ALFRED MURIITHI / Profil

- Information

|

10+ Jahre

Erfahrung

|

20

Produkte

|

270

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

👉 MY TELEGRAM @innovicient https://t.me/Innovicient

👍🏻 SUBSCRIBE TO MY YOUTUBE CHANNEL: https://www.youtube.com/c/RangingMarkets

📌 For a discount on my products or other requests, write me through https://t.me/Innovicient or innovicient@gmail.com

True Oversold Overbought MT4: https://www.mql5.com/en/market/product/68396

True Oversold Overbought MT5: https://www.mql5.com/en/market/product/79336

Hot Zones MT4: https://www.mql5.com/en/market/product/77292

Hot Zones MT5: https://www.mql5.com/en/market/product/77417

Outside The Box MT4: https://www.mql5.com/en/market/product/83143

Outside The Box MT5: https://www.mql5.com/en/market/product/76975

Ranging Market Detector MT4: https://www.mql5.com/en/market/product/66062

🏛 ALL EA https://www.mql5.com/en/users/pipmontra/seller

Re-enter the trend after pullbacks (Pullback trading strategy)

Take partial/complete profit(Profit taking strategy), and

Trade breakouts (Stock breakout strategy)

Irrespective of whether you are trading,Synthetic Indices,Forex,Cryptocurrencies, or Stocks the Outside The Box System works wonders.

How do I know there is a trend breakout- Breakout Zone

This is the zone between the continuous and dotted lines. The market is expected to breakout on the side of the solid continuous line. After the Breakout Zone draws, you should plan to open trades in the direction after the Re-Entry Zone is displayed. You are recommended to avoid opening buys when the price trends below the bearish breakout. Similarly, don’t go short when the bullish breakout is activated. Another vital point, expect the zones to act as support/resistance.

When do I re-enter the trend. Re-entry Zone

The Re-entry Zone is always below the Breakout Zone during a bear market. However, it can appear above the Breakout Zone if the market is consolidating. On the same note, the bull market Re-entry Zone is always above the Breakout Zone, though this may be overlooked in the early stages of the trend formation. Buy if a candle opens above the buy re-entry zone if bulls are in control and wait for a candle to open below the sell re-entry zone for you to sell during a bear market.

How do I take profit-Take Profit Zones

This module, Take Profit Zones, is useful in that irrespective of the indicator you are using it shows areas where you must lock or take some profit. These zones are displayed when there is either bull or bear market. This is helpful in that you are able to lock most of the gains before a retracement or reversal. On a downtrend, you can re-enter the market, with smaller lots, after a candle opens and closes below the Take Profit Zones. Equally, go long after a candle opens and closes above the zone if you are on an uptrend.

This system has been tested on ordinary and Renko charts. However, use the system together with Renko charts to experience the best outcome and display of these critical zones.

Always know the market level by using Outside The Box trading system.

For the first 10 buyers, we are giving a free copy of Price Elevator> https://www.mql5.com/en/market/product/82757

👉MT4 Version: https://www.mql5.com/en/market/product/83143

👉MT5 Version: https://www.mql5.com/en/market/product/76975

👉ALL Indicators: https://www.mql5.com/en/users/pipmontra/seller

New Update: It now draws Critical Boxes as support/resistance areas.

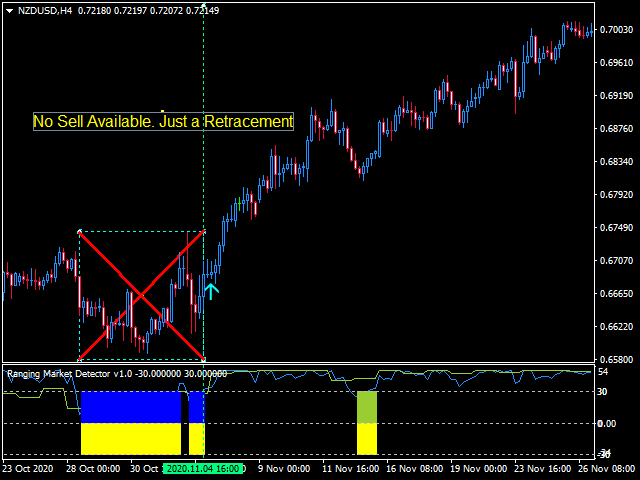

It works with all the all assets and visually shows you the instances when the market is either ranging or trending.

Informs when the price has finished a retracement, an opportune time to re-enter the trend early. This will help you in position management.

It works very well for Scalping, Day trading, and Swing trading. Helpful in all timeframes

Great tool for every trader.

Features:

If Disable Histograms=true. This disables the Histograms.

