The oil pice is falling by breaking key support levels to below for the bearish trend to be continuing so let's review some oil stocks in the technical point of view. Most oil stocks are located on the ranging market condition waiting for direction: this is not up, but has not yet down. For example.

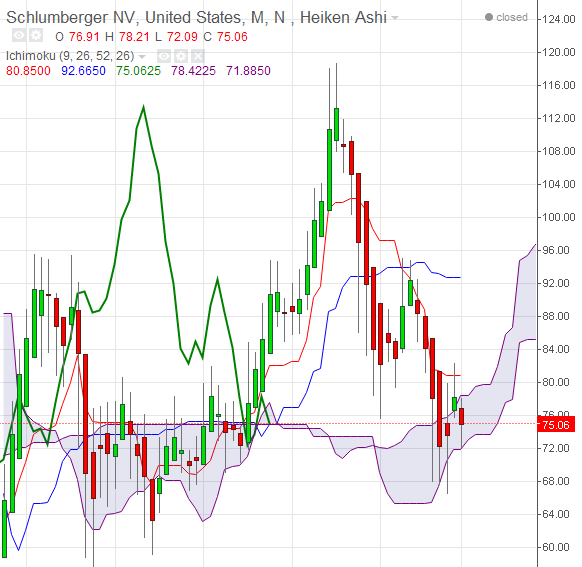

1. Schlumberger Ltd. (SLB): the biggest oilfield services company in the world. The stocks are going to be reversed from the primary bullish to the primary ebarish market condition: the price is located inside Ichimoku cliud for secondary ranging trying to break 72.0 support level for the bearish breakdown. Chinkou Span line is crossing the price from above to below on open motnhly bar for now indicating the good possible breakdown in the near future.

Thus, the tendency for SLB in 2016 is the strong bearish trend with the bearish breakdown.

Long-term strategy: watch the price to break 72.0 support level for possible sell trade with 66.5 as the next target.

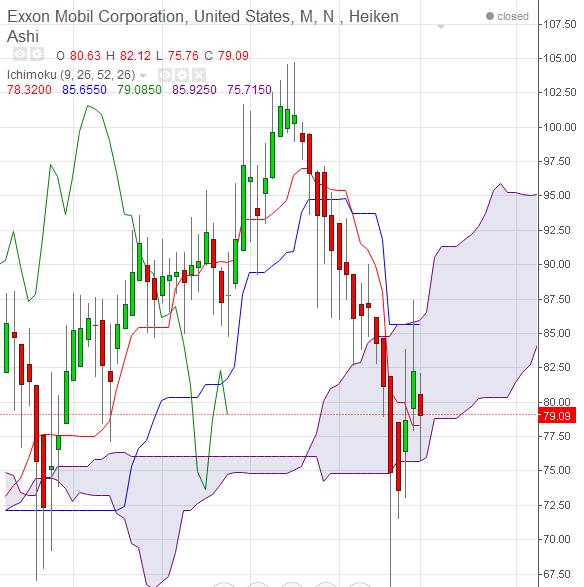

2. Exxon Mobil Corp. (XOM). Ranging waiting for direction. This is very similar situation with Schlumberge: the price is located inside Ichimoku cloud near the veresal border between the price barish and the primary bullish trend on the chart, and the key erversal support level si 78.80: if the price breaks this level to below on close monthly bar so we may see the global reversal of this stocks to the primary bearish market condition.

Anyway, according to Global Energy Strategist Dr. Kent Moors - oil stocks will rebound in 2016. But as almost all significant oil stocks are in ranging bearish market condition so this kind of recovering will not be happened in the first half of 2016 for example.