Introduction

I asked myself: Can I make money if my entries are random? In order to answer this question I wrote an Expert Advisor that has a random request of buys and sells orders. These are the steps I took.

Methodology

1) Create an random entry strategy: request a buy or a sell order depending on a random variable. Below is a snip of the code that is executed at every new candle if there are no positions open (following Netting rules, only one position is open at any time).

double r=MathRand()/32767.; return(r>=0.5?1:-1);

If the function returns 1, a buy order is requested, otherwise a sell order is requested. All orders are 2% of the initial deposit of 100000.

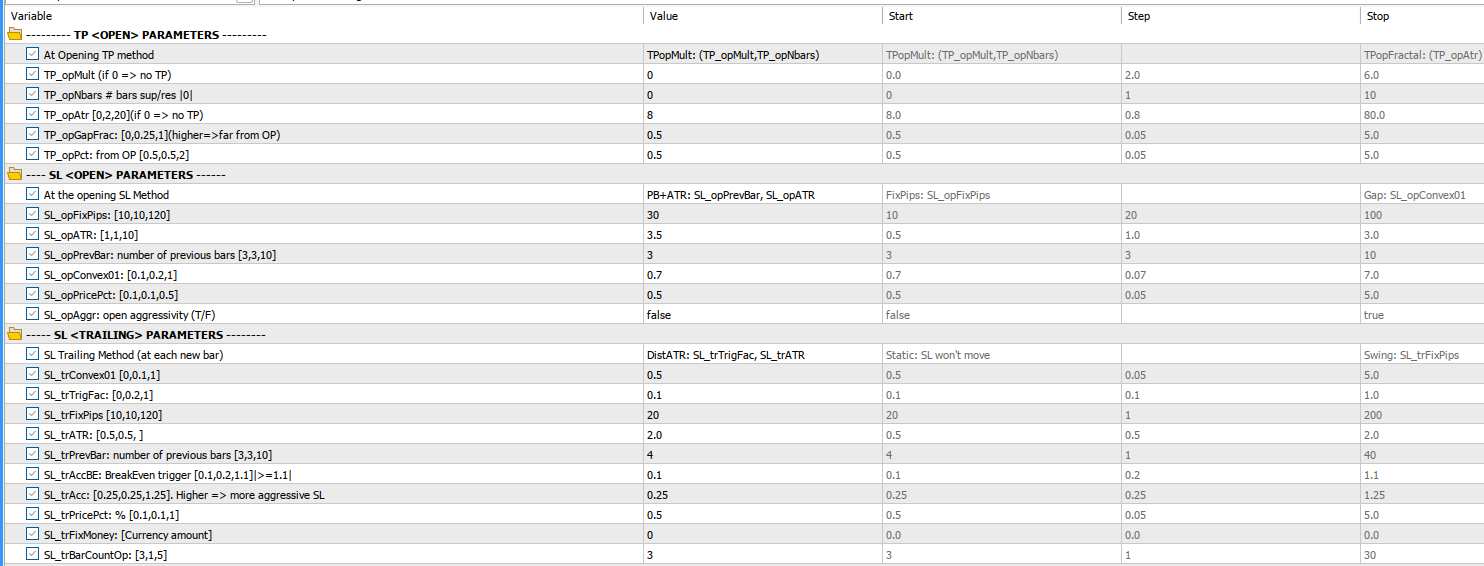

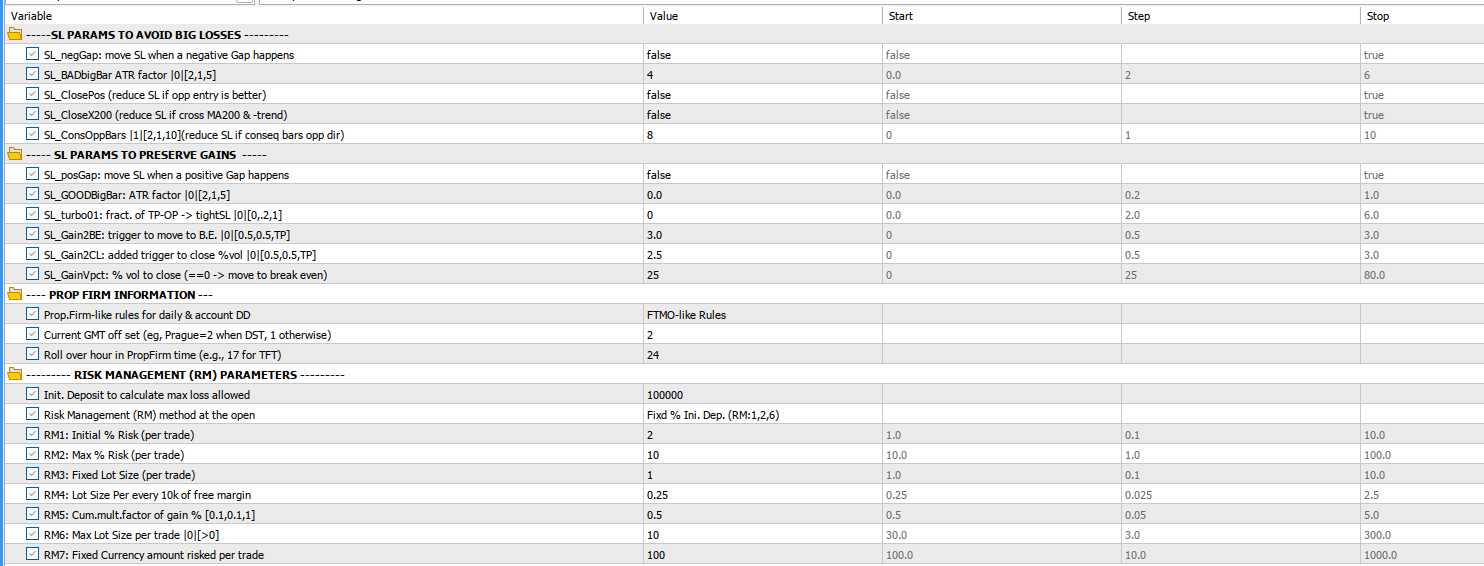

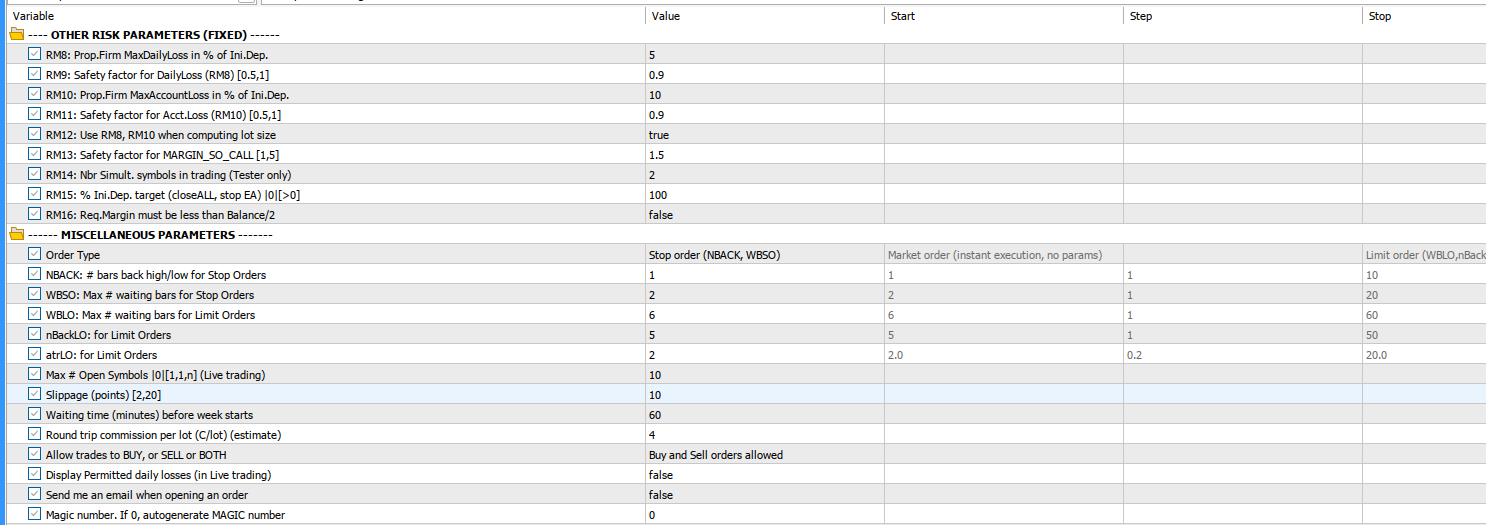

2) Perform an optimization of the risk management parameters such as TP @ open, SL @ open, SL while traling, etc. that I used in all my EAs

