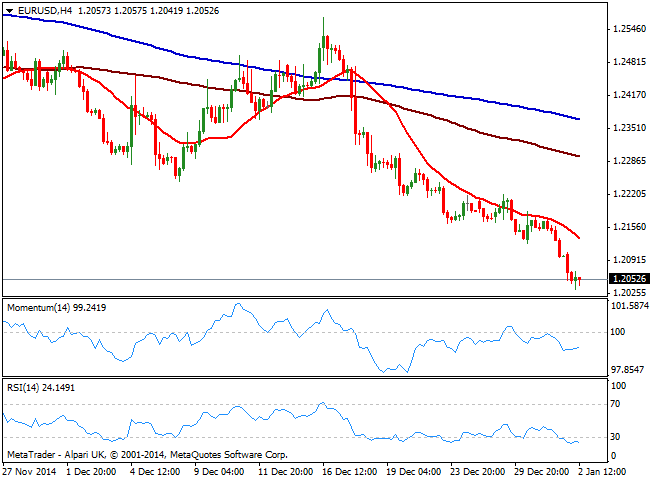

The EUR/USD pair has fallen quite drastically during most of the year for 2014, and although I think it’s still pretty bearish, you can see that I have a blue line on the chart near the 1.2050 region. That is an area where we have seen buyers step been several times now, and I don’t think that this year’s going to be any different. I think that the market falls down to that area before the buyers turn things back around and bring more stability to this marketplace.

I think that it will be a messy affair, but eventually we will find support in that region. Do I think that it’s going to go all the way back to the 1.38 handle? Of course not. I think that we continue the overall downtrend with massive support in this general vicinity. Ultimately, I feel that the Euro has been sold off far too hard, even though it looks like there will be loose monetary policy.

The Federal ReserveThe other player in this market of course is the Federal Reserve. Over the last several months, the Federal Reserve has made it clear that they are leaving the quantitative easing game. However, the marketplace has been selling the Euro overall, due to the fact that they feel the European Central Bank will have to loosen monetary policy. While I do agree with that consensus, I do not think that it will then continue the selling in this market. After all, the monetary policy coming out of the European Union should be looser than it is now, but it’s not necessarily going to be catastrophic. With that being the case, I think that a lot of players have got into the market try to get ahead of the Federal Reserve tightening interest rates, which I think we are a long way away from seeing.

I think that it will probably be sometime in February are so, we should see the market starts stabilize down near the 1.2050 region, and then spend a significant amount of 2015 retracing the massive selling move that we had seen during 2014.