Fractals, fractal structures, their graphic images + Canvas - page 12

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The second principle in hermetic philosophy is the Principle of Similarity (analogy).

"As above, so below, so below, so above" ("Cibalion" by Hermes Trismegistus).

To know the whole, it is enough to know the small.

The second principle in hermetic philosophy is the Principle of Similarity (analogy).

"As above, so below, so below, so above" ("Cibalion" by Hermes Trismegistus).

To know the whole, it is enough to know the small.

As an idea (haven't read everything here, maybe already discussed...)

You could try looking at Elliott wave sequences and twisting them into a fractal pattern. In fact, the ellipt idea itself is a fractal - according to which one large wave is divided into smaller waves, but drawn according to the same scheme.

At the very beginning of the topic - suggested a way of drawing a fractal chart from the middle of the square ...

One can try to improve this way using Elliott Wave Theory. For example, we have one sick wave - draw all movements upwards postponing dashes to the right from the centre, the height of the Y-axis is postponed as a ratio of the wave's beginning to its previous beginning. 3 large dashes to the right should come out as a result.

All corrective waves following a similar technique will end up with 2 dashes to the left.

Oklo each of these dashes - draw the same sequences... only take the information from the market. If the picture turns out the way I think - then you can try to do something with it...

I have not tried to use my algorithm yet, but the picture that I think we can get - will look like this (I repeat - this picture is only supposedly a fractal I drew in Paint):

Speaking of which, "Since we're having this conversation..." Does anyone know of a proven algorithm for marking up a software chart on Elliott waves?

Why? Here are the real fractals (curves) right now.

Why? Here are the real fractals (curves) right now.

If the question is addressed to me - then at least to see how "even" fractals are in the market now. What is on the screenshot - can be redrawn according to the scheme that came to my mind.

If it is possible to do it it will be interesting to test how successful it will be.

If the question is addressed to me - then at least I want to see how "flat" fractals are in the market now. What is in the screenshot - it can be redrawn using the scheme that came to my mind.

If it is possible to do it it will be interesting to test it.

I already tried to argue about physical principles...

Forum on trading, automated trading systems and trading strategy testing

From Theory to Practice

Nikolai Semko, 2018.09.06 07:10

I read here about polynomials, ANC, various approximation methods, forecasting capabilities, etc. ...

Some believe in prediction, some don't.

But what I hoped to find I never saw.

To try to explain what I mean, I will resort to an analogy with gravity in the universe.

Here's a look at the animated gif I recorded.

Answer the question for yourself. Is it possible to predict the trajectory of each object?

Well, of course you can.

But only if you know information about each object at the moment: its mass, current position and direction of movement, time of its appearance and time of its disappearance.

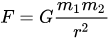

And then it is a matter of mathematics and calculations, using essentially only one formula (for a variant of classical mechanics for velocities far from the speed of light):

The program itself is a gravity sticker here. You are welcome to play with it.

You should also understand that even our planet does not move in a closed circle, but in fact it is a three-dimensional sine wave (spiral).

This video demonstrates it clearly:

So what if we don't have information about all the objects?

Can we predict the trajectory knowing only the trajectory itself in the past?

This is where the fun begins.

If someone says that it is not possible, the answer is wrong. An affirmative answer would also be wrong.

The solution to this problem will only be probabilistic.

The problem must be solved from the opposite direction. According to the past trajectory, we must first calculate the probabilistic trajectories of the main "clumps" of objects and their mass. To then predict probabilistic models of possible trajectories.

This is what the basic task of AI is for - pattern recognition.

This, as I understand it, is what Maxim Dmitrievsky was talking about.

About six years ago, I published my first developments in this area in the KB:https://www.mql5.com/ru/code/10882. I just used a polynomial of degree 1 (Linear Regression) for channel recognition there. After that I have advanced considerably in this area. But I don't publish anything and won't for obvious reasons. I only give hints for inquiring minds.

Finding linear channels is essentially finding the centres of these gravitational masses.

There are usually 5-10 such centres (channels) in any instrument (symbol). For the prediction of the price all of them should be taken into account simultaneously. Only in this case the accuracy of prediction going up or down will be much higher than 50%.

But everybody tries to find a special set of numbers and naively believes that they will predict the future.

The matter is that this "set of numbers" alive, dynamic, it constantly changes, as well as position of local centres of masses of set of objects in analogy with a material gravitation changes. And the problem is reduced to finding of the law of change of this "set of numbers" and even finding of the law of change of the law itself :))

Ideally, this "set of numbers" should be recalculated with every tick. This is exactly why I have said more than once that what many call optimization, finding a particular "set of numbers" is trivial tinkering with historical data.

I think the analogy with gravity is very apt. In the market, gravity is created by money. Some will go in with $100, others with a few billion. The same laws of gravity apply here, and even the same formula I gave above. The force of attraction is inversely proportional to the square of the distance and directly proportional to the masses. Therefore a polynomial regression of degree 2 (parabola) is the most appropriate tool. Although it would be more logical to use a hyperbola, because it is according to the laws of the hyperbola that two gravitational bodies interact. But, the fact is that the parabola is much more convenient for calculations, as well as parabola and hyperbola are very similar to each other at the most important interval.

You can see it clearly here. The red line is the parabola and the blue line is the hyperbola.

The main difference between the gravity of money and the gravity of celestial bodies is that money can suddenly appear and suddenly disappear, creating powerful gravitational fluctuations. But to calculate this event, and there is such a thing as a channel breakdown.