Gary Comey / Profile

- Information

|

9+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

3

signals

|

782

subscribers

|

I am a former stockbroker and Treasury Manager. I have worked in the industry for some time including at IG Group and Fidelity.

Managed Account: https://secure.blackwellglobal.bs/register/?lid=432&pid=12210

Telegram: https://t.me/BlackwaveTheReal

TWITTER: https://twitter.com/BlackwaveFx

YouTube: https://youtube.com/@BlackwaveFX

Website: https://www.Blackwave-Forextrader.com

Managed Account: https://secure.blackwellglobal.bs/register/?lid=432&pid=12210

Telegram: https://t.me/BlackwaveTheReal

TWITTER: https://twitter.com/BlackwaveFx

YouTube: https://youtube.com/@BlackwaveFX

Website: https://www.Blackwave-Forextrader.com

Friends

1806

Requests

Outgoing

Gary Comey

There may be an opportunity with USDCAD later in the day but looking around I am not seeing anything that fits my typical set-up amongst major and minor forex pairs. It's been a decent enough beginning to the month which only started yesterday and indeed September recorded an 8.61% growth in the Alpine managed account. The bad news is that performance fees are due but between today and yesterday they are sort of paid for in advance. Lets see what NFP's gives us but it's useful to be flat or at least have very few positions going into a weekend where the President of the United States apparently has Covid-19 a few weeks out from the election. I guess when he beats it he can look like a strong man vs "old man Biden". :-) Have a good weekend.

Doug Forenski

2020.10.02

Able body Joe vs corona trump

Gary Comey

The predominant theme this week as with all weeks is risk trends. Equity markets are 10% off their highs and while officially that is correction territory the S&P500 has been having a bit of difficulty with following through much lower up to now. If I'd stayed with GBPNZD we'd have made a good deal more by now but I am actually happy to leave some for the next guy. That market moves quickly as I am sure you recall from last month and we had two nice goes at it, took our money and left the table. We finish off the week selling into a relatively strong Yen (at least as measured on daily timeframes by RSI) which is of course risk correlated with the S&P500. Good week and good month to date and relatively painless too which is not always the case. End of month is next Wednesday and according to myfxbook the Alpine Managed account is up over 8% for the month so trying to tick over without getting into any hot water by month end.

Imtiaz73

2020.09.30

Hi Gary,

Imtiaz here from Melbourne. i want to subscribe and copy your signal through mql5 on my mt4 live platform. money is sitting in my account but fail to activate. i am trying from last 2 weeks but unsuccessful . i watched the video how to activate but some how link is not working. plz help me.

Kind Regards

my email imtiazkiwi@hotmail.com

Imtiaz here from Melbourne. i want to subscribe and copy your signal through mql5 on my mt4 live platform. money is sitting in my account but fail to activate. i am trying from last 2 weeks but unsuccessful . i watched the video how to activate but some how link is not working. plz help me.

Kind Regards

my email imtiazkiwi@hotmail.com

Gary Comey

2020.10.01

Imtiaz I’m afraid I’m the trader, I’m not mql5 so I don’t know what you are doing wrong. I’ve never copied anyone on mql5. Perhaps someone in the forum can help.

Gary Comey

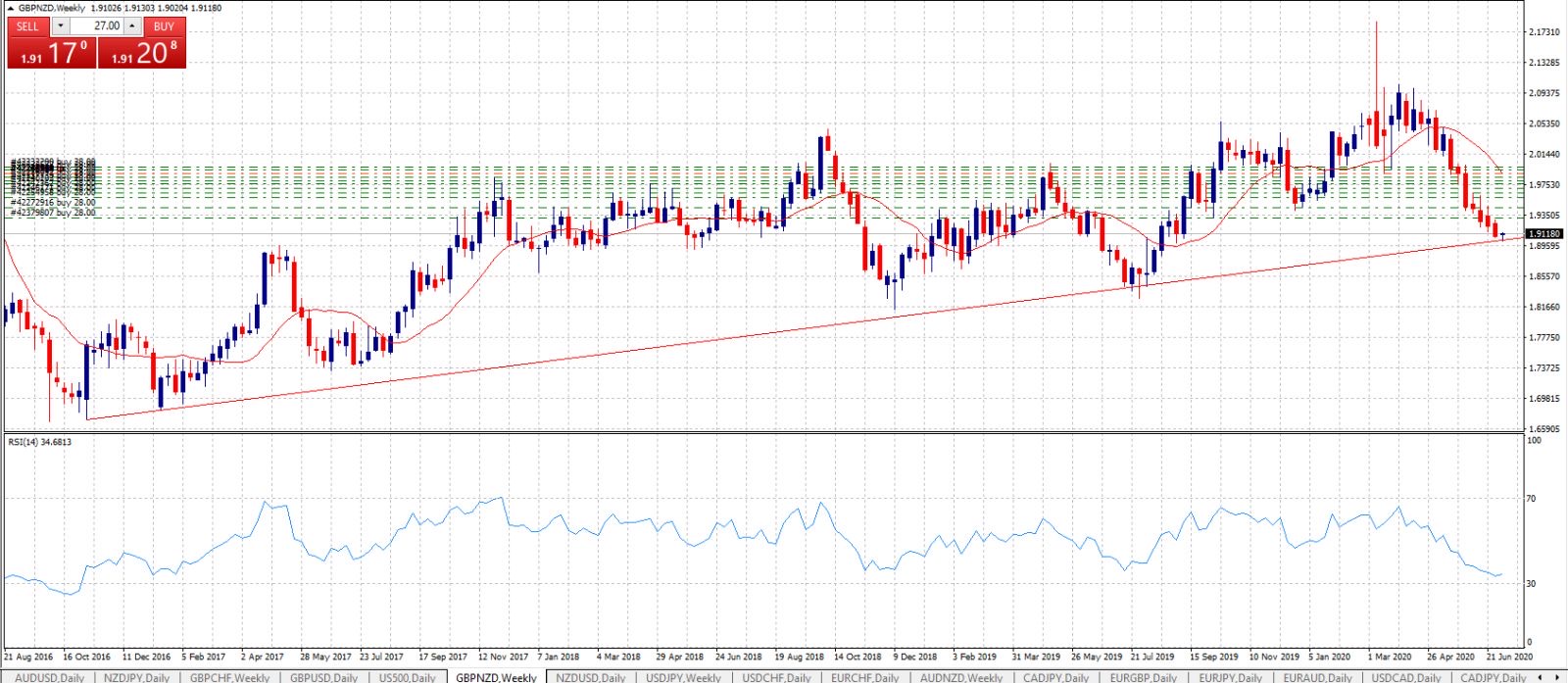

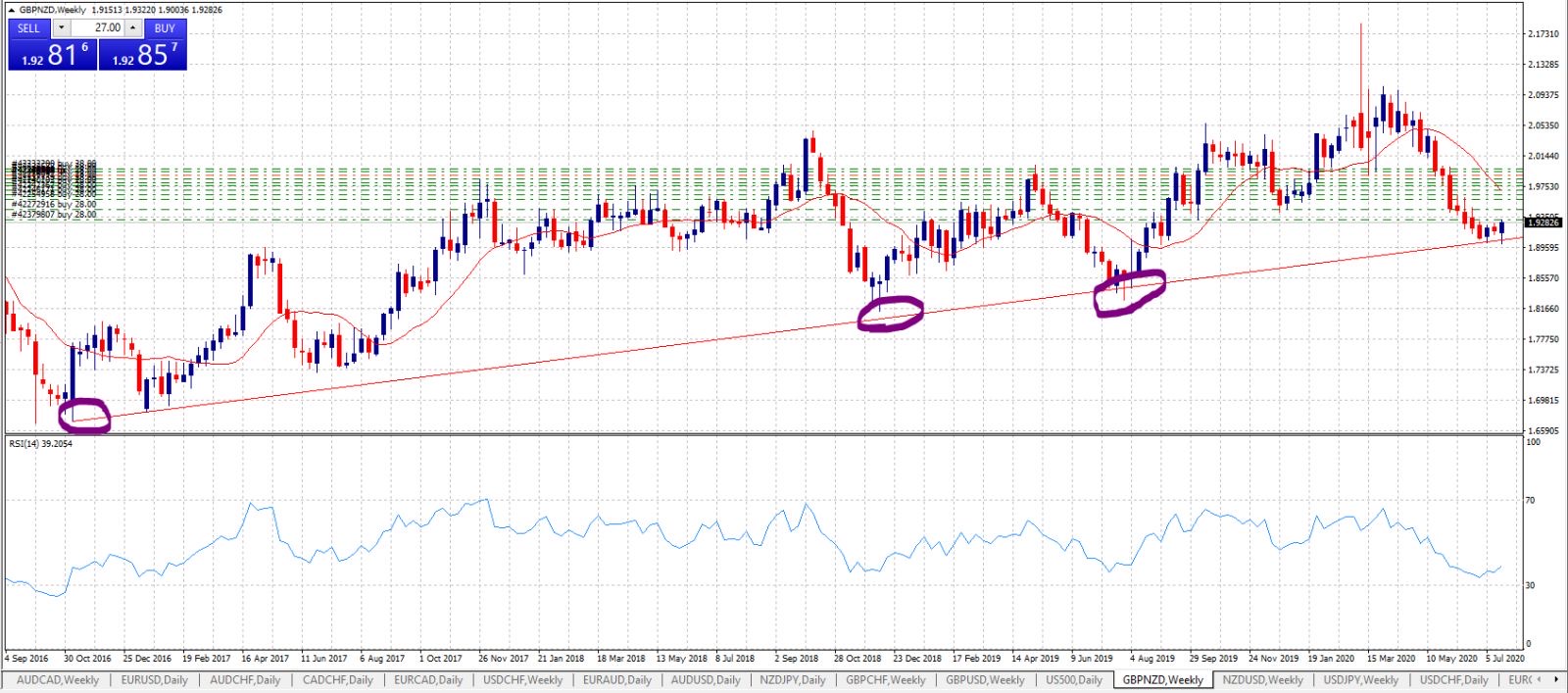

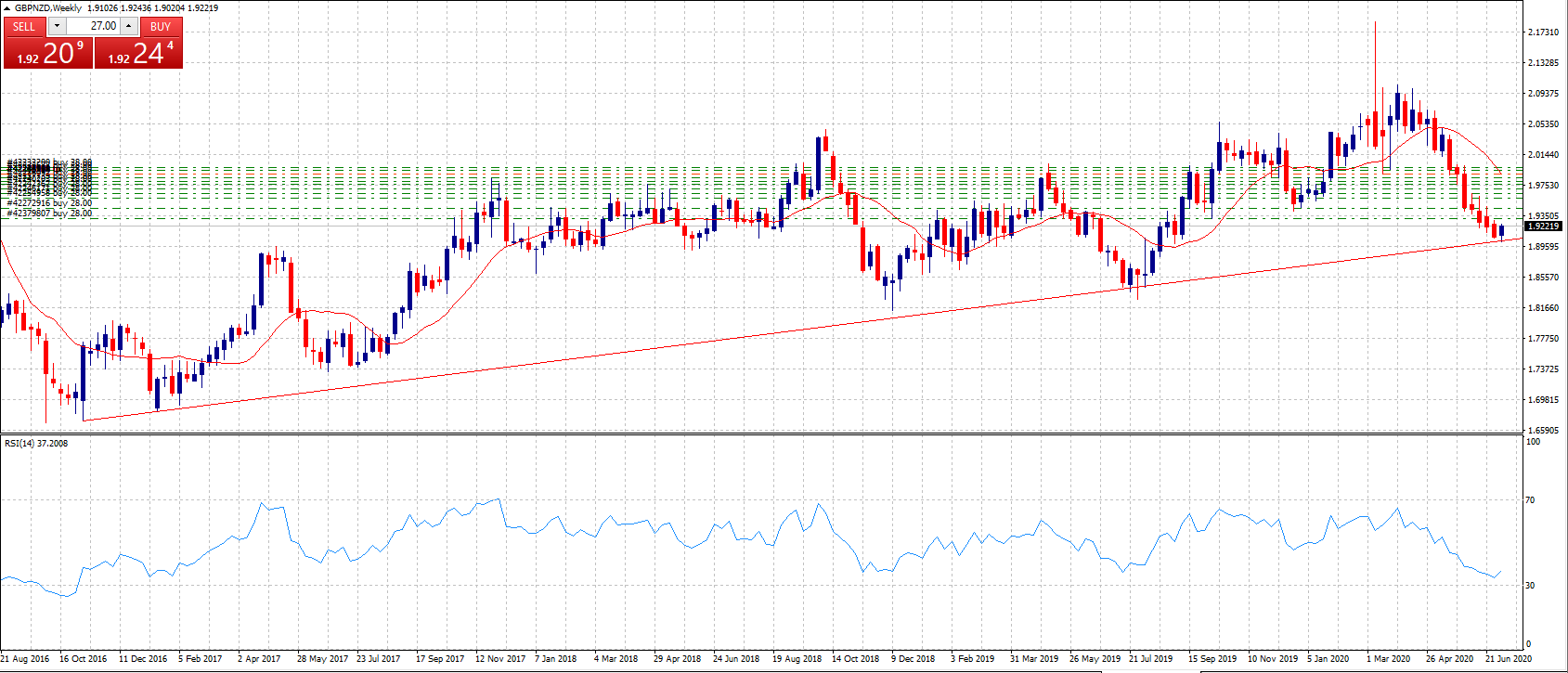

Reasonably good week. Shame I didn't close the GBPNZD yesterday but I was hoping for a move above 1.9320. We got close but it was not to be. That said the cash is higher again and at 2.5-3% in the HIGH RISK account the DD is well in control. Sterling is obviously weaker after the BOE said it was looking into the possibility of negative rates. Make no mistake ongoing talks with Brussels will override the central bank any day of the week so any positive news re: BREXIT negotiations will help this beaten down currency. Trading GBPNZD this time I have spaced the trades further apart than the last time as a safety measure even as it trades back at the multi-year rising line of support

sabot3116

2020.09.18

Hi Gary. Really love your weekly updates and your honesty. Yea, the GBPNZD trade was very unlucky. Taking two trades 1 and 5 minutes after the BOE rate decision and statement, and trying to catch a falling knife (market dropped 100 pips in one 15 minute candle...) was quite a gamble. Probably shouldn't have taken a trade this close to a major news event. Also should have been happy we made it back to break-even, let alone get into profit before markets went south again. But should have, would have, could have doesn't help anyone, and hindsight is always 20/20. If the past shows us anything it is that your cool head will eventually prevail and I'm certain we will make it out of this position. Other than those trades it has been a pretty good month. Keep up the good work! And let's hope for some positive brexit news next week. Have a nice weekend!

Gary Comey

Moving towards the beginning of Q3. In this is final quarter we have the high stakes poker game that is BREXIT plus a U.S Presidential election. This will provide plenty of volatility so the goal is to not get stuck with 12 positions in a big moving pair all within 200 pips and praying for a reversal. That is not speculating but rather gambling. We don't do that. However that said if we want to make money we must play the game. So we are predictably long the Pound which is weakening as the rhetoric heats up and it moves away from the Moving Average. No doubt the U.K Prime minister and various cabinet members plus a few heads from the E.U will be quoted in the Sunday papers so if I must add another position I'll wait until Monday's price action to see how it trades the weekend news. Our USDCAD basket is at about breakeven or better and looking healthy enough.

