You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

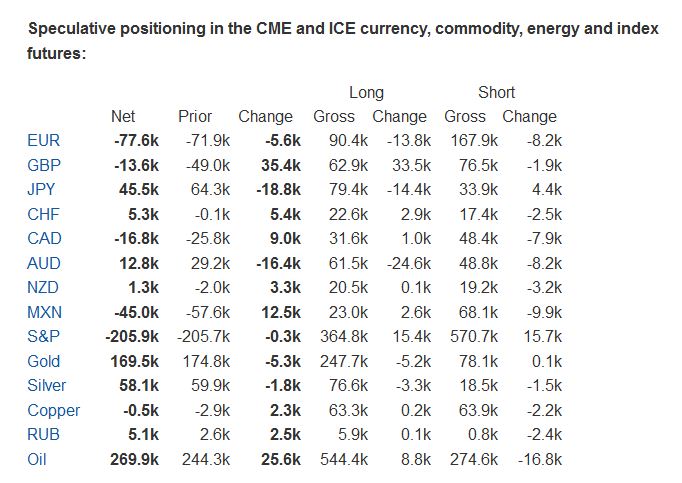

CFTC Commitments of Traders: Euro shorts and AUD longs in fashion Forex futures market speculator positions data from the CFTC Commitments of Traders report as of the close on March 1, 2016:

Whoever bought those 7,000 AUD futures contracts is feeling pretty good this weekend. What stands out about AUD is how quickly it's gone from -60K to +16K. The market falls in love with yield quickly.

The euro is bouncing but there is still plenty of for shorts. As recently as December, the net short was -160K.

CFTC - Commitments of Traders: Speculators More Bullish on Oil, Gold, JPY; More Bearish on EUR, GBP The Commodity Futures Trading Commission released its weekly Commitments of Traders report for the week ending March 1 on Friday.

CFTC Commitments of Traders: Specs wrong on EUR but right on AUD CFTC weekly positioning data released March 11, 2016 for forex futures:

The data reflects the close on Tuesday, March 8.

Speculators were betting against the euro headed into the ECB and some were no-doubt squeezed out afterwards.

The other takeaway is that the market is beginning to find itself smitten with the Australian dollar.

CFTC - Commitments of Traders: Speculators More Bullish on Oil, Gold, JPY The Commodity Futures Trading Commission released its weekly Commitments of Traders report for the week ending March 8 on Friday.

CFTC commitments of traders: GBP shorts pared before FOMC/BOE decisions CFTC weekly positioning data released March 18, 2016 for Forex futures

The GBP shorts were pared as of the close on business on Tuesday to 14K just before the rally which started on Wednesday.

Versus the EUR, traders were not as fortunate as short positions remained near prior week levels before the rally on Wednesday.

The AUD saw long positions cut by 16K prior to the rally started on Wednesday.

Commitments of Traders: Speculators More Bullish on Oil; Less Bullish on JPY, Gold, AUD

Commitments of Traders: Speculators More Bullish on Oil, Gold, JPY, AUD; Less Bearish on EUR, S&P 500

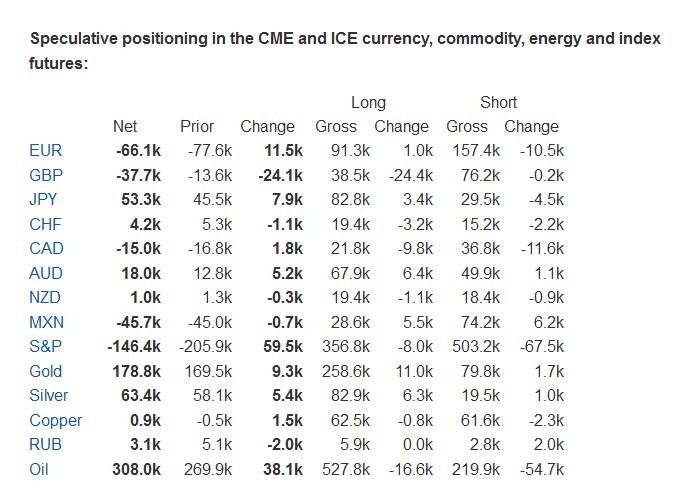

CFTC Commitments of Traders: Sterling whipsaw CFTC weekly positioning data as of the close on March 22 for forex futures:

The market piled back into pound shorts after fleeing last week.

CFTC Commitments of Traders: Net speculative positions little changed CFTC weekly positioning data as of the close on March 29 for forex futures

Overall net speculative positions were little changed in the current week as of the close on business on Tuesday March 29th.

The biggest change was the CAD which trimmed short positions from 15K to 6K. The AUD saw long positions increase by 5K to 23K

The other currencies changed by 1k to 2K.

CFTC - Commitments of Traders - No Major Changes in Speculative Positions