You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

newdigital, 2014.05.07 18:18

Just a reminderThere is good article concerning to fundamental trading (for creation of the EAs related to News Trading) :

============

Building an Automatic News Trader

As Investopedia states, a news trader is "a trader or investor who makes trading or investing decisions based on news announcements". Indeed, economic reports such as a country's GDP, consumer confidence indexes and employment data of countries, amongst others, often produce significant movements in the currency markets. Have you ever attended a U.S. Non-Farm Payrolls release? If so, you already know that these reports may determine currencies' recent future and act as catalysts for trends reversals.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.11 15:39

Fundamental Analysis

Fundamental analysis is the study of statistical reports and economic indicators of countries to trade currencies more effectively. Changes in interest rates, employment reports, and the latest inflation figures, all fall under the purview of fundamental analysis, which forex traders must pay close attention to, because they can have a direct bearing on the value of a nation’s currency. Data used in forex fundamental analysis can be classified by the degree to which they affect the market:

Given the importance of these indicators, it is necessary to closely follow economic calendars, and know beforehand when they are scheduled for release. The most powerful indicators that move forex market include:

Generally, if a country increases its interest rates, its currency will increase in value because investors will shift their assets to that country to gain higher returns.

GDP is the primary indicator of the strength of economic activity in a country, and is generally reported quarterly. A high GDP figure leads to expectations of higher interest rates, which is mostly positive for the given currency.

A decreases in payroll employment is considered as a sign of weak economic activity, and could eventually lead to lower interest rates, which has a negative impact on the currency.

A country with a significant trade balance deficit is likely to have a weak currency as there will be continuous commercial sellings of its currency.

Traders, who rely on fundamental analysis to study markets, will typically create models to formulate a trading strategy. These models generally utilize a host of empirical data and try to forecast market behavior and estimate future currency levels. This information is then used to draw out specific trades that best exploit the situation. Forecasting models are as varied and numerous as the traders that create them. Two people can analyze the exact same data and come up with two completely different conclusions about how it will impact the market. Therefore is it important to understand what is more relevant to the current market and economic conditions, and not succumb to ‘paralysis by analysis.’

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.09 15:55

Can You Trade Forex Well with a Small Balance?

“Ninety-five percent of the trading errors you are likely to make—causing the money to just evaporate before your eyes—will stem from your attitudes about being wrong, losing money, missing out, and leaving money on the table. What I call the four primary trading fears.”

“Attitude produces better total outcomes than analysis or technique.”

― Mark Douglas, Trading in the Zone

What’s the least amount I can’t start trading with? That’s a common question running through a trader-to-be’s head when they’re about to open a trading account. However, you’ll soon see how that line of thinking can breed a lot of poor thinking patterns and get you in trouble.

Let’s start off with some tough love. You’re not trying to buy something at a discount when you put down margin for a trading account. Less is not more and as you could understand, less is less. Put in other words, the attitude that comes with trying to get the best deal on a large purchase can do damage to your trading.

Here’s how. The attitude you trade with will follow through to how you manage risk and in keeping that mindset, you’ll likely overleverage your trading account and potentially be forced out of trades at the worst possible point. A better approach is to ditch the focus on a win percentage and instead focus on preserving capital / downside risk as opposed to a key juncture break long before an extreme pressed you out of the market. This new attitude that focuses on risk often produces better total outcomes than analysis or technique alone.

The Limits of a Small Balance

There’s a reason Hedge Funds don’t start with $5,000 or $50,000 or even $500,000. That’s because they know their inability to enter into a position with favorable risk: reward is directly tied to limited capital. Now, before you think, “I’m not a hedge fund so that doesn’t concern me,” think about this. Everyone is trying to extract money from the market while risking as little as possible however, there is an amount of agility that is needed to trade well and put the odds in your favor.

In short, a small trading balance limits your agility as a trade. Acute observations from traders with small balances show common traits that limit agility and your edge as a trader:

Agility is a mindset that traders need to have are often doomed without. When you’re agile, you’ll have the ability to pay attention to what matters most in trading, which is exploiting an edge in the market while always limiting risk. Of course, there’s an easy way to do this without trying to find a psychologist to change your mind frame.

The Better Path Regardless of Risk

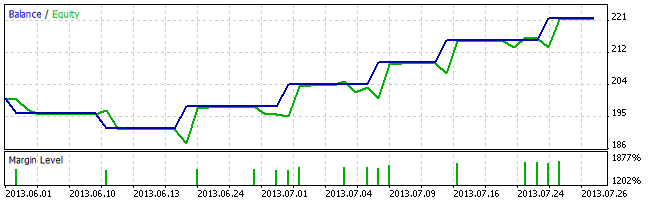

Always think risk first regardless of your account balance. However, the more trading capital and usable margin you have, the easier it is to stay level headed and agile as the market moves. It’s been said that to enter a trade without a clear risk-point in mind is reckless and I agree. However, the more usable margin you have, which goes hand in hand with a larger account balance, the less you’ll keep holding out for the big winner and rather look for fewer high probability trades. Here’s a look from the Traits of Successful Trader’s Research that shows the correlation to high balance and better performance

The graph above shows a clear pattern: the less equity you trade with, the more prone you are to use high amounts of leverage. The more amount of leverage you utilize, the more focus you’re likely to have on short-term gains. The only problem with an overt focus on short term gains with high leverage is that you’re unlikely to take a small loss in the near term which can eventually lead to a huge or devastating loss before long.

Closing Thoughts

Starting with a small account can become one of the most expensive ways to get started. This article has opened up many of the mental traps that lurk for those trading a small account. The question becomes, are you willing to take trading seriously enough to protect your mental capital and align yourself with those who have made a success in trading before you?

I hope your answer is yes.

Happy Trading!

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

newdigital, 2013.01.23 07:34

Concerning signals ... I see some members asked about how to unsubscribe from the signals. I subscribed to some free signal 3 days ago (with no problem so far). Just some information/topics about the signals which I collected about signals:

Forum on trading, automated trading systems and testing trading strategies

Financial and trading videos - Table of Contents

angevoyageur, 2013.10.02 15:46

Under construction - Stay tuned !

MT5 platform.

Famous traders / Interviews.

Indicators.Not yet Classified.

Trading and The Laws of Abundance - Video about trading psychology

How to Control Your Emotions When Trading. Part 1

How to Control Your Emotions When Trading. Part 2

What the forex is ?

Simple example about entry and exit method for swing traders (D1 timeframe).

Why 80% fail at using a trend following technique to trade the forex.

How to trade support resistance levels (s/r), and different kinds of s/r.

2 ways of analysis: fundamental analysis and technical analysis.

Trading Strategy - Day Trading Confirmation Entry.

Ichimoku vs Moving Average Trade Analysis.

High Frequency Trading Explained

Boris Schlossberg about Futures vs. Spot ForexHigh frequency trading in action. CNN's Maggie Lake gets a rare look inside the super-fast trading industry.

High Frequency Trading Explained (HFT)

Day Trading Methods So Easy Anyone Can Use

Financial Crisis in Euro Cyprus doesn't always mean short - sell when using price action.

Gold, Crude, Russell with price action trading by John Paul.

Market conditions -- where will the price move ?

Technical Analysis for Idiots - My Market Theory.

Technical Analysis Course - Module 1: Technical Analysis and the Dow Theory

Technical Analysis Course - Module 2: Charting Basics

Technical Analysis Course - Module 3: Trend Concepts

Technical Analysis Course - Module 4: Reversal and Continuation Patterns

Technical Analysis Course - Module 5: Volume and Open Interest

Technical Analysis Course - Module 6: Moving Averages

Technical Analysis Course - Module 7: Oscillators and Sentiment Indicators

Technical Analysis Course - Module 8: Further Charting

Technical Analysis Course - Module 9: Elliott Waves and Cycles of Time

Technical Analysis Course - Module 10: Cloud Charts: the Ichimoku Technique

Technical Analysis Course - Module 11: Money Management and Computers

Technical Analysis Course - Module 12: How to Build a Trading Systems

Technical Analysis Course - Module 13: The Stock Market

Technical Analysis Course - Module 14: Futures

Technical Analysis Course - Module 15: Options

Technical Analysis Course - Module 16: Forex Trading

Technical Analysis Course - Module 17: Strategies and Trading Principle

Best Forex Indicator To Use

Effective Forex Exit Strategy For Traders

Trading the Dow Jones: Wall Street Index

Trading the FTSE: UK 100

Trading the Natural Gas Price

Trading the Nikkei

Data Announcements: Non-Farm Payrolls, GDP Figures and Central Bank Interventions

Most Popular Indices: FTSE vs Dax vs Dow

Trading the USD/JPY Currency Pair

Forex Trading and Leverage

Range Bound or Trending | The Best Way Traders Can Determine Market Conditions

Technical Analysis vs Fundamentals: How Reliable are Technicals ?

Trading the Oil Price

Trading lesson #1 ADX Indicator

Trading lesson #2 CCI Indicator

Trading the Silver Price

EUR/USD - Most Popular Currency with Traders

The Importance of Exit Strategy, part 1

The Importance of Exit Strategy, part 2

The Importance of Exit Strategy, part 3

The Importance of Exit Strategy, part 4 - guidance of great traders

Moving Averages

Something Interesting in Financial Video June 2013

Something Interesting in Financial Video July 2013

Something Interesting in Financial Video August 2013

Something Interesting in Financial Video September 2013

Something Interesting in Financial Video October 2013

Something Interesting in Financial Video November 2013Forum on trading, automated trading systems and testing trading strategies

Financial and trading videos - Table of Contents

angevoyageur, 2013.10.02 16:02

Indicators.

Forum on trading, automated trading systems and testing trading strategies

Financial and trading videos - Table of Contents

angevoyageur, 2013.10.02 17:42

Famous traders / Interviews.

Trading legend John Bollinger discusses industry analysis

John Bollinger discusses some of the misconceptions about trading the bands.

High frequency trading provided by Steve Kroft.

10 Golden Rules of Trading explained by former floor trader and retired hedge manager, Adam Hewison

Martin J. Pring's Classic Trading Rules

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

newdigital, 2013.07.24 10:00

I just want to remind about how to insert the images to the post - read this small article

=========

MQL5.community - User Memo :

2. Messages Editor

All your texts in Forum, Articles and Code Base are edited in a single environment with a convenient and easy-to-use interface. Let us take a look at its capabilities.

The drop-down list where you can select one of the three languages in which your message will be automatically translated by the Google Translate service.

The button (Ctrl+Alt+L) is used for adding links into messages. The Link window appears as soon as you click this button (shown next).

button (Ctrl+Alt+L) is used for adding links into messages. The Link window appears as soon as you click this button (shown next).

In the Link field, you should specify the address of the link and then click the Insert button.

The button (Ctrl+Alt+I) is used for inserting pictures into messages. The Image window appears as soon as you click the button (shown next).

button (Ctrl+Alt+I) is used for inserting pictures into messages. The Image window appears as soon as you click the button (shown next).

In the Upload image field, you should specify the picture file. To do it, click the Browse button that opens the standard window to choose files. Select the necessary file and click the Insert button to confirm the choice, or click the Cancel button to end without uploading a file. In the Title field, you can specify the comment that will be displayed as a pop-up help if you move the mouse cursor over the picture.

In HTML mode, it is prohibited to insert external links to images (HTML tag "src"). It is also prohibited to insert text, containing such images.

When you try to save text that contains external links to images, such links will be automatically deleted. This is done to ensure safety of MQL5.community members.

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

RaptorUK, 2013.07.24 10:18

How to post code on this forum . . .

Forum on trading, automated trading systems and testing trading strategies

PriceChannel Parabolic system

newdigital, 2014.07.15 12:32

about how to post the charts from Charts section.

1. Click on this link :

2. After that - go to the post, place cursor on some place of the post, and press this button:

and the chart will be appeared on this 'some place'.

3. How to delete chart on the post (in case it is mistaken, or in any other reason)?

Press this button

and after that - use Backspace on keyboard to delete the chart/text.