Gary Comey / Profile

- Information

|

9+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

3

signals

|

782

subscribers

|

I am a former stockbroker and Treasury Manager. I have worked in the industry for some time including at IG Group and Fidelity.

Managed Account: https://secure.blackwellglobal.bs/register/?lid=432&pid=12210

Telegram: https://t.me/BlackwaveTheReal

TWITTER: https://twitter.com/BlackwaveFx

YouTube: https://youtube.com/@BlackwaveFX

Website: https://www.Blackwave-Forextrader.com

Managed Account: https://secure.blackwellglobal.bs/register/?lid=432&pid=12210

Telegram: https://t.me/BlackwaveTheReal

TWITTER: https://twitter.com/BlackwaveFx

YouTube: https://youtube.com/@BlackwaveFX

Website: https://www.Blackwave-Forextrader.com

Friends

1806

Requests

Outgoing

Gary Comey

Picking USDCAD first that pair has been showing some signs of exhaustion and may be forming a bottom via 1.2050. Separately to our grid, I have been trading this pair in and out in the Alpine client account only, slightly improving the average entry and slightly increasing the cash. This market remains deeply oversold with prices not seen since 2017 and with a monthly 14 period RSI measure not seen since 2007. I am quite optimistic on this trade and in my FXCM account I am actually trading this at three times the position size of the client Alpine account which is a deviation from the existing position size strategy though it will mean fewer total positions. EURGBP is now officially a pain in the butt and I will get out at not much more than breakeven when the opportunity arises. The SWAPS are adding up though it's not exactly an exotic pair so the SWAPS are still tolerable. 0.87 continues to be strong resistance and we probably need a EURUSD rally above 1.2180 plus a piece of fundamental news to get EURGBP above 0.87 with conviction. Technical analysis is a sort of self-fulfilling strategy though. We all see the same line in the graph making that line almost physically real. A daily close above 0.87 would be very useful technically and therefore in reality and we are less than 100 pips from that this evening. If EURGBP does not close first then in the meantime the USDCAD will likely bring the cash higher.

bartkins

2021.05.17

Hi Gary Please be advised ( i am compelled ) to inform you that approximately $60,000.00AUD was stolen from my Blackwave Pacific account on the 7th. of May 2012

bartkins

2021.05.17

Sorry Gary---typo error---should read `` 7th. of may 2021

Gary Comey

Our USDCAD is working out okay with a few winners. Right now it's deeply oversold hourly, four hourly, daily, weekly and almost at RSI 30 on a monthly timeframe. The plan is to be a bit greedy here. I am hoping to close this with all positions in profit. EURGBP is simply range trading between 0.86 and 0.87. The results of the Scottish elections will become more obvious over the weekend and perhaps that will be a catalyst for some movement next week in all Sterling pairs including our EURGBP.

Gary Comey

On our Daily timeframe in the attached graph you can see EURGBP has been getting tighter into the apex of a wedge formation. EURGBP will need to resolve one way or the other and the excuse to break 0.87 may come from more optimism about the European vaccine rollout which up to now has been lacklustre at best. 0.87 has been quite strong technical resistance. My first preference is to get people back to cash for a few days to allow them to make decisions but as this trade goes on the balance of risks in my view is turning towards needing to place new trades to keep some momentum going. Getting the cash higher will reduce the DD anyway and keep us pointing towards our own personal goals. EURGBP WILLL RESOLVE ITSELF. I must admit small enough as the profit might have been, closing USDCAD in profit within 24 hours of opening it was satisfying. Having been down 10% in the high risk account we will finish April still down but less than 4%. No doubt the rest of the year will go better than Q1 so stay tuned.

Gary Comey

In spite of the rally in equity markets today the Yen did manage to strengthen a bit pre-US equity markets open but is now more or less back to it's opening price. I got out. 1. It gives us more breathing room with the large number of EURGBP trades. 2. It gets us closer to being flat which is my goal. 3. In terms of Blackwave Alpine MAM account it more than halves the loss I took at the beginning of the month. So far this month after being down 10% in the cash we are down 4%. Who knows what EURGBP will give us with a week to go to the end of the month. This period has been the most difficult that I can recall including the big USDZAR DD of a few years ago. What saved us again was position size and the willingness to take a loss even if it was not a hard stop, it was more nuanced. If it had been a hard stop the loss would be 50% to the cash instead of 4% to the cash with a 2% DD and with a week to go to month end. The probability is that nothing like this happens again for years but it can happen. The likelihood is that it will spark withdrawals just like a good January brought on deposits. People try to game the system and generally underperform me. When things were bad I added $10K. When things are good I do nothing or withdraw. As you know I am contrarian. Obviously you must make the best decision given your circumstances but it's something worth considering. Anyway the goal is to get back to cash and with luck by month end. EURGBP has the wind in it's sails this evening. To the people who did not offer me advice. Sincerely thanks guys. :-) Even without your saying so I am usually thinking about you and your family.

