Analytical Review of the Walt Disney Company’s Shares

The Walt Disney Company, #DIS [NYSE]

Services, Entertainment, USA

Financial performance:

Index –DJIA, S&P 500;

Beta – 1.40;

Capitalization - 151.56 В;

Assets profitability - 9.60%;

Revenue 8.38B;

Average volume – 10.31 М;

P/E - 18.84;

ATR – 2.67.

Analytical review:

- The company's shares have grown by over 10.5% since the beginning of February. The quotes are expected to rise further.

- According to the latest report on the first quarter 2016, the company's revenue increased by 12.8%. The EPS grew by over 80% from 0.95 USD to 1.73USD.

- Walt Disney Co continues to expand business with LegoGroup. The companies used to release jointly Lego Star Wars characters and video games. LegoGroup has announced recently its 18th collection called "LEGO Minifigures" that features Disney's most famous characters. The LEGO brand is still extremely popular. In 2014, the Lego Movie grossed over $470 million.

- The Company's planning to have opened a new Disneyland in Shanghai by mid-June 2016. The theme park will be divided into 6 sections. A ticket will cost 45-75 USD.

- The majority of large investment funds and banks (Piper Jaffray, Deutsche Bank, JP Morgan) forecast a rise in the price of shares of up to 120 USD.

Summary:

- The company's report on the first quarter 2016 shows that the corporation's management has worked perfectly well. The Walt Disney has been the most profitable company in Hollywood so far. Cooperation with LEGO and opening of a new Disneyland will drive the company's shares to grow.

- Thus, we expect that the company's quotes will be rising in the nearest future.

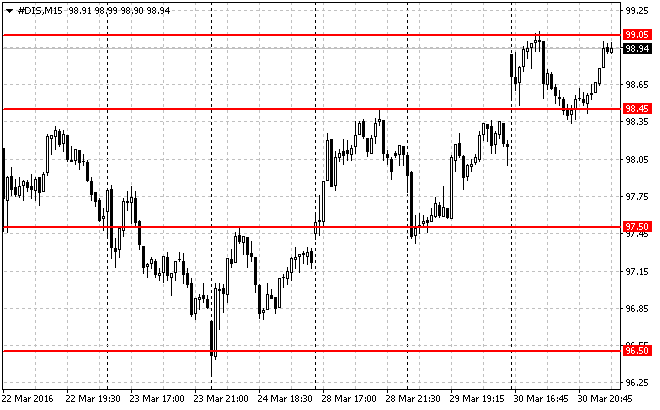

Trading tips for theWalt Disney Company’s CFDs

Medium-term trading: the issuer is trading at 96.50-99.65USD. Once a resistance level of 99.65 USD is broken and tested, and relevant confirming signals appear (PriceAction patterns, for example), we recommend searching for market entry points to open long positions. Risk per trade: no more than 2% of equity. Stop order shall be placed a bit below the signal line. We recommend that prospective profits should be fixed partly at the levels of 103.50 USD, 106.00 USD, and 108.50 USD, with Trailing Stop applied.

Short-term trading: On the 15M time-frame, the issuer is currently trading at 98.45-99.05 USD. Once the resistance level of 99.65 USD is broken and tested, we advise you to search for market entry points to open long positions. Risk per trade: no more than 3% of equity. Stop order shall be placed at 98.60 USD. We recommend that prospective profits should be fixed partly at the levels of 99.50 USD, 100.00 USD, and 101.50 USD, with Trailing Stop applied.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com