision upon the interest rate based on the current economical state and the rate of the inflation. An increase in interest rates strengthens the AUD. If interest rates remain unchanged or get cut, the AUD weakens.

Trade Balance. USA, 15:30 (GMT+2)

The Trade Balance data are due at 15:30 (GMT+2) in the USA. The value is expected to decrease to -45.0 billion USD in December from -45.2 billion USD in the previous month. The value represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the USD. Negative values represent the balance deficit and weaken the USD.

Consumer Credit Change. USA, 22:00 (GMT+2)

The Consumer Credit Change data are due at 22:00 (GMT+2) in the USA. The value is expected to decrease to 20.60 billion USD in December from 24.53 billion USD in the previous month. The value represents the change in the volume of outstanding consumer credit in the US. A high reading strengthens the USD. A low reading weakens the USD. Sometimes, a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Claws and Horns

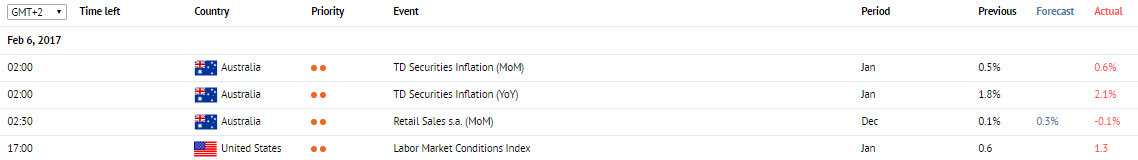

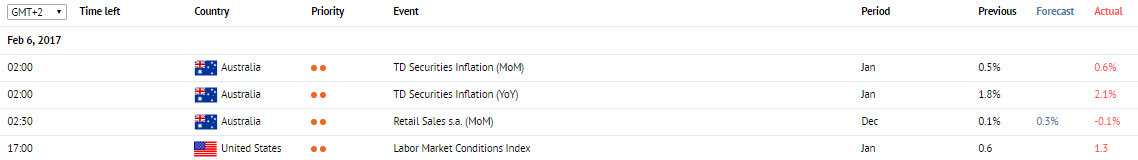

News of the day. 6.02.2017

TD Securities Inflation. Australia, 2:00 am (GMT+2)

Data on the TD Securities Inflation for January is due at 2:00 am (GMT+2). The indicator, released by Melbourne Institute, measures changes in the level of inflation. A growth in inflation might result in RBA’s decision to introduce higher interest rates. A growth in the indicator strengthens the AUD. A fall in the indicator, on the contrary, weakens the AUD.

Retail Sales. Australia, 2:30 am (GMT+2)

Data on Retail Sales for January is die at 2:30 am (GMT+2). The data on retail sales measures the volume of sales in the retail sector. Considered an indicator of consumer spending and economic growth. An increase in retail sales strengthens the AUD. A fall in retail sales weakens the AUD.

Labor Market Conditions Index. US, 5:00 pm (GMT+2)

The Labor Market Conditions Index for January is due at 5:00 pm (GMT+2). The index is calculated by Fed economists. Is made up of 19 different indicators describing the labour market. It is one of the major indicators of the US economic growth. A high reading strengthens the USD. A low reading weakens the USD.

TD Securities Inflation. Australia, 2:00 am (GMT+2)

Data on the TD Securities Inflation for January is due at 2:00 am (GMT+2). The indicator, released by Melbourne Institute, measures changes in the level of inflation. A growth in inflation might result in RBA’s decision to introduce higher interest rates. A growth in the indicator strengthens the AUD. A fall in the indicator, on the contrary, weakens the AUD.

Retail Sales. Australia, 2:30 am (GMT+2)

Data on Retail Sales for January is die at 2:30 am (GMT+2). The data on retail sales measures the volume of sales in the retail sector. Considered an indicator of consumer spending and economic growth. An increase in retail sales strengthens the AUD. A fall in retail sales weakens the AUD.

Labor Market Conditions Index. US, 5:00 pm (GMT+2)

The Labor Market Conditions Index for January is due at 5:00 pm (GMT+2). The index is calculated by Fed economists. Is made up of 19 different indicators describing the labour market. It is one of the major indicators of the US economic growth. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 3.02.2017

Caixin Manufacturing PMI. China, 3:45 am (GMT+2)

Data on the Caixin Manufacturing PMI for January is due at 3:45 am (GMT+2). The index is expected to fall from 51.9 to 51.8 points. The index evaluates the state of the manufacturing industry. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

Markit Services PMI. EU, 11:00 am (GMT+2)

The Markit Services PMI is due at 11:00 am (GMT+2). In January, the index is expected to remain unchanged at 53.6 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50, on the contrary, is perceived as negative and weakens the EUR.

Nonfarm Payrolls. US, 3:30 pm (GMT+2)

Data on the Nonfarm Payrolls is due at 3:30 pm (GMT+2). In January, the index is expected to increase from 156 thousands to 175 thousands. One of the main indicators of employment in the US. Represents the number of employed in non-agricultural sectors. Has a high impact on the market. A high reading represents employment growth and strengthens the USD. A low reading weakens the USD.

Factory Orders. US, 5:00 pm (GMT+2)

Data on Factory Orders is due at 5:00 pm (GMT+2). In December, the index is expected to increase from -2.4% to 1.0%. The index represents the change in the volume of factory orders. Allows estimating the pace of growth of the industrial sector. A growth in the index strengthens the USD. A fall in the index weakens the USD.

ISM Non-Manufacturing PMI. US, 5:00 pm (GMT+2)

Data on the ISM Non-Manufacturing PMI is due at 5:00 pm (GMT+2). In January, the index is expected to fall from 57.2 to 57.0 points. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 45-50 represents economic growth. A reading below 45-50 represents economy slowdown. A growth in the index strengthens the USD.

Caixin Manufacturing PMI. China, 3:45 am (GMT+2)

Data on the Caixin Manufacturing PMI for January is due at 3:45 am (GMT+2). The index is expected to fall from 51.9 to 51.8 points. The index evaluates the state of the manufacturing industry. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

Markit Services PMI. EU, 11:00 am (GMT+2)

The Markit Services PMI is due at 11:00 am (GMT+2). In January, the index is expected to remain unchanged at 53.6 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50, on the contrary, is perceived as negative and weakens the EUR.

Nonfarm Payrolls. US, 3:30 pm (GMT+2)

Data on the Nonfarm Payrolls is due at 3:30 pm (GMT+2). In January, the index is expected to increase from 156 thousands to 175 thousands. One of the main indicators of employment in the US. Represents the number of employed in non-agricultural sectors. Has a high impact on the market. A high reading represents employment growth and strengthens the USD. A low reading weakens the USD.

Factory Orders. US, 5:00 pm (GMT+2)

Data on Factory Orders is due at 5:00 pm (GMT+2). In December, the index is expected to increase from -2.4% to 1.0%. The index represents the change in the volume of factory orders. Allows estimating the pace of growth of the industrial sector. A growth in the index strengthens the USD. A fall in the index weakens the USD.

ISM Non-Manufacturing PMI. US, 5:00 pm (GMT+2)

Data on the ISM Non-Manufacturing PMI is due at 5:00 pm (GMT+2). In January, the index is expected to fall from 57.2 to 57.0 points. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 45-50 represents economic growth. A reading below 45-50 represents economy slowdown. A growth in the index strengthens the USD.

