Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.01 10:01

Weekly Fundamental Forecast for AUD/USD (based on the article)

AUD/USD - "The Australian Dollar has yet to do the same, however. At any moment, the markets’ take on US monetary policy is likely to drive AUD/USD, much as it does for any other currency pair with ‘USD’ on either side. And there’s little on this week’s horizon that is likely to change that. Yes, we will get a monetary policy decision from the Reserve Bank of Australia. But if there’s anyone who thinks Aussie interest rates will be rising, or indeed falling, from their current, record-low of 1.5% on Tuesday then they’re keeping it mighty quiet. There’s also plenty of key US economic data due this week, including the biggie – official labor-market stats – for which we must to wait until Friday. Assuming these numbers don’t diverge hugely in either direction from market expectations, the overall picture looks boringly neutral for the Australian Dollar, at least against its US cousin."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.03 07:38

AUD/USD Intra-Day Fundamentals: Australian Retail Sales and 24 pips range price movement

2017-04-03 02:30 GMT | [AUD - Retail Sales]

- past data is 0.4%

- forecast data is 0.3%

- actual data is -0.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From official report:

- "The trend estimate rose 0.1% in February 2017. This follows a rise of 0.2% in January 2017 and a rise of 0.2% in December 2016."

- "The seasonally adjusted estimate fell 0.1% in February. This follows a rise of 0.4% in January 2017 and a fall of 0.1% in December 2016."

==========

AUD/USD M5: 24 pips range price movement by Australian Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.04 09:32

AUD/USD Intra-Day Fundamentals: Australian Trade Balance and 16 pips range price movement

2017-04-04 02:30 GMT | [AUD - Trade Balance]

- past data is 1.50B

- forecast data is 1.75B

- actual data is 3.57B according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

From official report:

- "In trend terms, the balance on goods and services was a surplus of $3,320m in February 2017, an increase of $545m (20%) on the surplus in January 2017."

- "In seasonally adjusted terms, the balance on goods and services was a surplus of $3,574m in February 2017, an increase of $2,071m on the surplus in January 2017."

==========

AUD/USD M5: 16 pips range price movement by Australian Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.04 09:53

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and 43 pips range price movement

2017-04-04 04:30 GMT | [AUD - Cash Rate]

- past data is 1.50%

- forecast data is 1.50%

- actual data is 1.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

From abc.net.au article:

- "Don't expect any movement in official interest rates for the foreseeable future, for the Reserve Bank has found itself trapped."

- "The statement that accompanied today's decision to keep rates on hold — the eighth month in succession — contained the usual bland language for which central bankers are renowned."

==========

AUD/USD M5: 43 pips range price movement by RBA Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.06 07:41

AUD/USD after FOMC Minutes (based on the article)

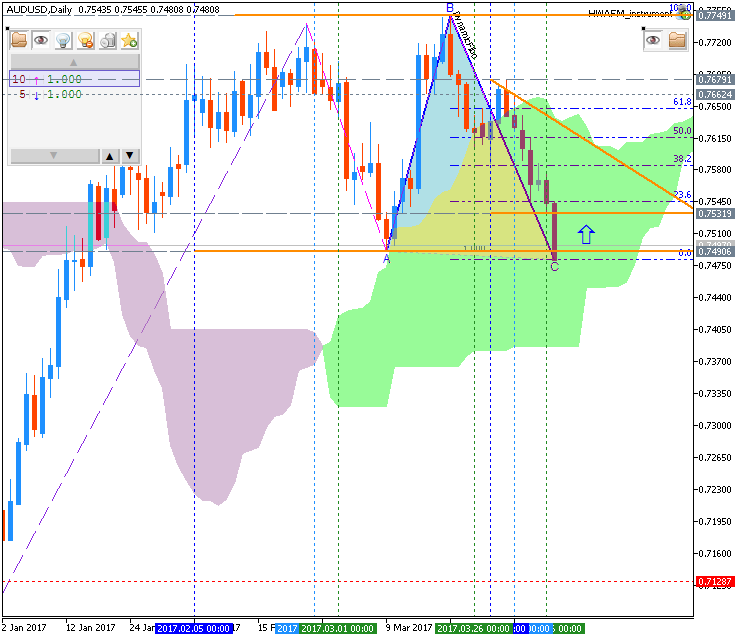

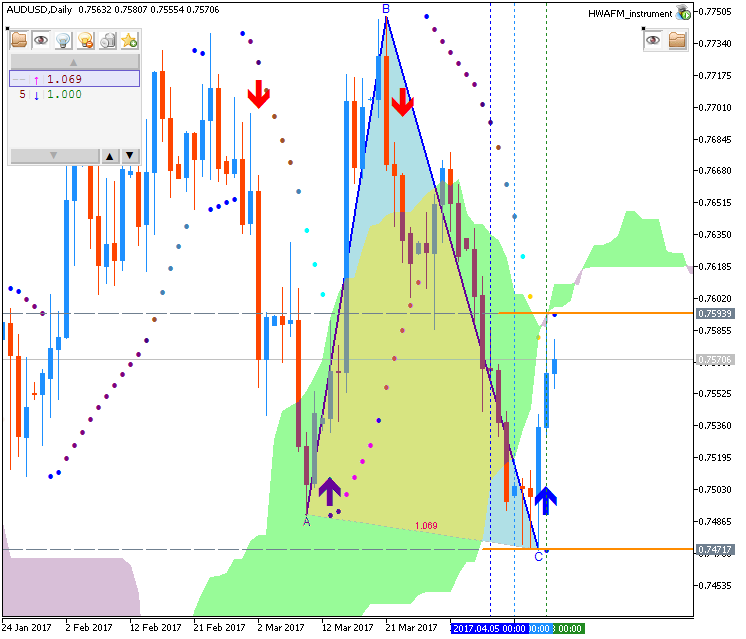

Daily price is located inside Ichimoku cloud in the ranging area of the chart for the wwaiting for the direction of the strong trend to be started. The price is breaking 0.7544 support level to below for the 0.7490 nearest daily target which is loacted near Senkou Span line on the border between the primary bearish and the primary bullish trend on the chart.

- "The AUD/USD is rebounding from fresh daily lows, as US Dollar pairs are now processing the release of the FOMC meeting minutes from March 15th. This event has been marked as a high importance release on the economic calendar, with traders searching for clues inside of last month’s minutes to help determine potential shifts in policy from the FED."

- "Technically the AUD/USD remains in a long term uptrend, with the pair remaining supported by its 200 day MVA (simple moving average) at .7552. If this uptrend is set to continue, traders will look for the pair to next breakout above its short term 10 day EMA (exponential moving average). This line is found at .7614, and a breakout above this EMA would suggest a bullish shift in the markets short term trend. If the AUD/USD fails to breakout higher in the short term, traders may watch for a bearish shift in the market below the previously mentioned 200 day MVA. A breakout below this line should be seen as significant. In this bearish scenario, traders may begin to target the standing March 2017 low found at .7505."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.08 12:45

Weekly Fundamental Forecast for AUD/USD (based on the article)

AUD/USD - "The intertest rate backdrop is that US rates will continue to rise while their Aussie counterparts are going nowhere this year, and possibly into next (protracted hostilities involving the US in Syria could change all this, of course). The Reserve Bank of Australia has said little which might challenge this view. More importantly, it put its worries about a stronger currency front and center in the minutes of its last monetary policy conclave. This is not an environment conducive to a higher Australian Dollar."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.13 08:29

AUD/USD Intra-Day Fundamentals: Australian Employment Change and 47 pips range price movement

2017-04-13 02:30 GMT | [AUD - Employment Change]

- past data is 2.8K

- forecast data is 20.3K

- actual data is 60.9K according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

From rttnews article:

- "Employment increased 60,900 to 12,059,600. Full-time employment increased 74,500 to 8,238,600 and part-time employment decreased 13,600 to 3,821,000."

- "Unemployment increased 4,000 to 753,100. The number of unemployed persons looking for full-time work increased 2,900 to 528,600 and the number of unemployed persons only looking for part-time work increased 1,100 to 224,500."

- "Unemployment rate remained steady at 5.9%."

==========

AUD/USD M5: 47 pips range price movement by Australian Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.15 10:45

Weekly Fundamental Forecast for AUD/USD (based on the article)

AUD/USD - "Looking ahead, though, the Aussie is generally one of the first currencies to suffer when traders decide to limit their risks by seeking havens such as the Japanese Yen and gold. And it would be unwise at the moment to rule out a rise in risk-off sentiment given the ongoing turmoil in Syria, the approach of the French elections and – particularly – the belligerence of North Korea."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.18 09:37

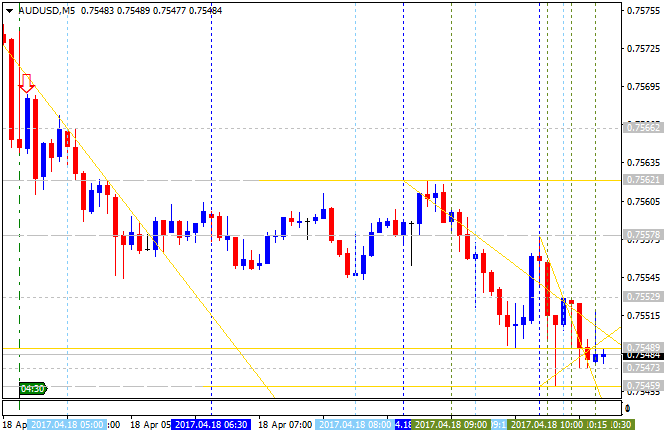

AUD/USD Intra-Day Fundamentals: RBA Monetary Policy Meeting Minutes and range price movement

2017-04-18 02:30 GMT | [AUD - Monetary Policy Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

From official report:

- "Although forward-looking indicators of labour demand continued to suggest an increase in employment growth over the period ahead, this had been true for some time without leading to an improvement in labour market conditions."

==========

AUD/USD M5: range price movement by RBA Monetary Policy Meeting Minutes news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

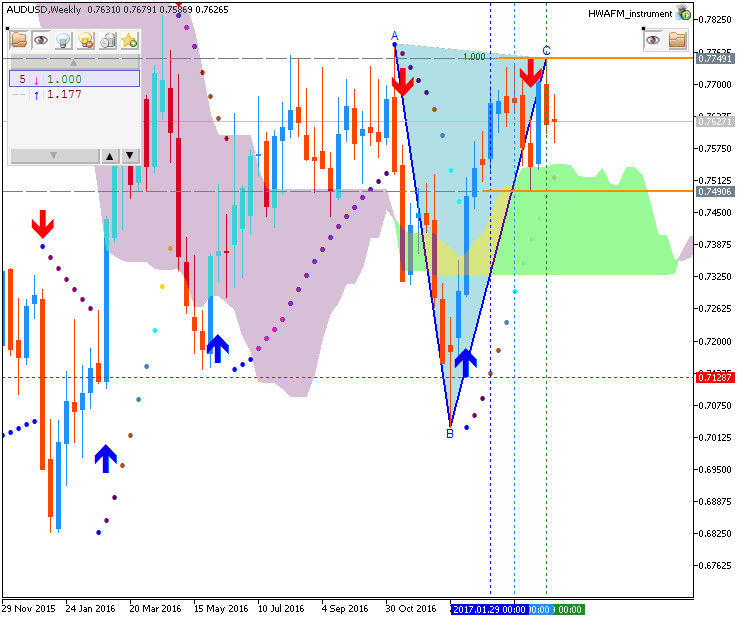

AUD/USD April-June 2017 Forecast: ranging within narrow s/r levels for the ranging bearish reversal or the bullish trend to be resumed

W1 price is located above Ichimoku cloud for the bullish ranging market condition within the following support/resistance levels:

- 0.7749 resistance level located above Senkou Span line (which is the virtual border between the primary bearish and the primary bullish trend on the chart) in the beginning of the bullish trend to be resumed, and

- 0.7490 support level located in the beginning of the bearish trend to be started.

Chinkou Span line is near and above the price indicating the ranging condition by direction, Trend Strength indicator is estimating the trend as a primary bullish, and Absolute Strength indicator is evaluating the trend as a ranging. Non-lagging Tenkan-sen/Kijun-sen signal is for bullish market condition for now and for near future for example.Trend:

W1 - bullish ranging