Analytical Review of the Stocks of Verizon Communications Inc.

Analytical Review of the Stocks of Verizon Communications Inc.

Verizon Communications Inc., #VZ [NYSE]

Technologies, Telecommunication, USA

Financial performance of the company:

Index – DJIA, S&P 500;

Beta – 0.20;

Capitalization – 213.22 В;

Return on asset – 7.40%;

Income – - 17.88 B;

Average volume – 17.79 М;

P/E – 11.98;

ATR – 0.81.

Analytical review:

- The company ranks the second on capitalization in the sector of “Telecommunication services” among the issuers traded in the American stock market.

- Yesterday the company issued a report for Q4 of the fiscal year of 2015. According to the press-release company’s revenue has grown by 0.6% to 32.17 billion USD against expectations of 32.40 billion USD. Net profit of the company rose to в 4.43 billion USD against 4.34 billion USD a year ago. EPS (earnings per share) was up to the forecast at the level of 1.06 USD.

- The company announced at the press-conference that net profit of Verizon was lower than expected due to strong pressure from the competitors AT&T Inc. and CenturyLink Inc. The company plans to regain competitive strengths by 2017.

- This year the company plans to develop such businesses as online advertising, content delivery and mobile video service. Therefore, acquisition of AOL and Millennium Media and the launch of new mobile service “Go90” will guarantee the increase in revenues in future.

- Over 65% of all company’s shares belong to institutional funds. The largest part of the shares belongs to Vanguard Group (5.87%) and Capital Research Global Investors (4.34%).

Summary:

- Last company’s report has increased investors’ confidence to the company. Despite pressure from the strong USD the company’s revenue and net profit have grown.

- Verizon Communications has strong growth potential. Successful implementation of the investment projects will increase the share of the company in the sector of “Telecommunication services”.

- Most part of Verizon Communications’ shares belong to the institutional funds.

- Therefore, It is likely that in the near future company’s quotes will go up.

Trading tips for CFD of Verizon Communications Inc.

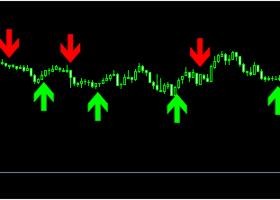

Medium-term trading: the moment the issuer is traded in the demand zone of 49.50-50.95 USD. If the price maintains this zone and in case of the respective confirmation (such as pattern Price Action), we recommend to open long positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 52.70 USD, 54.50 USD and 56.00 USD with the use of trailing stop.

Short-term trading: yesterday the issuer opened with the gap up due to the negative performance demonstrated in the company’s report. After breaking down and maintaining of the local resistance level of 50.50 USD, it is recommended to open long positions. Risk per trade is not more than 3% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 51.00 USD, 51.50 USD and 52.00 with the use of trailing stop.