Gary Comey

In spite of the rally in equity markets today the Yen did manage to strengthen a bit pre-US equity markets open but is now more or less back to it's opening price. I got out. 1. It gives us more breathing room with the large number of EURGBP trades. 2. It gets us closer to being flat which is my goal. 3. In terms of Blackwave Alpine MAM account it more than halves the loss I took at the beginning of the month. So far this month after being down 10% in the cash we are down 4%. Who knows what EURGBP will give us with a week to go to the end of the month. This period has been the most difficult that I can recall including the big USDZAR DD of a few years ago. What saved us again was position size and the willingness to take a loss even if it was not a hard stop, it was more nuanced. If it had been a hard stop the loss would be 50% to the cash instead of 4% to the cash with a 2% DD and with a week to go to month end. The probability is that nothing like this happens again for years but it can happen. The likelihood is that it will spark withdrawals just like a good January brought on deposits. People try to game the system and generally underperform me. When things were bad I added $10K. When things are good I do nothing or withdraw. As you know I am contrarian. Obviously you must make the best decision given your circumstances but it's something worth considering. Anyway the goal is to get back to cash and with luck by month end. EURGBP has the wind in it's sails this evening. To the people who did not offer me advice. Sincerely thanks guys. :-) Even without your saying so I am usually thinking about you and your family.

Gary Comey

You will see the Blackwave trade notifications on Twitter. No charge obviously.

TWITTER: https://twitter.com/BlackwaveFx

TWITTER: https://twitter.com/BlackwaveFx

Gary Comey

Remember to close one of these baskets relieves some of the anxiety of having so many open positions. The question as with most things in life is not what happens but how you control your response to events.

Gary Comey

USDJPY is looking encouraging and having gotten everyone on the wrong side of the fence by breakout out of longer term resistance it broke convincing back below and that is WITHOUT even a slight pullback in equity markets which will strengthen the Yen. Gold has been moving a little high in recent weeks while some stocks away from the headlines are not performing well. All is not well in the S&P500 under the hood I think.

