You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Fitch Retains China's 'A+' Rating

Fitch Ratings maintained China's sovereign ratings and 'stable' outlook on Friday, citing strong external balance sheet and the less volatile economic growth.

Fitch affirmed China's long-term foreign and local currency Issuer Default Ratings at 'A+'. The 'stable' outlook reflects Fitch's view that upside and downside risks to the rating are balanced.

The sovereign external balance sheet is China's core sovereign credit strength. China's foreign reserves rose to $3.82 trillion at end-2013. This was equal to 19.2 months of current external payments.

China's growth model faces tightening constraints from the rapidly increasing burden of leverage in the economy and from the deteriorating ability of the economy to absorb additional investment profitably.

According to Fitch, China's GDP growth would remain less volatile out to 2015 than the 'A' range median in Fitch's projections. However, the re-balancing process entails some risk of sharply higher volatility if things go less smoothly than Fitch expects.

Further, Fitch estimates the level of aggregate financing in China's economy at 217 percent of GDP at end-2013, up from 198 percent at end-2012. The authorities acted more aggressively to contain risks to financial stability since mid-2013.

However, fundamental credit weaknesses, including low average incomes and weak scores for governance, weigh on the credit profile relative to 'A' range peers.

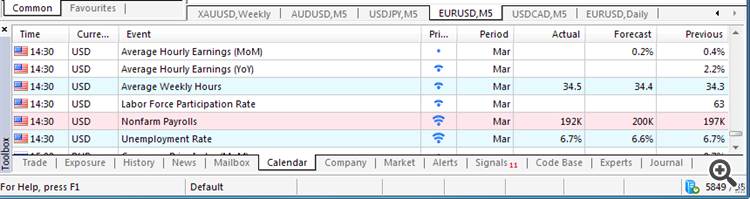

2014-04-04 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

if actual > forecast = good for currency (for USD in our case)

==========

2014-04-04 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Employment Change]

if actual > forecast = good for currency (for CAD in our case)

==========

What Does The Future Hold For Gold? (based on forexminute article)

Traditionally, the value of gold fluctuates with market sentiment. In times of military or geopolitical unrest, traders and investors buy gold and sell the more risky currencies to seek refuge in the safe haven asset. Conversely, when all is well in the markets and traders' and investors' perception of a nation's economic outlook is positive, gold generally depreciates versus the more risky assets.

The yellow metal has gained strength for the majority of the year, sustaining a considerable uptrend, likely fuelled by the ongoing situation in Crimea, gold topped out at 1,392.00 on March 17. Since then, the XAUUSD has traded to two month lows at 1.277.26, and now sits slightly higher at 1,299.44. A number of fundamental factors will likely decide the medium term outlook for the price of the precious metal.

The first is the aforementioned situation in Crimea. The tension looks to have reduced, as Putin withdrew troops from the Ukrainian border, and the markets look to have responded accordingly. However, the sanctions on Putin's Russia remain, and are set to be tightened for as long as Russia lays claim to Ukraine. At some point, one or the other parties will have to compromise, something that, at present, neither seems willing to do.

The second is the potential for a slowdown in China. As disappointing economic data continues to pour out of the Asian superpower, global markets become increasingly concerned of the ripple effect such a slowdown might create. China has large levels of foreign investment across a huge number of industries worldwide, and a slowdown would stem capital flow to these investments. This could switch sentiment, and drive up the price of gold.

Finally, Janet Yellen recently hinted at an interest rate hike. This would, in the medium term at least, afford US dollar safe haven status. Such an event would likely redirect the capital of risk averse investors from gold to the US dollar, and in turn, drive down the price of the precious metal.

China’s Foreign Exchange Watchdog Expects Country to Hit Current Account Surplus

The Chinese foreign exchange regulator announced on Friday that the nation’s current account will most likely remain in surplus in 2014; while it expects more capital outflows and inflows into the economy as Beijing moves in to implement its exchange rate reforms.

China’s current account, its widest gauge of trade with its partners such as U.S., hit a surplus totalling $182.8 billion in 2013, a decline of 15 percent from a year ago, according to the State Administration of Foreign Exchange in a statement posted on its website.

The surplus equals 2 percent of the country’s gross domestic product, a decline of 0.6 percent from a year ago, reported SAFE, according to Wall Street Journal.

The surplus in 2014 will likely be a major contributor, while surplus as a proportion of the GDP will remain at low levels, said SAFE. China’s trade surplus measured $259.8 billion in 2013.

SAFE announced that it will shift its focus towards minimizing risks from cross-border capital movements this year, and two-way capital flows will possibly rise as the yuan rate slowly edges towards the government considers an equilibrium level.

The financial and capital account, which incorporates investment, reached a surplus of $326.2 billion in 2013.

A separate statement issued on Friday showed that the regulator had revised slightly upwards the forecasts of the China’s current account surplus in the fourth quarter of 2013 to 44.0 billion from a surplus of $40.4 billion.

In the fourth quarter the revised forecast of financial account and capital totalled a surplus of $127.0 billion, up from a prediction of $81.0 billion.

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: BearishGOLD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: NeutralUSDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: NeutralUSD/JPY at Top of Near Term Channel; Caution Warranted

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: NeutralThe US dollar gained against most currencies and the euro was on the back foot in a busy week. And now, rate decisions in Japan and the UK, Australian employment data and the FOMC meeting minutes of Yellen’s first decision are the highlights of this week. Here is an outlook on the main market-movers ahead.

The all-important US Non-Farm Payrolls, slightly disappointed with a 192,000 jobs gain in March. The expectations were high since the winter storms were over and a strong rebound was anticipated. Nevertheless, the release still indicates recovery and consists of encouraging details. The taper train remains on track. Mario Draghi sent the euro lower on more dovish rhetoric and despite a lack of action. Is the ECB serious about QE? In the UK, PMIs weighed on the pound, and the loonie finally staged a recovery after a great Canadian jobs report. More volatility ahead? Let’s start: