Forum on trading, automated trading systems and testing trading strategies

Indicators: Price Action Indicator

newdigital, 2014.06.13 15:52

Indicators VS Forex Price Action (based on article)

There is an endless debate within the forex trading community whether investors are better suited to use price action mechanisms or technical indicators when developing their portfolio strategies. The reality is that both sets of strategies have advantages and disadvantages, but the benefits gained from them are based heavily on the timeframe. Let us take a look at some important factors to keep in mind when determining which strategy to use.

What is price action?

The

most basic definition of price action is a strategy that involves an

investor taking all forex trading decisions based solely on the movement

of a currency’s price. A price action strategy does not take into

account any technical indicators that may be typically used to determine

whether a currency is supporting or resisting a particular trend.

Regardless of the various complicated strategies that investors around

the world may use, their actions are all accounted for in the final

price chart. The need to predict the impact of external global events on

the market is eliminated because the price chart will inevitably come

to reflect the impact on its own.

The entire focus in price

action trading is the current movements taking place on a price chart.

There are a number of tools that price action traders use, with one

notable example being that of candlesticks. Candlesticks are tools that

are used to determine whether a currency is truly on an upward or

downward trend. The only information taken into account is that which is

provided on a currency’s price chart.

What are technical indicators?

Forex

trading using technical indicators goes above and beyond the

information presented on a currency’s price chart. While price action

trading involves using only price data, technical indicators are used to

discover why a particular currency is moving in a certain direction to

predict its future behavior. Nowadays, there are a number of technical

indicators available for use in the market. However, most forex traders

using technical analysis incorporate three main indicators – moving

averages, bolinger bands and average directional indexes.

A

moving average line is one of the most common indicators that helps

forex traders determine whether a currency is exhibiting a bearish or

bullish trend, or if there is no trend at all. Moving averages can also

help investors identify whether a currency is resisting or supporting

price movements. Moving averages are usually created by determining a

particular period of time, and calculating the average price within that

period.

Bolinger bands are bands that are typically located

around a moving average and a currency price. They help investors

determine whether a currency is trending, while also suggesting points

at which this trend may begin reversing. They help in identifying

support or resistance patterns, and in calculating the volatility of a

currency.

Average directional indexes are used in tandem with

Bolinger bands and moving averages. An ADX essentially calculates the

strength of a trend through measurement of gradient. From these calculations, an investor will be able to determine whether a trend is

strong or weak.

Which one works?

Financial

theorists who develop technical indicators and publish them within the

market do so by studying market behavior in the past. As such, they are

using previous data and creating measurements that fall in line with

this data. When these measurements hold, they can be used by investors

to predict the price movement of a currency.

Price action

traders, however, live in the present. They react to how a currency is

doing presently, and trends that are easily visible on a price chart.

When price action traders look at a price chart, they do not need to

understand the interplay between demand and supply, but only the final

outcome as reflected in a price movement.

The two types of

strategies both have their own uses. Technical indicators are shown to

have an extremely low probability of success when the timeframe is

short. The opposite holds for price action trading. However, as the

timeframe of analysis increases, the probability of technical indicators

working begins to rise. Investors who are looking for long-term trading

strategies may be best placed to use technical indicators over price

action. Conversely, investors who prefer to make quick trades within the

short term are better suited to a price action trading strategy.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video March 2014

newdigital, 2014.03.17 09:55

What is Price Action?

"A common beginner question to trading is what exactly is Price Action? Well, good question, let me sum it up for you."

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read February 2014

newdigital, 2014.02.04 15:21

Trading Price Action Reversals : Al Brooks

detailed guide to profiting from trend reversals using the technical analysis of price action

The key to being a successful trader is finding a system that works and

sticking with it. Author Al Brooks has done just that. By simplifying

his trading system and trading only 5-minute price charts he's found a

way to capture profits regardless of market direction or economic

climate. His first book, Reading Price Charts Bar by Bar, offered an

informative examination of his system, but it didn't allow him to get

into the real nuts and bolts of the approach. Now, with this new series

of books, Brooks takes you step by step through the entire process.

By breaking down his trading system into its simplest pieces:

institutional piggybacking or trend trading, trading ranges, and

transitions or reversals (the focus of this book), this three book

series offers access to Brooks' successful methodology. Trading Price

Action Reversals reveals the various types of reversals found in today's

markets and then takes the time to discuss the specific characteristics

of these reversals, so that you can use them in your everyday trading

endeavors. While price action analysis works on all time frames, there

are different techniques that you can use in trading intraday, daily,

weekly and monthly charts. This, among many other issues, is also

addressed throughout these pages.

- Offers insights on how to handle volatility and sharp reversals

- Covers the concept of using options when trading certain charts

-

Examines how to deal with the emotions that come along with trading

Other books in the series include Trading Price Action Trends and Trading Price Action Trading Ranges

If you're looking to make the most of your time in today's markets the

trading insights found in Trading Price Action Reversals will help you

achieve this goal.

================

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read February 2014

newdigital, 2014.02.10 16:20

Trading Price Action Trading Ranges : Al Brooks

Divided into five comprehensive parts, Trading Price Action Trading

Ranges skillfully addresses how to spot and profit from trading

ranges—which most markets are in, most of the time—using the technical

analysis of price action. Along the way, it touches on some of the most

essential aspects of this approach, including:

- Trading breakouts, which are transitions from trading ranges to trends, and understanding the gaps they create

- The two types of "Magnets," Support and Resistance, and what they mean once the market breaks out and begins its move

- Pullbacks, which are transitions from trends to trading ranges

- The characteristics commonly found in trading ranges—areas of largely sideways price activity—and examples of how to trade them

-

Honing your order and trade management skills so that you can make more informed entry and exit decisions

And much more

Throughout the book, Brooks focuses primarily on 5 minute candle

charts—all of which are created with TradeStation—to illustrate basic

principles, but also discusses daily and weekly charts. And since he

trades more than just E-mini S&P 500 futures, Brooks also details

how price action can be used as the basis for trading stocks, forex,

Treasury Note futures, and options. For your convenience, a companion

website, which can be found atwiley.com/go/tradingtrends, contains all

of the charts provided in the book.

=============

Check the other book from this series : Trading Price Action Reversals : Al Brooks

Good article -

Reversing: The holy grail or a dangerous delusion?

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2019.08.24 08:47

Using Price Action As Your First Indicator (based on the article)

- Price action is the study or analysis of price movement in the market. Traders use price action to form opinions and base decisions on trends, key price levels and suitable risk management. Trend identification is frequently utilized as the initial step in price action trading. All other facets to price action indicators require a trend basis to begin price action analysis.

- Technical analysis setups generally begin with price action as the initial form of evaluation. The first thing to remember when using an indicator is that it is a function of price action. The indicator itself is not the ultimate tool when it comes to trading, but rather comes in behind price action. Price action governs the information that the indicator will ultimately provide on the chart. As such, a trader must determine what price action is doing (i.e. the trend) before consulting the indicator for an entry signal. Once the trend is determined, the trader can then consult the indicator for an entry signal in the direction of the trend.Traders trade on the price movement of an instrument therefore, the focus is on the change in price as opposed to the change in indicator value. Some traders base trading decisions and analysis purely on price action whilst other prefer a combination of price action and technical indicators which serve as a support system.

- Technical indicators are derivatives of price action - price action governs the information that indicators provide on the chart. These indicators are calculated using varying periodic price data which provide substantiation for entry, exit, and stop distance criteria. Trend identification is also important in market analysis to ascertain how the market is functioning on a holistic scale (time frame dependent).

- Price action is a broad technical analysis technique that incorporates various trading strategies which traders apply to analyze the markets. Technical indicators work well in conjunction with price action to allow traders to formulate more accurate trade decisions.

============

And the article -

Forum on trading, automated trading systems and testing trading strategies

Resistance and Support Verification

Sergey Golubev, 2018.03.06 07:01

The Articles

----------------

- Automatic construction of support and resistance lines

- Identifying Trade Setups by Support, Resistance and Price Action

- A Method of Drawing the Support/Resistance Levels

- An example of an indicator drawing Support and Resistance lines

- Displaying of Support/Resistance Levels

- Drawing Resistance and Support Levels Using MQL5

- Indicator for Constructing a Three Line Break Chart

XXXUSD 10 points - expert for MetaTrader 5

The adviser expects a breakdown of yesterday's price by 10 points. There can only be one 'market entry' transaction on the bar (this is an internal parameter, it is not put out to the input parameters and this is not related to the ' Only one positions ' parameter). When working in the 'inside signals ' mode (' Search signals, in seconds ' is greater than or equal to '10'), the current bar is bar # 0, when operating in the 'only at the time of birth of a new bar' (' Search signals, in seconds ' less than '10') current bar - bar # 1.

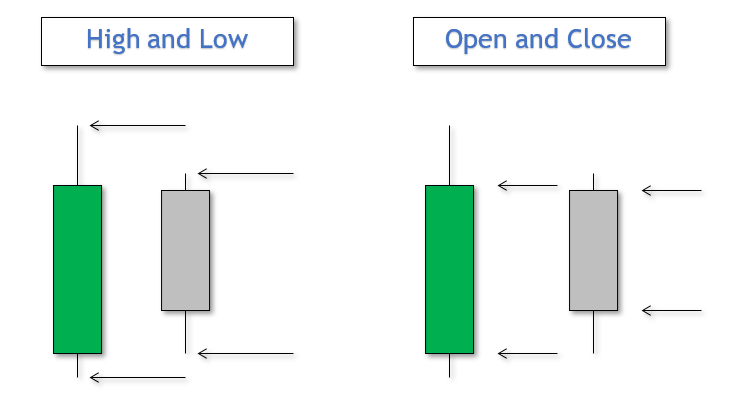

I entered the following settings in the settings of the adviser:

- type of yesterday's price - type of yesterday's price, maybe ' High and Low ' and ' Open and Close '

- type of yesterday's bar - type of yesterday's bar, maybe ' Bullish ', ' Bearish ' or ' Disable '

- breaking through - breaking

Up to the present, we have not had any mathematically rigorous price movement theory. Instead, we have had to deal with experience-based assumptions stating that the price moves in a certain way after a certain pattern. Of course, these assumptions have been supported neither by statistics, nor by theory. The article provides the concepts and foundations of the mathematical apparatus of the rigorous theory price movement theory.

- www.mql5.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Dear friends/Brothers/Sisters,

I want to start this post regarding Price Action. I want people to help about what I know. Please Respond this post, Share the way you know and learn the way I know. I am not a master but a trader like others and also like to know how others doing. Reply and Keep in touch with this post. :)