Claws and Horns / Profile

Claws and Horns

Home Loans. Australia, 3:30 am

Data on the Home Loans for August is due in Australia at 3:30 am (GMT+2). The indicator represents the number of recently extended home loans. It is one of the key indicators of the property market. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

ZEW Survey - Current Situation. Germany, 11:00 am

Data on the ZEW Survey - Current Situation for October is due in Germany at 11:00 am (GMT+2). The indicator is expected to grow from 55.1 to 55.5 points. The data is published by the Centre for European Economic Research (ZEW) and is based on survey responses from leading financial experts in Europe regarding their assessment of economic conditions. A high reading represents their optimistic view and strengthens the EUR. A reading below forecast represents pessimism and weakens the EUR.

ZEW Survey - Economic Sentiment. Germany, 11:00 am

Data on the ZEW Survey - Economic Sentiment for October is due in Germany at 11:00 am (GMT+2). The indicator is expected to grow from 0.5 to 4.0 points. The data is published by the Centre for European Economic Research (ZEW) and is based on surveys responses from leading financial experts in Europe regarding their assessment of economic conditions. A high reading represents their optimistic view and strengthens the EUR. A reading below forecast represents pessimism and weakens the EUR.

Data on the Home Loans for August is due in Australia at 3:30 am (GMT+2). The indicator represents the number of recently extended home loans. It is one of the key indicators of the property market. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

ZEW Survey - Current Situation. Germany, 11:00 am

Data on the ZEW Survey - Current Situation for October is due in Germany at 11:00 am (GMT+2). The indicator is expected to grow from 55.1 to 55.5 points. The data is published by the Centre for European Economic Research (ZEW) and is based on survey responses from leading financial experts in Europe regarding their assessment of economic conditions. A high reading represents their optimistic view and strengthens the EUR. A reading below forecast represents pessimism and weakens the EUR.

ZEW Survey - Economic Sentiment. Germany, 11:00 am

Data on the ZEW Survey - Economic Sentiment for October is due in Germany at 11:00 am (GMT+2). The indicator is expected to grow from 0.5 to 4.0 points. The data is published by the Centre for European Economic Research (ZEW) and is based on surveys responses from leading financial experts in Europe regarding their assessment of economic conditions. A high reading represents their optimistic view and strengthens the EUR. A reading below forecast represents pessimism and weakens the EUR.

Claws and Horns

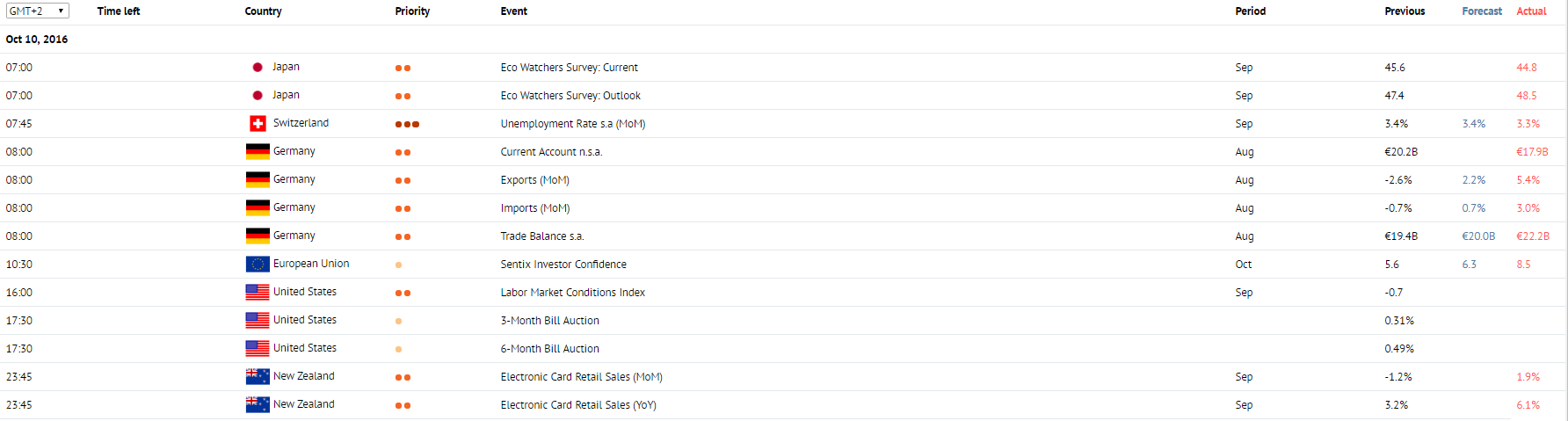

News of the day. 10.10.2016.

Unemployment Rate s.a. Switzerland, 7:45 am

Data on the Unemployment Rate for September is due at 7:45 am (GMT+2). The indicator represents the percentage of the total labour force in Switzerland that is currently unemployed. A growth in unemployment suggests a slowdown of the economy. A high reading weakens the CHF, while a low reading strengthens the CHF.

Trade Balance s.a. Germany, 8:00 am

Data on the Trade Balance for August is due at 8:00 am (GMT+2). The index represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values represent the balance deficit and weaken the EUR.

Electronic Card Retail Sales. New Zealand, 11:45 pm

Data on Electronic Card Retail Sales for September is due at 11:45 pm (GMT+2). The index measures purchases made with credit and debit cards. It is considered an indicator of the state of the retail sector. A growth in electronic card retail sales strengthens the NZD. A fall in the indicator weakens the NZD.

Unemployment Rate s.a. Switzerland, 7:45 am

Data on the Unemployment Rate for September is due at 7:45 am (GMT+2). The indicator represents the percentage of the total labour force in Switzerland that is currently unemployed. A growth in unemployment suggests a slowdown of the economy. A high reading weakens the CHF, while a low reading strengthens the CHF.

Trade Balance s.a. Germany, 8:00 am

Data on the Trade Balance for August is due at 8:00 am (GMT+2). The index represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values represent the balance deficit and weaken the EUR.

Electronic Card Retail Sales. New Zealand, 11:45 pm

Data on Electronic Card Retail Sales for September is due at 11:45 pm (GMT+2). The index measures purchases made with credit and debit cards. It is considered an indicator of the state of the retail sector. A growth in electronic card retail sales strengthens the NZD. A fall in the indicator weakens the NZD.

