[Русский] - [English] - [中文] - [Español] - [Português] - [日本語] - [Deutsch] - [한국어] - [Français] - [Italiano] - [Türkçe]

🔴 Download demo version: [Trading-Go.com] 🔴

💚 Buy in Market Mql5.com version for : MetaTrader 4💚

💚 Buy in Market Mql5.com version for : MetaTrader 5💚

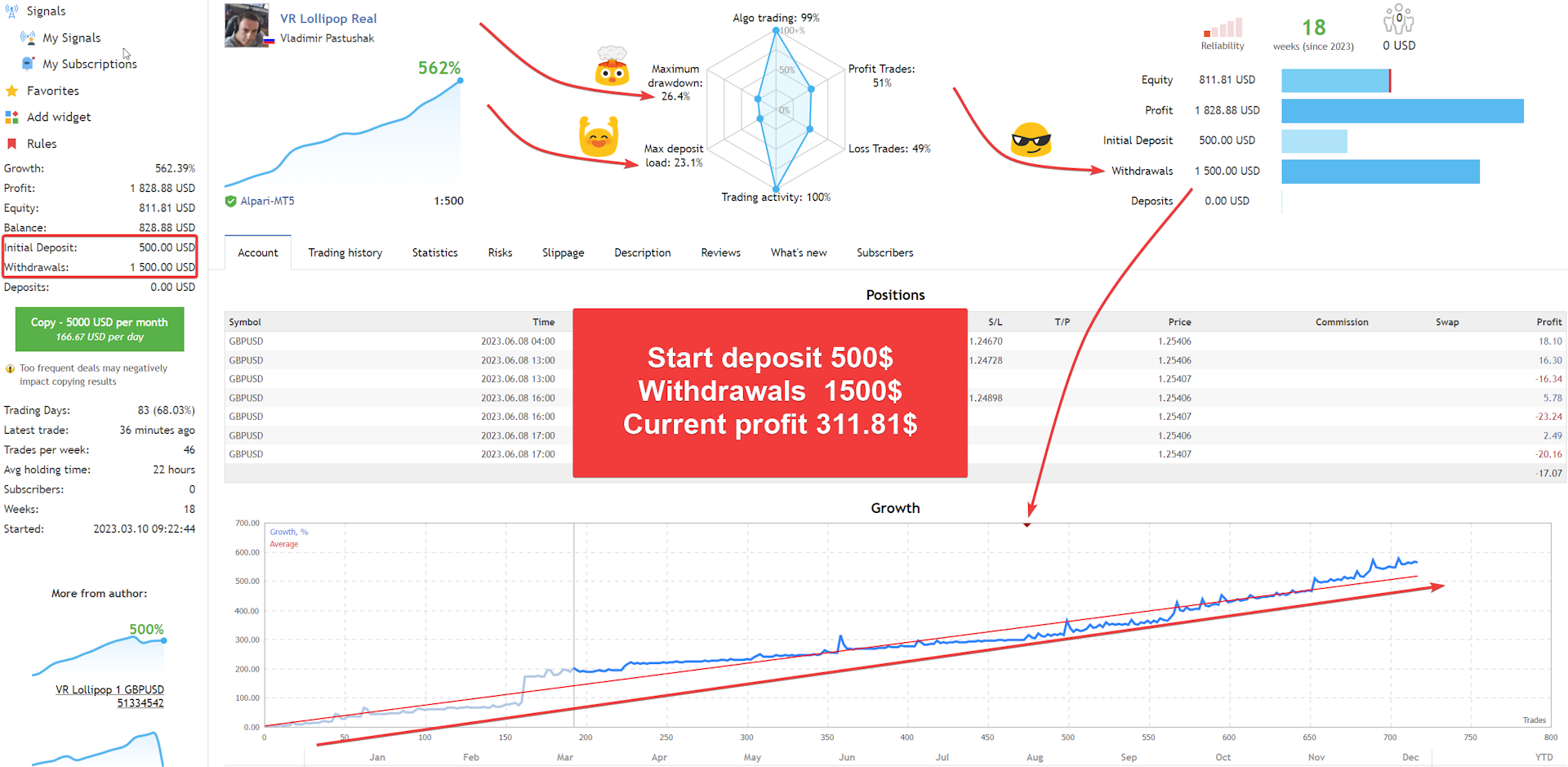

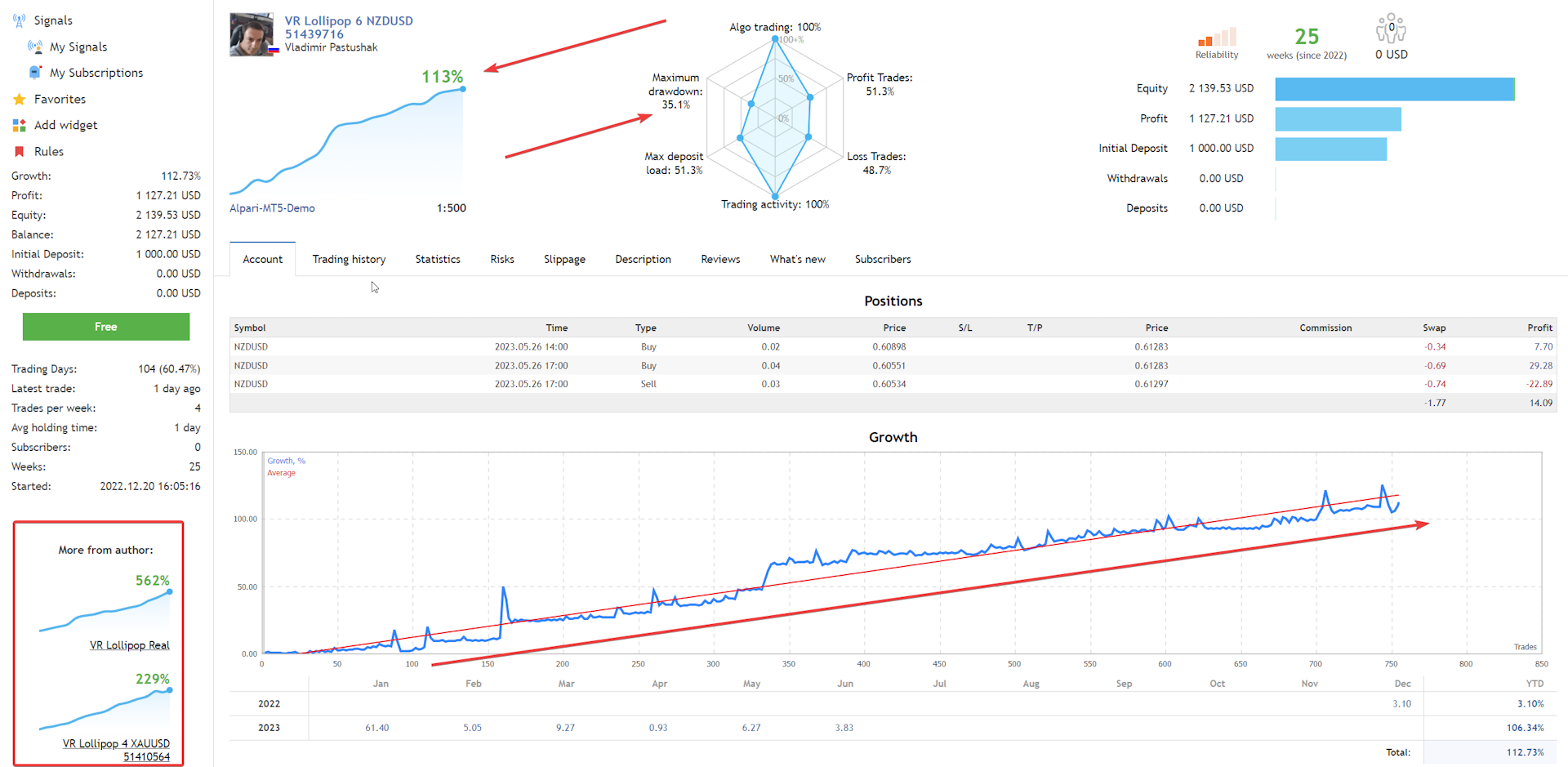

Make profits grow is the main strategy of the VR Lollipop robo trader. Trading along the trend, adding positions along the trend, transferring positions to the no-loss direction and cutting losses as fast as possible, – these were the principles behind the trading strategy of the VR Lollipop robot. Trend-following trading, combined with dynamic trailing stop, picks up all trend movements as efficiently as possible. The robo trader places real Stop Loss and Take Profit levels. Even when using virtual levels, Stop Loss and Take Profit serve as additional safeguards and a means of hiding the actual closing levels of positions.

The robo trader operates in cycles. Cycle is the moment when the program starts operating, when there are absolutely no positions previously opened by the robo trader, or when all positions have been transferred to no-loss, and the moment when all positions are closed or transferred to no-loss.

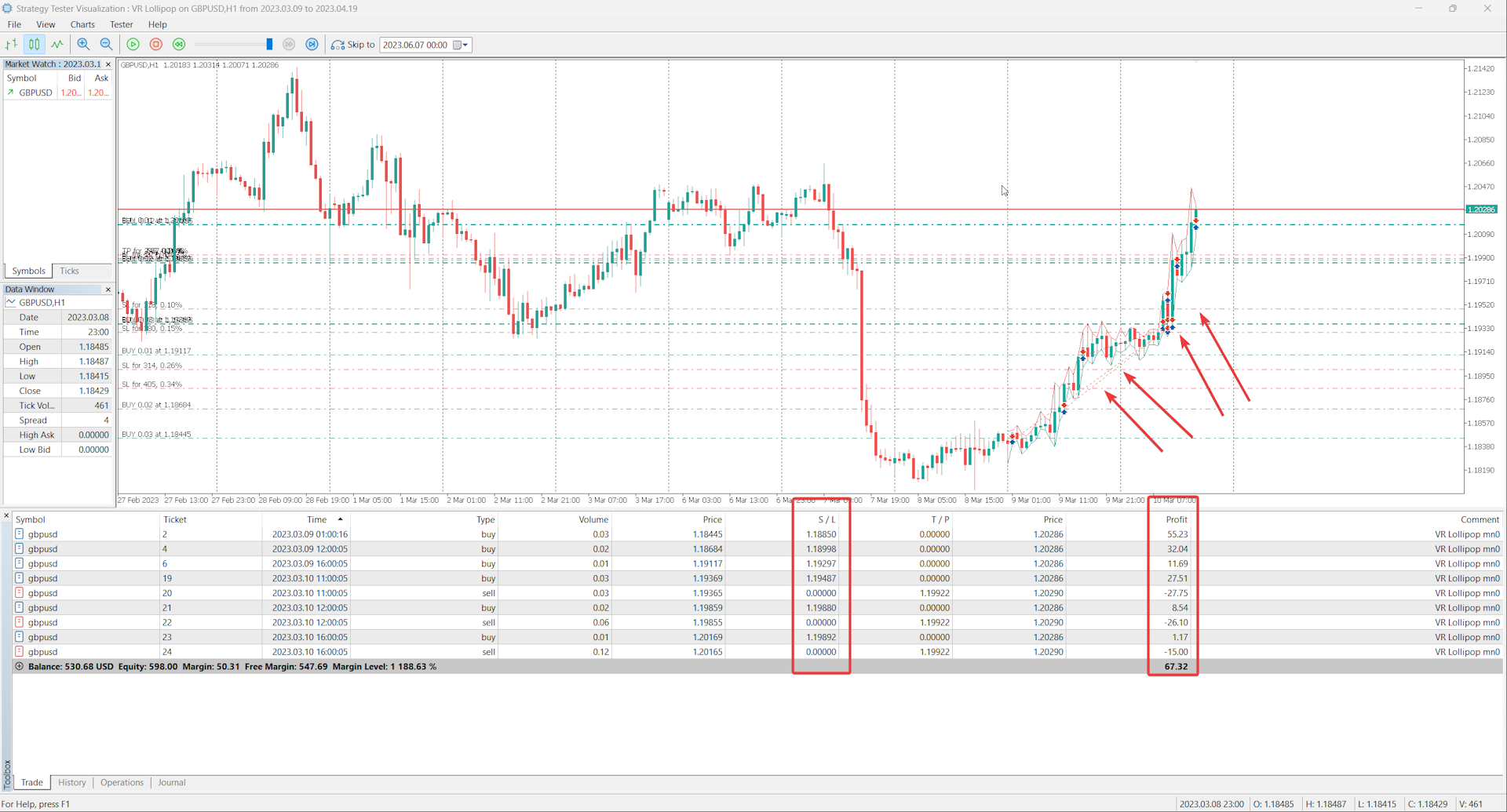

The robo trader starts the cycle by entering the market simultaneously with two positions of the same volume, one position to buy, another position to sell. VR Lollipop always operates in two different directions. When the price moves within the distance specified in the settings, the first thing the robot does is to move the position along the trend into a no-loss position. After the robot has moved the position to a no-loss position, the robot opens a new pair of positions. Depending on what settings have been set by the user, for counter-trend positions the lot may increase, and for trend positions the lot may both increase and decrease. Following several cycles of the VR Lollipop robo trader, on a financial instrument, the trader has several profitable positions transferred to the no-loss. Positions that have a real level without a loss are processed by a separate dynamic trailing stop algorithm.

The dynamic trailing stop, unlike the classic trailing stop, is smoother and trails the Stop Loss more smoothly, so positions are not closed early in the trend. The robo trader was developed in conditions as close to real as possible, so in the strategy tester the robot does not show reliable information.

The further stage of VR Lollipop operation is the analysis of opened positions along the trend and against the trend. If there are more than two positions against the trend, the robo trader calculates the total average price using such a formula to compensate for the loss of the last position against the trend which doesn't have no-loss. With a small backward movement against the trend, the robot closes positions that do not have no-loss with a small profit, while in the market, there remain positions with the stop loss moved to the no-loss zone. By repeating these cycles several times, VR Lollipop accumulates a large number of positions with no-loss in the direction of the trend.

What happens to positions with a stop loss set to no-loss.

The robo trader has a built-in no-loss management function for such positions. This feature is very similar to the classic trailing stop, when the robot pulls up the Stop Loss following the current price at a fixed distance. In the VR Lollipop robot, the trailing stop is modernized and works separately for each position. For the robo trader I created an upgraded trailing stop, which works according to a special formula calculated on the basis of the percentage. This is designed not to close positions which are transferred to no-loss at the slightest pullback. That also allows to accumulate a large number of positions and not to break them before the time.

I have several positions accumulated in profit, can I close them manually?

Yes, positions with a Stop Loss moved to the breakeven zone can be closed manually. I recommend not to do this, so that VR Lollipop itself closes all its positions. Let profits grow, don't rush to close profitable positions.

How to manage funds?

I recommend not saving large amounts of funds in an account. In the case when your deposit is increased withdraw your start-up capital. When trading using the robot, use only the capital that you can lose.

How to reduce risks when trading with this robot?

The first thing to do is to test the robot on demo accounts with the same conditions with which you are going to trade on real accounts. The second is to give the robot only the amount of funds that you are ready to lose. The third is to regularly withdraw earnings.

Default for 5-digit broker

- < Trading>

- * Maximum allowable spread (Point) (0 - Disable) - The maximum allowable spread for the trading robot to operate. If the actual spread on a financial instrument is greater than the specified one, the trading robot will stop and wait for a favorable spread.

- < Lot> - Trading lot calculation settings

- Initial lots - Initial starting lot. If all positions are closed or transferred to a loss-free position, the value specified by the user is used to open a pair of positions.

- Lot multiplier (0 - Disable) - Lot multiplier for increasing the lot against the trend. ( 0 - Disabled )

- Lot reduction - The lot size by which the next trading order will be reduced when trading in the direction of the trend. If you enter a value with a minus sign (-), then the next trade order will be increased by the value specified in the setting. ( 0 - Disabled )

- Minimum lot for trend trading - Minimum lot for trading, in cases where Initial lotsis greater than 0.10, and during calculations the new trading lot is less than Minimum lot for trend tradingthen for trading the value from this setting is taken.

- < Position> - Settings for calculating the step between pairs of positions

- Distance calculation method - Methods for calculating distance

- Points - The distance is calculated in points, points are specified in the setting - Distance value

- Percent - The distance is calculated as a percentage of price growth/decrease, the percentages are indicated in the setting - Distance value

- Bolinger line difference - The distance is calculated as the difference between the lines of the Bolinger indicator, the indicator period is specified in the setting - Distance value

- Counter positions - The distance is calculated depending on the number of positions, the step is multiplied by the number of positions according to the type of trading operations. The step is indicated in the setting - Distance value

- Awerage bars - The distance is calculated as the average value of the specified number of bars, the number is specified in the setting - Distance value

- * Distance value - The value of points, percentages, periods depending on the position calculation method.

- One bar one trade - The setting specifies trading based on the principle of one trade per bar. This does not take into account the opening time of a new bar.

- New Bar (Select the timeframe for the New Bar) - Opening positions taking into account the appearance of a new bar (Disabled)

- < Profit> - Profit taking settings

- * Profit to the Plus (Points) - Minimum profit value in points when closing a group of positions

- * Breakeven (Points) - Minimum value in points to create a position without loss

- < Trailing> - Settings for StopLoss movement to follow the price

- Trailing stop type - Trailing stop type

- Manual - Manual control mode - in this mode, the trader himself is responsible for setting and moving StopLoss manually (For experienced traders)

- Dynamic - Dynamic trailing stop mode - in this mode, the trailing stop works according to a complex percentage mathematical formula. (Recommended)

- * Trailing Stop Size (Points) (0 - Disable) - The size of the expected trend in points. The user sets the expected size of the future trend or measures the size of the previous trend and enters the value in points. This value can be from 1000 points to 20,000 points for Forex.

- Maximum % Trailing Stop (For Dynamic Trailing) - Maximum percentage of trailing stop fixation. In the case when the price has passed a given amount of the expected trend, so that the position is not knocked out ahead of time without a loss, the trading robot does not tighten the trailing stop by more than the percentage specified in the setting. Example: A trader indicated an expected trend of 10,000 points and a Maximum % Trailing Stop equal to 90. The price passed 9,900 points, a small movement will immediately knock a profitable position out of the market, no matter what happens and the position continues to work with a trailing stop, the trading robot blocks the pull-up StopLoss at 90%. In this case, the trailing stop will be at the level of 9000 points. With further price movement, the balance of 90% will be maintained. The price has passed a total of 20,000 points; the trailing stop will be at 18,000 points.

- Trailing % Stop Revers trend - The setting specifies the percentage of the StopLoss movement to meet the price. (Recommended range 10-200)

- * Trailing Stop Global (Point) - This setting allows you to set the global size of the Trailing Stop. Allows you to trawl positions whose stop loss is at a specified distance.

- < MM>

- Close all positions with profit (50 or -50) (0 - Disable) - Setting up the closing of all positions when a specified profit or loss is reached in the deposit currency. Example: The trader specified 50, as soon as the amount of unrecorded profit is equal to 50 or more, the trading robot will automatically close all open positions. Example: The trader indicated - 50, as soon as the amount of the unrecorded loss is equal to - 50 or less, the trading robot will automatically close all open positions. (0 - Disabled)

- Expert actions after closing all positions - The setting specifies the trading robot's further actions after closing all positions based on the amount of profit or loss.

- Close all positions and Full stop trading - This setting completely stops the trading robot until the next restart of the robot by the trader.

- Close all positions and Continue trading - The setting allows the robot to continue trading after closing all positions.

- < Other>

- MagicNumber - A unique number identifier of positions by which a trading robot distinguishes its positions from the positions of another robot or positions opened by a trader manually. Possible options (0 - not recommended) - at 0, the trading robot will pick up positions opened by the trader manually. ( - 1 - not recommended) - the trading robot will pick up absolutely all positions on the trading account. (Value greater than 0 - recommended) - the trading robot will only work with its own positions.

- * Slippage (Points) - Slippage - the setting specifies the ability for the server to accept a trade order in a price range from the current price. That is, the trading robot sent an order at a price of 1.23456 while the order was flying to the broker’s server, the price changed and became 1.23458. The trading server cannot accept the order because the price has changed and returns a requote to the robot. Whatever this happens, set the slippage parameter and the server will accept a trade order in the price range 1.23426 - 1.23488

- Commentary on positions - Commentary on positions

- The size of the settings marked with an *

- Number of characters after (.) 5 - If the broker has prices in the format of 5 characters, then the settings are specified 10 times more

- Number of characters after (.) 4 - If the broker has prices in the format of 4 characters, then the settings are specified 10 times less