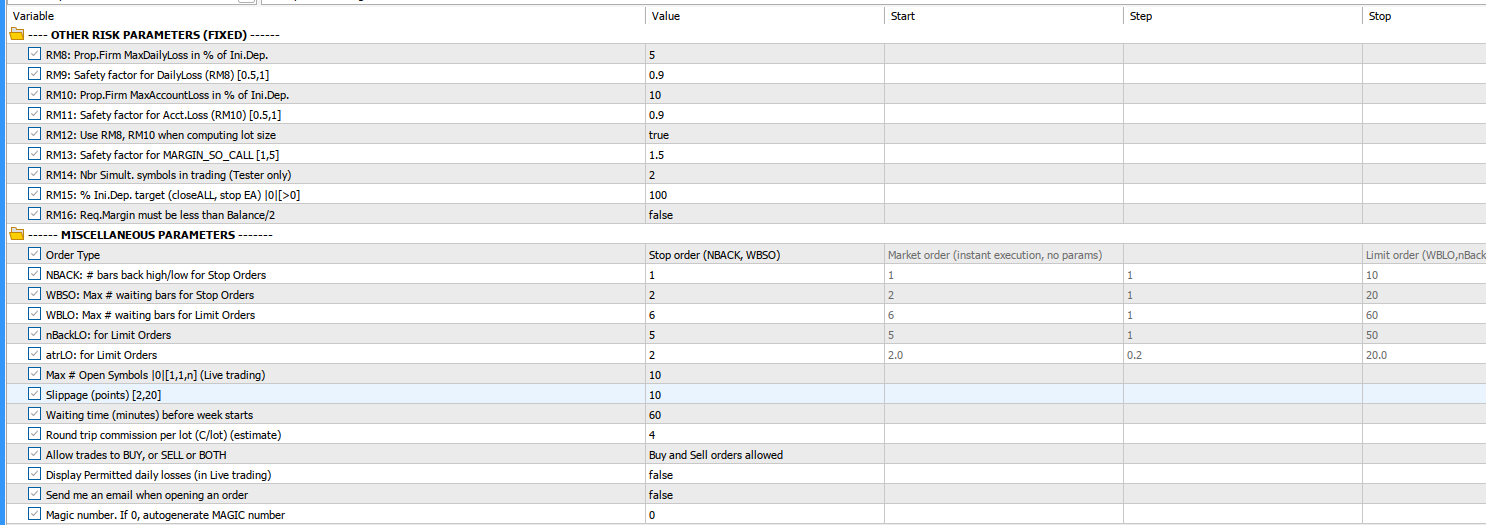

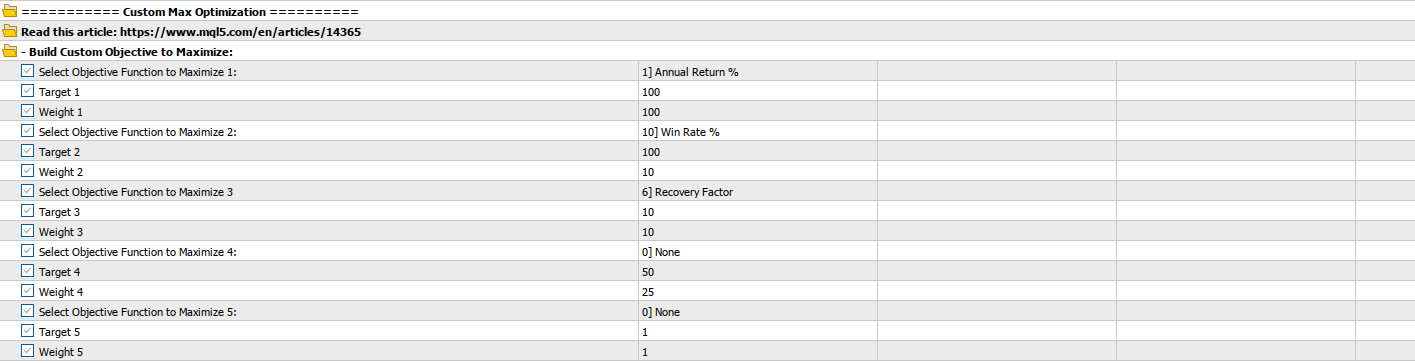

3) Set the right optimization objective and constraints as used in my EAs:

(if you want to learn more about how to set up such an optimization problem, go to the GOF explanation article.)

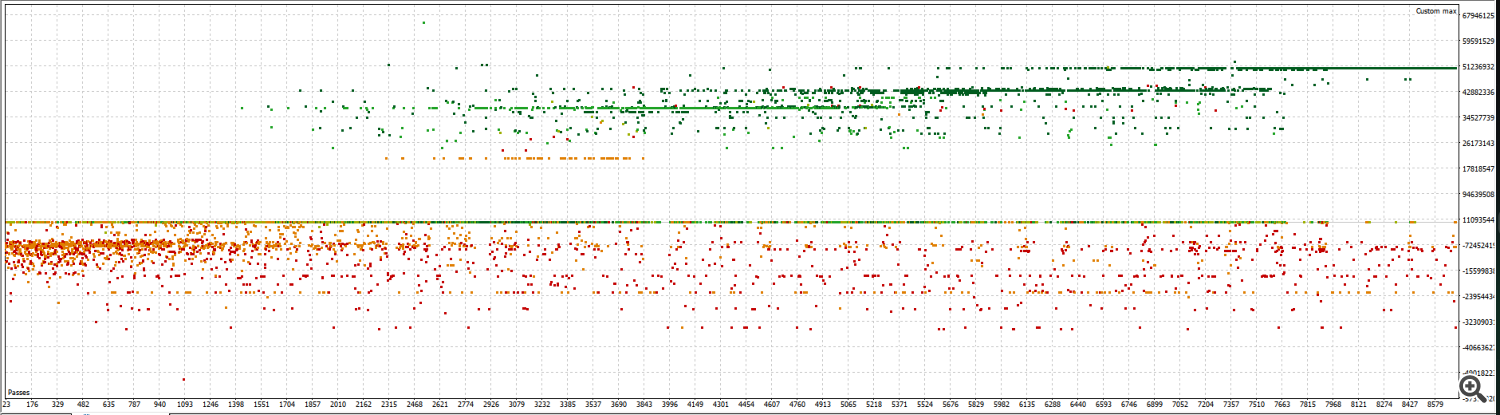

After the optimization ran I got this Custom Max vs Passes plot

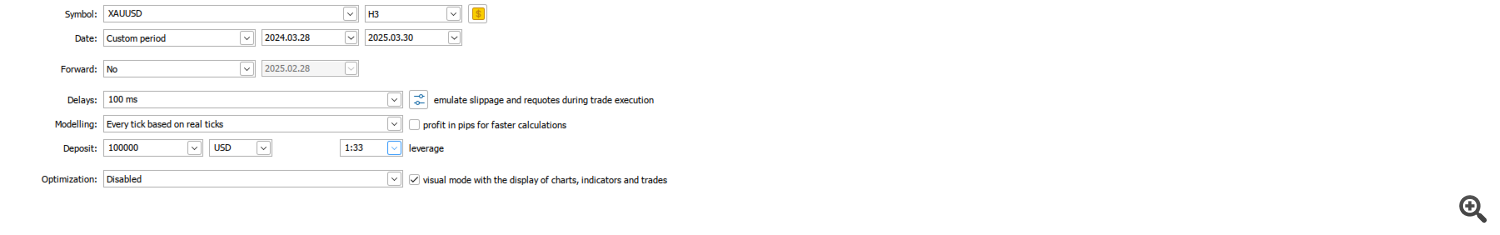

4) I then selected a combination of variables with good total profit, win rate and recovery factor. The inputs are shown in the images above. I ran it with this settings:

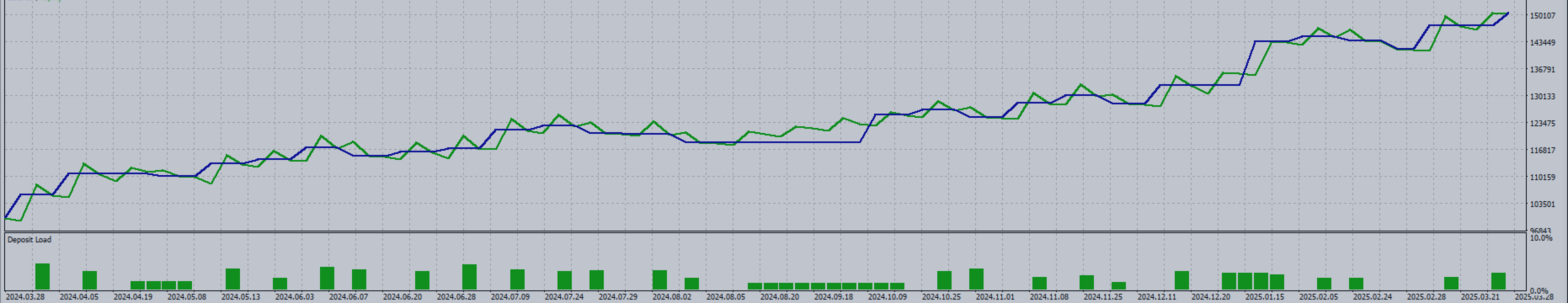

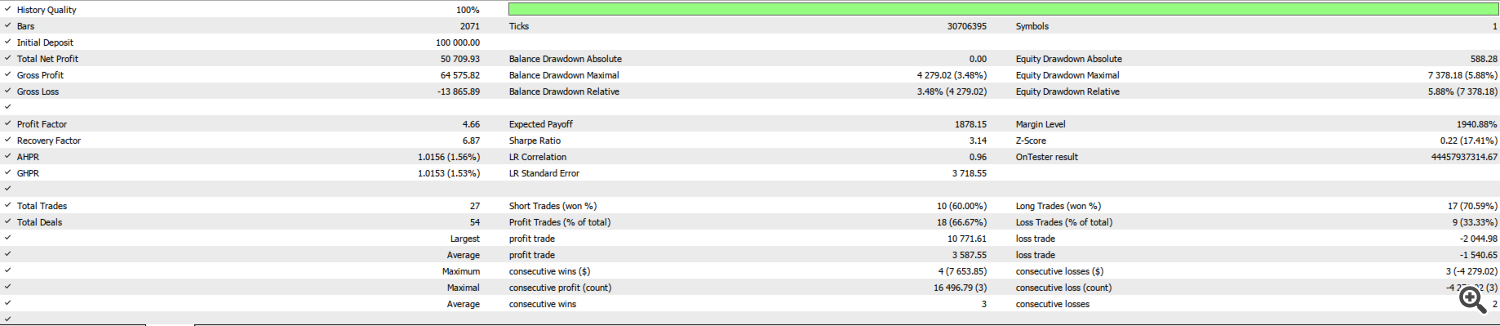

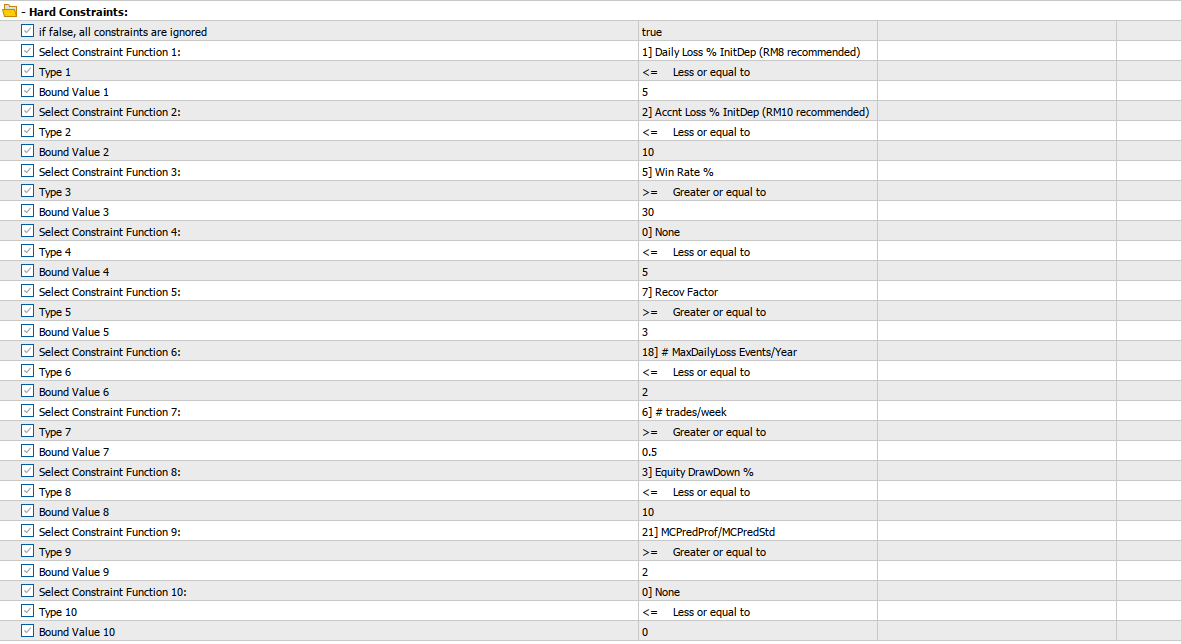

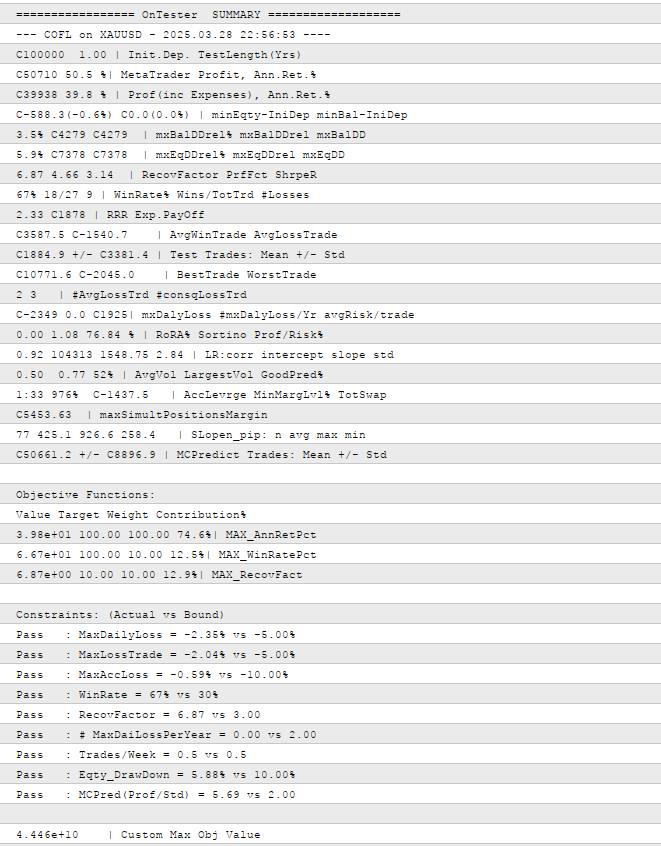

This is the Backtest result for a full year for the symbol XAUUSD using H3 time frame.

and also the GOF-generated Summary from the Journal tab:

A side note: notice that the last constraint gives a Monte Carlo prediction of mean profit that is 5.69 times the standard deviation of the same prediction. This is a very robust result, meaning the predicted probability of a negative profit year is super low (0.0000072 %).

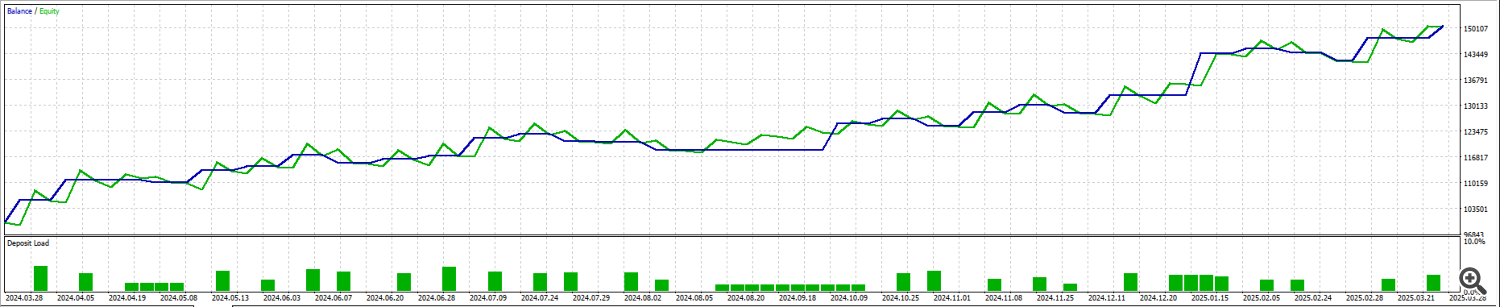

The balance & equity vs time curve is shown below, with a very low deposit load.

Analysis and Conclusion

The answer to my original question in the Introduction is: Yes, it is possible to make money, and in multiple ways as shown in the Custom Max vs Passes plot, using a random entry strategy, but we need to be careful with the conclusions.

Conclusion I) Even though it is possible to make money buying and selling randomly, the optimizer will find the best set of risk management parameters for that specific series of random entries.The same set of risk management parameters may not work for another random series of entries.

Conclusion II) It is possible to be profitable even with a bad entry strategy (as bad as random) if the risk management strategy is good and adapted to the entry strategy.

Conclusion III) As always, past performance is not a guarantee of future profitability. This is true for all strategies ever created (with EAs or manual), but more so for a random entry strategy.