Claws and Horns

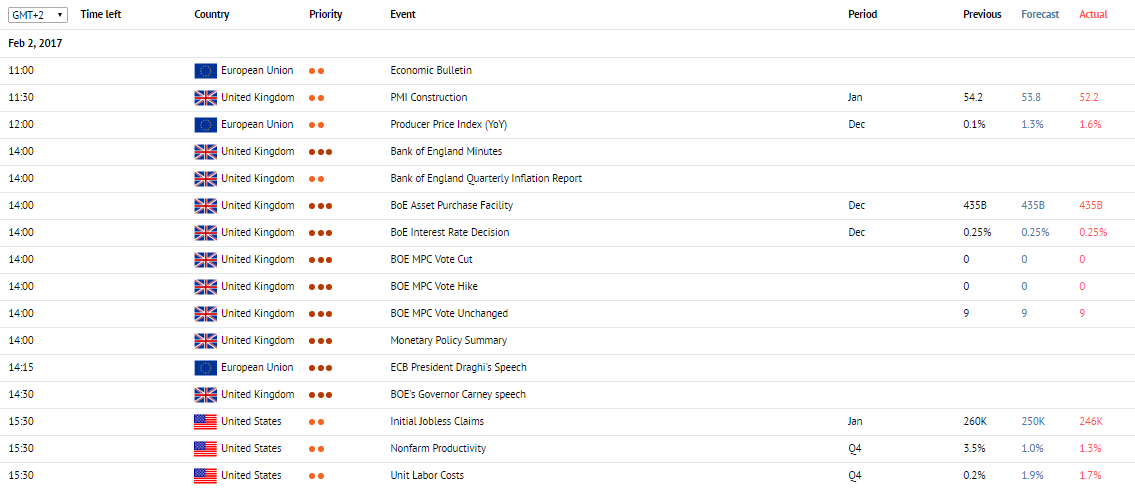

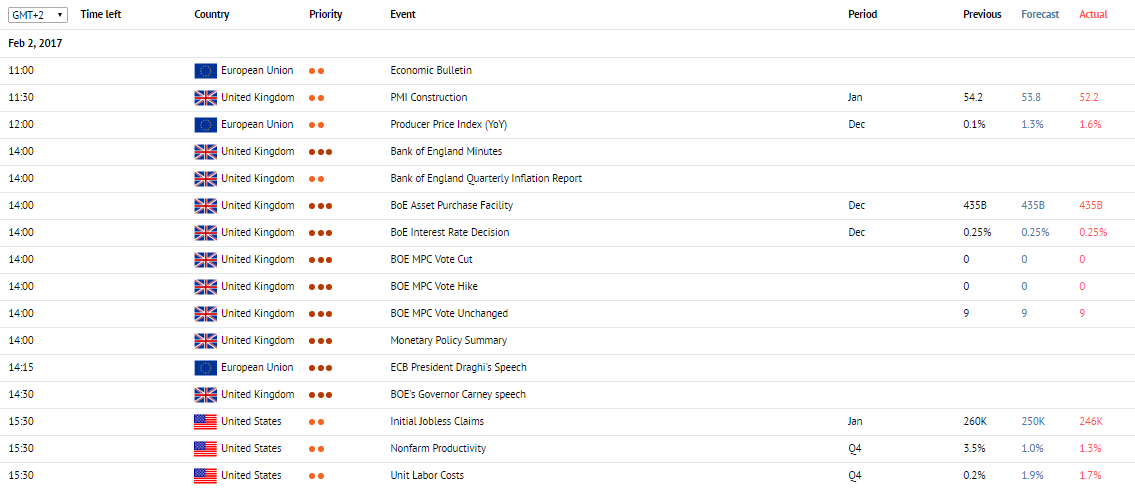

News of the day. 02.02.2017

Economic Bulletin. EU, 11:00 (GMT+2)

The Economic Bulletin is due to 11:00 (GMT+2) in the EU. It is released two weeks after the Governing Council meeting and provides an overview of the state of the economy in the region. It contains data on a series of macroeconomic indicators as well as commentaries on current economic conditions and monetary policy.

Producer Price Index. EU, 12:00 (GMT+2)

The December Producer Price Index is due at 12:00 (GMT+2) in the EU. The index represents a price change on goods, produced in the Eurozone. A growth in the index, generally, supports the EUR. A decline in the index weakens the EUR.

BoE Interest Rate Decision. United Kingdom, 14:00 (GMT+2)

The Bank of England Interest Rate Decision is due at 14:00 (GMT+2). The rate is expected to stay on the same level of 0.25%. Depending on the current economic situation and the level of inflation, the Bank of England makes its decision on the interest rate. The rate increase strengthens the GBP. If rate remains unchanged or get cut, the GBP weakens.

ECB President Draghi's Speech. EU, 14:15 (GMT+2)

The ECB President Draghi's Speech is due at 14:15 (GMT+2). Mario Draghi gives commentaries on current economic conditions in the Eurozone. Positive commentaries strengthen the EUR, while negative commentaries weaken the EUR.

BOE's Governor Carney speech. United Kingdom, 14:30 (GMT+2)

The Bank of England Governor Carney speech is due at 14:30 (GMT+2). Mark Carney is the Governor of the Bank of England and chairs the Monetary Policy Committee. He is giving commentaries regarding current economic conditions in the country.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The Initial Jobless Claims index is due at 15:30 (GMT+2) in the USA. The index is expected to lower to 250K per week с 259K in the previous month. The indicator represents the number of new unemployment claims and is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Economic Bulletin. EU, 11:00 (GMT+2)

The Economic Bulletin is due to 11:00 (GMT+2) in the EU. It is released two weeks after the Governing Council meeting and provides an overview of the state of the economy in the region. It contains data on a series of macroeconomic indicators as well as commentaries on current economic conditions and monetary policy.

Producer Price Index. EU, 12:00 (GMT+2)

The December Producer Price Index is due at 12:00 (GMT+2) in the EU. The index represents a price change on goods, produced in the Eurozone. A growth in the index, generally, supports the EUR. A decline in the index weakens the EUR.

BoE Interest Rate Decision. United Kingdom, 14:00 (GMT+2)

The Bank of England Interest Rate Decision is due at 14:00 (GMT+2). The rate is expected to stay on the same level of 0.25%. Depending on the current economic situation and the level of inflation, the Bank of England makes its decision on the interest rate. The rate increase strengthens the GBP. If rate remains unchanged or get cut, the GBP weakens.

ECB President Draghi's Speech. EU, 14:15 (GMT+2)

The ECB President Draghi's Speech is due at 14:15 (GMT+2). Mario Draghi gives commentaries on current economic conditions in the Eurozone. Positive commentaries strengthen the EUR, while negative commentaries weaken the EUR.

BOE's Governor Carney speech. United Kingdom, 14:30 (GMT+2)

The Bank of England Governor Carney speech is due at 14:30 (GMT+2). Mark Carney is the Governor of the Bank of England and chairs the Monetary Policy Committee. He is giving commentaries regarding current economic conditions in the country.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The Initial Jobless Claims index is due at 15:30 (GMT+2) in the USA. The index is expected to lower to 250K per week с 259K in the previous month. The indicator represents the number of new unemployment claims and is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Claws and Horns

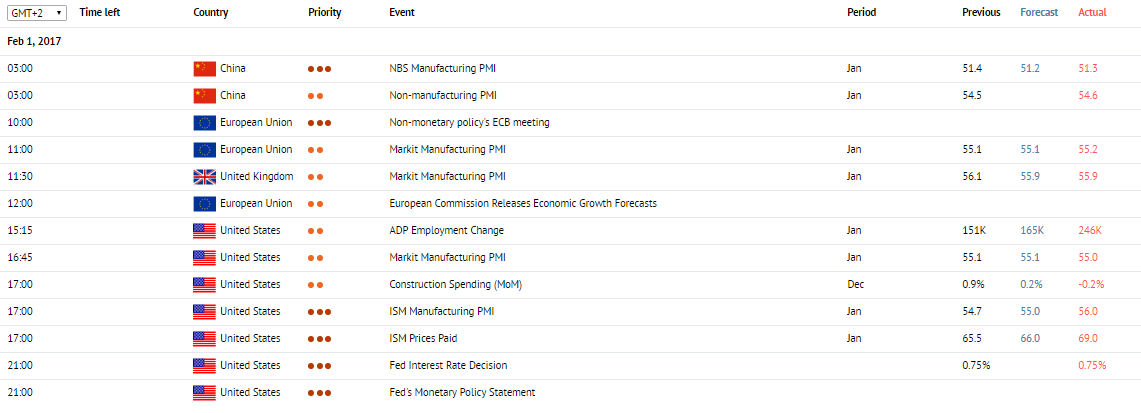

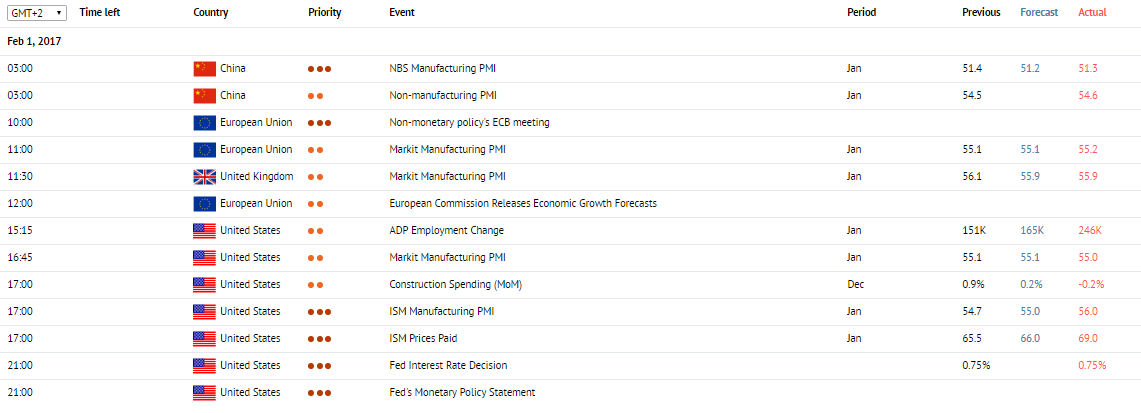

News of the day. 01.02.2017

Unemployment Rate. New Zealand, 00:45 am (GMT+2)

Data on the Unemployment Rate for the 4 quarter of 2016 is due at 00:45 am (GMT+2). The index is one of the main indicators of the labour market in New Zealand. It represents a percentage of the total labour force of the country that is currently unemployed. A growth in the indicator is a negative factor and weakens the NZD. A fall in the indicator, on the contrary, is a positive factor and strengthens the NZD.

NBS Manufacturing PMI. China, 4:00 am (GMT+2)

Data on the NBS Manufacturing PMI is due at 4:00 am (GMT+2). In January, the index is expected to fall from 51.4 to 51.2 points. The index evaluates the state of the manufacturing sector in China. A reading above 50 gives a positive sign. A reading below 50 represents negative dynamics.

Non-monetary policy’s ECB meeting. EU, 11:00 am (GMT+2)

The Non-monetary policy’s ECB meeting is due at 11:00 am (GMT+2). The Governing Council of the ECB holds its meeting regarding current economic conditions and monetary policy. The publication of the results can lead to volatility increase on the market. Note: monetary policy meetings are held every 6 weeks. Non-monetary policy meetings are held once a month.

Markit Manufacturing PMI. EU, 12:00 pm (GMT+2)

Data on the Markit Manufacturing PMI is due at 12:00 pm (GMT+2). In January, the index is expected to remain unchanged at 55.1 points. The index reflects economic situation in the manufacturing sector and its development prospects. A result above 50 point represents favorable state of the sector and can strengthen the EUR. A result below 50 points, on the contrary, is seen as a negative signal and can weaken the EUR.

