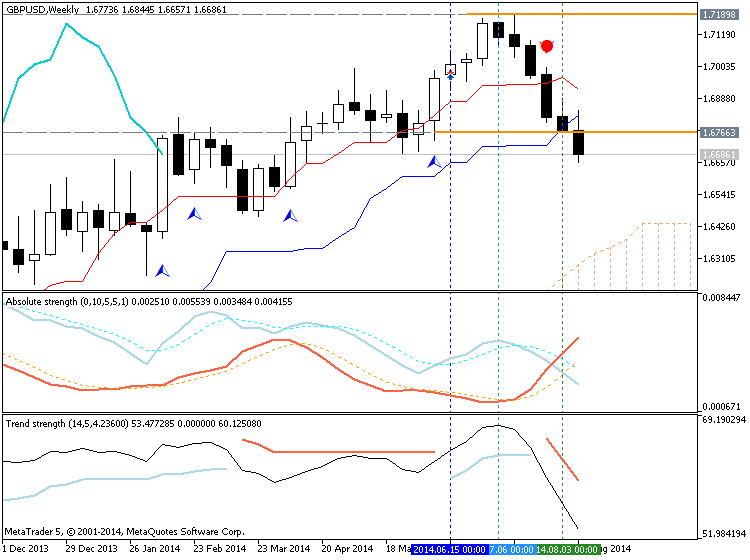

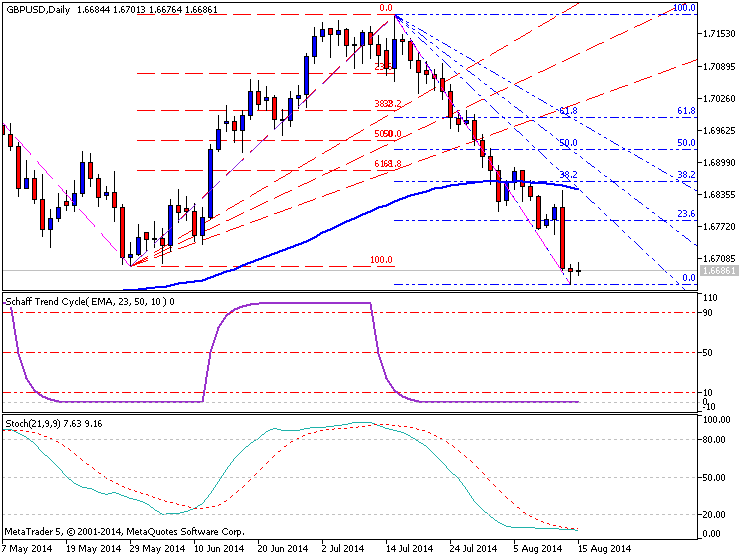

- British Pound shows important risk of reversal

- Solid Q2 UK economic growth figures encouraging for GBP

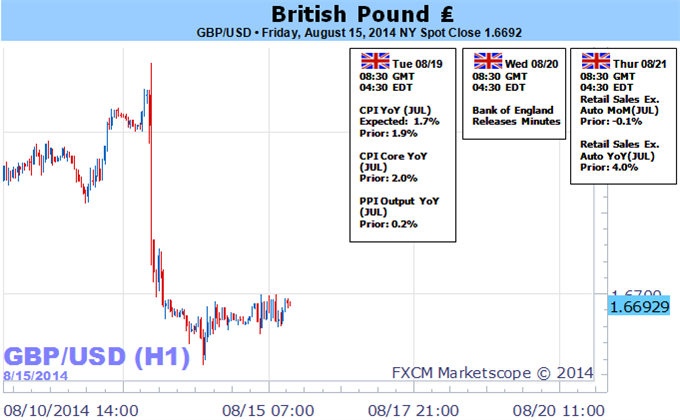

Upcoming UK CPI data could drive important volatility in the

British currency. Analysts expect that the numbers will show inflation

remained below the Bank of England’s official target, and indeed low

price pressures have limited expectations of future BoE interest rate

hikes. And indeed the bank’s recent Quarterly Inflation Report forced

an important GBP sell-off as officials talked down the likelihood of

tightening policy through the foreseeable future. Expectations have fallen so much that any higher-than-expected CPI

inflation figures could spark an important GBP bounce. The subsequent BoE minutes and Retail Sales figures are less likely to move markets but remain worth watching for potential surprises.

We thus head into a potentially pivotal period for the fast-falling

British currency, and we have to go back to the heights of the global

financial crisis in 2008 to find when the GBPUSD last fell for seven

consecutive weeks. This fact in itself hardly guarantees that the

Sterling could finally reverse, but we have seen concrete signs it may have set an important low through recent trading.