You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

A very impulsive fellow ;)))

The vertical line is its height, the period is its width. The ticks accumulate upwards and downwards over the same period of time. The line is the difference between the two.

One should try to answer the question right away - there is no quotation history - where will the price go and what will be the impulse? After all, it is not quite correct to judge the price trend by the quotation history in a short time period. It is enough to take statistics and everything will stand on its own feet. And I wrote here earlier that even on a one-minute chart the price goes up and down, i.e. 50/50. On a monthly chart, for example, it's not like that anymore.

What you are trying to do is a little bit from another field - the field of predictions. Well, we're good at that in the prediction thread )).

Renko?

Artem said it right - momentum doesn't need to be predicted, it needs to be caught!!!! )) But how to catch it is the question. First of all it must be formalized. Artem again suggested the method. Of course, there is something in it, but it's not quite right either...

What you are trying to do is a little bit from another field - the field of predictions. Well, there are experts at that in the prediction branch )).

OK. The pulse theme has been slightly adjusted. So it's not a pulse that's needed, but the rate of ticks per period?

You don't need history for such an indicator. Roman is already doing it.

OK. The pulse theme has been slightly adjusted. So it's not a pulse that's needed, but the rate of ticks per period?

You don't need history for such an indicator. Roman is already doing it.

Yep - 0.1p+(-0.1)n+0.2p+(-0.3)n+0.2p+0.1p - 6 ticks per period - caught the momentum

Quantum is needed, and what you've counted is the direction of movement (also needed, no argument). And an impulse is most likely to be a jerk (the automaton is correct) - i.e. a noticeable deviation from a stable tick arrival rate

Here's the big problem with speed. The speed changes direction and value very much even in neighbouring ticks.

Here is an example of the speed pattern for neighbouring ticks, without averaging ( ):

):

Quantum is needed, and what you have counted is direction of movement (also needed, no argument). And momentum is most likely to be an acceleration of price rise/fall (correctly written by Automat) - i.e. a noticeable deviation from the steady tick arrival rate. How many ticks per 1000 milliseconds (in 1 second) is more than an understandable and easily implemented algorithm for the indicator...

Here's the big problem with speed. The speed changes direction and value very much even in neighbouring ticks.

Here is an example of velocity pattern for neighbouring ticks, without averaging ( ):

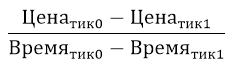

Wrong in the formula. We don't need to compare time, we need to take the result of ticks analysis (numerator) for N amount of time, i.e. for a second or for 5 seconds for example (time period in short). During this time we calculate movement direction and amount of ticks. Once the result is calculated, we again track the new time period. Then the chart will look more beautiful and clear.