Gold prices trade steady around USD 1265/Oz levels as the markets await the monthly Non-farm payrolls data in the US; a gauge of labor market strength which is actively tracked by the Fed officials.

Calm before the storm

Prices have been stuck largely in a range of USD 1255 to 1273 since the past couple of sessions. Moreover, a sharp rise in the monthly job additions could trigger the expectations of a early interest rate hike in the US and vice versa. Thus, investors preferred to stay on the sidelines and avoid making big bets ahead of the critical data set. Markets are expecting the data to show that the pace of job additions in January slowed to 230K, compared to the previous month’s figure of 252K.

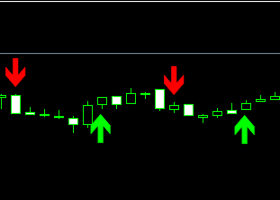

The metal prices are likely to breakout from the trading range post the release of payrolls data.

Gold Technical Levels

The immediate resistance is seen at 1267.92 (5-DMA), above which prices could test 1273.7 levels. On the flip side, support is seen at 1261.9 and 1255.2 levels.

Calm before the storm

Prices have been stuck largely in a range of USD 1255 to 1273 since the past couple of sessions. Moreover, a sharp rise in the monthly job additions could trigger the expectations of a early interest rate hike in the US and vice versa. Thus, investors preferred to stay on the sidelines and avoid making big bets ahead of the critical data set. Markets are expecting the data to show that the pace of job additions in January slowed to 230K, compared to the previous month’s figure of 252K.

The metal prices are likely to breakout from the trading range post the release of payrolls data.

Gold Technical Levels

The immediate resistance is seen at 1267.92 (5-DMA), above which prices could test 1273.7 levels. On the flip side, support is seen at 1261.9 and 1255.2 levels.