You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.26 07:33

AUD/USD Intra-Day Fundamentals: Australian Consumer Price Index and range price movement

2017-07-26 02:30 GMT | [AUD - CPI]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Consumer Price Index news event

Australia Employment Change worse than expected, while Business Confidence and Unemployment Rate somehow pared expectations. Only Oil price is kind of supporting AUD bullish trend: the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC producers discussed extending their deal to cut output by 1.8 million barrels per day (bpd) beyond March 2018 if necessary.

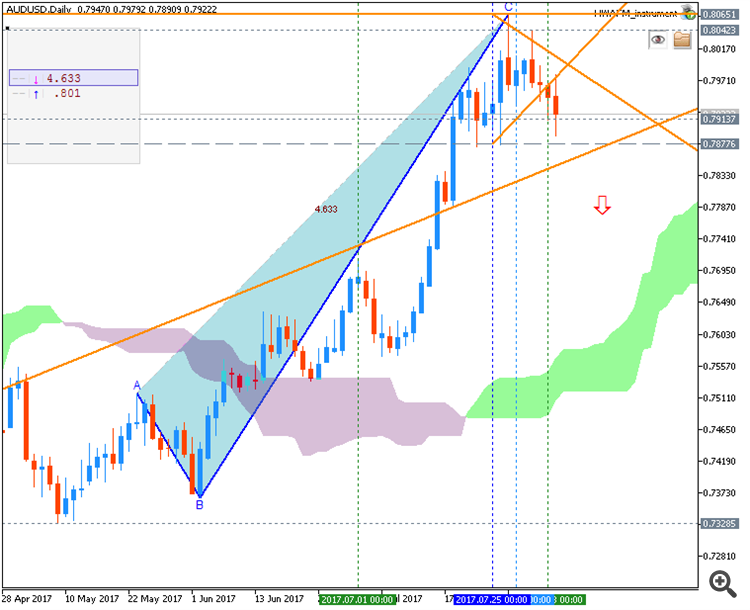

Overbought with over speculations because USD is falling, so no fundamental reasons for supporting AUD that high. 0.783 area will have to be retested. And 0.7735 is still now main Support and landing area of next-to-come correction downside.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.29 08:29

Weekly Fundamental Forecast for AUD/USD (based on the article)

AUD/USD - "Even though the RBA is widely expected to keep the official cash rate at the record-low of 1.50%, the accompanying statement may boost the appeal of the Australian dollar if the central bank shows a greater willingness to move away from its easing-cycle. The RBA may highlight a hawkish outlook as the ‘Australian economy is expected to strengthen gradually, with the transition to lower levels of mining investment following the mining investment boom almost complete,’ and Governor Lowe and Co. may start to prepare Australian households and businesses for higher borrowing-costsas ‘the data available for the June quarter had generally been positive.’"

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.01 07:54

AUD/USD Intra-Day Fundamentals: Cash Rate, Reserve Bank of Australia Statement and range price movement

2017-08-01 05:30 GMT | [AUD - Cash Rate]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

From official report :

==========

AUD/USD M5: range price movement by RBA Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.03 08:12

AUD/USD Intra-Day Fundamentals: Australian Trade Balance and range price movement

2017-08-03 02:30 GMT | [AUD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.04 07:50

AUD/USD Intra-Day Fundamentals: Australian Retail Sales and range price movement

2017-08-04 02:30 GMT | [AUD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video August 2017

Sergey Golubev, 2017.08.04 09:06

Video Manual: NON FARM PAYROLL

Non-farm Payrolls is the assessment of the total number of employees recorded in payrolls.

This is a very strong indicator that shows the change in employment in the country. The growth of this indicator characterizes the increase in employment and leads to the growth of the dollar. It is considered an indicator tending to move the market. There is a rule of thumb that an increase in its value by 200,000 per month equates to an increase in GDP by 3.0%.

=====

=====

AUDUSD M5 with 45 pips in profit (by equity) for NFP :

EURUSD M5 : 87 pips price movement by NFP news event :

AUD/USD M5: range price movement by Non-Farm Employment Change news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.05 11:07

Weekly AUD/USD Outlook: 2017, August 06 - August 13 (based on the article)

The Australian dollar struggled with the highs but did not give up on these levels, despite RBA pressure. Where next? The upcoming week features speeches from central bankers as well as important surveys.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.13 09:13

Weekly Fundamental Forecast for AUD/USD (based on the article)

AUD/USD - "The sole obvious likely market mover is official employment release which will come on Wednesday. Even that is likely to have a binary and probably transitory impact on the currency; good numbers will mean Aussie gains, poor ones will see it slip. Next week therefore is more likely to be about the background than the economic foreground as far as the Australian Dollar goes. That means investors will have one eye on global risk aversion and another on the Reserve Bank of Australia."