Gary Comey

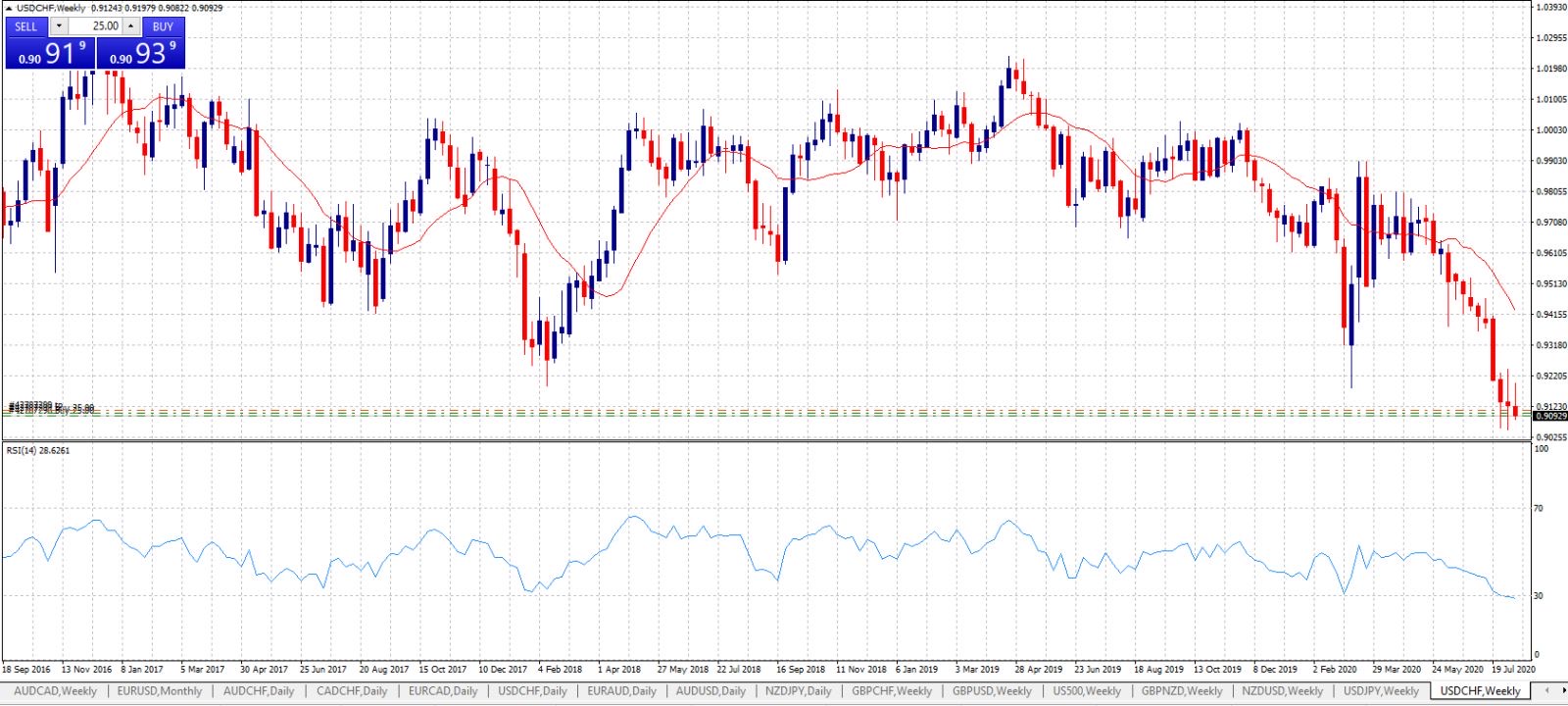

Not a bad 36 hours. Managed clients virtually got all of the performance fee for the last few months back in that period. There's a lots of indecision regarding the Dollar and EURUSD having technically broken it's down trend and acelerated higher, has moved off overbought conditions. I've used my usual contrarian strategy with these big moves off the moving average to make money using USDCHF, USDCAD and GBPUSD (Cable). All the talk a few days ago was for a convincing break of 1.20. Who knows maybe it will happen, maybe it won't, that possibility is sort of binary I guess. Either way there's a plan. Everything I touched was almost instantly profitable this week. There is an element of luck there just as there was an element of bad luck in the previous few months with DD's. The trick is to expect the DD and plan for getting out of jail. When you don't go to jail it's a bonus. Your talking to the guy who did the Escape From Alcatraz Triathlon in SF a few years ago.

Gary Comey

Decent enough week and month though the month is not quite over. Given recent months I’m also defining “decent” as low DD or as I said last week “staying close to shore”

Gary Comey

Just noticed on myfxbook that the cumulative profit in the Alpine Managed account has crossed $3m. On a cumulative basis people have withdrawn more money than they deposited but the balance is still $2.6m. Pretty cool though it's not like we have not taken risks to get it. Trading is risky. Anyway back to cash having made money again likely for the 30th consecutive month (the month ain't over yet). I'm trying to stay close to shore (so to speak) and not get too deep into a drawdown for a little while. Trading has a recency bias, in other words when markets are going down we expect them to continue, when they are going up we expect them to continue. When I have a string of drawdowns or a string of straight winners we expect it to continue. It never does. Enjoy the weekend

Joshua Barnard

2020.08.26

Hi Gary, I am signed up to your Pacific signal. I am not sure you are the person to ask this, but here goes. My account is not calculating the position size correctly, on 5k account and the ratio compared to your lot size, my account opens 0.01 lot when it should be +/- 0.03... Any idea? I know its not a signal question, but if you can help I would appreciate it. Thanks

sabot3116

2020.08.26

Hi dottybee. If you use MT4 make sure that in the Options -> Signals tab the "Use no more than" is at the maximum of 95% if you want to use full equity for the signal.

Gary Comey

Slowing getting back into positions and long the buck vs the Swiss Franc. As you can see from the charts weekly oversold position there's quite an amount of upside with the 14 period M.A above 0.94. The only thing that concerns me about this position is that we are short the Swiss Franc with the S&P 500 so relatively high. IF it falls the Franc would in theory strengthen though I think so would the dollar. Experience says the market will return to the M.A from deeply oversold conditions. IF anyone is still looking at GBPNZD you'll see that even more patience would have been even more profitable. Have a good weekend.

Gary Comey

I'm probably behind where I thought I'd be by July this year but I am taking two comforts. 1. It's been a kind of a Black Swan year and if you had been invested in the S&P500 you'd be flat to slightly down in spite of the massive and well intentioned central bank and government lead program which is destroying the value of paper money by printing countless trillions more of it. Dollars will soon be as plentyfull as baked beans so hopefully they are able to hold their value better than baked beans do. 2. I'm confident that my strategy will make me money and get me to where I want to be in life whether the market goes up or down and that's a hell of skill to have. I can use it to turn paper money into real assets and hopefully have a business I can pass on. I know this because I used to have no skills and just bought stocks and prayed for good non-farm payroll numbers. I know for a fact that despite all the congrats for which I am grateful, some of you looked into the abyss at some point in the last seven months. You held your nerve and that's a hell of a thing too. THANK YOU. To use an Irish term, "fair balls to ya". Trading is risky but more so the market can at any moment pin you to your belief in your strategy which is why I have no interest in any other strategy, I just need to be good at this and specialise in this strategy so that when I'm grabbed by the balls I hold my nerve because believe me plenty of amateurs lose thieir nerve and abandon countless millions at the table upon the first sign of trouble. People with no confidence or likely no deep understanding of their strategy, some with no strategy at all..... except pray for good non-farm payrolls etc. Anyway we are flat and back to cash. Take a few days to consider how you felt over the last few months, there's HIGH, MEDIUM and LOW risk versions of this strategy or if you withdraw money then obviously that money is safe from the volatile forex market. If something compelling happens I could be trading by this day next week but lets say there's no danger of it until next Thursday 13th.

Show all comments (5)

James Wilko

2020.08.10

Hi Gary, I am pretty new to signal trading and have been looking at your signals as a good place to start based on them appearing to be proven over a good amount of time. Am I correct in saying that the California is the lower risk signal and perhaps a good starting point for me? cheers.

Gary Comey

7.22% for Pacific is actually the best month this year.

Oh ye of little faith. Back to cash in the copy trading accounts. I’m going to let the proper managed accounts run a little longer. Good week! Thanks for sticking with me guys. 💪

The $20K earned today goes towards the €170K price tag for the second Blackwave apartment in Albufeira, Portugal 🇵🇹

I’ll be withdrawing $102,000 for this apartment from Blackwave Pacific on Monday leaving $200,000 with position sizes adjusted accordingly of course.

Oh ye of little faith. Back to cash in the copy trading accounts. I’m going to let the proper managed accounts run a little longer. Good week! Thanks for sticking with me guys. 💪

The $20K earned today goes towards the €170K price tag for the second Blackwave apartment in Albufeira, Portugal 🇵🇹

I’ll be withdrawing $102,000 for this apartment from Blackwave Pacific on Monday leaving $200,000 with position sizes adjusted accordingly of course.

Gary Comey

2020.08.04

Actually they want the money sooner for the apartment so a second 100K withdrawal. Leaves $100K and I’ll build back up from there.

Gary Comey

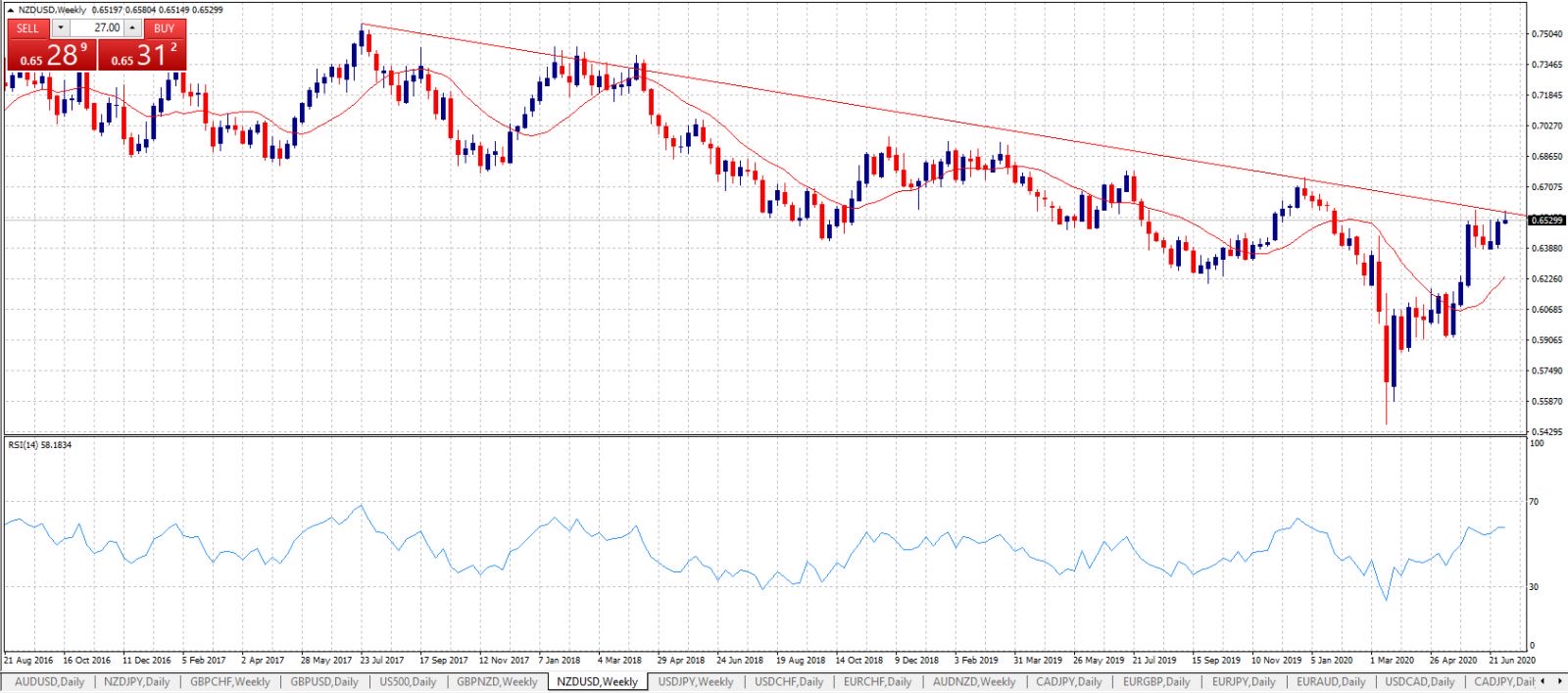

Satisfactory rally off what amounts to triple support as per the graph and finishing the week close to the highs. Next week is data packed with US data including consumer confidence, a Fed rate decision and press conference followed by US GDP on Thursday. That data can be a driver for the broader equity markets and a decline in those markets and a flight to safe assets would likely leave the Kiwi fairly twisting in the wind. I note Intel gapped down this morning, the biggest gap since 2002. Perhaps it is the canary in the Nasdaq coal mine. Anyway that's next week. Nice moves today.

Gary Comey

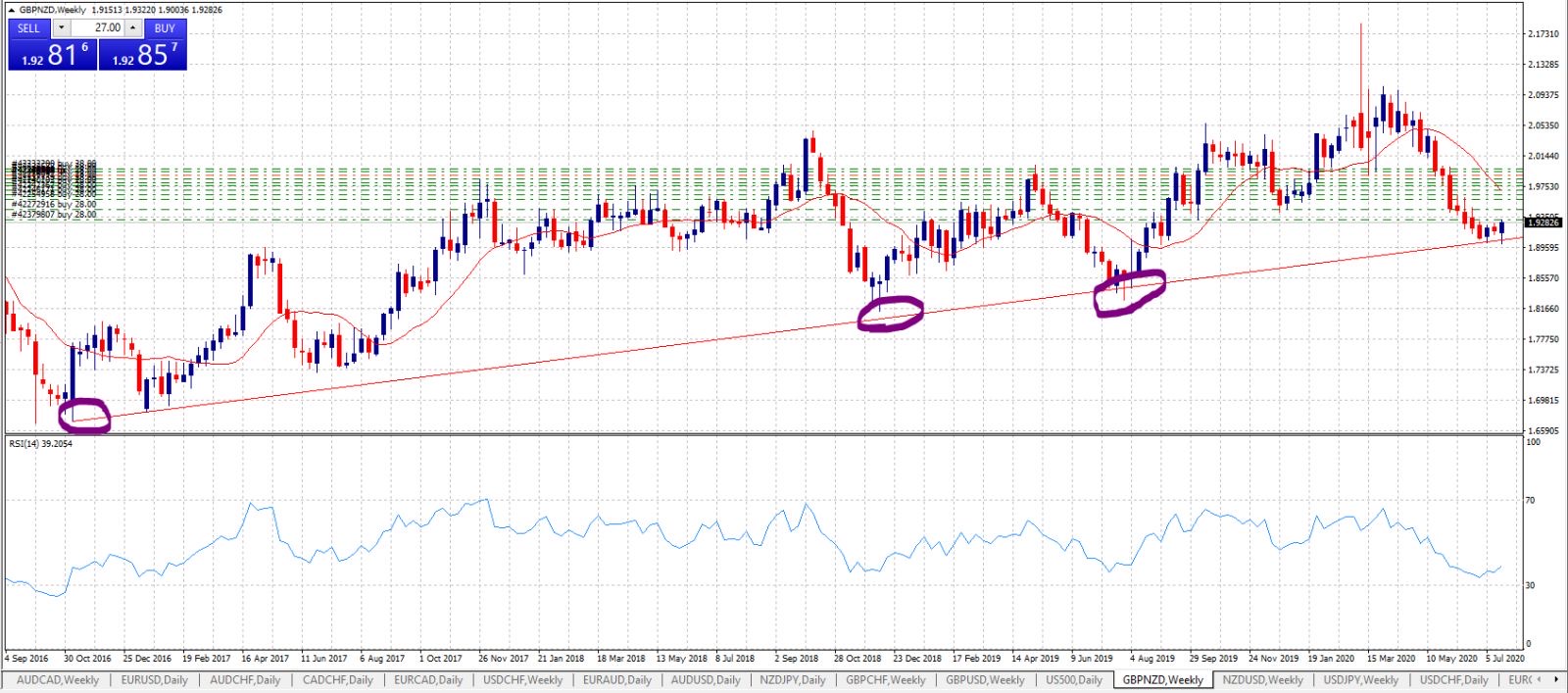

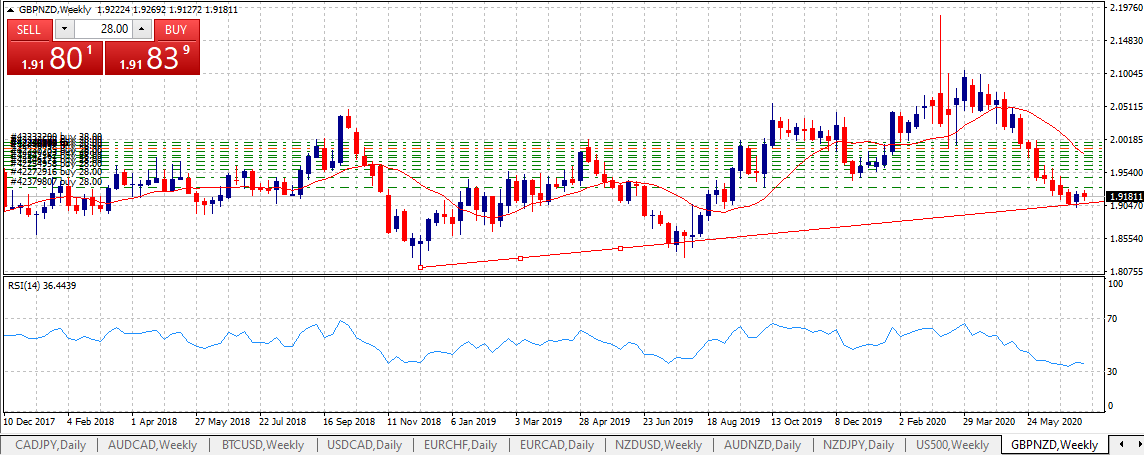

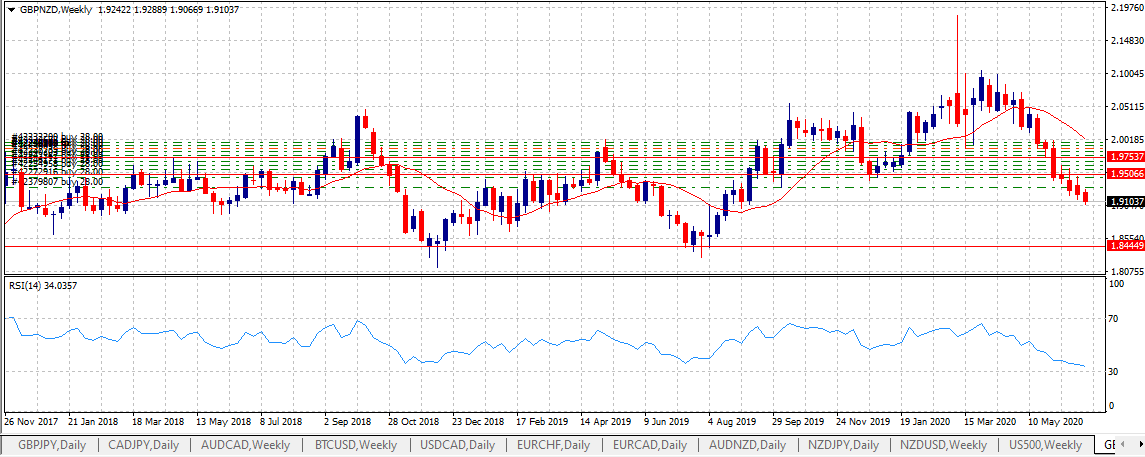

Tentative rally off longer term support continues slowly though as I said last week there can be plenty of false starts off a market "bottom" assuming a market bottom is what we got last week. After putting in a new low last week the market has tended to range sideways with an overall tighter range than in previous weeks which is interesting. The high of this weeks candle is higher than last weeks high which is a first in 11 or twelve weeks and that is interesting too. The 14 period MA is all the way higher at 1.98 and of course given enough patience the market will no doubt come back to that level and further for that matter. GBPNZD is a big mover and that can tend to exacerbate both profits and DD's (and emotions) given a fixed position size however I am happier with the stuttering move in our direction than with the previous weeks price action.

Gary Comey

So below is the latest picture. As you can see the market appears for now to be rallying off longer term support putting the drawdown back within stressed parameters. A few good days does not mean we can start picking out our new fur coat though, there are plenty of false starts in markets and picking tops or bottoms is always very difficult and fraught with errors. Tensions on the trade front are rising and some countries are partially going back into lockdown. This may be partly what's causing the weakening Kiwi as capital looks for safer assets though I think most of the move is down to Sterling strength which is stronger against the Euro and the Dollar too. A proper flight to safe assets caused for example by geopolitical tension would I think help the trade considerably. I like that GBPNZD has held up today above the Daily 14 period Moving Average for the first time in a few weeks. It may be a bit much to ask but last weeks high was 1.9288 and it would be encouraging to get and hold above it too. If we close tonight near the current level then it will be considerably less worrying than where we were at the start the week.

Gary Comey

Re:Alpine: The first graph below is NZDUSD, we are not trading this pair but I wanted to highlight the level of resistance Kiwi has now met. The second is GBPNZD and we are trading that. In this second graph Sterling is the base currency but as you can see there is now some technical support at around this level for Sterling against the recently strengthening Kiwi.

There will be a U.K mini budget tomorrow with a significant stimulus element. There are some indications that the possibility of a Joe Biden win in November is now beginning to get traction. Irrespective of your politics this represents uncertainty and the NZD will weaken on uncertainty being a risk correlated asset. So therefore, we may have a coincidence of technical support and fundamental support to the trade.

The brass tax here is that looking at the high-risk Alpine clients account I have some options. Firstly, we are 700 pips from complete Armageddon in the Alpine client account and I don’t really see this market going down to 1.83 but that is a fairly large cushion so Plan A is do nothing and if the price does indeed find a bid down here then doing nothing is Plan A. So far today is a good day and we have taken out yesterday’s high and come back to within level of DD I would have predicted was possible.

IF however we approach a 60% DD in Alpine then I could cut the three biggest losing positions bought at the highest level. That would represent a 20% loss to the cash position but usefully it would bring down my average entry to circa 1.9635 and also buy us another 140 odd pips (840 in total then) before complete Armageddon. Let’s call that Plan B but Plan B is not a definite Plan but rather another tool I can use. A 20% hit to the cash would be crap and take me a few months to get back but it would give us the wiggle room to get out of the situation within a few months be back to where we began.

Obviously in a fluid market plans need to be fluid too so I don’t want to jump too far ahead with the “what if’s” about Pacific and the lower risk versions of the strategy because I think it’s better to evaluate at the time but at least there is the bones of a plan for the next two steps ahead. Hope that makes sense.

There will be a U.K mini budget tomorrow with a significant stimulus element. There are some indications that the possibility of a Joe Biden win in November is now beginning to get traction. Irrespective of your politics this represents uncertainty and the NZD will weaken on uncertainty being a risk correlated asset. So therefore, we may have a coincidence of technical support and fundamental support to the trade.

The brass tax here is that looking at the high-risk Alpine clients account I have some options. Firstly, we are 700 pips from complete Armageddon in the Alpine client account and I don’t really see this market going down to 1.83 but that is a fairly large cushion so Plan A is do nothing and if the price does indeed find a bid down here then doing nothing is Plan A. So far today is a good day and we have taken out yesterday’s high and come back to within level of DD I would have predicted was possible.

IF however we approach a 60% DD in Alpine then I could cut the three biggest losing positions bought at the highest level. That would represent a 20% loss to the cash position but usefully it would bring down my average entry to circa 1.9635 and also buy us another 140 odd pips (840 in total then) before complete Armageddon. Let’s call that Plan B but Plan B is not a definite Plan but rather another tool I can use. A 20% hit to the cash would be crap and take me a few months to get back but it would give us the wiggle room to get out of the situation within a few months be back to where we began.

Obviously in a fluid market plans need to be fluid too so I don’t want to jump too far ahead with the “what if’s” about Pacific and the lower risk versions of the strategy because I think it’s better to evaluate at the time but at least there is the bones of a plan for the next two steps ahead. Hope that makes sense.

Gary Comey

To be honest I needed a break from trading but then the market doesn't care much for what I think, I'm a flea on the back of a lion and of all markets GBPNZD is a big enough lion.

Every now and then the market growls at you and you are forced to decide is your strategy sound or not. People are always corresponding with me making suggestions/updates to my strategy and asking for my opinion of their strategies. This morning a guy wondered about hedging the position but I won't. If it's an RSI strategy and I am buying when oversold why would I sell at this level of RSI? Panic presumably but I am not.

I wouldn't be where I am if I wasn't curious about strategies but I feel I've settled on this strategy and figure it's best to become the best I can be at this strategy rather than keep moving from one to the other. Any trader I've ever known who's successful definitely does not have a new strategy every week. It's helpful to know what you're about when the proverbial sh8t hits the fan. If you were in any doubt about your strategy you would surely fold.

Above is the weekly chart of GBPNZD. As I said my strategy is basically an RSI strategy. Relative strength is a moving average oscillator and the bet is that even though the moving average obviously follows the price, the price can get too far away from the moving average from time to time either on the buy side or sell side. If you look above at lower part of the screen shot this happens from time to time. The market then always comes back to the moving average and then further which is obviously still following the price. So hey presto we buy when oversold and sell when overbought across a grid. Actually this strategy is not so healthy when you think about it because the price can really move far off the moving average crushing you before the inevitable re-tracement sparked by some piece of news or whatever. Therefore to dull the madness of this strategy I have "POSITION SIZE", in other words don't bet too much on any individual position. Over the years that's refined into HIGH, MEDIUM and LOW risk versions. Most of my money is in MEDIUM. $282K to be exact. Anyway I began buying this when close to oversold on a daily time frame. It worked fine for a while then eventually the Lion turned and bit. Now we are well into the position as per the strategy and frankly now it's a waiting game. Plenty of guys would continue to add to the position but that would be to allow the madness of the strategy to take over. Therefore I won't.

There will be lots of U.K vs E.U news in the coming weeks but I am sure if we look back soon enough the market has no doubt returned and surpassed the moving average a few times. Where will we be? I think I will have turned a profit. We've faced this wall of worry many times since 2015 and patience of a saint plus position size got us out of it. I developed the strategy and called it Blackwave because of the wave pattern of markets.

Every now and then the market growls at you and you are forced to decide is your strategy sound or not. People are always corresponding with me making suggestions/updates to my strategy and asking for my opinion of their strategies. This morning a guy wondered about hedging the position but I won't. If it's an RSI strategy and I am buying when oversold why would I sell at this level of RSI? Panic presumably but I am not.

I wouldn't be where I am if I wasn't curious about strategies but I feel I've settled on this strategy and figure it's best to become the best I can be at this strategy rather than keep moving from one to the other. Any trader I've ever known who's successful definitely does not have a new strategy every week. It's helpful to know what you're about when the proverbial sh8t hits the fan. If you were in any doubt about your strategy you would surely fold.

Above is the weekly chart of GBPNZD. As I said my strategy is basically an RSI strategy. Relative strength is a moving average oscillator and the bet is that even though the moving average obviously follows the price, the price can get too far away from the moving average from time to time either on the buy side or sell side. If you look above at lower part of the screen shot this happens from time to time. The market then always comes back to the moving average and then further which is obviously still following the price. So hey presto we buy when oversold and sell when overbought across a grid. Actually this strategy is not so healthy when you think about it because the price can really move far off the moving average crushing you before the inevitable re-tracement sparked by some piece of news or whatever. Therefore to dull the madness of this strategy I have "POSITION SIZE", in other words don't bet too much on any individual position. Over the years that's refined into HIGH, MEDIUM and LOW risk versions. Most of my money is in MEDIUM. $282K to be exact. Anyway I began buying this when close to oversold on a daily time frame. It worked fine for a while then eventually the Lion turned and bit. Now we are well into the position as per the strategy and frankly now it's a waiting game. Plenty of guys would continue to add to the position but that would be to allow the madness of the strategy to take over. Therefore I won't.

There will be lots of U.K vs E.U news in the coming weeks but I am sure if we look back soon enough the market has no doubt returned and surpassed the moving average a few times. Where will we be? I think I will have turned a profit. We've faced this wall of worry many times since 2015 and patience of a saint plus position size got us out of it. I developed the strategy and called it Blackwave because of the wave pattern of markets.

Fabio Cavalloni

2020.07.04

No doubts that you know what you are doing since years and years: your reverse strategy handled with your rules always provided big profits despite of also big drawdowns. Lot of news are coming about UK and EU also, but what will happens with a weekly candle like the one with huge spike in the past (2020.03.08) ?

You have not an hard stop loss right? I suppose that lowest red line on chart is your stop out level and highest one is average price: now we are in the middle. Of course in a very oversold market there are more possibility that it will come back but... what do you think about waiting for a weekly candle that give some signal about reversing? Now it seems you entered first trade after a big bearish weekly candle, and you continued adding trades without any confirmation outside of distance from your average price.

Think about what I said and, write to me if you want to discuss more about some ideas, I always like to talk, learn and (sometimes) teach something.

Have a nice weekend Gary!

You have not an hard stop loss right? I suppose that lowest red line on chart is your stop out level and highest one is average price: now we are in the middle. Of course in a very oversold market there are more possibility that it will come back but... what do you think about waiting for a weekly candle that give some signal about reversing? Now it seems you entered first trade after a big bearish weekly candle, and you continued adding trades without any confirmation outside of distance from your average price.

Think about what I said and, write to me if you want to discuss more about some ideas, I always like to talk, learn and (sometimes) teach something.

Have a nice weekend Gary!

[Deleted]

2020.07.04

We only talk to show how smart we can be --- like me now, is sooo simple using this keyboard. Other people likes to produce profits, huge ones like Gary and build wealth along the bumpy road. REAL FACT: all strategies at one point in time in 100% cases will face the LION in the battle ring and you'll be forced by human nature to watch and see if your past results are built on sand with luck or have been made to stand out to last in the face of a angry crowd. This 'LION" is KING by nature and cannot forget that you are a little winner and took his place to try to be a KING like him, but guess what: will wait and wait with patience, will watch your little steps then when you are a little tired or to confident into your little actions, he will get back to you and force to fight again to test if you are a real lion or just another brave rabbit. You'll fight this kind of battles until you quit or you become a true LION.Along the time quitters must live the house. Lions should stay at the same table with other lions which made it through hard times. And this table is so tiny, it looks like a shadow: 3-5% are LIONS, the percentage difference are just met and food for this little table! Conclusion: quit or fight to win or keep your seat. Along the road I've checked: Gary is still on that table and yes, the bigger Lion is asking him to live, again. Is just a test, and Gary knows!

Gary Comey

The performance of the U.S equity market has been remarkable. I think it should get complicated for markets now that we are back close to the previous highs. With all the trillions promised I can understand how that would inflate markets but are we now to go to new highs and forget about the virus which is now causing re-openings to be delayed and postponed. Are things really THAT OKAY! For our trade to work we could definitely do with some weakness which pulls money out of the Kiwi and weakens it against the pound. There are some signs of it running into longer term resistance at least against the Greenback by about 0.6585. Lets see if the most recent lows can hold. I noticed that on the 22nd and 23rd we put in new low but finished closer to the highs on both days. Sign of a bottoming process? We will only know in retrospect.

Gary Comey

Definitely a testing enough market. Typically I was supposed to be taking a break from trading after this basket closed but it's making me pay for the break I guess. My expectation that 1.9375 was thereabouts the low was clearly wrong so as I said at the end of last weeks mail the strategy calls for control of the quantity of positions and position size and that's where we are right now. Equity markets continue to rally towards the previous highs and Sterling is having it's own issues namely bond buying by the Bank of England. So the trend is still down and the market remains oversold on multiple timeframes. Time for cool heads.

Gary Comey

Last week I wrote about the Pound though could well have mentioned the Euro or the Canadian dollar amongst a few others when I said it's "advance against the greenback has been strong which is in all sorts of trouble and losing it's safe haven status for now as again the preception of risk has declined." That story changed somewhat this week. New doubts about Covid 19 Wave No. 2 so....the S&P500 dropped and SO CALLED safe havens like the Swiss Franc, the U.S Dollar strengthened again. Not surprisingly so called riskier assets like the NZD weakened against the Pound. Round and round we go and it was starting to look good for being long GBPNZD. It didn't help us that at -20% U.K GDP monthly data was a bit worse than the -18% expected and the S&P500 has bounced a little today strengthening the NZD as will happen in this financial market ecosystem. So, we are officially still in a downtrend in GBPNZD though we may be forming a base by 1.9375 as it has rallied off that area after testing it on the 8th and 9th of June. President Clinton once said "You Can Put Wings On A Pig But That Doesn't Make It An Eagle". Perhaps the easy trade in the winged pig that is the S&P 500 is over and that is useful to know. We've had a very significant rally off the lows to the point where the S&P was nearly positive for the year which makes no sense. Things are likely to get complicated for the equity markets for a little while as we figure out what's risky and what are companies worth again. In such a scenario life for the NZD should stay complicated too hence my instinct that 1.9375 is thereabouts an attempt to form a bottom. All this is not withstanding the actual trading strategy and that the fact that the weekly 14 period MA is all the way higher at 2.02 and the market remains daily and almost weekly oversold. The strategy calls for control of the quantity of positions and the position size and buying when oversold though it would be boring to tell you that every week.

: