All Blogs

Setup 1Hour Chart Indicators: Weis Pip Wave, Weis Wave with Alert (+Speed Index) and No Demand No Supply ( https://www.mql5.com/en/users/takisd/seller) Our Story: Look at the chart is not clear yet but something is cooking...

There may be many reasons why your robot does not open operations, below I will list 9 main reasons and solutions 1. You just have to wait 24 hours : if you only added your robot to the chart now, you must wait at least 24 hours, sometimes 48 hours, to see the first operation 2...

One major risk to the market calm this week is Thursday’s virtual meeting between Saudi and Russia...

The US indices rallied past 3% before reversing gains on Tuesday, and closed the session a touch below zero. The US treasury yields were offered, the US 10-year yield rebounded to 0.73% and the dollar softened...

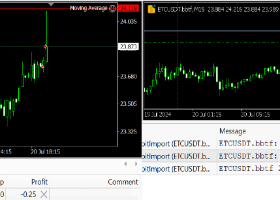

Pivot (invalidation): 25.30 Our preference Short positions below 25.30 with targets at 23.95 & 23.55 in extension. Alternative scenario...

Pivot (invalidation): 15.1600 Our preference Short positions below 15.1600 with targets at 14.7700 & 14.6200 in extension. Alternative scenario...

Pivot (invalidation): 1662.00 Our preference Short positions below 1662.00 with targets at 1636.00 & 1624.00 in extension. Alternative scenario...

Pivot (invalidation): 2756.00 Our preference Short positions below 2756.00 with targets at 2575.00 & 2530.00 in extension. Alternative scenario...

Pivot (invalidation): 10600.00 Our preference Short positions below 10600.00 with targets at 10070.00 & 9870.00 in extension. Alternative scenario...

Pivot (invalidation): 6.7450 Our preference Long positions above 6.7450 with targets at 6.7910 & 6.8150 in extension. Alternative scenario...

Pivot (invalidation): 0.6165 Our preference Short positions below 0.6165 with targets at 0.6095 & 0.6070 in extension. Alternative scenario...

Pivot (invalidation): 1.3995 Our preference Long positions above 1.3995 with targets at 1.4085 & 1.4145 in extension...

Pivot (invalidation): 0.9685 Our preference Long positions above 0.9685 with targets at 0.9740 & 0.9765 in extension. Alternative scenario...

Pivot (invalidation): 109.00 Our preference Short positions below 109.00 with targets at 108.50 & 108.30 in extension. Alternative scenario...

Pivot (invalidation): 1.2350 Our preference Short positions below 1.2350 with targets at 1.2300 & 1.2270 in extension. Alternative scenario...

Pivot (invalidation): 1.0890 Our preference Short positions below 1.0890 with targets at 1.0850 & 1.0820 in extension. Alternative scenario...

EURJPY continues to face recovery threats as it closed higher on Monday and followed through higher on Tuesday. On the downside, support comes in at the 118.00 level where a break if seen will aim at the 117.50 level. A cut through here will turn focus to the 117...

Setup 4Hour Chart Indicators: Weis Pip Wave, Weis Wave with Alert (+Speed Index) and No Demand No Supply ( https://www.mql5.com/en/users/takisd/seller) Our Story: 1. We have hit Support coming from Daily bars and started going up...

Setup 1Hour Chart Indicators: Weis Pip Wave, Weis Wave with Alert (+Speed Index) and No Demand No Supply ( https://www.mql5...