AI Color Gradient Volume

- Indikatoren

- Xin You Lin

- Version: 1.12

- Aktivierungen: 5

Introduction to the use of MT4 platform AI Color Gradient Volume indicators

I. Overview of indicators

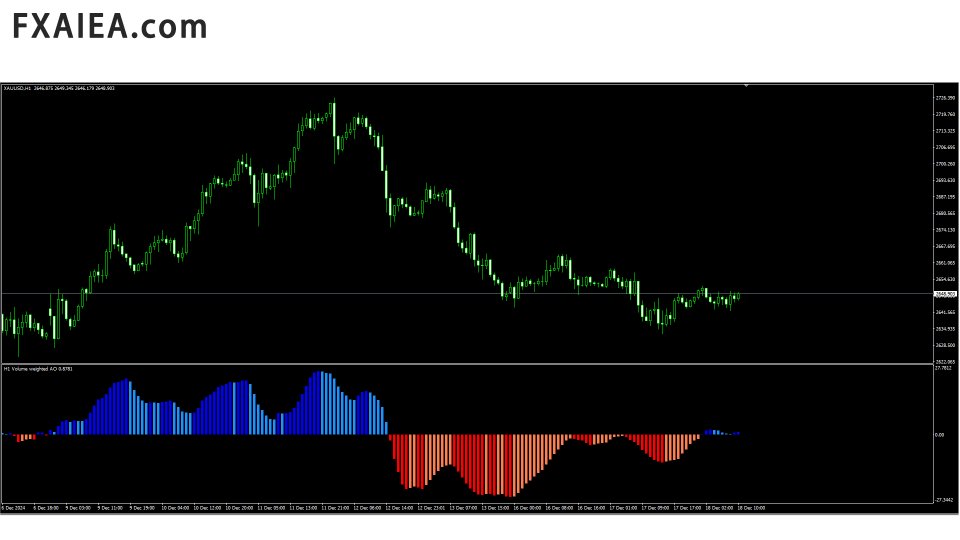

AI Color Gradient Volume is an innovative volume analysis indicator based on artificial intelligence technology for the MT4 platform. By converting the volume data into an intuitive color gradient graph, it helps traders to have a more acute insight into the inflow and outflow of funds in the market and the strength of the buying and selling forces, so as to provide strong support for trading decisions, which is suitable for various MT4 trading markets such as foreign exchange, stocks, futures and so on.

Second, installation and setup

Installation steps: First, download the AI Color Gradient Volume indicator file, which is usually in.ex4 format. Then, on the MT4 platform, click the "File" menu, select "Open Data folder", enter the "MQL4" folder, then find the "Indicators" folder, copy and paste the downloaded indicator file into this folder. Close and re-open the MT4 platform, select "Indicator" in the "Insert" menu, find the AI Color Gradient Volume indicator in the list of custom indicators and click to add it to the chart.

Parameter Settings: After installation, indicators may have some default parameter Settings, in general, these default Settings can meet the basic trading needs, but traders can also be further optimized according to their own trading strategy and market conditions.

Third, indicator interpretation

Color gradient meaning: The indicator mainly reflects the change of trading volume through color gradient. Generally speaking, lighter colors (such as light blue, light red, etc.) represent relatively low volume, which means that the market trading activity is low, and the buying and selling power is relatively balanced or weak; As the color gradually deepens (such as dark blue, dark red, etc.), it indicates that the volume is increasing, which may indicate that the market sentiment is changing, the balance of buying and selling power is beginning to be unbalanced, and more funds are flowing into the market to drive the price change. For example, in the foreign exchange market, if the Color of the AI Color Gradient Volume indicator on the chart of the euro/US dollar currency pair gradually changes from light red to dark blue, it may indicate that the trading activity of the currency pair increases significantly, and vice versa. With increased market attention, large price movements may be on the horizon, and traders need to pay close attention to changes in price movements and other technical indicators in order to find suitable trading opportunities.

Matching with price action: Observing the relationship between the color gradient of the indicator and the price action is the key to using this indicator. When the price rises, if the color of the volume also becomes darker, that is, the volume enlarges with the price rising, this is usually a positive signal, indicating that the market has strong bull power, the upward trend may have a certain continuity, traders can consider taking long or continue to hold long positions; On the other hand, if the price rises but the volume color becomes lighter or even stays at a low level, this may indicate a lack of upward momentum, the market may be about to face a correction or reversal, at this time traders should remain cautious and consider appropriate reduction or set a tight stop loss level. Similarly, in the process of price decline, the change of volume color can also provide a reference for judging the reliability of the downward trend. If the price decline is accompanied by the deepening of the volume color, it indicates that the short force is dominant and the downward trend may continue; If prices fall without a significant increase in volume, it may mean that the downtrend is not solid and the market could rebound at any time.

Fourth, trading signals and strategies

Trend judgment and following: Based on the color gradient trend of the indicator, traders can determine the overall trend direction of the market. If over a period of time, the volume color continues to remain in the darker area, and the price shows a clear upward or downward trend, this indicates that the market is in a strong unilateral trend. At this time, traders can adopt the trend following strategy, after the trend is confirmed, trade along the trend direction, that is, when the color continues to deepen and the price rises to buy on the dip, when the color continues to deepen and the price falls on the high short, and according to the change of the indicator color and the fluctuation rhythm of the price reasonably set the stop loss and stop profit, in order to obtain the profits brought by the trend market.

Reversal signal recognition: When the indicator's color gradient shows clear signs of reversal, such as a rapid change from a dark color to a light color, or a sudden start of darkening from a persistent light color, it may indicate that the market trend is about to reverse. Especially when this color reversal diverges from the price trend, the reliability of the reversal signal is higher. For example, the price keeps making new highs, but the volume color is gradually lightening, forming a top divergence pattern, which may be a signal that the market top is about to form, traders can consider gradually closing long positions, and at the right time to establish short positions; On the other hand, when the price keeps making new lows, but the volume color begins to darken, forming a bottom divergence pattern, it may be a signal of the bottom of the market, and traders can look for opportunities to buy dips.

Volatile market strategy: When the market is in a volatile range, the color of the indicator will usually fluctuate within a relatively narrow range, and there is no obvious continuous trend of darkening or lightening. At this time, traders can adopt a range trading strategy, near the upper and lower boundaries of the volatility range to sell high and buy low operations. When the price is close to the upper boundary of the shock range and the volume color is not significantly enlarged, you can consider selling; When the price is close to the lower boundary of the range and the volume color has not changed significantly, you can consider buying. At the same time, we should pay close attention to the sudden change in the color of the indicator, once the color breaks the sign of the shock range, it may indicate that the market will break through the shock pattern and enter a new trend market, at this time, it is necessary to adjust the trading strategy in time to follow the new trend direction.

5. Advantages and limitations

Advantages:

Intuitive visualization: The volume data is visually displayed on the chart through color gradient, so that traders can quickly and intuitively understand the fund dynamics and trading activity of the market, and can quickly grasp the changes in market sentiment without complex data analysis, which greatly improves the efficiency of trading decisions.

Intelligent algorithm has strong adaptability: Based on artificial intelligence algorithm, the index can automatically adapt to the changing characteristics of the volume of different market conditions and trading varieties. Whether it is in the mainstream market with high liquidity or in the niche market with relatively low liquidity, it can accurately reflect the real situation of the volume, and timely send effective trading signals, reducing the trouble that traders need to adjust the index parameters frequently due to market changes.

Comprehensive analysis ability: The combination of volume analysis and the visual effect of color gradient enables traders to analyze market information more comprehensively, not only focusing on the value of volume, but also obtaining more clues about the comparison of market buying and selling forces and the evolution of trends from the changing trend of color, so as to develop a more accurate and forward-looking trading strategy.

Limitations:

Risk of false signals: Although the indicator uses intelligent algorithms, some false signals may still be generated when the market experiences abnormal movements or is affected by sudden major events. For example, when sudden geopolitical events lead to instant panic selling or buying in the market, the volume may be dramatically amplified, and the color of the indicator will quickly become darker, but this situation may only be a short-term abnormal market reaction and does not necessarily represent a real change in the market trend, and traders may suffer losses if they blindly trade on these signals.

Reliance on volume data: The effectiveness of this indicator depends heavily on accurate volume data. However, in some markets, the volume data may be somewhat inaccurate or incomplete, especially in the over-the-counter (OTC) trading in the foreign exchange market, where the volume data is relatively less accurate than in centralized trading markets such as the stock market. In addition, some trading platforms may smooth the volume data or there are data delays and other issues, all of which may affect the accuracy and reliability of the indicators, leading traders to make wrong trading decisions.