Gold: View of Major Top Over the Last Month Remains

Gold near term outlook:

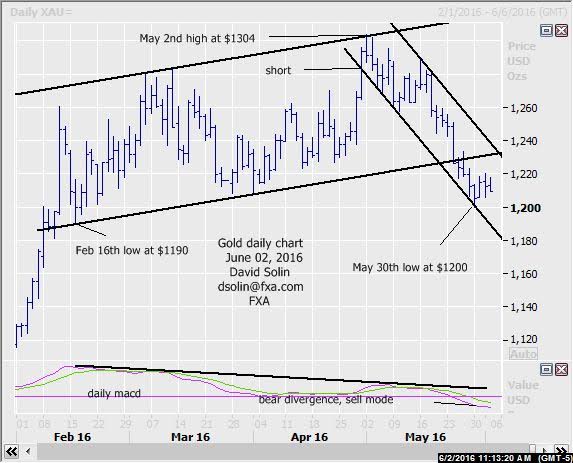

In the May 26th email once again affirmed the bearish view (important

top at the May 2nd high at $1304) and rolling over of the multi-month

topping/channel. The market has indeed continued lower since, currently

consolidating from the May 30th low at $1200.

Though starting to get

oversold after the tumble over the last month, there is still no

confirmation of even a short term low "pattern-wise" (5 waves up for

example), technicals remains negative (see sell mode on the daily macd)

while a more major top is still seen in place (see longer term below),

and in turn argues further downside.

Further support below that recent

$1200 low is seen at the base of the bearish channel from the high

(currently at $1187/90) and $1273/76 (50% retracement from the Dec 2015

low at $1046).

Nearby resistance is seen at the recent $1220/23 high),

the broken base of the bullish channel since Feb (currently at $1230/33)

and the ceiling of the bearish channel from the high (currently at

$1238/41). Bottom line : despite approaching oversold, there is still no confirmation of even a short term low so far.

Strategy/position:

Still short from the Apr 29th sell at $1279 and for now, would continue to stop on a close $3 above the ceiling of the bearish channel from the high. However, will want to get more aggressive on increasing signs of a shorter term bottom (slowing downside momentum, 5 waves up on very short term chart) to maintain a good risk/reward in the position.

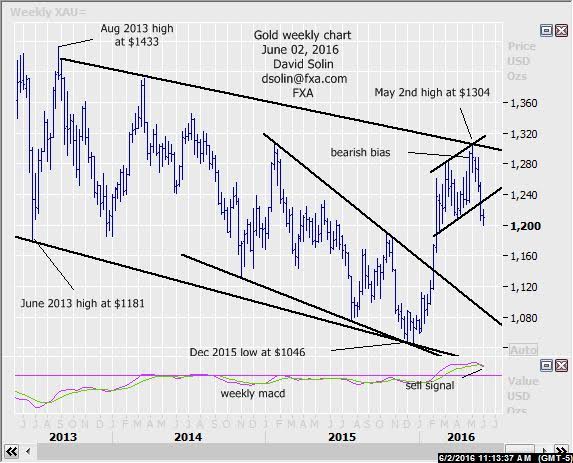

Long term outlook:

No change in the view of an important top at that May 2nd high at

$1304 (at least a few months), and as the market has indeed finally

"rolled over".

Note that the upmove from Dec to that May high lasted

about 5 months (has only been declining for 1 month so far, argues at

least another few months of downside), long term technicals have turned

negative (see sell mode on the weekly macd) and the US$ index is still

seen completing a more major bottom (though scope for a few weeks of

consolidating/bottoming, see email from yesterday, inverse

relationship). Additionally as been discussing, this pullback in gold

may be "deep" as there is scope for deep declines across a number of

correlated markets.

This includes silver which is still seen completing

a major top at that May 2nd high at $18.00 and with scope for declines

all the way back to its Dec 2015 low at $13.60 and even below (note that

the 3 wave upmove argues a large correction, see 3rd chart below, deep

decline in silver would argue a deep pullback in gold). Bottom

line : important top still seen in place at the May 2nd high at $1304

and with another few months of downside (and likely deep pullback)

favored.

Strategy/position:

Also switched the longer term bias to the bearish side on Apr 29th at $1279.

Current:

Nearer term : short from the Apr 29th sell at $1279, stop on close $3 above multi-week bearish channel.

Last : short Mar 14 at $1240, stopped Mar 16 back above t-line from Feb ($1247, closed $1263).

Longer term: bear bias on Apr 29th at $1279, potential for significant downside over next few months.

Last : bull bias Mar 4th at $1261 to neutral Mar 16 at $1263.