Claws and Horns

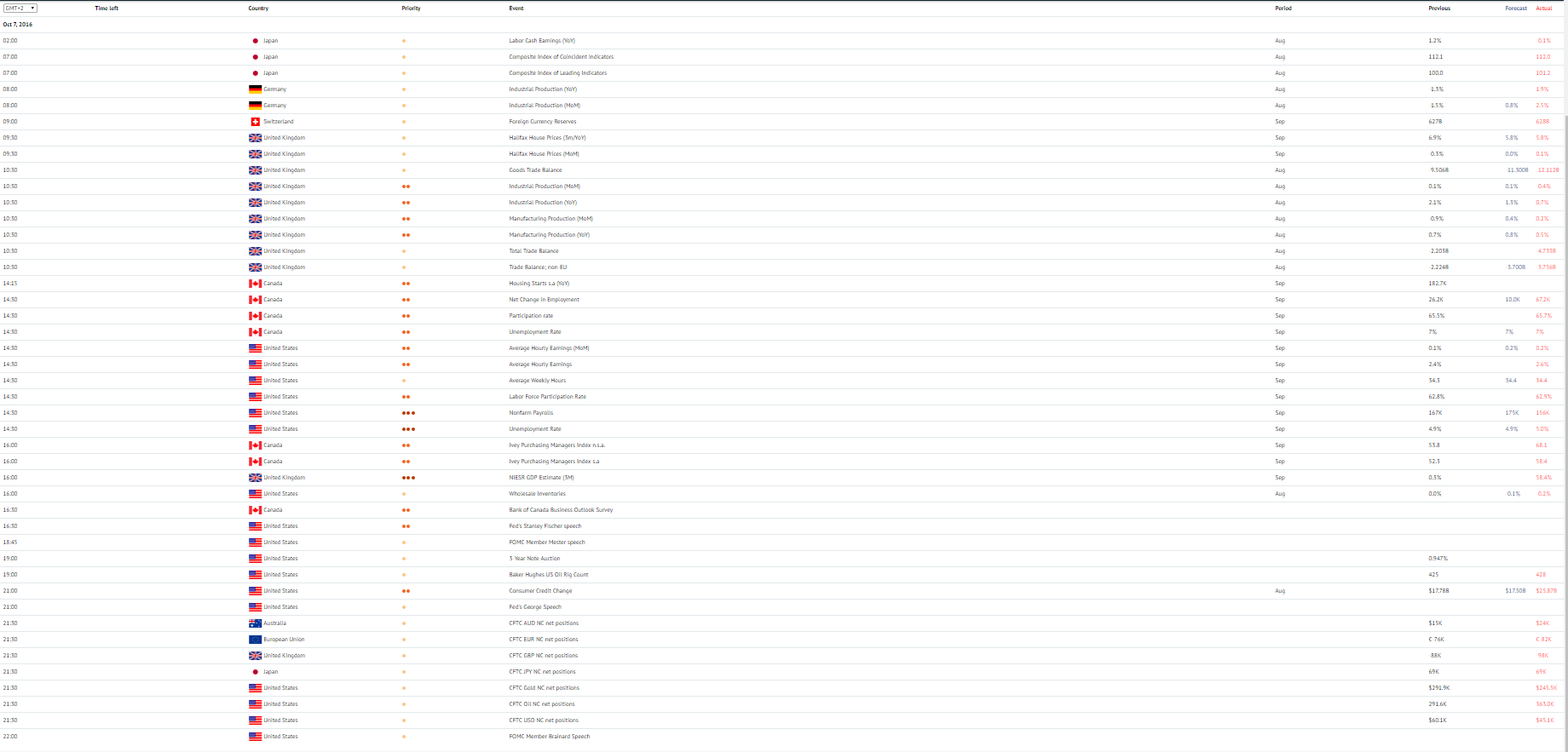

News of the day. 07.10.2016

Industrial Production. UK, 10:30

Data on Industrial Production for August is due at 10:30 am (GMT+2). According to forecasts, on a year-to-year basis the index will fall from 2.1% to 1.3%. Represents industrial output in the UK. It is one of the major indicators of the state of the national economy. The index includes manufacturing, mining and utilities. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Nonfarm Payrolls. US, 2:30 pm

Data on the Nonfarm Payrolls is due at 2:30 pm (GMT+2). In September, the index is expected to grow from 151 to 172 thousands. One of the main indicators of employment in the US. Represents the number of employed in non-agricultural sectors. Has a high impact on the market. A high reading represents employment growth and strengthens the USD. A low reading weakens the USD.

NIESR GDP Estimate. UK, 4:00 pm

The NIESR GDP Estimate for September is due at 4:00 pm (GMT+2). The report is published by the National Institute for Economic and Social Research. Tracks the UK economy growth for the last three months. The report has the potential to influence monetary policy in the country. A high reading strengthens the GBP. A low reading weakens the GBP.

Fed's Stanley Fischer speech. US, 4:30 pm

Fed's Stanley Fischer speech is due at 4:30 pm (GMT+2). Commentaries by Fed Vice-Chair Stanley Fischer regarding current economic conditions in the US. Fischer succeeded as vice-chair on 16 June 2014.

Consumer Credit Change. US, 9:00 pm

Data on the Consumer Credit Change is due at 9:00 pm (GMT+2). In August, the index is expected to fall from 17.71 billion to 17.5 billion USD. Represents the change in the volume of outstanding consumer credit in the US. A high reading strengthens the USD. A low reading weakens the USD. Sometimes, a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Industrial Production. UK, 10:30

Data on Industrial Production for August is due at 10:30 am (GMT+2). According to forecasts, on a year-to-year basis the index will fall from 2.1% to 1.3%. Represents industrial output in the UK. It is one of the major indicators of the state of the national economy. The index includes manufacturing, mining and utilities. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Nonfarm Payrolls. US, 2:30 pm

Data on the Nonfarm Payrolls is due at 2:30 pm (GMT+2). In September, the index is expected to grow from 151 to 172 thousands. One of the main indicators of employment in the US. Represents the number of employed in non-agricultural sectors. Has a high impact on the market. A high reading represents employment growth and strengthens the USD. A low reading weakens the USD.

NIESR GDP Estimate. UK, 4:00 pm

The NIESR GDP Estimate for September is due at 4:00 pm (GMT+2). The report is published by the National Institute for Economic and Social Research. Tracks the UK economy growth for the last three months. The report has the potential to influence monetary policy in the country. A high reading strengthens the GBP. A low reading weakens the GBP.

Fed's Stanley Fischer speech. US, 4:30 pm

Fed's Stanley Fischer speech is due at 4:30 pm (GMT+2). Commentaries by Fed Vice-Chair Stanley Fischer regarding current economic conditions in the US. Fischer succeeded as vice-chair on 16 June 2014.

Consumer Credit Change. US, 9:00 pm

Data on the Consumer Credit Change is due at 9:00 pm (GMT+2). In August, the index is expected to fall from 17.71 billion to 17.5 billion USD. Represents the change in the volume of outstanding consumer credit in the US. A high reading strengthens the USD. A low reading weakens the USD. Sometimes, a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Claws and Horns

News of the day. 06.10.2016.

