Technical Analysis for EURUSD, GBPUSD, AUDUSD, NZDUSD, USDJPY, USDCAD and USDCHF

- “BIG picture, monthly RSI has broken out of a triangle pattern. Sometimes, a pattern breakout in momentum (or OBV) precedes the breakout in price. The development’s implications are obviously significant.”

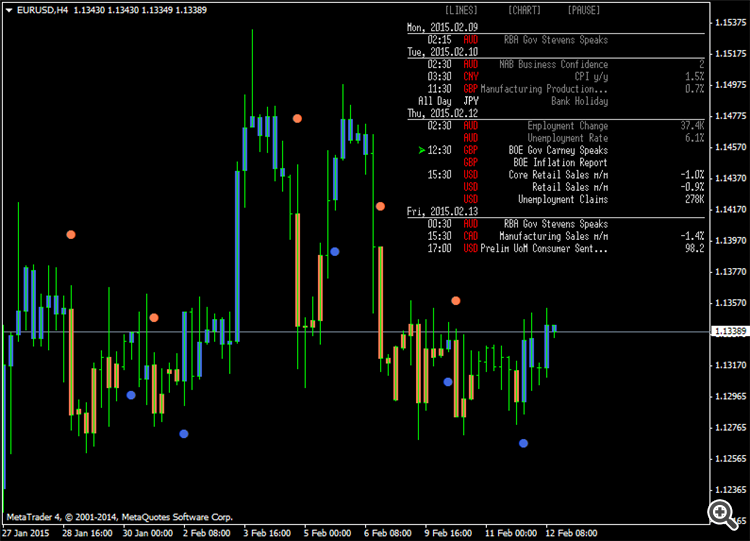

- A number of calls for parity have been published recently. While the long term pattern suggests an eventual print near .90, the sudden aggressively bearish calls come just after a record small speculator short position and record open interest in euro futures was recorded in November. The same COT profile was evident in May 2012, before the EURUSD bottomed in July. Aggressive forecasts are often published when it’s comfortable to do so, which means that the trend is embedded in the public consciousness to the point of extremity. The path to .90 or so won’t be smooth (in other words…more 2 way trade). Former support may provide resistance from 1.1640 to 1.2040.

GBPUSD, Weekly

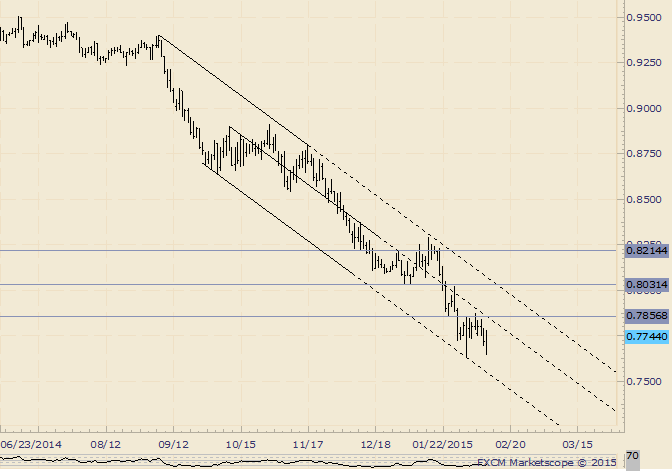

- The recent GBPUSD bounce was rejected at channel resistance, which sets the stage for additional weakness towards 1.4812 and possible 1.4550 (measured move).

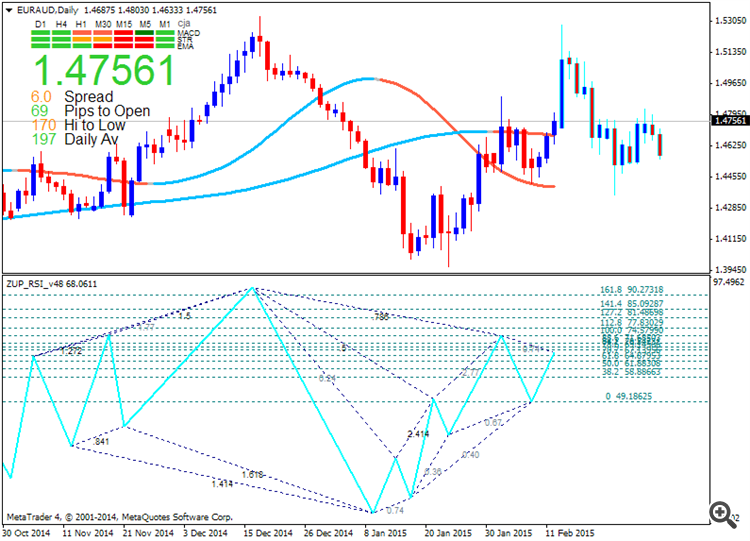

- AUDUSD may be trying to put in a floor of sorts as the rate has held up since putting in a large range and volume reversal on Tuesday. The larger trend remains lower however with resistance estimated at .8030/50. The next potentially important support probably isn’t until the 61.8% retracement of the 2001-2011 rally at .7183.

- “NZDUSD traded to the 61.8% retracement of its 3 year range today (.7929) and the next level of interest probably isn’t until the 2013 Labor Day gap at .7722. One can’t help but notice that an epic double top is possible with a target of .5898. That would trigger on a drop below .7370.”

- “USDJPY held up into the New Year and said January decline is underway. A sideways pattern could take hold between roughly 117 and 120.”

- Favor a broad range as 119.80-120.70 as resistance and 116.40-117.10 as

support. A move through either one of these zones would usher in larger

move towards 124-128 or 110-114.

USDCAD, Weekly

- “USDCAD has pushed through the 2007 high at 1.1875, 61.8% extension of

the 2007-2009 rally from the 2011 low at 1.1882, and several upward

sloping parallels. The next cluster of technical levels is between 1.25

and 1.2730.”

USDCHF, Weekly

- Since banging off of a lower parallel (after SNB), USDCHF has rallied

and is just pips from the median line of that structure. The line in

question is just pips from the October 2014 low at .9352. Watch for

resistance. A reaction targets .8820/30 as support. A move over the

mentioned median line opens up .9530/50 (November and December 2014

lows).