Gold has once again delighted its investors by reaching a new record high. The precious metal is benefitting from the tense geopolitical climate caused by the ongoing trade tensions between the U.S. and other countries.

The precious metal is actively attracting investment as people seek safe assets amid renewed worries of a trade war between the U.S. and China. Expectations of a Federal Reserve rate cut are undermining the dollar, which adds further support to the XAU/USD pair. This environment is fueling gold's momentum as its price continues to rise.

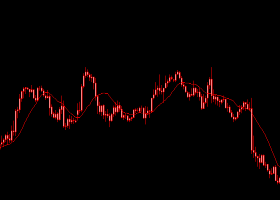

On Tuesday, February 4, the price of gold reached a record high once again. This upward trend is largely driven by investors' desire to acquire defensive assets following China's decision to impose tariffs on U.S. imports—a measure taken in response to tariffs implemented by President Donald Trump. In this context, the price of gold climbed to $2,843.56 per ounce. Bob Haberkorn, senior market strategist at RJO Futures, stated, "The dollar has risen at the start of the week, but further weakness is definitely helping to push the yellow metal higher."

On Wednesday, February 5, gold continued its ascent, reaching a new all-time high of $2,854 per ounce. The bullish trend for gold remains uninterrupted as investors continue to seek refuge in safe haven assets. Later, the precious metal climbed to $2,864 per ounce and showed no signs of retreating.

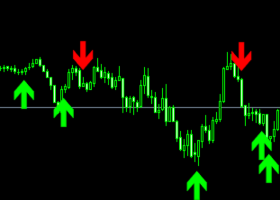

According to technical charts, the Relative Strength Index (RSI) for gold indicates slight overbought conditions, warranting caution from bullish traders. The recent breakout above $2,800 suggests that the path of least resistance for gold is upward, supporting the precious metal's bullish trend from its December 2024 lows.

However, any corrective decline in gold is expected to find support near $2,830 before reaching $2,800. Further price drops may be seen as buying opportunities but are likely to be limited around the horizontal resistance level of $2,773 to $2,772. A significant breakdown below this range could trigger technical sell-offs, leading to further losses.

Investors are concerned about the negative economic consequences of President Trump's trade tariffs in the current environment. This has fueled the demand for safe-haven assets. Additionally, JOLTS data released on Tuesday, February 4, became another headache for market participants. The latest reports indicate a slowdown in the U.S. labor market momentum, potentially forcing the Federal Reserve to continue its easing cycle despite persistent inflation. This serves as an additional factor driving capital into gold.

The Job Openings and Labor Turnover Survey (JOLTS), published by the U.S. Bureau of Labor Statistics, showed that job openings in December totaled 7.6 million, significantly lower than the 8.09 million recorded in the previous month. These figures highlight a slowdown in the U.S. labor market, nudging the Fed towards further rate cuts. This keeps dollar bulls on the defensive near weekly lows and is another factor favoring the XAU/USD pair.

Expectations of continued Fed policy easing are keeping the greenback near the weekly low reached on Tuesday, February 4, providing additional support to gold prices. However, Trump's decision to postpone tariffs against Canada and Mexico is sustaining risk appetite and may limit gold's growth due to its overbought status. Experts recommend waiting for short-term consolidation or a slight pullback before placing new bullish bets on gold in this situation.

The tariff conflict between Beijing and Washington significantly influences the dynamics of gold prices. Currently, China has responded to Donald Trump's new tariffs by implementing targeted tariffs on imports from the United States. This retaliation has heightened concerns about the escalation of the trade war between the two largest economies in the world. The situation has intensified, even though Trump has offered concessions to Mexico and Canada. As a result, gold has benefited from this conflict, reaching a new record high.

Representatives from the Federal Reserve warn that the new White House administration's plans regarding trade tariffs pose a risk of inflation. They indicated that uncertainty surrounding price forecasts necessitates a slower reduction in interest rates than would have been the case without the trade war.

Market participants are focused on the upcoming U.S. employment data, particularly the Nonfarm Payrolls (NFP) report. This key labor market report is due on Friday, February 7. Moreover, market volatility remains high due to the ongoing tariff confrontation.

According to Jim Wyckoff, Senior Analyst at Kitco Metals, given the current U.S. administration's "disruptive nature," which is creating market uncertainty and the potential for increased central bank gold purchases, gold prices could reach $3,000 per ounce this year. This forecast doesn't seem far-fetched, as gold is traditionally considered a hedge against inflation and geopolitical uncertainty. Large-scale gold purchases contribute to rising prices. However, experts add that higher interest rates reduce the appeal of the precious metal compared to bonds or stocks.