Trade Balance. Australia, 2:30 am

Data on the Trade Balance is due at 2:30 am (GMT+2). In August, the index is expected to grow from -2.41 billion to -2.3 billion AUD. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

Consumer Price Index. Switzerland, 7:15 am

Data on the Consumer Price Index is due at 7:15 am (GMT+2). In September, the index is expected to grow from -0.1% to 0.2%. The index represents changes in prices of goods and services for households. The data is considered the key indicator of inflation. A growth in the index strengthens the CHF, while a fall weakens the CHF.

ECB Monetary Policy Meeting Accounts. EU, 1:30 pm

The ECB Monetary Policy Meeting Accounts are due at 1:30 pm (GMT+2). Account of the monetary policy meeting contains an overview of the current economic situation, commentaries on the recent monetary policy decisions and macroeconomic forecasts.

Initial Jobless Claims. US, 2:30 pm

Data on Initial Jobless Claims is due at 2:30 pm (GMT+2). According to forecasts, against the previous week the index will increase from 254 thousands to 256 thousands. Represents the number of new unemployment claims. Published weekly on Thursdays. Allows estimating the upcoming Nonfarm Payrolls figure. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Trade Balance. Australia, 2:30 am

Data on the Trade Balance is due at 2:30 am (GMT+2). In August, the index is expected to grow from -2.41 billion to -2.3 billion AUD. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

Consumer Price Index. Switzerland, 7:15 am

Data on the Consumer Price Index is due at 7:15 am (GMT+2). In September, the index is expected to grow from -0.1% to 0.2%. The index represents changes in prices of goods and services for households. The data is considered the key indicator of inflation. A growth in the index strengthens the CHF, while a fall weakens the CHF.

ECB Monetary Policy Meeting Accounts. EU, 1:30 pm

The ECB Monetary Policy Meeting Accounts are due at 1:30 pm (GMT+2). Account of the monetary policy meeting contains an overview of the current economic situation, commentaries on the recent monetary policy decisions and macroeconomic forecasts.

Initial Jobless Claims. US, 2:30 pm

Data on Initial Jobless Claims is due at 2:30 pm (GMT+2). According to forecasts, against the previous week the index will increase from 254 thousands to 256 thousands. Represents the number of new unemployment claims. Published weekly on Thursdays. Allows estimating the upcoming Nonfarm Payrolls figure. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Claws and Horns

News of the day. 05.10.2016

Retail Sales. Australia, 2:30 am

Data on Retail Sales is due at 2:30 am (GMT+2). In August, the index is expected to grow from 0.0% to 0.2%. The index measures the volume of sales in the retail sector. The data is considered an indicator of consumer spending and economic growth. An increase in retail sales strengthens the AUD. A fall in retail sales weakens the AUD.

ADP Employment Change. US, 2:15 pm

The ADP Employment Change is due at 2:15 pm (GMT+2). In September, the index is expected to fall from 177 thousands to 165 thousands. The index represents employment change in non-agricultural sectors. Is based on data from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Trade Balance. US, 2:30 pm

The Trade Balance for August is due at 2:30 pm (GMT+2). The balance deficit is expected to increase from 39.47 billion to 41.10 billion USD. Represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the USD. Negative values represent the balance deficit and weaken the USD.

ISM Non-Manufacturing PMI. US, 4:00 pm

Data on the ISM Non-Manufacturing PMI is due at 4:00 pm (GMT+2). In September, the index is forecasted to grow from 51.4 to 53.0 points. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 50 represents economic growth. A reading below 50 indicates that the sector is shrinking. A growth in the index strengthens the USD.

Factory Orders. US, 4:00 pm

Data on Factory Orders is due at 4:00 pm (GMT+2). In August, the index is expected to fall from 1.9% to -0.4%. The index represents the change in the volume of factory orders. Allows estimating the pace of the growth of the industrial sector. A growth in the index strengthens the USD. A fall in the index weakens the USD.

Retail Sales. Australia, 2:30 am

Data on Retail Sales is due at 2:30 am (GMT+2). In August, the index is expected to grow from 0.0% to 0.2%. The index measures the volume of sales in the retail sector. The data is considered an indicator of consumer spending and economic growth. An increase in retail sales strengthens the AUD. A fall in retail sales weakens the AUD.

ADP Employment Change. US, 2:15 pm

The ADP Employment Change is due at 2:15 pm (GMT+2). In September, the index is expected to fall from 177 thousands to 165 thousands. The index represents employment change in non-agricultural sectors. Is based on data from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Trade Balance. US, 2:30 pm

The Trade Balance for August is due at 2:30 pm (GMT+2). The balance deficit is expected to increase from 39.47 billion to 41.10 billion USD. Represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the USD. Negative values represent the balance deficit and weaken the USD.

ISM Non-Manufacturing PMI. US, 4:00 pm

Data on the ISM Non-Manufacturing PMI is due at 4:00 pm (GMT+2). In September, the index is forecasted to grow from 51.4 to 53.0 points. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 50 represents economic growth. A reading below 50 indicates that the sector is shrinking. A growth in the index strengthens the USD.

Factory Orders. US, 4:00 pm

Data on Factory Orders is due at 4:00 pm (GMT+2). In August, the index is expected to fall from 1.9% to -0.4%. The index represents the change in the volume of factory orders. Allows estimating the pace of the growth of the industrial sector. A growth in the index strengthens the USD. A fall in the index weakens the USD.