Gary Comey

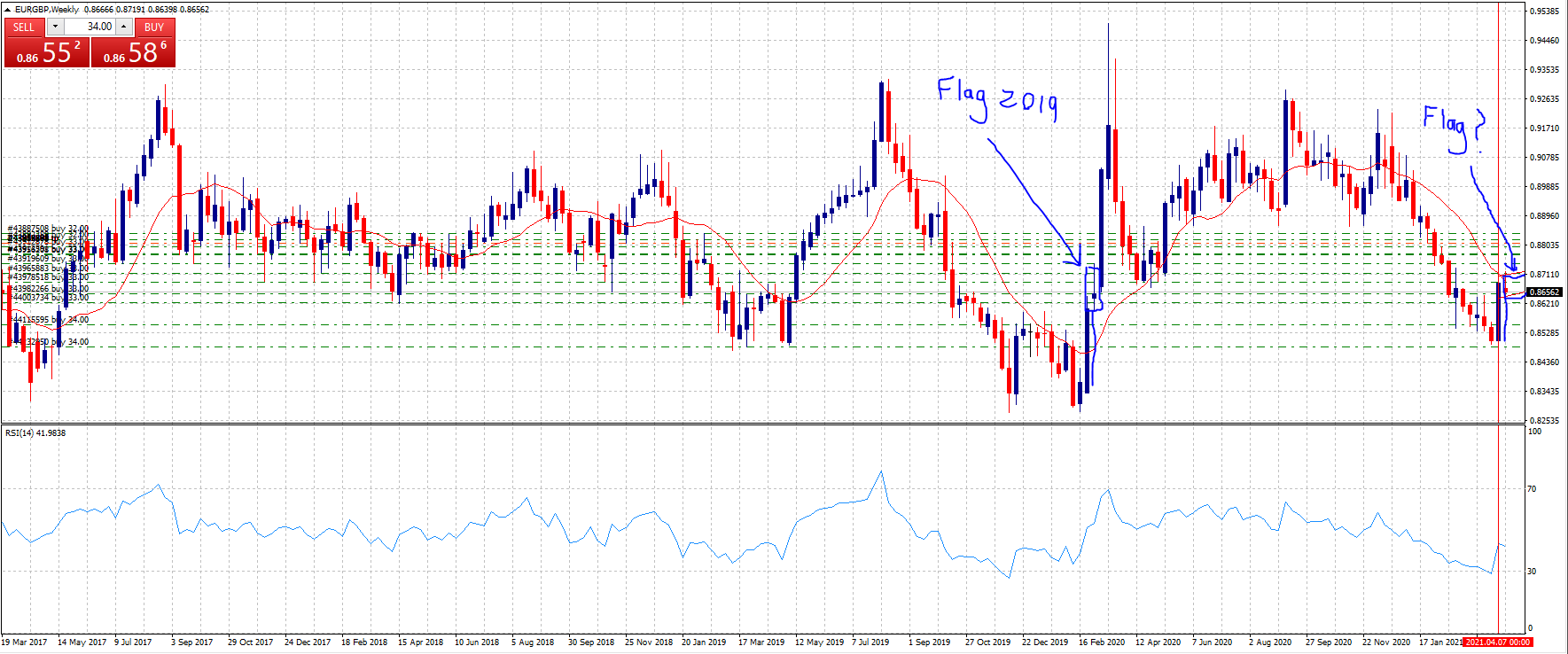

Both of out markets have become difficult mind games. While we traded well above 0.87 on Friday the SWAPS accumulated would have made closing those trades a loss situation certainly by the time I try to close with several hundred lots across six accounts plus all the copy traders. The market will trade higher at some point and all know this, but as I have read about trading recently and believe to be true, money finds patient traders but those impatient for the money will lose it instead. It's one thing to say this but it's another to go through the emotions of patience and I assure you I am as human as the rest. It could be the market is working off shorter term overbought oscillators and you could even suggest a flag pattern on weekly timeframes which suggests higher markets. I can see on the graph where this happened in 2019 but the truth is I don't know what will happen and anyone who tells you they do is lying to themselves at best. Best I can say is with 99% certainty EURGBP will trade from weekly oversold to weekly overbought in the medium term, because it's always been true before. Up towards 0.88 that would give us a profitable trade in the medium term too.

Josef Aigner

2021.04.23

If you can hold 400 pips in loss, the you are also able to hold till 400 pips profit! Would love to see running profits longer ;)

Gary Comey

The big driver this week was the fall in the Greenback and you can see that against the Swiss Franc and the Euro. Therefore by default the Euro was stronger helping our EURGBP higher and the dollar was as I said weaker, helping our USDJPY trade lower. That was the correlation even though I am officially not trading the same currency twice. Obviously EURGBP has had a good week and the weekly candle is extra significant in my mind because having put in a lower weekly low on Monday we are finishing the week close to the highs and well above the moving average. As EURGBP was responsible for the majority of the DD so the majority of the DD is now gone. There is some resistance at 0.87 but above that it's too early to declare a TP target. Obviously it's a balance between making the risk worth it and also reducing any further risk given the size of the basket. USDJPY is complicated but it did break back below the 110 mark as I suspected it would. You can never say anything in markets with 100% certainty but I wonder what it will do if the equity markets have a few bad days and capital moves to the Yen. My bet (literally) is that a pull back off all time highs in the equity markets will help the USDJPY trade further. In short progress after some anxious weeks I'd imagine.

Gary Comey

Our two markets EURGBP and USDJPY continue to trade in deep overbought and oversold territory and the difficulty is that both are getting deeper into DD at the same time. You might call that bad luck but we are where we are and as always our business is with the price. As you know there are various "soft" stop loss levels depending on high, medium or low risk. The most immediate danger is the High Risk account obviously and then on down the line to the low risk account. Therefore IF both markets continue to move deeper into DD AT THE SAME TIME I will begin to prioritise the EURGBP trades over the USDJPY trades and begin to cut some of the biggest losing USDJPY trades first. This will improve the USDJPY average entry and relieve some of the pressure on the account in general. Rather than the blunt instrument that is the hard stop loss, this strategy is more nuanced and in my opinion easier and faster to recover from. IF however one market eg EURGBP begins to improve then that improved DD will allow some flexibility on what we do with USDJPY. If USDJPY improves first then that also gives us more wiggle room overall. While I see the USDJPY break of the multi-year wedge formation at circa 110.00 I am not that impressed with the follow through so far even though the S&P500 has passed 4000 which in theory would weaken the risk correlated Yen. USDJPY is very stretched at this point and a close below 110 could have the "longs" scrambling to sell since their "buy signal" is now wrong and that could accelerate a move lower. EURGBP is responsible for most of the DD. It's trading a lot off the vaccination story which is going so much better in the U.K than in the EU and indeed France is now gone into another lockdown. Then again we've know this story for some time and the Pound has already benefited significantly from this fundamental trade. I do see support all the way down at 0.83 but in the 0.85's it is now as oversold weekly as it was at 0.83 back in January 2020. I think this market has a good chance of reversal. I know this update is a bit complicated but in fairness people have been looking to know what the plan is and this is the plan.

Albert Wong

2021.04.04

what is the photo of 999 days countdown timer stand for (saw it in your telegram)?

Gary Comey

USDJPY: Average Entry circa 108.20, EURGBP: Average Entry 0.8725. Having begun the week well it takes a bit of a psychological toll to see the EURGBP gains taken back. The driver with both EURGBP and USDJPY is partly rising yields favouring the dollar against the Euro which both drags the Euro down versus the Pound and also pushed USDJPY higher too. The other major component is risk trends with equity markets largely bullish though the past few session have seemed more indecisive. A pull back in equity markets will favour the Yen and the overbought USDJPY will drop if this happens and that would suit our trade where breakeven is actually not that far off. Average trade length is 8 days since 2015 but obviously averages don't tell the full story. There were long periods in every year where I opened trades as per the trading strategy and we got stuck in them for longer than was comfortable. This happens and it's the downside of the strategy. If position sizes were too large it could be fatal but they are not. However that is why I am always banging on about position size.

Show all comments (7)

Lun Cheung Leung

2021.03.31

90% of account blow in MQL5 is jpy related.. you know that in 2017 as well. you should avoid jpy

Gary Comey

2021.04.02

Hkterran. Yes USDJPY has humbled many traders over the years. That’s quite an mql5 statistic to have to hand. I wonder do you know how to withdraw money from mql5 using bank transfer. They owe me $10K at this stage and don’t really respond to tickets.

Lun Cheung Leung

2021.04.03

i think it is due to the current DD is too high, 10K will be released when DD release too lol

Gary Comey

USDJPY: Average Entry circa 107.85, EURGBP: Average Entry 0.8725. If it seems like our trades have gone nowhere in a week and that's because it's true. Right now the market is trading very close to how it finished last Friday represented by weekly doji (type) candles so in layman's terms after such an extended move both markets are indecisive. Frankly this is boring and if you are bored too then that's at least two of us. It occurred to me during the week that it's when we don't give in to fear, greed or boredom that extended profitable strategies are built. Both markets remain quite extended but don't always turn on the dime we are looking for.

Gary Comey

EURGBP Average entry circa 0.8725. This market has been attempting to form a bottom after recent declines and indications today are encouraging that is has. EURGBP has woken up a little and is attempting to swing higher to regain the 0.86 handle this afternoon. Weekly RSI conditions are as oversold as they've been since late 2019 into January 2020. The length of time in the trade is a little discouraging however trading tests our psychology in many ways and our capacity for patience is up there. USDJPY average entry circa 107.64 is a yield story up to now. The Biden stimulus package is assumed to be inflationary therefore higher rates, therefore the dollar strenghtens and buys more Yen. This makes sense though the aggressive move puts this market about as overbought as it's been since September 2018 and before that you have to go back to "Abenomics" (who remembers that). The market has shown some signs of exhaustion in recent sessions and notwithstanding today's price action may be beginning to get a little top heavy. We are six trades in and a temporary return of risk aversion like for example a few days decline of equity markets off lofty levels could see the bears take control in spite of the yield story as the Yen is seen as a safe haven.

Dinesh Kuamr

2021.03.12

No warry, yes patient is key in forex. Your money management is appropriated. Keep it up with your best judgment.

Gary Comey

We're out of the worst of the DD with the cash higher too. With GBPUSD closed that leaves me one hand to trade USDJPY which is quite overbought for the fundamental reason of yield differentials. Whatever! There's always a fundamental reason and I always place a counter trend trade. EURGBP is now open quite some time given recent history but being a major forex pair the SWAPs are perfectly manageable. The price of SWAPS is one of the reasons I no longer trader exotic pairs.

Gary Comey

2021.03.08

RE: EURGBP I know it gets a bit boring. The market may be looking for form a meaningful medium term bottom. The trouble is to add another position here might make us feel like we are taking action but in reality it only improves average entry by less than 20 pips while increasing risk and those metrics are not worth it. Either the market needs to fall further or I won't add. There is not much U.K data this week but that does not mean the market won't move. There is E.U GDP and an ECB rate decision and plenty of economic and political data from the U.S to keep every on their toes.

nick

2021.03.10

Over a month in DD , paying Swap fees every night.. closing orders in minimal profit to have a positiv „blue“ month in the Chart ..? Seriously ? Maybe is a Marketing strategy who knows, making you continue paying the subscribtion fees until your account is in break even

Gary Comey

At circa 2% I am afraid February was about as underwhelming as January was impressive. C'est la vie, however the DD has also improved in the past few sessions and as I speak the GBPUSD basket is actually in profit. Looking better for March.

ulrik.bels

2021.03.01

No worries, it can 't be amazing every month ;-) Many people would sign on a 2 % anyhow !

Michal Milko

2021.03.01

Hi, can you contract with me? I would like to discuss closer cooperation with you. :) If you have time, write me on mql5.com.

Well thank you :)

Well thank you :)

[Deleted]

2021.05.21

[Deleted]

Gary Comey

After a few days of stress the bad reviews begin, the panic sets in and weak hands fold their cards and go looking for the next strategy/trader completely and willfully ignoring the long history of these accounts. The "told you so" guys come out of the woodwork and push their own agenda. It's been like this for five years and it's no different now.

I get a sense people are looking for me to say something about the current trades. Actually it's more than a sense, people are taking conversations on other forums, copying them and then sending them to me via Telegram. They say it is to prove how much the "newbies" are panicking but lets face it, they are just looking for me to hold their hand and re-assure them too.

So there is no honest way I can say things will be okay. All I can point to is the fact that our position size is correct, our total number of trades is correct. The DD is well within stress levels designed for the account. Sterling is quite overbought and the prospects for the U.K are looking good. Hence I am selling it. Remember this is CONTRARIAN strategy and has been so since 2015. I am personally betting $260K across three accounts that I will be correct yet again. Patience and control is much harder to achieve than greed and fear.

I get a sense people are looking for me to say something about the current trades. Actually it's more than a sense, people are taking conversations on other forums, copying them and then sending them to me via Telegram. They say it is to prove how much the "newbies" are panicking but lets face it, they are just looking for me to hold their hand and re-assure them too.

So there is no honest way I can say things will be okay. All I can point to is the fact that our position size is correct, our total number of trades is correct. The DD is well within stress levels designed for the account. Sterling is quite overbought and the prospects for the U.K are looking good. Hence I am selling it. Remember this is CONTRARIAN strategy and has been so since 2015. I am personally betting $260K across three accounts that I will be correct yet again. Patience and control is much harder to achieve than greed and fear.

Dany Steyaert

2021.02.24

Risk management is important, I made the mistake myself because i was greedy and risked too much, now I reduced my assigned percentage and feels a lot safer now. Lessons learned...

Chang Kim

2021.02.26

Pinbar and a engulfing daily candle looks promising. Few more days, hopefully we will be able to close both baskets of trades

Shah

2021.02.28

too bad you have changed the sub fees :(( I am migrating from a broker to IC markets and had to cancel my subscription which was 30$ now its 59$ on signal start :(( is it going to be back on the previous price ?

Gary Comey

I wonder did we just have a blow off topping/bottoming process with GBPUSD and EURGBP. Someone just asked me how far would I go and I was tempted to say I'm a fan of Elon Musk and SpaceX but the joke could be lost. I did say I was going to take more risk in Q1 but I think we may be done with adding new trades at this point. The market is going to reverse off this fairly parabolic move. How do I know this? It always does/has. The question is not will it reverse, the question is can we be patient and given our total position size I think we can. To add too many positions is to begin to lose the power to speculate and begin gambling so let's not go that far.

Onebody

2021.02.20

After last summer, this basket doesn't seem so bad anymore)

We are deep in the overbought/oversold levels and have a drawdown of less than 20%

We are deep in the overbought/oversold levels and have a drawdown of less than 20%

Thomas Stefan Kreienbuehl

2021.02.21

Hey Indians, do not worry! Chef Comey will get us to profitable hunting grounds! Little DDs are absolutely normal, so no worries! The Chief leeds us well, thank you Chief Comey!!!

Gary Comey

A week of two trading stories. While the EURGBP basket remained range trading and I’ve been unable to hit my target price, all other trades such as USDCAD worked fairly well. Therefore the cash is higher though we go into the weekend stuck still with our EURGBP which remains oversold and just needs a little more time.

pototo420

2021.02.18

Hello Gary, I have a bit of an issue with one of the trades its probably nothing to do with the signal but I wanted to send you a screenshot and maybe you could have a quick look. I dont know how to contact you directly.

: