You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.03 14:16

2014-04-03 11:45 GMT (or 13:45 MQ MT5 time) | [EUR - Interest Rate]

if actual > forecast = good for currency (for EUR in our case)

==========

ECB Stays Pat Despite Deflation Worries

The European Central Bank maintained status quo on Thursday, despite rising fears of deflation in the euro area, as more data suggest the region's economic recovery remains on track.

Following the meeting in Frankfurt, the Governing Council decided to maintain the main refinancing rate unchanged at a record low 0.25 percent for the fifth month in a row. The decision was in line with economists' expectations.

The marginal lending facility rate was kept at 0.75 percent and the deposit facility rate at zero, where it has remained since July 2012.

The previous change in interest rates was in last November, when the bank unexpectedly cut the refi rate and the marginal lending rate by a quarter-point each.

ECB President Mario Draghi is set to hold the post-meeting press conference at 8.30 am ET, when he is expected to detail the central bank's assessment of the current economic situation in the euro area.

"The ECB's best policy option is verbal intervention and not new tangible action," ING Bank Senior Economist Carsten Brzeski said.

"We see the ECB stepping up its dovish language by aligning its next moves with changes in the inflation outlook over the next few months."

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.04.03

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 32 pips price movement by EUR - Interest Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.03 16:01

2014-04-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Trade Deficit Unexpectedly Widens To $42.3 Billion In February

Amid an increase in imports and a drop in exports, the U.S. trade deficit unexpectedly widened in the month of February, according to a report released by the Commerce Department on Thursday.

The Commerce Department said the trade deficit widened to $42.3 billion in February from a revised $39.3 billion in January.

Economists had been expecting the trade deficit to narrow to $38.5 billion from the $39.1 billion originally reported for the previous month.

The unexpectedly wider deficit was partly due to a notable drop in the value of exports, which fell 1.1 percent to $190.4 billion in February from $192.5 billion in January.

With the decrease, which largely reflected a steep drop in exports of industrial supplies, the value of exports hit its lowest level since last September.

On the other hand, the report showed that the value of imports rose by 0.4 percent to $232.7 billion in February from $231.7 billion in January.

A jump in royalties and license fees, including payments for the rights to broadcast the Winter Olympics, contributed to the increase in the value of imports.

Paul Ashworth, Chief U.S. Economist at Capital Economics, said, "Overall, we suspect that the unusually cold weather may have limited exports of industrial supplies, meaning that we could see a bounce back in March."

"That data won't be available until after the initial estimate of first-quarter GDP growth is released, however, suggesting that the latter [will] now come in under 2% annualized, although it might subsequently be revised a little higher," he added.

The Commerce Department noted that the goods deficit widened to $61.7 billion in February from $59.5 billion in January, while the services surplus narrowed to $19.4 billion from $20.2 billion.

Meanwhile, the report also showed that the U.S. trade deficit with China narrowed to $20.9 billion in February from $27.8 billion in the previous month.

Compared to the same month a year ago, the trade deficit for February was narrower by almost $1 billion. Exports were up by 1.9 percent year-over-year, while imports rose by 1.1 percent.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.04.03

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 51 pips price movement by USD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.04 09:49

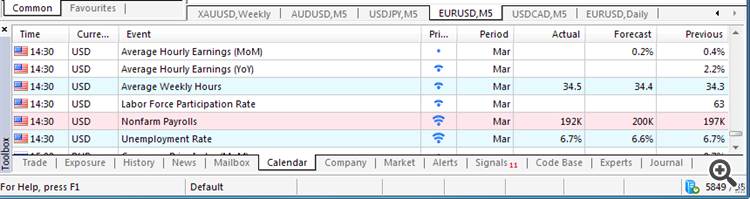

Trading the News: U.S. Non-Farm Payrolls (adapted from dailyfx article)

The U.S. Non-Farm Payrolls (NFP) report may in still a bullish outlook for the dollar (bearish EUR/USD) as employment is expected to increase another 200K in March, while the jobless rate is anticipated to narrow to an annualized 6.6% from 6.7%.

What’s Expected:

Why Is This Event Important:

Indeed, a material pickup in job growth may put increased pressure on the Federal Open Market Committee (FOMC) to normalize monetary policy sooner rather than later, but the reserve currency may struggle to hold its ground should the NFP report dampen the outlook for growth and inflation.

The resilience in private sector consumption along with the ongoing decline in planned job cuts may generate a positive employment report, and a large uptick in job growth may highlight an improved forecast for the USD as the Fed continues to see a stronger recovery in 2014.

Nevertheless, the persistent slack in the real economy paired with the downtick in business confidence may drag on NFPs, and a dismal print may trigger a sharp selloff in the greenback as it weighs on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: NFP Climb 200K+; Unemployment Slips to 6.6%

- Need to see red, five-minute candle following the NFP print to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: March Employment Disappoints- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

U.S. Non-Farm Payrolls (NFP) February 2014 :

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.04 14:39

2014-04-04 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

if actual > forecast = good for currency (for USD in our case)

==========

EURUSD M5 : 37 pips range price movement by USD - Non-Farm Employment Change news event :