Claws and Horns

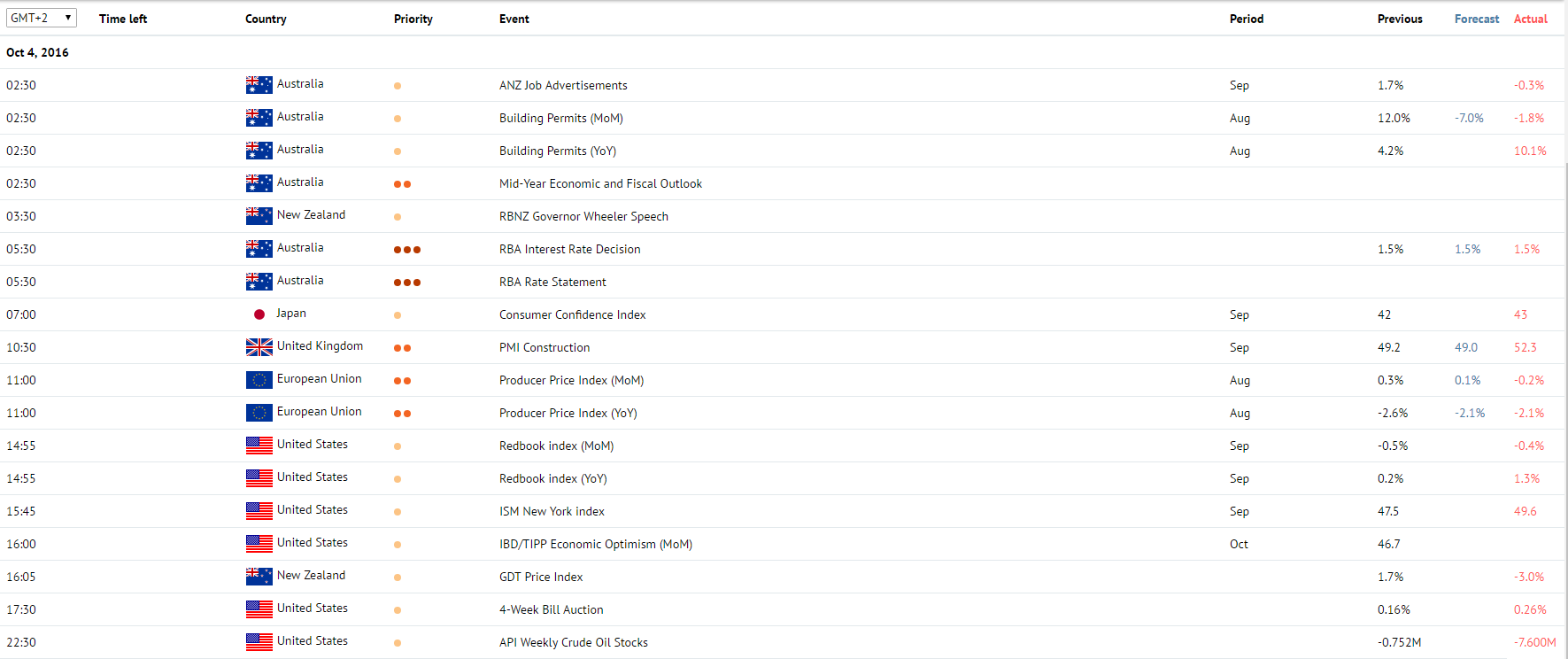

News of the day. 04.10.2016

RBA Interest Rate Decision. Australia, 5:30 am

The RBA Interest Rate Decision is due at 5:30 am (GMT+2). The rate is expected to remain unchanged at 1.5%. An increase in interest rates strengthens the AUD. If interest rates remain unchanged or get cut, the AUD weakens.

PMI Construction. UK, 10:30 am

Data on the PMI Construction is due at 10:30 am (GMT+2). In September, the index is expected to fall from 49.2 to 49.0 points. The index is based on surveys of executives of the biggest construction companies in the UK regarding their opinion on current economic conditions in the sector and its prospects. A reading above 50 is perceived as positive and strengthens the GBP. A reading below 50 is perceived as negative and weakens the GBP.

Producer Price Index. EU, 11:00 am

Data on the Producer Price Index is due at 11:00 am (GMT+2). In August, the index is expected to remain unchanged at 0.1%. The index represents a price change on goods, produced in the eurozone. A growth in the index, generally, supports the EUR. A decline in the index weakens the EUR.

RBA Interest Rate Decision. Australia, 5:30 am

The RBA Interest Rate Decision is due at 5:30 am (GMT+2). The rate is expected to remain unchanged at 1.5%. An increase in interest rates strengthens the AUD. If interest rates remain unchanged or get cut, the AUD weakens.

PMI Construction. UK, 10:30 am

Data on the PMI Construction is due at 10:30 am (GMT+2). In September, the index is expected to fall from 49.2 to 49.0 points. The index is based on surveys of executives of the biggest construction companies in the UK regarding their opinion on current economic conditions in the sector and its prospects. A reading above 50 is perceived as positive and strengthens the GBP. A reading below 50 is perceived as negative and weakens the GBP.

Producer Price Index. EU, 11:00 am

Data on the Producer Price Index is due at 11:00 am (GMT+2). In August, the index is expected to remain unchanged at 0.1%. The index represents a price change on goods, produced in the eurozone. A growth in the index, generally, supports the EUR. A decline in the index weakens the EUR.

