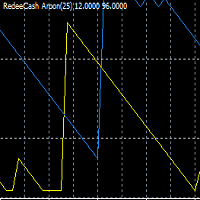

RedeeCash AROON

- Indikatoren

- Patrick Odonnell Ingle

- Version: 1.0

Version History

| Date | Version | Changes |

|---|---|---|

| 07/08/2022 | 1.00 | Initial Release |

Description

The Aroon indicator is a technical indicator that is used to identify trend changes in the price of an asset, as well as the strength of that trend. In essence, the indicator measures the time between highs and the time between lows over a time period. The idea is that strong uptrends will regularly see new highs, and strong downtrends will regularly see new lows. The indicator signals when this is happening, and when it isn't.

The RedeeCash AROON technical indicator adds global variables for the current strength of the UP TREND and DOWN TREND as well as the slope of the UP TREND and DOWN TREND AROON indicator lines.

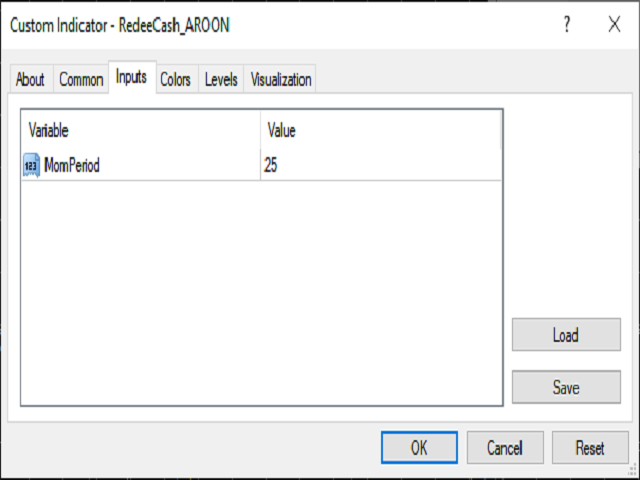

Code Sample

To invoke this indicator from an EA or script, call the iCustom metatrader function,

iCustom(Symbol(),PERIOD_D1,"Market/RedeeCash AROON",25,1,0); string AroonUpTrendVarName = StringConcatenate(Symbol(),"_aroon_UP"); string AroonDownTrendVarName = StringConcatenate(Symbol(),"_arron_DN"); string AroonUpTrendSlopeVarName = StringConcatenate(Symbol(),"_aroon_UPSlope"); string AroonDownTrendSlopeVarName = StringConcatenate(Symbol(),"_arron_DNSlope"); double upAroon = GlobalVariableGet(AroonUpTrendVarName); double dnAroon = GlobalVariableGet(AroonDownTrendVarName); double upSlope = GlobalVariableGet(AroonUpTrendSlopeVarName); double dnSlope = GlobalVariableGet(AroonDownTrendSlopeVarName); double maShort = iMA(Symbol(),PERIOD_D1,50,0,MODE_SMA,PRICE_CLOSE,0); double maLong = iMA(Symbol(),PERIOD_D1,200,0,MODE_SMA,PRICE_CLOSE,0); if (upAroon > dnAroon && upAroon < 70 && maShort > maLong && upSlope > 0) { OrderSend(Symbol(),OP_BUY,0.01,Ask,0,0,0); } else if (upAroon < dnAroon && dnAroon < 70 && maShort < maLong && dnSlope > 0) { OrderSend(Symbol(),OP_SELL,0.01,Bid,0,0,0); }

Usage

When the Moving Averages crosses indicate a DOWN trend, use the RedeeCash AROON indicator to confirm the entry point when the AROON DOWN TREAND value is greater than the AROON UP TREND value, while the AROON DOWN TREND value is less than 70 and the AROON DOWN TREND slop is positive (non-zero).