Markit Manufacturing PMI. UK, 11:30 am (GMT+2)

Data on the Markit Manufacturing PMI is due at 11:30 am (GMT+2). In January, the index is expected to fall from 56.1 to 55.9 points. The index evaluates the state of the manufacturing sector. Is based on surveys of executives of the biggest manufacturing companies. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

ADP Employment Change. US, 4:15 pm (GMT+2)

The ADP Employment Change for January is due at 4:15 pm (GMT+2). The index is expected to grow from 153 thousands to 168 thousands. The report represents employment change in non-agricultural sectors. Is based on data collected from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

ISM Manufacturing PMI. US, 6:00 pm (GMT+2)

Data on the ISM Manufacturing PMI is due at 6:00 pm (GMT+2). In January, the index is forecasted to fall from 54.7 to 54.5 points. The indicator of the general state of the US economy. Values above 50 represent economic growth and strengthen the USD. Values below 50 indicate a slowdown of the economy and weaken the USD.

Fed Interest Rate Decision. US, 10:00 pm (GMT+2)

The Monetary Policy Committee is announcing its decision on interest rates at 10:00 pm (GMT+2). The rate is expected to remain unchanged at 0.75%. Important economic event. Has an impact on commercial banks’ interest rates and the USD exchange rate. A rate increase strengthen the USD, the decrease – weakens the USD.

Fed's Monetary Policy Statement. US, 10:00 pm (GMT+2)

Fed's Monetary Policy Statement is due at 10:00 pm (GMT+2). After making its decision on interest rates, the Fed is presenting its commentaries regarding monetary policy. Positive comments strengthen the USD. Negative comments weaken the USD.

Unemployment Rate. New Zealand, 00:45 am (GMT+2)

Data on the Unemployment Rate for the 4 quarter of 2016 is due at 00:45 am (GMT+2). The index is one of the main indicators of the labour market in New Zealand. It represents a percentage of the total labour force of the country that is currently unemployed. A growth in the indicator is a negative factor and weakens the NZD. A fall in the indicator, on the contrary, is a positive factor and strengthens the NZD.

NBS Manufacturing PMI. China, 4:00 am (GMT+2)

Data on the NBS Manufacturing PMI is due at 4:00 am (GMT+2). In January, the index is expected to fall from 51.4 to 51.2 points. The index evaluates the state of the manufacturing sector in China. A reading above 50 gives a positive sign. A reading below 50 represents negative dynamics.

Non-monetary policy’s ECB meeting. EU, 11:00 am (GMT+2)

The Non-monetary policy’s ECB meeting is due at 11:00 am (GMT+2). The Governing Council of the ECB holds its meeting regarding current economic conditions and monetary policy. The publication of the results can lead to volatility increase on the market. Note: monetary policy meetings are held every 6 weeks. Non-monetary policy meetings are held once a month.

Markit Manufacturing PMI. EU, 12:00 pm (GMT+2)

Data on the Markit Manufacturing PMI is due at 12:00 pm (GMT+2). In January, the index is expected to remain unchanged at 55.1 points. The index reflects economic situation in the manufacturing sector and its development prospects. A result above 50 point represents favorable state of the sector and can strengthen the EUR. A result below 50 points, on the contrary, is seen as a negative signal and can weaken the EUR.

Markit Manufacturing PMI. UK, 11:30 am (GMT+2)

Data on the Markit Manufacturing PMI is due at 11:30 am (GMT+2). In January, the index is expected to fall from 56.1 to 55.9 points. The index evaluates the state of the manufacturing sector. Is based on surveys of executives of the biggest manufacturing companies. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

ADP Employment Change. US, 4:15 pm (GMT+2)

The ADP Employment Change for January is due at 4:15 pm (GMT+2). The index is expected to grow from 153 thousands to 168 thousands. The report represents employment change in non-agricultural sectors. Is based on data collected from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

ISM Manufacturing PMI. US, 6:00 pm (GMT+2)

Data on the ISM Manufacturing PMI is due at 6:00 pm (GMT+2). In January, the index is forecasted to fall from 54.7 to 54.5 points. The indicator of the general state of the US economy. Values above 50 represent economic growth and strengthen the USD. Values below 50 indicate a slowdown of the economy and weaken the USD.

Fed Interest Rate Decision. US, 10:00 pm (GMT+2)

The Monetary Policy Committee is announcing its decision on interest rates at 10:00 pm (GMT+2). The rate is expected to remain unchanged at 0.75%. Important economic event. Has an impact on commercial banks’ interest rates and the USD exchange rate. A rate increase strengthen the USD, the decrease – weakens the USD.

Fed's Monetary Policy Statement. US, 10:00 pm (GMT+2)

Fed's Monetary Policy Statement is due at 10:00 pm (GMT+2). After making its decision on interest rates, the Fed is presenting its commentaries regarding monetary policy. Positive comments strengthen the USD. Negative comments weaken the USD.

Claws and Horns

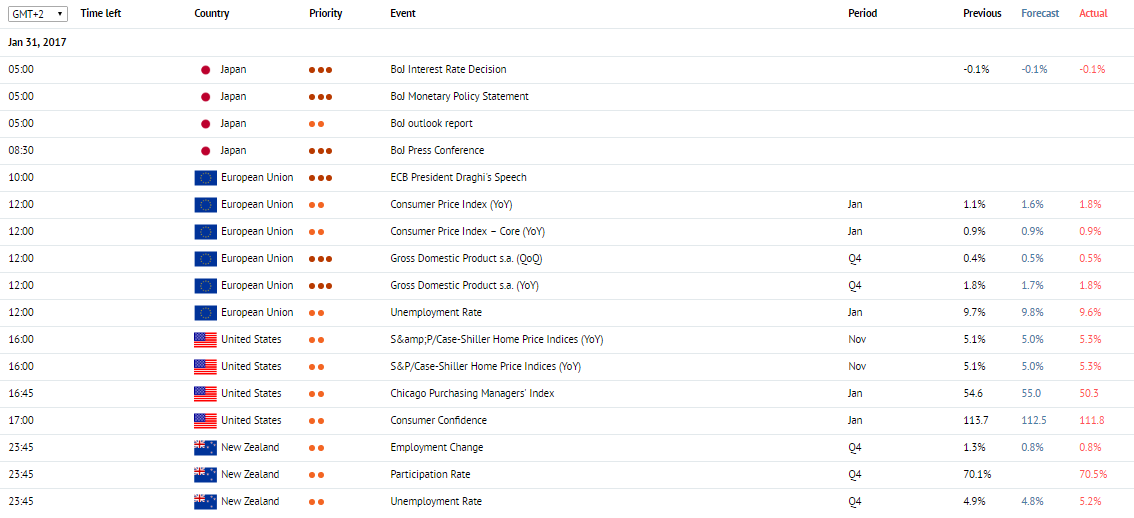

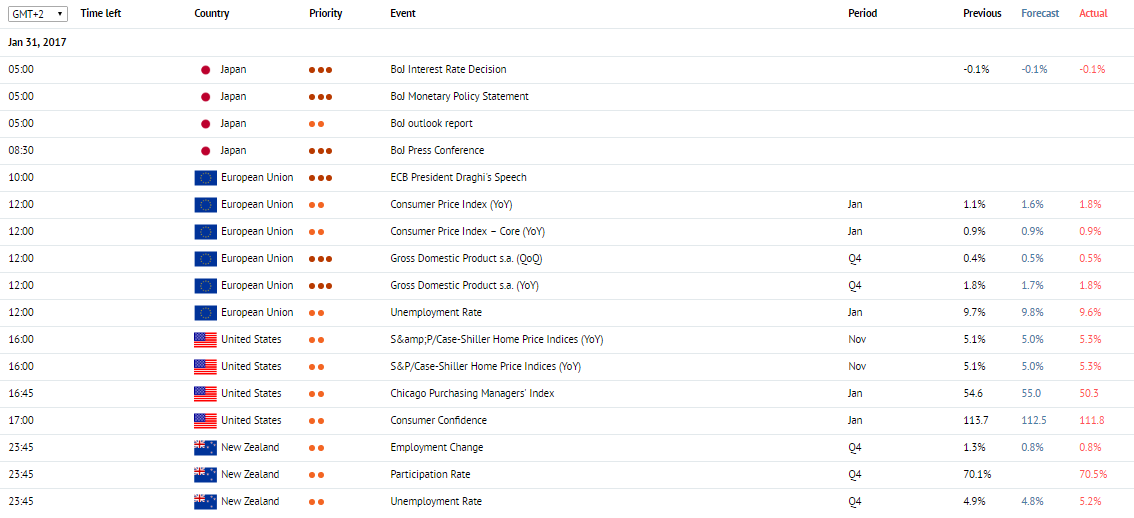

News of the day. 31.01.2017

Industrial Production. Japan, 1:50 am (GMT+2)

Data on Industrial Production for December is due at 1:50 am (GMT+2). On a month-to-month basis, the index is expected to fall from 1.5% to 0.3%. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Gross Domestic Product. EU, 12:00 pm (GMT+2)

Data on the Gross Domestic Product for the fourth quarter of 2016 is due at 12:00 pm (GMT+2). On a quarter-to-quarter basis, the index is expected to increase from 0.3% to 0.5% while on a year-to-year basis to remain unchanged at 1.7%. The indicator represents the value of all goods and services produced by the eurozone during a time period. A high reading strengthens the EUR. A low reading weakens the EUR.

