You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Because when there is a signal overripe on every candle is overripe and some indicators have overripe when it is updated!!! Such re-rising can be seen only when the indicator is put on the chart and run it in the tester and sit check your deals! And in the tester, go at least 100 times and the deal will be in the same place!

You should have put screenshots already, without them you will not be told anything good here

Hello , I am writing to you about a problem i had to pay for the Indexer !!! It does, even though the developer claims it does not.!!! Screenshot is!!! I wrote to the developer has not said anything yet!!! Will the money be refunded??? And what do I do???

If the highlighted is true - fraud or an unqualified seller. Either way, the buyer is misled.

The pre-purchase check can in no way be a protection against fraud or a way to make sure that the product works. It is only a "try on", whether it is comfortable or not. Sort of like buying a fur coat: the size is mine, but it's sable or dyed cat - the responsibility of the certifying/supervising body.

When the products are accepted by a vending machine, there is no room for fraudsters. And in the past, kodobaza was published (cats dyed :) ), and now probably 80 percent of it...

PS: I remember a moderator returning my bot three times, when a table didn't fit in a small screen and demanded that it be scaled to fit the window... The robot only got better, thanks to him... However, I took it out of the display case, as there was no interest from the customers. Good times, those were the days of quality :D

An error in the description of the standard library

Specifically in the description of CPositionInfo, PriceOpen() command

https://www.mql5.com/ru/docs/standardlibrary/tradeclasses/cpositioninfo/cpositioninfopriceopen

The returned value is not "open price" but"weighted average open price".

As an example:

We open a position for 1 lot at the price of 61532. In this case, PriceOpen() will return 61532.

We additionally increase our position by 1 lot at 61615. In this case, PriceOpen() will return the weighted average price of two lots 61573.5, not the opening price of the position.

I would like to see not only one word correction in the description, but also a short explanation-illustration.

Administration, at least write something about my previous message. I have the impression that I went to the wrong place and the message was ignored.

Separate positions at netting and at hedging.

There are no errors in the help and code.

Administration, at least write something about my previous message. I have the impression that I went to the wrong place and the message was ignored.

First read the documentation and understand what is an order, deal and position. Then you will have an immediate understanding and an answer to your question.

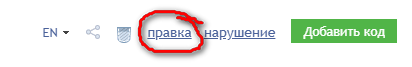

I discovered a difference in CodeBase - in the English and Russian versions.

In the English version, there is no Edit item.

Or am I doing something wrong?

ps. this is for MT5 codes, MT4 codes have this item)Separate positions at netting and at hedging.

There are no errors in the help or the code.

First, read the documentation and understand what an order, deal and position are. Then you will have an immediate understanding and the answer to your question.

I have already read the documentation and the code itself more than a dozen times. Of course, I understand such elementary things as "what is an order, deal and position". But judging by your replies, you have not grasped the meaning of my message. Do you understand the difference between the opening price and the weighted average opening price?

The opening price is a fixed number that cannot change regardless of any actions. The weighted average opening price is recalculated each time you increase your position.

I have already studied the documentation and the code itself more than a dozen times. And of course I understand elementary things such as "what is an order, a deal and a position". But judging by your replies, you have not grasped the meaning of my message. Do you understand the difference between"the opening price" and"the weighted average opening price"?

I explain, "opening price" is a fixed number that cannot change, regardless of any action. The"weighted average opening price" is recalculated after each increase in the position.

No, I got into it and got it right.

Forum on trading, automated trading systems and testing of trading strategies

Service Desk. Complaints, suggestions.

Francuz, 2019.06.13 11:36

Error in standard library description

Specifically in the description of CPositionInfo, PriceOpen() command

https://www.mql5.com/ru/docs/standardlibrary/tradeclasses/cpositioninfo/cpositioninfopriceopen

The returned value is not "opening price" but"weighted average opening price"

As an example:

We open a position for 1 lot at the price of 61532. In this case, PriceOpen() will return 61532.

Weadditionally increase our position by 1 lot at 61615. In this case, PriceOpen() will return the weighted average price of two lots 61573.5, not the opening price of the position.

I would like to see not only one word correction in the description, but also a short explanation-illustration.