Claws and Horns / Profile

Claws and Horns

News of the day. 24.03.2017

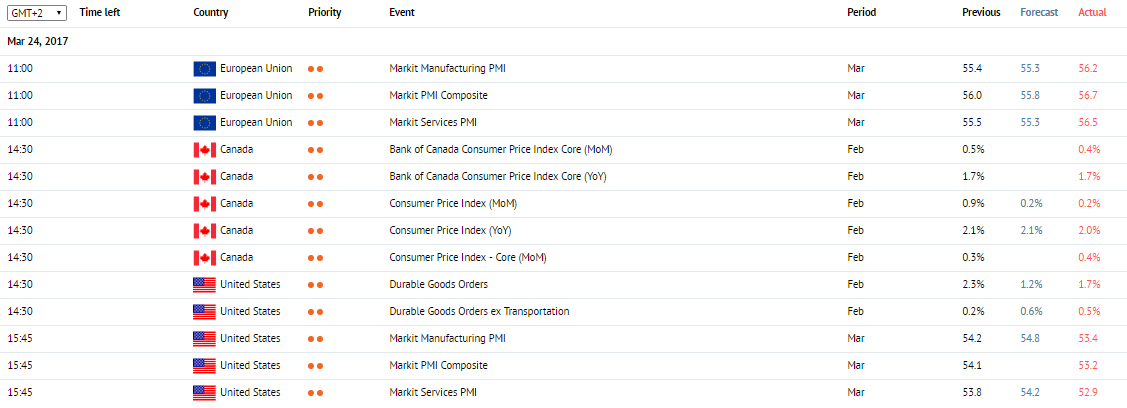

Markit Services PMI. EU, 11:00 (GMT+2)

Markit Services PMI is due at 11:00 (GMT+2). It is forecasted that the indicator will fall to 55.3 points in March compared to 55.5 points a month earlier. The index shows economic conditions in services sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen EUR, and those below 50 are considered a negative sign and subject EUR to pressure.

Markit Manufacturing PMI. EU, 11:00 (GMT+2)

Markit Manufacturing PMI is due at 11:00 (GMT+2). It is forecasted that the indicator will fall by 55.3 points in March compared to 55.4 points a month earlier. The index is built on the assessment of current economic situation in the industrial and service sectors made by the heads of relevant companies. Values above 50 strengthen EUR, and those below weaken it.

Durable Goods Orders. USA, 14:30 (GMT+2)

Data on demand for durable goods are due at 14:30 (GMT+2). It is forecasted that the indicator will fall to 1.2% in February from 2.0% a month earlier. The index demonstrates changes in the prices for durable goods including vehicles that have been in use for over 3 years. The growth of demand is viewed as a positive signal for the economy, and its decline indicates slower economic growth rate. High values strengthen USD.

Consumer Price Index. Canada, 14:30 (GMT+2)

Canadian Consumer Price Index is due at 14:30 (GMT+2). It is forecasted that the indicator will fall to 0.2% in February compared to 0.9% a month earlier. The indicator shows the changes in price of the basic market basket. High values are considered an indication of rate rise. The growth of the index strenthens CAD, and its fall weakens it.

Markit Services PMI. USA, 16:45 (GMT+2)

Markit Services PMI is due at 16:45 (GMT+2). The indicator is expected to increase to 54.2 points in March compared to 53.8 points in the previous month. The index is built upon polls of managers working in services sector to estimate current economic situation in this sector. Values above 50 are perceived as a positive signal and strengthen US dollar. Those below 50 are considered a negative sign and subject USD to pressure.

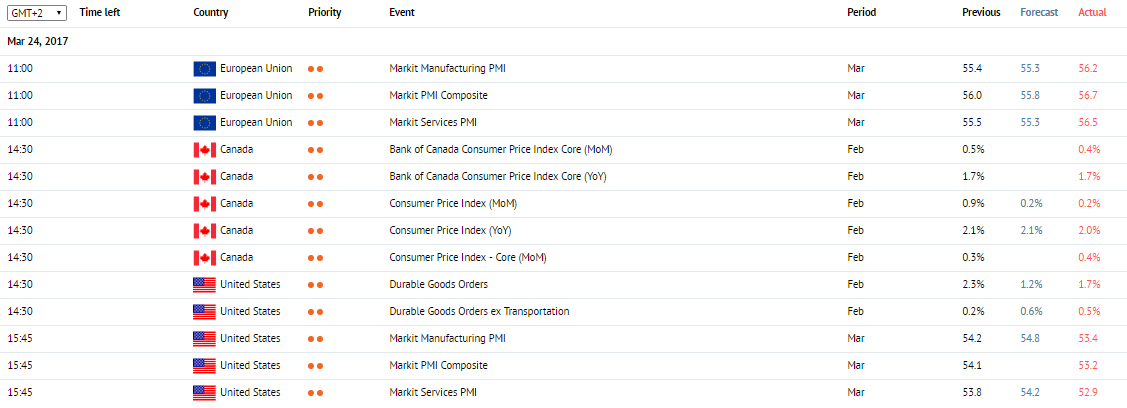

Markit Services PMI. EU, 11:00 (GMT+2)

Markit Services PMI is due at 11:00 (GMT+2). It is forecasted that the indicator will fall to 55.3 points in March compared to 55.5 points a month earlier. The index shows economic conditions in services sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen EUR, and those below 50 are considered a negative sign and subject EUR to pressure.

Markit Manufacturing PMI. EU, 11:00 (GMT+2)

Markit Manufacturing PMI is due at 11:00 (GMT+2). It is forecasted that the indicator will fall by 55.3 points in March compared to 55.4 points a month earlier. The index is built on the assessment of current economic situation in the industrial and service sectors made by the heads of relevant companies. Values above 50 strengthen EUR, and those below weaken it.

Durable Goods Orders. USA, 14:30 (GMT+2)

Data on demand for durable goods are due at 14:30 (GMT+2). It is forecasted that the indicator will fall to 1.2% in February from 2.0% a month earlier. The index demonstrates changes in the prices for durable goods including vehicles that have been in use for over 3 years. The growth of demand is viewed as a positive signal for the economy, and its decline indicates slower economic growth rate. High values strengthen USD.

Consumer Price Index. Canada, 14:30 (GMT+2)

Canadian Consumer Price Index is due at 14:30 (GMT+2). It is forecasted that the indicator will fall to 0.2% in February compared to 0.9% a month earlier. The indicator shows the changes in price of the basic market basket. High values are considered an indication of rate rise. The growth of the index strenthens CAD, and its fall weakens it.

Markit Services PMI. USA, 16:45 (GMT+2)

Markit Services PMI is due at 16:45 (GMT+2). The indicator is expected to increase to 54.2 points in March compared to 53.8 points in the previous month. The index is built upon polls of managers working in services sector to estimate current economic situation in this sector. Values above 50 are perceived as a positive signal and strengthen US dollar. Those below 50 are considered a negative sign and subject USD to pressure.

Claws and Horns

News of the day. 23.03.2017

Retail Sales. UK, 11:30 (GMT+2)

The data on UK retail sales are due at 11:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 0.4% in February from -0.3% a month earlier. On year-on-year basis, the indicator is expected to grow to 2.6% in February from 1.5% in January. The indicator is based on the total number of receipts for retail purchases in stores and characterizes the level of consumer expenses and demand. Sales volume growth is an important factor of economic development. High values have positive effect on the economy and strengthens GBP, and low ones weaken it.

Janet Yellen's Speech. USA, 14:00 (GMT+2)

Janet Yellen's Speech is due on 14:00 (GMT+2) today. Comments of FOMC's head may lead to increased USD volatility.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The data on initial jobless claims in the USA is due at 14:30 (GMT+2). The indicator is expected to decline to 240 thousand from 241 thousand in the previous week. The value indicates the number of new jobless claims. The index is published every Thursday and shows the value of nonfarm payrolls indicator. The reduction of the number of claims is a positive factor for US dollar, and the growth of this indicator is considered a negative development.

Consumer Confidence. EU, 17:00 (GMT+2)

Consumer Confidence data is due at 17:00 (GMT+2). The indicator is expected to grow to -5.8 points in March against -6.2 points in the previous month. The indicator shows the level of consumer confidence in the current economic situation. High values are considered a positive signal and support EUR, while lower than expected values weaken it.

Trading Balance. New Zealand, 23:45 (GMT+2)

The data on the trading balance of New Zealand is due at 23:45 (GMT+2). The indicator shows gap between export and import of goods and services in monetary terms. A positive value indicates balance proficiency (positive balance) and consolidates NZD, and a negative one shows balance deficiency (negative balance) and weakens the national currency.

Retail Sales. UK, 11:30 (GMT+2)

The data on UK retail sales are due at 11:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 0.4% in February from -0.3% a month earlier. On year-on-year basis, the indicator is expected to grow to 2.6% in February from 1.5% in January. The indicator is based on the total number of receipts for retail purchases in stores and characterizes the level of consumer expenses and demand. Sales volume growth is an important factor of economic development. High values have positive effect on the economy and strengthens GBP, and low ones weaken it.

Janet Yellen's Speech. USA, 14:00 (GMT+2)

Janet Yellen's Speech is due on 14:00 (GMT+2) today. Comments of FOMC's head may lead to increased USD volatility.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The data on initial jobless claims in the USA is due at 14:30 (GMT+2). The indicator is expected to decline to 240 thousand from 241 thousand in the previous week. The value indicates the number of new jobless claims. The index is published every Thursday and shows the value of nonfarm payrolls indicator. The reduction of the number of claims is a positive factor for US dollar, and the growth of this indicator is considered a negative development.

Consumer Confidence. EU, 17:00 (GMT+2)

Consumer Confidence data is due at 17:00 (GMT+2). The indicator is expected to grow to -5.8 points in March against -6.2 points in the previous month. The indicator shows the level of consumer confidence in the current economic situation. High values are considered a positive signal and support EUR, while lower than expected values weaken it.

Trading Balance. New Zealand, 23:45 (GMT+2)

The data on the trading balance of New Zealand is due at 23:45 (GMT+2). The indicator shows gap between export and import of goods and services in monetary terms. A positive value indicates balance proficiency (positive balance) and consolidates NZD, and a negative one shows balance deficiency (negative balance) and weakens the national currency.

Claws and Horns

News of the day. 22.03.2017

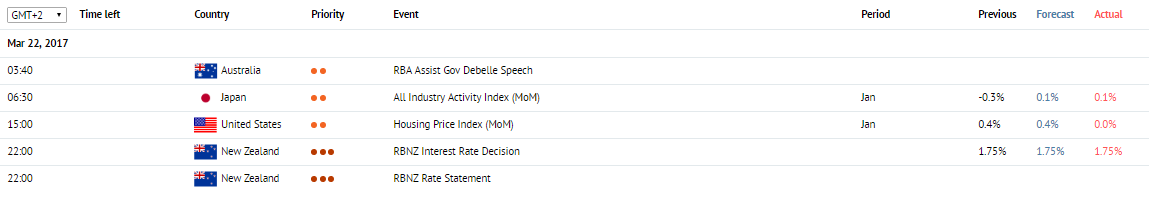

BoJ Monetary Policy Meeting Minutes. Japan, 01:50 (GMT+2)

Bank of Japan Monetary Policy Meeting Minutes is due at 01:50 (GMT+2). The Bank of Japan releases an overview of current economic conditions in the country and assesses economic prospects.

RBA Assist Gov Debelle Speech. Australia, 04:40 (GMT+2)

The Reserve Bank of Australia Assist Governor Debelle Speech is due at 04:40 (GMT+2). Guy Debelle is Assistant Governor at the Reserve Bank of Australia. He has oversight of the Bank's operations in the domestic and global financial markets.

Housing Price Index. USA, 15:00 (GMT+2)

The Housing Price Index is due at 15:00 (GMT+2). It represents property prices dynamics. A high reading strengthens the USD. A low reading weakens the USD.

RBNZ Interest Rate Decision. New Zealand, 22:00 (GMT+2)

The Reserve Bank of the New Zealand Interest Rate Decision is due at 22:00 (GMT+2). The Reserve Bank of New Zealand announces its decision on interest rates. A rate increase strengthens the NZD. A rate decrease weakens the NZD.

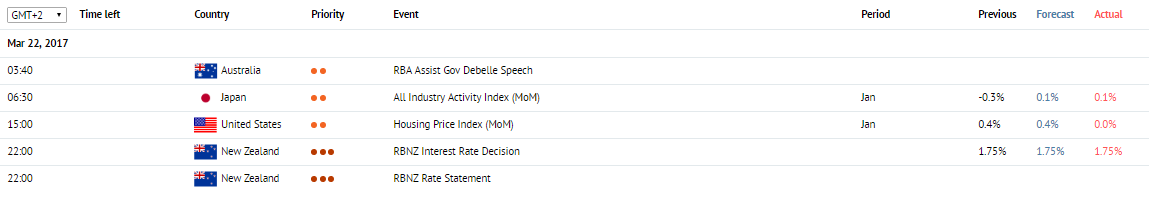

BoJ Monetary Policy Meeting Minutes. Japan, 01:50 (GMT+2)

Bank of Japan Monetary Policy Meeting Minutes is due at 01:50 (GMT+2). The Bank of Japan releases an overview of current economic conditions in the country and assesses economic prospects.

RBA Assist Gov Debelle Speech. Australia, 04:40 (GMT+2)

The Reserve Bank of Australia Assist Governor Debelle Speech is due at 04:40 (GMT+2). Guy Debelle is Assistant Governor at the Reserve Bank of Australia. He has oversight of the Bank's operations in the domestic and global financial markets.

Housing Price Index. USA, 15:00 (GMT+2)

The Housing Price Index is due at 15:00 (GMT+2). It represents property prices dynamics. A high reading strengthens the USD. A low reading weakens the USD.

RBNZ Interest Rate Decision. New Zealand, 22:00 (GMT+2)

The Reserve Bank of the New Zealand Interest Rate Decision is due at 22:00 (GMT+2). The Reserve Bank of New Zealand announces its decision on interest rates. A rate increase strengthens the NZD. A rate decrease weakens the NZD.

Claws and Horns

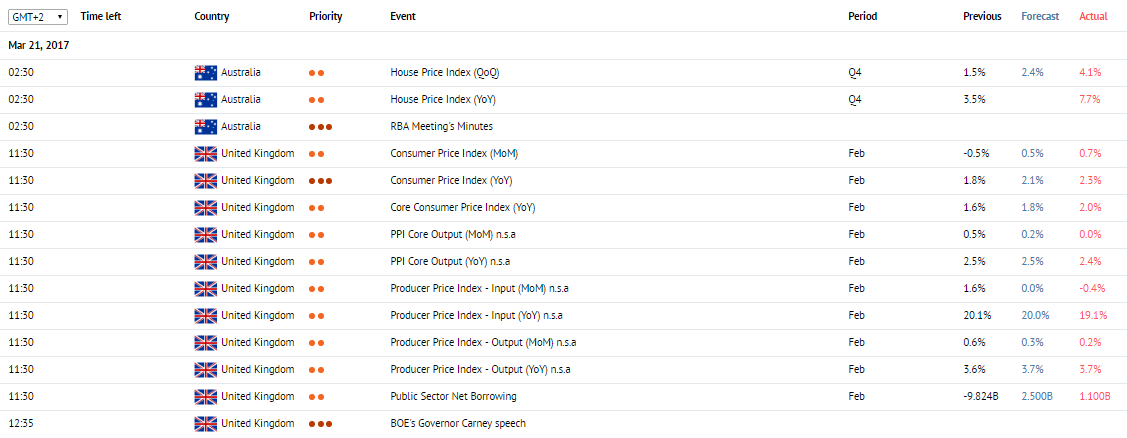

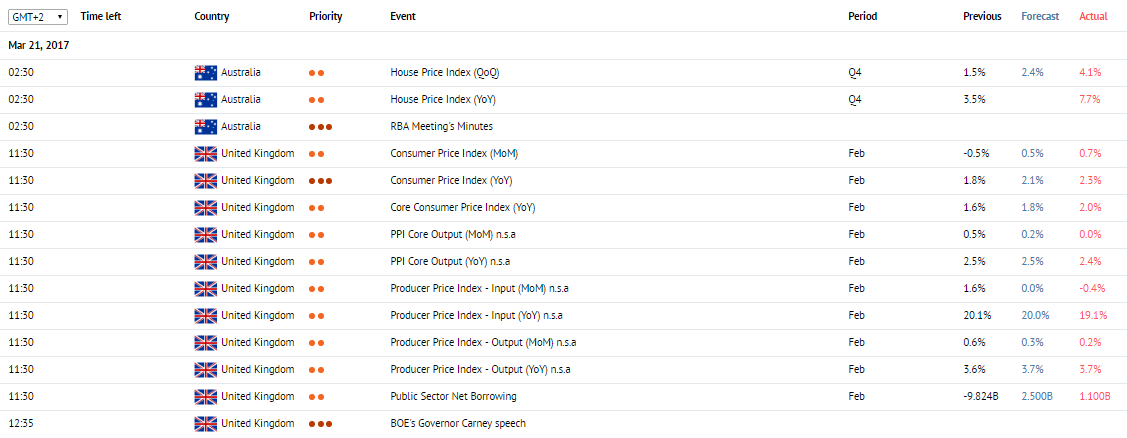

News of the day. 21.03.2017

RBA Meeting Minutes. Australia, 02:30 (GMT+2)

RBA Meeting Minutes will be released at 02:30 (GMT+2). The document is published two weeks after making the decisions regarding the interest rate and contains comments on the results of the meeting. The minutes also contains information about the votes of certain Monetary Policy Committee members.

Consumer Price Index. UK, 11:30 (GMT+2)

Consumer Price Index is due at 11:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 0.5% in February from -0.5% a month earlier. On year-on-year basis, the indicator is expected to grow to 2.1% in February from 1.8% in January. Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

Net public sector borrowings. UK, 11:30 (GMT+2)

The data on net public sector borrowings is due at 11:30 (GMT+2). The indicator is expected to increase to GBP 2.500 bln from GBP -9.842 bln in the previous month. The indicator describes net state indebtedness. Positive values mean budget deficiency and weaken GBP, and negative ones indicate proficiency and the strengthening of the pound.

RBA Meeting Minutes. Australia, 02:30 (GMT+2)

RBA Meeting Minutes will be released at 02:30 (GMT+2). The document is published two weeks after making the decisions regarding the interest rate and contains comments on the results of the meeting. The minutes also contains information about the votes of certain Monetary Policy Committee members.

Consumer Price Index. UK, 11:30 (GMT+2)

Consumer Price Index is due at 11:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 0.5% in February from -0.5% a month earlier. On year-on-year basis, the indicator is expected to grow to 2.1% in February from 1.8% in January. Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

Net public sector borrowings. UK, 11:30 (GMT+2)

The data on net public sector borrowings is due at 11:30 (GMT+2). The indicator is expected to increase to GBP 2.500 bln from GBP -9.842 bln in the previous month. The indicator describes net state indebtedness. Positive values mean budget deficiency and weaken GBP, and negative ones indicate proficiency and the strengthening of the pound.

Claws and Horns

News of the day. 21.03.2017

RBA Meeting Minutes. Australia, 02:30 (GMT+2)

RBA Meeting Minutes will be released at 02:30 (GMT+2). The document is published two weeks after making the decisions regarding the interest rate and contains comments on the results of the meeting. The minutes also contains information about the votes of certain Monetary Policy Committee members.

Consumer Price Index. UK, 11:30 (GMT+2)

Consumer Price Index is due at 11:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 0.5% in February from -0.5% a month earlier. On year-on-year basis, the indicator is expected to grow to 2.1% in February from 1.8% in January. Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

Net public sector borrowings. UK, 11:30 (GMT+2)

The data on net public sector borrowings is due at 11:30 (GMT+2). The indicator is expected to increase to GBP 2.500 bln from GBP -9.842 bln in the previous month. The indicator describes net state indebtedness. Positive values mean budget deficiency and weaken GBP, and negative ones indicate proficiency and the strengthening of the pound.

RBA Meeting Minutes. Australia, 02:30 (GMT+2)

RBA Meeting Minutes will be released at 02:30 (GMT+2). The document is published two weeks after making the decisions regarding the interest rate and contains comments on the results of the meeting. The minutes also contains information about the votes of certain Monetary Policy Committee members.

Consumer Price Index. UK, 11:30 (GMT+2)

Consumer Price Index is due at 11:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 0.5% in February from -0.5% a month earlier. On year-on-year basis, the indicator is expected to grow to 2.1% in February from 1.8% in January. Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

Net public sector borrowings. UK, 11:30 (GMT+2)

The data on net public sector borrowings is due at 11:30 (GMT+2). The indicator is expected to increase to GBP 2.500 bln from GBP -9.842 bln in the previous month. The indicator describes net state indebtedness. Positive values mean budget deficiency and weaken GBP, and negative ones indicate proficiency and the strengthening of the pound.

Claws and Horns

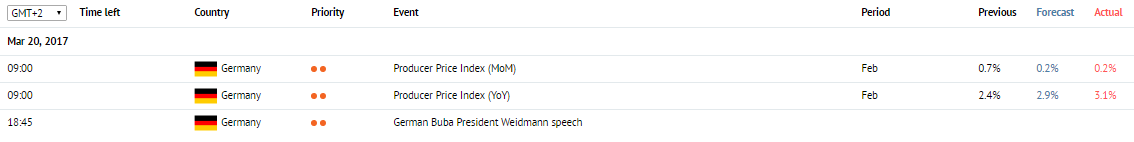

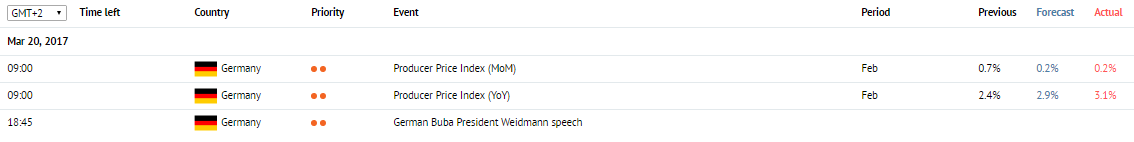

News of the day. 20.03.2017

Producer Price Index. Germany, 09:00 (GMT+2)

The Producer Price Index is due at 09:00 (GMT+2). The MoM index is expected to lower to 0.2% In February from 0.7% in the previous month. The YoY index is expected to grow to 2.9% in February from 2.4% in the previous month. Represents the wholesale prices change from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

German Buba President Weidmann speech. Germany, 18:45 (GMT+2)

The German Bundesbank President Weidmann speech is due at 18:45 (GMT+2). His commentaries can lead to the growth of volatility.

Producer Price Index. Germany, 09:00 (GMT+2)

The Producer Price Index is due at 09:00 (GMT+2). The MoM index is expected to lower to 0.2% In February from 0.7% in the previous month. The YoY index is expected to grow to 2.9% in February from 2.4% in the previous month. Represents the wholesale prices change from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

German Buba President Weidmann speech. Germany, 18:45 (GMT+2)

The German Bundesbank President Weidmann speech is due at 18:45 (GMT+2). His commentaries can lead to the growth of volatility.

Claws and Horns

News of the day. 17.03.2017

Trade Balance. EU, 12:00 (GMT+2)

The Trade Balance data are due at 12:00 (GMT+2). The surplus is expected to lower to 22.3 billion EUR in January from 24.5 billion EUR in the previous month. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Industrial Production. USA, 15:15 (GMT+2)

The Industrial Production index is due at 15:15 (GMT+2). The MoM index is expected to grow to 0.2% in February from - 0.3% in the previous month. It represents industrial output in the US. It is one of the major indicators of the state of the national economy and has a high impact on the market. A growth in the index supports the USD. A fall in the index pressures the USD.

Capacity Utilization. USA, 15:15 (GMT+2)

The Capacity Utilization data are due at 15:15 (GMT+2). The index is expected to grow to 7 5.5% in February from 7 5.3% in the previous month. It is the percentage expression of the production capacity utilisation in the economy of the country. It represents economic growth and the level of demand. The value of 85% is considered optimal and represents a good balance between economic growth and inflation. A value above 85% represents inflation acceleration. A growth in the index generally strengthens the USD.

Trade Balance. EU, 12:00 (GMT+2)

The Trade Balance data are due at 12:00 (GMT+2). The surplus is expected to lower to 22.3 billion EUR in January from 24.5 billion EUR in the previous month. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Industrial Production. USA, 15:15 (GMT+2)

The Industrial Production index is due at 15:15 (GMT+2). The MoM index is expected to grow to 0.2% in February from - 0.3% in the previous month. It represents industrial output in the US. It is one of the major indicators of the state of the national economy and has a high impact on the market. A growth in the index supports the USD. A fall in the index pressures the USD.

Capacity Utilization. USA, 15:15 (GMT+2)

The Capacity Utilization data are due at 15:15 (GMT+2). The index is expected to grow to 7 5.5% in February from 7 5.3% in the previous month. It is the percentage expression of the production capacity utilisation in the economy of the country. It represents economic growth and the level of demand. The value of 85% is considered optimal and represents a good balance between economic growth and inflation. A value above 85% represents inflation acceleration. A growth in the index generally strengthens the USD.

Claws and Horns

News of the day. 16.03.2017

Employment Change s.a. Australia, 02:30 (GMT+2)

The Employment Change s.a. data are due at 02:30 (GMT+2). The MoM index is expected to grow to 16.0K in February from 1 3.5K in the previous month. The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

BoJ Interest Rate Decision. Japan, 04:00 (GMT+2)

The Bank of Japan Interest Rate Decision is due at 04:00 (GMT+2). The value is expected to stay on the same level of - 0.1%. The Bank of Japan announces its decision on interest rates. A rate increase strengthens the JPY, while a decrease weakens the JPY.

BoJ Monetary Policy Statement. Japan, 07:30 (GMT+2)

The Bank of Japan Monetary Policy Statement is due at 07:30 (GMT+2). During a press conference, voting results regarding the recent interest rate decision are announced.

SNB Interest Rate Decision. Switzerland, 10:30 (GMT+2)

The Swiss National Bank Interest Rate Decision is due at 10:30 (GMT+2). The value is expected to stay on the same level of - 0.75%. The Swiss National Bank announces its decision on interest rates. A rate increase strengthens the CHF, while a decrease weakens the CHF.

Consumer Price Index. EU, 12:00 (GMT+2)

The Consumer Price Index data are due at 12:00 (GMT+2). The MoM value is expected to grow to 0.4% in February from - 0.8% in the previous month. It is the key indicator of inflation in the Eurozone. It represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

BoE Interest Rate Decision. United Kingdom, 14:00 (GMT+2)

The Bank of England Interest Rate Decision is due at 14:00 (GMT+2). The value is expected to stay on the same level of 0.25%. Depending on the current economic situation and the level of inflation, the Bank of England makes its decision on the interest rate. The rate increase strengthens the GBP. If rate remains unchanged or get cut, the GBP weakens.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims index is due at 14:30 (GMT+2). The index is expected to lower to 240K this week from 243K in the previous week. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Employment Change s.a. Australia, 02:30 (GMT+2)

The Employment Change s.a. data are due at 02:30 (GMT+2). The MoM index is expected to grow to 16.0K in February from 1 3.5K in the previous month. The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

BoJ Interest Rate Decision. Japan, 04:00 (GMT+2)

The Bank of Japan Interest Rate Decision is due at 04:00 (GMT+2). The value is expected to stay on the same level of - 0.1%. The Bank of Japan announces its decision on interest rates. A rate increase strengthens the JPY, while a decrease weakens the JPY.

BoJ Monetary Policy Statement. Japan, 07:30 (GMT+2)

The Bank of Japan Monetary Policy Statement is due at 07:30 (GMT+2). During a press conference, voting results regarding the recent interest rate decision are announced.

SNB Interest Rate Decision. Switzerland, 10:30 (GMT+2)

The Swiss National Bank Interest Rate Decision is due at 10:30 (GMT+2). The value is expected to stay on the same level of - 0.75%. The Swiss National Bank announces its decision on interest rates. A rate increase strengthens the CHF, while a decrease weakens the CHF.

Consumer Price Index. EU, 12:00 (GMT+2)

The Consumer Price Index data are due at 12:00 (GMT+2). The MoM value is expected to grow to 0.4% in February from - 0.8% in the previous month. It is the key indicator of inflation in the Eurozone. It represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

BoE Interest Rate Decision. United Kingdom, 14:00 (GMT+2)

The Bank of England Interest Rate Decision is due at 14:00 (GMT+2). The value is expected to stay on the same level of 0.25%. Depending on the current economic situation and the level of inflation, the Bank of England makes its decision on the interest rate. The rate increase strengthens the GBP. If rate remains unchanged or get cut, the GBP weakens.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims index is due at 14:30 (GMT+2). The index is expected to lower to 240K this week from 243K in the previous week. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Claws and Horns

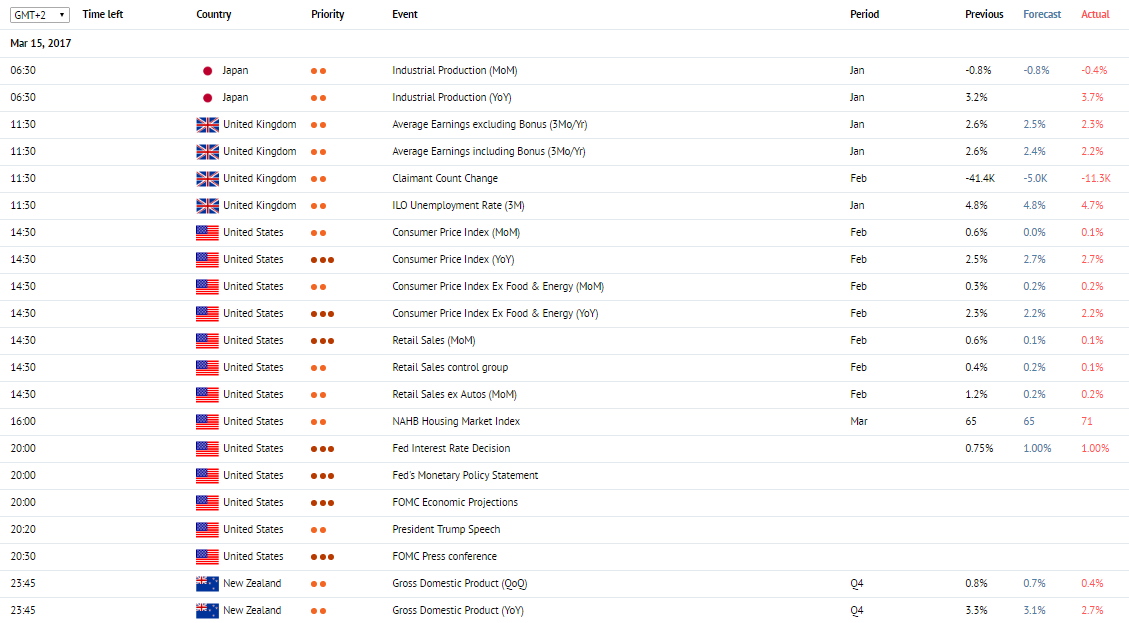

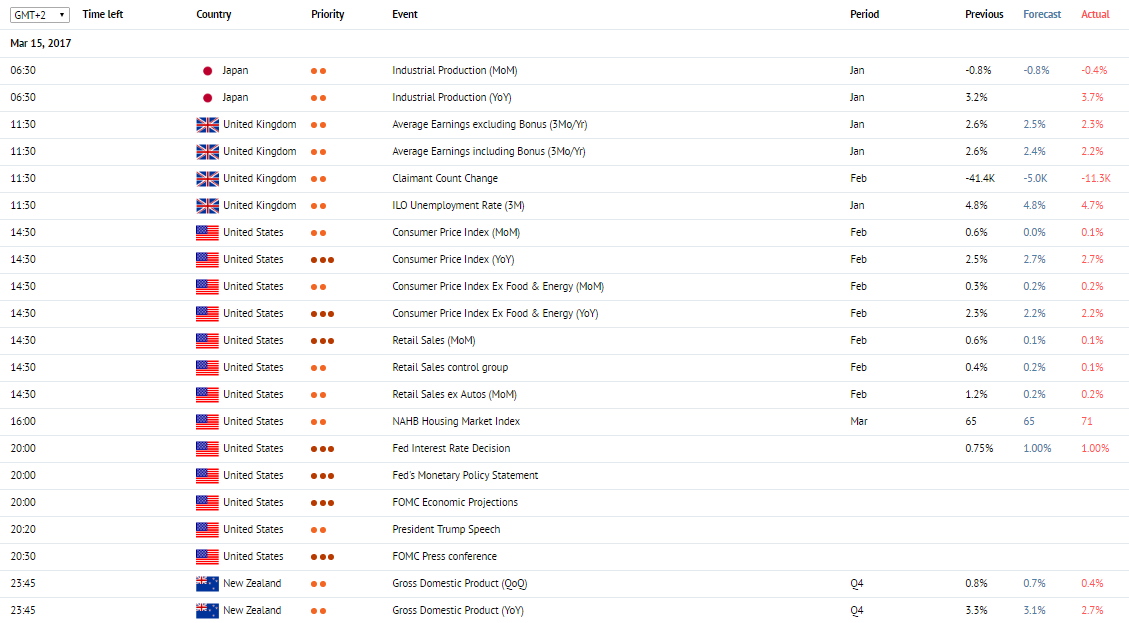

News of the day. 15.03.2017

Industrial output. Japan, 06:30 (GMT+2)

The data on industrial output is due at 06:30 (GMT+2). It is expected that in January, the indicator will remain unchanged at the level of 0.8%. It reflects changes in Japan's industrial output and shows the state of national economy. Growth of this indicator leads to national currency growth, decrease of the indicator leads to national currency weakening.