Consumer Price Index. EU, 12:00 pm (GMT+2)

Data on the Consumer Price Index for January is due at 12:00 pm (GMT+2). On a year-to-year basis, the index is expected to grow from 1.1% to 1.4%. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Unemployment Rate. EU, 12:00 pm (GMT+2)

Data on the Unemployment Rate is due at 12:00 pm (GMT+2). In January, the index is expected to remain unchanged at 9.8%. The unemployment rate measures the percentage of the total labour force that is currently unemployed. A growth in the index represents a slowdown of economic growth. A high result can pressure the EUR, while a low one, on the contrary, can strengthen the EUR.

Consumer Confidence. US, 5:00 pm (GMT+2)

Data on the Consumer Confidence is due at 5:00 pm (GMT+2). In January, the index is forecasted to fall from 111.7 to 112.5 points. The index represent consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Unemployment Rate. New Zealand, 11:45 pm (GMT+2)

Data on the Unemployment Rate for the fourth quarter of 2016 is due at 11:45 pm (GMT+2). This is one of the main indicators of the labour market in New Zealand. It represents a percentage of the total labour force of the country that are currently unemployed. A growth in the indicator is a negative factor and weakens the NZD. A fall in the indicator, on the contrary, is a positive factor and strengthens the NZD

Industrial Production. Japan, 1:50 am (GMT+2)

Data on Industrial Production for December is due at 1:50 am (GMT+2). On a month-to-month basis, the index is expected to fall from 1.5% to 0.3%. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Gross Domestic Product. EU, 12:00 pm (GMT+2)

Data on the Gross Domestic Product for the fourth quarter of 2016 is due at 12:00 pm (GMT+2). On a quarter-to-quarter basis, the index is expected to increase from 0.3% to 0.5% while on a year-to-year basis to remain unchanged at 1.7%. The indicator represents the value of all goods and services produced by the eurozone during a time period. A high reading strengthens the EUR. A low reading weakens the EUR.

Consumer Price Index. EU, 12:00 pm (GMT+2)

Data on the Consumer Price Index for January is due at 12:00 pm (GMT+2). On a year-to-year basis, the index is expected to grow from 1.1% to 1.4%. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Unemployment Rate. EU, 12:00 pm (GMT+2)

Data on the Unemployment Rate is due at 12:00 pm (GMT+2). In January, the index is expected to remain unchanged at 9.8%. The unemployment rate measures the percentage of the total labour force that is currently unemployed. A growth in the index represents a slowdown of economic growth. A high result can pressure the EUR, while a low one, on the contrary, can strengthen the EUR.

Consumer Confidence. US, 5:00 pm (GMT+2)

Data on the Consumer Confidence is due at 5:00 pm (GMT+2). In January, the index is forecasted to fall from 111.7 to 112.5 points. The index represent consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Unemployment Rate. New Zealand, 11:45 pm (GMT+2)

Data on the Unemployment Rate for the fourth quarter of 2016 is due at 11:45 pm (GMT+2). This is one of the main indicators of the labour market in New Zealand. It represents a percentage of the total labour force of the country that are currently unemployed. A growth in the indicator is a negative factor and weakens the NZD. A fall in the indicator, on the contrary, is a positive factor and strengthens the NZD

Claws and Horns

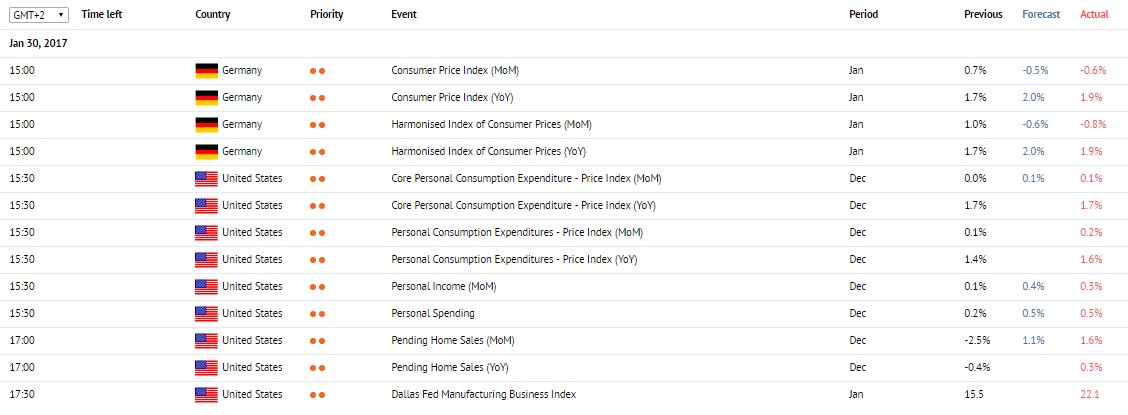

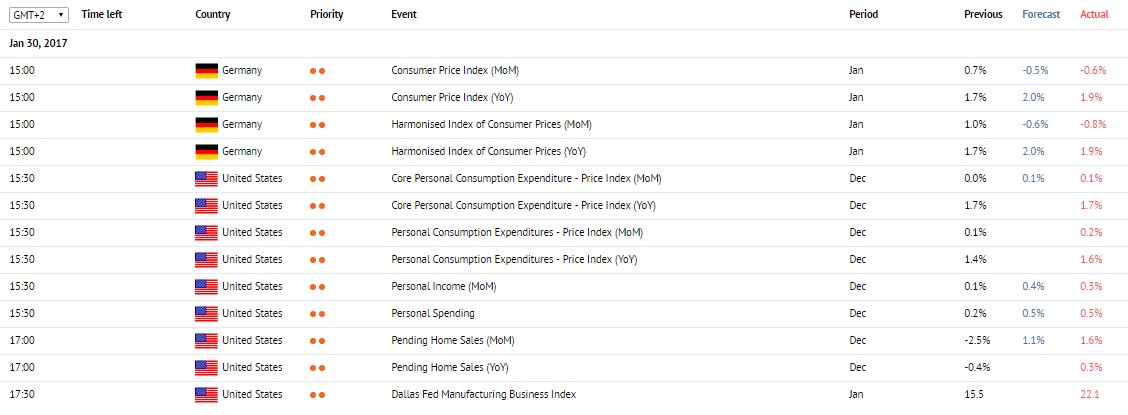

News of the day. 30.01.2017

Consumer Price Index. Germany, 3:00 pm (GMT+2)

Data on the Consumer Price Index for January is due at 3:00 pm (GMT+2). The index represents the change in prices for goods and services for households and is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Personal Spending. US, 3:30 pm (GMT+2)

Data on the Personal Spending for December 2016 is due at 3:30 pm (GMT+2). Personal spending by the US consumer. The index consists of three components: spending on services and spending on durable and nondurable goods.

Personal Income. US, 3:30 pm (GMT+2)

Data on the Personal Income for December 2016 is due at 3:30 pm (GMT+2). The index represents an income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the index indicates consumer readiness to spend money in current economic conditions.

Consumer Price Index. Germany, 3:00 pm (GMT+2)

Data on the Consumer Price Index for January is due at 3:00 pm (GMT+2). The index represents the change in prices for goods and services for households and is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Personal Spending. US, 3:30 pm (GMT+2)

Data on the Personal Spending for December 2016 is due at 3:30 pm (GMT+2). Personal spending by the US consumer. The index consists of three components: spending on services and spending on durable and nondurable goods.

Personal Income. US, 3:30 pm (GMT+2)

Data on the Personal Income for December 2016 is due at 3:30 pm (GMT+2). The index represents an income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the index indicates consumer readiness to spend money in current economic conditions.

Claws and Horns

News of the day. 27.01.2017

Gross Domestic Product Annualized. USA, 15:30 (GMT+2)

The Gross Domestic Product Annualized index is due at 15:30 (GMT+2) in the USA. The 4 quarter index is expected to lower to 2.2% from 3.5% in the previous month. The index shows the total value of goods and services, created in the country during the year, and indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Core Personal Consumption Expenditures. USA, 15:30 (GMT+2)

The Core Personal Consumption Expenditures index is due at 15:30 (GMT+2) in the USA. The QoQ index is expected to grow to 2.1% in the 4 quarter against 1.5% in the previous month. The Real Personal Consumption Expenditure released by the Bureau of Economic Analysis, Department of Commerce is an average of the amount of money the consumers spend in a month on durable goods, consumer products, and services. It is considered as an important indicator of inflation. Generally speaking, a high reading is bullish for the USD, while a low reading is bearish.

Durable Goods Orders. USA, 15:30 (GMT+2)

The Durable Goods Orders index is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 2.6% in December against -4.5% in the previous month. The index represents the value change for durable goods (including transportations) that last for more than 3 years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy.

Gross Domestic Product Annualized. USA, 15:30 (GMT+2)

The Gross Domestic Product Annualized index is due at 15:30 (GMT+2) in the USA. The 4 quarter index is expected to lower to 2.2% from 3.5% in the previous month. The index shows the total value of goods and services, created in the country during the year, and indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Core Personal Consumption Expenditures. USA, 15:30 (GMT+2)

The Core Personal Consumption Expenditures index is due at 15:30 (GMT+2) in the USA. The QoQ index is expected to grow to 2.1% in the 4 quarter against 1.5% in the previous month. The Real Personal Consumption Expenditure released by the Bureau of Economic Analysis, Department of Commerce is an average of the amount of money the consumers spend in a month on durable goods, consumer products, and services. It is considered as an important indicator of inflation. Generally speaking, a high reading is bullish for the USD, while a low reading is bearish.

Durable Goods Orders. USA, 15:30 (GMT+2)

The Durable Goods Orders index is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 2.6% in December against -4.5% in the previous month. The index represents the value change for durable goods (including transportations) that last for more than 3 years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy.

: