From theory to practice - page 1619

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Eh, I'm worried aboutRenat Akhtyamov. He was in bad company last Friday. I listened to bad music.(((.

Renat Akhtyamov:

MM ? - Well, don't fill your head with ideas about the market from 30 years ago, it's been running on automatic for a long time now.

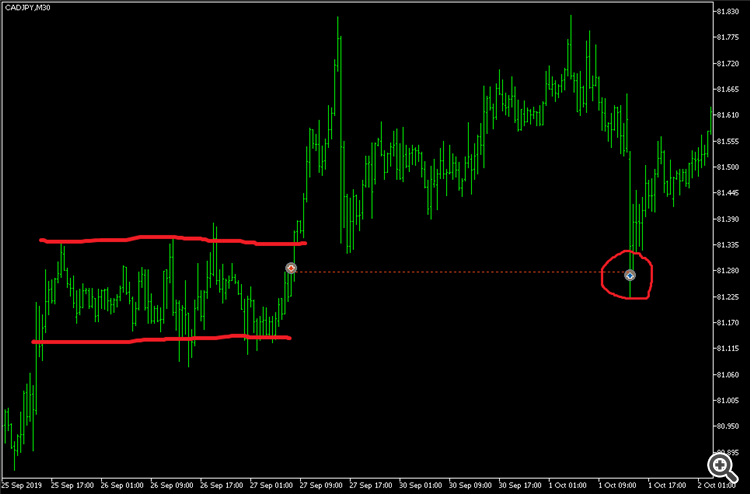

that's how MM works (the chart looks different now, right?) :

you have to watch the wrong crowd. you have to watch the crowd of institutional traders. they move the price.

The retail crowd has no effect on the price.

It's just that at a certain time the 10 big banks in the world said to the Deutsche banks: bring your clients to us, we will serve them.

In the past, your dts acted as a kitchen for you, and you traded against it.

now your market maker is your kitchen. it acts as your counterparty.

For the last 5 years, dealing centres have been saying "we take trades to the market". in reality, no one takes trades to the market, but to market makers.

And market makers serve retail traders at the current average price of the interbank forex market. they just put the ask a little higher and the ask a little lower.

they also provide leverage. the same kitchen that your brokerage house used to be for you, now it's MM.

MM earns on the spread. but at the moments of strong movements he can get caught, so at such moments he widens the spread a lot.

the statement "the market maker drives the price against the crowd" is wrong. to see this, just compare the price chart and the chart of the retail-top.

You can see that price reversals occur first, and then the reversal of the crowd chart occurs.

It is not the price that moves against the crowd, but the crowd that trades against the price.

You can even calculate the average price chart that they use. it's Ma200 on the m30 timeframe.

As a rule, the market makers may widen spreads or include slippages.

One owner of a forex broker told me that a market maker can ask a broker not to transfer an inappropriate client to him.

In this case, the client may stop earning.

In this case, the client may stop earning. in addition, the broker who owns a brokerage company tells me that some brokerage companies have very low spreads but high slippage, while others have bigger spreads but no slippage.

The market is driven by the psychology of the crowd.

For example, frozen orders work.

Here, for example, in a channel, opened downwards.

but I missed the big news on the Japanese. And the price went against me.

And what about me? I'm like the crowd that doesn't like to close losing orders and waits for the price to return to the opening line to close at zero.

I decided to "cross" too.

But when the price went back to that line, to my surprise, it bounced back and went up.

it means i wasn't the only one hanging there.

Why do forex levels work, from which price rebounds many times?

Because at these levels people put trades upwards.

Price went against them and they closed when they went to zero. (And a close is an opposite trade)

Everyone says "if only we knew where the crowd opens en masse, then we could open with it and ride that movement".

It would also be nice to know where the crowd would close en masse. And closing orders are opposing trades and price will move sharply at such times.

It's just a pity that the positions of institutional traders are nowhere to be seen.

And what the "muppets" are talking about is not market makers, it's central bankers.

They need to regulate the price to keep it stable.

They don't benefit from big trends, the more people who see a trend, the more people who join it. And they can drive the price into the sky.

That is why central banks tend to reverse trends. People trade visually, so the regulator needs to turn the "trend" figure in the eyes of traders into a "poker" figure. And then new traders will no longer want to join the movement.

Generally, I think the regulator regulates the market with visual images. You just need to show them the right pattern to provoke the right reaction.

if you look at the functions of central banks, you see that one of their main functions is to ensure the stability of the national monetary unit.

but stability is an elastic term. and different central banks have different definitions of it.

for example, the swiss used to be very pegged to the euro. then the peg was removed. now I think they also look at the dollar.

there is a 'tight' peg policy. the Singapore dollar is 'tight' to the US dollar. If its rate deviates from the us dollar by half a spread, the central bank steps in and resets the rate.

Many countries have a policy of a strict peg to a strong currency.

It is also common practice to peg not to a single currency, but to a portfolio of strong currencies.

It is rumoured that if you find a formula for a portfolio of currencies to which it is pegged, you get a stationary chart, which is very easy to trade.

About central banks:

....

+++

The i's are correctly dotted.

And what the "muppets" are talking about are not market makers, they are central bankers.

They need to regulate the price so that it is stable.

They do not benefit from big trends; the more people who see a trend, the more people who join it. And they can drive the price into the sky.

That is why central banks tend to reverse trends. People trade visually, so the regulator needs to turn the "trend" figure in the eyes of traders into a "poker" figure. And then new traders will no longer want to join the movement.

Generally, I think the regulator regulates the market with visual images. You just need to show them the right pattern to provoke the right reaction.

It is a spherical situation in a vacuum. Firstly, normal central banks such as the European, British or Fed do not intervene in the trade with their interventions. Moreover, people like Soros once punished the British Central Bank for trying to keep the exchange rate at a certain level. The less the central bank pushes the exchange rate, the better and safer it is. The Swiss central bank tried for a long time to keep the franc fixed against the euro and eventually gave up. I'm sure a bunch of PEOPLE (read "crowd") lost their deposits that night, but those who understood that the holdback was a completely artificial thing made good money back then. Now the Chinese Central Bank is doing the crazy thing of trying to undervalue the yuan in response to U.S. duties, but given the level of economic development in China, it is an unnatural situation, and one day the spring will unwind. That is why normal Central Banks do not get involved in exchange rate regulation with their rigid exchange rates and currency interventions. The most you can expect from them is verbal rhetoric. But that is not all, because the Central Bank has a much, MUCH more effective tool - interest rate policy. And if anyone hasn't yet realised that the key to any asset is the combination of yield and safety, then now is finally the time to realise this. Because if an asset is safe enough, like the Euro, and it is yielding more interest as it did before the crisis in 2008, the trend is inexorable: The money from less profitable currencies with a similar degree of confidence, like the USD, is flowing into more profitable assets, as a result the EURUSD has reached as high as 1.60. Now the yield of the American dollar is higher, therefore it is not surprising that the USD has been growing steadily for several years.

On the subject of "dolt". There are those in the market who can only be "passengers" in this train (and that's you and me), and there are those who actually have enough money to drive this "train", i.e. to move market prices by deals. In fact, the situation is such that most people not only don't want to be passengers, but also throw themselves under the train. A suicide club of sorts. And then they blame everything on the train driver (the "puppeteer") just because he drove the train from point A to point B. Don't stop the train driver from doing his job; he's only carrying tons of money. So don't get in his way! :)

A spherical situation in a vacuum. Firstly, normal central banks, like the European, British or Fed, do not pry into the trade with their interventions. Moreover, people like Soros once punished the British Central Bank for trying to keep the exchange rate at a certain level. The less the central bank pushes the exchange rate, the better and safer it is. The Swiss central bank tried for a long time to keep the franc fixed against the euro and eventually gave up. I'm sure a bunch of PEOPLE (read "crowd") lost their deposits that night, but those who understood that the holdback was a completely artificial thing made good money back then. Now the Chinese Central Bank is doing the crazy thing of trying to undervalue the yuan in response to U.S. duties, but given the level of economic development in China, it is an unnatural situation, and one day the spring will unwind. That is why normal Central Banks do not get involved in exchange rate regulation with their rigid exchange rates and currency interventions. The most you can expect from them is verbal rhetoric. But that is not all, because the Central Bank has a much, MUCH more effective tool - interest rate policy. And if anyone hasn't yet realised that the key to any asset is the combination of yield and safety, then now is finally the time to realise this. Because if an asset is safe enough, like the Euro, and it is yielding more interest as it did before the crisis in 2008, the trend is inexorable: The money from less profitable currencies with a similar degree of confidence, like the USD, is flowing into more profitable assets, as a result of which the EURUSD has reached as high as 1.60. Now the yield of the USD is higher, therefore it is not surprising that the USD has been rising steadily for several years.

On the subject of "dolt". There are those in the market who can only be "passengers" in this train (and that's you and me), and there are those who actually have enough money to drive this "train", i.e. to move market prices by deals. In fact, the situation is such that most people not only don't want to be passengers, but also throw themselves in front of the train. A suicide club of sorts. And then they blame everything on the train driver (the "puppeteer") just because he drove the train from point A to point B. Don't stop the train driver from doing his job; he's only carrying tons of money. So don't get in his way! :)

24 hours have passed and not a single reply to your good post.

What does that tell you?

There aren't many people here who get into such matters.

I once purposely conducted two interrelated surveys.

How long did it take you to create a profitable trading robot?https://www.mql5.com/ru/forum/193557

Do you trust your trading system?https://www.mql5.com/ru/forum/193557

It's becoming clear to the dedicated few.

We have what we have.)

P.S.

Anyone interested in the conclusion of the polls?

It is quite simple. TC has not yet been created, but everyone believes in it 100%.

Poll power))))

24 hours have passed and not a single reply to your good post.

What does that tell you?

About the post being another blahblahblah))

You've done a great job in that role.))) We are waiting for more pearls...)