Roberto Jacobs / Profil

- Information

|

8+ Jahre

Erfahrung

|

3

Produkte

|

75

Demoversionen

|

|

28

Jobs

|

0

Signale

|

0

Abonnenten

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

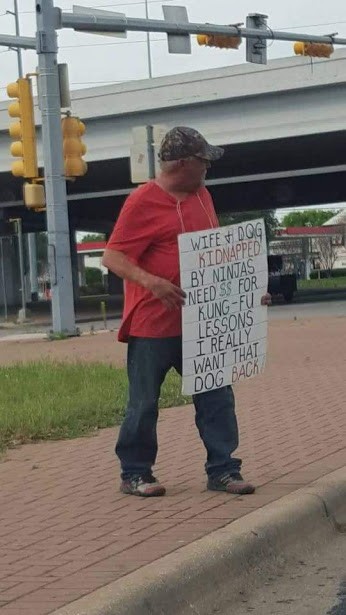

Roberto Jacobs

Analytical Review of the Stocks of Coca-Cola The Coca-Cola Company, #KO [NYSE] Consumer goods, Drinks – Free of alcohol drinks, USA Financial performance of the company: Index – DJIA, S&P 500...

In sozialen Netzwerken teilen · 2

104

Roberto Jacobs

US: Important Releases Next Week - Danske Analysts from Danske Bank look into next week economics reports, to be released next week in the US. Key Quotes: “Wednesday, we get data on retail sales in March, which we expect to show control group sales increased by 0.3% m/m...

Roberto Jacobs

Will the Euro Keep on Climbing? - Commerzbank Despite more expansionary ECB policies, the euro has appreciated considerably. As far as moves against the US dollar are concerned, this is partly due to markets having lost faith in a tightening of US monetary policy...

Roberto Jacobs

EUR/USD: Wave Analysis and Forecast for 08.04 – 15.04 EUR/USD: Wave analysis and forecast: Uptrend continues. Locally the pair is undergoing correction. Estimated pivot point is at the level of 1.1140. Our opinion: Buy the pair from correction above the level of 1.1140 with the target of 1.16 – 1...

Roberto Jacobs

GBP/USD: Wave Analysis and Forecast for 08.04 – 15.04 GBP/USD: Wave analysis and forecast: Downtrend continues. Estimated pivot point is at the level of 1.4460. Our opinion: Sell the pair from correction below the level of 1.4460 with the target of 1.36 – 1.34...

Roberto Jacobs

USD/CHF: Wave Analysis and Forecast for 08.04 – 15.04 USD/CHF: Wave analysis and forecast: Downtrend continues. Estimated pivot point is at the level of 0.9643. Our opinion: Sell the pair from correction below the level of 0.9643 with the target of 0.9390 – 0.9245...

Roberto Jacobs

USD/JPY: Wave analysis and forecast for 08.04 – 15.04 USD/JPY: Wave analysis and forecast: Downtrend continues. Estimated pivot point is at the level of 113.80. Our opinion: Sell the pair from correction below the level of 113.80 with the targets of 106.60 – 106.00...

Roberto Jacobs

USD/СAD: Wave Analysis and Forecast for 08.04 – 15.04 USD/СAD Wave analysis and forecast: A chance of decline in the pair remains. Estimated pivot point is at the level of 1.3213. Our opinion: Sell the pair from correction below the level of 1.3213 with the target of 1.2780 – 1.2660...

Roberto Jacobs

USD/CAD Tanks to Lows Near 1.3000 on Data The Canadian dollar is now rapidly appreciating vs. its American neighbor, dragging USD/CAD to test lows near the psychological support at 1.3000 the figure...

Roberto Jacobs

Fed’s Dudley – Cautions Approach to Rate Hikes Appropriate New York Fed’s Dudley, while speaking in Connecticut, said a cautious and gradual approach to rate hikes is appropriate...

Roberto Jacobs

Further Consolidation Seen in NZD/USD – UOB The research team at UOB Group sees the pair extending its rangebound pattern in the next weeks. Key Quotes “While the initial NZD strength held below 0.6870 as expected, the subsequent sharp drop from the high of 0.6864 was unexpected...

Roberto Jacobs

JPY: Seasonality Slows Foreign Bond Flows – Nomura Yujiro Goto, Research Analyst at Nomura, suggests that Japanese investors sold foreign bonds aggressively last week, according to the MOF. Key Quotes “They sold JPY1555bn ($14.1bn) of foreign bonds, for the first time in seven weeks...

Roberto Jacobs

US Index Futures Rise on Oil US stock futures are indicating Wall Street is set to have a good time on the last trading day of the week on account of higher oil prices. At the time of writing, Dow futures were up 97 points or 0.56%. S&P futures were up 0...

In sozialen Netzwerken teilen · 2

123

Roberto Jacobs

BoE Could be a ‘Non-Event’ Next Week – TDS In opinion of strategists at TD Securities, the Bank of England would leave unchanged its monetary conditions at its meeting next week...

Roberto Jacobs

XAU/USD: If the US Fed Increases Interest Rate in June Investors’ risk aversion, amid the decline in prices of oil since the end of March and uncertainty of economic situation in the world, has triggered the rise in demand of the Yen and gold...

Roberto Jacobs

USD/CAD Turned to Neutral Near Term – Scotiabank Eric Theoret, FX Strategist at Scotiabank, noted the neutral outlook for the pair in the short-term horizon...

Roberto Jacobs

Analytical Review of the Currency Pair GBP/USD Technical data of the currency pair: Previous closing: 1.4057; Daily range: 1.4049-1.4080; Opening: 1.4057...

Roberto Jacobs

EUR/USD Stuck Around 1.1360, Fedspeak Eyed The common currency keeps the negative tone at the end of the week, with EUR/USD meandering the 1.1360 area. EUR/USD focus on Fedspeak The pair has quickly faded the bullish attempt to daily tops around 1...

Roberto Jacobs

Russian Energy Minister Sees a Slight Rise in Oil Exports in 2016 As per Bloomberg report, Russian energy minister Novak said their oil exports in 2016 could be ‘slightly higher’. Iran is already working to boost its production to 4 million barrels per day...

: