You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Levenberg-Marquardt algorithm

Sergey Golubev, 2017.09.19 10:08

New article was published -

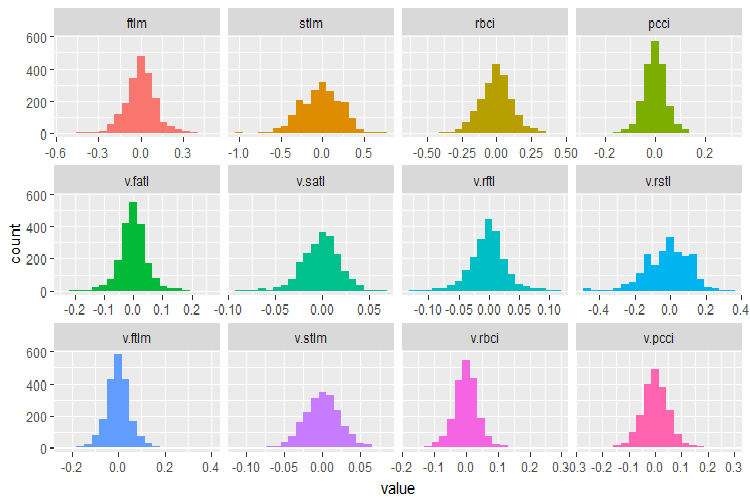

Deep Neural Networks (Part II). Working out and selecting predictors

ContentsForum on trading, automated trading systems and testing trading strategies

...

Sergey Golubev, 2009.10.09 08:43

Neural Network

Neural Network: discussion/development threads

Neural Network: Indicators and systems development

Neural Network: EAs

Neural Network: The Books

The article

Deep Neural Networks (Part II). Working out and selecting predictors - MT5

CodeBase

This is very interestin, I would like to contribute but I don't see where we are now. Do you get some results?

if you want a self learning EA we need neural networks or similar approach, a synthetic way to achieve smthg is post-maintein the EA and optimize it with a rolling fashion.

Regards

Forum on trading, automated trading systems and testing trading strategies

How to start with MetaTrader and forex, the beginning

Sergey Golubev, 2021.02.08 16:30

Developing a self-adapting algorithm (Part I): Finding a basic pattern

Any trading algorithm is generally a tool which may bring profit to an experienced trader or instantly destroy a deposit of an inexperienced one. The issue of creating a profitable and reliable algorithm is that we cannot understand what needs to be done in order to earn money and what methods are used by "successful traders". While HFT, arbitrage, option strategies and calendar spread-based systems boast a solid theoretical basis clearly stating what needs to be done to make profit, the algorithms based on price analysis and fundamental data are much more ambiguous. This area has no full-fledged theoretical basis that would describe pricing making it extremely difficult to create a stable trading algorithm. Trading turns into art here, while science helps systematizing everything.

But is it possible to create a fully automated trading algorithm based only on the analysis of price changes working on any trading instrument without optimization and with no need to manually adjust parameters for each trading instrument separately? Is there an algorithm you can simply apply to a necessary trading instrument chart so that it immediately defines profitable parameters for it?

Forum on trading, automated trading systems and testing trading strategies

How to start with MetaTrader and forex, the beginning

Sergey Golubev, 2021.02.19 18:08

Developing a self-adapting algorithm (Part II): Improving efficiency

Before reading this article, I recommend that you study the first article "Developing a self-adapting algorithm (Part I): Finding a basic pattern". This is not necessary, since the main point will still be clear, but reading will be more interesting.

In the previous article, I detected a simple pattern and developed a very simple algorithm that exploits it. But the algorithm has no flexible structure, and it makes no sense to expect any outstanding results from it.

We need to greatly improve it so that it becomes more flexible and adjusts its operation parameters depending on the market situation so that it is possible to achieve better results and stability.

Do you think it's achievable idea? let's set on the rounded table!

Do you think it's achievable idea? let's set on the rounded table!

Forum on trading, automated trading systems and testing trading strategies

How to start with MetaTrader and forex, the beginning

Sergey Golubev, 2021.03.12 09:56

Self-adapting algorithm (Part III): Abandoning optimization

Before reading this article, I recommend that you study the second article in the series "Developing a self-adapting algorithm (Part II): Improving efficiency". The methodology applied in the current article differs significantly from everything discussed earlier, but it will be useful to read the previous articles to understand the topic.

This strategy, if it would work, would be the same than artificial intelligence.

Here it is : "non standart automated trading"

It work with accelerator or awesome indicator, instead of an MA, but the principle is the same.

Do a backtest using different data for accelerator (or ma), and then use the best data for forward trading.

The only difference is : instead of being a "self adaptative expert", one's has to make backtest every week (days) to verify that he still has the best value for his EA.This strategy, if it would work, would be the same than artificial intelligence.

Here it is : "non standart automated trading"

It work with accelerator or awesome indicator, instead of an MA, but the principle is the same.

Do a backtest using different data for accelerator (or ma), and then use the best data for forward trading.

The only difference is : instead of being a "self adaptative expert", one's has to make backtest every week (days) to verify that he still has the best value for his EA.Interesting.