Jobless Claims. Great Britain, 11:30 (GMT+2)

The data on Jobless Claims is due at 11:30 (GMT+2). It is forecasted that the indicator will amount to -5,0K in February compared to -42.2K a month earlier. The indicator shows the amount of British citizens not having a job. Higher values weaken GBP, lower values strengthen it.

Retail Sales. USA, 14:30 (GMT+2)

The data on retail sales are due at 14:30 (GMT+2). It is forecasted that on monthly basis, the indicator will decrease to 0,1% in January from 0.4% a month earlier. This indicator reflects consumer spending and represents the change in the volume of retail sales. Growth of the index is a positive factor for the economy and strengthens the USD. Fall of the index weakens the USD.

Consumer Price Index. USA, 14:30 (GMT+2)

Consumer Price Index is due at 14:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 2.7% in January from 2.5% a month earlier. It is the key indicator of inflation in the country. Represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

FOMC's decision of the interest rate is due today at 20:00 (GMT+2).

It is forecasted that the interest rate will be raised to 1.00% from the current value of 0.75%. FOMC is going to announce its decision on interest rate. This indicator is very important for the economy and influences interest rate levels of commercial banks and exchange rate of US dollar. Interest rate hike influences US national currency in a positive way. Rate decrease leads to USD rate falling.

FOMC Press Conference. USA, 20:30 (GMT+2)

FOMC Press Conference is due today at 20:30 (GMT+2). After announcing FOMC's decision on interest rate, Janet Yellen is going to answer questions regarding current economic situation in the USA. Comments of the Chair of the Board of Governors have significant influence on the market and are able to strengthen or weaken USD rate.

Gross Domestic Product. New Zealand, 23:45 (GMT+2)

The data on New Zealand GDP are due at 23:45 (GMT+2). It is expected that from one quarter to the next, the indicator will fall to 0.7% in Q4 compared to 1.1% during previous period. On YoY basis, the indicator will fall to 3.1% in Q4 from 3.5% during previous period. The indicator shows value of all goods and services produced in the country for a certain period. Higher values strengthen NZD, lower values weaken it.

Industrial output. Japan, 06:30 (GMT+2)

The data on industrial output is due at 06:30 (GMT+2). It is expected that in January, the indicator will remain unchanged at the level of 0.8%. It reflects changes in Japan's industrial output and shows the state of national economy. Growth of this indicator leads to national currency growth, decrease of the indicator leads to national currency weakening.

Jobless Claims. Great Britain, 11:30 (GMT+2)

The data on Jobless Claims is due at 11:30 (GMT+2). It is forecasted that the indicator will amount to -5,0K in February compared to -42.2K a month earlier. The indicator shows the amount of British citizens not having a job. Higher values weaken GBP, lower values strengthen it.

Retail Sales. USA, 14:30 (GMT+2)

The data on retail sales are due at 14:30 (GMT+2). It is forecasted that on monthly basis, the indicator will decrease to 0,1% in January from 0.4% a month earlier. This indicator reflects consumer spending and represents the change in the volume of retail sales. Growth of the index is a positive factor for the economy and strengthens the USD. Fall of the index weakens the USD.

Consumer Price Index. USA, 14:30 (GMT+2)

Consumer Price Index is due at 14:30 (GMT+2). It is forecasted that on monthly basis, the indicator will rise to 2.7% in January from 2.5% a month earlier. It is the key indicator of inflation in the country. Represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

FOMC's decision of the interest rate is due today at 20:00 (GMT+2).

It is forecasted that the interest rate will be raised to 1.00% from the current value of 0.75%. FOMC is going to announce its decision on interest rate. This indicator is very important for the economy and influences interest rate levels of commercial banks and exchange rate of US dollar. Interest rate hike influences US national currency in a positive way. Rate decrease leads to USD rate falling.

FOMC Press Conference. USA, 20:30 (GMT+2)

FOMC Press Conference is due today at 20:30 (GMT+2). After announcing FOMC's decision on interest rate, Janet Yellen is going to answer questions regarding current economic situation in the USA. Comments of the Chair of the Board of Governors have significant influence on the market and are able to strengthen or weaken USD rate.

Gross Domestic Product. New Zealand, 23:45 (GMT+2)

The data on New Zealand GDP are due at 23:45 (GMT+2). It is expected that from one quarter to the next, the indicator will fall to 0.7% in Q4 compared to 1.1% during previous period. On YoY basis, the indicator will fall to 3.1% in Q4 from 3.5% during previous period. The indicator shows value of all goods and services produced in the country for a certain period. Higher values strengthen NZD, lower values weaken it.

Claws and Horns

News of the day. 14.03.2017

Consumer Price Index. Germany, 09:00 (GMT+2)

Consumer Price Index is due at 09:00 (GMT+2). It is expected that on YoY basis, the indicator will remain unchanged at the level of 2.2% in February. On monthly basis, the indicator will remain unchanged at the level of 0.6%.

Industrial output. EU, 12:00 (GMT+2)

The data on industrial output is due at 12:00 (GMT+2). It is forecasted that on YoY basis, the indicator will fall to 1.1% in January from -2.0% a month earlier. On monthly basis, the indicator is expected to grow to 1,5% in January from -1.6% a month earlier. The indicator shows changes in industrial output volume and is one of the most important indices of state of the economy. Higher values strengthen the EUR, low values weaken it.

Producer Price Index USA, 14:30 (GMT+2)

Producer Price Index is due at 14:30 (GMT+2). It is forecasted that on monthly basis, the indicator will decrease to 0,1% in January from 0.6% a month earlier. The indicator shows changes in producer prices. Higher values strengthen the USD, low values weaken it.

Consumer Price Index. Germany, 09:00 (GMT+2)

Consumer Price Index is due at 09:00 (GMT+2). It is expected that on YoY basis, the indicator will remain unchanged at the level of 2.2% in February. On monthly basis, the indicator will remain unchanged at the level of 0.6%.

Industrial output. EU, 12:00 (GMT+2)

The data on industrial output is due at 12:00 (GMT+2). It is forecasted that on YoY basis, the indicator will fall to 1.1% in January from -2.0% a month earlier. On monthly basis, the indicator is expected to grow to 1,5% in January from -1.6% a month earlier. The indicator shows changes in industrial output volume and is one of the most important indices of state of the economy. Higher values strengthen the EUR, low values weaken it.

Producer Price Index USA, 14:30 (GMT+2)

Producer Price Index is due at 14:30 (GMT+2). It is forecasted that on monthly basis, the indicator will decrease to 0,1% in January from 0.6% a month earlier. The indicator shows changes in producer prices. Higher values strengthen the USD, low values weaken it.

Claws and Horns

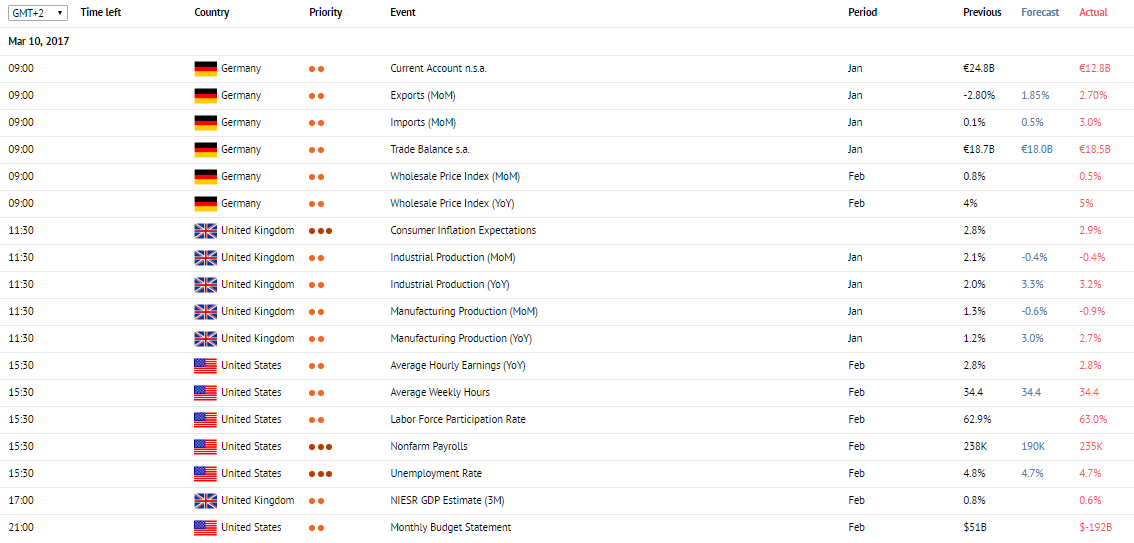

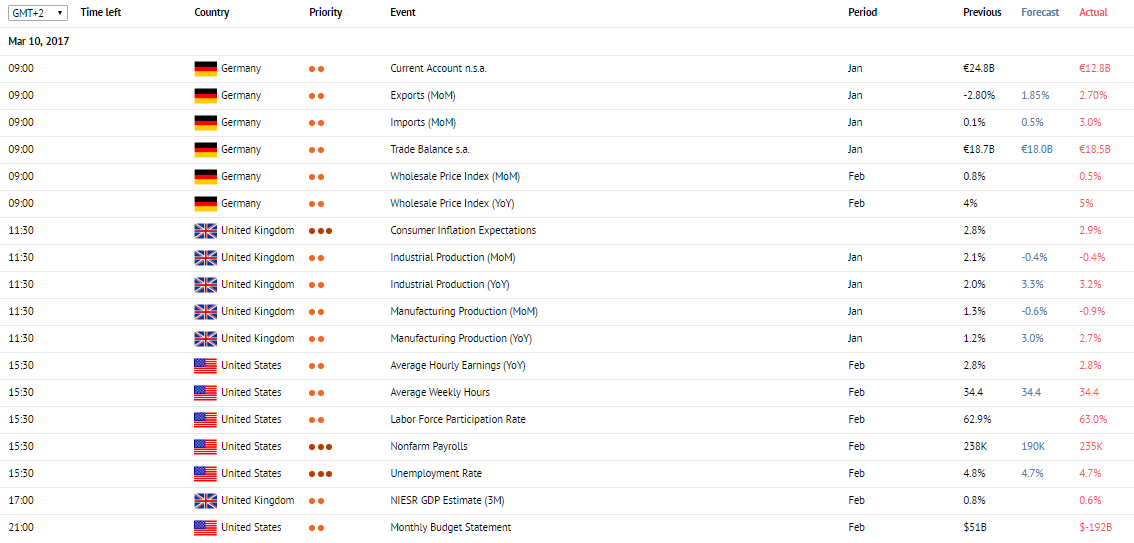

News of the day. 10.03.2017

Balance of trades. Germany, 09:00 (GMT+2)

The data on trade balance are due at 09:00 (GMT+2). It is expected that the indicator will fall to 18.0 billion euro in February compared to 18.4 billion euro a month earlier. The indicator shows gap between export and import of goods and services in monetary terms. Positive value means trade balance proficit, i.e. export prevails over import. Negative value means trade balance deficit: import prevails over export. Increasing export influences Germany economy in a positive way. Higher values strengthen EUR, lower values weaken it.

Industrial output. Great Britain, 11:30 (GMT+2)

The data on industrial output is due at 11:30 (GMT+2). It is forecasted that on monthly basis, the indicator will decrease to -0,4% in January from 2.1% a month earlier. On year-on-year basis, vice versa, the indicator is expected to grow to 3.3% in January compared to 2.0% a month earlier. Index shows industrial output level in Great Britain. This in one of the most important indicators of the state of national economy, including manufacturing and primary industry and power sector. Growth of this indicator leads to national currency growth, decrease of the indicator leads to national currency weakening.

Nonfarm Payrolls (NFPR). USA, 15:30 (GMT+2)

Nonfarm Payrolls data are due at 15:30 (GMT+2). It is forecasted that the indicator will fall to 190K in February compared to 246K a month earlier. It is one of the most important indices of employment in USA, shows the number of salaried employees outside the agriculture sector, and makes a great influence on the market. Higher values indicate job gains and strengthen USD, lower values weaken it.

Unemployment rate. USA, 15:30 (GMT+2)

The data on unemployment rate are due at 15:30 (GMT+2). It is forecasted that the indicator will fall to 4.7% in February compared to 4.8% a month earlier. This is one of the key macroeconomic indicators showing the rate of unemployed citizens to the overall number of work force. Growth of this indicator weakens the USD, decrease of the indicator strengthens the USD.

Balance of trades. Germany, 09:00 (GMT+2)

The data on trade balance are due at 09:00 (GMT+2). It is expected that the indicator will fall to 18.0 billion euro in February compared to 18.4 billion euro a month earlier. The indicator shows gap between export and import of goods and services in monetary terms. Positive value means trade balance proficit, i.e. export prevails over import. Negative value means trade balance deficit: import prevails over export. Increasing export influences Germany economy in a positive way. Higher values strengthen EUR, lower values weaken it.

Industrial output. Great Britain, 11:30 (GMT+2)

The data on industrial output is due at 11:30 (GMT+2). It is forecasted that on monthly basis, the indicator will decrease to -0,4% in January from 2.1% a month earlier. On year-on-year basis, vice versa, the indicator is expected to grow to 3.3% in January compared to 2.0% a month earlier. Index shows industrial output level in Great Britain. This in one of the most important indicators of the state of national economy, including manufacturing and primary industry and power sector. Growth of this indicator leads to national currency growth, decrease of the indicator leads to national currency weakening.

Nonfarm Payrolls (NFPR). USA, 15:30 (GMT+2)

Nonfarm Payrolls data are due at 15:30 (GMT+2). It is forecasted that the indicator will fall to 190K in February compared to 246K a month earlier. It is one of the most important indices of employment in USA, shows the number of salaried employees outside the agriculture sector, and makes a great influence on the market. Higher values indicate job gains and strengthen USD, lower values weaken it.

Unemployment rate. USA, 15:30 (GMT+2)

The data on unemployment rate are due at 15:30 (GMT+2). It is forecasted that the indicator will fall to 4.7% in February compared to 4.8% a month earlier. This is one of the key macroeconomic indicators showing the rate of unemployed citizens to the overall number of work force. Growth of this indicator weakens the USD, decrease of the indicator strengthens the USD.

Claws and Horns

News of the day. 9.03.2017

ECB Interest Rate Decision. EU, 14:45 (GMT+2)

The ECB Interest Rate Decision is due at 14:45 (GMT+2). The index is expected to stay on the same level of 0%. The interest rate decision is made according to the current economic state and the inflation level. A rate increase strengthens the EUR, while a decrease weakens the EUR.

ECB Monetary policy statement and press conference. EU, 15:30 (GMT+2)

After the interest rate decision is made, the ECB Head comments on the recent monetary policy decision and answers questions about current economic conditions in the Eurozone.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The Initial Jobless Claims data are due at 15:30 (GMT+2) in the USA. The index is expected to grow to 235K WoW from 223K in the previous week. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Electronic Card Retail Sales. New Zealand, 23:45 (GMT+2)

The Electronic Card Retail Sales data are due at 23:45 (GMT+2) in the New Zealand. The MoM index is expected to lower to -0.4% in February from 2.7% in the previous month. The data on electronic card retail sales measures purchases made with credit and debit cards. The data is considered as an indicator of the retail sector. A growth in electronic card retail sales strengthens the NZD. A fall in the indicator weakens the NZD.

ECB Interest Rate Decision. EU, 14:45 (GMT+2)

The ECB Interest Rate Decision is due at 14:45 (GMT+2). The index is expected to stay on the same level of 0%. The interest rate decision is made according to the current economic state and the inflation level. A rate increase strengthens the EUR, while a decrease weakens the EUR.

ECB Monetary policy statement and press conference. EU, 15:30 (GMT+2)

After the interest rate decision is made, the ECB Head comments on the recent monetary policy decision and answers questions about current economic conditions in the Eurozone.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The Initial Jobless Claims data are due at 15:30 (GMT+2) in the USA. The index is expected to grow to 235K WoW from 223K in the previous week. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Electronic Card Retail Sales. New Zealand, 23:45 (GMT+2)

The Electronic Card Retail Sales data are due at 23:45 (GMT+2) in the New Zealand. The MoM index is expected to lower to -0.4% in February from 2.7% in the previous month. The data on electronic card retail sales measures purchases made with credit and debit cards. The data is considered as an indicator of the retail sector. A growth in electronic card retail sales strengthens the NZD. A fall in the indicator weakens the NZD.

Claws and Horns

News of the day. 8.03.2017

ADP Employment Change. USA, 15:15 (GMT+2)

The ADP Employment Change index is due at 15:15 (GMT+2) in the USA. The index is expected to lower to 190K in February from 246K in the previous month. The index represents employment change in non-agricultural sectors. It is based on data from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Housing Starts s.a (YoY). Canada, 15:15 (GMT+2)

The Housing Starts s.a (YoY) data are due at 15:15 (GMT+2) in Canada. The index is expected to lower to 200.0K in February from 207.4K in the previous month. The index is published by Canada Mortgage and Housing Corporation. It represents the number of housing starts for single-family homes. Construction volumes are closely linked to the population income, thus a growth in the index indicates economy growth. A high reading strengthens the CAD. A low reading weakens the CAD.

Nonfarm Productivity. USA, 15:30 (GMT+2)

Nonfarm Productivity is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 1.5% in the 4 quarter from 1.3% in the previous period. It evaluates hourly productivity of labour and influences GDP forecasts. A high reading strengthens the USD. A low reading weakens the USD.

ADP Employment Change. USA, 15:15 (GMT+2)

The ADP Employment Change index is due at 15:15 (GMT+2) in the USA. The index is expected to lower to 190K in February from 246K in the previous month. The index represents employment change in non-agricultural sectors. It is based on data from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Housing Starts s.a (YoY). Canada, 15:15 (GMT+2)

The Housing Starts s.a (YoY) data are due at 15:15 (GMT+2) in Canada. The index is expected to lower to 200.0K in February from 207.4K in the previous month. The index is published by Canada Mortgage and Housing Corporation. It represents the number of housing starts for single-family homes. Construction volumes are closely linked to the population income, thus a growth in the index indicates economy growth. A high reading strengthens the CAD. A low reading weakens the CAD.

Nonfarm Productivity. USA, 15:30 (GMT+2)

Nonfarm Productivity is due at 15:30 (GMT+2) in the USA. The index is expected to grow to 1.5% in the 4 quarter from 1.3% in the previous period. It evaluates hourly productivity of labour and influences GDP forecasts. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 7.03.2017

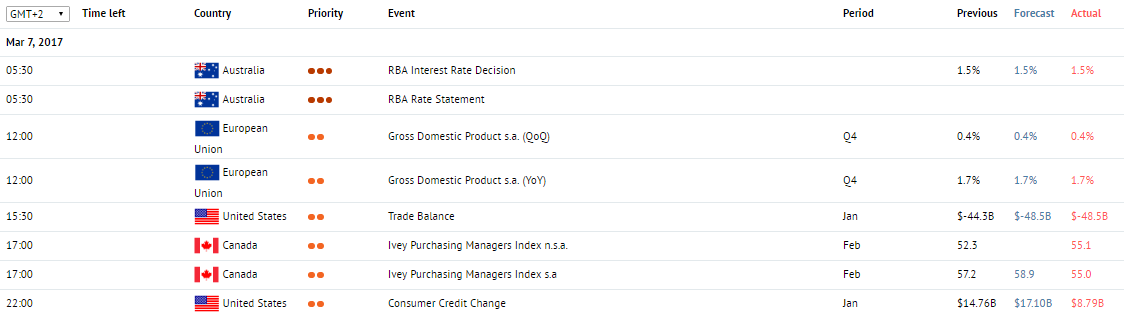

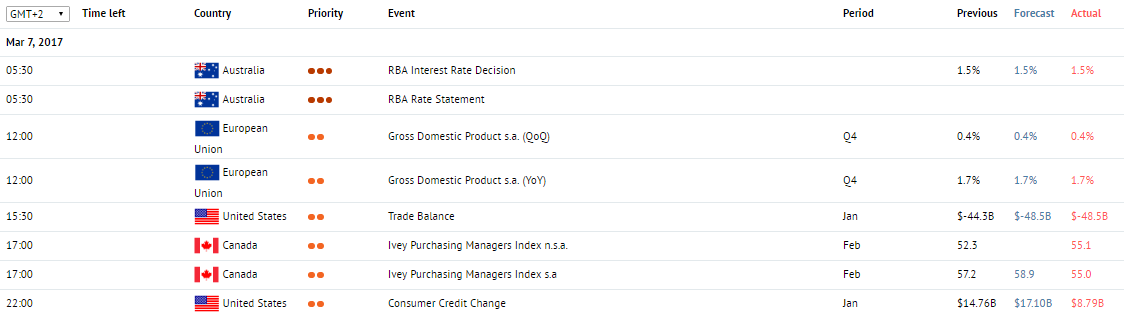

Decision of Reserve Bank of Australia on the interest rate. Australia, 05:30 (GMT+2)

The decision of Reserve Bank of Australia on the interest rate is due today at 05:30 (GMT+2). It is expected that the indicator will remain unchanged at the level of 1.5%. RBA makes the decision based on current economic situation and inflation level. Growth of this indicator strengthens the AUD. If the rate stays at the same level or goes down, the national currency rate is decreased.

Gross Domestic Product. EU, 12:00 (GMT+2)

The data on Gross Domestic Product is due at 12:00 (GMT+2). It is expected that from one qaurter to the next, the indicator will remain unchanged at the level of 0.4% in Q4. On year-on-year basis, the indicator will remain unchanged at the level of 1.7%. The indicator shows market value of all final goods and services produced in euro zone within the period. Higher values strengthen EUR, lower values weaken it.

Balance of trades. USA, 15:30 (GMT+2)

The data on US balance of trades are due at 15:30 (GMT+2). It is forecasted that the balance deficit will grow to -45,5 billion dollars in January, compared to -44,3 billion a month earlier. The indicator shows gap between export and import of goods and services. Positive value gives evidence of balance of payments surplus and strengthens USD, negative value shows that the balance is unfavorable, and weakens USD.

Ivey Purchasing Managers Index. Canada, 17:00 (GMT+2)

Ivey PMI is due at 17:00 (GMT+2). It is forecasted that the indicator will rise to 58.9 points in February compared to 57.2 points a month earlier. The index is calculated by Ivey Business School and gives estimation of current economic conditions in the country. The values above 50 show that business activity is increasing, thus strengthening CAD. The values above 50 show business decline, weakening CAD.

Decision of Reserve Bank of Australia on the interest rate. Australia, 05:30 (GMT+2)

The decision of Reserve Bank of Australia on the interest rate is due today at 05:30 (GMT+2). It is expected that the indicator will remain unchanged at the level of 1.5%. RBA makes the decision based on current economic situation and inflation level. Growth of this indicator strengthens the AUD. If the rate stays at the same level or goes down, the national currency rate is decreased.

Gross Domestic Product. EU, 12:00 (GMT+2)

The data on Gross Domestic Product is due at 12:00 (GMT+2). It is expected that from one qaurter to the next, the indicator will remain unchanged at the level of 0.4% in Q4. On year-on-year basis, the indicator will remain unchanged at the level of 1.7%. The indicator shows market value of all final goods and services produced in euro zone within the period. Higher values strengthen EUR, lower values weaken it.

Balance of trades. USA, 15:30 (GMT+2)

The data on US balance of trades are due at 15:30 (GMT+2). It is forecasted that the balance deficit will grow to -45,5 billion dollars in January, compared to -44,3 billion a month earlier. The indicator shows gap between export and import of goods and services. Positive value gives evidence of balance of payments surplus and strengthens USD, negative value shows that the balance is unfavorable, and weakens USD.

Ivey Purchasing Managers Index. Canada, 17:00 (GMT+2)

Ivey PMI is due at 17:00 (GMT+2). It is forecasted that the indicator will rise to 58.9 points in February compared to 57.2 points a month earlier. The index is calculated by Ivey Business School and gives estimation of current economic conditions in the country. The values above 50 show that business activity is increasing, thus strengthening CAD. The values above 50 show business decline, weakening CAD.

Claws and Horns

News of the day. 6.03.2017

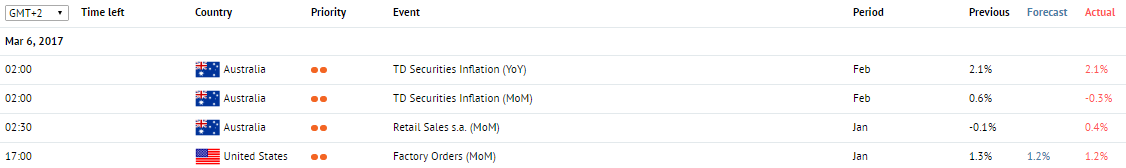

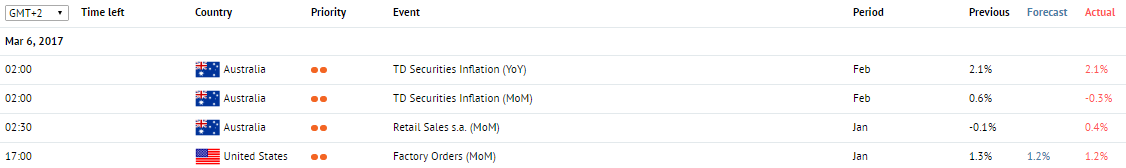

Retail Sales. Australia, 2:30 am (GMT+2)

Data on Retail Sales is due at 2:30 am (GMT+2). In January, the index is expected to grow from -0.1% to 0.4%. The index measures the volume of sales in the retail sector. The data is considered an indicator of consumer spending and economic growth. An increase in retail sales strengthens the AUD. A fall in retail sales weakens the AUD.

Factory Orders. US, 5:00 pm (GMT+2)

Data on Factory Orders is due at 5:00 pm (GMT+2). In January, the index is forecasted to fall from 1.3% to 1.2%. The index represents the change in the volume of factory orders. Allows estimating the pace of the growth of the industrial sector. A growth in the index strengthens the USD. A fall in the index weakens the USD.

Retail Sales. Australia, 2:30 am (GMT+2)

Data on Retail Sales is due at 2:30 am (GMT+2). In January, the index is expected to grow from -0.1% to 0.4%. The index measures the volume of sales in the retail sector. The data is considered an indicator of consumer spending and economic growth. An increase in retail sales strengthens the AUD. A fall in retail sales weakens the AUD.

Factory Orders. US, 5:00 pm (GMT+2)

Data on Factory Orders is due at 5:00 pm (GMT+2). In January, the index is forecasted to fall from 1.3% to 1.2%. The index represents the change in the volume of factory orders. Allows estimating the pace of the growth of the industrial sector. A growth in the index strengthens the USD. A fall in the index weakens the USD.

Claws and Horns

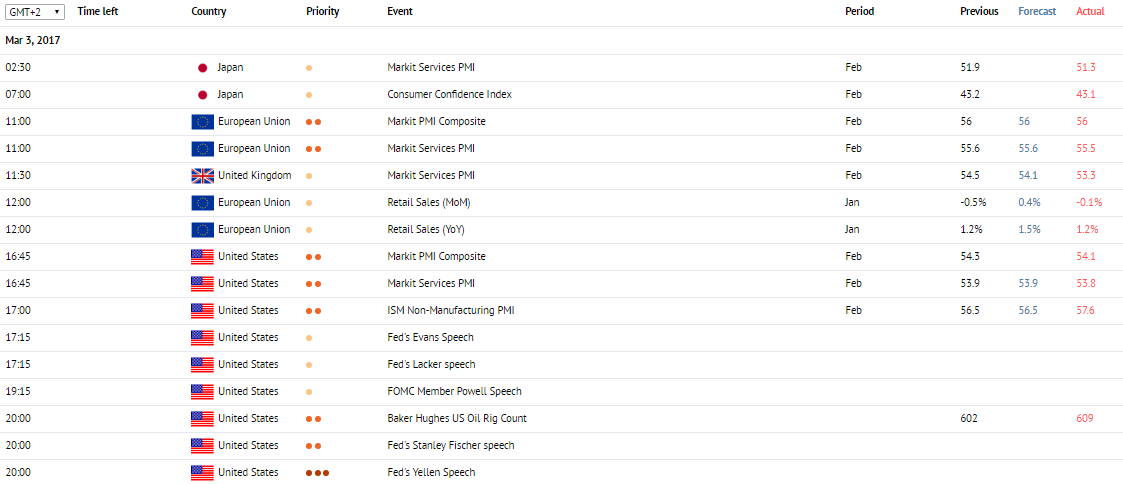

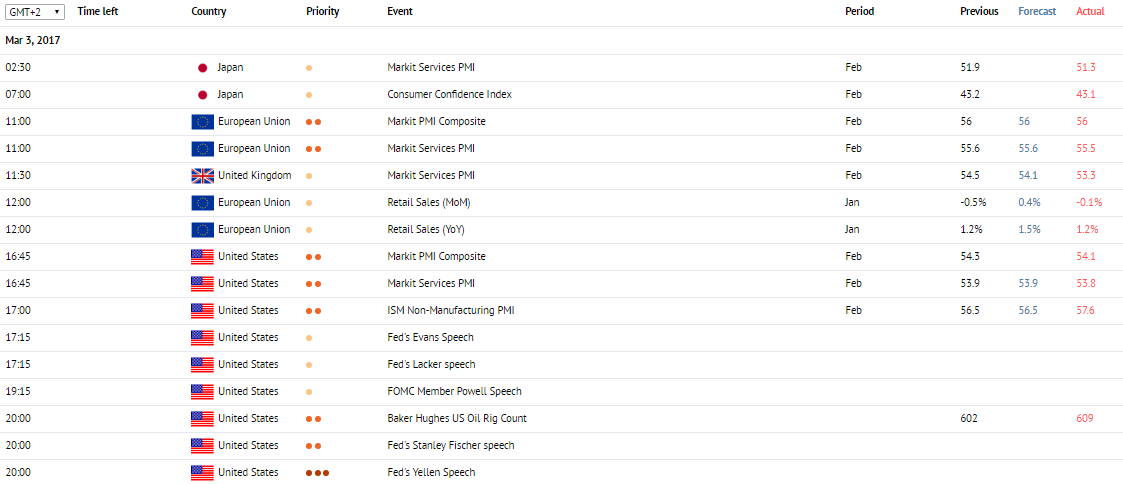

News of the day. 3.03.2017

Unemployment rate. Japan, 01:30 (GMT+2)

The data on unemployment rate are due at 01:30 (GMT+2). It is forecasted that the indicator will fall to 3.0% in January compared to 3.1% a month earlier. The indicator shows the ratio of unemployed citizens to the total amount of citizens able to work. Growth of this indicator is negative for the country's economy and weakens JPY. Lower results, on the contrary, point at economic growth and strengthen JPY.

Markit Services PMI. EU, 11:00 (GMT+2)

Markit Services PMI is due at 11:00 (GMT+2). It is expected that in February, the indicator will remain unchanged at the level of 55.6 points. The index shows economic conditions in services sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthens EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Markit Services PMI. Great Britain, 11:30 (GMT+2)

Markit Services PMI is due at 11:00 (GMT+2). It is forecasted that the indicator will fall to 54.2 % in February compared to 54.5% a month earlier. The indicator shows economic conditions in services sector and is built upon polls of company leaders working in this sector. Values above 50 are perceived as a positive signal and strengthens GBP. Values below 50 are perceived as a negative signal and call for decreasing GBP rate.

ISM Non-Manufacturing PMI. USA, 17:00 (GMT+2)

ISM Non-Manufacturing PMI is due at 17:00 (GMT+2). It is forecasted that the indicator will fall to 56.2 % in February compared to 56.5% a month earlier. The index is built upon polls of managers working in services sector to estimate current economic situation in this sector. Values above 45-50 show good economy growth tempo. Values above 45-50 show that the economy is slowing down. Growth of this indicator supports the USD.

Fed's Yellen Speech USA, 20:00 (GMT+2)

Fed's Janet Yellen Speech is due at 20:00 (GMT+2). Her speech can lead to increase in volatility for the pairs with US dollar.

Unemployment rate. Japan, 01:30 (GMT+2)

The data on unemployment rate are due at 01:30 (GMT+2). It is forecasted that the indicator will fall to 3.0% in January compared to 3.1% a month earlier. The indicator shows the ratio of unemployed citizens to the total amount of citizens able to work. Growth of this indicator is negative for the country's economy and weakens JPY. Lower results, on the contrary, point at economic growth and strengthen JPY.

Markit Services PMI. EU, 11:00 (GMT+2)

Markit Services PMI is due at 11:00 (GMT+2). It is expected that in February, the indicator will remain unchanged at the level of 55.6 points. The index shows economic conditions in services sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthens EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Markit Services PMI. Great Britain, 11:30 (GMT+2)

Markit Services PMI is due at 11:00 (GMT+2). It is forecasted that the indicator will fall to 54.2 % in February compared to 54.5% a month earlier. The indicator shows economic conditions in services sector and is built upon polls of company leaders working in this sector. Values above 50 are perceived as a positive signal and strengthens GBP. Values below 50 are perceived as a negative signal and call for decreasing GBP rate.

ISM Non-Manufacturing PMI. USA, 17:00 (GMT+2)

ISM Non-Manufacturing PMI is due at 17:00 (GMT+2). It is forecasted that the indicator will fall to 56.2 % in February compared to 56.5% a month earlier. The index is built upon polls of managers working in services sector to estimate current economic situation in this sector. Values above 45-50 show good economy growth tempo. Values above 45-50 show that the economy is slowing down. Growth of this indicator supports the USD.

Fed's Yellen Speech USA, 20:00 (GMT+2)

Fed's Janet Yellen Speech is due at 20:00 (GMT+2). Her speech can lead to increase in volatility for the pairs with US dollar.

Claws and Horns

News of the day. 2.03.2017

Trade Balance. Australia, 02:30 (GMT+2)

The Trade Balance is due at 02:30 (GMT+2) in Australia. The index is expected to grow to 3800 million in January from 3511 million in the previous month. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

PMI Construction. United Kingdom, 11:30 (GMT+2)

The PMI Construction index is due at 11:30 (GMT+2) in the UK. The index is expected to grow to 52.4 points in February from 52.2 points in the previous month. The index evaluates the state of the construction sector. It is based on surveys of executives of the biggest construction companies regarding their opinion on current economic conditions in the sector and its prospects. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

Consumer Price Index. EU, 12:00 (GMT+2)

The Consumer Price Index is due at 12:00 (GMT+2) in the European Union. The YoY index is expected to grow to 2.0% in February from 1.8% in the previous month. The index is the key indicator of inflation in the Eurozone. It represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The Initial Jobless Claims index is due at 15:30 (GMT+2) in the USA. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Gross Domestic Product. Canada, 15:30 (GMT+2)

The Gross Domestic Product index is due at 15:30 (GMT+2) in Canada. The MoM index is expected to lower to 0.3% in December from 0.4% in the previous month. It represents the value of all goods and services created in the country during a certain period. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Trade Balance. Australia, 02:30 (GMT+2)

The Trade Balance is due at 02:30 (GMT+2) in Australia. The index is expected to grow to 3800 million in January from 3511 million in the previous month. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

PMI Construction. United Kingdom, 11:30 (GMT+2)

The PMI Construction index is due at 11:30 (GMT+2) in the UK. The index is expected to grow to 52.4 points in February from 52.2 points in the previous month. The index evaluates the state of the construction sector. It is based on surveys of executives of the biggest construction companies regarding their opinion on current economic conditions in the sector and its prospects. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

Consumer Price Index. EU, 12:00 (GMT+2)

The Consumer Price Index is due at 12:00 (GMT+2) in the European Union. The YoY index is expected to grow to 2.0% in February from 1.8% in the previous month. The index is the key indicator of inflation in the Eurozone. It represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Initial Jobless Claims. USA, 15:30 (GMT+2)

The Initial Jobless Claims index is due at 15:30 (GMT+2) in the USA. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Gross Domestic Product. Canada, 15:30 (GMT+2)

The Gross Domestic Product index is due at 15:30 (GMT+2) in Canada. The MoM index is expected to lower to 0.3% in December from 0.4% in the previous month. It represents the value of all goods and services created in the country during a certain period. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Claws and Horns

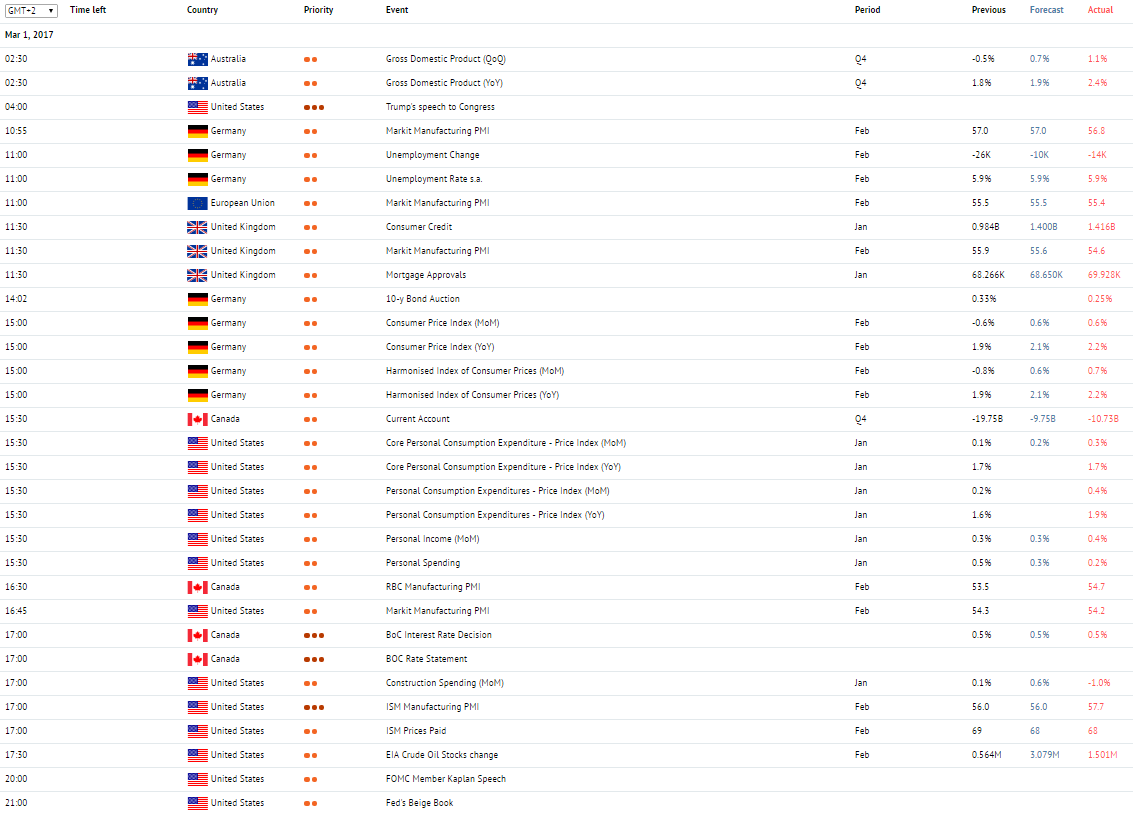

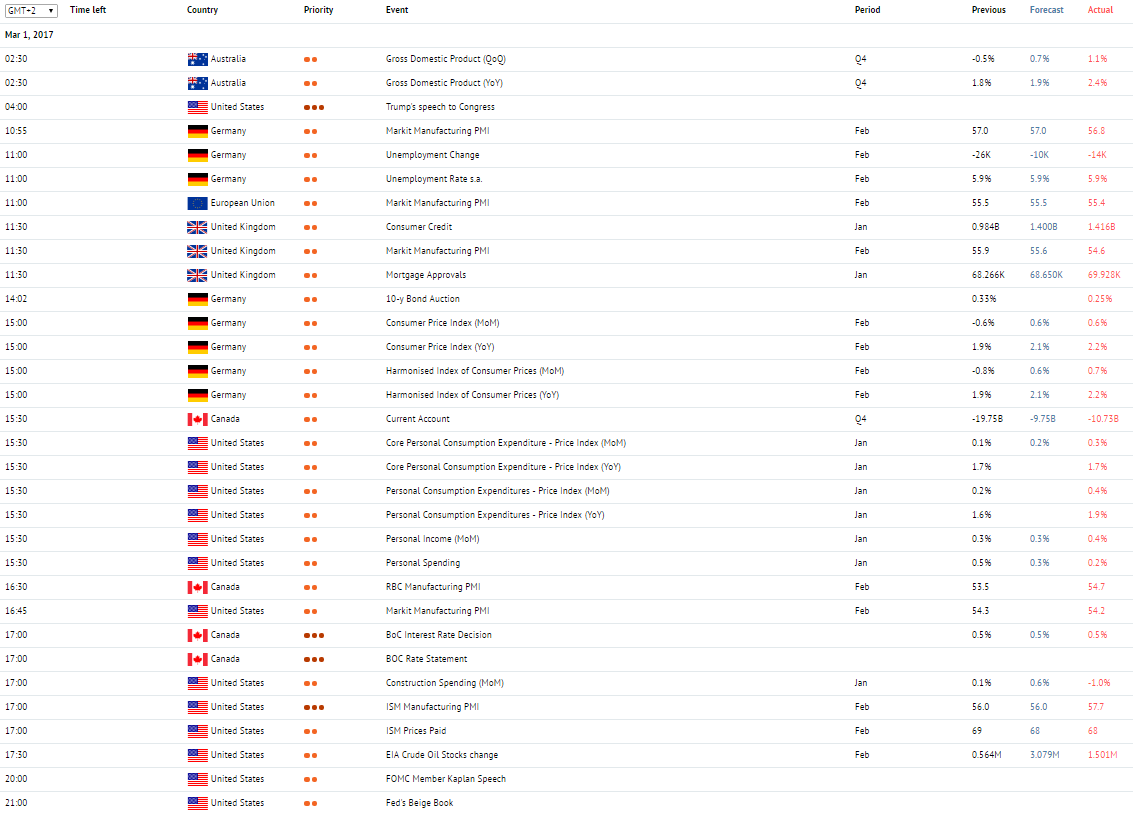

News of the day. 1.03.2017

Gross Domestic Product. Australia, 02:30 (GMT+2)

The Gross Domestic Product is due at 02:30 (GMT+2) in Australia. The YoY index is expected to grow to 1.9% in the fourth quarter from 1.8% in the previous quarter. The QoQ index is expected to grow to 0.7% in the fourth quarter from - 0.5% in the previous period.

Markit Manufacturing PMI. EU, 11:00 (GMT+2)

The Markit Manufacturing PMI is due at 11:00 (GMT+2) in the European Union. The index is expected to stay on the same level of 55.5 in February. The index reflects economic situation in the manufacturing sector and its prospects. A result above 50 point represents favorable state of the sector and can strengthen the EUR. A result below 50 points, on the contrary, is seen as a negative signal and can weaken the EUR.

Markit Manufacturing PMI. United Kingdom, 11:30 (GMT+2)

The Markit Manufacturing PMI is due at 11:30 (GMT+2) in the UK. The index is expected to lower to 55.5 points in February from с 55.9 points in the previous month. The index evaluates the state of the manufacturing sector. It is based on surveys of executives of the biggest manufacturing companies. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

Consumer Credit. United Kingdom, 11:30 (GMT+2)

The Consumer Credit data is due at 11:30 (GMT+2) in the UK. The value is expected to grow to 1.400 billion GBP from 1.039 billion in the previous month. It represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Consumer Price Index. Germany, 15:00 (GMT+2)

The Consumer Price Index is due at 15:00 (GMT+2) in Germany. The YoY index is expected to grow to 2.1% in February from 1.9% in the previous month. The MoM index is expected to grow to 0.6% in February from - 0.6% in the previous month. The index represents the change in prices for goods and services for households. The index is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

ISM Manufacturing PMI. USA, 17:00 (GMT+2)

The ISM Manufacturing PMI is due at 17:00 (GMT+2) in the USA. The index is expected to grow to 55.7 points in February from 56.0 points in the previous month. It is the indicator of the general state of the US economy. Values above 50 represent economic growth and strengthen the USD. Values below 50 indicate a slowdown of the economy and weaken the USD.

BoC Interest Rate Decision. Canada, 17:00 (GMT+2)

The Bank of Canada Interest Rate Decision is due at 17:00 (GMT+2). The index is expected to stay on the same level of 0.5%. Important economic indicator. It influences interest rates of retail banks and the CAD exchange rate. An interest rate increase strengthens the CAD. The rate decrease weakens the CAD.

Fed's Beige Book. USA, 21:00 (GMT+2)

The Fed's Beige Book report is due at 21:00 (GMT+2) in the USA. The report is prepared by the 12 Federal Reserve Banks and evaluates current economic conditions in the US. Optimistic commentaries strengthen the USD. Pessimistic commentaries weaken the USD.

Gross Domestic Product. Australia, 02:30 (GMT+2)

The Gross Domestic Product is due at 02:30 (GMT+2) in Australia. The YoY index is expected to grow to 1.9% in the fourth quarter from 1.8% in the previous quarter. The QoQ index is expected to grow to 0.7% in the fourth quarter from - 0.5% in the previous period.

Markit Manufacturing PMI. EU, 11:00 (GMT+2)

The Markit Manufacturing PMI is due at 11:00 (GMT+2) in the European Union. The index is expected to stay on the same level of 55.5 in February. The index reflects economic situation in the manufacturing sector and its prospects. A result above 50 point represents favorable state of the sector and can strengthen the EUR. A result below 50 points, on the contrary, is seen as a negative signal and can weaken the EUR.

Markit Manufacturing PMI. United Kingdom, 11:30 (GMT+2)

The Markit Manufacturing PMI is due at 11:30 (GMT+2) in the UK. The index is expected to lower to 55.5 points in February from с 55.9 points in the previous month. The index evaluates the state of the manufacturing sector. It is based on surveys of executives of the biggest manufacturing companies. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

Consumer Credit. United Kingdom, 11:30 (GMT+2)

The Consumer Credit data is due at 11:30 (GMT+2) in the UK. The value is expected to grow to 1.400 billion GBP from 1.039 billion in the previous month. It represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Consumer Price Index. Germany, 15:00 (GMT+2)

The Consumer Price Index is due at 15:00 (GMT+2) in Germany. The YoY index is expected to grow to 2.1% in February from 1.9% in the previous month. The MoM index is expected to grow to 0.6% in February from - 0.6% in the previous month. The index represents the change in prices for goods and services for households. The index is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

ISM Manufacturing PMI. USA, 17:00 (GMT+2)

The ISM Manufacturing PMI is due at 17:00 (GMT+2) in the USA. The index is expected to grow to 55.7 points in February from 56.0 points in the previous month. It is the indicator of the general state of the US economy. Values above 50 represent economic growth and strengthen the USD. Values below 50 indicate a slowdown of the economy and weaken the USD.

BoC Interest Rate Decision. Canada, 17:00 (GMT+2)

The Bank of Canada Interest Rate Decision is due at 17:00 (GMT+2). The index is expected to stay on the same level of 0.5%. Important economic indicator. It influences interest rates of retail banks and the CAD exchange rate. An interest rate increase strengthens the CAD. The rate decrease weakens the CAD.

Fed's Beige Book. USA, 21:00 (GMT+2)

The Fed's Beige Book report is due at 21:00 (GMT+2) in the USA. The report is prepared by the 12 Federal Reserve Banks and evaluates current economic conditions in the US. Optimistic commentaries strengthen the USD. Pessimistic commentaries weaken the USD.

Claws and Horns

News of the day. 28.02.2017

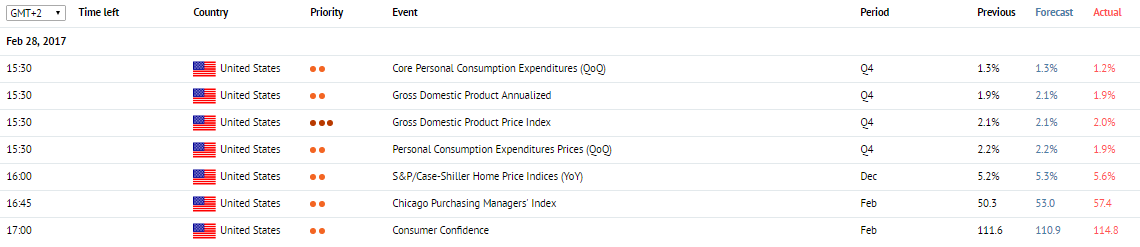

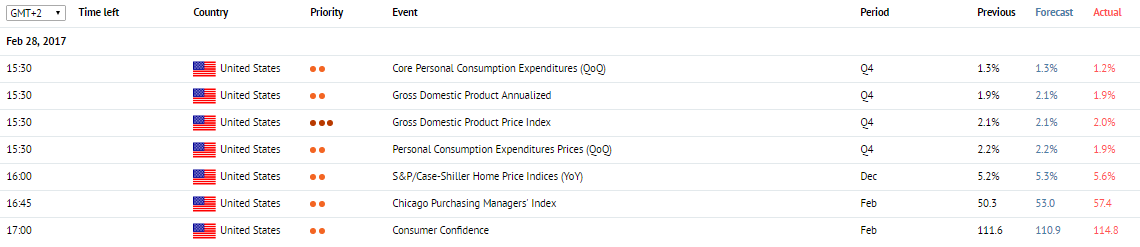

Gross Domestic Product Annualized. USA, 15:30 (GMT+2)

The Gross Domestic Product Annualized data are due at 15:30 (GMT+2) in the USA. The index is expected to grow to 2.1% in the fourth from 1.9% in the previous period. The index shows the total value of goods and services created in the country during the year and indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

S&P/Case-Shiller Home Price Indices. USA, 16:00 (GMT+2)

The S&P/Case-Shiller Home Price Indices are due at 16:00 (GMT+2) in the USA. The S&P/Case-Shiller Home Price Indices released by the Standard & Poor's examines changes in the value of the residential real estate market in 20 regions across the US. This report serves as an indicator for the health of the US housing market. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative, or bearish.

Consumer Confidence. USA, 17:00 (GMT+2)

The Consumer Confidence index is due at 17:00 (GMT+2) in the USA. The index is expected to lower to 110.9 point in February from 111.8 points in the previous month. The index represent consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Gross Domestic Product Annualized. USA, 15:30 (GMT+2)

The Gross Domestic Product Annualized data are due at 15:30 (GMT+2) in the USA. The index is expected to grow to 2.1% in the fourth from 1.9% in the previous period. The index shows the total value of goods and services created in the country during the year and indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

S&P/Case-Shiller Home Price Indices. USA, 16:00 (GMT+2)

The S&P/Case-Shiller Home Price Indices are due at 16:00 (GMT+2) in the USA. The S&P/Case-Shiller Home Price Indices released by the Standard & Poor's examines changes in the value of the residential real estate market in 20 regions across the US. This report serves as an indicator for the health of the US housing market. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative, or bearish.

Consumer Confidence. USA, 17:00 (GMT+2)

The Consumer Confidence index is due at 17:00 (GMT+2) in the USA. The index is expected to lower to 110.9 point in February from 111.8 points in the previous month. The index represent consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 27.02.2017

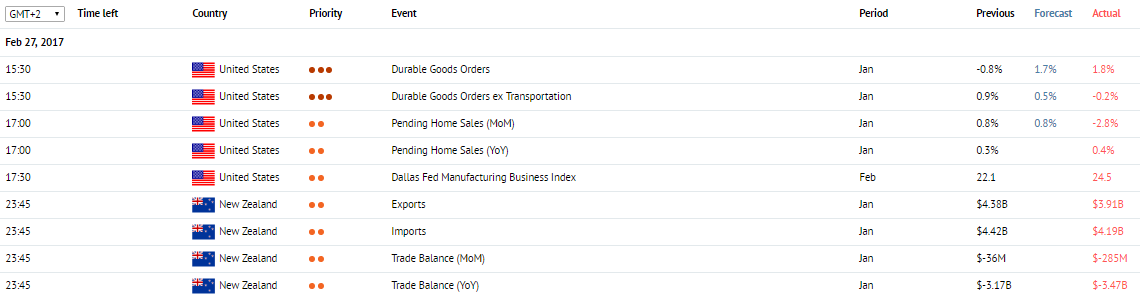

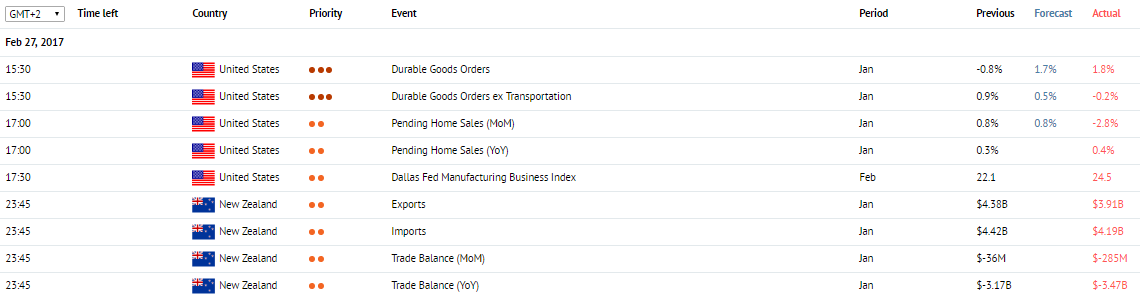

Durable Goods Orders. USA, 15:30 (GMT+2)

The Durable Goods Orders data are due at 15:30 (GMT+2) in the USA. The data represent the change in the volume of orders against the value in the previous months. It represents the value change for durable goods that last for more than 3 years. The index reflects the consumers’ confidence in the economy state and is the advanced indicator of the production activity. The index is expected to be positive and to significantly grow by 1.9% against the lowering by 0.5% in December, which will support the USD.

Pending Home Sales. USA, 17:00 (GMT+2)

The January Pending Home Sales index is due at 17:00 (GMT+2) in the USA. The index shows the number of homes sales in which a contract is signed but the sale has not yet closed (the pending time is about 1-2 months) and is one of the main indicators of the property market. The December index has grown by 1.6% MoM and can continue to grow in January, but the growth will probably be that great.

Trade Balance. New Zealand, 23:45 (GMT+2)

The January Trade Balance is due at 23:45 (GMT+2) in the New Zealand. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD. The New Zealand trade deficit is lowering from September, 2016, and can continue to decrease in January.

Durable Goods Orders. USA, 15:30 (GMT+2)

The Durable Goods Orders data are due at 15:30 (GMT+2) in the USA. The data represent the change in the volume of orders against the value in the previous months. It represents the value change for durable goods that last for more than 3 years. The index reflects the consumers’ confidence in the economy state and is the advanced indicator of the production activity. The index is expected to be positive and to significantly grow by 1.9% against the lowering by 0.5% in December, which will support the USD.

Pending Home Sales. USA, 17:00 (GMT+2)

The January Pending Home Sales index is due at 17:00 (GMT+2) in the USA. The index shows the number of homes sales in which a contract is signed but the sale has not yet closed (the pending time is about 1-2 months) and is one of the main indicators of the property market. The December index has grown by 1.6% MoM and can continue to grow in January, but the growth will probably be that great.

Trade Balance. New Zealand, 23:45 (GMT+2)

The January Trade Balance is due at 23:45 (GMT+2) in the New Zealand. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD. The New Zealand trade deficit is lowering from September, 2016, and can continue to decrease in January.

: