You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

2014-04-03 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Trade Balance]

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Has A$1.20 Billion Trade Surplus

Australia posted a seasonally adjusted merchandise trade surplus of A$1.20 billion February, the Australian Bureau of Statistics said on Thursday - down 14 percent on month.

That topped forecasts for a surplus of A$850 million following the downwardly revised surplus of A$1.392 billion in January (originally A$1.433 billion).

Exports were roughly flat on month at A$29.970 billion, up from A$29.76 billion in the previous month.

Non-rural goods added A$420 million (2 percent). Net exports of goods under merchanting remained steady at A$15 million.

Rural goods fell A$157 million (4 percent) and non-monetary gold fell A$133 million (10 percent). Services credits fell A$10 million.

Imports added 1.0 percent to A$28.770 billion, up from A$28.33 billion a month earlier.

Capital goods climbed A$791 million (15 percent) and non-monetary gold surged A$109 million (43 percent).

Intermediate and other merchandise goods fell A$531 million (5 percent) and consumption goods fell A$58 million (1 percent). Services debits added A$3 million.

Also on Thursday, the ABS said that the total value of retail sales in Australia was up a seasonally adjusted 0.2 percent on month in February, coming in at A$22.972 billion.

That missed forecasts for an increase of 0.3 percent following the 1.2 percent jump in January.

2014-04-03 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Service PMI]

if actual > forecast = good for currency (for CNY in our case)

==========

China Services PMI Rises To 51.9 In March

The service sector in China expanded at a faster pace in March, the latest PMI from HSBC and Markit Economics revealed on Thursday, coming in with a four-month high score of 51.9.

That's up from 51.0 in February, and it moves farther above the boom-or-bust line of 50 that separates expansion from contraction.

The employment sub-index moved higher for the first time in five months, the data showed, while input costs declined at manufacturers but gained at service providers. Manufacturers' new orders fell at the strongest rate in 28 months.

Outstanding business fell for the second month in a row at manufacturers, albeit marginally. Backlogs of work also decreased slightly at service sector firms. Input costs faced by Chinese manufacturers fell at the sharpest rate since August 2012.

"The HSBC China Services PMI suggests a modest improvement of business activities in March, with employment expanding at a faster pace. However, combined with the weaker manufacturing PMI reading, the underlying strength of the economy is softening, which should ultimately weigh on the labor market," said Hongbin Qu, HSBC Chief Economist, China & Co-Head of Asian Economic Research.

Trading the News: European Central Bank Interest Rate Decision (adapted from dailyfx article)

According to a Bloomberg News survey, 54 of the 57 economists polled see the European Central Bank (ECB) sticking to the sidelines in April, but the market speculation (rate cut, negative deposit rates, verbal intervention, unsterilized bond purchases, Long-Term Refinancing Operation) surrounding the interest rate decision may spark increased volatility in the EUR/USD as market participants weigh the outlook for monetary policy.

What’s Expected:

Why Is This Event Important:

The EUR/USD may push higher over the remainder of the week should the ECB merely reiterate the policy statement from the March 6 meeting, but the single currency may continue to give back the rally from earlier this year should central bank President Mario Draghi lay the groundwork to implement more non-standard measures across the monetary union.

Indeed, the heightening risk for deflation may put increased pressure on the ECB to further embark on its easing cycle, and the EUR may face a larger decline in the coming days should the central bank take additional steps to shore up the ailing economy.

However, President Mario Draghi may retain a rather neutral tone for monetary policy amid the positive developments coming out of the euro-area, and the EURUSD may continue to carve a series of higher highs & higher lows as the central bank remains reluctant to move away from its current policy.

How To Trade This Event Risk

Trading the ECB interest rate decision may not be as clear cut as some of our other trade setups as the press conference with President Draghi ends with a Q&A session

Bearish EUR Trade: ECB Implements More Easing/Draghi Adopts Dovish Tone

- Need red, five-minute candle following the decision/statement to consider a short Euro trade

- If market reaction favors a short trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Retains Neutral OutlookPotential Price Targets For The Rate Decision

European Central Bank (ECB) March 2014 Interest Rate Decision

EURUSD M5 : 46 pips price range movement by EUR - Interest Rate news event :

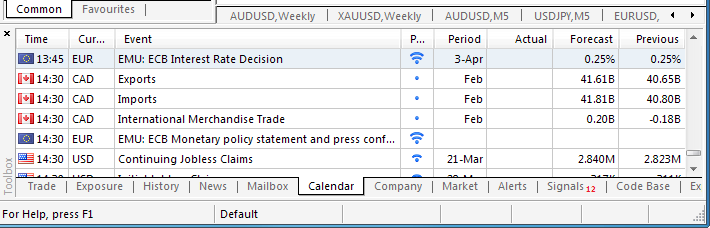

2014-04-03 11:45 GMT (or 13:45 MQ MT5 time) | [EUR - Interest Rate]

if actual > forecast = good for currency (for EUR in our case)

==========

ECB Stays Pat Despite Deflation Worries

The European Central Bank maintained status quo on Thursday, despite rising fears of deflation in the euro area, as more data suggest the region's economic recovery remains on track.

Following the meeting in Frankfurt, the Governing Council decided to maintain the main refinancing rate unchanged at a record low 0.25 percent for the fifth month in a row. The decision was in line with economists' expectations.

The marginal lending facility rate was kept at 0.75 percent and the deposit facility rate at zero, where it has remained since July 2012.

The previous change in interest rates was in last November, when the bank unexpectedly cut the refi rate and the marginal lending rate by a quarter-point each.

ECB President Mario Draghi is set to hold the post-meeting press conference at 8.30 am ET, when he is expected to detail the central bank's assessment of the current economic situation in the euro area.

"The ECB's best policy option is verbal intervention and not new tangible action," ING Bank Senior Economist Carsten Brzeski said.

"We see the ECB stepping up its dovish language by aligning its next moves with changes in the inflation outlook over the next few months."

2014-04-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Trade Deficit Unexpectedly Widens To $42.3 Billion In February

Amid an increase in imports and a drop in exports, the U.S. trade deficit unexpectedly widened in the month of February, according to a report released by the Commerce Department on Thursday.

The Commerce Department said the trade deficit widened to $42.3 billion in February from a revised $39.3 billion in January.

Economists had been expecting the trade deficit to narrow to $38.5 billion from the $39.1 billion originally reported for the previous month.

The unexpectedly wider deficit was partly due to a notable drop in the value of exports, which fell 1.1 percent to $190.4 billion in February from $192.5 billion in January.

With the decrease, which largely reflected a steep drop in exports of industrial supplies, the value of exports hit its lowest level since last September.

On the other hand, the report showed that the value of imports rose by 0.4 percent to $232.7 billion in February from $231.7 billion in January.

A jump in royalties and license fees, including payments for the rights to broadcast the Winter Olympics, contributed to the increase in the value of imports.

Paul Ashworth, Chief U.S. Economist at Capital Economics, said, "Overall, we suspect that the unusually cold weather may have limited exports of industrial supplies, meaning that we could see a bounce back in March."

"That data won't be available until after the initial estimate of first-quarter GDP growth is released, however, suggesting that the latter [will] now come in under 2% annualized, although it might subsequently be revised a little higher," he added.

The Commerce Department noted that the goods deficit widened to $61.7 billion in February from $59.5 billion in January, while the services surplus narrowed to $19.4 billion from $20.2 billion.

Meanwhile, the report also showed that the U.S. trade deficit with China narrowed to $20.9 billion in February from $27.8 billion in the previous month.

Compared to the same month a year ago, the trade deficit for February was narrower by almost $1 billion. Exports were up by 1.9 percent year-over-year, while imports rose by 1.1 percent.

Discovering the Forex Holy Grail

This is a title that is hard to read or write without smiling. The “holy grail” is the mother of all Forex jokes and cynical constructions. Yet it exists, is staring us all in the face, but is widely ignored, because the psychological stresses of working with the grail are paradoxically greater than most people can cope with.

Before the existence of the holy grail can be proven, it has to be defined, as many grail hunters are not really clear about what it is they are looking for.The Forex Holy Grail Concept

The holy grail is a system or strategy with clear rules that works well enough to ensure effortless trading which is profitable overall. Very often such a system is seemingly found, only for it to fail later, at which point the grail quest must begin again. This is also a larger metaphor for the journey undergone by many retail traders as they struggle to achieve profitability by hopping between different systems and styles.

The major mistakes that less experienced traders make when they build strategies are either to base them on too limited an amount of historical data, or to over-optimize them with too many indicators that make it curve-fitted. This is important to understand, and if you are one of these traders, the sooner that you come to the realization that this is a fruitless and time-wasting path, the better it will be for you. I hope this article will shorten your path to profitability.

The Holy Grail Revealed

The answer is simple. Instead of trying to build the perfect strategy that most profitably fits the historical data, take a step back, relax, and contemplate the big picture of how markets statistically tend to move. After all, as the holy grail is surely a robustly profitable trading strategy that never stops working, logic holds that it has to take advantage of a permanent and persistent “flaw” or phenomenon in the market. So forget about candlesticks and indicators for the time being, and think about speculative markets. What phenomena do they exhibit that might be exploited by the trader? There are two that are common and repetitive:

Mean Reversion – after the price pulls away from a longer-term average price, sooner or later it always returns to the average price, which is another way of saying “what goes up, must come down”.

Fat Tails within the Returns Distribution Curve – in plain language, markets tend to overreact, rising and falling excessively due to the human sentiments of greed and fear acting upon market participants.

Can either of these phenomena be exploited? Looking at mean reversion first, it is possible but problematic, as stop losses may need to be very wide and profits are by definition limited. I cannot see this as the basis for a holy grail.

The overreaction of markets and their tendency to produce excessive returns on a statistical basis is the holy grail, or rather, provides the basis for a holy grail: a methodology that will make effortless profits over time.

The best way this can be explained is to imagine taking a handful of salt grains and throwing them up in the air. Suppose you were then able to measure the distance of each grain of salt from the throwing point. You would find that most of them would be relatively close to you, with a few outliers that had travelled further away. If you make a graph showing the distribution of the results, the graph would look like a bell curve, which is a typical and “normal” distribution:

The bottom axis shows the distance travelled by each grain of salt. The percentages show how many grains travelled each given distance.

Now suppose that you were constantly buying and selling randomly in the Forex market, and you measured and recorded the maximum possible gain of each trade over thousands of trades and thousands of days. If you constructed a version of the above graph with those results and superimposed it upon the earlier graph, the result would look something like this, with the dotted lines representing the market’s returns distributions:

So, it can be established that speculative markets such as the Forex market produce more excessive returns, both positive and negative, than can be expected from a “normal” returns distributions model. A greater number of excessive price events happen than would normally be produced by simple randomness. In plain language, the market offers more big winners and losers than it really should.

Here is the holy grail: the use of tight stop losses will remove the excessive losing events, and the use of wide take profit targets will allow the “fat tail” of excessively positive returns to be captured. Yes, it can be this simple, although it is not without a few potential pitfalls.

In order to illustrate exactly how the fat tail phenomenon can be exploited, let’s examine some back test data run on Gold and the major Yen crosses from 2011 to 2013 over a period of 3 years. These were the most volatile and trending instruments in the Forex markets during most of this period. If a very simple trading strategy of entering upon the next bar break of any engulfing bar on the H4 chart in the direction of the engulf was followed, using a stop loss placed just the other side of the engulfing candle, the following results would have been achieved by instrument and reward to risk profit targets:

Notice how a very simple, straightforward strategy that takes no account whatsoever of trend, direction and support and resistance can be made into a positive expectancy of 53 cents gain for every dollar risk, simply by not taking profit until reward has reached 50 times risk!

It would be simple to improve these results by moving stop losses to break even after a certain period of time on every trade. This is because the strongest winners usually will only retest the entry, if at all, relatively quickly.

Even the Holy Grail has Pitfalls

The holy grail exists, but it has to be handled with caution. You can find the grail by trading the right instruments that move with maximum volatility, i.e. those markets that are most attractive to speculation, and using simple entry strategies to ensure you participate in the market’s excessive movements in the direction of your trade. You do not have to be right or forecast the major moves: you just have to be there, cut your losers short, and let your winners run. The natural tendency of the market to produce fat tails will do your work for you.

There are two major pitfalls that this might lead you to. The first is that you will be better served by a more intelligent exit strategy than simply aiming for a fixed reward to risk multiple. You need to be booking wins above 10 R:R, ideally towards 25 R:R or even beyond, but each trade will be different. Look to exit around those levels but use some intelligence and discretion. Also, being prepared to move stops to break even when the trade is a certain distance or time in profit should help.

The second major pitfall lies in the fact that this type of strategy will always produce very low win rates, where you will lose as much as over 90% of your trades. This will inevitably cause very large losing streaks which will severely test both your mental strength and your money management strategy. The grail gives gold, but it is hot to touch and burns the unwary! Do you have what it takes to sit through twenty or more losing trades in a row? Do you have a money management strategy that will properly protect you from ruin should you begin with a long losing streak? Will you be diversified and uncorrelated enough in order to keep losing streak risk to a minimum?

One final danger is worth a mention. It is natural to try to filter entries. However it is very problematic to distinguish entries that are likely to reach a ratio of 25:1. Furthermore, missing just one of these winners will set back your overall expectancy, unless the method used will also filter out at least 25 losing trades at the same time.

These are some questions to ponder and investigate. Spend some time back testing. The holy grail has been placed in your hands!

Euro Plunges as Policy Makers Announce “Unconventional Measures” to Increase Inflation (based on forexminute article)

The euro plunged today after the European Central Bank hinted that it will resort to unconventional measures to combat the low inflation in the eurozone, and maintained the interest rates.

The 18-nation currency fell to $1.3736 as ECB President Mario Draghi briefed reporters, before plunging even further to $1.3711 shortly after. The currency was last trading 0.4 percent lower against the greenback at $1.3716; and went down 0.14 percent and 0.25 percent lower against the British pound and the Japanese yen respectively.

"The (ECB's) Governing Council is unanimous in its commitment to using also unconventional instruments within its mandate in order to cope effectively with risks of a too prolonged period of low inflation," Draghi told reporters.

Inflation in the economic bloc was 0.5 percent in March, its lowest so far since the 2009 global economic recession. It is also in the sixth month of what Draghi terms as the “danger zone” of under 1 percent.

"The ECB is being slightly more dovish than the market expected," Kathy Lien, the New York-based head of BK Asset Management told Reuters. "The main takeaway is that the council is considering unusual techniques, and that's negative for euro/dollar."

The U.S. dollar index was up at 80.418 in early trade in New York. The U.S. currency went higher against the yen at 103.95 yen after earlier reaching a peak of 104.06, the highest since January 23.

So far, the dollar has advanced roughly 3 percent versus the yen after U.S. Federal Reserve Chair Janet Yellen disclosed that the Fed may increase borrowing costs this spring. Tomorrow’s data on job statistics may determine the direction the dollar will further head.

Draghi Says ECB Does Not Exclude Further Policy Easing

European Central Bank President Mario Draghi on Thursday vowed swift action against risks of a prolonged period of low inflation in the euro area and downside risks to the region's growth.

"We will monitor developments very closely and will consider all instruments available to us," Draghi said in his introductory statement in the customary post-meeting press conference in Frankfurt.

"We are resolute in our determination to maintain a high degree of monetary accommodation and to act swiftly if required."

The central bank left the main refi rate unchanged at a record low 0.25 percent for a fifth month running, earlier today. The marginal lending facility rate was retained at 0.75 percent, while the deposit rate was kept at zero.

"We do not exclude further monetary policy easing and we firmly reiterate that we continue to expect the key ECB interest rates to remain at present or lower levels for an extended period of time," Draghi said. He cited the overall subdued outlook for inflation, given the broad-based weakness of the economy, the high degree of unutilised capacity and subdued money and credit creation as reasons behind the bank's assessment.

"The Governing Council is unanimous in its commitment to using also unconventional instruments within its mandate in order to cope effectively with risks of a too prolonged period of low inflation," Draghi added.

The moderate recovery in euro area is proceeding as expected and the inflation trajectory is consistent with its assessment of a prolonged period of low inflation, followed by a gradual upward movement in HICP inflation rates, the ECB said. Inflation expectations remain anchored to ECB's price stability target of 'below, but close to 2 percent', the bank added.

Responding to questions from reporters, Draghi said the bank has not exhausted its pool of conventional tools and its forward guidance has been successful. Policymakers discussed lower interest rates and narrowing of the rate corridor today, he said.

The Governing Council also considered unconventional measures such as quantitative easing and negative deposit rate, during the discussion, which Draghi described was "ample and rich".

There is no risk of deflation in euro area as of now, he repeated, adding that his biggest fear is a protracted stagnation of economic recovery. Further, he said the longer inflation remains low, the higher will be the risk for long-term inflation expectations.

Draghi's dovish comments caused the euro to promptly drop against the U.S. dollar. While euro exchange rate is very important for price stability, it is not a policy target, he reiterated, adding that policymakers are closely monitoring geopolitical risks and exchange-rate developments.

Consumer price inflation eased to a more than four-year low of 0.5 percent in March, which Draghi said was a 'genuine surprise' for the ECB and producer prices declined the most since late 2009.

He also said policymakers will study the March figures more closely, as it was distorted partly by the effect of Easter holidays falling in April this year, while they were in March in 2013.

The ECB expects inflation to pick up in April. He also acknowledged that ECB underestimated energy prices due to profound changes taking place in the energy market.

The International Monetary Fund upped the pressure on the ECB to act with IMF Managing Director Christine Lagarde, in a speech on Wednesday, warning of an emerging risk of "low-flation", particularly in the euro area.

While welcoming the IMF's 'generous' suggestions, Draghi asserted that the Governing Council's viewpoints were different.

Elsewhere today, the Paris-based Organisation for Economic Cooperation and Development said in a report that Eurozone monetary policy should remain accommodative for an extended period of time as inflation rates are substantially below the ECB's objective and output below its potential.

"Risks of deflation or a protracted period of very low inflation remain as the large degree of economic slack has put persistent downward pressure on inflation, which is well below the ECB's quantitative definition of price stability," the think tank said.

"If substantial uncertainties were to re-emerge, or if deflationary risks intensify, additional non-conventional measures should be considered."

The US Dollar advanced for a fifth consecutive day against the Japanese Yen having launched higher as expected after carving out a Triangle chart pattern. Prices are now testing resistance at 104.11, the 00.0% Fibonacci expansion.

Trading the News: U.S. Non-Farm Payrolls (adapted from dailyfx article)

The U.S. Non-Farm Payrolls (NFP) report may in still a bullish outlook for the dollar (bearish EUR/USD) as employment is expected to increase another 200K in March, while the jobless rate is anticipated to narrow to an annualized 6.6% from 6.7%.

What’s Expected:

Why Is This Event Important:

Indeed, a material pickup in job growth may put increased pressure on the Federal Open Market Committee (FOMC) to normalize monetary policy sooner rather than later, but the reserve currency may struggle to hold its ground should the NFP report dampen the outlook for growth and inflation.

The resilience in private sector consumption along with the ongoing decline in planned job cuts may generate a positive employment report, and a large uptick in job growth may highlight an improved forecast for the USD as the Fed continues to see a stronger recovery in 2014.

Nevertheless, the persistent slack in the real economy paired with the downtick in business confidence may drag on NFPs, and a dismal print may trigger a sharp selloff in the greenback as it weighs on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: NFP Climb 200K+; Unemployment Slips to 6.6%

- Need to see red, five-minute candle following the NFP print to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: March Employment Disappoints- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

U.S. Non-Farm Payrolls (NFP) February 2014 :