![[Guide] How to backtest the best way, correctly with 99% real tick data, the best guide 2019 [Guide] How to backtest the best way, correctly with 99% real tick data, the best guide 2019](https://c.mql5.com/6/784/splash-704853-1504021080.jpg)

[Guide] How to backtest the best way, correctly with 99% real tick data, the best guide 2019

Dear Traders,

today I want to present you my Guide "How to backtest the best way" and achieve realistic results, even for scalping EA, with highest precicion.

At the end I will attach a youtube video guide how to use the tool and show you how to backtest in practice.

Many trader struggle to backtest correctly. When I remember back, some years ago it has been a difficult task and it took ages to set up the tick data etc.

These days it has become quite easy due to much better 3rd party applications, nonetheless there are some pitfalls you need to know !

1. Use a 3rd party application to obtain free high quality Tick Data and the tool that you can use to test.

The market for this is not huge. There are two bigger providers: TickDataSuite and TickStory. I have used both of them for several years, but today, I can definitely only recommend TickDataSuite.

TickDataSuite made my life become so easy!!!! I love the developer, the features like testing with slippage, variable spread, execution delay, the fast engine and the best: the low disk space and easy usage make TickDataSuite really unique!

You will appreciate what I am talking about if you try out other 3rd party applications.

2. Download high quality Tick Data of reputable ECN Broker

In pratice: I show you the backtest result of a Scalper from the MQL5 Market:

regular MT4 Data Backtest (90% quality)

- vs. -

Real Tick Backtest using Dukascopy Data (99%)

maybe you now have a first idea why Your tests look good, but Your live results fail .. .

When it comes to Tick Data quality it is obvious that we need the best possible data that matches with our broker, since we want to evaluate and optimize our strategy on this data.

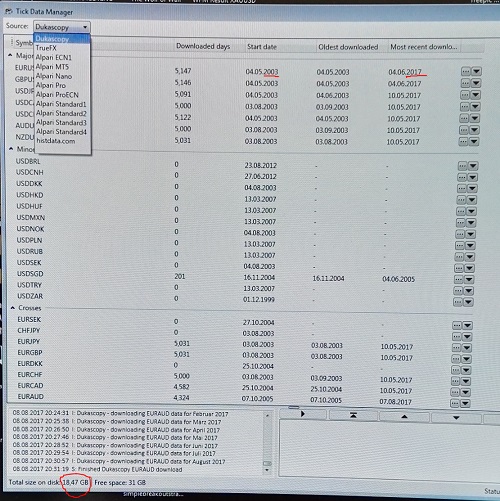

here TickDataSuite makes our life become easy again. Currently we can choose between different data providers:

we can choose between Dukascopy, Alpari, TrueFX and in future many other data sources, or can add custom data sources and download it very simple and fast.

You can always update your data by pushing the download button and it will only add the new to your existing data in less than a minute.

^^ the best is that, as you can see, it only took 18,5 GB disk space, and I have downloaded all major pairs and many others (also other data sources) from 2003-2017.

I remember using tickstory or the old TDS Versions, with some 600 GB disk space for the same data.

3. Use the correct settings for your Broker

Here are the common pitfalls:

3.1 Wrong spread

Always remeber that 1 Pip in MT4 tester settings is 10.

So, if you are testing a night scalper trading EURAUD, and you have found out that EURAUD has an average spread of 4 Pips in the night session, you have to enter 40 in the tester. Many EA Vendors do this wrong, of course with 4 instead of 40 the backtest will look 100 times better than is.

If you dont know the average spread, then I recommend to use a spread recorder. (you may pm me if you want the one that I use).

3.2 GMT and DST Settings

Enter the correct GMT and DST setting of your Broker in TickDataSuite.

My Broker has GMT+2 and is a European Broker, thats why I chose +2 and Europe.

Ask your Broker for his server time if you are unsure or take a look in the Market Watch Window in Mt4, there the Server Time of your Broker is displayed.

3.3 Most Broker have slippage

I recommend to find out the average slippage of your broker and enter it in the TickDataSuite settings.

With my broker I have an average negative slippage of 0,3 pip per trade, thats why I enter -3. This will add 0,3 pip Slippage for each operation.

3.4 Check that the account settings are correct before you start testing

TickDataSuite puts the correct values automatically, if you are logged into your live account!

I recommend to use your live account being logged in as investor (not that you accidentally open trades) and use a new mt4 instance for the purpose of backtesting.

3.5 Usage of variable spread

If you are testing spread sensitive Scalper or EA that trade during news etc. I recommend to test with variable spread !

Simply check "use variable Spread" in the tab: Basic and variable spread will be used.

4. Sounds good... But does it really work that accurately ?

I did doubt the accuracy of the MT4 Strategy Tester for a long time. But I wanted to find out and have done several tests. The MT4 Strategy Tester works 100% accurately. The key is the right tick data and the correct settings, then even fast scalping EA can be evaluated accurately!

I have tested my own EA: Pure Alpha Scalp using TickDataSuite and compared the results from backtest to the results of my live account.

I could see that it matches very good, and this is a scalper. I will upload a video soon and post the link here.

You can purchase TickDataSuite here or test it 14 days for free here.

PS: If you are looking for an affordable high performance VPS with lowest latency I can recommend: Best affordable low latency VPS . It has 1 ms ping to IC Markets.

© Alexander Gerlach, 2017. You are not allowed to copy/publish this guide without my permission.

MerkenMerkenMerkenMerken