The indicator then displays only the Short-term/Fast Signal lines, the Multi-timeframe Long-term Signal lines, and levels -20, 0, 20, and colored Dots.

BUY: After the LightGreen dot forms, but wait for the candle to open above the YellowGreen box on the chart.

OR After the Red dot forms, but a candle open above the Red box on the chart.

SELL: After the Red dot forms, but wait for the candle to open below the Red box on the chart.

OR After the YellowGreen dot forms, but a candle open below the YellowGreen box on the chart.

If Disable Histograms=false. This displays the Histograms, both signal lines and levels -30, 0, and 30

When the Histograms are drawn on a section of the indicator, the market is either entering ranging state or changing direction.

If there are no histograms being drawn, the market has started to trend.

BUY:

If both the short-term and the Long-term signal lines are above 0 , but wait for the candle to open above the YellowGreen box on the chart.

OR If both the short-term and the Long-term signal lines are below 0 , but a candle open above the Red box on the chart.

SELL:

If both the short-term and the Long-term signal lines are below 0 , but wait for the candle to open below the Red box on the chart.

OR If both the short-term and the Long-term signal lines are above 0 , but a candle open below the YellowGreen box on the chart.

👉 Ranging Market Detector: https://www.mql5.com/en/market/product/66062

🔥🔥🔥🔥🔥 Download other indicators: https://www.mql5.com/en/users/pipmontra/seller

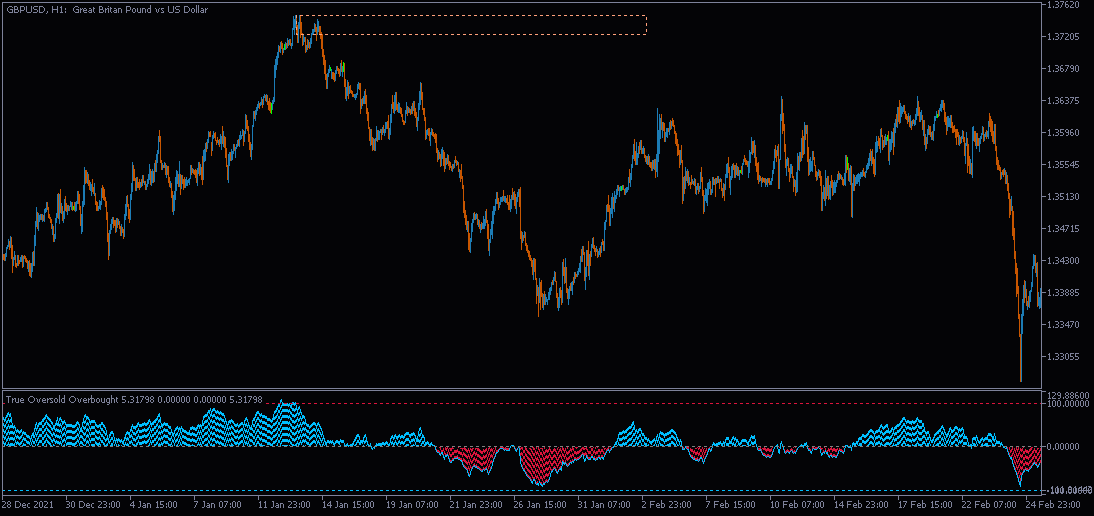

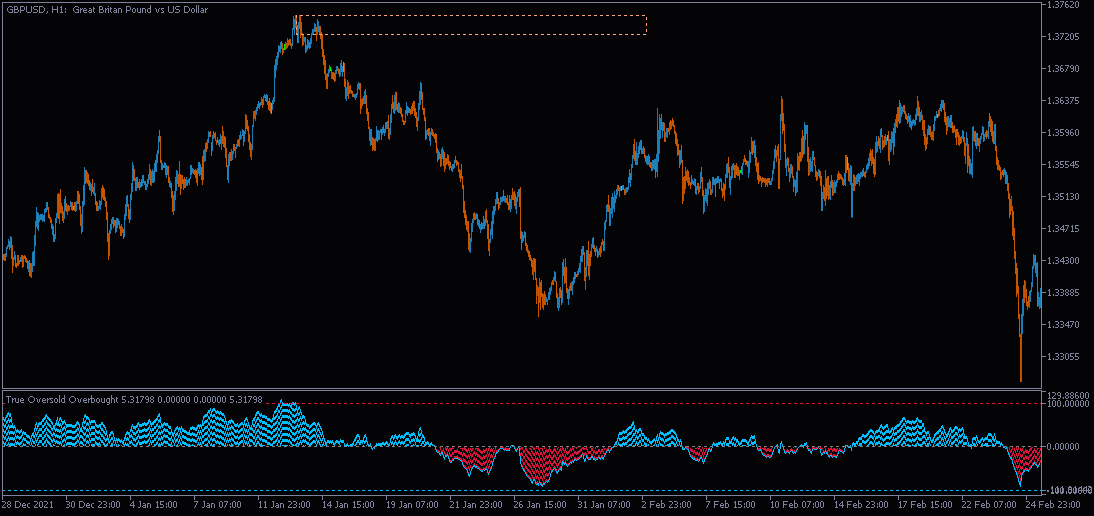

The True Oversold Overbought indicator provides you with ability to swiftly check whether the asset is oversold or overbought.

Other than complementing your trading with True Oversold Overbought, you can use the indicator as your only trading system.

It works with all forex instruments and will save you the headache of estimating when the market is due for a reversal or retracement.

When the "Super Charge" feature is enabled, the areas where the price is in oversold/overbought status are amplified to give you a clear state of the market,therefore, you will not miss the moment to prepare for a reversal/retracement.

Alternatively, when the "Super Charge" feature is disabled, the indicator still shows the oversold and overbought levels but this time you get a broader view of the market.

Advantages

✔️It is not overly sensitive or keep touching oversold/overbought levels.

✔️Open trades early when the price is exiting overbought / oversold levels and close trades at the right time.

✔️Trade when there is noise and when the market is silent.

✔️No complex settings since the default settings work perfectly.

✔️The indicator displays on the separate window and also show rectangles on the main chart.

✔️When the overbought and oversold rectangles draw, it is time to buy if price opens above the rectangles and sell if the candle opens below.

Note: If the overbought rectangle is formed but a candle open above it, its an indication the trend will continue surging for a while before breaking below.

Similarly, the continued drop in price below the oversold rectangle indicates the price might continue in the same direction before bulls takes control.

⭐️⭐️⭐️⭐️⭐️True Oversold Overbought MT5: https://www.mql5.com/en/market/product/79336

⭐️⭐️⭐️⭐️⭐️True Oversold Overbought MT4: https://www.mql5.com/en/market/product/68396

🔥🔥🔥🔥🔥 Download other indicators: https://www.mql5.com/en/users/pipmontra/seller

Re-enter the trend after pullbacks (Pullback trading strategy)

Take partial/complete profit(Profit taking strategy), and

Trade breakouts (Stock breakout strategy)

Irrespective of whether you are trading,Synthetic Indices,Forex,Cryptocurrencies, or Stocks the Outside The Box System works wonders.

How do I know there is a trend breakout- Breakout Zone

This is the zone between the continuous and dotted lines. The market is expected to breakout on the side of the solid continuous line. After the Breakout Zone draws, you should plan to open trades in the direction after the Re-Entry Zone is displayed. You are recommended to avoid opening buys when the price trends below the bearish breakout. Similarly, don’t go short when the bullish breakout is activated. Another vital point, expect the zones to act as support/resistance.

When do I re-enter the trend. Re-entry Zone

The Re-entry Zone is always below the Breakout Zone during a bear market. However, it can appear above the Breakout Zone if the market is consolidating. On the same note, the bull market Re-entry Zone is always above the Breakout Zone, though this may be overlooked in the early stages of the trend formation. Buy if a candle opens above the buy re-entry zone if bulls are in control and wait for a candle to open below the sell re-entry zone for you to sell during a bear market.

How do I take profit-Take Profit Zones

This module, Take Profit Zones, is useful in that irrespective of the indicator you are using it shows areas where you must lock or take some profit. These zones are displayed when there is either bull or bear market. This is helpful in that you are able to lock most of the gains before a retracement or reversal. On a downtrend, you can re-enter the market, with smaller lots, after a candle opens and closes below the Take Profit Zones. Equally, go long after a candle opens and closes above the zone if you are on an uptrend.

This system has been tested on ordinary and Renko charts. However, use the system together with Renko charts to experience the best outcome and display of these critical zones.

Always know the market level by using Outside The Box trading system.

For the first 10 buyers, we are giving a free copy of Price Elevator> https://www.mql5.com/en/market/product/82757

👉MT4 Version: https://www.mql5.com/en/market/product/83143

👉MT5 Version: https://www.mql5.com/en/market/product/76975

👉ALL Indicators: https://www.mql5.com/en/users/pipmontra/seller

Trend Re-entry

In this case you would plan your buy entries above the green dotted box (make sure to set the Buy / Sell Retracement Floor=30). The SL should be placed below the immediate low. Sell when the red dotted box appears below the red separator and place the SL above the previous high. You can also use any other indicator or Fibonacci for your re-entry.

If you use Fibonacci, 100% retracement should be on the red /green separator line. If you want to open sells using fibo wait for the price to hit 50% mark, and then draw a rectangle between 61.8 and 38.2 lines. Go short if the price falls below the rectangle and place SL above the rectangle. Same logic applies when opening buys but your base line is the greed separator.

Trend Exhaustion

Alternatively if you want to know when the trend is almost coming to exhaustion, set the Buy / Sell Retracement Floor=80 to 95. Price will most likely retreat after pushing higher above the green dotted box or below the red dotted box.

The Price Elevator indicator is best suited to work with Renko Charts where the noise is greatly reduced.

🔥🔥🔥🔥🔥 Price Elevator MT5 >https://www.mql5.com/en/market/product/82757

🔥🔥🔥🔥🔥 Price Elevator MT4 >https://www.mql5.com/en/market/product/82760

👉 Download other indicators: https://www.mql5.com/en/users/pipmontra/seller

Re-enter the trend after pullbacks (Pullback trading strategy)

Take partial/complete profit(Profit taking strategy), and

Trade breakouts (Stock breakout strategy)

Irrespective of whether you are trading,Synthetic Indices,Forex,Cryptocurrencies, or Stocks the Outside The Box System works wonders.

How do I know there is a trend breakout- Breakout Zone

This is the zone between the continuous and dotted lines. The market is expected to breakout on the side of the solid continuous line. After the Breakout Zone draws, you should plan to open trades in the direction after the Re-Entry Zone is displayed. You are recommended to avoid opening buys when the price trends below the bearish breakout. Similarly, don’t go short when the bullish breakout is activated. Another vital point, expect the zones to act as support/resistance.

When do I re-enter the trend. Re-entry Zone

The Re-entry Zone is always below the Breakout Zone during a bear market. However, it can appear above the Breakout Zone if the market is consolidating. On the same note, the bull market Re-entry Zone is always above the Breakout Zone, though this may be overlooked in the early stages of the trend formation. Buy if a candle opens above the buy re-entry zone if bulls are in control and wait for a candle to open below the sell re-entry zone for you to sell during a bear market.

How do I take profit-Take Profit Zones

This module, Take Profit Zones, is useful in that irrespective of the indicator you are using it shows areas where you must lock or take some profit. These zones are displayed when there is either bull or bear market. This is helpful in that you are able to lock most of the gains before a retracement or reversal. On a downtrend, you can re-enter the market, with smaller lots, after a candle opens and closes below the Take Profit Zones. Equally, go long after a candle opens and closes above the zone if you are on an uptrend.

This system has been tested on ordinary and Renko charts. However, use the system together with Renko charts to experience the best outcome and display of these critical zones.

Always know the market level by using Outside The Box trading system.

For the first 10 buyers, we are giving a free copy of Price Elevator> https://www.mql5.com/en/market/product/82757

👉MT4 Version: https://www.mql5.com/en/market/product/83143

👉MT5 Version: https://www.mql5.com/en/market/product/76975

👉ALL Indicators: https://www.mql5.com/en/users/pipmontra/seller

The True Oversold Overbought indicator provides you with ability to swiftly check whether the asset is oversold or overbought.

Other than complementing your trading with True Oversold Overbought, you can use the indicator as your only trading system.

It works with all forex instruments and will save you the headache of estimating when the market is due for a reversal or retracement.

When the "Super Charge" feature is enabled, the areas where the price is in oversold/overbought status are amplified to give you a clear state of the market,therefore, you will not miss the moment to prepare for a reversal/retracement.

Alternatively, when the "Super Charge" feature is disabled, the indicator still shows the oversold and overbought levels but this time you get a broader view of the market.

Advantages

✔️It is not overly sensitive or keep touching oversold/overbought levels.

✔️Open trades early when the price is exiting overbought / oversold levels and close trades at the right time.

✔️Trade when there is noise and when the market is silent.

✔️No complex settings since the default settings work perfectly.

✔️The indicator displays on the separate window and also show rectangles on the main chart.

✔️When the overbought and oversold rectangles draw, it is time to buy if price opens above the rectangles and sell if the candle opens below.

Note: If the overbought rectangle is formed but a candle open above it, its an indication the trend will continue surging for a while before breaking below.

Similarly, the continued drop in price below the oversold rectangle indicates the price might continue in the same direction before bulls takes control.

⭐️⭐️⭐️⭐️⭐️True Oversold Overbought MT5: https://www.mql5.com/en/market/product/79336

⭐️⭐️⭐️⭐️⭐️True Oversold Overbought MT4: https://www.mql5.com/en/market/product/68396

🔥🔥🔥🔥🔥 Download other indicators: https://www.mql5.com/en/users/pipmontra/seller

Re-enter the trend after pullbacks (Pullback trading strategy)

Take partial/complete profit(Profit taking strategy), and

Trade breakouts (Stock breakout strategy)

Irrespective of whether you are trading,Synthetic Indices,Forex,Cryptocurrencies, or Stocks the Outside The Box System works wonders.

How do I know there is a trend breakout- Breakout Zone

This is the zone between the continuous and dotted lines. The market is expected to breakout on the side of the solid continuous line. After the Breakout Zone draws, you should plan to open trades in the direction after the Re-Entry Zone is displayed. You are recommended to avoid opening buys when the price trends below the bearish breakout. Similarly, don’t go short when the bullish breakout is activated. Another vital point, expect the zones to act as support/resistance.

When do I re-enter the trend. Re-entry Zone

The Re-entry Zone is always below the Breakout Zone during a bear market. However, it can appear above the Breakout Zone if the market is consolidating. On the same note, the bull market Re-entry Zone is always above the Breakout Zone, though this may be overlooked in the early stages of the trend formation. Buy if a candle opens above the buy re-entry zone if bulls are in control and wait for a candle to open below the sell re-entry zone for you to sell during a bear market.

How do I take profit-Take Profit Zones

This module, Take Profit Zones, is useful in that irrespective of the indicator you are using it shows areas where you must lock or take some profit. These zones are displayed when there is either bull or bear market. This is helpful in that you are able to lock most of the gains before a retracement or reversal. On a downtrend, you can re-enter the market, with smaller lots, after a candle opens and closes below the Take Profit Zones. Equally, go long after a candle opens and closes above the zone if you are on an uptrend.

This system has been tested on ordinary and Renko charts. However, use the system together with Renko charts to experience the best outcome and display of these critical zones.

Always know the market level by using Outside The Box trading system.

For the first 10 buyers, we are giving a free copy of Price Elevator> https://www.mql5.com/en/market/product/82757

👉MT4 Version: https://www.mql5.com/en/market/product/83143

👉MT5 Version: https://www.mql5.com/en/market/product/76975

👉ALL Indicators: https://www.mql5.com/en/users/pipmontra/seller

The Convergence Divergence Suite contains 17 indicators, built-in MT4 technical indicators and custom ones.

The list will be increased in subsequent versions as per users' requests.

Convergence Divergence Suite

Any selected indicator is loaded on your chart then automatic Convergence and Divergence trend lines are drawn on the chart and indicator.

This tool is important if you use any of the listed indicators or convergence/divergence in your strategy.

Advantages

With the Convergence Divergence Suite you do not need to load multiple indicators to your chart, all you need to do is select the indicator from the dropdown menu to load it.

You receive screen alerts when there is convergence/ divergence.

You get automatic convergence /divergence trendlines for all the listed indicators under one suite.

Keep your chart clean and neat with one suite.

Settings

The setup is straight forward. All you need to do is set the values for the following indicators. You can do it at once or for the indicator you usually use:

Momentum

Chaikin Money Flow

Rate of Change (ROC)

Money Flow Index

Relative Strength Index

Stochastic Oscillator

Averaged RSI & MFI

Averaged RSI, MFI & Stochastic

Moving Average of Oscillator

Moving Average Convergence Divergence

William's Percentage Range

Commodity Channel Index

Force Index

DeMarker

Relative Vigor Index

William's Accelerator/Decelerator

William's Awesome Oscillator

DOWNLOAD: https://www.mql5.com/en/market/product/69003

We are ready to help you to set up if needed.

Re-enter the trend after pullbacks (Pullback trading strategy)

Take partial/complete profit(Profit taking strategy), and

Trade breakouts (Stock breakout strategy)

Irrespective of whether you are trading,Synthetic Indices,Forex,Cryptocurrencies, or Stocks the Outside The Box System works wonders.

How do I know there is a trend breakout- Breakout Zone

This is the zone between the continuous and dotted lines. The market is expected to breakout on the side of the solid continuous line. After the Breakout Zone draws, you should plan to open trades in the direction after the Re-Entry Zone is displayed. You are recommended to avoid opening buys when the price trends below the bearish breakout. Similarly, don’t go short when the bullish breakout is activated. Another vital point, expect the zones to act as support/resistance.

When do I re-enter the trend. Re-entry Zone

The Re-entry Zone is always below the Breakout Zone during a bear market. However, it can appear above the Breakout Zone if the market is consolidating. On the same note, the bull market Re-entry Zone is always above the Breakout Zone, though this may be overlooked in the early stages of the trend formation. Buy if a candle opens above the buy re-entry zone if bulls are in control and wait for a candle to open below the sell re-entry zone for you to sell during a bear market.

How do I take profit-Take Profit Zones

This module, Take Profit Zones, is useful in that irrespective of the indicator you are using it shows areas where you must lock or take some profit. These zones are displayed when there is either bull or bear market. This is helpful in that you are able to lock most of the gains before a retracement or reversal. On a downtrend, you can re-enter the market, with smaller lots, after a candle opens and closes below the Take Profit Zones. Equally, go long after a candle opens and closes above the zone if you are on an uptrend.

This system has been tested on ordinary and Renko charts. However, use the system together with Renko charts to experience the best outcome and display of these critical zones.

Always know the market level by using Outside The Box trading system.

For the first 10 buyers, we are giving a free copy of Price Elevator> https://www.mql5.com/en/market/product/82757

👉MT4 Version: https://www.mql5.com/en/market/product/83143

👉MT5 Version: https://www.mql5.com/en/market/product/76975

👉ALL Indicators: https://www.mql5.com/en/users/pipmontra/seller

Other than picking the most optimal entry points, the Hot Zone indicator can act as your typical support/resistance indicator for pullbacks for all timeframes.

You can use this indicator as the only trading indicator or use it with another indicator for reentry purposes. Besides, when using Hot Zones, the risk/reward ratio should be well above 1:2. Place your SL some few points below the zones and keep locking profit for you to take advantage of the trend since the reward may be significantly large-depends what's your goal.

In addition, there is an inbuilt dynamic support/resistance function that keeps track of the most immediate areas where the price is most likely to react.

Ideal for all instruments: Currencies, Cryptocurrencies, Stocks,Synthetic Indices on Deriv, etc.

THE NEXT PRICE IS $120

⭐️⭐️⭐️⭐️⭐️Download MT4 Version Here:: https://www.mql5.com/en/market/product/77292

⭐️⭐️⭐️⭐️⭐️Download MT5 Version Here:: https://www.mql5.com/en/market/product/77417

Notes:

Watch the market if the hot zone boxes are wide, especially after candle spikes. This increases your SL, therefore, may decrease your risk/reward ratio.

If the violet and light green hot zones form close to each other, your target profits should be tight until price breaks out on either of the side of both zones.

As the hot zone shadows (dotted lines) move away from the start of the box, the less effective they become, therefore, signals that emerge at the beginning are stronger.

If both the Hot Zones and the Dynamic Support/Resistance boxes form, the breakout is expected to be significant. However, you can chose to use any one of those functions.

You can chose to work with either Hot Zones or the Dynamic Support/Resistance independently depending on your trading style.

Under the Hot Zones function there are three trading modes, Cheetah, Jumbo, and Sloth. The Cheetah module is more reactive and provides more trading signals compared with the Jumbo whereas Sloth module takes longer than Jumbo to scan for hot zones- these animals react at different speeds, but all are effective at what they do.

This system has been tested with all trading instruments and works well for manual traders. In addition, it has been tested on Deriv Broker's synthetic indices and produces same predictability as other financial instruments.

You can use Hot Zones indicator to compliment your trading system as well.

Basic Guidelines

Buy if price opens above any of the box zones. When the light green zone forms buys are often stronger since this is a retracement. However, if candles open below the zone, this may be an indication that the trend has changed

Sell if the price opens below any of the boxes. Sells are stronger when the violet zone are formed. Similarly, if candles open above this zone is a signal that the price direction is changing.

The default settings work perfectly well. However, should you need help to guide you on the most effective usage drop me a chat message.

🔥🔥🔥🔥🔥 Download other indicators: https://www.mql5.com/en/users/pipmontra/seller

The True Oversold Overbought indicator provides you with ability to swiftly check whether the asset is oversold or overbought.

Other than complementing your trading with True Oversold Overbought, you can use the indicator as your only trading system.

It works with all forex instruments and will save you the headache of estimating when the market is due for a reversal or retracement.

When the "Super Charge" feature is enabled, the areas where the price is in oversold/overbought status are amplified to give you a clear state of the market,therefore, you will not miss the moment to prepare for a reversal/retracement.

Alternatively, when the "Super Charge" feature is disabled, the indicator still shows the oversold and overbought levels but this time you get a broader view of the market.

Advantages

✔️It is not overly sensitive or keep touching oversold/overbought levels.

✔️Open trades early when the price is exiting overbought / oversold levels and close trades at the right time.

✔️Trade when there is noise and when the market is silent.

✔️No complex settings since the default settings work perfectly.

✔️The indicator displays on the separate window and also show rectangles on the main chart.

✔️When the overbought and oversold rectangles draw, it is time to buy if price opens above the rectangles and sell if the candle opens below.

Note: If the overbought rectangle is formed but a candle open above it, its an indication the trend will continue surging for a while before breaking below.

Similarly, the continued drop in price below the oversold rectangle indicates the price might continue in the same direction before bulls takes control.

⭐️⭐️⭐️⭐️⭐️True Oversold Overbought MT5: https://www.mql5.com/en/market/product/79336

⭐️⭐️⭐️⭐️⭐️True Oversold Overbought MT4: https://www.mql5.com/en/market/product/68396

🔥🔥🔥🔥🔥 Download other indicators: https://www.mql5.com/en/users/pipmontra/seller

Re-enter the trend after pullbacks (Pullback trading strategy)

Take partial/complete profit(Profit taking strategy), and

Trade breakouts (Stock breakout strategy)

Irrespective of whether you are trading,Synthetic Indices,Forex,Cryptocurrencies, or Stocks the Outside The Box System works wonders.

How do I know there is a trend breakout- Breakout Zone

This is the zone between the continuous and dotted lines. The market is expected to breakout on the side of the solid continuous line. After the Breakout Zone draws, you should plan to open trades in the direction after the Re-Entry Zone is displayed. You are recommended to avoid opening buys when the price trends below the bearish breakout. Similarly, don’t go short when the bullish breakout is activated. Another vital point, expect the zones to act as support/resistance.

When do I re-enter the trend. Re-entry Zone

The Re-entry Zone is always below the Breakout Zone during a bear market. However, it can appear above the Breakout Zone if the market is consolidating. On the same note, the bull market Re-entry Zone is always above the Breakout Zone, though this may be overlooked in the early stages of the trend formation. Buy if a candle opens above the buy re-entry zone if bulls are in control and wait for a candle to open below the sell re-entry zone for you to sell during a bear market.

How do I take profit-Take Profit Zones

This module, Take Profit Zones, is useful in that irrespective of the indicator you are using it shows areas where you must lock or take some profit. These zones are displayed when there is either bull or bear market. This is helpful in that you are able to lock most of the gains before a retracement or reversal. On a downtrend, you can re-enter the market, with smaller lots, after a candle opens and closes below the Take Profit Zones. Equally, go long after a candle opens and closes above the zone if you are on an uptrend.

This system has been tested on ordinary and Renko charts. However, use the system together with Renko charts to experience the best outcome and display of these critical zones.

Always know the market level by using Outside The Box trading system.

For the first 10 buyers, we are giving a free copy of Price Elevator> https://www.mql5.com/en/market/product/82757

👉MT4 Version: https://www.mql5.com/en/market/product/83143

👉MT5 Version: https://www.mql5.com/en/market/product/76975

👉ALL Indicators: https://www.mql5.com/en/users/pipmontra/seller

>Take partial/complete profit(Profit taking strategy), and

>Trade breakouts (Stock breakout strategy)

The Outside The Box (OTB) is a complete trading system that provides the user with immense trading ability by highlighting on the chart areas where the trader should prepare to Re-enter the trend after pullbacks (Pullback trading strategy) Take partial/complete profit(Profit taking strategy), and Trade breakouts (Stock breakout strategy) - We have updated the indicator to show/hide Micro breakout areas around the major breakouts (Micro Breakouts). The above is supported by an alert system

Re-enter the trend after pullbacks (Pullback trading strategy)

Take partial/complete profit(Profit taking strategy), and

Trade breakouts (Stock breakout strategy)

Irrespective of whether you are trading,Synthetic Indices,Forex,Cryptocurrencies, or Stocks the Outside The Box System works wonders.

How do I know there is a trend breakout- Breakout Zone

This is the zone between the continuous and dotted lines. The market is expected to breakout on the side of the solid continuous line. After the Breakout Zone draws, you should plan to open trades in the direction after the Re-Entry Zone is displayed. You are recommended to avoid opening buys when the price trends below the bearish breakout. Similarly, don’t go short when the bullish breakout is activated. Another vital point, expect the zones to act as support/resistance.

When do I re-enter the trend. Re-entry Zone

The Re-entry Zone is always below the Breakout Zone during a bear market. However, it can appear above the Breakout Zone if the market is consolidating. On the same note, the bull market Re-entry Zone is always above the Breakout Zone, though this may be overlooked in the early stages of the trend formation. Buy if a candle opens above the buy re-entry zone if bulls are in control and wait for a candle to open below the sell re-entry zone for you to sell during a bear market.

How do I take profit-Take Profit Zones

This module, Take Profit Zones, is useful in that irrespective of the indicator you are using it shows areas where you must lock or take some profit. These zones are displayed when there is either bull or bear market. This is helpful in that you are able to lock most of the gains before a retracement or reversal. On a downtrend, you can re-enter the market, with smaller lots, after a candle opens and closes below the Take Profit Zones. Equally, go long after a candle opens and closes above the zone if you are on an uptrend.

This system has been tested on ordinary and Renko charts. However, use the system together with Renko charts to experience the best outcome and display of these critical zones.

Always know the market level by using Outside The Box trading system.

For the first 10 buyers, we are giving a free copy of Price Elevator> https://www.mql5.com/en/market/product/82757

👉MT4 Version: https://www.mql5.com/en/market/product/83143

👉MT5 Version: https://www.mql5.com/en/market/product/76975

👉ALL Indicators: https://www.mql5.com/en/users/pipmontra/seller

Re-enter the trend after pullbacks (Pullback trading strategy)

Take partial/complete profit(Profit taking strategy), and

Trade breakouts (Stock breakout strategy)

Irrespective of whether you are trading,Synthetic Indices,Forex,Cryptocurrencies, or Stocks the Outside The Box System works wonders.

How do I know there is a trend breakout- Breakout Zone

This is the zone between the continuous and dotted lines. The market is expected to breakout on the side of the solid continuous line. After the Breakout Zone draws, you should plan to open trades in the direction after the Re-Entry Zone is displayed. You are recommended to avoid opening buys when the price trends below the bearish breakout. Similarly, don’t go short when the bullish breakout is activated. Another vital point, expect the zones to act as support/resistance.

When do I re-enter the trend. Re-entry Zone

The Re-entry Zone is always below the Breakout Zone during a bear market. However, it can appear above the Breakout Zone if the market is consolidating. On the same note, the bull market Re-entry Zone is always above the Breakout Zone, though this may be overlooked in the early stages of the trend formation. Buy if a candle opens above the buy re-entry zone if bulls are in control and wait for a candle to open below the sell re-entry zone for you to sell during a bear market.

How do I take profit-Take Profit Zones

This module, Take Profit Zones, is useful in that irrespective of the indicator you are using it shows areas where you must lock or take some profit. These zones are displayed when there is either bull or bear market. This is helpful in that you are able to lock most of the gains before a retracement or reversal. On a downtrend, you can re-enter the market, with smaller lots, after a candle opens and closes below the Take Profit Zones. Equally, go long after a candle opens and closes above the zone if you are on an uptrend.

This system has been tested on ordinary and Renko charts. However, use the system together with Renko charts to experience the best outcome and display of these critical zones.

Always know the market level by using Outside The Box trading system.

For the first 10 buyers, we are giving a free copy of Price Elevator> https://www.mql5.com/en/market/product/82757

👉MT4 Version: https://www.mql5.com/en/market/product/83143

👉MT5 Version: https://www.mql5.com/en/market/product/76975

👉ALL Indicators: https://www.mql5.com/en/users/pipmontra/seller

The Outside The Box (OTB) is a complete trading system that provides the user with immense trading ability by highlighting on the chart areas where the trader should prepare to Re-enter the trend after pullbacks (Pullback trading strategy) Take partial/complete profit(Profit taking strategy), and Trade breakouts (Stock breakout strategy) - We have updated the indicator to show/hide Micro breakout areas around the major breakouts (Micro Breakouts). The above is supported by

Trend Re-entry

In this case you would plan your buy entries above the green dotted box (make sure to set the Buy / Sell Retracement Floor=30). The SL should be placed below the immediate low. Sell when the red dotted box appears below the red separator and place the SL above the previous high. You can also use any other indicator or Fibonacci for your re-entry.

If you use Fibonacci, 100% retracement should be on the red /green separator line. If you want to open sells using fibo wait for the price to hit 50% mark, and then draw a rectangle between 61.8 and 38.2 lines. Go short if the price falls below the rectangle and place SL above the rectangle. Same logic applies when opening buys but your base line is the greed separator.

Trend Exhaustion

Alternatively if you want to know when the trend is almost coming to exhaustion, set the Buy / Sell Retracement Floor=80 to 95. Price will most likely retreat after pushing higher above the green dotted box or below the red dotted box.

The Price Elevator indicator is best suited to work with Renko Charts where the noise is greatly reduced.

🔥🔥🔥🔥🔥 Price Elevator MT5 >https://www.mql5.com/en/market/product/82757

🔥🔥🔥🔥🔥 Price Elevator MT4 >https://www.mql5.com/en/market/product/82760

👉 Download other indicators: https://www.mql5.com/en/users/pipmontra/seller