Analytical Review of the Stocks of Apple Inc.

Apple Inc., #AAPL [NASD]

Consumer goods, Electronic equipment, USA

Financial performance of the company:

Index – DJIA, S&P 500;

Beta – 0.93;

Capitalization – 534.66 В;

Return on asset – 19.20%;

Income – 75.9 В;

Average volume – 47.64 М.

P/E – 10.25.

ATR – 3.09.

Analytical review:

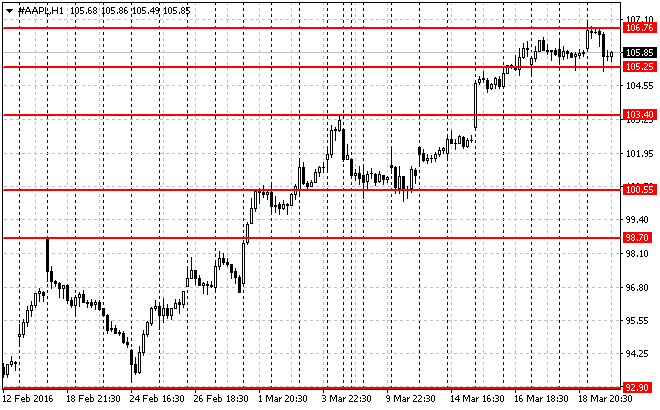

- Since mid-February the company’s shares has grown by over 9%. It is expected that the rise in quotes will continue.

- The company ranks the first on capitalization among the issuers traded in the American stock market.

- According to the last report, the company has reached a new record for the revenue (75.5 billion USD) and net profit (over 18 billion USD).

- Yesterday the company presented to the world its new products: iPhone SE and reduces iPad Pro. New iPhone has 4 inch screen and has the same capacity of a processer and graphics capacity as iPhone 6S. New products of the company are designed for people who like more compact devices. According to Mixpanel market research over 30% of the owners of iPhone use the device with 4 inch screen. The starting price of the new iPhone SE is from 399 USD.

- The company is aggressively penetrates into Chinese market. In February Apple Inc. concluded an agreement with China UnionPay to use Apple Pay system by the card holders.

- At the moment, company’s stocks are traded at the level of 106 USD. Most of the large investment funds and banks (Morgan Stanley, JPMorgan, Barclays) predict that the company’s stocks will rise up to 120-140 USD.

Summary:

- The last company’s report showed that management of the company is on the right track. Despite pressure from strong USD the company set a new record on revenue and net profit. Expansion of activity in Chinese market creates potential for the further development of company’s activity. New products of the company are designed to attract bigger number of clients, which will increase future sales.

- It is likely that in the near future company’s quotes will go up.

Trading tips for CFD of Apple Inc.

Medium-term trading: the moment the issuer is traded in the range of 105.25-106.75 USD. After breaking out and testing of resistance level of 106.75 USD and in case of the respective confirmation (such as pattern Price Action), we recommend to open long positions. Risk per trade is not more than 1.5% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 109.50 USD, 112.50 USD and 115.00 USD with the use of trailing stop.

Short-term trading: on the chart with the timeframe 15M the issuer is traded near the local support level of 105.45 USD. If the price maintains demand zone of 104.95-105.45 USD, we will recommend to open long positions. Risk per trade is not more than 2.5% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 106.70 USD, 108.00 USD and 109.50 with the use of trailing stop.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com