Claws and Horns

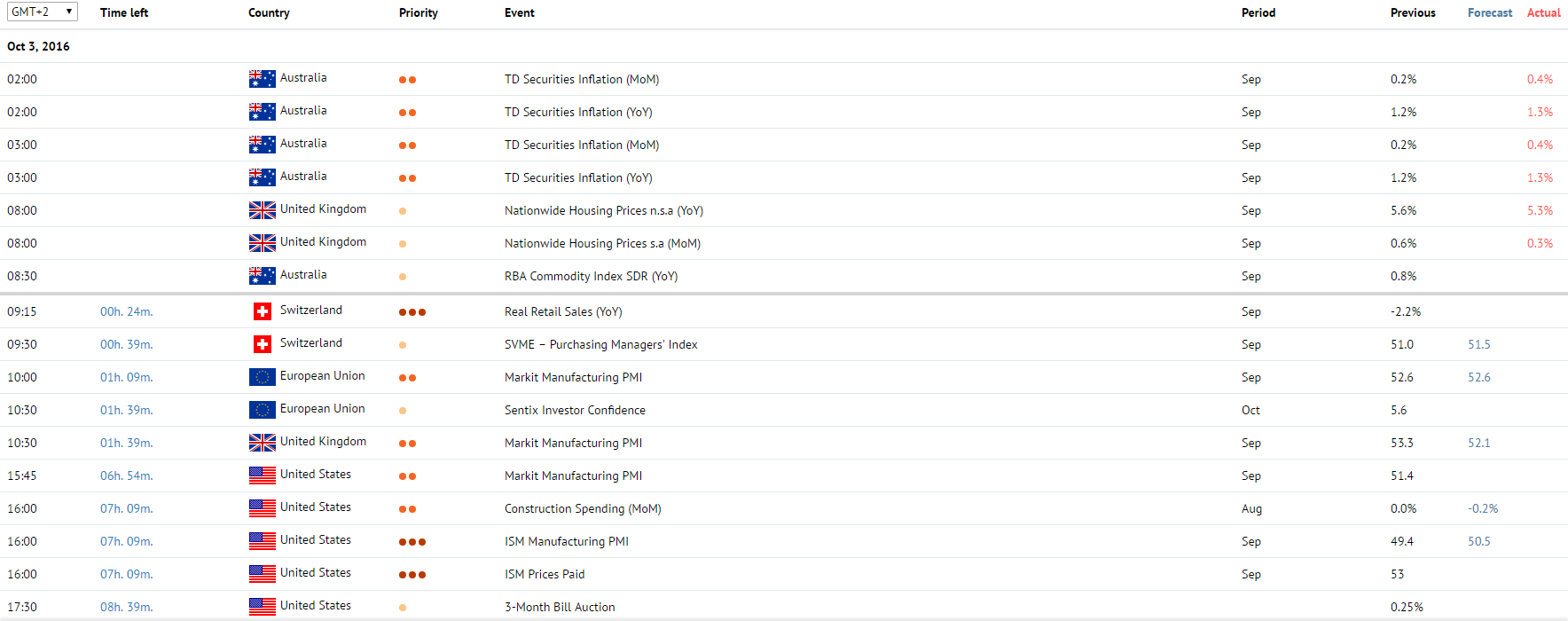

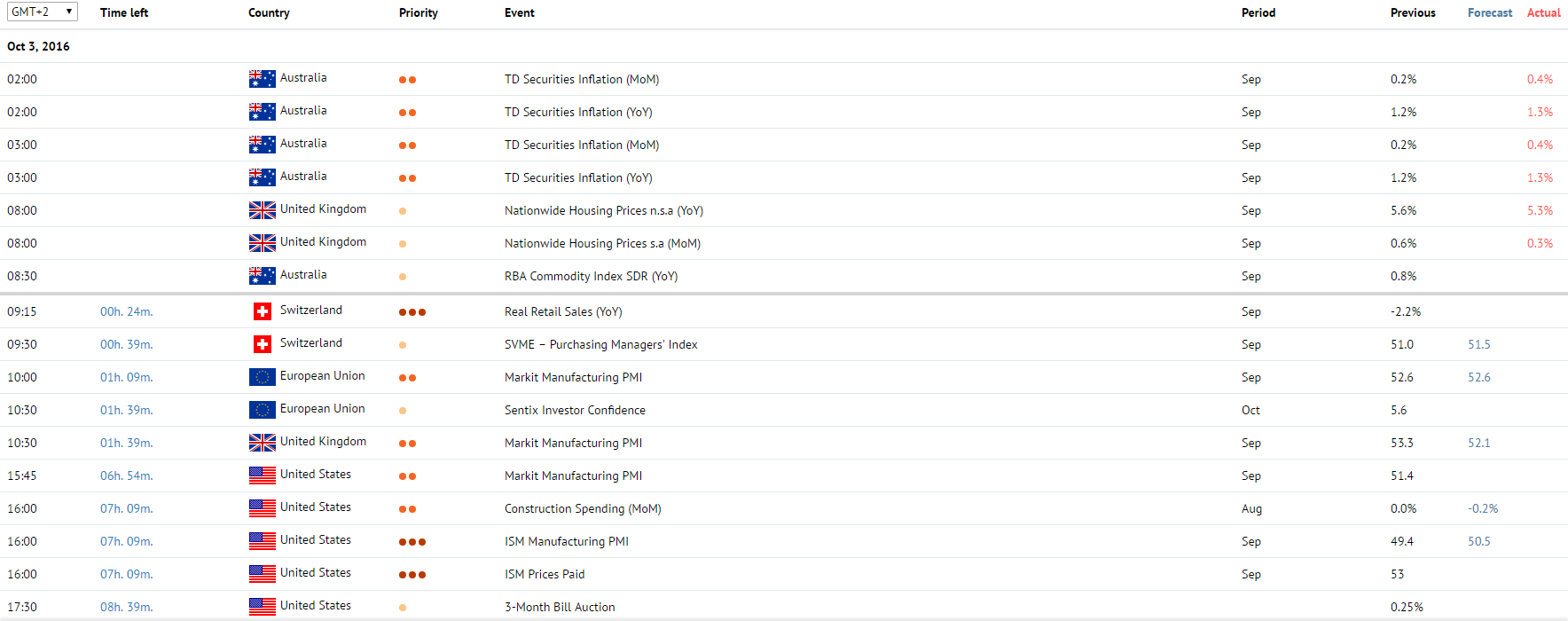

News of the day. 03.10.2016

TD Securities Inflation. Australia, 3:00 am

Data on the TD Securities Inflation for September is due at 3:00 am (GMT+2). The indicator, released by Melbourne Institute, measures changes in inflation. A growth in inflation might result in RBA’s decision to introduce higher interest rates. A growth in the indicator strengthens the AUD. A fall in the indicator, on the contrary, weakens the AUD.

Real Retail Sales. Switzerland, 9:15 am

Data on Real Retail Sales for September is due at 9:15 am (GMT+2). The index represents changes in the volume of retail sales and is considered an indicator of consumer spending. A growth in retail sales indicates a growth in consumption and has a positive impact on the economy. A fall in retail sales is considered as a negative factor for the economy. A high reading strengthens the CHF. A low reading weakens the CHF.

Markit Manufacturing PMI. Germany, 10:00 am

The Markit Manufacturing PMI for September is due at 10:00 am (GMT+2). The index represents the state of the manufacturing sector and its growth perspectives. One of the key indicators of the state of the German economy. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and weakens the EUR.

ISM Prices Paid. US, 4:00 pm

Data on the ISM Prices Paid for September is due at 4:00 pm (GMT+2). The index is based on surveys of executives of manufacturing companies. Evaluates current economic conditions in the manufacturing sector. A high reading strengthens the USD. A low reading weakens the USD.

ISM Manufacturing PMI. US, 4:00 pm

Data on the ISM Manufacturing PMI for September is due at 4:00 pm (GMT+2). The indicator represents the general state of the US economy. Values above 50 represent economic growth and strengthen the USD. Values below 50 indicate a slowdown of the economy and weaken the USD.

TD Securities Inflation. Australia, 3:00 am

Data on the TD Securities Inflation for September is due at 3:00 am (GMT+2). The indicator, released by Melbourne Institute, measures changes in inflation. A growth in inflation might result in RBA’s decision to introduce higher interest rates. A growth in the indicator strengthens the AUD. A fall in the indicator, on the contrary, weakens the AUD.

Real Retail Sales. Switzerland, 9:15 am

Data on Real Retail Sales for September is due at 9:15 am (GMT+2). The index represents changes in the volume of retail sales and is considered an indicator of consumer spending. A growth in retail sales indicates a growth in consumption and has a positive impact on the economy. A fall in retail sales is considered as a negative factor for the economy. A high reading strengthens the CHF. A low reading weakens the CHF.

Markit Manufacturing PMI. Germany, 10:00 am

The Markit Manufacturing PMI for September is due at 10:00 am (GMT+2). The index represents the state of the manufacturing sector and its growth perspectives. One of the key indicators of the state of the German economy. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and weakens the EUR.

ISM Prices Paid. US, 4:00 pm

Data on the ISM Prices Paid for September is due at 4:00 pm (GMT+2). The index is based on surveys of executives of manufacturing companies. Evaluates current economic conditions in the manufacturing sector. A high reading strengthens the USD. A low reading weakens the USD.

ISM Manufacturing PMI. US, 4:00 pm

Data on the ISM Manufacturing PMI for September is due at 4:00 pm (GMT+2). The indicator represents the general state of the US economy. Values above 50 represent economic growth and strengthen the USD. Values below 50 indicate a slowdown of the economy and weaken the USD.

Claws and Horns

News of the day. 30.09.2016

Caixin Manufacturing PMI. China, 3:00 am

The Caixin Manufacturing PMI is due at 3:00 pm (GMT+2). In September, the index is expected to grow from 50.0 to 50.1 points. The index evaluates the state of the manufacturing industry. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

Caixin China Services PMI. China, 3:45 am

Data on the Caixin China Services PMI for September is due at 3:45 am (GMT+2). The index evaluates the state of the services sector. Is based on surveys of executives of the Chinese companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

Gross Domestic Product. UK, 10:30 am

Data on the Gross Domestic Product for the second quarter of the year is due at 10:30 am (GMT+2). On a year-to-year basis, the index is expected to remain unchanged at 2.2%. Represents the total value of all goods and services created in the UK. Indicates the pace of a growth/decline of the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

Consumer Price Index. EU, 11:00 am

The Consumer Price Index for September is due at 11:00 am (GMT+2). On a year-to-year basis, the index is expected to grow from 0.2% to 0.4%. The key indicator of inflation in the eurozone. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Unemployment Rate. EU, 11:00 am

The Unemployment Rate is due at 11:00 am (GMT+2). In August, the index is expected to fall from 10.1% to 10.0%. The unemployment rate measures the percentage of the total labour force that is unemployed. A growth in the index represents a slowdown of economic growth. A high result can pressure the EUR, while a low one, on the contrary, can strengthen the EUR.

Personal Spending. US, 2:30 pm

Data on Personal Spending is due at 2:30 pm (GMT+2). In August, the index is expected to fall from 0.3% to 0.2%. Personal spending by the US consumer. The index consists of spending on services, durable goods and nondurable goods.

Personal Income. US, 2:30 pm

Data on Personal Income is due at 2:30 pm (GMT+2). In August, the index is expected to fall from 0.4% to 0.2%. The index represents income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the index indicates consumer readiness to spend money in current economic conditions.

Gross Domestic Product. Canada, 2:30 pm

Data on the Gross Domestic Product is due at 2:30 pm (GMT+2). In July, the index is expected to fall from 0.6% to 0.3%. Represents the total value of all goods and services created in Canada. Indicates the pace of a growth/decline of the economy. A high reading strengthens the CAD. A low reading weakens the CAD.

Caixin Manufacturing PMI. China, 3:00 am

The Caixin Manufacturing PMI is due at 3:00 pm (GMT+2). In September, the index is expected to grow from 50.0 to 50.1 points. The index evaluates the state of the manufacturing industry. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

Caixin China Services PMI. China, 3:45 am

Data on the Caixin China Services PMI for September is due at 3:45 am (GMT+2). The index evaluates the state of the services sector. Is based on surveys of executives of the Chinese companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

Gross Domestic Product. UK, 10:30 am

Data on the Gross Domestic Product for the second quarter of the year is due at 10:30 am (GMT+2). On a year-to-year basis, the index is expected to remain unchanged at 2.2%. Represents the total value of all goods and services created in the UK. Indicates the pace of a growth/decline of the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

Consumer Price Index. EU, 11:00 am

The Consumer Price Index for September is due at 11:00 am (GMT+2). On a year-to-year basis, the index is expected to grow from 0.2% to 0.4%. The key indicator of inflation in the eurozone. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Unemployment Rate. EU, 11:00 am

The Unemployment Rate is due at 11:00 am (GMT+2). In August, the index is expected to fall from 10.1% to 10.0%. The unemployment rate measures the percentage of the total labour force that is unemployed. A growth in the index represents a slowdown of economic growth. A high result can pressure the EUR, while a low one, on the contrary, can strengthen the EUR.

Personal Spending. US, 2:30 pm

Data on Personal Spending is due at 2:30 pm (GMT+2). In August, the index is expected to fall from 0.3% to 0.2%. Personal spending by the US consumer. The index consists of spending on services, durable goods and nondurable goods.

Personal Income. US, 2:30 pm

Data on Personal Income is due at 2:30 pm (GMT+2). In August, the index is expected to fall from 0.4% to 0.2%. The index represents income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the index indicates consumer readiness to spend money in current economic conditions.

Gross Domestic Product. Canada, 2:30 pm

Data on the Gross Domestic Product is due at 2:30 pm (GMT+2). In July, the index is expected to fall from 0.6% to 0.3%. Represents the total value of all goods and services created in Canada. Indicates the pace of a growth/decline of the economy. A high reading strengthens the CAD. A low reading weakens the CAD.

Claws and Horns

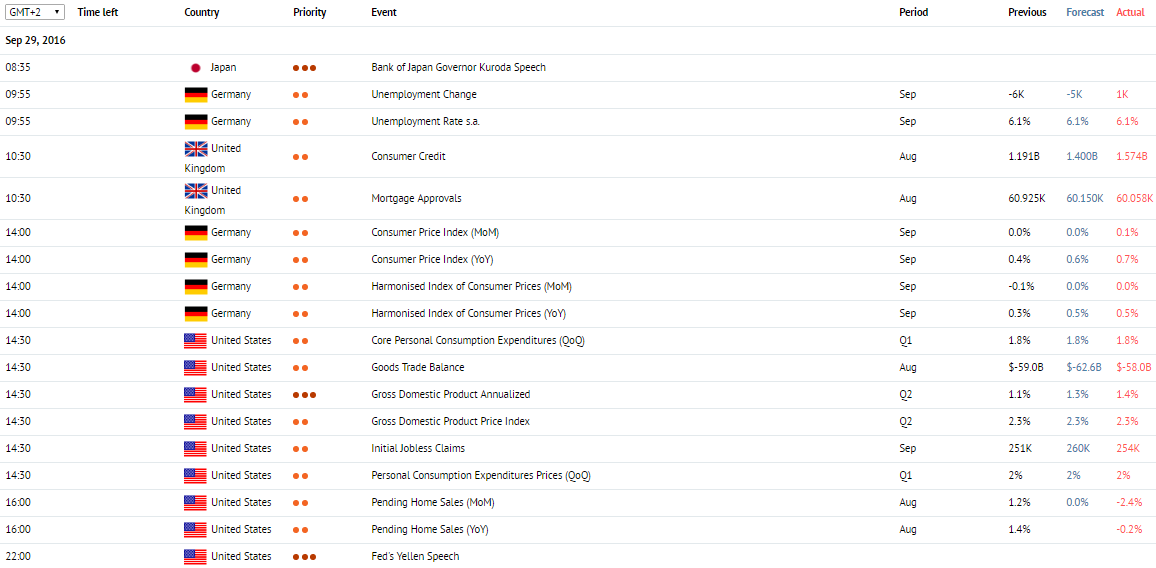

News of the day. 29.09.2016

Bank of Japan Governor Kuroda Speech. Japan, 8:35 am

The Bank of Japan Governor Kuroda Speech is due at 8:35 am (GMT+2). The Governor of the Bank of Japan Haruhiko Kuroda holds a press conference regarding monetary policy.

Unemployment Rate. Germany, 9:55 am

Data on the Unemployment Rate is due at 9:55 am (GMT+2). In September, the index is expected to remain unchanged at 6.1%. Represents the number of unemployed as a percentage of the total labour force. A growth in the index indicates a slowdown of the economy and weakens the EUR. A fall in the index supports the national economy growth and strengthens the EUR.

Consumer Credit. UK, 10:30 am

Data on the Consumer Credit is due at 10:30 am (GMT+2). In August, the index is forecasted to grow from 1.181 billion to 1.4 billion Pounds. Represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in current economic conditions. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need for living.

Mortgage Approvals. UK, 10:30 am

Data on Mortgage Approvals is due at 10:30 am (GMT+2). In August, the index is expected to fall from 60.916 thousands to 60.15 thousands. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Consumer Price Index. Germany, 2:00 pm

The Consumer Price Index for September is due at 2:00 pm (GMT+2). On a year-to-year basis, the index is expected to grow from 0.4% to 0.6%. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Initial Jobless Claims. US, 2:30 pm

Data on Initial Jobless Claims is due at 2:30 pm (GMT+2). According to forecasts, for the week the index will increase from 252 thousands to 260 thousands. Represents the number of new unemployment claims. Published weekly on Thursdays. Allows estimating the upcoming Nonfarm Payrolls figure. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Gross Domestic Product Annualized. US, 2:30 pm

Data on the Gross Domestic Product Annualized is due at 2:30 pm (GMT+2) in the US. In the second quarter, the index is expected to increase from 1.1% to 1.3%. It shows the total value of all goods and services created in the country during the year. Indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Fed’s Yellen Speech. US, 10:00 pm

Fed’s Yellen Speech is due at 10:00 pm (GMT+2). Janet Yellen is the Chair of the Fed since 2014.

Bank of Japan Governor Kuroda Speech. Japan, 8:35 am

The Bank of Japan Governor Kuroda Speech is due at 8:35 am (GMT+2). The Governor of the Bank of Japan Haruhiko Kuroda holds a press conference regarding monetary policy.

Unemployment Rate. Germany, 9:55 am

Data on the Unemployment Rate is due at 9:55 am (GMT+2). In September, the index is expected to remain unchanged at 6.1%. Represents the number of unemployed as a percentage of the total labour force. A growth in the index indicates a slowdown of the economy and weakens the EUR. A fall in the index supports the national economy growth and strengthens the EUR.

Consumer Credit. UK, 10:30 am

Data on the Consumer Credit is due at 10:30 am (GMT+2). In August, the index is forecasted to grow from 1.181 billion to 1.4 billion Pounds. Represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in current economic conditions. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need for living.

Mortgage Approvals. UK, 10:30 am

Data on Mortgage Approvals is due at 10:30 am (GMT+2). In August, the index is expected to fall from 60.916 thousands to 60.15 thousands. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Consumer Price Index. Germany, 2:00 pm

The Consumer Price Index for September is due at 2:00 pm (GMT+2). On a year-to-year basis, the index is expected to grow from 0.4% to 0.6%. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Initial Jobless Claims. US, 2:30 pm

Data on Initial Jobless Claims is due at 2:30 pm (GMT+2). According to forecasts, for the week the index will increase from 252 thousands to 260 thousands. Represents the number of new unemployment claims. Published weekly on Thursdays. Allows estimating the upcoming Nonfarm Payrolls figure. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Gross Domestic Product Annualized. US, 2:30 pm

Data on the Gross Domestic Product Annualized is due at 2:30 pm (GMT+2) in the US. In the second quarter, the index is expected to increase from 1.1% to 1.3%. It shows the total value of all goods and services created in the country during the year. Indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Fed’s Yellen Speech. US, 10:00 pm

Fed’s Yellen Speech is due at 10:00 pm (GMT+2). Janet Yellen is the Chair of the Fed since 2014.

Claws and Horns

News of the day. 28.09.2016

RBA Assist Gov Edey Speech. 2:20 am

RBA Assist Gov Edey Speech is due at 2:20 am (GMT+2). Malcolm Edey is responsible for the Bank’s work on financial stability.

Gfk Consumer Confidence Survey. Germany, 8:00 am

The Gfk Consumer Confidence Survey for October is due at 8:00 am (GMT+2) in Germany. The index is released by the marketing company Gfk and is based on surveys of consumers regarding their level of confidence in the economy of the country. Values above 0 represent optimistic moods and strengthen the EUR. Values below 0 represent pessimistic moods and weaken the EUR.

UBS Consumption Indicator. Switzerland, 8:00 am

The UBS Consumption Indicator for August is due at 8:00 am (GMT+2). The index is based on five economic indicators of consumption: car sales, consumer confidence, retail sales, the number of domestic overnight hotel stays and credit card transactions volumes.

KOF Leading Indicator. Switzerland, 9:00 am

Data on the KOF Leading Indicator for September is due at 9:00 am (GMT+2). The index, based on 12 economic indicators, is used to assess economic conditions in Switzerland. A high reading is considered as a positive factor for the economy and strengthens the CHF. A low reading, on the contrary, is perceived as negative and weakens the CHF.

Durable Goods Orders. US, 2:30 pm

Data on the Durable Goods Orders is due at 2:30 pm (GMT+2). According to forecasts, in August the index will have declined from 4.4% to -1.5%. Represents the value change for durable goods (including transportations) that last for more than 3 years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy. A high reading strengthens the USD.

ECB President Draghi’s Speech. EU, 3:30 pm

ECB President Draghi’s Speech is due at 3:30 pm (GMT+2). Mario Draghi gives commentaries on current economic conditions in the eurozone. Positive commentaries strengthen the EUR, while negative commentaries weaken the EUR.

