Is martin so bad? Or do you have to know how to cook it? - page 52

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

You don't get it anyway - keep reading.

Tried it - in reverse the picture will be the same))

The owl is built that way.

Explain if I don't get it and you do. What I don't get.

In order for the asset that an investor adds to the portfolio to benefit the portfolio, it must reduce risk more than it reduces return.

E® - expected return

Rf - risk free rate of return

Rp - portfolio return

Sigma - standard deviation of the asset and the portfolio

p - correlation coefficient.

I have been doing martingale for a long time. In all my versions of EAs it takes 9 orders at the most to make a profit. Confirmed by testing on all history since 1999. So it is not by chance that it is 9?

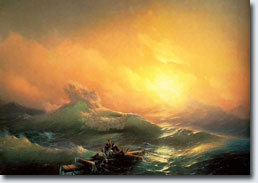

Aivazovsky Shaft 9

not coincidentally, the wave essence of the handicap ))))

If it is not a secret, what are the criteria for entering a trade?

This is an Owl. In sight: above MA100 and CCI(14) - m5, m15, m30, h1 - green.

I've been using the Strategy Tester since the beginning of the year. The point is in Hedging, it does not allow to go to a negative balance.

It is true, sometimes I have to wait a long time for the return.

But I compensate for that by working on 5 pairs at a time. The settings are different for each of them.

You can look here:

Aivazovsky Shaft 9

not coincidentally, the wave essence of the fora ))))

This is an Owl. In sight: above MA100 and CCI(14) - m5, m15, m30, h1 - green.

I've been using the Strategy Tester since the beginning of the year. The point is in Hedging, it does not allow to go to a negative balance.

It is true, sometimes I have to wait a long time for the return.

But I compensate for that by working on 5 pairs at a time. The settings are different for each of them.

You can look here:

It is the balance that should be of least concern. The main thing is the growth of equity.

The statement is rather controversial.

The options for dealing with a negative balance are too limited.

Who thinks on Euro/Dollar - is it already a reversal or a correction to a decrease?

The statement is rather controversial.

The options for dealing with a negative balance are too limited.

Who thinks on the Euro/Dollar - already a reversal or still a downward correction?

You have Buy so clearly open on peaks. Not on those. Well, open Sell on them. There are so many people who are catching peaks and you have everything but going the wrong way.

The "peaks" there are caught by accident. And I can see that BUY and SELL are open there at the same time. This is MT4.

There are martins in the forums who play by the trend, but increase the lots against it. It is clear that in a channel (or flat) they do it that way: BUY on the upper peaks, and SELL - on the lower ones. But for them not to start another chain at the end of the trend (at the reversal), they embed some protection such as to see how far the trend has gone, how long it lasts, etc. (RSI, MACD, WPR...)