Fed’s Yellen testifies. US, 4:00 pm

Fed’s Yellen will testify before the Congress at 4:00 pm (GMT+2). Will give commentaries on current economic conditions in the country.

RBA Assist Gov Edey Speech. 2:20 am

RBA Assist Gov Edey Speech is due at 2:20 am (GMT+2). Malcolm Edey is responsible for the Bank’s work on financial stability.

Gfk Consumer Confidence Survey. Germany, 8:00 am

The Gfk Consumer Confidence Survey for October is due at 8:00 am (GMT+2) in Germany. The index is released by the marketing company Gfk and is based on surveys of consumers regarding their level of confidence in the economy of the country. Values above 0 represent optimistic moods and strengthen the EUR. Values below 0 represent pessimistic moods and weaken the EUR.

UBS Consumption Indicator. Switzerland, 8:00 am

The UBS Consumption Indicator for August is due at 8:00 am (GMT+2). The index is based on five economic indicators of consumption: car sales, consumer confidence, retail sales, the number of domestic overnight hotel stays and credit card transactions volumes.

KOF Leading Indicator. Switzerland, 9:00 am

Data on the KOF Leading Indicator for September is due at 9:00 am (GMT+2). The index, based on 12 economic indicators, is used to assess economic conditions in Switzerland. A high reading is considered as a positive factor for the economy and strengthens the CHF. A low reading, on the contrary, is perceived as negative and weakens the CHF.

Durable Goods Orders. US, 2:30 pm

Data on the Durable Goods Orders is due at 2:30 pm (GMT+2). According to forecasts, in August the index will have declined from 4.4% to -1.5%. Represents the value change for durable goods (including transportations) that last for more than 3 years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy. A high reading strengthens the USD.

ECB President Draghi’s Speech. EU, 3:30 pm

ECB President Draghi’s Speech is due at 3:30 pm (GMT+2). Mario Draghi gives commentaries on current economic conditions in the eurozone. Positive commentaries strengthen the EUR, while negative commentaries weaken the EUR.

Fed’s Yellen testifies. US, 4:00 pm

Fed’s Yellen will testify before the Congress at 4:00 pm (GMT+2). Will give commentaries on current economic conditions in the country.

Claws and Horns

News of the day. 27.09.2016

S&P/Case-Shiller Home Price Indices. US, 3:00 pm

The S&P/Case-Shiller Home Price Indices is due at 3:00 pm (GMT+2). According to forecasts, on a year-over-year basis the index will remain unchanged at 5.1%. Represents the property prices change in 20 of the biggest US regions. Important indicator. A high reading strengthens the USD. A low reading weakens the USD.

Markit Services PMI. US, 3:45 pm

Data on the Markit Services PMI for September is due at 3:45 pm (GMT+2). The index is based on surveys of executives of the American companies operating in the service sector regarding their opinion on current economic conditions and their future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Consumer Confidence. US, 4:00 pm

Data on the Consumer Confidence is due at 4:00 pm (GMT+2). In September, the index is expected to fall from 101.1 to 99.8 points. The index represent consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

S&P/Case-Shiller Home Price Indices. US, 3:00 pm

The S&P/Case-Shiller Home Price Indices is due at 3:00 pm (GMT+2). According to forecasts, on a year-over-year basis the index will remain unchanged at 5.1%. Represents the property prices change in 20 of the biggest US regions. Important indicator. A high reading strengthens the USD. A low reading weakens the USD.

Markit Services PMI. US, 3:45 pm

Data on the Markit Services PMI for September is due at 3:45 pm (GMT+2). The index is based on surveys of executives of the American companies operating in the service sector regarding their opinion on current economic conditions and their future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Consumer Confidence. US, 4:00 pm

Data on the Consumer Confidence is due at 4:00 pm (GMT+2). In September, the index is expected to fall from 101.1 to 99.8 points. The index represent consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 26.09.2016

IFO - Business Climate. Germany, 10:00 am

The IFO German Business Climate Index for September is released at 10:00 am (GMT+2). The indicator is expected to grow from 106.2 to 106.3 points. The index is based on surveys of executives of more than 7000 companies regarding their opinion on economic conditions for businesses. A growth in the index is perceived as a positive signal and strengthens the EUR. A fall in the index is perceived as a negative factor for the EUR.

IFO - Current Assessment. Germany, 10:00 am

The IFO German Current Assessment Index for September is released at 10:00 am (GMT+2). The indicator is expected to grow from 112.8 to 112.9 points in September. The index is based on surveys of executives of more than 7000 companies regarding their opinion on economic conditions for businesses. A growth in the index is perceived as a positive signal and strengthens the EUR. A fall in the index is perceived as a negative factor for the EUR.

New Home Sales. US, 4:00 pm

Data on the New Home Sales for August is due in the US at 4:00 pm (GMT+2). The indicator is expected to fall form 654 000 to 601 000. It is an important indicator of the US property market. Generally, a growth in the index suggests improvement in economic conditions. A high reading supports the USD; a low reading pressures the USD.

ECB President Draghi's Speech. EU, 4:00 pm

At 4:00 pm (GMT+2), Mario Draghi is giving commentaries on current economic conditions in the eurozone. Positive commentaries strengthen the EUR; negative commentaries weaken the EUR.

IFO - Business Climate. Germany, 10:00 am

The IFO German Business Climate Index for September is released at 10:00 am (GMT+2). The indicator is expected to grow from 106.2 to 106.3 points. The index is based on surveys of executives of more than 7000 companies regarding their opinion on economic conditions for businesses. A growth in the index is perceived as a positive signal and strengthens the EUR. A fall in the index is perceived as a negative factor for the EUR.

IFO - Current Assessment. Germany, 10:00 am

The IFO German Current Assessment Index for September is released at 10:00 am (GMT+2). The indicator is expected to grow from 112.8 to 112.9 points in September. The index is based on surveys of executives of more than 7000 companies regarding their opinion on economic conditions for businesses. A growth in the index is perceived as a positive signal and strengthens the EUR. A fall in the index is perceived as a negative factor for the EUR.

New Home Sales. US, 4:00 pm

Data on the New Home Sales for August is due in the US at 4:00 pm (GMT+2). The indicator is expected to fall form 654 000 to 601 000. It is an important indicator of the US property market. Generally, a growth in the index suggests improvement in economic conditions. A high reading supports the USD; a low reading pressures the USD.

ECB President Draghi's Speech. EU, 4:00 pm

At 4:00 pm (GMT+2), Mario Draghi is giving commentaries on current economic conditions in the eurozone. Positive commentaries strengthen the EUR; negative commentaries weaken the EUR.

: